Plus500 demo account: How to use it – A precise trading tutorial

Table of Contents

The article talks about the usage of Plus500 demo account for trading actively. The article throws light on how the accounting software works so that you open your first trade without a hitch. The article also covers the most frequently asked questions related to trading on Plus500 demo account so that you can make the right investment decisions. Trading on the market is easy if you have the right platform to do it. This article is a write-up to help budding traders who want to try out the Plus500 demo account.

Risk warning: 82% of retail CFD accounts lose money. You should consider whether you can afford to take the high risk of losing your money.

What is the demo account?

The Plus500 demo account is a platform from an established online trade broker that people use to trade and invest in different kind of underlying assets. The platform offers a wide range of trading tools and helps new traders.

Through the Plus500 platform, people invest in any number of markets. A trader does not have to pay a commission fee for trading on the platform.

The general markets of the platform are cryptocurrencies, commodities, and forex pairs. This article helps you to open your Plus500 demo account and start your first demo trade.

Millions of users use the Plus500 platform every day, and it is a trustworthy one for traders. The account opening process is very fast and digitized. Therefore, the user base of Plus500 increases day by day. The account opening process finds an explanation in the next section.

How to open the demo account?

The process to open a Plus500 demo account starts with filling up some necessary information. The Plus500 demo account opens up for free. The account is therefore accessible to everyone who wants to trade.

