How much does it cost to trade with XTB? – Spreads & fees explained

Table of Contents

The pursuit of getting rich and creating more wealth can overpower all other desires. It is perhaps one of the most encouraging and dangerous desires out there. People can do seemingly impossible things if you motivate them with money.

We can understand that making money is an essential need for everyone. Regardless of some people’s belief that you can survive by reducing your expenses, there are many aspects where only money can play a vital role.

It is not false to say that you don’t require huge money to lead a dignified life. The basic lifestyle can also be a blessing. But for those who want to have a piece of what worldly pleasures feel like, they cannot ignore money and wealth.

Moreover, leading a simple lifestyle does not mean you should stop being ambitious. Irrespective of your life goals, you must explore the ways to multiply your assets. Increasing your wealth does not always mean you should aim to become a billionaire.

It also signifies the importance of financial growth and smart investment decisions. You must learn to manage your finances regardless of your financial position. It should be a quality that everyone must develop to grow in life. Therefore, you must seek a fruitful way to do the same.

Trading is perhaps the most suitable way to enhance your financial capabilities. It allows you to get involved in asset transactions that teach financial growth. It is conceivably one of the oldest elements of human civilizations. Since the people first migrated for survival and living, we have been around.

So, it is a centuries-old process that allows you to trade in various assets now. It was primarily limited to livestock and grocery trading in the olden days. Gradually it grew into tools and weapons, then currencies, and now multiple assets are available to trade.

People realized that exchanging an asset for a better one is the key to survival. As a result of that idea, trading was born. During the olden days, it served the major purpose of survival. But with our progression over the years, we can see that it serves a beyond-basic purpose.

Now, it has the potential to fulfill the desires of getting rich in its wildest forms. Many smart investors who trade passionately have increased their assets and financial value manifolds. Therefore, we must also know that making smart decisions determines excellence in the trading world.

Without a doubt, it can be a terrific tool to enrich one’s financial status. It can open doors to opportunities that enable you to increase your wealth. As mentioned before, we can survive and live peacefully without being rich. But we should never despise the act of making money.

Different people may enter the trading world with various goals in their minds. Their choice of assets and methods may vary, yet the aim will always be to earn more profits. But you should not blindly follow such an aim.

There also exist people who get desperate while searching for a way to become rich. As a result, such misguided persons follow unfruitful shortcuts or lead the illegal path.

However, as a smart person, you must choose trading over other means to increase wealth. There can be no other better way that gives you better returns in profits. Also, it is the most legal way that allows you to reap the profits in the least amount of time.

