Five best Forex Brokers and platforms in Kyrgyzstan – Comparison and reviews

Table of Contents

Introduction

Forex traders who want to start trading have to register a trading account with a forex broker. Here is a list of five regulated forex brokers offering low forex spreads, Industry-standard trading resources, and a wide range of trading instruments.

See the list of the best Forex Brokers in Kyrgyzstan:

Forex Broker: | Review: | REgulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. Capital.com  | CySEC, FCA, ASIC | Starting 0.0 pips variable & no commissions | 3,000+ (70+ currency pairs) | + Best platform + TradingView charts + MT4 + Best education + Personal support | Live-account from $ 20(Risk warning: 78.1% of retail CFD accounts lose money) | |

2. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 78.1% of retail CFD accounts lose money) | |

3. RoboForex  | IFSC | Starting 0.0 pips & $ 4.0 commission per 1 lot traded | 9,000+ (50+ currency pairs) | + Huge variety + Micro accounts + Free bonus program + Leverage up to 1:2000 + ECN accounts + MT4/MT5/cTrader | Live-account from $ 10(Risk warning: 78.1% of retail CFD accounts lose money) | |

4. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

5. IQ Option  | CySEC | Starting 0.1 pips variable & no commission | 500+ (25+ currency pairs) | + Easy to use + Binary Trading + Support 24/7 + Min. Deposit 10$ + Lowest spreads on main trading hours | Live-account from $ 10(Risk warning: Your capital might be at risk.) |

These forex brokers have registered traders from various regions globally and accept forex traders from Kyrgyzstan.

The five best forex brokers and platforms in Kyrgyzstan

- Capital.com

- BlackBull Markets

- RoboForex

- Pepperstone

- IQ Option

1. Capital.com

It has been in the market since 2016 and has registered 5 million traders since then. Trading instruments include stocks, commodities, shares, cryptocurrencies, and indices.

It has Regulations from the Financial Conduct Authority, Australian Securities and Investment Commission, and Cyprus Securities and Exchange Commission.

Its users can select from the three account types offered, the Standard account with an initial $20, the Plus account with $2000, and the Premier account with $10,000. Forex spreads start from 0.8 pips, and Capital.com is a zero-commission broker.

Overview

- Minimum deposit-$20

- License-FCA, ASIC, CySEC

- Platforms-MT4, web-trader

- Spreads- from 0.8 pips on major pairs

- Support-24/5

- Free demo-yes

- Leverage-1:30

Capital.com has an award-winning AI trading platform, and it offers a comprehensive and sufficient learning resource that new traders can use to learn how to trade. It is a low-cost forex broker with low commissions and tight forex spreads.

It makes it one of the best forex brokers traders can use to start trading. It also has a user-friendly trading platform that is easy to understand and use. It offers the Investmate app, which has educational materials on the mobile app.

Disadvantages of Capital.com

- High initial deposit on the Premier account. The Premier account, an institutional account, has a high initial deposit of $10,000 which may be a limiting factor for traders who prefer volume trading.

- Limited research materials. It has limited news and researched resources that traders can use when preparing to enter or exit the financial markets.

(Risk warning: 78.1% of retail CFD accounts lose money)

2. RoboForex

It has been operating since 2009, and since then, it has had over one million clients trading on its platforms. Its traders can trade commodities, forex, stocks, energies, metals, CFDs, ETFs, and stocks.

It has regulations by the International Financial Service Commission in Belize. It is a broker that offers five types of trading accounts; Prime, ECN, Pro, and Pro-cent accounts have a minimum deposit of $10, while the R-stocks trader has $100.

Overview

- Minimum deposit-$10

- License-IFSC

- Platform-R-stocks trader, c Trader, MT4 and MT5

- Spreads-0.0 pips

- Support-24/7

- Free demo-yes

- Leverage-1:2000

The cost of trading in RoboForex is low. The Pro and Pro-cent have no commission and forex spreads from 1.3 pips, and the ECN has commissions of $20 for every one million and Prime with commissions of $15 for every $1 million while its forex spreads start at 0.0 pips.

The R-stocks trader trading account offers trading features best suited for trading stocks, indices, forex, ETFs, and CFDs. It has spreads from $0.01 and commissions starting at $1.5.

Disadvantages of RoboForex

- Limited trading instruments. It has a limited number of tradable assets compared to the industry standards of international forex brokers.

(Risk Warning: Your capital can be at risk)

3. BlackBull Markets

It has registered thousands of investors since its inception in 2014. Users can trade financial assets like Commodities, Indexes, shares, energies, metals, forex, and CFDs.

