How to withdraw money from a broker? – Tutorial

Table of Contents

The reason one engages in trading is to earn money. After all, it is an investment that has helped many people make a fortune.

All you have to do is ensure that trades are successful in earning a profit. However, earning isn’t enough because you can’t use the money until you withdraw it. Unlike with a bank account, withdrawing funds from an online broker trading account involves extra steps. Fortunately, the additional steps do not complicate the process of withdrawing money.

Do you know how to withdraw money from a broker upon making a profit? If not, this article is a must-read.

So, without much ado, let’s look at this tutorial to learn and understand how to go about it. Read on!

How to withdraw money from a broker?

Moving money from an online broker trading account is easier than many people imagine it. In fact, the entire process gets completed electronically in no time. Almost all brokerage firms follow the same steps, but they can vary slightly.

Here’s how you can transfer funds from your broker account to your bank account:

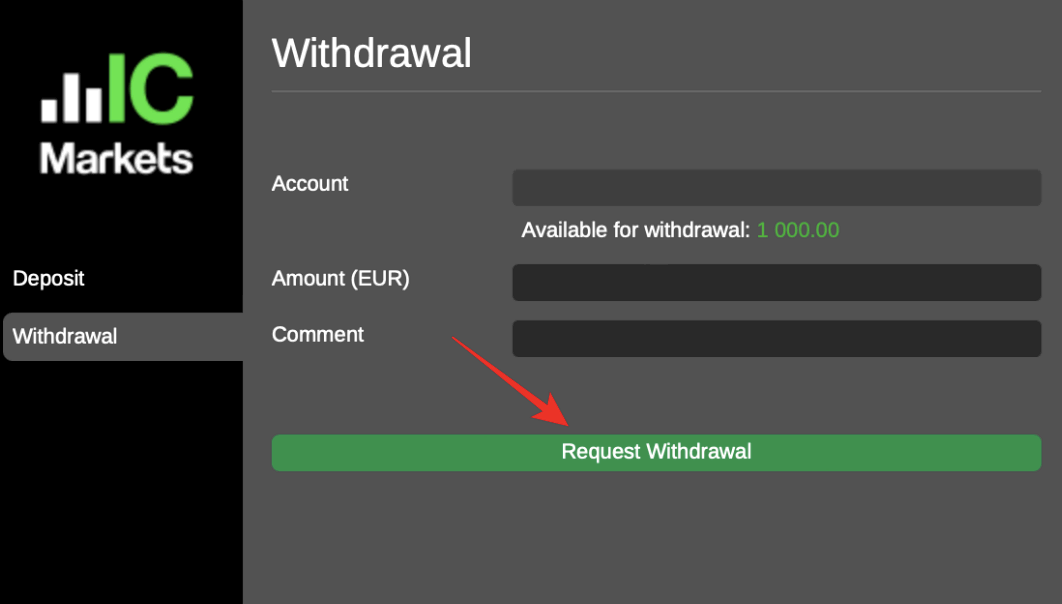

- Login to your trading account from where you want to withdraw the money

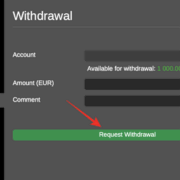

- Go to the transfer page and select the section that says funds or accounts

- Following this, you will have two choices, i.e., withdraw funds or add funds

- Click on Withdraw funds and choose the amount you wish to transfer to your bank account

Most brokers don’t charge a fee when you withdraw money. But the third-party method used during the process can charge a small amount. You can also see the total balance in your trading account.

If you want to withdraw money from a broker, consider the following methods:

