4 best Forex Brokers and platforms in Lithuania – Comparison and reviews

Table of Contents

The foreign exchange (forex) market is the world’s largest and most liquid financial market, with over $5 trillion daily. And as Lithuania’s economy continues to grow, investors in the country need to understand the basics of Forex trading. In this article, we look at the five best Forex brokers and platforms in Lithuania.

When looking for a Forex broker, it’s essential to find one that offers the best trading platform for your needs. Lithuanian Forex brokers offer a range of platforms and tools to help you make informed decisions when trading. Here are 4 of the best Forex brokers and platforms in Lithuania.

See the list of the best 4 Forex Brokers in Lithuania:

Forex Broker: | Review: | Regulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. Capital.com  | CySEC, FCA, ASIC, SCB | Starting 0.0 pips variable & no commissions | 3,000+ (70+ currency pairs) | + Userfriendly platform + TradingView charts + MT4 + Best education + Personal support | Live-account from $ 20(Risk warning: 78.1% of retail CFD accounts lose money) | |

2. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 78.1% of retail CFD accounts lose money) | |

3. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

4. IQ Option  | CySEC | Starting 0.1 pips variable & no commission | 500+ (25+ currency pairs) | + Easy to use + Binary Trading + Support 24/7 + Min. Deposit 10$ + Lowest spreads on main trading hours | Live-account from $ 10(Risk warning: Your capital might be at risk.) |

The list of the 5 best forex brokers in Lithuania includes:

- Capital.com

- BlackBull Markets

- Pepperstone

- IQ Option

1. Capital.com

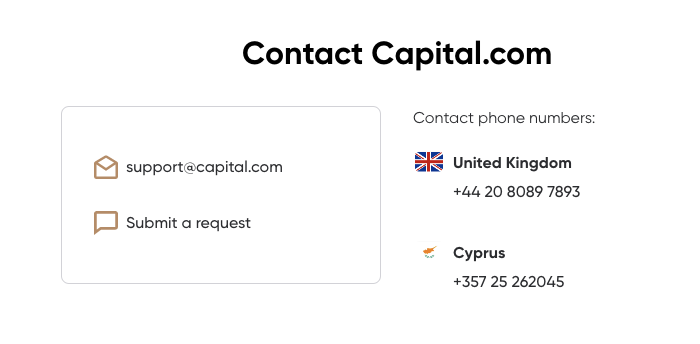

Capital.com is a broker that offers you access to the world’s financial markets. Capital.com is a new generation of online brokers that allows traders to make informed and intelligent investment decisions. Capital.com offers access to more than 3,000 assets, including stocks, indices, commodities, and currencies, across 45 global exchanges.

The company is registered with the Financial Conduct Authority (FCA) in the United Kingdom and is, therefore, subject to the rigorous regulatory standards of the FCA. It is also regulated by CySEC, ASIC, and the SCB

Capital.com is a licensed broker that offers CFDs (contracts for difference). A CFD is a derivative product that allows traders to speculate on the price of assets such as stocks, commodities, and currencies. The platform is a regulated broker with years of experience in the industry. They offer a wide range of markets and products and 24/7 customer support.

Benefits of Capital.com

- Capital.com is a regulated broker, safe for traders to trade.

- Customer support is available 24/7.

- Traders are offered free education and daily market insights.

- You can start trading on Capital.com with as little as $20 by Card.

Drawback of Capital.com

- Traders from the United States are not accepted on the Capital.com trading platform.

- Traders do not get price alerts on the Capital.com web trading platform.

(Risk warning: 78.1% of retail CFD accounts lose money)

2. BlackBull Markets

BlackBull Markets is a South African company authorized and regulated by the Financial Services Board. They offer their clients access to global markets through online trading platforms, providing an intuitive user experience combined with first-class customer service. At BlackBull Markets trading platform, they are committed to educating clients and giving them the tools they need to make informed investment decisions.

Though BlackBull Markets is a relatively new player in the retail Forex industry, it has wasted no time making a big impression. Boasting over two million account holders and more than $50 billion in transactions each month, the company has cemented its reputation as one of the world’s most reliable and customer-centric Forex brokers.

