The 5 best Forex Brokers and platforms in Sri Lanka – Comparisons and reviews

Table of Contents

It is tough to choose the best broker among the many that accept Sri Lankan, forex traders. It is especially difficult to find a licensed broker offering low trading fees. We have done the hard part by reviewing several forex trading platforms.

See the list of the best Forex Brokers in Sri Lanka:

Forex Broker: | Review: | Regulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. RoboForex | IFSC | Starting 0.0 pips & $ 4.0 commission per 1 lot traded | 9,000+ (50+ currency pairs) | + Huge variety + Micro accounts + Free bonus program + Leverage up to 1:2000 + ECN accounts + MT4/MT5/cTrader | Live-account from $ 10(Risk warning: 78.1% of retail CFD accounts lose money) | |

2. Capital.com  | CySEC, FCA, ASIC | Starting 0.0 pips variable & no commissions | 3,000+ (70+ currency pairs) | + Best platform + TradingView charts + MT4 + Best education + Personal support | Live-account from $ 20(Risk warning: 78.1% of retail CFD accounts lose money) | |

3. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 78.1% of retail CFD accounts lose money) | |

4. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

5. IQ Option  | Not regulated | Starting 0.1 pips variable & low commission | 300+ (25+ currency pairs) | + Easy to use + Binary Trading + Support 24/7 + Min. Deposit 10$ + Low spreads on main trading hours | Live-account from $ 10(Risk warning: Your capital might be at risk.) |

We now bring you the 5 best forex brokers in Sri Lanka.

Here is a summary of these 5 regulated brokers that Sri Lankan forex traders can work with:

1. RoboForex

RoboForex is an award-winning global broker established in 2009 with its headquarters in Belize. The brokers offer the opportunity to trade forex and CFDs. RoboForex operates with a license from the International Financial Service Commission (IFSC).

Sri Lankan investors can start trading with this broker with as low as a $10 minimum deposit. A demo account is available, allowing newcomers to test the broker before they begin live trading.

RoboForex’s customer service is among the best. Customer support is responsive and easily reachable via phone, Skype, Livechat, WeChat, Whatsapp, Facebook, email, and even a call-back request.

Its trading environment is beginner-friendly, with helpful educational content and responsive support services. Experienced traders will find this a conducive forex trading platform with many practical trading tools embedded. Sri Lankans can choose from the MT4, MT5, cTrader, and rTraders, which are compatible with smartphones and desktop computers.

RoboForex offers several market instruments for traders’ portfolios, including 35 forex pairs and hundreds of CFDs in indices, stocks, commodities, etc.

Traders can choose from different types of accounts, including:

- Demo (for tests)

- Micro

- Mini

- Standard account

- Zero spread

- STP

- ECN

- Islamic

RoboForex advantages:

- Easy to start trading with a low minimum deposit.

- A flexible broker that allows different trading approaches, including hedging and scalping.

- Offers STP accounts with competitive spreads.

- Offers welcome and deposit bonus programs

RoboForex disadvantages:

- Forex pairs and other market instruments are comparably limited.

(Risk Warning: Your capital can be at risk!)