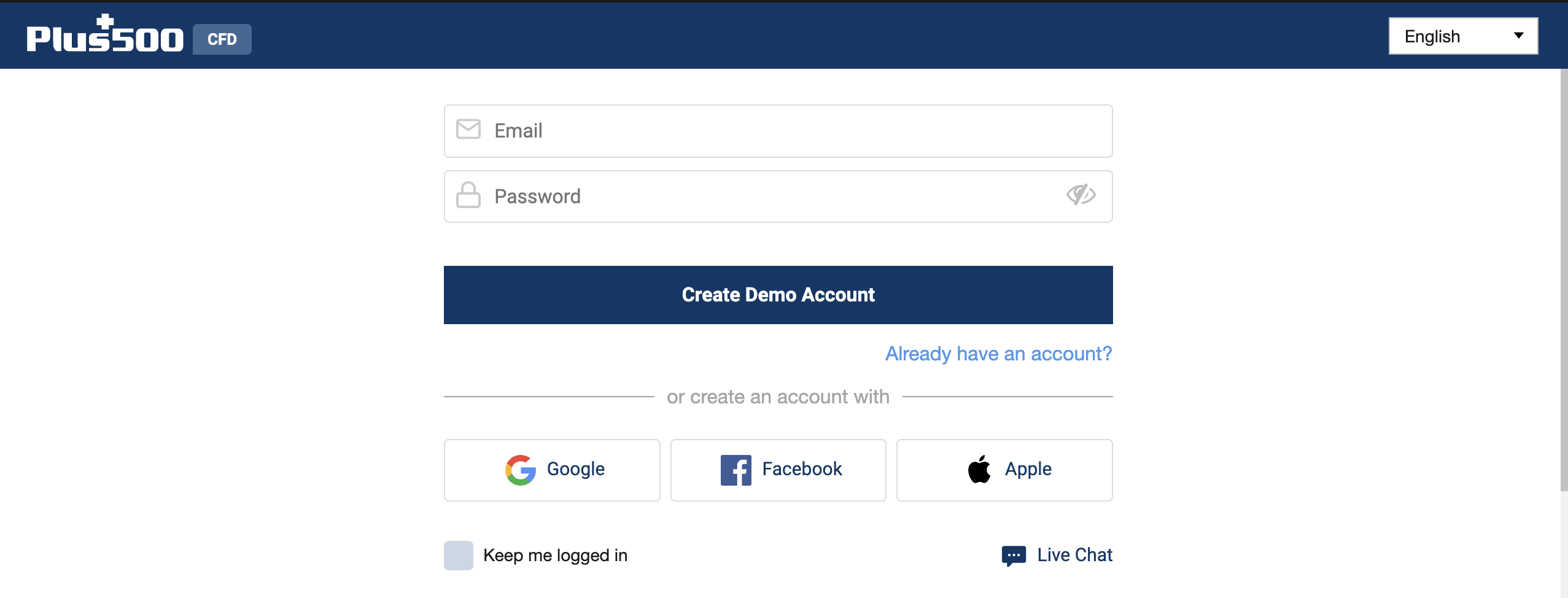

The process starts with the provision of an email address and password for the trader. The trader accesses the platform with the help of this email address and password later.

After you sign up as a trader on the platform, your new account holds some € 40,000 or $ 50,000 in demo cash. The demo cash helps you experience real-time trading without any risks. You practice all your trading strategies with this demo cash.

The cash helps in the establishment of your base as a trader on Plus500. With the opening of a Plus500 demo account, you access the platform for practice in an unlimited way. In addition to this, you also trade in all the popular CFD stocks.

The account opening process is very fast. It takes only three to four minutes to complete. The process can also start from your Facebook or Google ID.

Risk warning: 82% of retail CFD accounts lose money. You should consider whether you can afford to take the high risk of losing your money.

The process is as follows:

- Go to the official Plus500 website and click on the Start Trading Now button.

- Select the demo mode for your first trading experience. You can also reset the mode to real money later.

- Enter the email address you want and create a strong password linked with it.

- Click on the Create account button for completing the process

- Start trading with demo money from your account.

How to use the demo account?

Once the Plus500 demo account becomes active, you can use it every day. Before starting the trade, you need to understand the software behind Plus500. The software of Plus500 is the skeleton of your trade.

The software is very user-friendly and convenient to use. You can search and choose a CFD market for investment through the software. The available balance in your account is always on display on the top bar.

A user keeps track of his portfolio and expenditure from the top bar. The top bar acts as a single dashboard for all kinds of trading actions. The middle screen of the platform displays all the prices of stocks that you can invest in.

The screen gives you an overview of the prices in the market so that decision-making fast as possible. By looking at the screen, you decide whether to buy or sell that particular stock.

From the screen, the search for a certain stock is available with a few clicks. On the other hand, you can also place an order with a simple click. At the bottom of the screen for a selected CFD, you see a graphical representation of price fluctuations for it.

Opening a position on Plus500 for trade

Your trading process starts with opening a position in the market. When you open a position, you open the option of selling or buying the stock. You buy when there is a chance of a price increase in the future.

By buying, you keep the stock to sell it at a profitable price later. You can sell the stock at any time. However, it is always better to sell at a profit.

When you click on the buy or sell option, the platform floats an order window. The order window indicates how many CFD stocks go for sale or purchase. By clicking on the buying option, you open a position.

The account also allows you to trade automatically when the rate is at a certain point. This threshold of opening a trade is an intelligent feature of Plus500.

Once you have opened a trade, it comes through in the category of the open position. The tracking of a trade is very important for the best profits at closure. Next to the open position, a number comes up.

This number indicates if the trade-in progress is in profit or loss. Always keep a close eye on an open trade. Moreover, always keep a threshold balance in your account. In the absence of balance in your account, you have the risk of losing trade in progress.

The Plus500 platform allows you to study and speculate on trade graphs. Accurate speculation of the stock price graph reduces the chances of loss from a trade. The speculation method stops you from selling when the stock price is under fall.

With each asset for investment, you have a buy button. When you go for the buy button, the screen displays a positive result in the case of rising prices. On the other hand, if the prices are falling, the result is negative.

On the other hand, when you click the sell button, an increased price shows a negative figure, and a declining price shows a positive number. The Plus500 platform has many risk management tools that help in risk reduction.

You can easily use leverage to maximize your trade on the platform. Proper trade leverage helps you take a bigger position even with a small amount of investment. The leverage in use for each CFD is different from the other and includes high risk!

