The 5 best Forex Brokers and platforms in Zambia

Table of Contents

Forex trading in Zambia is now prevalent. The number of traders in Zambia increases every year and has risen rapidly in the last five years. The rapidly happened for various reasons, including the urge to secure a steady income through an alternative means and many people losing their jobs due to the pandemic (covid 19). Also, many forex trading platforms now have a presence in Zambia by accepting traders to trade on their platform, allowing them to participate in the forex market.

The Forex industry is one of the largest industries in the financial sector, and many people have access to the industry. The forex industry experiences a high number of transactions every day to about $5 trillion.

Forex trading became more accessible to traders in Zambia due to the proven technology, better internet coverage as well as the increase in competition among assets available for trading. These have also helped reduce the costs of trading in Zambia.

See the list of the best Forex Brokers in Zambia:

Forex Broker: | Review: | REgulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. Capital.com  | CySEC, FCA, ASIC | Starting 0.0 pips variable & no commissions | 6,000+ (70+ currency pairs) | + Best platform + TradingView charts + MT4 + Leverage up to 1:500 + Best education + Personal support | Live-account from $ 20(Risk warning: 78.1% of retail CFD accounts lose money) | |

2. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 78.1% of retail CFD accounts lose money) | |

3. RoboForex  | IFSC | Starting 0.0 pips & $ 4.0 commission per 1 lot traded | 9,000+ (50+ currency pairs) | + Huge variety + Micro accounts + Free bonus program + Leverage up to 1:2000 + ECN accounts + MT4/MT5/cTrader | Live-account from $ 10(Risk warning: 78.1% of retail CFD accounts lose money) | |

4. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

5. IQ Option  | CySEC | Starting 0.1 pips variable & no commission | 500+ (25+ currency pairs) | + Easy to use + Binary Trading + Support 24/7 + Min. Deposit 10$ + Lowest spreads on main trading hours | Live-account from $ 10(Risk warning: Your capital might be at risk.) |

As a beginner in Zambia, you need to know the reliable trading platforms you can trade with. As you read ahead, this article will provide you with extensive knowledge about the top 5 best forex brokers in Zambia.

The list of the 5 best brokers and platforms in Zambia includes:

- Capital.com

- Blackbull Markets

- Roboforex

- Pepperstone

- IQ Option

1. Capital.com

Capital.com was established in 2016, and since then, until the present, it has about 500 thousand users. The company is regulated by four regulatory bodies: the FCA in the United Kingdom, the ASIC of Australia, the CySEC located in Cyprus, and the National Bank of Belarus.

Capital.com provides a well-organized training program for its traders when they start with them. This training includes the provision of training articles, educational videos, and a training curriculum. The training course is sectioned into 5, including an assessment to know if you understand trading platforms.

Capital.com is among the top trading platforms mainly because of the advanced technology of its platform. Traders get to use Capital.com’s unique trading platform to make a selective decision on which of the trading assets available on the platform would they trade-in.

On Capital.com, the following assets are available for traders to trade-in in but are not limited to this list; Stocks, indices, cryptocurrencies, commodities, and foreign exchange. Capital.com ensures that all its traders are protected by law. This makes Capital.com well known to traders.

Advantages of Capital.com

- Capital.com has one of the most competitive spreads in the industry.

