How to buy IOTA (MIOTA) – Trading guide for beginners

Table of Contents

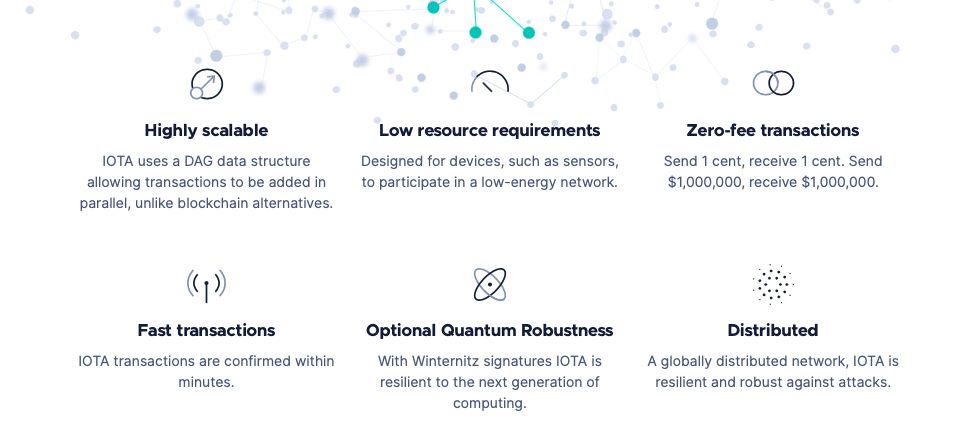

IOTA is a decentralized open-source distributed ledger designed with high scalability in mind to ensure seamless data and value transfer. The network focuses on IoT, allowing data to be transferred quickly and securely between people, machines, and computers without obstacles. The IOTA network provides low resource demand, intrusion prevention data, and fee-free transactions, enabling the Internet of Things (IoT) without organizations or companies that require significant infrastructure investments.

Like all other blockchain networks, IOTA has its own token called MIOTA. At the time of writing, the MIOTA token is trading for $0.25 a penny and has a market value of $700 million. The main goal of IOTA is to play a key role in the upcoming industrial revolution, which will require us to control the machine economy and manage the economic relationship between humans and machines.

What is IOTA?

Iota ranks 12th on coinmarketcap.com, rated at 400 cryptocurrencies in terms of market value not related to the blockchain. Instead of concatenating transaction blocks, Iota uses a transaction tree called a tangle. Iota got its name from the Internet of Things (IoT) where you can find many applications.

Iota confirms each individual transaction by contacting the other two transactions upon touch. No mining is required, as the transaction validator can process new transactions.

IOTA Tangle

Iota Tangle processes individual transactions faster because Iota doesn’t need to create a block of transactions before validation. Directed Acyclic Graph (DAG) is a technology name that is a mixture of the torso, limbs, branches, and Iota branches.

The transaction with the longest and most validated period before the root transaction is of paramount importance when managing other transactions. Because Iota enables machine-to-machine communication, Iota promises IoT applications such as connecting washing machines to online drivers or autonomous vehicles with computer machines.

Buying IOTA

There are a few options to trade IOTA:

- Purchase another crypto coin

- Purchase other digital currencies with IOTA on the crypto change

- Peer-to-Peer

This means, that it is mandatory to trade with other cryptos like Bitcoin before trading with IOTA. Why? You can only buy MIOTA tokens with other cryptocurrencies. Through this, the cryptocurrency is definitely exclusive to a small group of traders.

Trade cryptocurrencies CFDs with the best conditions and a regulated broker:

Crypto Broker: | Review: | Advantages: | account: |

|---|---|---|---|

1. Capital.com  | # More than 200 crypto CFD assets # No commissions # Best platform for beginners # No hidden fees # More than 3,000 markets | Live account from $ 20: (Risk warning: 75% of retail CFD accounts lose money) | |

2. Libertex  | # More than 50 crypto CFD assets # Trade with leverage 1:2 # Userfriendly # Fiat deposits & withdrawals # PayPal | Live account from $ 100: (Risk warning: 74.91% of retail investor accounts lose money when trading CFDs with this provider.) |

Purchase another crypto coin

Prior to the MIOTA buyer, the buyer must already own another cryptocurrency, such as Bitcoin or Ethereum. IOTA can only be purchased through other cryptocurrency exchanges. Coinbase is a convenient and reliable exchange for Bitcoin for the first time, or any other cryptocurrency purchase that accepts fiat initial funds (dollars, euros, etc.) via debit or credit card or direct bank transfer. However, many banks no longer accept cryptocurrency purchases with credit cards.

