3 best Forex Brokers and platforms in Greece – Comparison and reviews

Table of Contents

The current state of the global economy has had a significant impact on international currency markets, with exchange rates fluctuating dramatically in recent years. For individuals looking to invest in foreign currencies, the choice of a forex broker is critical. The right broker can mean the difference between profitable and unprofitable trading, so it’s essential to do your research before signing up.

See the list of the best 3 Forex Brokers in Greece:

Forex Broker: | Review: | Regulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. Capital.com  | CySEC, FCA, ASIC, SCB | Starting 0.0 pips variable & no commissions | 3,000+ (70+ currency pairs) | + Userfriendly platform + TradingView charts + MT4 + Best education + Personal support | Live-account from $ 20(Risk warning: 78.1% of retail CFD accounts lose money) | |

2. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 78.1% of retail CFD accounts lose money) | |

3. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) |

You will get extensive information about the 5 best brokers and their platforms that you can trade within Greece. The forex platforms and brokers include:

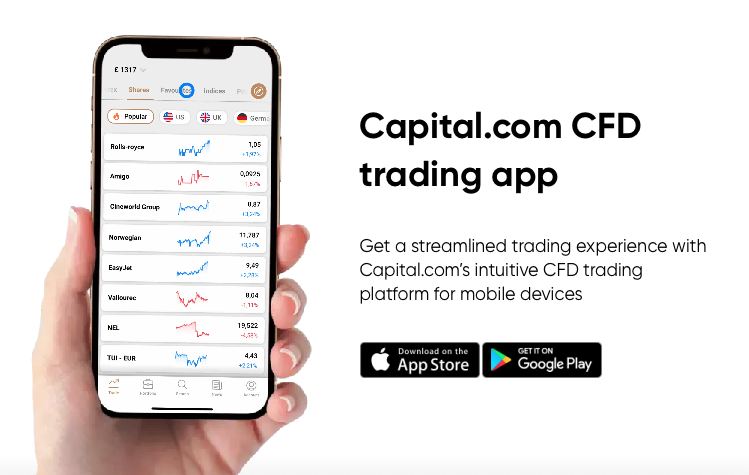

1. Capital.com

This platform is a fintech start-up that offers a mobile app that allows users to invest in stocks, commodities, and currencies via CFDs.

They were motivated to create the company after they experienced first-hand the barriers that retail investors face when trying to invest in the stock market. Capital.com has raised over $20 million in venture capital funding, and its app has been downloaded over 1 million times.

This brokers’ platform is a unique new player in online trading and investment. The company’s goal is to make it easy for anyone to trade stocks, currencies, and commodities without commission fees and simple user interfaces. Capital.com hopes to open up the world of finance to everyone, regardless of experience or investment portfolio size.

Capital.com has a user-friendly interface that makes it easy for anyone to start trading. There are no commissions on trades, and users can invest in stocks, currencies, and commodities for as little as £1.

Capital.com has a rapidly growing user base of over 580,000 registered users from 180 countries. Capital.com also provides an education center that offers instructional videos, articles, and webinars on trading forex, CFDs, and stocks.

The Capital.com platform is designed to be user-friendly and accessible to traders of all experience levels. The site’s social media features allow users to share trading insights, strategies, and ideas.

Pros of using Capital.com

- The broker platform provides its traders with investment educational apps that help them learn faster.

- Capital.com also provides its traders with educational courses.

- Capital.com offers its traders excellent customer support.

- Capital.com’s traders enjoy low forex CFD fees.

Cons of using Capital.com

- On the Capital.com trading platform, the MT5 trading platform is not available.

- Traders in Canada and the US do not have trading rights on the platform.

(Risk warning: 78.1% of retail CFD accounts lose money)

2. BlackBull Markets

This forex company is a popular CFD broker globally. It offers a number of assets to trade, including stocks, indices, commodities, and Forex. BlackBull Markets broker has a wide variety of platforms for traders to use, including the BlackBull Markets MetaTrader 4 platform and the BlackBull WebTrader platform. The company also offers a mobile app available for Android and iOS devices.

The company has its HQ in Auckland, New Zealand, and was founded in 2013. BlackBull Markets is authorized by the FMA, the financial regulator in New Zealand. The company has a very positive reputation and has been awarded “Fastest Growing Company” and “Best Forex Brokerage” at various awards ceremonies.

BlackBull Markets offer a number of account types, which includes a demo or practice account, to suit the needs of all traders.

