The 5 best Forex Brokers and platforms in Lesotho – Comparison and reviews

Table of Contents

Forex trading can be difficult for a person to start, especially if you a new to it. To start forex trading, you need first to know the meaning of forex and other information like if it’s right to trade forex in your country. After that, you can proceed to learn how to trade forex from an online source such as this article.

In this article, you will get to know the best five forex brokers available in your country. Then the article will cover financial regulations in your country, security for you as a trader, if forex is legal in your country, and then you will learn how to start your forex trading journey. Let’s jump right into the contents of the article below.

See the list of the best Forex Brokers in Lesotho:

Forex Broker: | Review: | REgulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. Capital.com  | CySEC, FCA, ASIC | Starting 0.0 pips variable & no commissions | 6,000+ (70+ currency pairs) | + Best platform + TradingView charts + MT4 + Leverage up to 1:500 + Best education + Personal support | Live-account from $ 20(Risk warning: 78.1% of retail CFD accounts lose money) | |

2. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 78.1% of retail CFD accounts lose money) | |

3. RoboForex  | IFSC | Starting 0.0 pips & $ 4.0 commission per 1 lot traded | 9,000+ (50+ currency pairs) | + Huge variety + Micro accounts + Free bonus program + Leverage up to 1:2000 + ECN accounts + MT4/MT5/cTrader | Live-account from $ 10(Risk warning: 78.1% of retail CFD accounts lose money) | |

4. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

5. IQ Option  | CySEC | Starting 0.1 pips variable & no commission | 500+ (25+ currency pairs) | + Easy to use + Binary Trading + Support 24/7 + Min. Deposit 10$ + Lowest spreads on main trading hours | Live-account from $ 10(Risk warning: Your capital might be at risk.) |

The list of the five best Forex brokers and platforms in Lesotho includes:

- Capital.com

- BlackBull Markets

- RoboForex

- Pepperstone

- IQ Option

1. Capital.com

Capital.com is a regulated broker with a comprehensive user range that numbers more than 500000 traders worldwide. The broker is regulated by international bodies in countries like Australia, the UK, Cyprus, and Seychelles. The broker has a platform that favors the trader’s trading conditions.

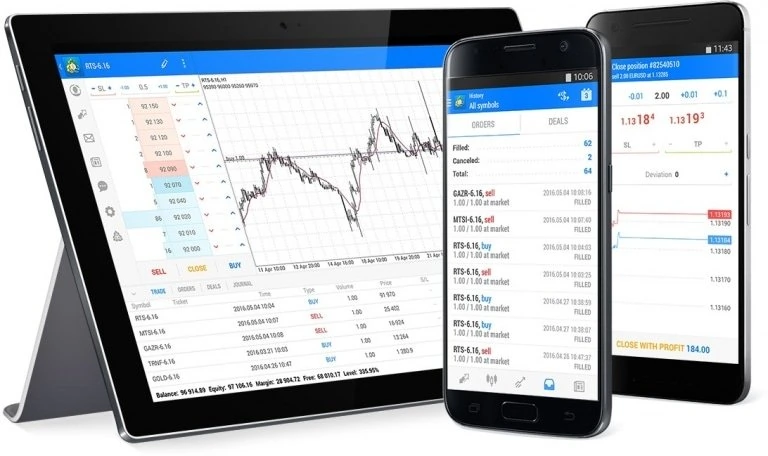

The platform is available for users to trade on a phone or laptop. Traders can trade and experience the same feel on both devices. The platform is available with different kinds of assets that traders can trade—cryptocurrencies, CFDs, gold, and more easily on the broker platform.

Traders can choose either the standard account or the plus account, and traders can make a minimum deposit of $20. Both accounts have equal spreads and no commission.

Capital.com provides its traders with educational materials. Traders can learn the essential terms, assets, and best strategies while trading. Its platform even has tests that the traders can take to show that they are improving in their knowledge about forex trade.