Another option is to withdraw cash from your bank account and insert it into the cryptocurrency machine. The ATM issues a receipt with an alphanumeric key to your online wallet.

Purchase other digital currencies with IOTA on the crypto exchange

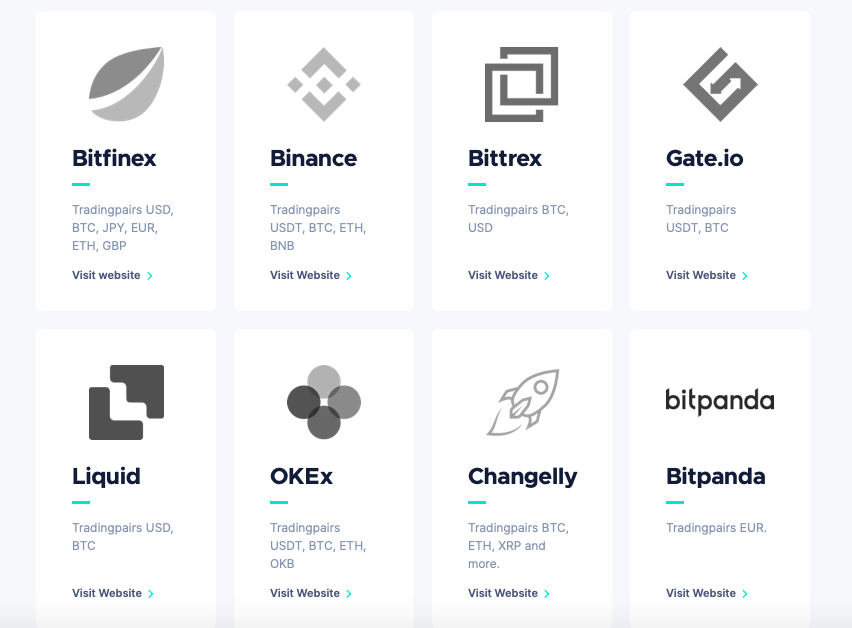

All exchanges accept bitcoin as a deposit, so bitcoin can be used as a source of funds to purchase MIOTA. Since the process of converting cryptocurrency back to fiat can take days, IOTA can be quickly exchanged for bitcoin, which may be less volatile than other cryptocurrencies. The IOTA website recommends exchanging Binance, Bitfinex, Coinone, OKEx and Exrates. All of these recommended exchanges also trade in bitcoin, so the process of obtaining bitcoin first and then using it to deposit it will work.

Use a Peer-to-Peer platform to trade MIOTA

You can purchase IOTA tickets using the method above, but there are other lesser-known sources that you can use to purchase MIOTA. It’s not as practical as the other options, but it’s a reliable and useful way. A Peer-to-Peer (P2P) website that provides a platform for cryptocurrency buyers and sellers. Instead of buying through the platform, you trade with individual vendors.

The advantage is that you can enter the terms of your purchase until you find a suitable deal. Before buying, check the seller’s reputation. All MIOTA tokens are currently in circulation and cannot be excavated. Having covered all aspects of purchasing IOTA tickets, you are now ready to begin your MIOTA journey. We have already reviewed various platforms, including stock exchanges and brokers, and have recommended the best services that provide the highest reliability, availability, and compliance.

Market Volatility

Fear of defeat only motivates a person to make an emotional investment, while fear, uncertainty, and doubt can prevent a person from taking an almost obvious opportunity. A $19,000 bitcoin might look good, but a $10,000 bitcoin might look like a fair price for two pizzas. When investing over a period of time, it is important to have a strategy that anticipates all possible outcomes.

Note:

The general rule for stocks is to strive for a 20% profit and beware of a 5% loss. However, cryptocurrency is far more volatile than any other investment. If an asset purchased with borrowed money becomes worthless, it can lead to losses of 100% or more.