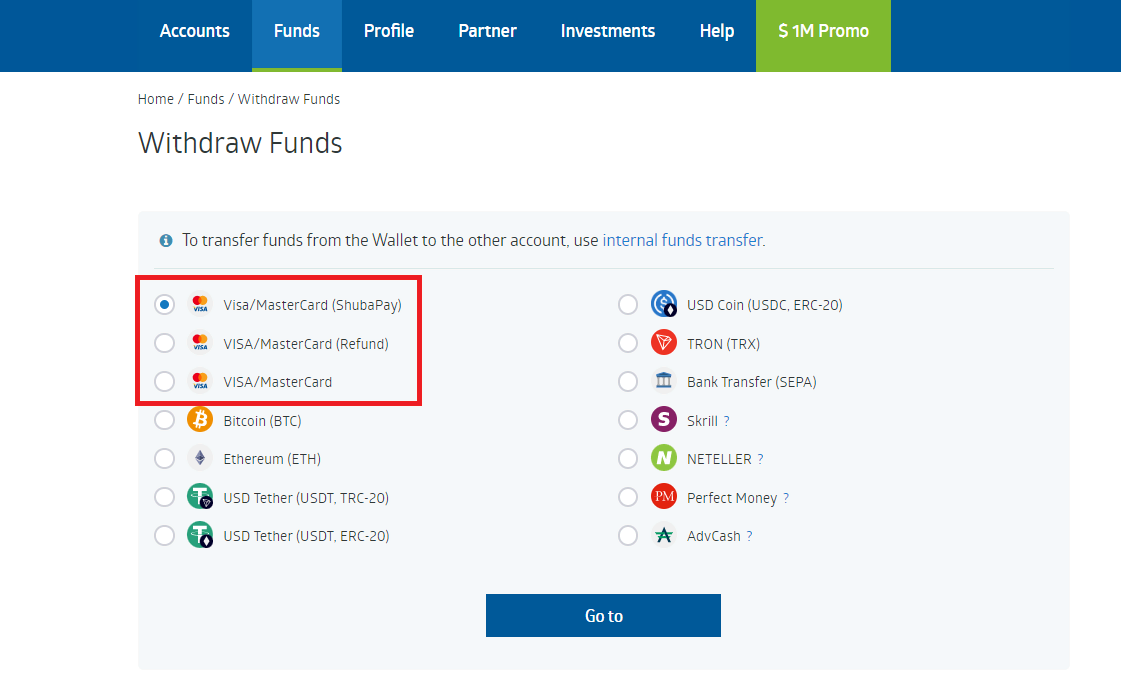

- Bank Transfers

- Card Payments

- Electronic Wallets

- Cryptocurrency

Bank Transfers

Regarding common withdrawals, this method tops the list thanks to its simplicity. After all, the process only requires you to enter your banking details correctly to receive your dues.

Equally important, most brokers accept bank transfers when making withdrawals. For this method, you don’t have to worry about fees or commissions on the broker’s side.

It is fast and hence suitable for making withdrawals when time is of the essence. Its convenience is also indisputable since you can withdraw your money anytime, anywhere.

Card Payments

Cards, both debit and credit, are also a common withdrawal method among trading brokers. It is highly acceptable by almost every brokerage firm.

It also makes it easy to use the money you withdraw. The convenience is impressive, and you don’t have to wait long to receive your funds after a withdrawal.

Electronic Wallets

Carrying several cards is no longer necessary because electronic wallets can integrate them excellently. Common options include Skrill and Neteller.

They are convenient and fast payment methods you should consider when withdrawing your trading profits. Besides, they are easy to use.

Cryptocurrency

You should also take a look at a new payment method when withdrawing money from a broker. Its privacy is excellent, and so is its security.

Don’t worry about availability because most brokers will provide this option. Cryptos include Ethereum, Bitcoin, Bitcoin Cash, and Dogecoin.

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 67% of retail CFD accounts lose money)

What to consider when withdrawing money from a broker?

When withdrawing money from a broker, it is crucial to consider the following points since they will affect the speed and your investment returns:

- Time delay for closing trades

- Time delay for cash withdrawal

- Fees

- The consequences regarding margin calls

- Taxes

Time delay for closing trades

The mere fact that your trading account shows that your trade is successful and has earned a profit doesn’t mean you can withdraw the money immediately. It sounds odd and unfair, but that’s how it is.

It is because as instant as updates regarding buying, selling, new positions, and balance seem, that’s not how it goes in real life. The behind-the-scenes is far from how it looks from your end.

For instance, brokers work with other financial organizations to facilitate trade and everything else around it. As a rule, a broker has up to 2 business days to conclude a trade.

