Can you transfer the trades to another online broker?

Are you not satisfied with your online broker and want to switch to a better one? Are you worried about how you will transfer trades to other online brokers? Don’t worry; you have come to the right place.

The right brokerage account can help you get the most out of your investments. Once you have found a better broker, follow the below steps to transfer stocks between brokers easily.

Table of Contents

Steps to transfer the trades to another online broker

Be cautious while transferring trades from one broker to another because if not done correctly, you could lose huge money.

Here’s how you can transfer trends without the hassle:

1. Open a new trading account

Do thorough research to find a better trading broker than your existing one. After you have finalized your broker, a new trading account can be opened by filling out a form with basic details.

For verification, upload KYC documents. You might also be required to complete the video verification process. Once all the verification is successfully completed, your account will be opened.

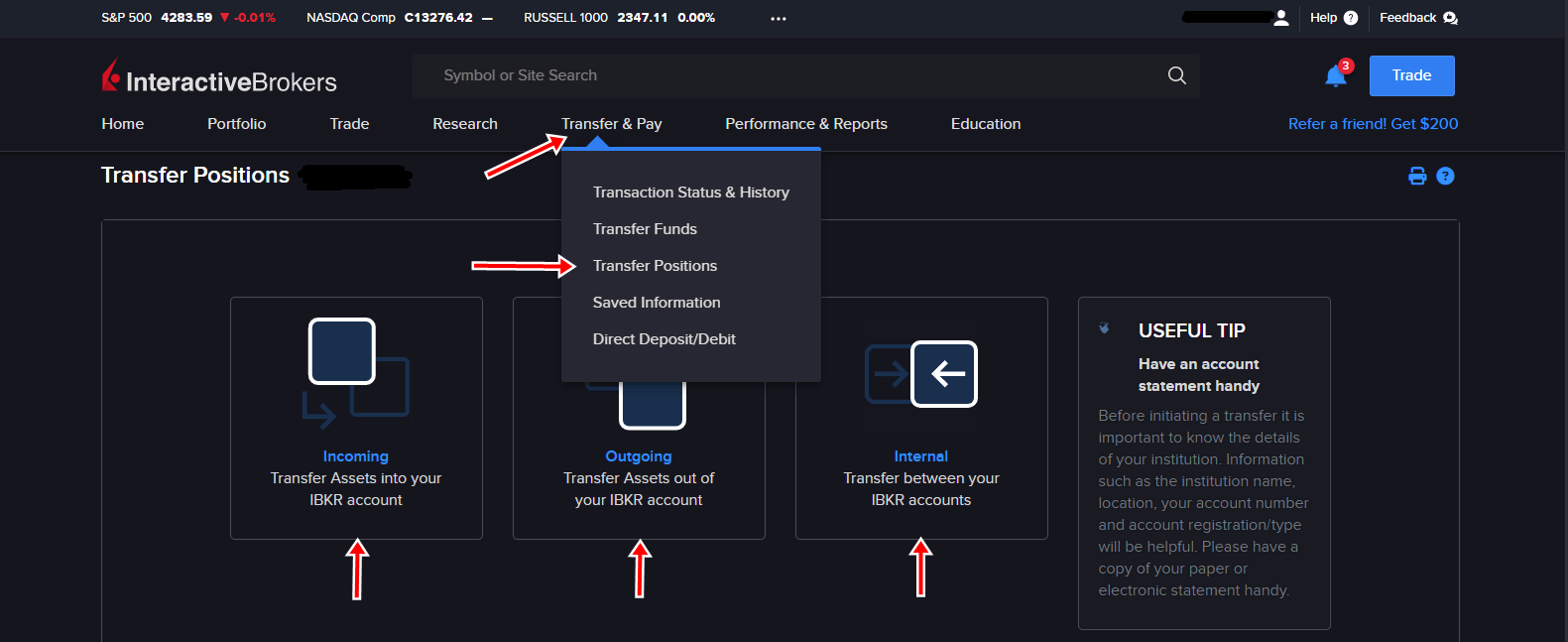

2. Transfer trades with the same depository

Transfer can be easily done if you are transferring trades with the same depository, meaning both your new and old brokers are registered under the same depository.

No matter whether the depository is NSDL or CDSL, or another platform, if it’s the same, trade transfer can be carried out online. For CDSL accounts, you need to register on the CDSL Easiest platform. The rules can be different from county to country. Often you do not need to fill out a form for the tax department.

3. Transfer trades with different depository

If your new and old trading brokers are registered under different depositories, you would have to fill out a debit instruction slip. Submit the slip with your existing depository to request a trade transfer. The process can take up to two days to complete.

4. Close old account

After successfully transferring your trades, close your trading account with the old broker. You can also withdraw any remaining cash from your old trading broker before placing an instruction to close it.

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 67% of retail CFD accounts lose money)

Reasons for a transfer

The trading account holder decides to transfer trades from one broker to another due to two main reasons:

- Not satisfied with a current broker: Many times, traders are not satisfied with the features, profitability, and services of their current broker. If you are also not satisfied, transfer your trades

- You hold multiple trading accounts: Traders with different accounts want to merge them into a single account. Thus, they need to transfer trades. Conversely, a trader might have a single trading account and would want to open different accounts for trading several assets

No matter what the reason is, the trade transferring process from one broker to another is similar.

How the transfer of shares can happen?

Special circumstances under which share transfer can happen:

1. Transfer between the same depository with no credit due

This trade transfer is fairly easy because you don’t have any debits or credits on your account. Also, your old and new trading brokers are under the same depository. That means you need no additional permission.

2. Transfer between different depositories

If your old and new trading brokers are registered under different depositories, submit a debit instruction slip to your current broker. The slip is a formal request to transfer trades.

This transfer process can take up to 2 days. Once the process is completed, you can close your old trading account with your earlier broker.

3. Transferring the account with the open positions

Another common scenario is transferring trades with an open position. Well, the process is easy. Besides Futures and Options (F&O), you can transfer all your open position trades to a new account. For F&O, you need to close all your open positions.

Also, if you have debits or credits, clear them to proceed. Doing so also helps you eliminate the hassle in the future.

4. Transferring the account with credits

The most complex scenario is transferring trades with credits. The due credits can be shares for which you haven’t received credit to your old account. When you are owed something from the broker, you can do one of the three things:

- Check if you owe something to your broker. If you do, your broker might have held back your credit. In this case, you can authorize the broker to deduct the dues from your credits

- If the matter is not resolved, contact your existing broker. Mostly, brokers transfer the credits in a week

- If your credits are still not processed, move the matter to NSDL/CDSL along with the relevant stock exchange. You can also file a complaint with SEBI

Conclusion about the transfer of the trades to another online broker

Even experienced traders are often not sure about transferring trades from one broker to another. But you can rest assured because the entire transferring process is extremely safe.

While transferring trades from one account to another, always discuss the fees involved. This way, you can avoid any future complications.

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 67% of retail CFD accounts lose money)

Last Updated on June 7, 2023 by Yuriy Kunets