How to withdraw money on IC Markets – An easy withdrawal tutorial

Table of Contents

You can withdraw funds from your IC Markets account just as easily as you deposit funds into it. You can use any payment option to make an IC Markets withdrawal that you used to deposit funds. So, IC Markets is one of those online trading platforms that do not cause much trouble to its users while making an IC Markets withdrawal.

The IC Markets withdrawal process is undemanding. You don’t have to spend much time making a withdrawal request. On the contrary, you can request IC Markets withdrawal with a few clicks on the mouse. We will discuss everything about the process of withdrawing funds from your IC Markets online trading account.

How to withdraw money? – Step by step tutorial!

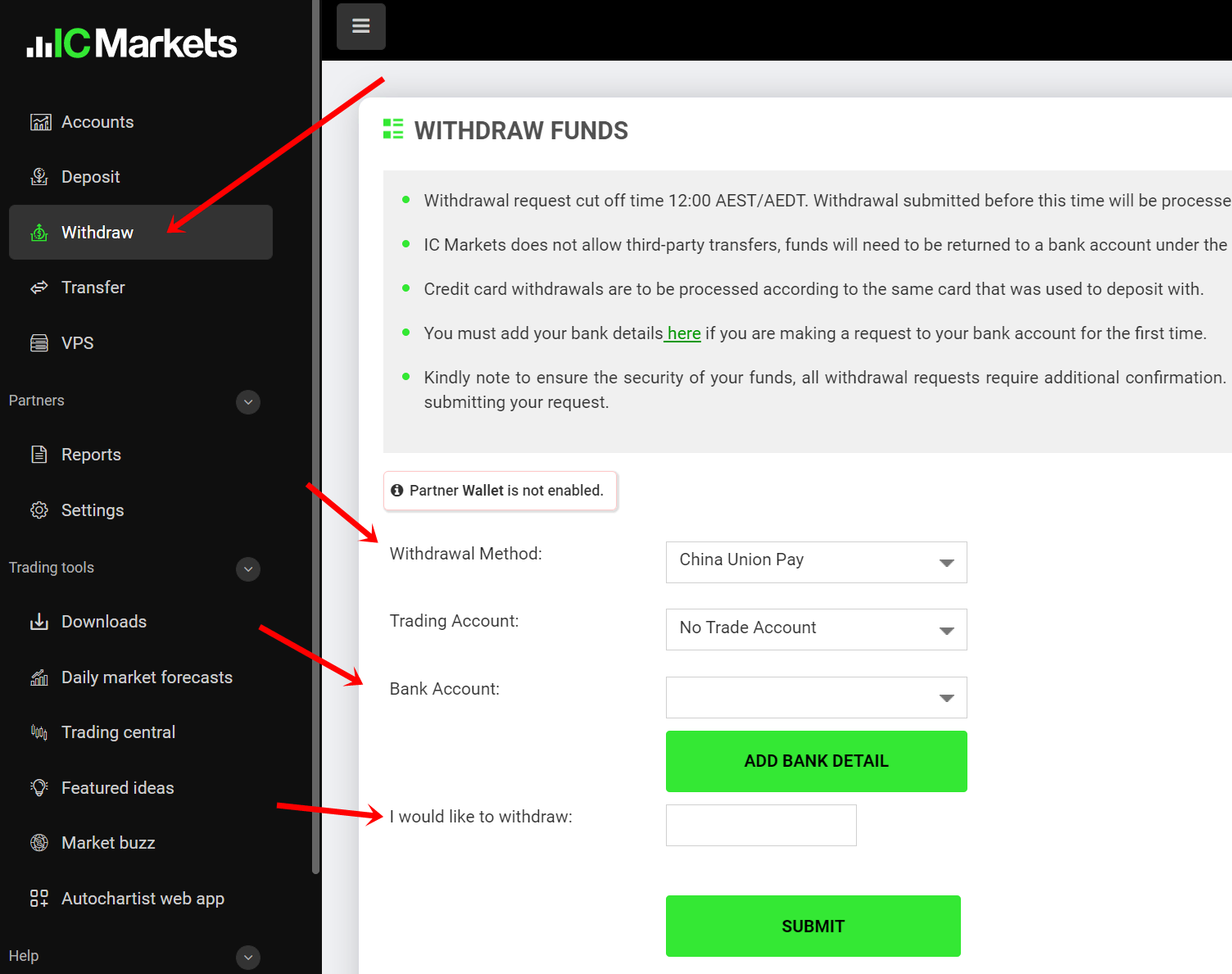

To make an IC Markets withdrawal from your online trading account, you can follow these steps.

