How to withdraw money on Exness? – A detailed withdrawal tutorial

Table of Contents

Exness is the biggest brand nowadays in the global brokerage firm that delivers their services from main offices to users in Seychelles and Cyprus Broker. This service is designed for people to give them freedom for financial services and investment solutions.

Moreover, this offers vast opportunities to both retail and corporate businesses. It is an EU-based company in Cyprus that gives fully-regulated services to members within the EEA and the World.

Besides, the broker has also expanded their global reach and established the UK-based fully-regulated company. Moreover, Exness has won numerous awards as a retail broker as they offer reliable and most stable services with a comfortable trading environment.

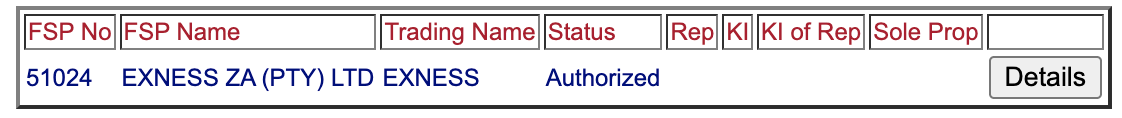

Many people believe that Exness is a scam, but it is not. It operates by the relevant country’s legal requirements authorized by FSCA South Africa, providing low-risk forex and CFDs.

What is Exness?

Exness is a trustworthy platform and worthwhile broker that is very competitive in its trading fees. However, the spread is low and offers first-time traders a sign-up bonus.

Besides, it currently maintains the brokerage offices in the three various locations to represent the three different entities such as Cyprus, the UK, and Seychelles. While researching over the internet in South Africa, we found it was established in 2008.

It is one of the fastest ZAR account brokers and also the fastest-growing broker in Africa. More than that, it provides brokerage services that are reliable and stable and deliver a comfortable trading environment to everyone.

Exness provides traders with tight spreads as low as 0.1 pips, and there are no hidden commission fees to be concerned about at all. It also provides customer assistance and is available in 13 different languages, ensuring that you are always up to speed with the latest financial news.

Moreover, Exness is very competitive in trading fees and spreads. So, if you are willing to get started with Exness or already using it, then following the Exness withdrawal guide will help you understand the terms of doing it safely.

Pros and cons of Exness

Pros

- Come with tight spreads and give minimum balances plus reduce financial commitment.

- Include various accounts such as classic, Mini, ECN, and Islamic.

- It is regulated and complains with regulators like FCA, CySEC, etc.

- It provides strong financial instruments with more than 120 forex pairs.

Cons

- It might include smaller numbers of financial instruments than the brokers.

- It might give leverage to European clients.

Hopefully, now you know what Exness is and how it can benefit you. Now, let us move further and know how to withdraw Money on Exness.

How to withdraw money on Exness?