Under such circumstances, you may have to wait 2 days for the funds to be available for withdrawal. In some cases, including holidays and weekends, the wait can even be longer.

Time delay for cash withdrawal

Whereas some withdrawal methods are instant, others take time for transactions to complete. Therefore, always factor in such time delays for cash withdrawal.

If you want to withdraw funds within a short period, ensure that you choose methods that facilitate that. Always check the details your brokerage firm avails regarding how long you should wait for a complete withdrawal transaction.

Fees

Equally important, don’t overlook the fees you will pay for a withdrawal. Some don’t charge anything; others ask for little, whereas the rest demand much.

Remember to factor in all the applicable fees to avoid expecting more than what hits your bank account eventually. One can’t also insist enough on how important it is to look for brokers with reasonable prices.

The consequences regarding margin calls

Has your broker set the minimum account balance you should have in your trading account at all times? If so, ensure that you adhere to it to avoid the dire consequences of margin calls.

After all, any account below that minimum will attract a fee. That’s money you would have used in other ways, and since it is avoidable, strive not to incur unnecessary costs.

Therefore, ensure that your trading account doesn’t go below that figure when making withdrawals.

Taxes

Lastly, withdrawals are subject to taxes, and trading ones aren’t an exception. So, don’t be surprised if what you withdrew doesn’t correspond with what you were expecting.

The best brokers for traders in our comparisons – get professional trading conditions with a regulated broker:

Broker: | Review: | Advantages: | Free account: |

|---|---|---|---|

1. Capital.com  | # Spreads from 0.0 pips # No commissions # Best platform for beginners # No hidden fees # More than 3,000+ markets | Live account from $ 20: (Risk warning: 67% of retail CFD accounts lose money) | |

2. RoboForex  | # High leverage up to 1:2000 # Free bonus # ECN accounts # MT4/MT5 # Crypto deposit/withdrawal | Live account from $ 10 (Risk warning: Your capital can be at risk) | |

3. Vantage Markets  | # High leverage up to 1:500 # High liquidity # No requotes # MT4/MT5 # Spreads from 0.0 pips | Live account from $ 200 (Risk warning: Your capital can be at risk) |

Challenges while withdrawing funds

While withdrawing funds from your online broker trading account, you can encounter certain challenges:

- You don’t have enough information

- You are withdrawing using a different card

- Is your broker fraud?

You don’t have enough information

Before you sign up with a trading account, read their criteria for withdrawing money. The best trading platform would require you to submit a lot of details before you can transfer money.

Trading brokers do this because they have KYC policies requiring you to submit all your data. The broker will recognize the false information if anyone tries to get unauthorized access to your account.

Compared to the details you provide during sign-up, you would have to enter even more details while withdrawing your first fund. It decreases the chances of your funds getting stolen.

You are withdrawing using a different card

Online broker trading account requires traders to deposit and withdraw money using the same card to prevent money laundering.

Thus, if you are withdrawing money from your trading account for the first time, try to use the same card to avoid complications. If you don’t have access to the card you used to deposit money, you cannot withdraw it.

This policy has helped brokers to prevent many cases of money laundering. That’s why traders trust these trading brokers more than others.

Is your broker fraud?

As the number of fake brokers has increased, there is a high risk that you might be working with a con trading broker. If this is the case, you might face trouble withdrawing the money.

Shady online trading brokers use different methods to prevent traders from withdrawing their money. For instance, they might place strict restrictions on withdrawal during certain situations. Or they can ask you to make a certain profit on your trades.

So, check your details if you are facing an issue while withdrawing money. If it’s correct, check whether or not your withdrawal method is similar to deposit money.

Or it’s also possible that your trading broker is unreliable and it doesn’t want you to withdraw money.