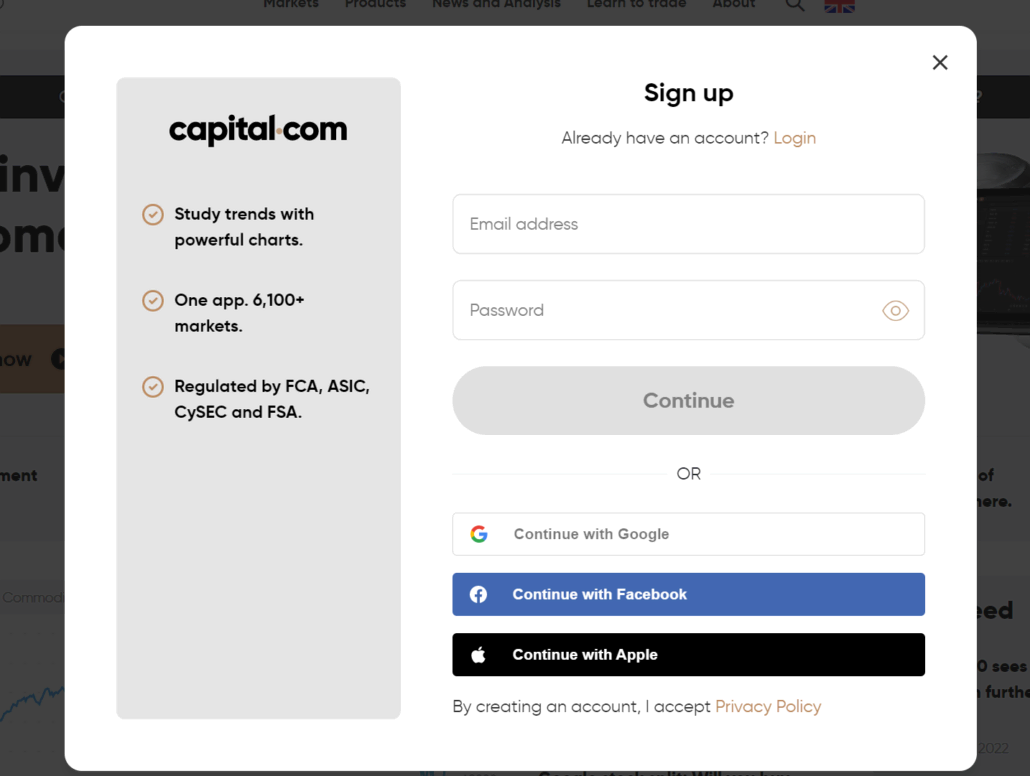

2. Capital.com

Capital.com is an internationally recognized CFD broker with offices in the UK, Australia, Seychelles, Cyprus, and Gibraltar.

The broker holds licenses from these regions, including:

- Financial Conduct Authority (FCA)

- Cyprus Securities and Exchange Commission (CySEC)

- Australian Securities and Investments Commission (ASIC)

- Financial Services Authority, Seychelles (FSA)

Its trading platforms are highly recommended for their unique user-friendliness and the broker’s quality customer support services.

With a minimum deposit of $20, anyone can start trading forex with Capital.com.

A free demo account is available if you wish to test its platform before you begin.

Capital.com offers three account types:

- Standard account

- Plus

- Premier account.

The minimum deposit for the premier account is $1000. This account is better suited to experienced forex traders.

The broker charges zero commission, and spreads can go as low as 0.6 pips on major forex pairs.

Traders have options to use the broker’s in-house platform or the MT4. All the features are compatible with mobile phones and computers. Social trading is also offered on Tradingview.

Benefits of trading with Capital.com

- Uniquely designed trading platform that is suitable for traders of all levels.

- Low trading costs with zero commission and tight spreads.

- Many assets, including stocks, cryptocurrencies, CFDs in equity, indices, commodities, and 138 forex pairs.

Drawbacks of trading with Capital.com

- High cost of trading stocks and index CFDs.

- Clients in the UK can not trade cryptocurrencies.

(Risk warning: 78.1% of retail CFD accounts lose money)

3. BlackBull Markets

BlackBull Markets is among the best and most well-known global forex brokerages in the Asia-Pacific. With headquarters in New Zealand, the broker welcomes traders from many parts of the world, including Sri Lanka. BlackBull Markets was founded in 2014 and is regulated by its home-based authority. That is the Financial Markets Authority of New Zealand. It also holds a license from the Financial Service Authority of Seychelles.

Though its minimum deposit is comparatively higher at $200, traders enjoy low fees on its raw spreads and ECN accounts.

BlackBull Markets offer three account types, these are called:

- Standard account

- Prime

- Institutional account

Traders can use these accounts on the famous MT4 and MT5 trading platforms. Zulutrade is available, and clients enjoy social and automated trading, plus several exceptional tools to enrich the trading experience.