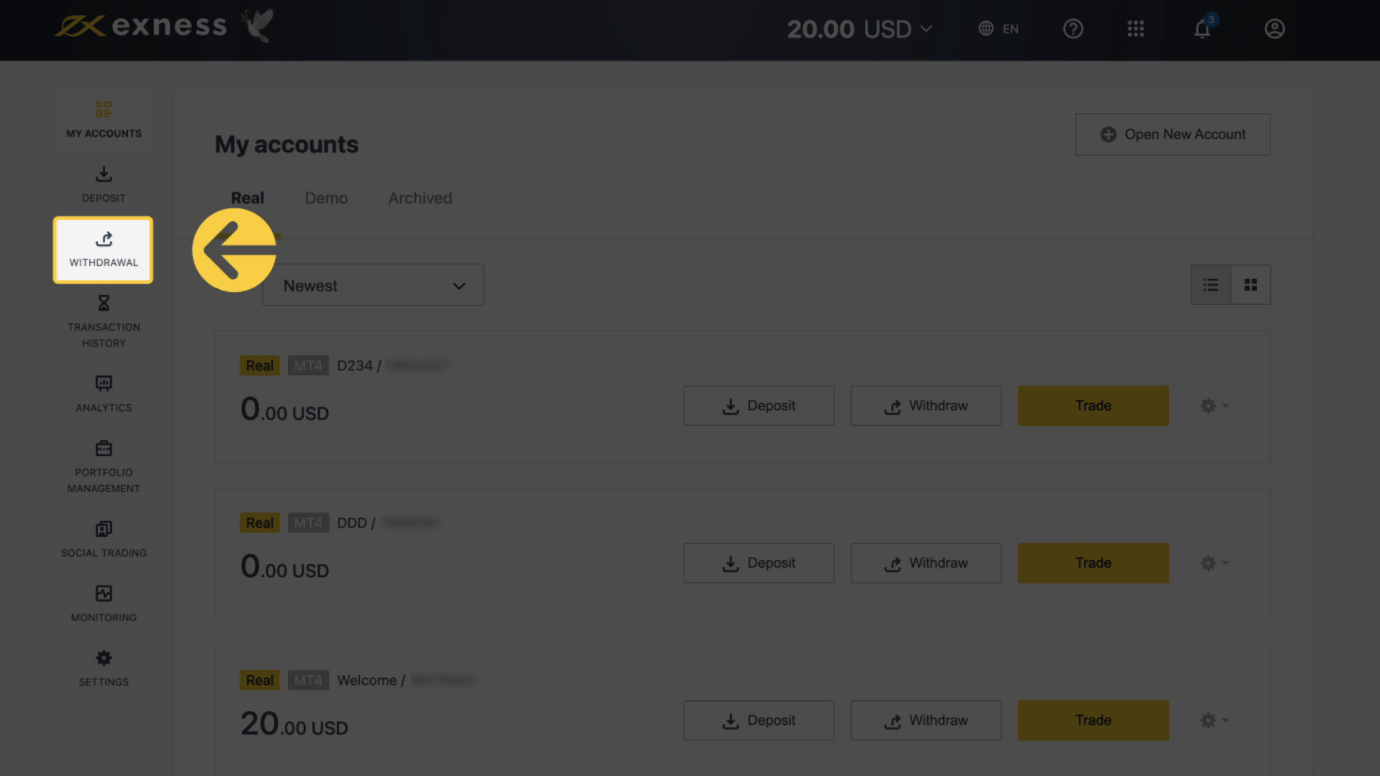

When using an Exness account, withdrawal is much simpler than Deposit.

- Log into your Exness account, Exness personal area on your home page.

- Choose the withdrawal option from the homepage section.

- Choose the payment method you want to use.

- Next, the pop-up menu appears, and choose the account you want to withdraw from.

- Select the currency for the payment system.

- Enter the payment system account details.

- Next, enter the amount you need to withdraw and tap on the Next button.

- Check the withdrawal details and enter the OTP code to confirm the transaction.

- Then confirm the withdrawal.

The above-mentioned withdrawal process is easy, like depositing in the Exness bank. Be careful while performing the steps, as one mistake can give you trouble.

Another thing you need to keep in mind is that one can withdraw funds only through the payment system you have used for the Deposit. Since some payment providers might request you to set up the profile first, you withdraw through them.

Thus, it might need extra steps to perform, such as adding credentials and more. If you’re having trouble withdrawing or depositing the amount in Exness, then calling customer support can be the best option.