- Log in to your IC Markets trading account by entering your login credentials.

- Check the availability of funds in your account before submitting an IC Markets withdrawal request.

- Submit a withdrawal request from the client area by clicking on the ‘Withdraw Funds’ option.

- Enter the withdrawal amount from your IC Markets trading account. The broker does not specify any minimum withdrawal amount, which means you can take out any amount from your IC Markets online trading account.

- Select the mode of payment that you used to deposit funds into your trading account and submit your withdrawal request.

Following these steps, you can withdraw funds from your IC Markets trading account without any trouble. You can select any payment method to deposit or withdraw funds from your online trading account.

However, you should note that you can withdraw funds only into that payment method that you used to make the deposit. It means that if you used your credit card to deposit funds into your IC Markets trading account, you could request to withdraw funds through the same credit card.

The same holds for all the other payment options. If you use wire transfers to deposit funds, you can request IC Markets withdrawal through the same payment method.

Here is a brief description of all the payment methods you can use to request IC Markets withdrawal.

(Risk warning: Your capital can be at risk)

Available payment methods:

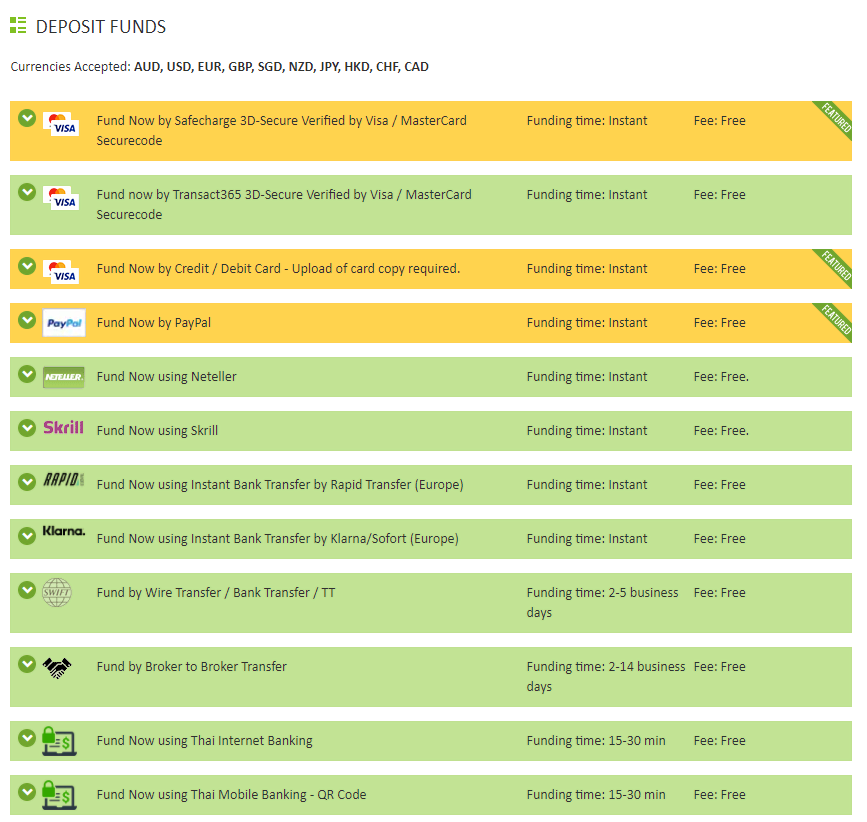

All online trading platforms offer multiple payment methods to their clients for their convenience, and IC Markets is no exception. It offers clients alternative payment methods, so they don’t feel stuck with only one choice.

It won’t help a trader if an online trading platform supports payments only through credit cards. If his credit card stops working or gets stolen, his trades can suffer. He may lose the opportunity of investing in profitable instruments. On the other hand, if there are multiple payment options, a trader can feel relieved using alternative methods.

With IC markets, you can use the payment methods shown below.

- Bank or wire transfers

- Credit or debit cards

- Electronic wallets

Let us look at the IC Markets payment methods one by one.

1. Bank or wire transfers

As a beginner, you should know that depositing and withdrawing funds through bank or wire transfers is just like sending someone money online. Many investors choose bank transfers as a payment method because it is safe and secure.