Forex traders can choose from 72 forex pairs to trade in the currency market. Stocks and ETFs are also available, and trading costs are highly competitive. Spreads on the raw ECN account start from 0.0 pips. There are low inactivity or withdrawal fees.

Pros of trading with BlackBull Markets:

- Responsive and dependable customer service, available 24-5 via phone, email, and live chat.

- Incredibly tight spreads on raw and ECN accounts, starting from 0.0 pip

- No unnecessary fees, such as inactivity or deposit and withdrawal charges.

- High-tech trading platforms with helpful tools and research content.

Cons of trading with BlackBull Markets:

- The $200 minimum deposit is higher than the market average.

(Risk Warning: Your capital can be at risk)

4. Pepperstone

Pepperstone is one of the largest forex and CFD global broker. Founded in 2010, Pepperstone is indeed acclaimed and has won several awards as the most trusted brokerage in the industry.

Its head office is in Australia. So it is regulated by the Australian Securities and Investments Commission (ASIC). Pepperstone also operates under licenses from several financial bodies, including:

- Federal Financial Supervisory Authority of Germany, BaFIN.

- Financial Conduct Authority, FCA.

- Cyprus Securities and Exchange Commission, CySEC

Though the broker is mostly recommended for experienced traders, its platform’s user-friendly interface makes it good enough for beginners and inexperienced traders too.

Clients can trade over 100 forex pairs and other market instruments, such as stocks and CFDs.

Pepperstone offers multiple account types, and each comes with its unique benefits. Traders can access the guide that contains all the features of the account they choose to trade with. Although, all account types offer competitive spreads, starting from 0.1 pips for majors. Commission can be as low as $0.08 per round turn on 0.01 lot size.

The broker recommends a $200 deposit to start trading, but traders can begin with a much lower amount. Pepperstone offers low fees, negative balance protection, and a highly conducive trading environment.

Multilingual customer support is available round-the-clock through phone, live chat, or email.

Pepperstone Pros

- Acclaimed and trusted broker with many years of industry experience.

- A safe and genuine broker with several licenses in different jurisdictions.

- Multiple account types cater to different trading styles.

Pepperstone Cons

- None.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

5. IQ Option

IQ Option is an acclaimed broker offering forex and binary options trading. The broker’s head office is in Saint Vincent and the Grenadines.

Traders can access the broker’s free demo to test its platform and trading environment. There are two types of accounts from which you can choose. That’s the real account and the VIP account.

Traders can access a wide range of market instruments with this broker, including over 25 forex pairs, 17 cryptocurrencies, and CFDs in US stocks, indices, commodities, and ETFs.

IQ Option provides multiple popular payment methods, including Visa, Mastercard, bank wire, Skrill, and Neteller.

IQ Option advantages:

- A $10 minimum deposit makes it easy to begin live trading.

- Low inactivity and withdrawal fees.

IQ Option disadvantage:

- MT4 and MT5 platforms are not available.

(Risk warning: Your capital might be at risk.)

What are the financial regulations in Sri Lanka?

Considering that Sri Lanka’s population is only about 22.5 million, it has more financial firms than some of its other Asian neighbors.

Financial service is one of the key contributors to its developing economy. Forex trading is a tiny part of this activity, with many citizens trading with offshore brokers even though its Central bank has warned against it.

Sri Lanka’s central bank is the highest financial body and regulates all such activities. The Apex bank would sometimes ban forex activities for international trades attempting to enhance its currency reserve.

There is hardly any Sri Lankan-based forex brokerage firm, mainly due to this instability and the Central bank’s regulation. Brokers that accept Sri Lankan investors do so without authorization from any financial body in the country. There’s no forex governing institution here, and forex trading is considered illegal in Sri Lanka.

Regardless of this, its citizens still trade forex, and more people join the trade as it grows in popularity. Many now earn a living from the currency trading market.

Security for traders from Sri Lanka

There have been many forex scams in Sri Lanka over the years. Several people reported losing money to illegal forex “dealers” who advertised their services on the internet to Sri Lankans.