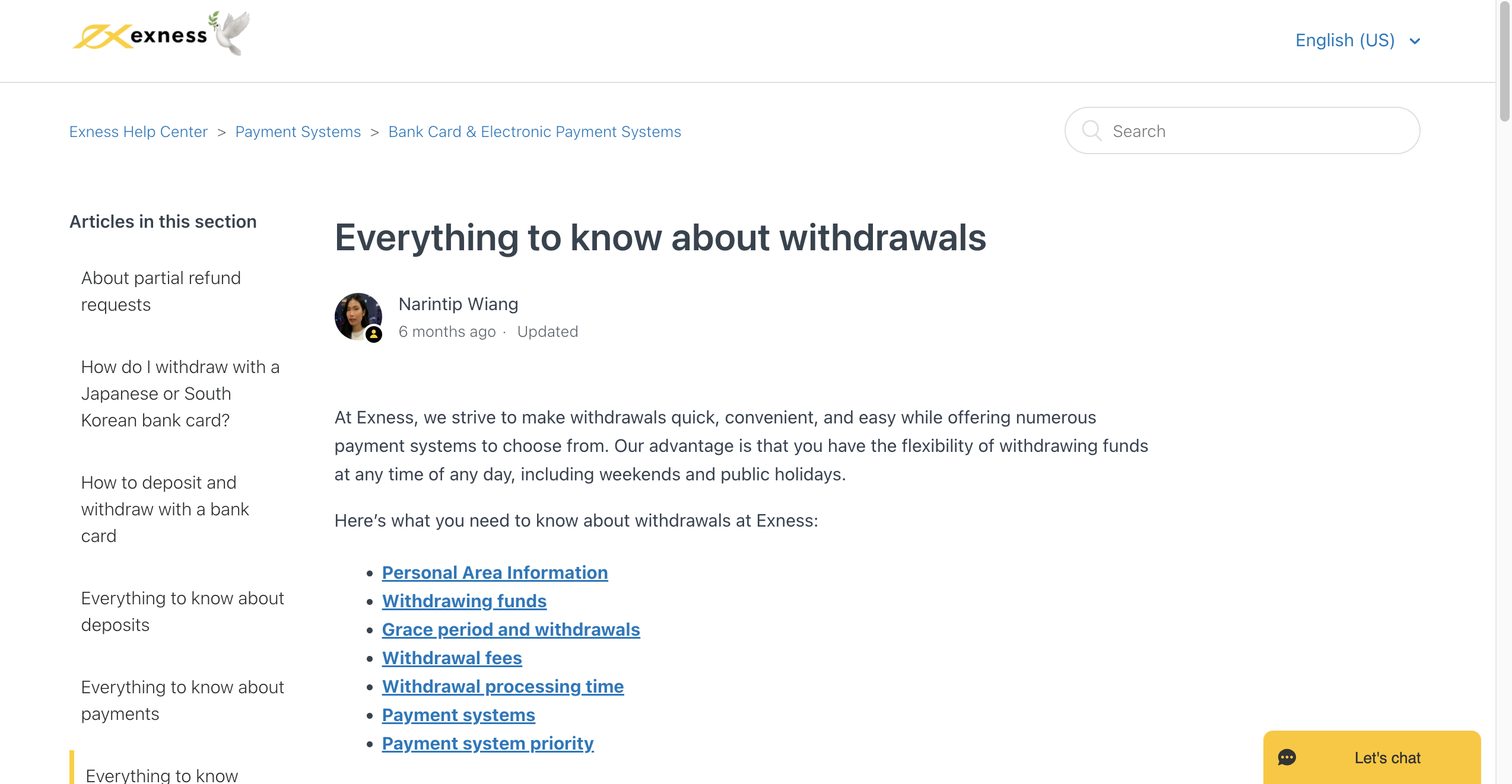

Exness payment methods – Everything you need to know!

At Exness, you will be enriched with several payment methods to easily transact the money they want. It prompts the transaction processing time and gives you good results. However, before using Payment methods, one must be aware of the general rules of payments set by Exness.

Rules for Exness payments

- Here the term instant is easily understood as it indicates the transaction is carried faster without manual processing from the financial expert.

- The funds are withdrawn into the registered Exness account holder’s personal bank account. It is done to protect financial security and avoid money cleaning.

- The company will not accept direct payments or payments to third parties; nevertheless, all essential information is available from an Exness account holder area while completing a transaction. However, payments to third parties will not be accepted by the company.

- Regardless of the time, deposits and withdrawals are possible. If not processed immediately, it will take up to 24 hours to process a deposit or withdrawal.

- If the payment system causes delays in processing deposits and withdrawals, the firm will not be accountable for any delays.

- A withdrawal must be made using the same payment system, account, and currency as was used to make the deposit for it to be successful. Whenever a trading account is funded by a single payment system or by numerous wallets within the same payment system, money is withdrawn in the same ratio as entered into the account.

- It is the company’s right to vary the processing time for deposits and withdrawals at any moment and without prior notice.

- Clients from specific countries may be denied access to particular payment systems if the corporation so chooses.