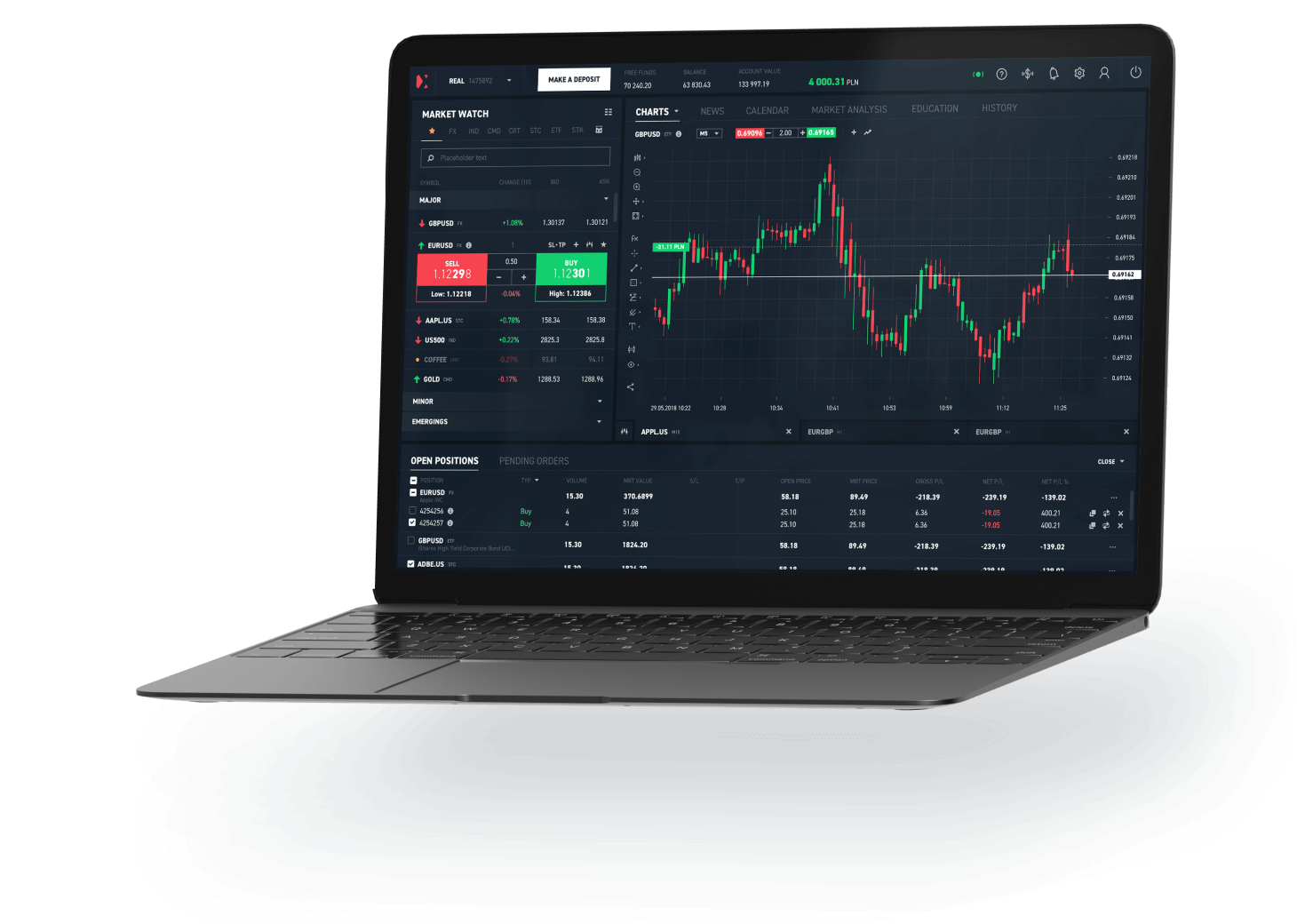

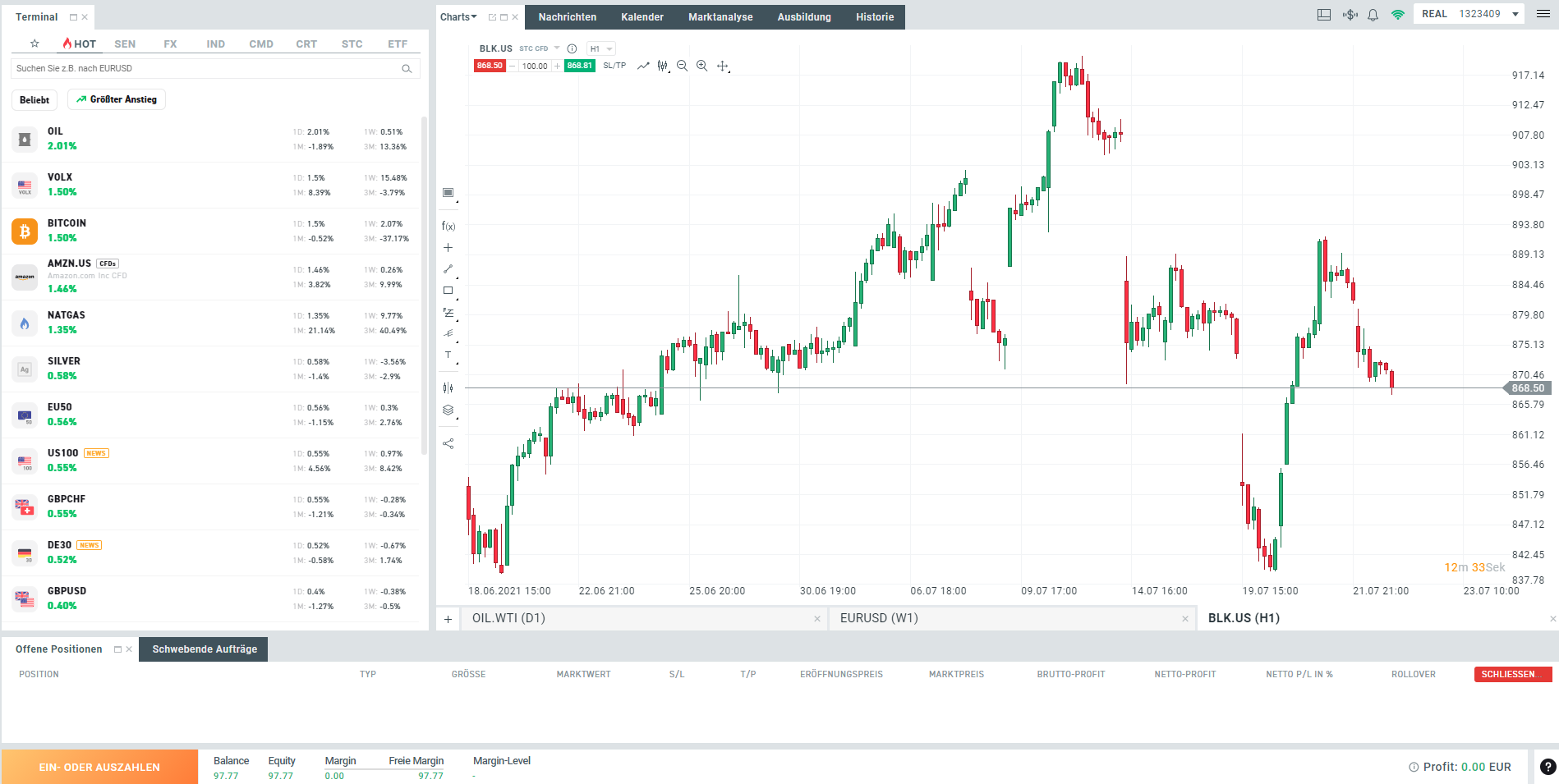

Presently, we can witness an overall online takeover in all domains. Trading is also among them. Now, you can trade in multiple asset classes and markets with just one device and a couple of clicks.

However, being so easy comes with its drawbacks. Since it is so easy to enter online trading, beginners often neglect the importance of gaining prior knowledge. Eventually, they get easily drawn towards the attractive aspects.

Moreover, trading does not require years of training to make the initial trade. As a result, they are at the biggest risk of losing all the funds. Though their luck might save them for a while, it is important to understand the need for a reliable broker in such scenarios.

The role of a broker is immense when it is about online trading. They mediate and guide every transaction for you. So, it would be wise if you searched for a reliable broker like XTB. It is a name that deserves to be your partner.

As a beginner, when you have a dependable broker by your side, more returns and fund safety are just the added rewards. XTB is a broker that offers effortless withdrawal and deposit processes. It does not ask you to pay additional charges while doing so except in certain cases.

So, you can deposit and withdraw the same amount you wish and don’t have to calculate the deductions always. Moreover, you can decide the amount completely when depositing as the minimum deposit amount is capped at $0.

Though it does not charge you much on withdrawal or deposit fees, there are spreads and costs that a trader has to pay while trading. Therefore, we must consider the conditions for the spreads and fees before choosing XTB as the broker.

Most of the time, Costs are the only thing that prevents keen traders from entering the business. Since the digital tech era has made people more aware of the potential that trading has, they desire to join soon. However, thinking about the costs makes them hesitant.

It is normal to think that you may be charged a fortune while trading through broker services like XTB. However, if you focus on knowing about their fees and spreads, it can alleviate such worries. Therefore, let us first understand the broker and the basic terms and then determine how much it will cost to trade with XTB.

About XTB

XTB is one of the largest CFDs and forex brokers across the globe. The world’s biggest supervision authorities, including the FCA, regulate it. XTB is a stock exchange-listed broker that offers award-winning services.