The Financial Services Authority regulates BlackBull Markets.

BalckBull Markets is a forex broker that offers fast execution for orders dues to the ECN accounts offered. It has three types the ECN Standard with a minimum deposit of $200, the ECN Prime has $2000, and the ECN institutional offers $20,000.

Overview

- Minimum deposit-$200

- License-FSA

- Platforms-MT4, MT5

- Spreads-0.0 pips

- Support-24/5

- Free demo-yes

- Leverage-1:30

Trading costs in this trading broker depend on the account. The ECN Standard forex spreads start at 0.8 pips and no commissions; ECN Institutional from 0.0 pips, and the commissions are based on the volume and the asset, and the ECN Prime has 0.1 pips with a $6 commission for every $100,000 traded.

For users with an account balance of $2000, an application to get the VPS hosting is offered at a premium cost. It also offers Social trading or copy trading using Myfxbook, AutoTrade and ZuluTrade.

Disadvantages of BlackBull Markets

- Limited educational resources. Educational content offered on BlackBull Markets is limited and does not cover most trading topics. Under the standards of a forex broker, it offers international standard trading services.

(Risk Warning: Your capital can be at risk)

4. Pepperstone

It has registered thousands of traders since it got established in 2010. It has trading instruments such as commodities, shares, forex, indices, and ETFs. It has regulations from the Financial Conduct Authority and Australian Securities and Investment Commission.

It offers the Standard and Razor accounts for an initial $200. The Standard account has no commissions and forex spreads from 1.3 pips. The Razor account has commissions of $7 per $100,000 and spreads from 0.0 pips.

This forex broker supports the MT4 and MT5, and C trader trading platforms popular among forex traders and investors. It also offers the stop-loss features such as the Guaranteed stop-loss that a few forex brokers offer.

Overview

- Minimum deposit-$200

- License-ASIC, FCA

- Platform-MT4, MT5,c Trader

- Spreads-0.0 pips on the Razor account

- Support-24/5

- Free Demo-yes

- Leverage-1:400

Traders can access various trading features such as market analysis and news published daily on the trading platform as articles and videos. It also has the trading View platform, which offers fast execution rates for orders and trading indicators and is cloud-based, ensuring no data is lost.

The demo account has a limited demo account for 30 days after registration and has virtual funds of $50,000. It supports a variety of payment methods, Bpay, PayPal, Skrill, Neteller, POLi, UnionPay, debit cards, credit cards, and bank transfers.

Disadvantages of Pepperstone

- Limited learning resources. It has a limited number of educational content for traders. Compared to other international forex brokers, the educational resources still require more to meet the required standards.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

5. IQ Option

It has been trading in the financial market for more than a decade since its operations in 2013. Traders can access CFDs, Cryptocurrencies, Options, Forex, ETFs, and commodities. It has regulations from Cyprus Securities and Exchange Commission.

It offers the VIP account with varying high initial deposits while the Standard account has $10. Forex spreads vary with the liquidity and type of trading instrument. It also has no commissions for most trading instruments but 2.9% for cryptocurrencies.

Overnight costs range from 0.1-0.5%; it also has inactivity costs of $10 for dormant accounts for more than three months. Deposits are free, but withdrawals using bank transfers have a $31 fee.

Overview

- Minimum deposit-$10

- License-CySEC

- Platform-IQ Option trading platform

- Spreads-from 0.8 pips

- Support-24/7

- Free demo-yes

- Leverage-1:500

IQ Option Platform has a user-friendly trading platform that even new traders can easily understand. It has multiple charts, market updates, and numerous trading tools such as indicators. It also has risk management tools such as stop-loss and take-profit orders.

Its users can apply the multiple order types available on the platform. Its trading platform is available as a mobile app, desktop, and web version compatible with windows and MAC, allowing traders to access their trades from wherever they are.

Disadvantages of IQ Option

- Limited trading instruments. It started as a Binary Options (only for professional traders and outside EAA countries) trader but has diversified and offered other trading instruments. Even though it has Options, it still has a limited number of educational resources for traders to use.

(Risk warning: Your capital might be at risk.)

What are the financial regulations in Kyrgyzstan?

The capital markets started in 1994 when the Kyrgyz Stock Exchange offered favorable conditions for trading securities and stocks. It consisted of financial companies, brokers, and agencies that offered securities authorized by the Kyrgyzstan government.

It became a self-regulatory organization in 1998; this feature was meant to ensure that market participants who trade stocks and securities adhere to the regulatory requirements. The regulatory framework was amended again in 2000 when it joined the International Association of exchanges.