Trade more than 100 different cryptocurrencies CFDs on professional platforms:

(Risk warning: 75% of retail CFD accounts lose money)

Where can I buy MIOTA? – Trading guide

It is assumed that a beginner will own the token when considering buying MIOTA or any other cryptocurrency. However, remember that there are many ways to invest when buying IOTA tickets. While you have the opportunity to purchase IOTA yourself, you can also purchase financial products such as Difference Agreements (CFDs) and MIOTA futures that offer many benefits.

If your strategy is less than average return, then it’s best to pursue financial products. It’s easy to buy, and you don’t have to go through the whole process of buying, protecting, and storing IOTA tickets. Instead, if you only guess the price of MIOTA and decide that the currency has reached its highest price, you can lose your job and sell your financial products.

This means that if you have a long-term strategy and want to keep MIOTA coins, it is cheaper to buy tickets. Instead of going to a trading platform, you should choose a cryptocurrency exchange where you can buy MIOTA tokens and store them securely in your wallet. So it can be kept for months or even years in some cases to generate long-term profits.

Don’t forget that investments in cryptocurrencies can be as risky as other traditional investments, especially since the prices of these tokens are highly volatile. That is why it is important to diversify your investment portfolio by investing in various cryptocurrencies and assets. This allows you to manage risk and maximize profitability.

What is the difference between IOTA exchange and broker?

The IOTA exchange is a platform that allows you to buy or exchange cryptocurrencies or lesser-known altcoins for more popular tokens such as Ethereum and Bitcoin. If you own and want to hold MIOTA and are looking for the best exchange rates, cryptocurrency exchanges are the right platform for you.

On the other hand, if you want to take advantage of MIOTA’s price volatility quickly, the broker has the best tools and infrastructure to facilitate trading. So you don’t have to deal with issues related to cryptocurrency wallets and transfer the tokens to the broker’s account or vice versa. Brokers can also participate in induction trading. This means you can open a site for $1 or more for $10 or more. However, there are a lot of risks, and only older traders know what they are doing. It should be part of the average deal.

Trade more than 100 different cryptocurrencies CFDs on professional platforms:

(Risk warning: 75% of retail CFD accounts lose money)

How to buy MIOTA from a broker

To trade IOTA, you need to be very careful about the trading platform you choose. I want to invest through a reputable and regulated platform. You should also consider other factors related to your investment experiences, such as the security, usability, reliability, and availability of your information and personal funds. Check out online reviews and reviews written by real consumers to make sure you trust the right trading platform.

Poor trading or investment experience can seriously hamper your earnings outlook when you focus more on solving technical problems than focusing all your attention on trading.

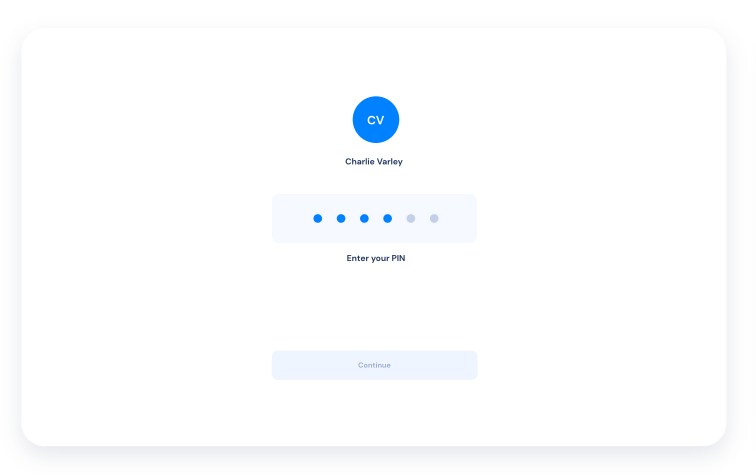

Register with the broker

All you need to do is provide basic information when registering an account with a crypto broker. For example, eToro, one of the most important trading platforms, only requires a strong username, email address, and password. The password must contain at least one uppercase letter, one number, and one special character, and must be between 6 and 20 characters long. Some trading platforms also allow you to sign up for a Facebook or Google account for your convenience.