BlackBull Markets is a CFD and Forex Trading Brokerage which offers STP/ECN execution, tight spreads, and no commission trading.

The company offers traders access to the global Forex and CFD markets with over 500 instruments available, including currency pairs, stocks, indices, commodities, and ETFs.

BlackBull Markets traders enjoy the trading conditions they are offered. BlackBull Markets offer instant execution, low spreads, and no commission trading.

Pros of BlackBull Markets

- BlackBull Markets offers traders tight spreads.

- Traders enjoy the benefits of trading at a no commissions rate.

- Orders are executed quickly on the BlackBull Markets trading platform.

- BlackBull Markets’ trading platform is user-friendly.

Cons of BlackBull Markets

- Traders are charged withdrawal fees on the BlackBull Markets trading platform.

- The research tools available to traders on this platform are limited.

(Risk Warning: Your capital can be at risk)

3. Pepperstone

Pepperstone is a forex broker that offers online trading services to clients worldwide. The company is based in Melbourne, Australia, and was founded in 2010. Pepperstone offers clients access to the global foreign exchange (forex) market through its online trading platform, which provides real-time spreads and execution for various currency pairs. The company has won multiple awards from the Forex Trading Expo and other financial publications.

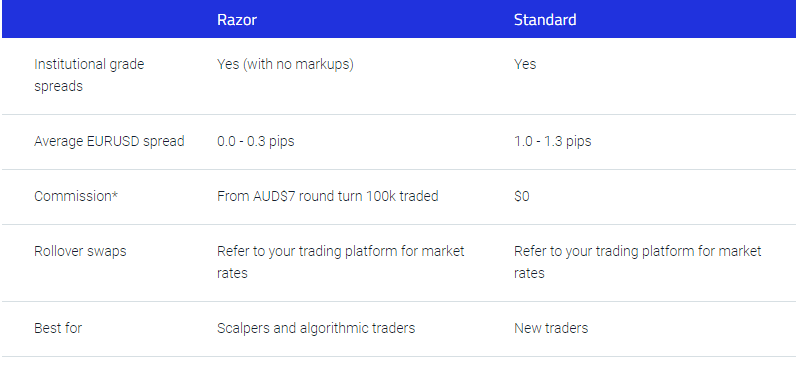

Pepperstone has more than 150,000 clients from over 180 countries. The company offers trading in more than 150 instruments, including currencies, commodities, indices, and CFDs on stocks. Pepperstone offers five types of trading accounts: Razor, Standard, ECN MT4 Disabled, ECN MT4 Active, and RAW.

The company was founded by experienced traders who wanted to provide retail traders with access to institutional-grade liquidity and technology.

Pepperstone offers a wide range of products, including Forex, CFDs, and cryptocurrencies. Pepperstone also offers a wide range of trading platforms, including MetaTrader 4, cTrader, and MetaTrader 5.

Benefits of Pepperstone

- Traders on the Pepperstone trading platform are not charged deposit fees.

- Pepperstone customer service is top-notch.

- Opening an account on the Pepperstone trading platform is swift and fully digital.

- Traders are not charged withdrawal fees.

Drawbacks of Pepperstone

- As a trader on the Pepperstone trading platform, you are charged a high sum to hold your position overnight.

- The demo account provided to traders expires.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

4. IQ Option

IQ Option broker is a regulated and secure online trading platform that offers customers the opportunity to trade in binary options (only for professional traders and outside EAA countries), forex, stocks, and ETFs. The company has over 14 million registered users.

The broker offers a wide range of tradable assets and a variety of account types to suit the needs of all traders. The company also offers a range of educational materials to help traders learn about online trading and how to make successful trades.

IQ Option is a binary options broker licensed and regulated in six jurisdictions. IQ Option offers a free demo account to anyone who wants to try out their platform. The company also has a wide range of products for its clients to trade, including stocks, commodities, indices, and currencies.

The platform is a regulated binary options broker (only for professional traders and outside EAA countries), providing a simple platform for digital trading assets. They offer a wide range of option types, various expiry times, and strike prices.