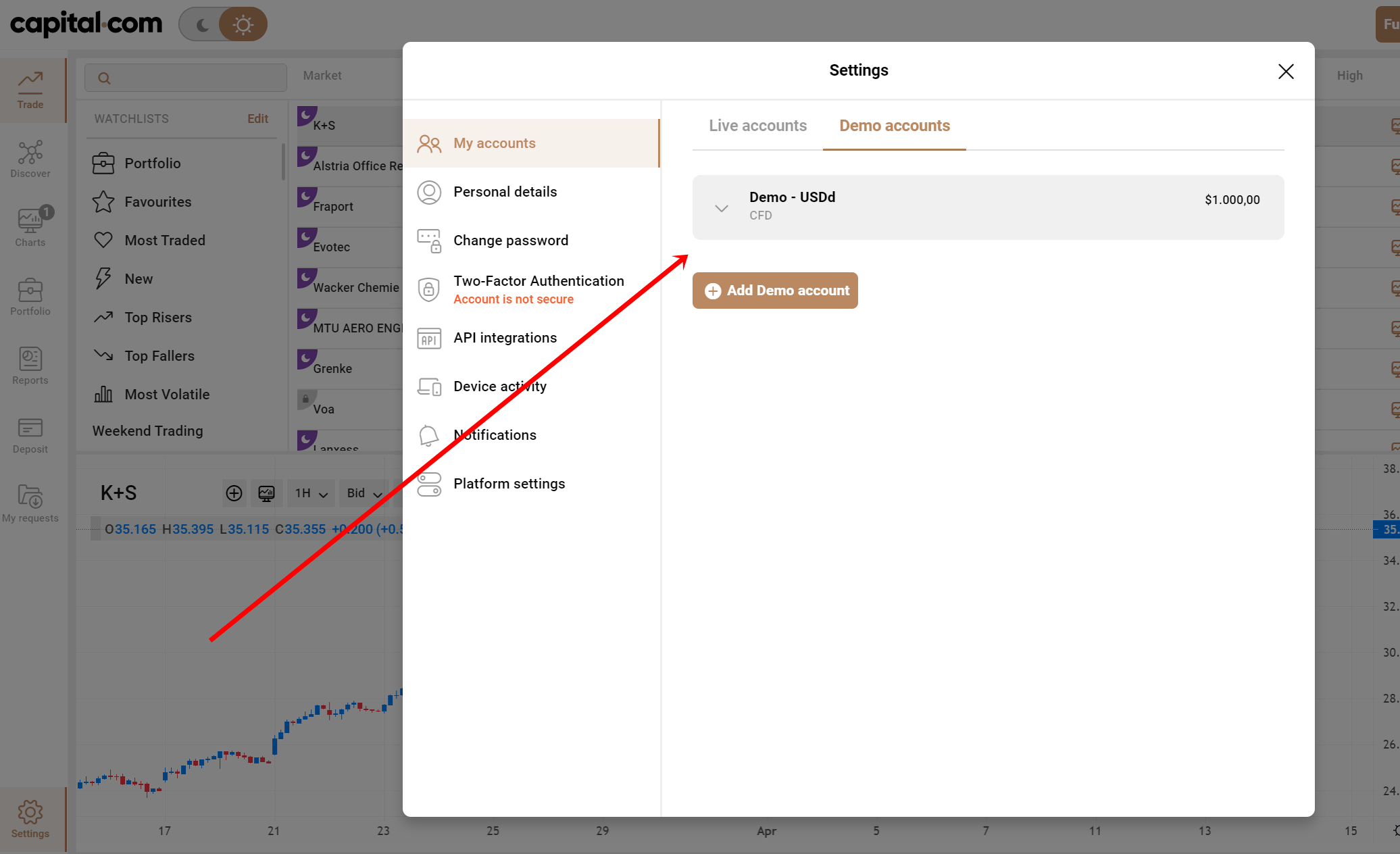

Aside from the plus and standard account types. Capital.com provides its traders with a demo account to trade with. The demo account is a toy account that helps traders navigate through the spread and chart of the platform. The demo account does not expire.

