How much does it cost with FXTM – Spreads and fees explained

Table of Contents

Getting rich can sometimes become more than a mere desire. Some people pursue it passionately. On the other hand, some despise chasing money. However, we cannot ignore the need for money in both cases.

Everyone requires money to fulfill their needs. It is something that helps in sustaining our lifestyle. The financial status also determines your social status. So, it becomes more important to focus on increasing your wealth.

However, many people either ignore it or choose not to pursue growth. They may argue that even minimizing your expenses can help you live a dignified life, which is true. But that should not necessarily mean that you must become a billionaire.

Getting rich does not always mean surpassing everyone in the world. It also means to grow your wealth to become richer than before. Improving your financial condition will help you in a lot of ways. By doing so, you can afford to enjoy such worldly pleasures that seemed unaffordable earlier.

Some people think that trading is the riskiest of all tasks. But, that is not true, though risks are part of trading. And we cannot imagine trading without any risks as they are inseparable. However, if we ponder, we realize that everything is risky in life.

All of that comes with their risks, from household decisions to personal decisions. Even while playing sports or driving a car, we are at risk of injury. So refraining from trading based on risks alone is an unwise decision.

Unlike any other method, it is the only legal way to get the profits in minimum time. Trading is possibly one of the oldest facets of human civilizations. Since people started to migrate for their survival and living, it continued. It has been around us for centuries now.

People realized that exchanging goods and services is necessary for sustaining life. Trading was born as a result of it. During ancient days, people traded as a means to survive, but over the years of progression, now we have arrived at the time where it serves something beyond the ordinary means.

It offers a domain where everybody can get the chance to fulfill their desire of getting rich. That is where trading offers a solution to get more income in a short time. However, you need to make smart investment decisions to excel in it.

Now, Forex and Stocks are arguably the dominant assets for trading. But, that does not suggest we cannot trade in other instruments. Other than those two, there are various assets like options, commodities, cryptos, CFDs, etc.

However, with the increasing popularity of online trading, Forex and Stocks have occupied the top position. Although they also have differences in their instruments, Forex’s role is more important than others. It is a market that deals with currencies as assets.

And currencies are an inherent part of all economies. When you trade for the first time and win the trade, it can give you immense pleasure. You cannot compare the feeling of a successful trade with anything else.

Your first win can give you the sense of being at the top of the world. So we can see the trading business is a vast area to explore. Often the newcomers step forward into trading with hopes of getting rich.

No one should ignore that making money is a need for everyone. People even end up leading towards the wrong path in that pursuit. In contrast, trading offers a way to reap faster returns in profits. So traders must explore it.

Also, it is a fact that online trading has taken over the world in the past few decades. So, the chances to trade in various assets with the convenience of sitting before a device and a few clicks are now higher than ever.

However, before entering into the online trading world, you must always expect some expenses that may come along in the journey. It would be surreal to assume that trading would be completely free.

We know that a trader has to invest her funds while participating in a live trade. But, she might also need to pay additional charges to the broker. The role of a broker in online trading is immense. They mediate and guide every transaction you make. So, when you search for a reliable broker, FXTM is a name that deserves to be your partner.

Different people enter the trading world with different objectives in their minds. Their choice of assets and methods may vary. But, the aim will always be to earn more profits. So, if you are a beginner trader, it is important to understand the need for a reliable broker.

Expecting more returns and fund safety when you have a trustworthy broker are just the additional rewards. Therefore, when you search for a reliable brokerage, FXTM should not miss your list. It is one of the leading Forex and CFD brokers that help millions of investors across the globe fulfill their trading goals.

FXTM or Forex Time Company comes as a great online broker for you. Established in 2011, it currently has headquarters at Limassol, Cyprus. It is an award-winning regulated broker with certifications from FCA and CySEC.

Though it offers to trade in numerous asset classes, it specializes in Forex. It can boast of being the fastest growing and the best forex broker. FXTM has shown rapid growth through its dedicated service within Europe in a short period. Now it also has extended its services to Asia and Africa.

FXTM entices more attention among traders because it utilizes best-in-class technology. So, if you are looking for an online trading platform that serves in Forex or CFD, FXTM can be the right choice for you.

The digital tech era has made people more aware of the potential that trading has. As a result, they are also showing keen interest. But, the only thing preventing them from entering the trading business is the costs.