Pros of IQ Option

- IQ Option trading platform is user-friendly.

- The customer service on the IQ Option trading platform is excellent.

- IQ Option provides a demo account to its traders to familiarize them with the trading platform.

- IQ Option provides educational materials to its traders.

Cons of IQ Option

- The withdrawal process on the IQ Option trading platform takes a while.

- IQ Option does not provide service to traders in Canada.

(Risk warning: Your capital might be at risk.)

What are the financial regulations in Lithuania?

The global financial crisis of 2007-2008 led to the enactment of several regulatory reforms intended to prevent a similar debacle from happening again. Many countries, including Lithuania, enacted new financial regulations to improve the stability and resilience of their respective banking systems. A recent study by the World Bank assessed the impact of these new regulations on Lithuanian banks. The results indicate that most of the new regulations have had a positive effect on bank performance, with only a few having negative consequences.

The Republic of Lithuania is the latest country to announce plans to implement a regulatory regime for cryptocurrencies and Initial Coin Offerings (ICOs). The new rules, which will come into effect in March 2019, will cover digital asset issuance, trade, and storage. Lithuanian regulators hope that the new regulations will foster innovation in the cryptocurrency sector while protecting investors.

Lithuania is one of the most open economies in the world. The country has a liberal business environment and a low corporate tax rate. Lithuania also has a well-developed financial sector with a strong tradition of banking and insurance.

Lithuania’s leading financial regulatory authority is the Bank of Lithuania, which is responsible for the prudential supervision of banks, credit institutions, and investment firms. The Bank of Lithuania also issues licenses to payment institutions and e-money institutions and regulates the activities of these institutions.

The financial sector in Lithuania is regulated by the Bank of Lithuania, which is the country’s central bank. The main objective of the Bank of Lithuania is to maintain price stability and ensure the smooth functioning of the financial sector.

The Bank of Lithuania has several regulatory functions, including:

- Regulating the activities of credit institutions, payment systems, and electronic money institutions.

- Regulating financial markets and financial instruments.

- Supervising the safety and soundness of credit institutions, payment systems, and electronic money institutions.

- Monitoring and assessing systemic risk.

(Risk warning: 78.1% of retail CFD accounts lose money)

Security for traders from Lithuania – Good to know

Lithuania is a country in the Baltic region of Northern Europe. Latvia borders it to the north, Belarus to the east, Poland to the south, and the Kaliningrad Oblast exclave of Russia to the southwest.

The economy of Lithuania is the largest in the Baltic States, and it is classified as a high-income economy by the World Bank. Lithuania is a member of the European Union (EU) and the eurozone. The main economic sectors are industry (metalworking, engineering, chemical production, food processing), electricity, gas, water supply, and construction.

Cybercrime is on the rise, not just the big banks and corporations that are in the line of fire. Forex traders are increasingly becoming targets of cybercriminals, as they represent an easy mark with juicy financial rewards. Forex traders in Lithuania face a unique set of security challenges. They must protect their computers and online accounts from thieves and hackers, and they must also protect their money from criminals who want to steal it.

There are several steps traders can take to protect themselves. They can install antivirus software and malware protection, use strong passwords, and keep their computer software up to date. They should also be careful about where they do their trading and should never disclose their login information to anyone. As a trader, ensure that the trading platform you want to trade on is licensed and recognized out of Lithuania.

Is it legal to trade Forex in Lithuania?

Lithuania is a member of the European Union, and as such, it follows the EU regulations regarding financial services. Forex trading is legal in Lithuania, and there are no restrictions on Lithuanian residents when it comes to trading forex. Forex trading is one of the most popular activities among Lithuanians. Several licensed and regulated forex brokers in Lithuania offer their clients a wide range of products and services.

Forex trading is legal in Lithuania. The Bank of Lithuania, the country’s central bank, oversees Forex trading and issues licenses to companies that offer Forex services. Lithuanian traders can trade currencies through licensed brokers who offer a variety of products and services, including online trading platforms, margin trading, and hedging tools.

The legality of Forex trading is a complicated issue with no easy answer. In Lithuania, Forex trading is legal, but several restrictions are in place. For example, it is illegal to trade on margin. This means that traders cannot borrow money to increase their investment.