Trade cryptocurrencies CFDs with the best conditions and a regulated broker:

Crypto Broker: | Review: | Advantages: | account: |

|---|---|---|---|

1. Capital.com  | # More than 200 crypto CFD assets # No commissions # Best platform for beginners # No hidden fees # More than 3,000 markets | Live account from $ 20: (Risk warning: 75% of retail CFD accounts lose money) | |

2. Libertex  | # More than 50 crypto CFD assets # Trade with leverage 1:2 # Userfriendly # Fiat deposits & withdrawals # PayPal | Live account from $ 100: (Risk warning: 74.91% of retail investor accounts lose money when trading CFDs with this provider.) |

ID verification (KYC processes)

Regulated brokers must follow KYC (Know Your Customer) and AML rules to protect consumers. This is why your broker asks you to provide documents that can identify you, including your passport, a copy of your driver’s license, or other identification. Brokers are required by law to follow these rules, but these rules also protect your personal and financial information.

This process may take a little longer than expected, but it is for your greatest benefit. After the broker has verified your account, you are ready to start trading.

Deposit using your preferred payment method

After registering and completing the entire validation process, you can start shopping with a minimal deposit. Different platforms have different minimums, so you should keep an eye on this as well. Brokers usually offer a variety of payment methods including bank transfers, bank cards, and electronic payment methods. Convenience, availability, cost, and speed factors should be considered before choosing a payment method.

For example, many investors want to use PayPal, but payment options are not available on many platforms due to some complex rules. Similarly, some IOTA investors use a credit or debit card to deposit working capital, which can be expensive in terms of fees, but it is quick and convenient. It depends on the product you prefer and how you shop.

Go long or short with MIOTA

Before you get into a short or long-term job, you need to understand what the two jobs mean. Bulls or investors take a long-term position because they believe MIOTA’s price will continue to rise, so they buy and hold coins to make a profit. Conversely, a bear or trader who believes that MIOTA’s price is falling and that this price drop can make money will take a short position.

Understanding the difference between short and long positions will give IOTA a better understanding of whether it is a short or long position. Leading brokers such as eToro and Plus500 have risk management capabilities including stop-loss and earning profits.

Buy or speculate on the price of MIOTA?

It’s up to you. Buying IOTA coins actually means becoming the owner of the ticket, and it’s best to use a cryptocurrency exchange for this. On the other hand, trading is primarily a financial instrument such as CFD, which involves speculation on price, and a trading platform or broker is more suitable.

5 Steps to buying IOTA with eToro now Buying cryptocurrency CFDs with capital.com is easy. Please follow these steps:

- Register for free with capital.com by entering your details in the required fields.

- Fill out the form. This is useful information for you and capital.com.

- Click “Deposit” and you will be asked how to deposit your account.

- Choose your preferred payment method and follow the simple instructions to connect your payment.

- Enter the amount you want to deposit, and you’re done!

Exit your trade

To minimize the risk, you should always define a stop-loss and bring a profit, so that work can be automatically closed when a certain limit is reached. It can help manage risk and control trading issues.

These limits are designed to maximize profits and minimize losses. You are still in control of the transaction, and if you think you want to close the situation before a set limit, you can. For example, if you think that MIOTA’s public transaction has generated enough revenue, and you think that leaving it public could put the transaction at greater risk, you can close the situation and prepare your money.

Trade more than 100 different cryptocurrencies CFDs on professional platforms:

(Risk warning: 75% of retail CFD accounts lose money)

How to buy MIOTA on the crypto exchange

If you want to keep your MIOTA tokens for a long time, we recommend using a cryptocurrency exchange instead of a broker. As mentioned earlier, this buying method is for traders who want to show their support for the blockchain by playing long-term investment games or sticking to the original currency. Whatever the reason, you need to choose your switches carefully to get the best deal.

Just as you consider various factors when choosing a broker, you need to consider several factors before choosing a cryptocurrency exchange. This may include compliance, reputation, transaction costs, platform usability, reliability, security, and customer support. While some cryptocurrency exchanges are incompatible and may seem promising, they make investments even more vulnerable.