Because of this, the Central has issued several warnings to citizens to avoid getting involved in forex trading. Sri Lankans see this warning as directed toward the safety of people’s funds than monetary regulations by the Central bank. For them, it is meant to prevent forex scams and protect citizens from fraudsters. The Central bank declared that only commercial banks are authorized to trade forex.

Sri Lankans still engage in forex trading despite this warning. This is because they found ways to trade forex safely with licensed brokers.

Clients from Sri Lanka can rely on brokers’ reputation and trustworthiness, which comes from operating under licenses from well-known bodies in strictly regulated regions, such as:

- The United Kingdom, FCA.

- The United States – SEC and CFTC.

- Australia – ASIC.

- Cyprus – CySEC.

- South Africa – FSCA.

- Germany – BaFin.

There is no regulatory body in Sri Lanka. But its neighboring countries in south and east Asia have reputable financial bodies that manage forex activities in the jurisdiction.

Popular Asian regulatory organizations include:

- Japanese Financial Service Authority, JFSA.

- Monetary Authority of Singapore, MAS.

- Securities and Exchange Board of India, SEBI.

Therefore, if you are new and looking for a trusted broker in Sri Lanka, your first consideration must be regulations.

Not all genuine brokers have an Asia regulatory license, but the trader must confirm that their chosen firm operates under a well-known financial body.

The Singaporean dollar and Japanese yen are famous currencies in the forex market. Many Sri Lankans love to speculate on them, especially the Singapore dollar. Traders from Sri Lanka, for their safety, should look for licensed brokers authorized by MAS.

Is it legal to trade forex in Sri Lanka?

According to the Central bank’s “foreign exchange dealer” act, only commercial banks and authorized persons can trade forex in Sri Lanka.

This act allows “Authorized dealers, restricted dealers, and dealers for specific purposes” to trade forex.

Authorized dealers refer to commercial banks. The “restricted dealers” are those permitted by the Central bank based on some terms and conditions. While “dealers for a specific purpose” refers to anyone authorized by Apex bank to trade for a specific reason.

The general public does not fall into any of these three categories. Therefore, forex trading is not legal in Sri Lanka.

Trading forex without authorization may attract a hefty fine according to the act. Although many Sri Lankans trade in the financial market.

We recommend thorough research on the Central bank’s policy regarding forex before you begin if you are in the country. The act recognizes other dealers apart from commercial banks. So traders may look closely into this regulation to understand the requirements for getting involved in forex in the country.

How to trade forex in Sri Lanka – Tutorial

We have given recommendations on the best brokers and explained important regulations on currency trading in Sri Lanka.

Now, we will give a step-by-step guide on trading forex.

Follow the guide below:

Open a forex trading account

You should first find a suitable broker for this. As we mentioned, make sure the broker operates under the supervision of one or more acclaimed financial bodies.

We have listed some of these bodies above. Next is to find out about their fees so that you have an idea of the trading costs before you begin.

After this, visit the broker’s website to fill out your details in the signup form. Click on the verification link that the broker sends to your email and complete the rest of the signup form.

The broker may request an ID and proof of residence. All you need to do here is scan copies of your valid ID and a utility bill that carries your address. Then upload it to the broker.

Once you do these processes, your account is ready to get funded and traded.

(Risk warning: 78.1% of retail CFD accounts lose money)

