Can a forex trader steal your money? – The hard truth

Table of Contents

As a retail forex trader, you need a broker to trade in the financial market. It is nearly impossible for you to trade directly in the interbank market as it requires capital. The brokerage company you choose will be your only link to this market.

Unfortunately, more than people realize, there are bad actors in the forex brokers’ industry like other aspects of the financial market. It is up to you to be mindful of this fact and research the broker thoroughly before signing up with them.

Some brokers are not regulated. Others are, but with licensing bodies that are not known and have not built credibility. Not all of these brokers are bad, but it is safer to deal with the ones who are trustworthy and reputable.

Without proper research, apart from the risk inherent in buying and selling foreign currency, you may have something else to worry about.

Can a forex trader steal your money?

Sadly, the straight answer to this is YES. As we mentioned, there are bad brokers in the forex market who take advantage of unsuspecting forex traders.

Although rookie traders tend to lose money due to a lack of knowledge of profitable trading strategies, some of the loss may occur as a result of a scam by the broker.

Let us look at the different ways through which this can happen.

Ways in which a broker can steal your money:

1. Direct theft.

A forex broker has access to your account and may blatantly steal or misappropriate your funds. As an expert, the broker may also have a smart way of covering their tracks and making this thievery go unnoticed.

New traders and the elderly sometimes fall victim to this fraud, mostly because they may not keep a close watch on their account statements.

As a forex trader, you must monitor your funds by paying close attention to the activities in your account statements.

2. Churning (too much trading to earn more commission).

Some brokers rely on commission from your trading activities. So the more you trade, the more commission they earn.

Constant activity on your account can increase or decrease your profit. It can also shoot up your taxes. Your broker is legally obligated to execute your orders and should not place trades without your knowledge. Churning is unethical and illegal. The broker gains commission, but you stand the chance of losing your funds and paying huge taxes. Paying close attention to your account statements is also vital in this case if you want to check for churning. Look out for buy and sell trades for pairs that do not match your objectives.

3. Spreads manipulation.

This scam involves using computers to manipulate the ask-bid spreads. The spread is the difference between the buy(ask) and the sell(bid) price. It represents the broker’s fee for that trade.

A higher spread means more money for the broker, so some bad brokers tweak this in their system.

Always look out for offers by other brokers. If the spread on your trade is 8 or 9 pips, while other brokers are offering much less, say 3 or 4 pips, your broker might be manipulating the spreads.

4. Stop-hunting by the broker.

As we mentioned before, your broker place trades on your behalf, according to your orders. So they have access to your accounts. They also know where you’ve placed all your stop losses. A bad broker can try to force you out of your position by manipulating price movement to the point where your stop loss is placed.

This may usually happen with market maker brokers who do not place your trades directly in the interbank market but execute it in-house among themselves.

5. Negative slippage.

Negative slippage occurs when the trader’s buy or sell orders are filled at unfavorable prices. Bad brokers are known to manipulate their trading platforms, making it disadvantageous to forex traders. And negative slippage is a common form of this fraudulent act. For example, a buy order that you placed can be executed at a higher price, thereby reducing your profit for that trade.

Sadly, in this case, it is difficult to tell if your broker is scamming you, and this is the case with a lot of broker scams.

That’s why your best bet is to trade with a good and reputable broker. A well-known and trustworthy broker would adhere to strict policies from their regulatory bodies. They would be subject to some regional financial laws that would keep you safe from fraud.

How to find a good broker.

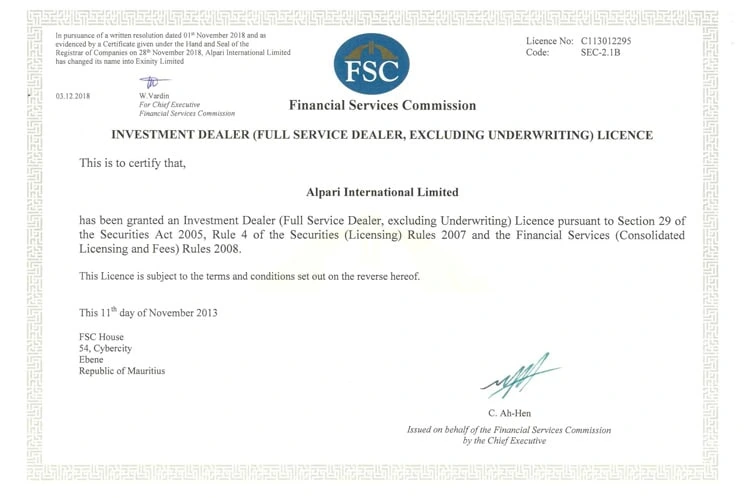

1. Check for its licenses and regulations.

The first thing to note about a good broker is its license. They must operate under strict regulations from a well-known financial body. If they can meet the requirements of a good regulatory body, then the broker is most likely a genuine one.

2. Ensure the regulatory bodies have credibility.

There are many broker licensing bodies, but not all of them are internationally known. It is safer to trade with brokers regulated by credible financial bodies whose details are verifiable online.

3. Read the company’s reviews online.

Customer testimonials are a great way to tell if a broker is good or bad. Look out, especially, for complaints of difficulty withdrawing funds. That might be a red flag.

Though, in this age of technology and chat robots, you should not solely rely on reviews to make your decisions. Customer review should be part of your research, not all of it.

4. Read the broker’s full information on its website.

A good broker will have its full information displayed on its website, such as its head office, the company history, financial details, achievements, etc.

5. Verify its awards and achievement, if stated.

If the company claims some awards and recognition, verify this claim by clicking on the award on its website. You should be redirected to the awarding organization’s link showing the details of the award. Or google the claim to find out if it’s a real award.

In conclusion, trading forex carries enough risks on its own. You can avoid additional worries by choosing a good broker to prevent scams and unnecessary losses. That way, you can focus on your business and making a profit instead of dealing with the troubles of fraud.

FAQ – The most asked questions about Can a forex trader steal your money :

Can a Forex Broker steal your money?

The answer to, can a Forex trader steal your money is, Yes. It is quite unfortunate that most people do not realize that there are many bad actors within the industry of Forex brokers. It is just like any other financial instrument market. So, it is totally upon the traders how mindful they can be while looking for facts and researching brokers in a thorough manner before signing up.

How to know if the forex broker is real?

If you are worried about whether the forex broker can steal your money and you wish to know if the Forex broker is real. Identifying if any regulatory authority authorizes the Forex Broker would be the first and the right step. To do that, identify the registration number that is offered through the disclosure text provided at the bottom of the homepage of the broker.

Now, not all brokers are registered or regulated, while some are registered with the licensing bodies with not enough credibility to be known. This doesn’t mean that all brokers are bad, but it would be suitable if you go ahead and look for reputable and trustworthy brokers.

Who controls the forex market?

The forex market is decentralized. It means there isn’t a single authority controlling it. There are some major players within this market, like the government and commercial banks.

Commercial banks are the major contributor to the largest capital that gets traded within the forex market. Some other contributors are government and hedge fund managers.

Here is our list of the 20 best forex brokers

Last Updated on January 27, 2023 by Arkady Müller