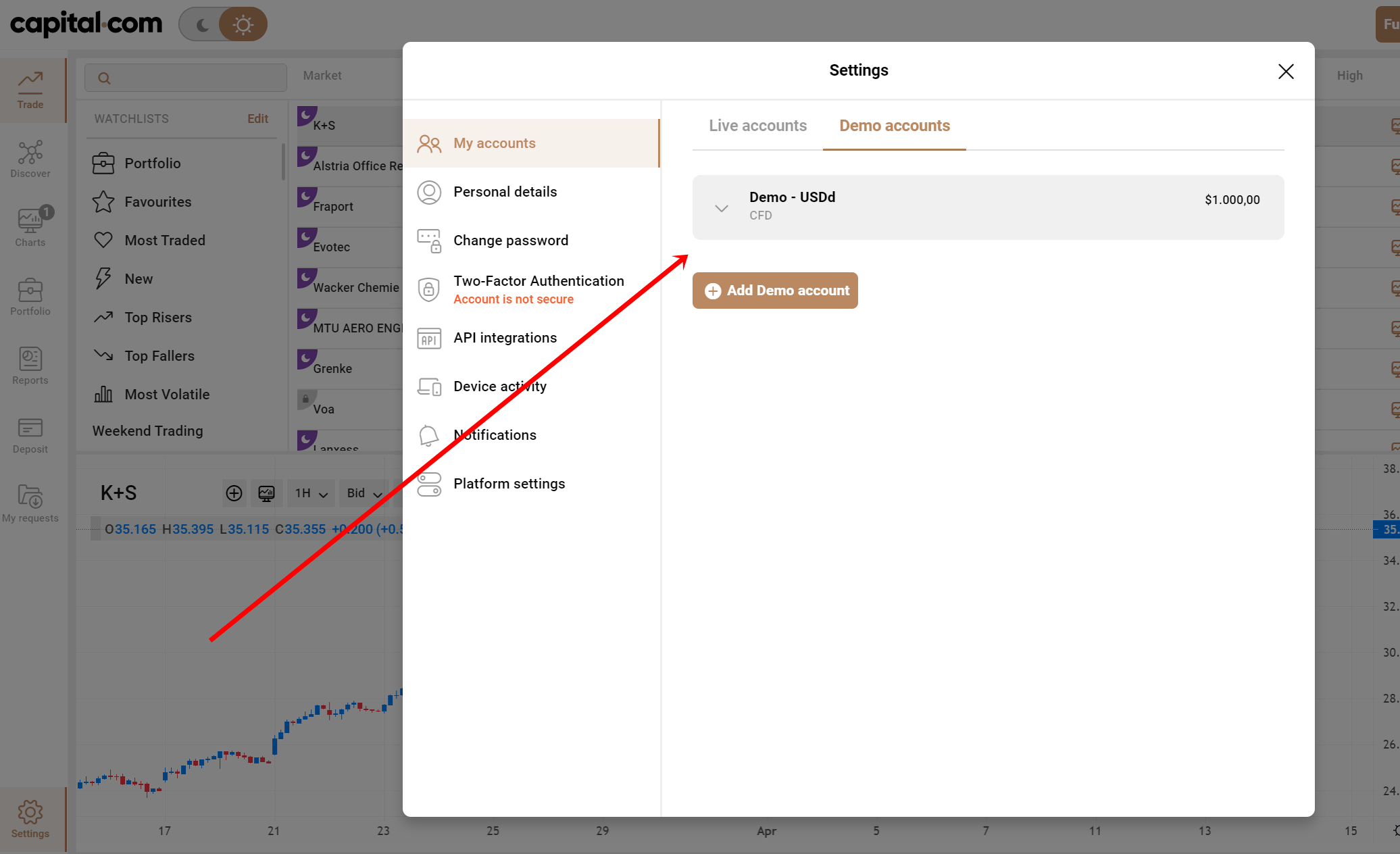

- On the Capital.com trading platform, you are provided with a demo account that you can use to get familiar with the platform before you start trading.

Disadvantages of Capital.com

- Capital.com does not accept client’s from the United States.

- Capital.com has several assets available for trading on its platform, but this number of assets is below average compared to other trading platforms.

(Risk warning: 78.1% of retail CFD accounts lose money)

2. BlackBull Markets

BlackBull Markets was established in 2014; its headquarters is in New Zealand. BlackBull Markets is a well-known MetaTrader broker that supports many third-party social copy trading platforms.