Lithuania is a member of the European Union, which means that its regulations concerning Forex trading are in line with EU regulations. The EU has made it clear that Forex trading is a legitimate form of investment and that member states are free to regulate it as they see fit.

How to trade Forex in Lithuania – Tutorial

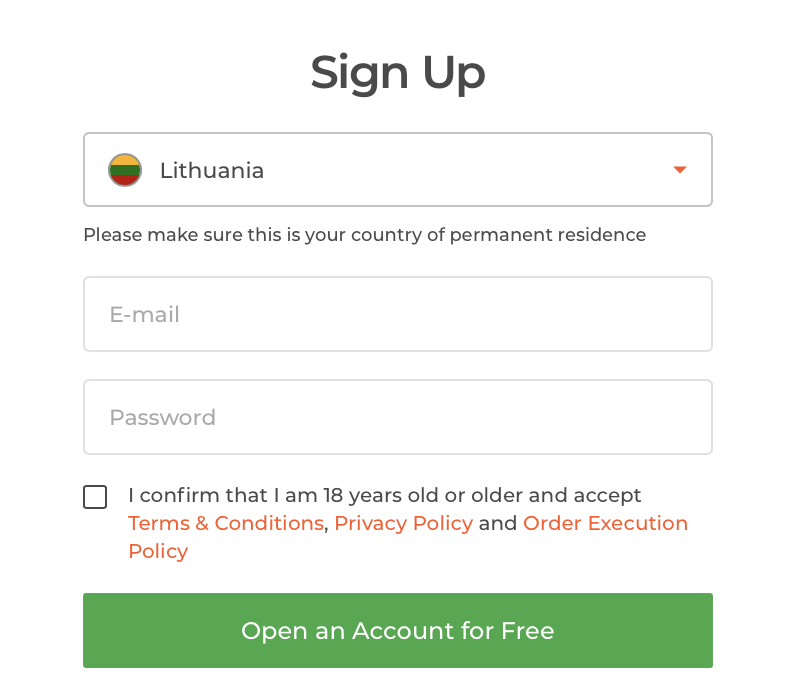

Open an account for Lithuanian traders

Opening a forex account can seem like a daunting task, but it can be pretty easy with the proper guidance. Here is a simple guide on how to open a forex account:

Choose a broker – When choosing a broker, it is essential to consider the type of account you want, the minimum deposit requirements, and the trading platform.

Complete the application process – To open an account; you must complete an application form and provide identification documents. Fund your

Start with a demo or real account

When starting in forex, it can be challenging to transition from a demo account to a live account. Many beginners start by trading on a demo account, giving them a false sense of security. A demo account allows you to trade with fake money, so you are not risking any natural capital. However, when you trade with a demo account, you are not learning how to trade in the real world. You need to trade with a real account to experience the emotions that come with trading forex.

Demo accounts also help new traders get familiar with the trading platform they are trading on. Just make sure you do not take on the demo account for too long.

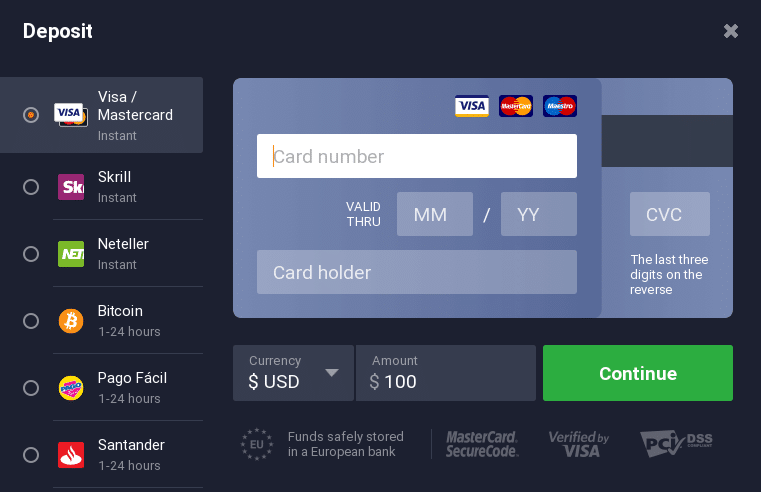

Deposit money

When you are ready to start trading forex, you will need to deposit money into your account. This is relatively easy to do, but you should know a few things before you get started.