The financial crisis of 2008 affected the Kyrgyzstan capital markets, including the Kyrgyz Stock Exchange, and the volume of trades reduced. It slowly increased the volume in 2009, and in 2010 Kyrgyzstan adopted new laws regarding the securities markets.

The Capital markets in Kyrgyzstan are still developing and introducing more securities such as commodities. The Government is trying to increase the activity in the capital markets’ volume internationally through international relations and improving the infrastructure used in finance to international standards.

The (SSRSFM) State Service for Regulation and Supervision of Financial has the mandate to ensure that forex traders and market participants comply with the ethical standards when operating in the capital markets in Kyrgyzstan. It has light regulations, which means forex traders can rely on foreign regulators.

Banks that offer securities and exchange and facilitate foreign currency transactions have to get a license from the bank of Kyrgyzstan. Forex traders who transact foreign currency beyond the stipulated limit must offer their official identification.

Forex investors have the right to get information from the financial issuers, especially on matters that affect the investments directly or indirectly.

Security for traders from Kyrgyzstan

The legislation on foreign exchange ensures security for traders through transparency. Financial issuers must provide information without withholding any important details concerning securities.

Regulated forex brokers implement other efforts, including compensation funds for lost trades. The registration of forex traders uses AML laws to ensure transparency and ban illegal and manipulative activities from financial issues such as forex brokers.

(Risk warning: 78.1% of retail CFD accounts lose money)

Is it legal to trade Forex in Kyrgyzstan?

Yes, it is legal to trade forex; many forex brokers accept forex traders from Kyrgyzstan. The SSFSFM has the mandate to ensure it establishes and executes policies on foreign exchange within Kyrgyzstan.

It has implemented laws to ensure the fairness of Kyrgyzstan’s securities and exchange markets.

How to trade Forex in Kyrgyzstan

Open account for Krygystan traders

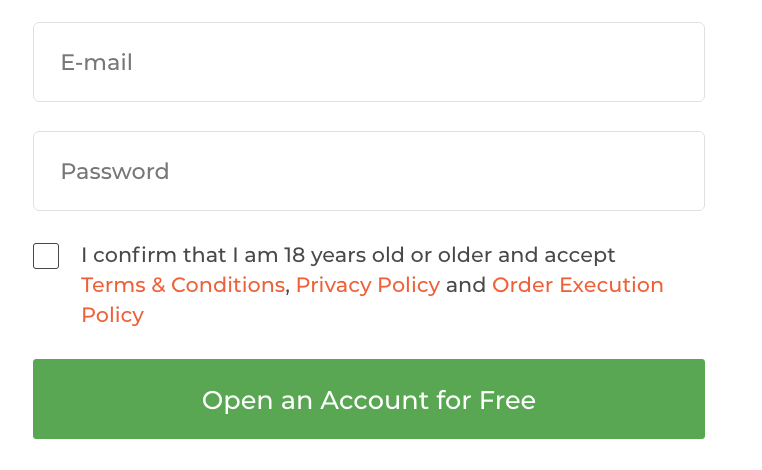

It is the first crucial step traders have to take when trading forex in any region. Many offshore forex brokers accept forex traders from Kyrgyzstan. We recommend regulated offshore forex traders since they have globally accredited regulatory institutions.

When searching for a reliable forex broker, some factors to check include regulation, trading instruments offered at low trading costs, and trading features. Ensure you confirm the regulation and choose a forex broker compatible with your trading objectives.

Forex brokers have numerous trading accounts based on capital and diversity. Open a trading account based on your financial capability; most international regulated forex brokers offer Islamic accounts.

Opening a trading account is fast and easy; you must submit your name, email account, nationality, date of birth, account type, and password. They may also need you to verify this information as part of registration by sending a copy of your national ID and Utility statements.

Forex brokers use trading platforms to access financial markets. International brokers support a variety of trading platforms traders can select from. The forex broker will need you to download a trading platform compatible with your trading account. After downloading, you can look at the features offered and adjust them according to your trading specifications.