BlackBull Markets is registered with the Financial Services Provider Registry (FSPR) FSP403326. The firm is also a member of FSCL, Financial Services Complaints Limited, involved in the dispute resolution scheme.

BlackBull Markets uses the ANZ Bank, one of Australia’s top banks. The use of ANZ bank helps BlackBull Market secure traders’ funds by separating traders’ money from the organization’s. This gives traders a great sense of security while trading with BlackBull Markets.

As a trader on BlackBull Markets, you are provided with several educational materials, including forex analysis guides and videos.

Advantages of Blackbull Markets

- BlackBull Markets has a fast account opening process.

- On the BlackBull Market trading platform, you have access to low forex and CFD fees.

- Also, you are provided with educational instruments such as videos.

Disadvantages of Blackbull Markets

- The research tools you are provided on the BlackBull Markets trading platform are limited.

- At every withdrawal you make, you are charged a fee.

(Risk Warning: Your capital can be at risk)

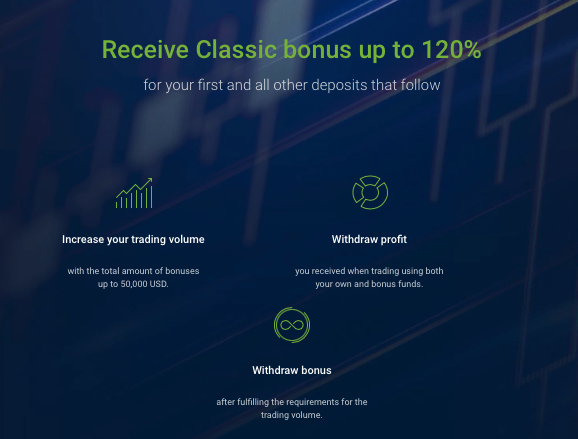

3. RoboForex

RoboForex provides its services to traders worldwide, it is a recognized trading platform, and it is registered. RoboForex allows you to trade with about seven assets on their platform. These assets include currency pairs, stocks, indices, ETFs, commodities, metals, and energies. The number of trading tools available on RoboForex amounts to 12,000.

There are five types of accounts available on the RoboForex trading platform, and you have to deposit a minimum of $10 once you open an account with them.

RoboForex allows its traders to get bonuses at intervals. Such bonuses include the welcome bonus of about 30% for all new traders. A profit share bonus of about 60% when you deposit into your account and a Classic premium of nearly 120%.

Advantages of RoboForex

- RoboForex has support for its customers available in 11 different languages. Hence the problem of the language barrier has been removed.

- Customer service is available round the clock.

- On the RoboForex trading platform, orders are executed fast.

- There are four account currencies (EUR, USD, CNY, GOLD)

Disadvantages of RoboForex

- On the RoboForex trading platform, there are no cryptocurrency tools available when trading on the R trader platform.

- When you open an account with RoboForex, a minimum deposit of $10 must be made into the account.

(Risk Warning: Your capital can be at risk)

4. Pepperstone

Pepperstone was established in 2010, and since then, it has come top in the forex trading industry as one of the best. The assets available of Pepperstone for traders to trade with are forex, shares, indices, metals, commodities, and even cryptocurrencies.

As a new trader on the Pepperstone trading platform, your minimum deposit is $200. Pepperstone is regulated in the United Kingdom and registered with the Financial Conduct Authority with FCD #684312 and the Australian Securities and Investments Commission with registered number ASIC #147055703.

Pepperstone separates traders’ funds from the company’s. This single act makes traders more convenient for trading on this platform because they feel secure with them.

Merits of Pepperstone

- Pepperstone provides the MetaTrader and cTrader platforms to their traders. Both platforms combined are great for algorithmic traders and copy traders.

- You are provided with multiple platform add-ons on the Pepperstone trading platform.

- The assets available on the Pepperstone trading platform are fast-growing assets.

Demerits of Pepperstone

- Pepperstone provides average educational material for their traders; as a trader on the Pepperstone trading platform, you need to do more research as the educational material provided won’t be enough for you.