- Any withdrawal request coming from a trading account with no trading activity may be investigated, canceled, and/or subjected to fees/charges (based on payment method) by the firm.

- When a pattern of deposits and withdrawals occurs on a trading account with no trading activity, the software may refuse a withdrawal action. According to our General Business Terms, this is a precaution to guarantee that trading accounts are utilized correctly. If this happens to you, please contact customer support for more help.

Payment methods available on Exness

Exness provides several payment methods such as:

- Internet banking

- Bank card

- Neteller

- WebMoney

- Skrill

- Perfect Money

- Tether

- Mybux

Let’s dive a little deeper and know how to access these payment methods on Exness. Let’s start!

How to withdrawal with Internet banking on Exness?

With the trend in the digital era, multiple payment methods are introduced in internet banking is one of the best payment methods to get faster transactions. Here’s how you can make the payment via internet banking.

- Go to the main screen of your Exness account and select Deposit from the drop-down menu on the left-hand side of the window. Then select the appropriate payment option, which is online banking.

- Once you’ve decided on a payment option, you’ll need to put money into your account. As a result, click on the deposit option and enter the amount you wish to deposit. Remember to double-check the amount information and click on the “Confirm Payment” button.

- The next step is to select a financial institution that offers internet banking services. You have a choice of any.

- Following your selection of the internet banking method, you will need to finish the payment procedure.

- You will need to complete the request access by the bank for the procedure to be completed. Ensure you are accessible to finish the step thoroughly since you will be required to enter an OTP to confirm the data and complete the transaction.

How to withdraw with Neteller?

- In the Withdrawal section, select Neteller from the drop-down menu.

- Select the trading account from which you wish to withdraw funds.

- Select the currency in which you wish to withdraw funds, enter the email address associated with your Neteller account, and specify the withdrawal amount in the currency of your trading account.

- Select Next from the drop-down menu.

- Displays summary once the transaction completes.

- Enter the verification code sent to you via email or SMS, depending on the level of security you have set up in your Personal area.

- To confirm your withdrawal, click Confirm withdrawal.

How to withdraw with WebMoney?

- In the withdrawal section, select WebMoney from your personal area.

- Enter your trading account, withdrawal currency, WebMoney account number, and the amount you want to withdraw in your trading currency.

- In addition, you may enable the protection code and choose the number of batch days that you want to run.

- Select Next.

- Displays transaction summary.

- Verify your Personal Area security type by entering the verification code you received through email or SMS.

- Confirm your withdrawal by clicking the Confirm withdrawal button.

How to withdraw with Skrill?

- In your Personal Area, go to the Withdrawal section and pick Skrill.

- Your Skrill email address and the amount you wish to withdraw need to enter to complete the transaction.

- Click the Continue button.

- Verify your Personal Area security type by entering the verification code you received through email or SMS.

- Confirm your payment by clicking the Confirm payment button.

- The procedure will begin.

How to withdraw with perfect money?

- In the Withdrawal section of your Personal Area, select Perfect Money from the drop-down menu.

- Select the trading account from which you wish to withdraw cash, then choose your withdrawal currency, enter your Perfect Money account number, and specify the withdrawal amount in the currency of your trading account (in this case, USD).

- Select next from the drop-down menu.

- Displays summary once the transaction completes.

- Enter the verification code provided to you via email or SMS, depending on the level of protection you have set up in your Personal Area.

- To confirm your withdrawal, click Confirm withdrawal.

- Perfect Money funds will be credited to your Perfect Money account in a matter of minutes.

How to withdraw with Tether?

- Select Tether in the Withdrawal section of your Personal Area.

- Once you’ve chosen your trading account, you’ll need to input your Tether wallet address and the amount you want to withdraw.

- Select Next from the drop-down menu.

- Displays transaction summary on the screen.

- Enter the verification code provided to you via email or SMS, depending on the level of protection you have set up in your Personal Area.

- To confirm your withdrawal, click Confirm Withdrawal.

- Within 72 hours, the funds from your withdrawal will be deposited into your Tether wallet.

How to withdraw with MyBux?

- In the Withdrawal area of your Personal Area, locate the MyBux link.