Risk warning: 82% of retail CFD accounts lose money. You should consider whether you can afford to take the high risk of losing your money.

With the use of leverage, the volume of profits and losses from the trade increase. Therefore, one must apply leverage after much consideration.

While you can open a trade at any time you like, you have to be very careful of the time of trade. Before you open a position, always answer why do you want to open the trade. The choice of CFD also needs a lot of thought and analysis.

You need to decide your price of closing on profit and closing on losses. Deciding on minute points of the strategy gives you clarity during the trade. Thought and analysis behind trade keep your emotions and impulses in check for better trade experience.

An analytical approach to trading is very necessary. A trader needs to master analysis in all its forms. The first type of analysis in trade is fundamental analysis.

In fundamental analysis, you look at the bottom line figures and the numbers of the trade. You take the projections and finances of the trade into consideration.

The second type of analysis is sentimental analysis. Sentimental analysis is the understanding of mass psychology, where you understand what the masses will do in such a situation.

With sentimental analysis, you predict the trends of the market and the mindset that drives it. A deep sentimental analysis helps in making a logical trade decision even when the market is difficult to read.

Technical analysis is a bit difficult for a beginner on Plus500. Technical analysis is the study of graphs for better projections and decisions. A user has to learn technical analysis with time.

The use of these three analysis techniques helps make logical and comfortable trade decisions. The use of features and tools from the platform helps to analyze the markets for the user.

Features

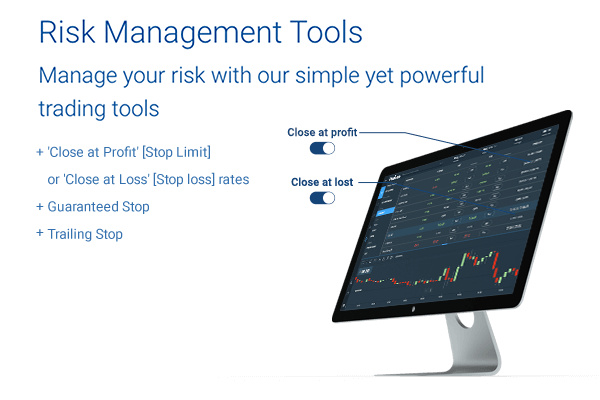

There are features that a user can use to reduce risks while trading on the Plus500 demo account before expiry. One of the features is the stop-loss feature that helps in minimizing losses from trade.

The platform has multiple tools like the close at a profit and closes at loss feature. Guaranteed stops, margin calls, and trailing stops are also some of the features of the platform.

These limits and features help a trader in closing a trade after a certain limit of profits or losses. The limits help manage your profits and minimize your losses.

Guaranteed stops are similar to other stops and limits. However, the guaranteed stops put forth absolute limits which prevent any loss from trades. The stops reduce slippage on specific terms.

Guaranteed stops, however, do not come with the edit option. These types of stops come with an additional spread charge.

Margin calls are a part of any margin trade on Plus500. The margin calls also protect your money. The calls liquidate your money before your balance goes negative. The margin calls liquidate the order before your order goes into loss higher than the balance in your account.

Risk warning: 82% of retail CFD accounts lose money. You should consider whether you can afford to take the high risk of losing your money.

Trailing stops are also features of Plus500. The trailing stops allow a trader to close at a loss during a trade. The trailing stop changes automatically as long as the market trends are favorable.

Besides the risk management features, the Plus500 platform also includes safety features that protect against bad trading practices.

The trading practices banned on Plus500 are insider trading, hedging, and market abuse.

Another feature of Plus500 that favors traders is an economic calendar. The economic calendar lists out the dates and events that affect trading trends and market prices. The study of the economic calendar helps predict future movements in the market.

The calendar is accurate and lists out the upcoming corporate events and predictions related to them. The Plus500 platform also allows you to set up alarms for certain events and processes.

The alarms feature you follow the market event and use them in your favor during the trade. The alerts include price alerts, change percentages alerts, etc. These alerts reach the trader through emails, texts, and push notifications.