Merits of Capital.com

- The platform is commission-free

- Traders are provided a demo account

- Minimum deposit of $20 for the standard account

- There are educational articles and videos for clients.

Demerits of Capital.com

- The plus account minimum deposit is $3000

- US clients are not allowed on Capial.com

(Risk warning: 78.1% of retail CFD accounts lose money)

2. BlackBull Markets

Traders on BlackBull Markets enjoy one of the fastest transactions. The broker was founded in 2014 with different assets that traders can trade with. Traders can trade with commodities, gold, and CFDs. The BlackBull Markets company is well regulated by international financial organizations worldwide, making the broker reliable and trusted.

Forex traders of BlackBull Markets enjoy free in-house market resources. These resources are helpful to traders because it helps them strategize on how to go about trading. It also gives them tips on the market competition, allowing traders to know when the best time is to open and close markets.

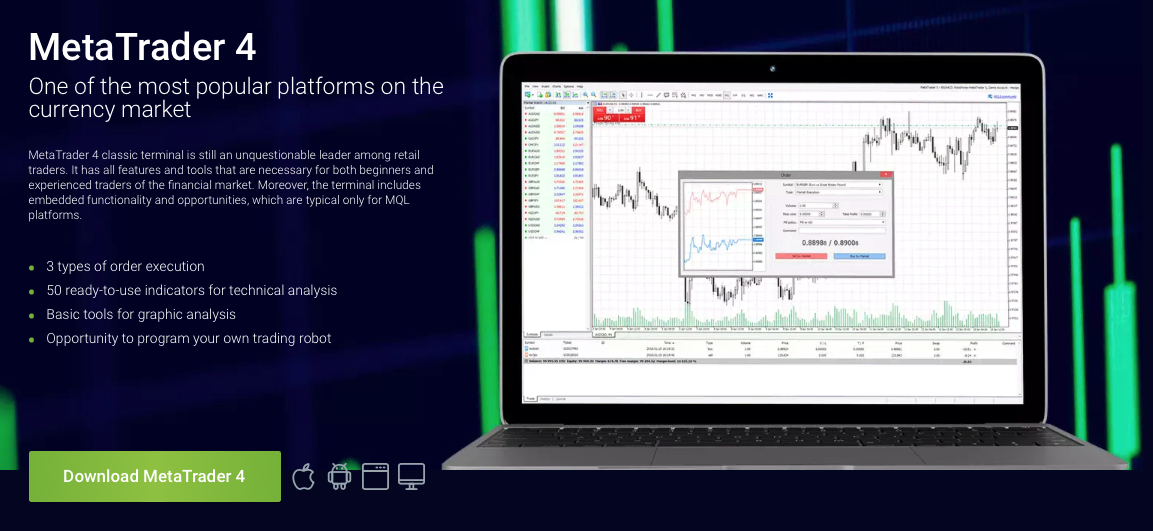

BlackBull Markets is readily available for both phone and desktop users. The MetaTrader platforms are both devices. Making traders enjoy the same trading experience whether you use the mobile app or the web version on your desktop.