It is natural to think that you may be charged a fortune while trading through broker services like FXTM. However, knowing about their fees and spreads can relieve you from such worries. Therefore, we must understand the basic terms and know how much FXTM trading can cost.

What do spreads and fees signify?

A spread is a term used commonly with brokers. It is nothing but the difference between an asset’s buy and sell prices. The financial world uses this term a lot. It impacts how much trades would cost – the lower the spread means, the trade will cost less. Many online trading brokers, market makers, and other providers use spreads to cite their pricing.

On the other hand, the customers may also be required to pay fees to the platform in exchange for their services. Though most platforms make their money using spreads, some also add fees. Moreover, you should know that the brokers rarely change the fees because they are usually fixed charges.

A spread is employed to cover the cost of the broker’s order execution. At the same time, many brokers also have fees associated with placing trades on your behalf. A broker also has to look into the costs of creating systems and paying the employees and marketing.

Fees and spreads help the brokers finance such charges. However, if you are trading for the first time, you should know that some assets like stocks may exclude spreads. Instead, the brokers charge a commission in such cases. However, other assets might require a combination of both.

When you open and close positions to enter a trade, the spread is calculated automatically. As a result, the trader need not pay the compensation separately. Therefore, while entering a trade, the spread is automatically taken into account.

The buying price remains slightly higher and a little lower than the asset’s original price. Major currency pairings offer a lower spread since they are traded in big volumes, and vice versa is applicable to obscure currency pairs.

A spread is usually expressed in percentage in points (pips). It refers to a minor shift in the value of the particular asset. So when it is regarding Forex trading, it is the shift in a currency pair. We can understand it further with the example of a currency pair.

Most currency pairs are generally priced to four decimal places. The last decimal point denotes the pip change. Therefore, a pip equals 1/100 of one percent.

In Forex trading, a currency pair is what we trade as an asset. We can understand it as a quote of two separate currencies. The price of one currency is expressed against the other’s price in a currency pair. For example, EUR/USD is trading at 1.1117, so if a trader wants to buy 1 EUR, he must pay 1.1117 USD.

As a beginner, you must also know that the currency is also the most liquid asset in the world. That is why we call it the lifeblood of an economy. As a result, it has the finest bid-ask spreads, the most common type of spreads. In comparison, Stocks and other less liquid assets may have wider spreads.

We can see that a bid-ask spread is normally applicable when trading in currency pairs or stocks. Measuring market liquidity is one of its main uses. Some markets have more liquidity than others. As a result, their spreads are lower, and we can evaluate that with a Bid-ask spread.

A spread is something that comes as a cost for exchanging an asset. Numerous factors can affect the size of the spread. It may vary depending on the liquidity, volatility, and volume. Moreover, a broker may offer a spread as floating or variable.

A trader must always check the spread size and place their orders accordingly. Since you want to profit, the market price should be above the spread price. Moreover, a new trader must remember that heavily traded assets will have a tight spread. Also, the trading volume and demand level affect how high a bid-ask spread can go.

In the trading world, a bid-ask spread is not the only type. There is another type that is rarely observed. It is known as a credit spread or a yield spread. It tells us the ratio of returns on different investments.

Such investments may have varying maturities or risk profiles. You can view a yield spread if you subtract the return from one asset from the other. We must know that the Brokers’ main revenue source is spread. So we can view it as a charge for their services.

Such services include the trading platform and the data they provide both. But it is beyond the broker’s power to entirely set the data and control it. Therefore, we must observe various factors affecting the spread rate as well.

Knowledge of spreads and their function is a must for anyone preparing to begin trading. Beginners often make the mistake of entering the trades without knowing about spread rates. Such a move can bring unforeseen losses to the trader. So, if you are a beginner, you must always keep an eye on the spreads.

FXTM spreads

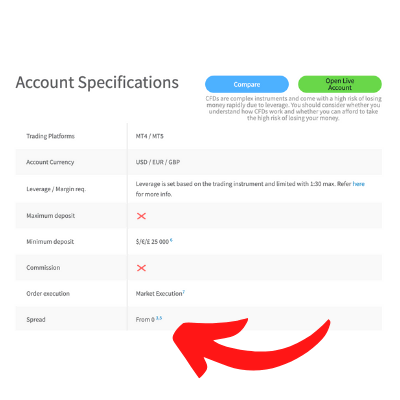

The spreads in FXTM vary depending on the account type you have chosen.