- The courses provided to traders are not interactive, and there are no assessments. Hence you can assess how well you grasp the procedure.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

5. IQ Options

IQ Options is a forex trading platform established under the IQ Option Europe company. IQ Option was established in 2013; its headquarters is located in Cyprus. This platform is licensed by the Cyprus Securities and Exchange Commission; with this license, IQ Option can provide its services to clients in the European Economic Area zone.

As a trader on the IQ Option trading platform, you can trade with the following binary options (only for professional traders and those outside of EAA countries): stocks and shares, currencies, and ETF trading. IQ Option is recognized as one of the fastest-growing trading platforms worldwide, with over 25 million traders.

IQ Option has clients in about 178 countries all around the world. However, they still can’t provide services to traders in the United States, Canada, Syria, Australia, Iran, Russia, Sudan, Turkey, and Israel based on some strict restrictions.

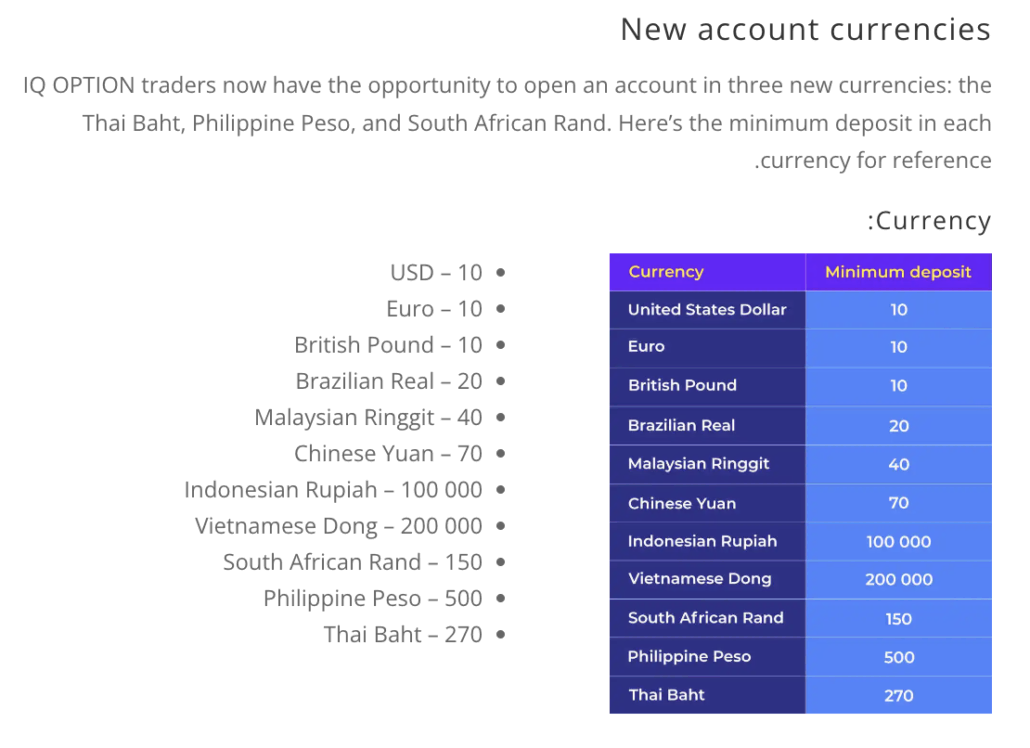

IQ Option has its trading platform and website available to traders in 13 different languages. As a trader on IQ Options, you can choose the currency you want to trade in. The options of currencies available are EUR, IDR, RUB, USD, MUR, GBP, and Yuan.

Merits of IQ Option

- IQ Option is supervised by a reputable body which is the Cyprus Securities and Exchange Commission (CySEC)

- It is straightforward for you to open an account on IQ Option.

- There is a wide range of trading tools available to choose which to trade with.