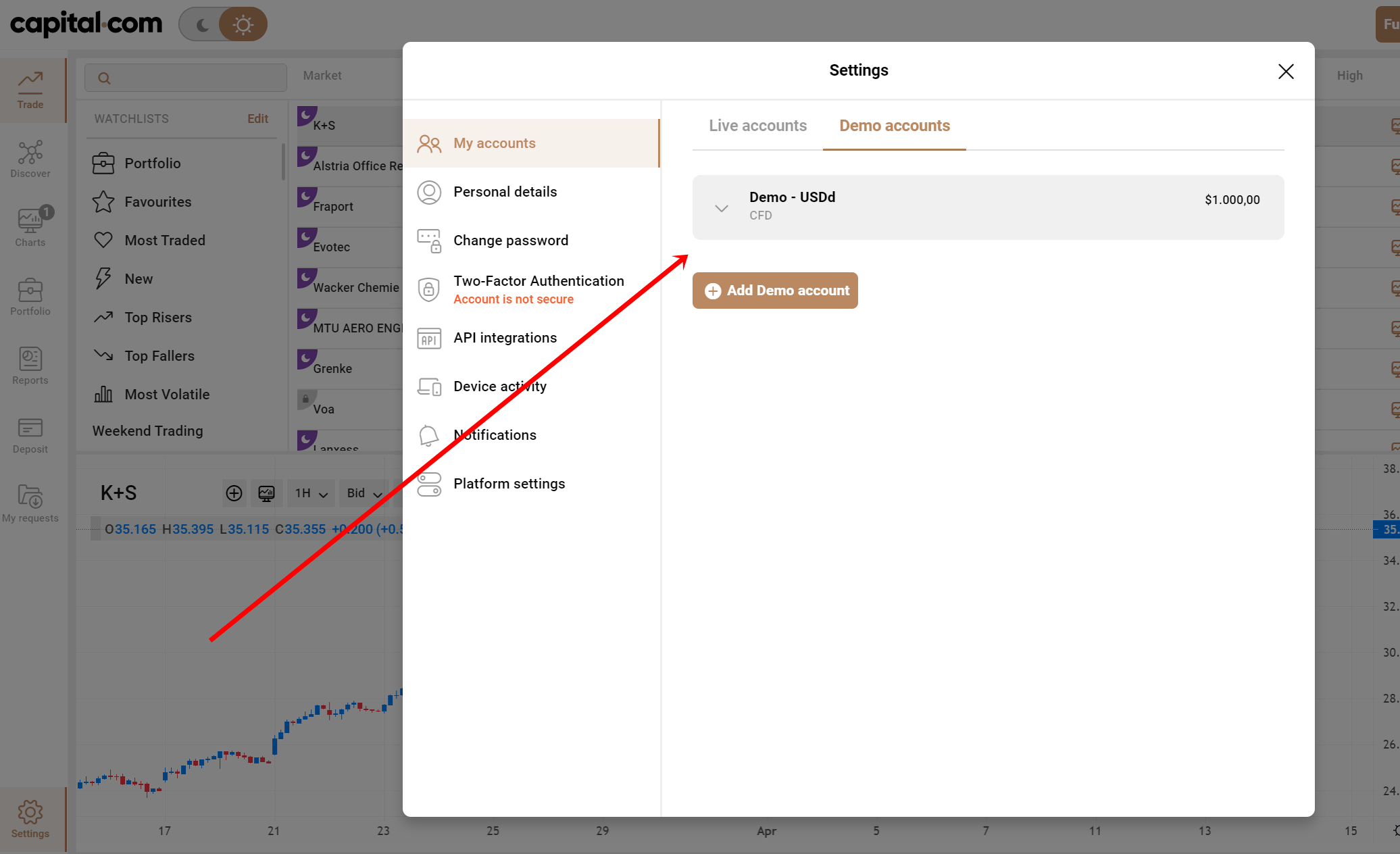

Start with the demo or real account

Forex traders with experience can start trading, but new traders are recommended to start with the demo account. The demo account allows you to access trading instruments in the financial market and trade using virtual funds. It is used to help traders practice their trading strategies and other financial instruments.

It is also used to help new traders to learn how to trade forex. Traders can apply the trading strategies they learn and practice before moving to the real account.

Deposit money

Deposit funds using the payment methods the forex broker supports. Forex trading has become popular, and there are forex traders from all over the world. Forex brokers have to adapt by supporting payment methods that are available for the majority of the traders.

You can link your trading account with the payment method, deposit the capital you can start with, and start trading.

Notice:

The payment methods are depending on your country of residence. Forex Brokers are offering all kinds of methods separately for each country.

Use analysis and strategies

Analysis

As a forex trader, you have to ensure you know the conditions you are entering the market when you want to trade. It is by employing analysis. There are two types of analysis to evaluate market conditions, technical and fundamental analysis.

Technical analysis is the most widely used and assists traders in understanding the market conditions such as momentum, trend, and volatility of the price action. If you are trading a currency pair, apply technical tools such as indicators, price charts, and the price action history through previous price charts.

There is also fundamental analysis which involves looking at factors that cause the price action to experience volatility. For example, suppose you are trading a currency pair. In that case, you have to monitor the interest rates of both currencies, the trade relations between the involved countries, prices of major imports and exports, the GDP and economic performance, and political status.