It stands ready to offer retail investors access to hundreds of global markets. Moreover, you can trade in more than 2100 financial instruments with it. That is why it has the trust of more than 447000 customers.

XTB has grown tremendously during the last 15 years. Since its opening, it has served its clients in the best ways possible. Moreover, traders across more than 14 countries are within its reach.

XTB is a committed broker that aims to enhance the experience of retail investors through its trading platform. XTB is mindful of the changes taking place in its technological surroundings. That is why it ensures that none of its investors suffer or stay behind its competitors merely because of obsolete technology.

XTB constantly aims at providing its users with the best experience on its website. That is why it also offers efficient customer support. You can resolve any trading trouble with XTB customer service as they are always ready for your service.

What do spreads and fees signify?

We can often hear the trading brokers using the term spread. It is not a new term. It signifies nothing more than the difference between an asset’s buy and sell prices. The financial world uses this term commonly.

It influences the cost of a trade. We can determine the cost by looking at the spreads. The lower the spread means the trade will cost less. Many online trading brokers, market makers, and other providers use spreads to mention their pricing. They primarily generate their revenue through it.

On the other hand, some brokers require the customers to pay fees to the platform in exchange for their services. They may charge it separately or add on the fees and the spreads.

However, most of the platforms make their money through spreads alone. While knowing about the fees, you must remember that the brokers rarely change the fees because they prefer to keep the fees as a fixed charge.

At the same time, a spread is engaged to compensate for the cost of the broker’s order execution. Many brokers also have fees associated with placing trades on your behalf.

That happens mainly because a broker needs to take care of various costs. It needs to pay for creating systems and the employees working under them—all of that, along with the marketing.

Therefore, fees and spreads enable the brokers to finance those charges. However, if you are a complete fresher and enter for the first time, you should know more. Some assets, such as stocks, may exclude the spreads while trading.

Instead of the spreads, the broker levies a commission in such cases. But, it may vary with other assets as some may include a combination of both.

The spread calculation happens on its own when you enter a trade by opening or closing the position. As a result, the trader need not worry about paying the settlement separately.

Therefore, while entering a trade, the spread is automatically taken into account. Moreover, the buying price remains slightly higher and vice versa for the selling price, compared to the asset’s original price.

We can find that a lower spread is offered mostly by major currency pairs. It is because they are traded in big volumes. Whereas the opposite applies to obscure currency pairs.

A spread is normally expressed in pips, which means a percentage in points if we expand it. It denotes a minor shift in the value of the particular asset. For instance, Forex trading refers to the shift in a currency pair as it is the major asset there.

Moreover, if we try to understand it further, most currency pairs are priced to four decimal points. Wherein the last decimal point denotes the pip. So, we can understand that a pip equals 1/100 of one percent. Spreads also vary in the trading world, and the most common spread type is the bid-ask spread.

It is typically applicable when we trade in currency pairs or stocks. One of the main uses of a bid-ask spread is that it allows us to measure market liquidity. The term liquidity means how many liquid assets are available to the market or a company.

We can see that some markets will have more liquidity than others. So, consequently, their spreads are lower. A bid-ask spread is particularly useful in evaluating that.

It is clear that whenever you exchange an asset, a spread arises as to its cost. But, several factors may affect a spread rate. At certain times it can vary depending on the liquidity; in other cases, the volatility and volume can cause a change.

A spread also comes in two forms; a floating or variable spread. Therefore, a trader must always check on these factors and the spread size. After that, she can place the orders accordingly. You should also ensure that the market price is above the spread price since your goal is to profit.

In the trading world, a bid-ask spread is only one type. There is another rarely observed type of spread. It is known as a credit spread or a yield spread. We can know the ratio of the returns on different investments through a yield spread.

However, such investments can have variable maturities or risk profiles. To find a yield spread, you only have to subtract the return from one asset from the other.

We already know that the Brokers’ main revenue source is spread. So we can view it as a charge for their services. Such services include the trading platform and the data they provide.

However, they should not be followed blindly, as the broker does not hold the power to set the data entirely. Therefore, we must also observe various factors affecting the spread rate.

