How to withdraw money on FXTM – Withdrawal tutorial

Table of Contents

Making withdrawals at FXTM is quick and straightforward, and it takes veritably little time. We’re always working to give you further deposit and pullout choices and to make the process as simple as possible.

You may wish to reap the prices of your trading exertion if you’ve been making economic trades, or you may just bear access to your cash for whatever reason if you are using an online broker for short-term trading or longer-term investments. To do so, you must first separate funds from your broker account.

Without question, CFD and FX markets are always the most attractive investment choices for consumers looking for a higher return on investment. Greater financial understanding has contributed to increased acceptance in worldwide capital market investment in past years.

To capitalize on this circumstance, numerous online brokers have developed complex trading programs to assist customers in investing their money. Pocket Option is one of the most well-known internet brokers.

However, before deciding on FXTM, it is best to learn all there is to know about its withdrawal procedure. This FXTM review might assist you in learning more about the firm’s withdrawal method.

About FXTM

Cyprus-based ForexTime Limited, also known as FXTM, has been among the best forexes and contract for difference (CFD) brokerage firms in the world since the year 2011.

Numerous regulatory agencies have supervised it, such as the UK Financial Conduct Authority (FCA) and the Cyprus Securities and Exchange Commission (CySEC). Since it is overseen by the top-tier FCA, FXTM is regarded as a secure broker.

FXTM client service gives fast and applicable answers. They can be communicated in several languages. There are several learning options available, along with a demo account and live web-based seminars. Account registration is quick and entirely online.

That does not feel delicate, but brokers range significantly in terms of pullout choices (similar as bank transfer or credit/ debit cards), as well as pullout speed and ease. While numerous brokers offer free recessions in utmost cases, some brokers and withdrawals types may charge a fee.

So, let’s get into the details.

How to draw out funds from the FXTM trading account?

The most popular system of withdrawals is bank transfer. It’s accessible at nearly all brokers, including FXTM.

In alternative to money transfers, FXTM offers you to withdraw funds to a debit or credit card. Because numerous brokers don’t give this service, FXTM has a distinct advantage.

You can, however, make withdrawals using digital wallets. This is a useful point that not all brokers offer. You may withdraw finances from FXTM to the following e-wallets like PayPal, Skrill/ Moneybookers, Dotpay, Neteller, and Western Union Quick Pay, which are all respectable methods of withdrawal.

It’s also important to be quick. Withdrawals are infrequently quick, unlike other deposit druthers. Your money will be transferred within 1 working day, to a maximum of five working days.

To withdraw funds from FXTM, you must first complete the following process:

- Sign in to your account.

- From the applicable menu, select’ Withdrawal’ or’ Withdraw funds.’

- If more than one choice is offered, select a withdrawal method and/or an account toward which you would like to withdraw money.

- Specify the withdrawal amount, and also a short description or summary when necessary.

- Submit your request.

- You can only make withdrawals to bank accounts or cards in your name, regardless of the method you use.

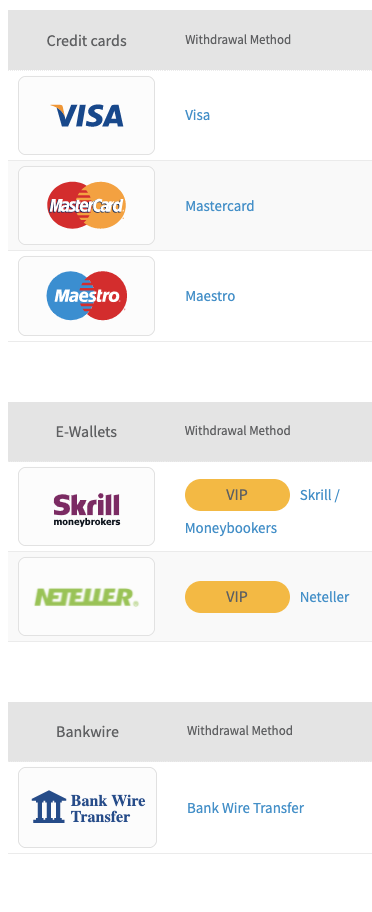

Payment methods provided by FXTM

FXTM provides customers with a variety of payment and withdrawal alternatives. The firm does not accept cash deposits or withdrawals.

The withdrawal methods offered by FXTM are as follows:

- Debit & Credit cards

- Skrill

- cryptocurrencies

- Maestro

- QIWI

- Webmoney

- Bank & Wire Transfer

- Neteller

Credit and debit cards, as well as original payment approaches, can be used to make the payment. Customers can also pay by bank line.

FXTM has also made chosen payment options available to users, similar to PayPal Ewallet and WebMoney.