- Select the trading account from which you wish to withdraw funds, the currency in which you want to withdraw cash, and the quantity of money you want to withdraw.

- Select Next from the drop-down menu.

- Displays transaction summary once the transaction completes.

- Enter the verification code provided to you via email or SMS, depending on the level of protection you have set up in your Personal Area.

- To confirm your withdrawal, click Confirm withdrawal.

- Next, please enter the contact information (email address) (details about your MyBux voucher to the value of the withdrawal amount is sent here).

- Call the phone number- this is the phone number linked to the MyBux voucher for withdrawal.

- When you’re finished, click Confirm.

- After the withdrawal procedure is complete, you will be given a confirmation page.

- Click on this link to continue.

- You may now redeem your MyBux coupon on MyBux.co.za by selecting ‘Cash Out mybux’ from the drop-down menu and following the on-screen instructions.

While performing the steps mentioned above, one must follow the steps carefully since if you see a delay in a transaction, it might be your fault (while performing steps) or there is an issue in the server. You can contact customer support for help.

What is the minimum withdrawal of Exness?

The minimum withdrawal of Exness usually depends on the specific payment method you’re using. You need to check with payment methods and their terms and conditions so you can enjoy the hassle-free banking system. Find the minimum withdrawal as follows:

- Internet banking- $1

- Bank card- $3

- Neteller- $4

- WebMoney – $1

- Skrill- $10

- Perfect money- $2

- Tether- $100

- Mybux- $1,000

What are the fees?

When you make a deposit using one of the electronic payment systems listed above, you will not charge any deposit or withdrawal fees. The sole exception is when you withdraw funds using Skrill, in which case there is no cost if you withdraw more than USD 20, but a commission of USD 1 will be charged if you withdraw less than that amount.

What are withdrawal errors, and how can you fix them?

- You cannot withdraw an amount more than the limit set by Exness. You need to check the terms and conditions to proceed with the withdrawal request.

- You cannot use another bank account rather a personal account for withdrawal. It is a safeguard that gives financial security and prevents money laundering.

For instance, if you’re using internet banking, you can withdraw money to your bank via this. However, if you recharge the amount with Visa/MasterCard, you must use the original visa/MasterCard account.

- The withdrawal process completes 24/7, and in case it is not processed in the given time, then the transaction may process within 24 hours. If it does not happen, then contact customer support.

The bottom line

With the above guide on withdrawing Money on Exness, we hope you have found the best knowledge in your mind. However, if you have queries, then share them with us.

FAQ – The most asked questions about withdraw money on Exness :

How long will it take for my withdrawal to be processed through Exness?

Once the request is sent, whether it is Deposit or withdrawal, it will not process; it will take 24 hours. However, it will depend on your bank too.

Can you tell me how long it takes to get money out of Exness?

With Exness, all withdrawal requests are processed immediately. Once you submit the request, the Exness team sends it to the card processor or bank, and the entire process takes 14 business days to reflect the payment in your bank account.

What is the time required for processing?

When you deposit or withdraw using an electronic payment system, the money is credited to your account immediately. It means that once you finish the transaction, the cash will be credited to your account within a few minutes.

How can I request for Exness withdrawal?

You can check the status of Exness withdrawal by visiting the account. You can get a bunch of all transactions on the account. There is information on withdrawals, deposits, and internal transfers. Go to the personal area and look for all the details you want. For that, go through these steps: log in to your account’s personal area. Then, select the transaction history option. You can get along with all the completed and pending transactions.

How long does Exness withdrawal take?

Well, all the Exness withdrawal takes less time. And the requests get processed in no time. When you fill in the withdrawal request, it will reach the card processors of the company. And the whole thing can take 7 business days. Then, you can see your funds in your bank account.

Can I make an Exness withdrawal of more than my deposit?

No, there is no option to make an Exness withdrawal of more than your deposit. It can happen if you refund your deposit first. If you can’t make a refund, you will have to wait up to 90 days from the date of your deposit. Then, consider making a withdrawal of less than the deposited amount.

See more articles about forex trading:

Last Updated on January 27, 2023 by Arkady Müller