Besides, BlackBull Markets is a broker that offers a number of markets to trade, competitive spreads, and no commissions.

One unique feature that BlackBull Markets provides is social trading. Social trading allows traders to follow and copy the trading activities of other traders on the platform. This can be a great way to learn and make profits from the trading activities of others.

Benefits of BlackBull Markets

- Traders trade on this platform trade at a no commissions rate.

- BlackBull Markets provides its traders with competitive spreads.

- They also offer fast execution speeds

- The account opening process is straightforward.

The drawback of BlackBull Markets

- Traders are required to pay withdrawal fees on this platform.

- The research tools available on BlackBull Markets are limited.

(Risk Warning: Your capital can be at risk)

3. Pepperstone

This trading platform is an Australian Forex broker that offers some of the most innovative. Clients have access to various products, including spot metals, commodities, indices, and stocks, on global exchanges. In addition, Pepperstone offers a unique product in a cTrader ECN account that allows clients to trade with real liquidity from Tier-1 banks.

Pepperstone is a broker that offers access to the Forex and CFD markets. Pepperstone has some of the tightest spreads in the industry and a number of deposit and withdrawal methods. They offer several resources to help traders succeed, including an education center, trading signals, and automated trading tools.

Pepperstone has its headquarters in Australia and even has satellite offices in London and Tokyo. Pepperstone offers clients access to more than 70 FX pairs and over 2000 CFDs that are on stocks, commodities, indices, and cryptocurrencies.

The company has won numerous awards over the years, including being named the best Forex broker in Australia in 2017 and 2018 by the International Finance Magazine. Pepperstone has been awarded four stars by the investment research firm Morningstar.

Pepperstone offers a range of account types to suit traders of all experience levels. It provides 24/5 support in 14 languages. Withdrawals are processed quickly and without hassle, and there are various deposit and withdrawal methods available.

Advantages of using Pepperstone

- Pepperstone offers its traders competitive pricing.

- Several social copy forex trading platforms are available to traders on the Pepperstone trading platform.

- Adequate research materials are available to traders.

Disadvantages of using Pepperstone

- Educational materials provided to traders are close to the average.

- Assessment sections are not included in the educational materials provided to traders.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

What are the financial regulations in Greece?

Athens is the capital and largest city in Greece. As of 2016, the population of Greece was estimated to be 10.815 million. The Greek economy has been in recession for many years, and the financial crisis of 2007-08 only made matters worse. The current state of the Greek economy is tumultuous.

The current financial regulation in Greece is characterized by several weaknesses that adversely affect the health of the Greek banking system and, more generally, the Greek economy.

In the early 2000s, Greece adopted liberalization measures that opened its banking sector to foreign competition. This led to a dramatic expansion in credit, which fueled a real estate bubble. The bubble eventually burst, leading to a banking crisis and an economic recession.

The Bank of Greece is responsible for regulating, supervising, and resolving issues with banks in Greece in coordination with the Single Supervisory Mechanism made under Council Regulation (EU) No. 1024/2013 (SSMR).

The cooperation between the ECB and BoG is governed by Regulation (EU) No. 468/2014 (SSM Operational Framework). The ECB is responsible for the direct prudential supervision of systemically important banks (SIs) established in the Eurozone, including Greece. At the same time, BoG exercises prudential supervision powers over less significant institutions (LSIs). BoG also retains its authority as the national resolution authority. The potential resolution measures for banks may require cooperation with the Ministry of Finance, the Hellenic Financial Stability Fund (HFSF), and the Hellenic Deposit and Investment Guarantee Fund (HDGIF).

(Risk warning: 78.1% of retail CFD accounts lose money)

Security for traders from Greece – What you should know

Greece has been through a lot of turmoil in recent years, and the security situation for forex traders that are in the country is uncertain.

One of the most significant security risks for traders in Greece is theft. There have been numerous reports of thieves targeting traders in the country, often stealing their money and equipment to protect themselves from this risk.

In light of the recent financial crisis in Greece, many forex traders are looking for ways to ensure their security and protect their assets.

Here are three tips for protecting your money while trading in Greece:

- Choose a reputable broker. Make sure to do your research and choose a well-established broker with a good reputation.

- Use a secure connection. Always trade over a secure connection, such as HTTPS, to protect your data from being intercepted by third parties.

- Use a strong password and change it regularly.

- Install anti-virus software and keep it up to date.

- Don’t trade on a public computer.

Is it legal to trade Forex in Greece?