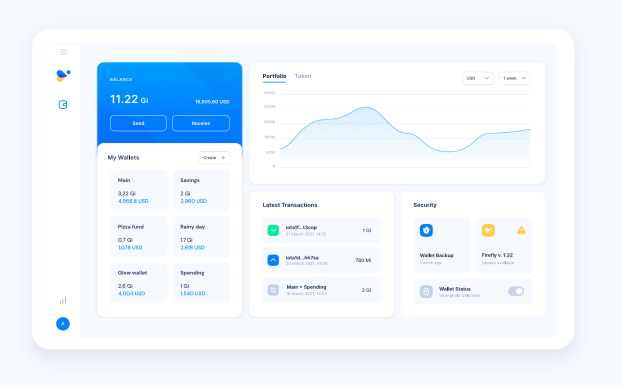

Configure your MIOTA wallet

You can’t go out and buy MIOTA, especially if you want to keep it for a while. Special software (mobile or desktop) or cold wallet is required to protect IOTA coins. It may sound cumbersome, but it’s a fairly straightforward process in most cases. Depending on your investment strategy, you can choose from different types of cryptocurrencies, such as:

- Exchange/web wallets are the cheapest wallets, but they do not provide the best security when storing MIOTAs for long periods of time. Some cryptocurrency exchanges offer additional security measures, but they still cannot match the security of custom wallets.

- Desktop / Mobile Wallet: You can get a desktop or mobile wallet on any platform including Windows, macOS, Android, and iOS. They provide MIOTA Coin with many convenient features and adequate security.

- Hardware wallets (also known as cold wallets) are the best solution for storing IOTA tokens. It contains hardware to protect cryptocurrencies and is completely isolated from all networks to limit vulnerabilities. These wallets often look like flash drives for secure storage and portability.

By the way:

In addition to storing cryptocurrencies in your wallet, you should also pay attention to the security of IOTA tokens. Make sure there are no security breaches that could allow unauthorized access to your IOTA ticket using two-factor authentication and a password.

Keep your MIOTA safe in your wallet

Again, if two-factor authentication is enabled, you must enter the verification code before performing the transfer transaction. This can add an extra step, but it keeps your money safe. You may also need to note that some exchanges, such as Binance, do not allow you to send MIOTA tickets to your wallet or elsewhere until 24 hours after purchase.

If you’ve purchased IOTA tickets for a few days, it’s a good idea to keep them in your exchange wallet, as you can save on withdrawal fees. However, if you want to keep IOTA tickets for a long time, they need to be transferred to special software or cold wallet for better security. You need to enter the public key in the recipient’s address field and specify the amount to be transferred to the wallet.

Select and sign up for the MIOTA sales exchange

When it comes to cryptocurrency exchanges, there are many popular players on the market including Coinmama, Coinbase, Binance, CEX.io, and more. Here you can buy and sell not only MIOTA, but also various cryptocurrencies. Evaluate the pros and cons of each before making a choice.

You need to make sure you’re calling correctly, taking into account various factors such as transaction fees, deposit/withdrawal fees, customer service, usability, reliability, compliance, etc.

Trade more than 100 different cryptocurrencies CFDs on professional platforms:

(Risk warning: 75% of retail CFD accounts lose money)

3 Tips for Buying MIOTA

By this time, you should have understood the basics of buying MIOTA and how you can buy it in different ways for different purposes. We will give you some helpful and informative information.

- Choose the right time and do your own MIOTA research: Don’t rely on rumors or simple sources of information. Read other articles from other analysts to determine the price movement. This gives you more opportunities to develop a successful trading strategy.

- MIOTA purchase cost comparison: New investors are often wary of learning to price and commissioning structures, ultimately eroding their profits. Always compare the costs of different exchanges and brokers, including fees, spreads, transaction fees and deposit/withdrawal fees.

- Security measures to put in place when purchasing IOTA: Investors are responsible for keeping IOTA tickets secure. Have the best wallet and minimize your risk with a wide portfolio. Do not disable features such as two-factor authentication and password protection.

Long and short investment

Long-term investments are made when the investor really believes in the project and what the developers are doing. They stick to IOTA tickets because they believe the price will continue to rise in the long run. Cryptocurrency exchanges are best suited for this type of investment.