Trading strategies

Traders apply different trading strategies depending on the type of trader they are. Short-term traders make short-period trades, while long-term traders make longer trades that take weeks or months. The trading strategies help the trader know how to enter or exit a market.

Some trading strategies include:

Scalping – takes place by making small trades that can take seconds to one minute. It is a short-term trading strategy that requires an experienced trader because if you take longer to exit, you can offset the entire profit you make with smaller trades.

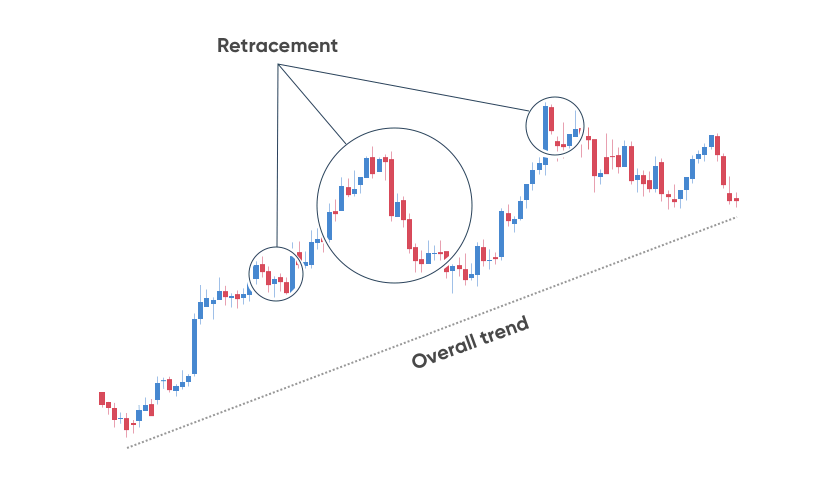

Trend trading – involves identifying a trend and opening a position based on the direction of the price action. You use technical and fundamental analysis to identify a trend or understand the trend momentum. If it is an uptrend, you can go long; you can go short if it is a downtrend.

Position trading – is a trading strategy where traders open a trading position of an asset after speculating that the asset’s value will increase. A trader has to ensure that they conduct quality technical and fundamental analysis to ensure the price direction of an asset.

Day trading – is a strategy for forex traders who want to take forex trading professionally. It is opening and closing trading positions during the daytime. Traders trade the fluctuations from the opening markets during the day. It requires the traders to be fast to profit from the fast market movements during the day and is meant for traders who wish to avoid overnight volatility.

Make a profit

Limit the leverage you are using if you are a new trader to reduce the risk. Ensure you follow your trading strategy when trading to avoid emotional influence. Use fundamental and technical analysis to evaluate the favorable opportunities to enter or exit the market.

Understand the trading instrument you are trading before opening a trading account. It assists the trader in making insightful choices based on the previous trading patterns of the trading instrument.

Making profits in forex means that you know the strategic time to exit the financial markets before the price movement changes direction.

(Risk warning: 78.1% of retail CFD accounts lose money)

Conclusion: The best Forex Brokers are available in Kyrgyzstan

Forex trading has grown, and many forex traders register trading accounts from different continents and regions where forex trading was not possible a decade ago. There are also increased cases of forex scams as they have taken advantage of the increased number of new traders.

It is why traders have to look for regulated forex brokers from reputable regulatory agencies. Besides that, forex traders need to practice trading before investing their funds, have trading discipline, and apply risk management tools to protect their investments.

.

FAQ – The most asked questions about Forex Broker Kyrgyzstan :

How can a Kyrgyzstan forex broker help me trade?

Both novice and experienced traders may find a foreign exchange to be daunting. But if the right platform is employed, this procedure could be carried out successfully and without any problems.

These are the main steps you must take to be successfully and profitably trade FX. The process may differ significantly depending on the platform, but the fundamental procedures remain the same.

You ought to open a trading account.

With a demo or real account, begin your trials.

Invest money in your account.

Investigate the market and discover fresh tactics.

Earn money.

Take your money out.

Increase your income by using your experience.

What forms of payment can I use on the forex market in Kyrgyzstan?

The environment for FX trading online is always evolving. Businesses, banks, and governments are developing new payment mechanisms that may or may not be employed in the foreign currency market. The most common forms of payment in Iran include bank transfers, credit cards, debit cards, and other systems.

There are many benefits to using credit or debit cards for payment. It makes it incredibly simple for a trader to deposit money, withdraw it, exchange currencies, and lend or borrow money.

Last Updated on March 2, 2023 by Arkady Müller

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)