Demerits of IQ Option

- IQ Option does not provide services for traders in the US, Australia, Japan, Canada, and other countries.

- IQ Options does not have MT4 and MT5 trading platforms.

(Risk warning: Your capital might be at risk.)

What are the financial regulations in Zambia?

In Zambia, the authority to give license, oversee and regulate those who provide financial services is defined under two legislation which are; The Banking and Financial Services Act (BFSA), Chapter 387 of the Laws of Zambia, and the Bank of Zambia Act, Chapter 360 of the Laws of Zambia.

The Bank of Zambia‘s main aim is to form and implement monetary policy and oversee policies that will ensure the price of items in the country is maintained and the stability of the financial system to promote balanced macroeconomic development in Zambia. Hence, the bank carries out the following responsibilities but is not limited to; the bank oversees and regulates the activities carried out by banks and financial institutions.

The Banking and Financial Services Act supports the Bank of Zambia by enlarging the legal and regulatory framework of providing licenses overseas and controlling the Financial service providers in the country.

In the early days, the main aim of The Banking and Financial Services Act was to regulate the conduct of financial companies and banks and provide protection for customers and investors in the financial industry. The Banking and Financial Services Act aims to give a well-detailed regulatory and supervisory framework for the financial sector at large.

(Risk warning: 78.1% of retail CFD accounts lose money)

Security for traders from Zambia – What you need to know

Trading online is now the order of the day, a lot of traders trade primarily online. The majority feel the need to have an extra source of income, and forex trading fits perfectly into that box. As an investor, you do not have to meet up with brokers physically before you can close a deal. Many technologies are available now that can help you close your deals remotely.

The first thing is to verify if the online trading platform you want to trade with is internationally recognized. If the trading platform doesn’t have a presence outside of Zambia, it is likely, not legit. It is advisable that you don’t trade on such a platform.

Afterward, check the trading platform’s historical spread provided by different trading platforms. The spread refers to the amount you have to pay to the broker every time you close a trade. Ensure you trade on the trading platform that has the smallest spread. It is also essential to ensure the broker’s customer service is top-notch.

Watch out for Bucket retailers, as much as you can avoid them altogether. Bucket retailers are brokers who do not have any regulatory body that regulates them. They trade on your behalf, but most of the time, the Bucket retailers wait for the trade price to change before closing the trade so that they can pocket more money and give you the amount you have agreed to collect from the onset.

Is it legal to trade Forex in Zambia?

As a forex trader in Zambia, your best available trading platforms have been discussed extensively. Pick the platform that works best for you.

Forex trading is a fast-growing industry in Zambia. Zambia forex traders have increased tremendously within the last five years; worldwide, $ 5.1 trillion is traded in forex.

Trade of forex in Zambia is allowed and very active. Trade with the brokers that accept traders in Zambia. Forex trading is essential for export, import, and international investment.

Trading of Forex in Zambia hasn’t been banned. Many brokers provide excellent service to traders in Zambia.

As a forex trader in Zambia, ensure that you file taxes in due time, even make you make losses while trading, and also make sure to pay the appropriate amount as tax. File your taxes with the appropriate government agency in Zambia. Should in case you are lost in the process, or you don’t understand the tax filing process in Zambia, ask for help from a Zambia tax official.

In Zambia, Islamic accounts get support from brokers. However, Islamic accounts do not have rollover interest when using the overnight positions trade. This is simply in compliance with the Muslim faith. Zambia brokers provide accounts suitable for Muslim traders. Such brokers comply with Sharia law.

The economy and population in Zambia are multiplying, hence the large number of the middle class, which in turn provides a growing clientele.

How to trade Forex in Zambia – An overview

The processing of trading forex in Zambia is simple. First, you need to get a reliable internet connection that works well because you will be making your trades online. Ensure that the internet connection is not one that fluctuations so it doesn’t fluctuate during peak trading hours.