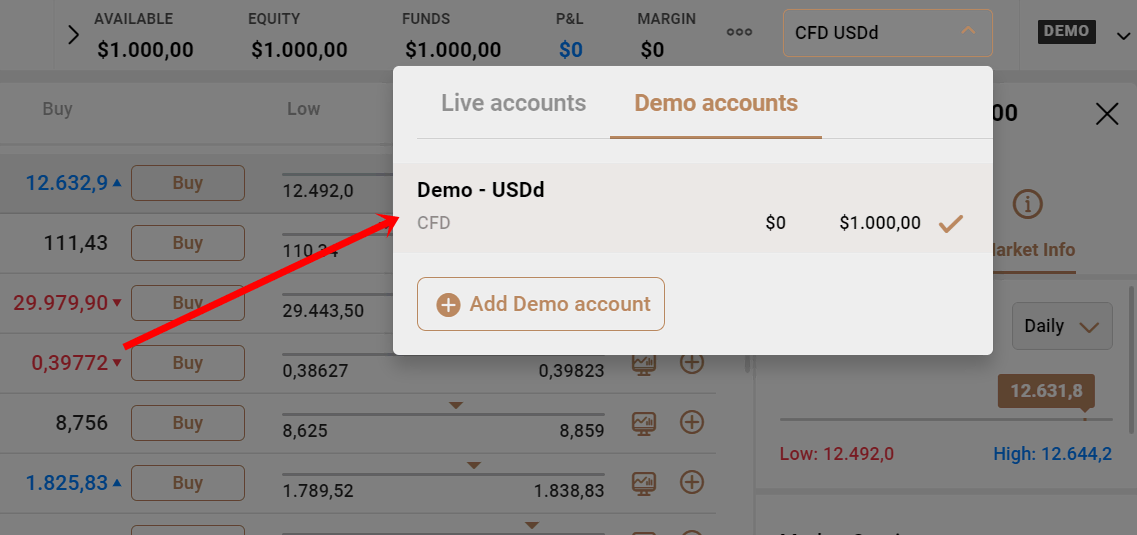

Start with a demo account or real account

If you are totally new to foreign exchange trading, we recommend starting with a demo.

Demo accounts present “real” market environments but with fake money for testing. It lets you see what forex trading is like before you start.

Use the demo to test the broker’s platform and try out some trading strategies before funding your live account.

Some traders test a broker with real accounts as this gives a full actual experience of dealing with that broker. “Real” accounts allow access to all the platform features according to what’s available for the account type. This experience helps you fully decide if the broker is right for you or not. But your funds will be at risk. We recommend micro-accounts or trading with the minimum deposit for this.