Short-term investments are made only by traders who want to make quick returns using market volatility. They are not interested in the long-term outlook for the currency. For these consumers, a reputable regulated broker is the perfect choice.

What is the IOTA purchase fee?

There are a few fees you need to take in account when trading IOTA. Please be aware that fees are always charged, but they can differ between brokers or crypto exchanges. Especially, deposit and withdrawal fees depend on the conditions of the broker or cryptocurrency exchange itself. Please take a look at the fees that are charged:

- Transaction Fee: Even if there is no transaction fee on the IOTA network, a fee will be charged for purchases on the stock exchange. The amount varies by exchange.

- Deposit Fee: Some exchanges charge a fee every time you deposit on the platform, regardless of money or payment method. It may be constant or subject to change depending on the type of deposit source.

- Withdrawal Fee: In addition to the transaction fee, you pay a percentage when you withdraw IOTA coins from an exchange to a coin wallet or other exchange.

- Spreads and Fees: Fees are common on trading platforms. The spread is the difference between the buy price and the selling price. It is smaller on the stock exchange and significantly different on the trading platform.

Please note:

It should be remembered that commission should not be the only criterion for choosing the right exchange. Platforms with low deposit fees reward the same as high transaction or withdrawal fees and vice versa.

Trade more than 100 different cryptocurrencies CFDs on professional platforms:

(Risk warning: 75% of retail CFD accounts lose money)

Strength and weakness

Like all the great things in life, IOTA has strengths and weaknesses. Here is a summary of some of the biggest pros and cons:

- Own its technology: Most cryptocurrency networks rely on other blockchain platforms. So, in order to complete the transaction on the network, you have to pay the user’s fee. However, the IOTA network uses its own Tangle transaction technology. This enables free P2P transactions.

- No mining: Mining has three main effects on one coin. First, the power required to break blocks can make the currency environmentally unsustainable. Second, the transaction fee is increased, and miner fees are included. Finally, unlimited mining leads to a devaluation of the currency. IOTA developers avoided all of this by cutting out all coins before launching the network.

- Scalability: The IOTA network is highly scalable. The higher the number of users, the more transactions can be seen by the system because each user has to check two transactions for each transaction.

However, critics say that the technology is untested. The main argument for the profitability of the IOTA network is a new technology, Tangle. Most experts and experts have written about this. True, but this is not a convincing reason to challenge cryptocurrency. Bitcoin and Ethereum also suffered technical difficulties.

Summary: The Wrap up

Once invested, external factors can come into play. While Iota is making every effort to increase its recognition as a common currency for the Internet of Things, the cryptocurrency market can still negatively impact prices. Exchanges may be hacked, bitcoin whales may decide to sell, or large ICOs like EOS may fail. The global economy can go into recession as it did in 1929 or 2009, and everyone can decide to sell everything everywhere.

Trade more than 100 different cryptocurrencies CFDs on professional platforms:

(Risk warning: 75% of retail CFD accounts lose money)

FAQ – The most asked questions about IOTA :

What is IOTA?

IOTA is a platform based on smart contract technology created for handling payments of physical devices that are in connection to the internet. They are also used for other transactions other than handling payments. The transactions on the platform take place through MIOTA, a cryptocurrency token.

Is IOTA future proof?

IOTA is a smart contract technology platform that has given a new definition to distributed ledger companies, and people consider it a safe investment in terms of the long term. It has the potential to reach higher ground and become a reputed name in the market. But it is important to do your own research before investing your money in any sort of trade and not rely only on speculations.

What blockchain is IOTA on?

IOTA does not use any blockchain; instead, it had a vision of operating on a different kind of blockchain technology, and thus, it created its own node system known as Tangle. It operates with MIOTA, which is the cryptocurrency used by IOTA.

Is IOTA worth buying?

According to many crypto experts, they estimate that the average price of MIOTA, the cryptocurrency on which IOTA operates, will go around 1.86 dollars, and it has the probability to reach 2.13 dollars towards the year 2027.

See our other blog posts:

Last Updated on November 11, 2023 by Andre Witzel

(5 / 5)

(5 / 5)