Open an account for Forex traders

Make your inquiries about reputable local brokers as well as international brokers. Ensure the broker you finally decide to trade with is regulated by a popular body. Then go-ahead to open an account with the broker.

To successfully open an account on any trading platform, you have to complete the verification process, which involves you providing proof of residency or a valid identity card. Make sure you attach your bank details to your account to make the withdrawal of your funds easy.

Start with a demo account or real account

Once you have successfully opened your account, you choose to start with a demo account or with real money. It is advisable you start trading with a demo account. This helps you familiarize yourself with the trading platform before trading with real money. This enables you to avoid losing money.

Deposit money

The next step is to put money into your account, which would be used to trade. You might want to demo accounts to practice forex trading and perfectly understand how the trading is done.

Brokers’ accounts for forex traders in Zambia can be quickly funded using payment methods like direct bank deposit, master card payment, or other accepted payment methods. It is also advisable that you opt for efficient money deposit methods, which would help you quickly scale through the hurdle of back and forth with your broker.

Notice:

The payment methods are depending on your country of residence. Forex Brokers are offering all kinds of methods separately for each country.

Use analysis and strategies

Successful forex traders mostly rely on data from genuine sources to quickly make informed decisions about the trading activity. The graphs and prediction analysis also help the traders to understand which strategy will yield a better result. Here are the common strategies used by traders;

Position trading

Forex traders using this trading strategy often like to maintain a position where they can easily benefit from the trading activities over a long period. They can hold the position for a week, two weeks, or even years.

Aside from that, traders using these strategies can easily tolerate slight changes in the market and still bounce back to their position. The trading approach requires that the trader use a long-term strategy that will keep them in position always.

Scalping

Here is another effective trading strategy used by some people to enjoy profits through a minimal shift in the market. Although the profit could be small when accumulated over time can be worthwhile.

With this in mind, traders using these methods always prefer to maximize their profits from all possible small accumulations. Meanwhile, holding off on a forex position for a long time is the opposite scalping strategy.

Also, due to the liquidity and increased volatility of forex trading, scalping is one of the popular strategies many traders implement.

Day trading

As the name sounds, the strategy process only uses a technique that relies on single-day trading activity. The forex trader opens the market at a specific time and closes the market trading option at the end of the day.

Make profit

Of course, forex trading aims to profit from market activities. Whenever you are trading, always remember that the forex market is volatile and could swing in any direction at any time. Take minimal risk so you can make necessary gains.

(Risk warning: 78.1% of retail CFD accounts lose money)

Conclusion: The best Forex Brokers are available in Zambia

Forex beginners can easily make mistakes and lose much money if they lack proper training. However, the easy way to become a successful forex trader is to practice with a demo account and invest a tiny amount when getting started.

Additionally, it is essential to stick to a strategy and master it to help you understand how trading is done and make you stand out from rookie traders.

FAQ – The most asked questions about Forex Broker Zambia :

Can traders in Zambia trade forex?

Yes, traders in Zambia are benefitting immensely from forex trading. Forex trading is a fully legal affair in Zambia. Traders can have their pick amongst the best forex brokers in Zambia. The broker market in Zambia is highly competitive. It offers an enhanced scope to traders looking forward to trading forex. Besides, traders can pick their desired forex pairs and trade forex with many monetary rewards.

What to look for in a forex broker when trading forex in Zambia?

If you are looking forward to forex trading in Zambia, you need a forex broker to enhance your trading experience. The forex broker should offer you the best trading facilities. Besides, they should also offer all forex trading features that make it fun. So, traders in Zambia should choose a forex broker who offers them the best trading services and leading underlying assets.

Can a trader in Zambia use a forex demo account for trading?

Yes, a trader in Zambia can trade forex using a demo account. However, it is not a real trade. It happens with virtual currency, and the traders make money virtually only. Most brokers in Zambia will allow traders to sign up for a forex demo account.

Last Updated on January 27, 2023 by Arkady Müller

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)