The first thing you need to do is find a broker you trust. There are many brokers to choose from, so take your time and do your research. Once you have found a broker, open an account and deposit your money. Most brokers will accept various payment methods, including credit cards, debit cards, and wire transfers.

Once your money is in your account, you can start trading.

Notice:

The payment methods depend on your country of residence. Forex Brokers offer all kinds of methods separately for each country.

Use analysis and strategies

Position trading

Position trading is a type of trading that takes place over a more extended period, typically weeks or months. In this type of trading, you are looking to buy or sell stocks based on your market analysis and then hold those positions for some time.

This type of trading can be more profitable than day trading, as it allows you to take advantage of swings in the market which would be missed if you were only buying and selling stocks daily. However, it also requires a more excellent analysis and understanding of the market and a more considerable investment capital.

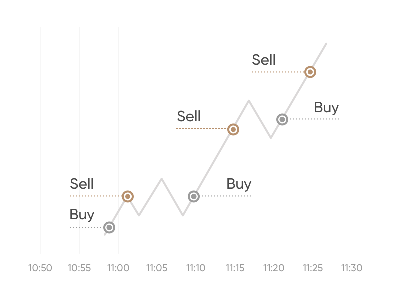

Scalping

Scalping is the process of buying large quantities of security to sell it immediately at a profit. It usually refers to the buying and selling of stocks but can also be used for other investments such as commodities and derivatives.

Day trading

Day trading is buying and selling stocks, commodities, or other financial instruments within the same day. It usually occurs during an exchange and is a form of speculation. Day trading aims to make a profit by buying and selling stocks at a higher price than what was paid for them.

Day traders use various methods to make profits, including technical analysis, fundamental analysis, and swing trading. They also use various tools, including real-time market data, charts, and margin accounts. Day trading can be profitable, but it is also hazardous.

Make profit

Forex trading is a great way to make some extra money on the side. It’s also a great way to lose money if you’re not careful.

Here are a few tips to help you make a profit while trading forex:

- Choose a reliable broker. Make sure your broker is licensed and regulated.

- Do your research. Learn about the different currencies and how they trade against each other.

- Use stop losses. This will help protect your investment in case the market moves against you.

- Stay disciplined. Don’t overtrade or bet too much.

(Risk warning: 78.1% of retail CFD accounts lose money)

Conclusion: The best Forex Brokers are available in Lithuania

This article has looked at the five best forex brokers in Lithuania. If you are looking to trade forex, it is essential to choose a reputable broker. All of the brokers listed in this article are licensed and regulated. They offer a variety of features, including tight spreads, multiple currency pairs, and 24/7 customer support.

FAQ – The most asked questions about Forex Broker Lithuania:

What should a trader look for in a trustworthy forex broker in Lithuania?

While selecting a credible forex broker in Lithuania, you need to consider the following aspects:

1. Check the broker’s reputation and see whether they comply with the legal regulations.

2. Compare the account offerings of different brokers.

3. See the currency pairs that they offer.

4. Judge the customer service by the broker.

Are forex traders liable to pay tax while dealing with forex broker Lithuania?

While trading with a forex broker in Lithuania, if the trader reaches a specific income level, they need to pay taxes on the money they owe. In such cases, it becomes crucial to consult tax professionals so you do not end up breaking the law. Taxes should also get filed even if there were losses in the year. The appropriate government agency in Lithuania should receive the amount and information about the taxes.

What does the forex trading market of Lithuania through the forex broker look like?

Although the forex trading market is known to be unsafe, it is the opposite. The forex broker Lithuania states the activeness and growing popularity of this trading in the area. Forex trading has become more accessible at lesser costs due to advanced technology, higher internet coverage, and enhanced competition in the market.

Last Updated on March 31, 2024 by Andre Witzel

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)