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 67% of retail CFD accounts lose money)

5 best brokers with easy withdrawal

Consider the following trading brokers if you want your withdrawals to be straightforward, fast, and cheap:

- Pocket Option

- Nadex

- CX Markets

- IQ Option

- Quotex

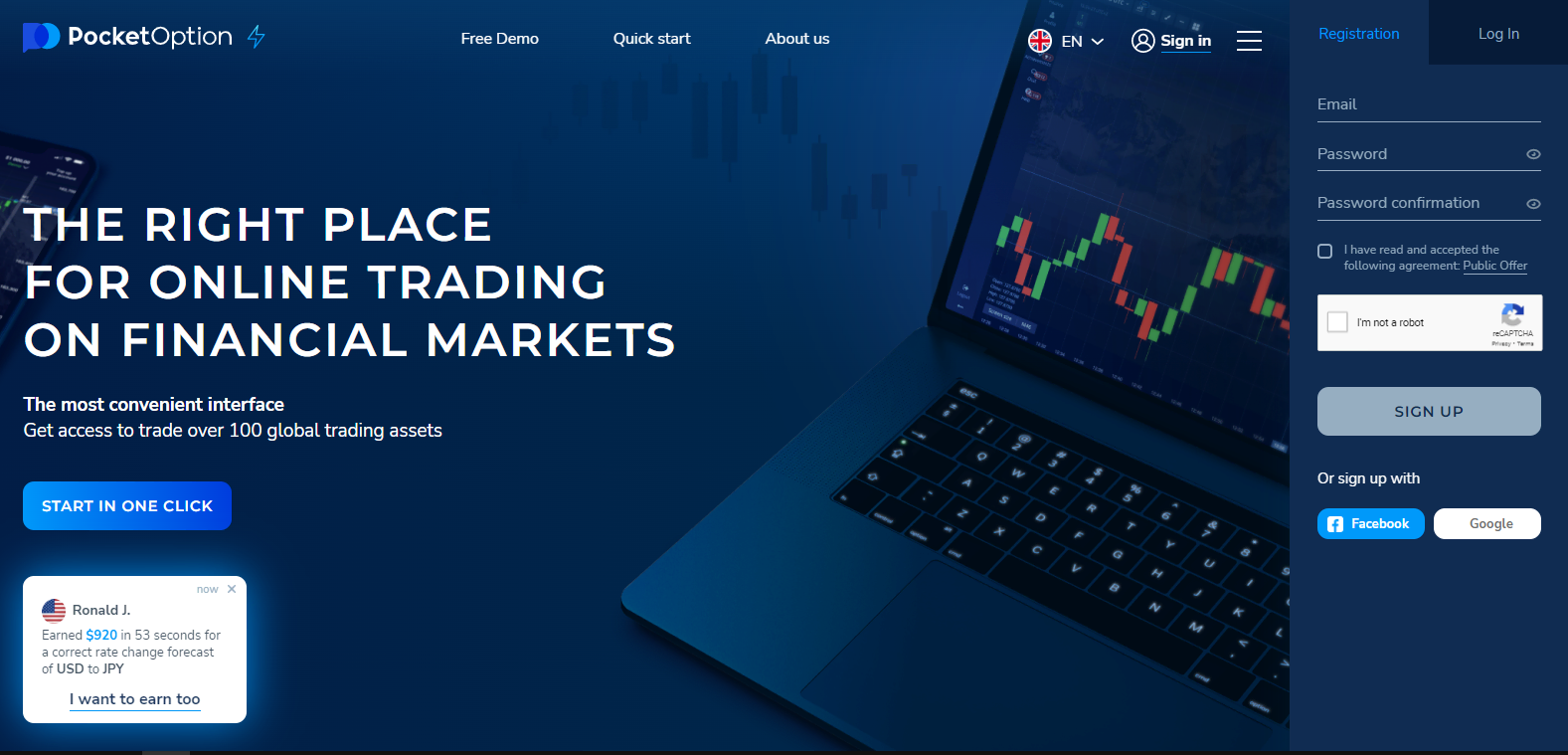

1. Pocket Option

If you need an innovative trading platform, consider Pocket Option since it is an excellent choice. It allows you to trade various underlying assets, including commodities, options, indices, stocks, forex, and cryptocurrencies.

One of the reasons why beginners appreciate it is the minimum trade amount of $1. It allows these newbies to trade and earn experience without risking much money.

It also has a demo account to help traders gain experience without risking a penny. You can use it across common operating systems, including Windows, Android, and iOS.