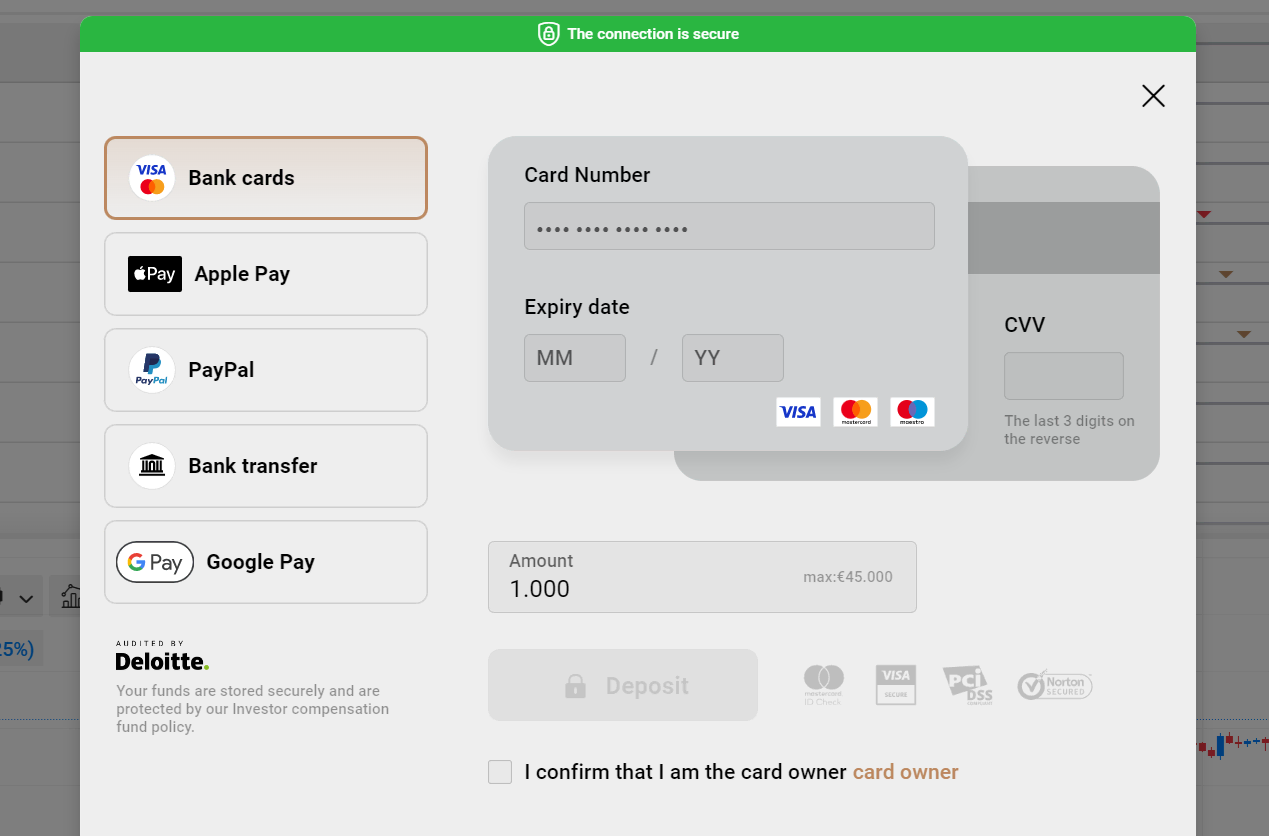

Deposit money

Once you have completed the signup process and are comfortable with the broker, you can transfer funds to the trading account.

Many good brokers offer straightforward and popular payment methods for this. The broker may offer an option to deposit money in rupees in most cases. Bank transfers or debit and credit card funding will be easy to do for this.

Other payment methods can include online third-party payment portals, such as Skrill, Neteller, or Paypal. But make sure these are available in Sri Lanka before using them.

Notice:

The payment methods depend on your country of residence. Forex Brokers offer all kinds of methods separately for each country.

Use analysis and strategies

Before trading, research different forex strategies and do some market analysis. It helps you understand the market conditions of your chosen instrument. That way, you can make profitable trading decisions.

The analysis and technique you use would depend on the forex pair you wish to invest in.

Here are popular trading strategies:

News release trading

It involves speculating on currencies based on the news. News release trading is a profitable strategy for skilled traders who understand market participants’ behaviors and how they react to economic data.

Day trading strategy

With this strategy, the trader ensures they close all trades within the day.

Scalping

Scalping is a form of day trading that involves closing positions within a few minutes and making some profits, which accumulate to a considerable amount.

Conclusion: The best Forex Brokers are available in Sri Lanka

The Central bank of Sri Lanka prohibits forex trading unless authorized by persons or organizations. If you wish to trade forex in Sri Lanka, you should look into these regulations thoroughly. You must also ensure your desired broker operates under the required license and authorizations.

FAQ – The most asked questions about Forex Broker Sri Lanka :

How can I pick a trustworthy broker in Sri Lanka?

The broker’s regulation is one important consideration. A broker is required by Sri Lankan law to reveal all information, including name, registration information, legal address, etc. The most important document is the financial activity license.

Is forex trading allowed in Sri Lanka?

In Sri Lanka, trading in forex is legitimate, standard, and subject to strict regulation. Foreign exchange trading is only permitted by the Central Bank of Sri Lanka with FX brokers authorized by the Exchange Control division.

What is the minimum age for one to trade forex in Sri Lanka?

Forex trading by local investors is not restricted by a specific age. However, the country’s 18-year-old minimum gambling age might be considered the correct legal age for forex trading. To ensure profitability, there are actions to take that include self-education, using a demo account, and more.

Which Forex broker is the best in Sri Lanka?

There isn’t a single Forex Brokerage Company that is ideal for all investors. Before settling on a brokerage, forex traders must consider variables, including regulation and customer service. It is feasible to make money when trading foreign exchange.

Last Updated on January 4, 2024 by Arkady Müller

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)