Knowledge of spreads and their function is necessary for anyone who plans to begin trading. Beginners often commit the mistake of entering the trades without researching spread rates. Such a move can bring unforeseen losses to the trader. So, if you are a beginner, you must always keep an eye on the spreads.

XTB spreads

Forex spread

INSTRUMENT | NOMINAL VALUE OF ONE LOT | MIN SPREAD |

AUD 100 000 | 0.00044 | |

AUD 100 000 | 0.00044 | |

AUD 100 000 | 0.027 | |

AUD 100 000 | 0.00091 | |

AUD 100 000 | 0.00011 | |

CAD 100 000 | 0.00047 |

Commodities spread

INSTRUMENT | NOMINAL VALUE OF ONE LOT | MIN SPREAD |

Instrument level * USD 50 | 11 | |

Instrument level * USD 1000 | 0.02 | |

0 | 11 | |

Instrument level * USD 2000 | 0.25 | |

Instrument level * USD 30 | 21 | |

Instrument level * USD 500 | 0.36 | |

Instrument level * USD 500 | 0.19 | |

Instrument level * USD 5000 | 0.07 |

Fees that can occur with XTB

Funding fees

The funding fees signify the non-trading fee that arises when the trader transfers money to the trading account from the bank account. Often, brokers do not charge for depositing or funding your account.

However, with XTB, you need to pay a nominal amount as the funding fees. But, the fees do not always arise as it depends on the method of payment you choose. Only some of the methods incur additional charges.

While funding the XTB account, you need not pay anything if you choose the credit cards or bank transfer. But, choosing an Ewallet will require you to pay 2% of the amount.

Withdrawal fees

Withdrawal through XTB is an effortless process, but you sometimes need to pay a withdrawal fee. Usually, withdrawals from most of the methods are free of charge.

However, you need to pay a fee depending on the amounts you wish to withdraw. So, if you go below the required amount, you need to pay the fee to XTB. Moreover, the fee will also depend on the base currency you choose.

Fees Lesser Than Threshold | Threshold | Amounts Larger Than Threshold |

20 USD | 100 USD | Free |

16 EUR | 80 EUR | Free |

12 GBP | 60 GBP | Free |

3000 HUF | 12 000 HUF | Free |

Swap fees

Swap fees help maintain a trade or roll over the trade from one day to the next. A rollover is required when the trader holds a position longer than allowed. And such a trade is subject to a swap.

A swap fee is an interest that a broker charges from you to maintain the trade. It also differs across instruments. XTB also charges a swap fee. With XTB, the swap points are calculated manually after calculating the value of a pip.

XTB also has a dedicated xStation which offers an inbuilt calculator for calculating the swap rates. The traders can use it for automatic calculations. However, that depends on the market and the volume of the trades.

Conclusion

XTB is a reliable broker that offers you the best trading experience. However, the trading opportunities come with spreads and fees. It also charges a commission depending on the account type.

But, XTB makes sure that all its charges are kept to the lowest possible and can be afforded by any trader.

FAQs – The most asked questions about cost to trade with XTB:

Does XTB charge commission?

Yes, XTB charges a commission based on the account types. It offers three types of accounts, namely Basic, Standard, and pro. The Basic and Standard accounts charge the commission on equity trades only.

At the same time, the cost of the commission is already covered through the spread in other assets like FX, commodities, etc.

The pro account charges a commission when you open and close a lot. However, the commission cost depends on the base currency a trader chooses.

Is XTB free?

We must not expect a broker to offer free services. Though XTB also charges through spreads like most other brokers, it excludes many additional charges. But, you may have to pay a nominal amount at certain times. So, we can say that it is not a free broker but is an affordable one.

Do I need to pay a fee to trade with XTB?

No, there is no minimum deposit when you are trading with XTB. As a trader, you must know that a broker cannot offer free service. XTB offers additional charges, but there are also many extra charges that it excludes. But you must also pay some minimum charges at certain points. Thus, you can easily state that XTB is not a free broker but is an affordable and customer-friendly broker.

See more articles about forex trading here:

Last Updated on January 27, 2023 by Arkady Müller