Forex trading, or foreign exchange trading, involves buying and selling currencies to make a profit. Because it takes place internationally, forex trading is considered a legal grey area in many countries. Greece is no exception; while there are laws regulating forex trading, they are not always strictly enforced. This lack of clarity can make things difficult for traders operating in Greece. It is essential to be aware of the current regulations in place.

Yes, it is legal to engage in forex trading in Greece. The global foreign exchange market is worth trillions of dollars each day, and traders worldwide are free to participate. However, there are a few things you should know before getting started.

The Hellenic Financial Stability Fund (HFSF) stated in July 2015 that FX trading is a legal activity and that there are no restrictions on it.

It is advisable to seek legal advice if you intend to engage in forex in Greece to ensure that you are fully aware of the legal implications and operating within the law.

How to trade Forex in Greece – Tutorial

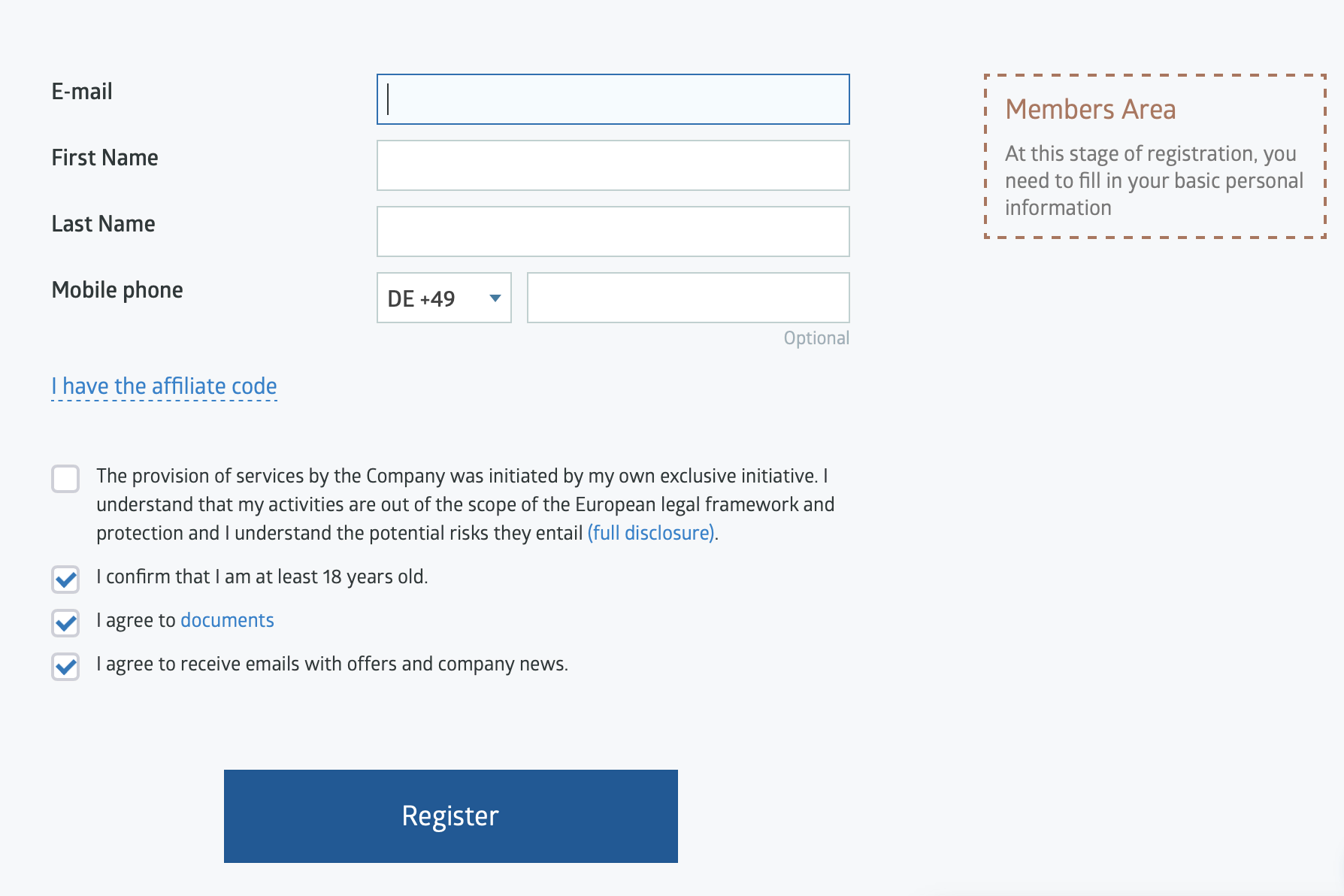

Open a Forex trading account

When looking to start trading on the foreign exchange market, you must find the right broker that you can trade on its platform. Not all brokers are created equal, and some are much better suited for traders in Greece than others.