Account Type | Minimum Spreads |

Standard Account | 1.3 pips |

Cent Account | 1.5 pips |

Shares Account | 0.1 pips |

ECN Account | 0.1 pips |

ECN Zero Account | 1.5 pips |

FXTM Pro Account | 0.0 pips |

Fees that can occur with FXTM

FXTM is a broker that believes in charging only a reasonable fare for its services. Therefore, unlike other brokers, its fee structure is distinct and focuses on affordability.

Deposit fees

It is a common non-trading fee that various brokers charge from their customers. However, FXTM is a broker that excludes the charges for depositing the client’s own money. As a result, you can view the same amount in your trading account as your deposit amount.

Withdrawal fees

Though FXTM offers you instant withdrawals through various methods, it charges a withdrawal fee in the form of commissions. However, it purely depends on the payment method. So, you are the one to choose and decide the fee you want to pay by selecting the method.

Withdrawal Methods | Fees |

Debit/Credit Cards (Visa Secure, MasterCard and Maestro) | US Dollar 3/£2/€2 |

Crypto wallets | 1% |

WebMoney | 2% |

Yandex Money | 1.5% |

QIWI Wallet | 1.5% |

Perfect Money | 0.5% |

Bitcoin | 1% |

Connexion | 2% |

Bank Wire Transfers | €30 |

Swap fees

A swap fee is otherwise known as an overnight fee. It arises when the trader does not follow the time limit. That means, when she holds the same position longer than the permissible time that extends 22:00 GMT, a swap fee is applied.

Usually, most brokers levy it to prevent the customers from violating the time slot. However, FXTM differs from the rest as it is swap-free. So, you can trade without worrying about the swap fees.

Inactivity fees

An inactivity fee is a needful charge for the maintenance, administration, and compliance management of inactive accounts. Often, a trader keeps an account dormant for a long time. So, it is levied to prevent them from doing so and compelling them to trade or make a deposit before the expiry of the inactivity period.

You must pay an inactivity fee of 5 EUR/USD/GP or its equivalent if your account is left inactive for 6 continuous months. When the sixth month also passes, FXTM will deduct the fee from your account every month.

Conclusion

FXTM is a renowned name in the trading industry, serving for almost a decade. It offers trading opportunities in various assets and provides different types of accounts. However, a wise trader would never select a broker based on just the features and reliability.

The brokers must offer an affordable spread and fee structure to attract more customers. While assessing the spreads and fees of FXTM, we have come to know that it is among the lowest offering brokers, with spreads starting at just 0.1 pips.

Therefore, we can conclude that FXTM can become an ideal trading partner for anyone who looks for affordable trading.

FAQs – The most asked questions about FXTM:

Is FXTM free?

It would be an unreal expectation to get the free services from a broker. You can try your hand in the demo trading without any fees. But, when you enter the live trading, you must expect charges from the brokers.

FXTM, like most other brokers, also generates its revenue from spreads. Moreover, it differs from other brokers, excluding most additional fees. Though it charges a commission, it largely depends on the withdrawal methods and the account types.

Also, they are quite nominal and can be afforded by any new trader. Therefore, we cannot say that FXTM is a free broker. However, we can assuredly say that it is one of the most affordable brokers out there.

Does FXTM charge commission?

Yes, FXTM charges commission from its customers. So we cannot say that it is commission-free. However, the commissions depend and vary according to the type of accounts.

The Advantage MT5 accounts charge a fixed commission that is nominal and affordable. It charges only $4 per lot. Moreover, it is stable and does not change with volume or equity. It does not get affected by the market either.

On the other hand, the Advantage MT4 account offers a flexible commission structure. The commission charged will be less when you trade in a larger volume and have higher equity. Such a structure is also called a floating commission.

Hence, we can say that FXTM offers you the most competitive commission terms in the entire trading field.

Do I have to make a minimum deposit in order to open an FXTM account?

Yes, when you are depositing in FXTM, it must be remembered that the minimum deposit amount that is essential for you to invest in registering an FXTM is $10 USD and $500 USD. This amount is specifically for the Advantage and Advantage Plus accounts, respectively.

See more articles about forex trading:

Last Updated on January 27, 2023 by Arkady Müller