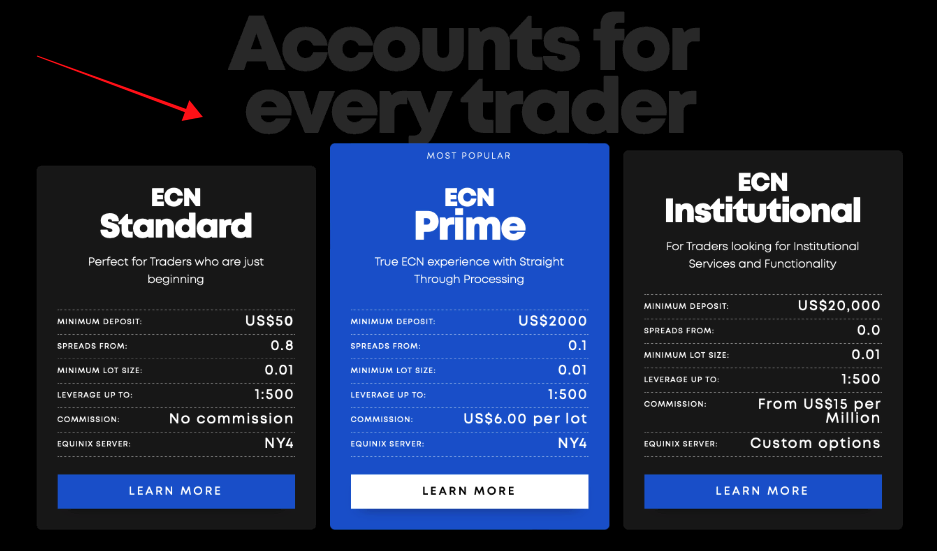

BlackBull Markets allows traders to start trading on the platform with the two account types. The platform has a standard account and an ECN prime account. The standard account traders can make an initial deposit of $200 with a different spread from the ECN account.

Traders of the ECN prime account have a minimum deposit of $2000. They also enjoy a price commission, and the spread is different from the standard account.

Merits of BlackBull Markets

- The broker has MetaTrader platforms.

- Traders enjoy commission if they are using the ECN account

- They offer low trading fees

- There is a free demo account available

- Their market resources are well trusted

Demerits of BlackBull Markets

- Its clients are not provided with education resources

- USA clients are not allowed on the broker platform

(Risk Warning: Your capital can be at risk)

3. RoboForex

RoboForex has a user range that numbers up to one million traders worldwide. The broker is well known for its user-friendly trading platform and customer service. Its customer service has languages from which different traders can communicate with the customer’s service according to their country.

The IFSC regulates RoboForex. The platform has proper security for traders because of the regulatory policies given to it by the IFSC. Traders have protected fraud, market price manipulation, and other forms of financial abuse.

The broker has three platforms on which traders can trade: the MetaTrader platforms and the reader. BlackBull Markets’ MetaTrader platform consists of MT4 and MT5 platforms. The MetaTrader platforms are known to be technologically improved and provide security for traders. The cTrader platform is more advanced than the MetaTrader platforms.

RoboForex clients must make an initial deposit of $10 into their standard account before they can begin trading. R Stocks Trader account owners deposit $100 first. The broker also provides two other account types with the same minimum deposit as the standard account.

RoboForex has a demo account available for traders to know all about the Forex platform. The demo account is helpful to new traders on the platform or those who are new to forex trading.

Merits of RoboForex

- MetaTrader and cTrader platforms are available

- A demo account is provided for clients

- Standard account traders can make the minimum deposit of $10

- It is available on mobile and desktop

Demerits of RoboForex

- Spread is not fixed.

- Clients from the US are not allowed on the platform.

(Risk Warning: Your capital can be at risk)

4. Pepperstone

The AISC in Australia regulates Pepperstone. The platform was founded in 2010 and won an award for the best customer support broker. Pepperstone is not only regulated by the AISC, and it has other regulatory bodies that control the functioning of the broker company.

Pepperstone offers a variety of assets that traders can use to perform transactions. Traders can trade with gold, metals, and cryptocurrencies. Traders have more than one assets that they can use to carry out transactions on the platform.

Pepperstone is a MetaTrader platform. There are both MT4 and MT5 platforms on it. Pepperstone’s MetaTrader is unique because it has plugins that can help a trader’s trading experience. The plugins available on the MetaTrader platform help traders strategize and even pick the best trading positions during the market.

Two account types are available for the traders. Traders can use the standard account, which has an initial deposit of $200 with a different spread from the other account type. Traders that use the standard account don’t get to have a commission in their trade.