PayPal-wallet is available to everyone in Europe, and it’s a step toward their dealer’s security and simplicity of entering and spending money since it’s veritably easy to use.

WebMoney is preferred by numerous significant and accomplished brokers, and it’s also regarded as one of the safest payment options available.

They give consumers speedy deposits and do not charge any additional costs. Also, consumers receive fast payment notifications, making it extremely reliable.

It’s also worth noting that the maximum amount that may be placed in a single day varies depending on the payment provider.

After making a successful payment, customers may see the specifics by examining their transaction history.

FXTM invest asset classes & markets

The company’s customers have access to a different variety of asset classes through which they can invest.

Precious metals are one of the asset types available as an indispensable investment. Unexpectedly, these precious metals are among the most extensively traded asset types.

Goods are also available to help clients in exploring trading possibilities in some of the world’s largest natural resource markets, similar to oil and natural gas.

The organization also allows its traders to share in a slice-edge fiscal means similar to bitcoin trading.

Likewise, the business has inked out over 300 US-listed companies, which are accessible to their traders via the MT5 platform.

Still, consumers can also request access to other equities, if they wish.

Currencies Trading | yes |

Commodities Trading | yes |

Indices Trading | yes |

Stock Trading | yes |

Cryptocurrency Trading | yes |

ETFs Trading | no |

Bonds Trading | no |

Futures Trading | no |

Options Trading | no |

Supported Crypto coins | Bitcoin, Ethereum, Litecoin |

Total Tradable Assets | 6 |

Number Of Currency Pairs | 50 |

Number Of Indices | 3 |

Number Of Stocks | 180 |

Number Of Commodities | 3 |

Number Of Futures | na |

Number Of Options | na |

Number Of Bonds | na |

Number OF ETFs | na |

How long will my withdrawal be pending on FXTM?

The time required for processing the withdrawal request depends on the mode of transfer and the financial institution.

Withdrawals via credit/debit card is immediate. Unlike bank transfers, which might take multiple working days.

Transfer Method | Time Taken |

Bank Wire Transfers | 3 To 5 Business Days |

Credit/Debit cards | 3 to 10 Business Days |

E-Wallets | 1 to 2 Working Days |

FXTM charges fees for most of the withdrawal options. For withdrawals, you have the option of using a bank transfer, a credit card, or an electronic wallet. Except for Alfa-Click, Western Union Quick Pay, and Dotpay, you can use the same electronic wallets as for depositing.

Just money from accounts in your name can be deposited.

Fees that can occur

The charge for making a withdrawal is determined by your country of residency, the method you employ, and the currency you withdrew in.

Withdrawal Methods | EU | UK | Other Countries |

Credit cards | €2, $3, or £2 | €2, $3, or £2 | €2, $3, or £2 |

Cryptos (BTC, ETH, LTC, DASH) | €20/£25 | €10/£5 | €30 |

Bank wire Transfer | €20/$40/£25 | NA | NA |

Deutsche Handelsbank transfer | Free | Free | Free |

Neteller,Skrill | NA | NA | Free |

China union pay | 1.5% | NA | NA |

Yandex.money,QIWI | NA | NA | 1.5% |

VLOAD | NA | NA | 2% |

WebMoney | Free | NA | 2% |

PayPal | NA | NA | 0.5% |

PerfectMoney,Fasapay,DixiPay | NA | NA | $1 |

Dusupay | NA | NA | 1.1%+$0.05 |

NganLuong | NA | NA | 1.5% |

Nigerian Local Bank Wire Transfer | NA | NA | Free |

China Online BankingCashUGlobePay | NA | NA | Free |

Southeast Asia Banking | NA | Na | 1.4% |

You can draw out money from FXTM by following these steps:

- Log in to MyFXTM.

- Go to ‘My Money’ and select ‘Draw out Funds.’

- Select the withdrawal method.

- Enter the sum you wish to transfer and the reason why.

- Start the withdrawal process.

- You’ll receive a four-digit code on your phone, which you must confirm.

FXTM deposit charges

When you transfer funds to your brokerage account from a bank account, you will be charged a deposit fee. Brokers usually do not charge fees for this, and FXTM is no exception. You will see the exact money on your trading account which you deposited using any of the payment options FXTM provides.

Withdrawal Fee | $3 |

Deposit Fee | $0 |

Inactivity Fee | Yes |

Account Fee | No |

Unfortunately, FXTM, like the utmost of the online brokers we have looked at, charges a$ 3 bank transfer withdrawal charge. This implies that when you transfer your money back to your bank account, you must pay this sum. It’s over to you to judge whether or not this is a large sum, as it’s substantially determined by the amount of the transferred money.