To start an account, you should provide your personal information. Personal information such as your valid identification card and your proof of residency. You will also be asked to choose a broker who will help you with the trading process.

Start with a demo or real account

When you are ready to start trading, the up next is to choose between a demo or a real account. A demo or practice account is a virtual account that you can use to trade stocks, options, and futures contracts. A real account is an account with a broker that you use to buy and sell stocks, options, and futures contracts.

There are some factors that you should consider when you want to decide whether to trade with an open demo or a real account. One of the most critical factors is your trading experience. If you are a beginner, you should start with a demo or practice account.

Deposit money

Immediately you first start trading Forex, and you will have to fund your account with an amount. This process is relatively straightforward and can be completed in a few simple steps.

The first step is to choose a broker. Not all brokers allow you to make a deposit into your account. You should find a broker that offers this service. Once you have chosen a broker, you then create an account with them. This account will provide you with access to the trading platform and your trading account.

If you want to make a deposit into your account, you must provide your account information and select a payment method. You can use a credit, a debit card, a bank transfer, or Skrill.

Once you have selected your payment method, you are required to provide the necessary information. If you want to make a deposit into your account using credit or debit cards, you need the card number, expiration date, and security code.

Notice:

The payment methods depend on your country of residence. Forex Brokers offer all kinds of methods separately for each country.

Use of analysis and strategy

Position trading

Position trading is a type of trading that takes place over a more extended time than day trading or swing trading. The goal is to hold a position in a security for weeks or months in the hopes that the price will move in the desired direction and the trader can sell at a higher price.

Position traders use technical analysis to identify potential entry and exit points and typically do not use margin or leverage. They may also use hedging strategies to protect their positions from adverse price movements.

Scalping

Scalping is quite a common forex strategy that attempts to make many small profits by using the markets’ changes. The scalper enters and exits the market quickly, making a small profit on each transaction. It is often used in stocks, commodities, and foreign exchange markets.

Day trading

Day trading simply is buying and selling stocks, commodities, and other securities within the same day. It is an active investment that attempts to take advantage of short-term price movements.

Day traders usually make use of various tools and strategies to identify potential trades. They may use technical analysis, which looks at past price data to help predict future movements. They may also use fundamental analysis, which looks at a company’s financials to determine its value.

Make profit

Trading forex, indeed, is a popular way to make money online. Millions of people around the world trade currencies every day in hopes of making a profit. However, forex trading is not without risk.

To make money trading forex, it is important that you understand how the forex market works. It would be best if you also had a strategy for trading. Finally, be prepared to lose some money to make more.

(Risk warning: 78.1% of retail CFD accounts lose money)

Conclusion: The best Forex Brokers are available in Greece

This article has looked at the top 3 forex platforms and brokers for trading in Greece. With the global economy in a state of flux, it is more important to make sure you are using a platform that is licensed and regulated in Greece. By using a broker compliant with Greek regulations, you can be sure that your money is safe and that you are trading in a fair and transparent market.

FAQ – The most asked questions about Forex Broker Greece :

Which forex brokers in Greece offer the best services to traders?

There are several brokers in Greece that offer the best services to traders. These include RoboForex, Capital.com, Pepperstone, and BlackBull Markets.

These brokers have a perfect trading platform with all the modern features. Moreover, their customer support is also perfect. They can contact customer support whenever a trader encounters a problem while trading forex.

How can a trader fund his trading account with the forex broker in Greece?

Traders can log in to their trading accounts with the forex broker in Greece to fund it. Then, they will see the ‘add funds’ option on the dashboard. Traders can click on this option and choose a payment method they wish to use for funding their trading accounts. Then, they can confirm the payment, and funds will get credited into their forex trading account.

Which forex broker in Greece is the best for beginners?

Beginners need to be extra cautious while choosing a forex broker. Among all brokers, the following four forex brokers in Greece are the best for any trader.

BlackBull Markets

Pepperstone

Capital.com

These brokers allow traders to start with a low minimum deposit amount and offer many educational resources.

Last Updated on March 31, 2024 by Andre Witzel

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5)