The second account type is called the Razor account. The spread is different from the standard account, as already mentioned. Traders that own this account enjoy a commission of $3 at the end of every trade.

Pepperstone is also available on your phone and desktop. This makes the trading experience as flexible as it can be. Opening an account on the platform is straightforward and follows simple steps.

Merits of Pepperstone

- Metatrader platforms are on the broker platform.

- Plugins that can assist a trader in making better positioning options

- Traders of razor accounts enjoy commission

- Good customer service

Demerits of Pepperstone

- Razor account deposit starts from $2000

- The demo account provided expires after a month

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

5. IQ Option

IQ Option came into existence in the year 2013. The company only offered a binary option (only for professional traders and outside EAA countries) as its tradable asset when it started. But over the years, with improved technology, they have added CFDs and some other tradable assets. The broker company is headquartered in Cyprus and is also regulated by the Cyprus Securities and Exchange Commission (CySEC)

IQ Option provides traders with two account types. Both have different initial deposit amounts and spreads to them. The standard account users deposit a minimum amount of $10 before they can trade on the platform. The VIP account traders make an initial deposit of $1000. VIP account traders get a commission at the end of a trade.

The broker platform provides educational resources for traders. Traders can learn how forex works. IQ Option’s market resources are top-notch. Traders can strategize and plan their moves in the forex market.

Aside from the educational resources and market resources, IQ Option has forums where traders can discuss and get to know how the primary market works from big-time traders on their platform. The broker sends emails to clients to join webinars where they can gain helpful information.

IQ Option is available on the phone and desktop. The platform is user-friendly. Traders can interact with the platform’s chart and choose the chart type that suits them most.

Merits of IQ Option

- Good customer support

- Account type that supports a $10 minimum deposit exists

- There is a demo account that does not expire

- Educational and market resources are provided for traders

Demerits of IQ Option

- Traders do not get to trade on a MetaTrader platform because it is unavailable.

- US clients cannot trade on IQ Option

(Risk warning: Your capital might be at risk.)

What are the financial regulations in Lesotho?

Lesotho is a country in the southern part of Africa. It is usually called the Kingdom of Lesotho. The Act of 2000 brought the Central bank of Lesotho into existence, and this also states the functions that will perform in the country.

The Central Bank of Lesotho regulates all the other financial institutions in the region. Including commercial banks, mortgage banks, and others. All of these financial institutions are checked and balanced by the Central bank of Lesotho.

The bank was first known as the Lesotho Monetary Authority in 1978. It was also charged with specific duties that it performed in the country. The country has four commercial banks that help in better banking activities.

(Risk warning: 78.1% of retail CFD accounts lose money)

Security for traders from Lesotho

Forex trading is a virtual means of currency exchange. And often, there are many misconceptions that it is a form of cybercrime or a means through which people steal money from others. In some cases, this is true because some forex traders get involved with broker platforms that are not regulated. Any tech person might have just created such broker companies to steal from those who fall into their hands.

Forex trader’s security is best attained in licensed broker companies. They follow regulations. Traders should look out for brokers that international financial organizations regulate. They offer favorable trading conditions.

Trading on a broker platform that is not regulated is hazardous because anything can happen with the platform. If anything happens, there is no higher authority that it can be reported.

Is it legal to trade Forex in Lesotho?

Forex trading in Lesotho is legal. Traders from the region can trade forex freely because the government did not put any ban or a stop to forex trading there. However, no laid down regulations guide forex brokers in Lesotho. Therefore, traders are advised to trade with forex brokers that have international bodies regulating them.

International organizations regulate the 5 forex brokers above. This ensures protection and security for every trader on their platform. Traders from Lesotho can begin trading with these brokers once they have deposited the required amount into their accounts.

Again, there is no legal framework that guides forex brokers in Lesotho. There are no regulations that guide forex brokers. This is why it is advised that traders should trade with brokers that have international regulatory organizations.