It’s reasonable to state that FXTM’s charges are generally modest. They either do not charge a brokerage charge for services that other brokers charge, or they charge a minimum price for services that other brokers charge. This means you may use FXTM indeed if you frequently trade, similar to numerous times per week or on a day-to-day basis.

Problems one can counter when withdrawing funds from an FXTM trading account

- Third-party payments aren’t accepted. The Receiver’s name must match the one on file with FXTM.

- Still, you must do so using the same source of cash that you used to make it If you want to withdraw your original investment.

- Any earnings earned after your original deposit can be withdrawn using any other accessible payment option.

- You must ensure that your account has an acceptable free periphery to accommodate your withdrawal. However, your account may be forced to cancel certain open positions, if you don’t.

- Still, the transaction will be converted, and costs may be incurred, as shown in the Conversion Rates table in MyFXTM (login needed) If your trading account and withdrawal are in different currencies.

- Their conversion rates are streamlined regularly.

- The amount withdrawn will be reduced by the withdrawal charge.

Why choose FXTM brokerage over others?

FXTM provides outstanding training materials for beginner traders, including live online webinars and unique seminars, videos, and tutorials. You may also obtain open accessibility to one of the most fashionable educational materials offered to every forex trader – a demo account. However, you really can’t go wrong with FXTM’s expansive learning coffers, If you’re a new trader.

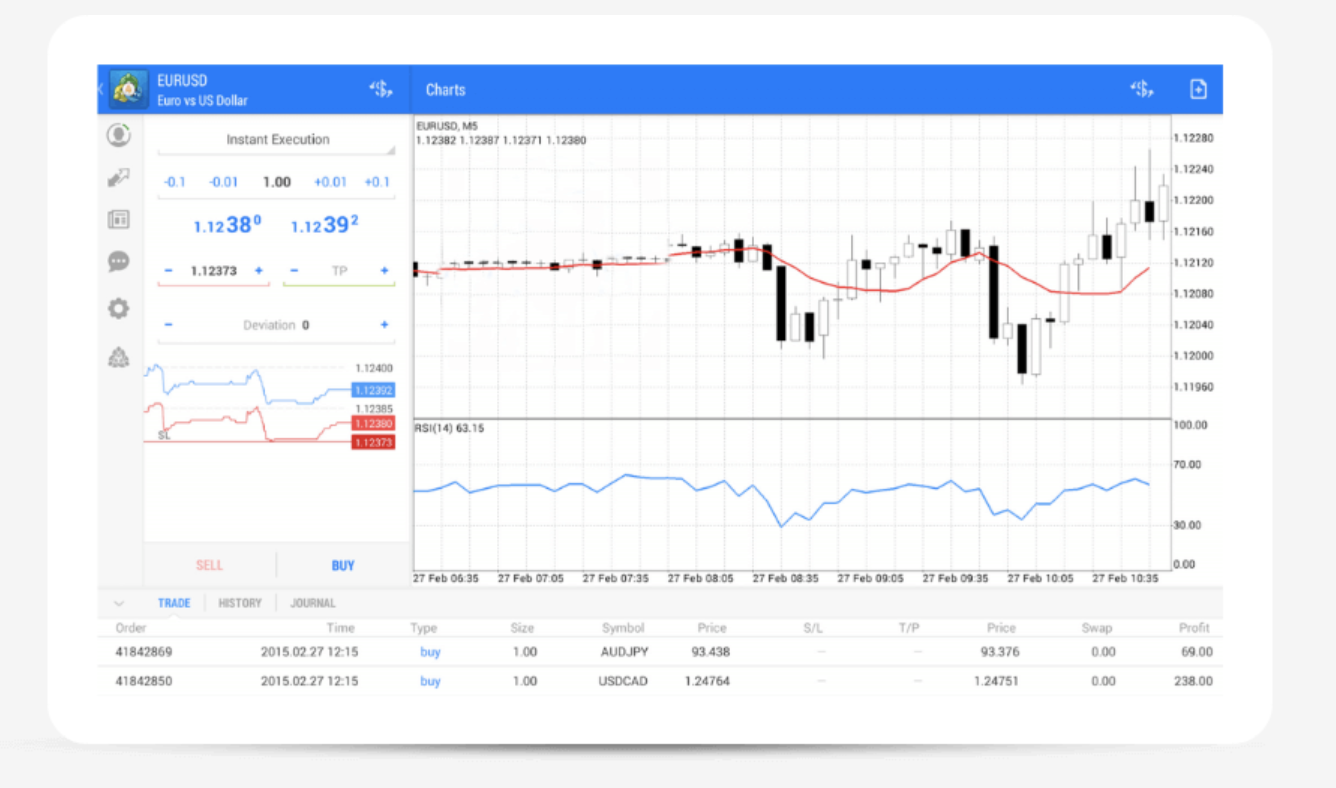

FXTM’s client support for users utilizing the renowned MetaTrader 4 and 5 (MT4 & 5) platforms provides a simple and advanced trading UI that many traders may start using immediately (its platform is also available in a mobile application). One factor where FXTM outperforms many competitors is its PAMM and supervised accounts. These accounts provide a viable solution for consumers who wish to make a profit in the forex market but do not want to handle the market personally.