Despite minimal requirements, its payout rates are high. Traders can access various powerful technical analysis tools for successful trading.

The withdrawal is reasonable because you can withdraw as little as $10. Available methods include cryptos, electronic payments, debit cards, and credit cards.

Features:

- Its knowledge base is relevant and comprehensive

- Your payouts can reach 218%

- It has various trading signals and indicators

- Traders also enjoy several varying trading instruments

- Simple payment processing

2. Nadex

First of all, Nadex stands for Northern American Derivatives Exchange. Despite its name and being based in the US, its services are available in other countries.

Equally important, the Commodity Futures Trading Commission (CFTC) has approved it. It is best known for binary options, knock-outs, and call spreads.

Traders can access various markets, including events, indices, commodities, and forex. Its proprietary software allows traders to place orders directly.

Expect it to be easy to use with filters that enhance the experience further. Beginners can access a demo account to help them master the art of trading.

Features:

- You can use your mobile phone or desktop to trade

- Its reward and risk contracts are predefined

- It is possible to exit trades early, thus minimizing losses

- Ease of use

- It avails diverse technical analysis tools to traders

3. CX Markets

If you are a US trader, don’t hesitate to consider CX Markets. Its choices include precious metals, forex, weather forecasts, and binary options.

It falls under the regulation of the CFTC. One must admit that it is quite cost-effective since there is no fee for withdrawing funds, making deposits, or opening an account with the broker.

However, an inactive account will cost you a brokerage fee. The minimum trade amount is low and thus affordable even for beginners.

As a newbie, you can always seek help from the experienced traders that the platform puts at your disposal. Alternatively, you can check the video tutorials and how-to guides, among other educational resources available in its rich library.

Features:

- It is a platform suitable for experts and novices alike

- Its commissions and fees are relatively low

- The customer support is impressive

- It operates under the regulation of the CFTC

4. IQ Option

The broker IQ Option is also an excellent option for trading cryptocurrencies, forex, stocks, commodities, ETFs, and binary options.

Can you imagine having more than 300 financial instruments to choose from to trade? That’s something that perfectly describes the situation when using IQ Option.

The minimum deposit is affordable to many traders, including beginners, because it is as low as $10. The payout rate is also high, ranging around 100% for binary options.

However, the rate can go as high as 900% when trading digital options. You can trade with as low as $1, thus risking little.

On the other hand, if you want to risk more, the maximum limit is $20,000. The icing on the cake is a fast withdrawal since it takes 1 to 3 business days to complete such transactions.

Its features are available to all its traders regardless of your trading volume or frequency. There is also a demo account to ensure you don’t risk much, especially if you lack the necessary experience.

Features:

- Over 300 financial deposits

- Withdrawals take between 1 and 3 business days

- The broker puts various assets at your disposal

- You can deposit as little as $10

- You also enjoy a demo account worth $10000

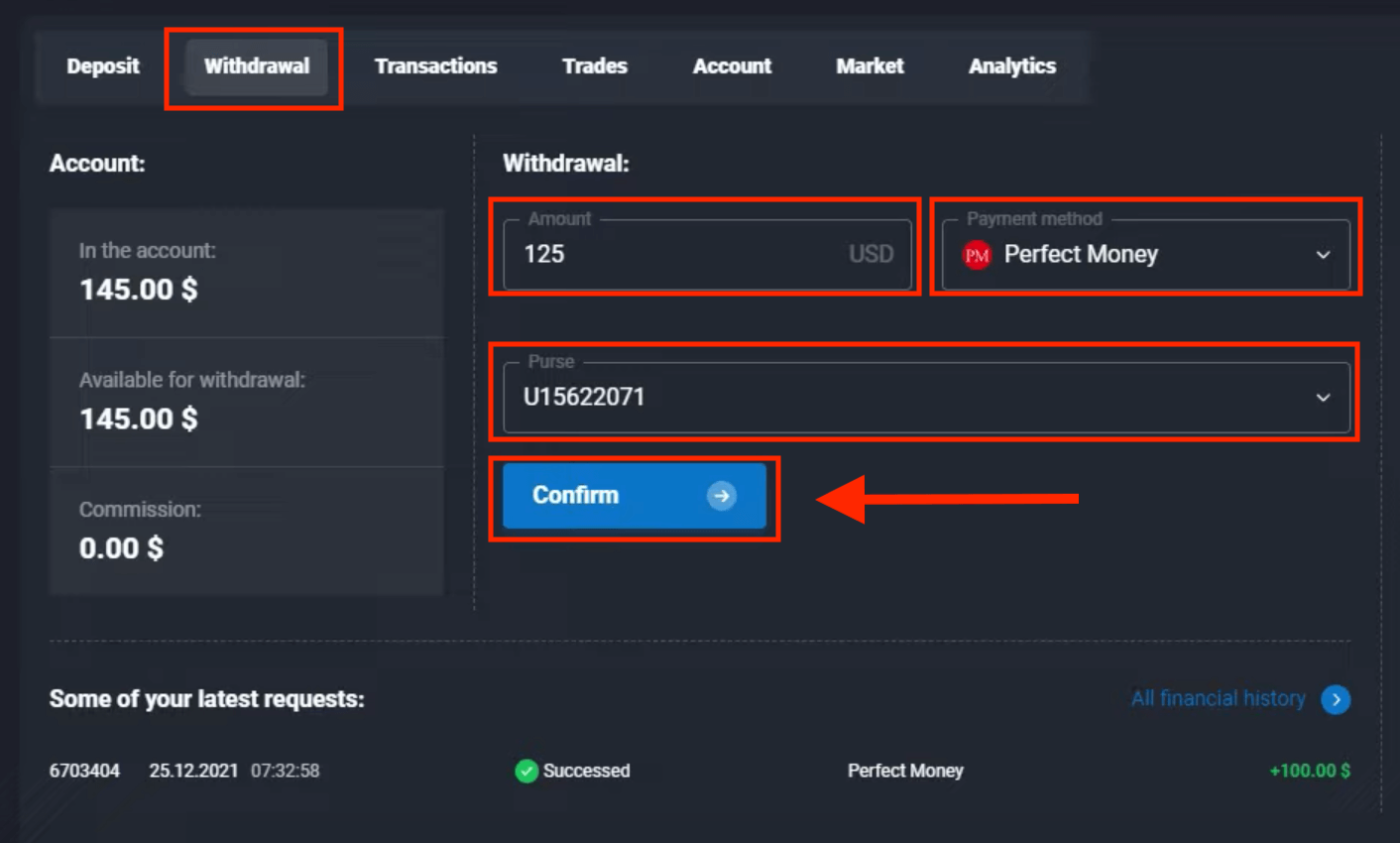

5. Quotex

Quotex is a broker that makes it easy for traders to withdraw their proceeds. They promote a variety of trades, including indices, stocks, commodities, and forex.

It has a demo account that helps novices gain trading experience without risking money. Its withdrawal methods include Perfect Money, cards, and cryptocurrencies. The payout rates are also high, thus increasing your chances of making a fortune.

The minimum deposit or withdrawal amount is $10. However, it is $50 when using Bitcoin and Ether.

The broker won’t charge you anything for withdrawal or deposit. It is also available on smartphones for convenience.

Features:

- The deposit minimum limit is low; thus, affordable

- Its payout rates are high

- You won’t incur any trading fees

- It supports several payment methods for withdrawals and deposits

- Beginners have the demo account option

Conclusion about how to withdraw money from a broker

Withdrawing money from a broker is important. After all, it allows you to enjoy the fruits of your hard work after trading successfully.

Traders have many methods to consider during withdrawals. They include bank transfers, cryptocurrency, electronic wallets, and card payments. One is free to choose the method that works best for them.

It is worth noting that withdrawals are hardly instant. That’s attributed to the need for time to process trades and withdrawal transactions.

Other factors, such as fees and taxes, explain the difference between what you earn and what reaches your account. As you withdraw, avoid margin calls due to its dire consequences, such as additional costs.

Lastly, consider the above recommendations for a great withdrawal experience when trading.

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 67% of retail CFD accounts lose money)

Last Updated on June 4, 2023 by Yuriy Kunets

(5 / 5)

(5 / 5)