How to trade Forex in Lesotho – Tutorial

Open account for Lesotho trader

Once you know the broker company you want to use their platform to trade with, the next step is to open an account for Lesotho Trader. It is pretty easy to open an account on any broker because all you need to do on the platform can be done right in your comfort zone. Your broker company will ask for documents from you to verify your account with them. Every trader is asked to provide a valid means of identification like an international passport. You will also be asked to submit valid proof that you reside in that place, such as your utility bill.

Traders can easily submit these details on the broker platform and wait till their account is verified.

Start with a demo account or a real account

A demo account is simply a toy account. If you’re a beginner, it is suggested that you use the demo account. This will enable you to get familiar with the platform you are trading on. Demo accounts are funded with an amount that can or cannot be refreshed, depending on your platform.

A trader’s real account is the main deal. Traders must deposit an initial amount in their real account before starting trading. The initial deposit depends on the Forex company’s platform.

Deposit money

To deposit money into your real account, you must first select a payment method. The payment method determines which means you choose to deposit funds into your account. Traders can pick from a direct bank transfer, debit or credit cards, and even Apple pay to fund their real account.

Notice:

The payment methods are depending on your country of residence. Forex Brokers are offering all kinds of methods separately for each country.

Use analysis and strategies

A good trader always has the technique they use while and even before trading. Forex is a tricky game and needs specific strategies to approach it. The use of analysis and strategy helps traders open, and close markets on FX spread carefully.

Some of these strategies used by forex traders are below.

Scalping

Scalping is used by traders who want to make small profits from multiple trades. The scalper does that. He opens more than one trade in a short while and closes them. The aim is to earn little profits from all positions.

Day trading

As the name suggests, day trading is a forex strategy that traders use to make a profit in a day. A forex trader can take a particular position on the chart for a whole day without changing. This helps you to notice the spread for the day.

Position trading

Position trading involves staying in the same position for more than a week. A trader can even spend years in the same position. This helps the trader notice how the market competition works for a lengthened period. The trader does not take notice of any temporary change.

Make profit

Profit in forex is made depending on your position by the time the primary market ends. Strategizing can help you improve your chances of making more profit than the loss in forex trade.

(Risk warning: 78.1% of retail CFD accounts lose money)

Conclusion: The best Forex Brokers are available in Lesotho

Forex trading involves high risks and should not be taken as just anything. Traders must take time and be careful while trading forex on any platform. To ensure their security, traders should try and make sure that the broker platform they are using has regulations that they follow. The rules help keep in check the Forex company.

Traders can also help themselves by getting acquainted with articles, videos, and courses on forex trading. Some forex brokers may provide their traders with some of these educational materials. But if not, ensure that you get yourself educated. Forex trading is not just a kind you want to jump right into without proper knowledge.

FAQ – The most asked questions about Forex Broker Lesotho :

Is forex trading legal in Lesotho?

Forex trading is legal in Lesotho. A forex trader has no restrictions on depositing money in the forex broker account. However, there are certain rules and laws in Lesotho to keep traders safe from scams and save forex traders by offering them a protected trading environment.

Which is the best forex broker in Lesotho?

There are many forex brokers in Lesotho. BlackBull Markets, IQ Option, RoboForex, Pepperstone, and Capital.com are the best ones.

These are trusted and safe forex brokers and also give bonuses to new traders.

How to trade forex in Lesotho?

There are a few steps to start forex trading in Lesotho. A firm internet connection is significant for a trader in Lesotho, select a broker, log in to your forex trading program, and finance your account. Then, you can place your forex trade.

What are the strategies for forex trading in Lesotho?

There are three types of strategies that traders in Lesotho can use for forex trading – short-term, mid-term, and long-term. The traders using short-term strategy look upon small price movements. The traders using a mid-term strategy, clutch their money for hours or days. The traders who use long-term strategy depend on basic analysis to regulate how the money will change its value.

Last Updated on January 27, 2023 by Arkady Müller

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)