Conclusion

A stock market is a dynamic place where you earn or lose in a matter of minutes if the strategy is correct. Apart from the strategy, the platform for trading and the tools with you also carry a lot of importance.

Always choose a platform like Plus500 that is feature-packed and has many risk management tools. Choose a platform that works for millions of people and is simple to use. A platform like Plus500 that allows a trader to practice and predict market trends with analytics is a great option.

The Plus500 platform is user-friendly and has many options to invest in. Anyone who wants to go into the stock market and trade should make a Plus500 demo account. A demo account on the platform helps you learn the tricks of the trade.

The creation of a demo account is easy on Plus500. When you think of it, trading as a whole is very easy on the platform. However, to turn into a full-fledged trader, you need discipline and tactics on your side.

Many people have doubts about using a platform like Plus500 for the first time. The fear of losses and fraud may keep you away from such platforms. To assuage your doubts, the next section addresses the frequently asked questions on Plus500.

Risk warning: 82% of retail CFD accounts lose money. You should consider whether you can afford to take the high risk of losing your money.

FAQ – The most asked questions about Plus500 demo account :

What are the types of accounts on Plus500?

Plus500 supports account types such as demo accounts and real money accounts. The platform does not support any company or organizational account. A user easily registers for a demo account. Then, he can convert it to a real money account by depositing money for trading.

There is an option to convert an account to a professional account; However, for the creation of a professional account, there are certain criteria. One of the conditions is sufficient trading activity on the platform.

Another condition for a professional account setup is a robust financial instrument portfolio with more than 500,000 pounds in total valuation.

You must be an experienced professional in the financial sector. The trader should possess at least a year of experience in the sector. The professional must be adept at financial transactions.

If the trader fulfills these criteria, he or she can easily open a professional account. However, the most popular one is a demo account on Plus500. Established traders use the real money account for trading in real-time.

How to verify account on Plus500?

The account verification process establishes your portfolio as one of a trusted trader. Once account verification is complete, the trader uses all the capabilities of his account. He also unlocks more features with account verification.

The account verification process takes your date of birth, address, your identity verification. The process also verifies the payment details and email address of the trader. The verification process completes only when the trader agrees to the regulatory framework of the platform.

Does the platform Plus500 have customer support?

Customer support is a must in today’s digitized world. The Plus500 platform provides customer support 24/7. The platform reaches out to traders through email and lives chat support.

The chat support extends in 15 languages for a global user base. The user can reach out to customer support by going to the contact us section. After the request form reaches the customer support team, the response is quick and relevant.

The platform also provides insights into market information and financial statement for help. The trader will not feel he is alone in the labyrinth of trading. The Plus500 customer support is your reliable partner in the journey of trading CFDs.

What is the procedure for opening a Plus500 demo account?

You can create a demo account during the registration process. First, select the “Demo Mode” option in the “Select Account Mode” window. However, there is an option that enables you to swap between modes. Tap “Switch to Demo Mode” on the home platform page or in the application’s submenu to change from Actual Money mode to Demo account. And you will get into the plus500 demo account. From there, you can start learning strategies of the trading platform.

How can I close my Plus500 demo account?

Perform the following steps to close your Plus500 demo account:

First, enter your name.

Give in your email address linked to the account you want to delete.

Choose ‘Other Issues’ in the ‘Type of Query’ area.

Note ‘Account Closure Request’ in ‘Subject’

Specify the reason(s) for your desire to delete your account.

At last, click ‘Send’ to ensure the account deletion process.

Does the Plus500 demo account offer customer support?

The Plus500 demo account offers customer support 24/7. Also, the platform contacts the traders via email and live chat support. The chat support expands to 15 languages for an international user base. Visit the contact us page to get in touch with customer service if you have any questions. Once the request form reaches the customer support team, the response is immediate and relevant.

See more articles about forex trading:

Last Updated on October 27, 2023 by Andre Witzel