Narrow trading spreads and accessibility to an electronic communication network (ECN) account type that offers straightforward access to markets will appeal to experienced and slightly elevated investors. In regard to the tough market trading that unfolds for the ECN accounts, a little fee is imposed.

Whether you’re just starting as a forex dealer or have been trading for times, FXTM can fit your requirements and give excellent forex brokerage services anyhow of your position of expertise.

Conclusion

FXTM is a large web FX, CFDs, and live commodities brokerage that functions globally with a few exclusions, the most noteworthy of which being its refusal to welcome US users. Customer accounts are isolated from corporate money to provide adequate protection for account owners, and the brokerage is subject to monitoring by three main authorities:

- The Financial Conduct Authority (FCA)

- The Cyprus Securities and Exchange Commission (CySEC)

- The Financial Services Commission of Mauritius (FSCA)

FXTM also has excellent teaching resources for new traders and integrates the MetaTrader platforms, which provide a plethora of perks for expert traders. Low trading spreads and cheap costs on ECN accounts provide an even less compelling reason to utilize FXTM.

Overall, FXTM is a great option for foreign exchange and CFD brokers, even if you are new to trading or have been doing so for years.

Both neophyte and professional traders or investors can profit from FXTM’s trading possibilities. There are also other benefits with ForexTime, similar to the account variety, which allows any trader to choose the best option for them, similar as flexible or floating leverage – an influence that’s determined based on the trader’s experience and knowledge, tight spreads starting at0.1 pips, and low deposit demands.

FAQ – The most asked questions about withdrawal in FXTM:

What is the minimum deposit in FXTM?

The minimum deposit at FXTM is $50.

What is the minimum withdrawal in FXTM?

To be precise, there’s no specific minimum withdrawal amount. It must be noted that the charge for processing fund recessions can be easily decreased from the amount withdrawn. There must also be a confirmation of the free credits n your account to support the withdrawal.

What is the maximum withdrawal in FXTM?

Maximum EUR/USD. However, their back-office team may communicate with you to discuss the choice of available methods, If the card processor is unfit to process your withdrawal request. FXTM doesn’t keep customer card data. The maximum withdrawal is also flexible depending on the card processor.

How can I deposit and withdraw earnings from FXTM?

They accept a wide range of payment methods for depositing and withdrawing funds, including but not limited to:

FasaPay, Bitcoin, Online Banking, Bank Wire Transfers, Debit/Credit Cards, WebMoney, and a range of additional options are available.

Can FXTM be trusted?

To be precise, we can claim that FXTM is a trustworthy and honest broker who is highly competitive in its trading charges. The spread that it offers is also low when compared and is often considered a low-threat trading domain. As it is regulated by the elite FCA, thus FXTM is considered trustworthy.

What are their conversion rate standards on FXTM?

Transfers in Dollar, Euro, Pound, and NGN are carried out without conversions.

Transactions involving these denominations will be processed using the FXTM currency exchange table.

Transfers in some other currencies will be adjusted at the rates of the payments provider/exchange bank.

How is FXTM customer support?

FXTM has great client support. You may connect with them in a variety of ways, and they respond quickly and appropriately. Client assistance is still only offered throughout the week.

You can communicate FXTM via

Online chat

Call

Email

It’s great that FXTM supports multiple languages Malaysian Arabic, Urdu, Czech, Chinese, Russian, English, French, Italian, Korean, Polish, Spanish, Vietnamese, Hindi, Indonesian and Farsi.

FXTM has a nice web chat. We did, however, receive straight explanations to more difficult queries, such as how backup costs are computed. In addition, to live chat, you will be able to communicate with FXTM customer care via Viber, Telegram, WhatsApp as well as Facebook Messenger.

FXTM phone assistance is excellent. We were connected to an agent in a matter of seconds and received informative and knowledgeable responses. We received responses by email within a few hours, and they were also relevant.

The single thing we missed was 24/7 support.

See more articles about forex trading here:

Last Updated on January 27, 2023 by Arkady Müller