You can opt for IC Markets fund withdrawal through bank or wire transfer if you have deposited funds into your account through this payment method. All you need to do is select ‘Bank Transfer’ as your payment method while submitting an IC Markets withdrawal request. Then, you can enter your bank account details and upload your bank statement as proof of your identity.

After submitting a request for IC Markets withdrawal through bank transfer, you can wait for a few days to receive funds into your bank account.

(Risk warning: Your capital can be at risk)

2. Credit/debit cards

Credit or debit cards are another payment method preferred by many traders to fund their online trading accounts. One may use his credit or debit card to withdraw funds from his IC Markets trading account.

If you want to withdraw your funds through your credit or debit card, you can select this withdrawal option. You can submit an IC Markets withdrawal request by entering the details of your card. You can enter your card number to withdraw funds through it.

IC markets can also prompt you to upload a picture of your credit or debit card to verify if the card belongs to you. After approval of your withdrawal request, you will receive funds within due time.

3. Electronic wallets

Electronic wallets or e-wallets are fast growing as a favorable payment option for many investors. A reason for this is that payments made through electronic wallets are fast. It means that if a trader fears missing out on big deals due to a lack of funds in his account, he can quickly fund his trading account through his electronic wallet.

You can use your Skrill, Neteller, Unionpay, Bpay, Fasapay wallets to request IC Markets withdrawal. However, you can do it only if you funded your account through this option. You can enter the details of your electronic wallet and submit a withdrawal request. Withdrawals through electronic wallets are fast and secure. You will receive your IC Market withdrawal into your e-wallet within a few hours. Electronic wallets like Fasapay, Bpay, Poli, etc., may involve withdrawing funds through bank transfers. In that case, it can take 4-5 days for the funds to get credited to your account.

How long does it take to withdraw money from IC Markets?

The time involved in IC Markets withdrawals depends upon the payment method that a trader selects. As we know that there are various payment methods available at IC Markets, the withdrawal speed will differ across these methods. Some payment methods take a long time for the withdrawal process. On the other hand, other payment methods help you get hold of your funds quickly.

From the following table, you can get an overview of the time involved in withdrawing money from your IC Markets trading account.

Payment method | Time involved |

Bank transfer | 4-5 business days |

Credit or debit card | 24-48 hours |

Electronic wallets | A few hours, some electronic wallets like Fasapay, Poli, etc., can take longer as the transaction takes place through a bank transfer. |

(Risk warning: Your capital can be at risk)

Some electronic wallets like Fasapay, Poli, etc., can take longer as the transaction takes place through a bank transfer.

IC markets Withdrawals through bank transfers can take up to 5 working days. Though IC Markets processes your withdrawal within 24 hours, it might take time for your funds to reach your bank account.

Similarly, IC Markets withdrawals through card payments can take up to 24-48 working hours to reflect into your account. Electronic wallet withdrawal requests will only take a few hours for the amount to reflect in your electronic wallet. Thus, you can choose a payment method that suits your needs keeping in view the speed of transactions of each medium.

You can only choose that payment method for your IC Markets withdrawal which was the funding source for the deposit.

Fees that can occur

Many investors worry about the fees they have to pay to the online brokers for withdrawing funds from their trading accounts. Sometimes online trading platforms charge a very high withdrawal fee from their users. It is one thing that many traders seek to avoid.

IC Markets withdrawal fee for domestic withdrawals | None |

IC Markets withdrawal fee for international transfers | 20 AUD or equivalent |

Well, you can relieve yourself of the worry of paying any withdrawal fee to the IC Markets. It does not charge any withdrawal fee from its clients. It does not matter what amount you want to withdraw from your online trading account. You need not pay a penny to IC Markets for making a withdrawal as long as it is domestic.

For international bank transfers, IC Markets charge their users 20 AUD. If you are transacting in a currency other than AUD, you will have to pay a withdrawal fee equivalent to 20 AUD in that currency for international bank transfers.

If you are making a domestic bank transfer or withdrawing funds through your credit or debit card, you might have to incur a convenience or handling fee. Your bank or the financial institution might charge you this handling fee when transacting for IC Markets withdrawal. This situation is completely out of IC Markets’ control.

IC Markets minimum withdrawal amount

If you are worried about the hefty minimum IC Markets withdrawal you have to make, you can relieve yourself. IC Markets does not stipulate any minimum withdrawal amount for its users. You can withdraw funds from your trading account as you like.

| IC Markets minimum withdrawal amount | $0 |

If you make a very low minimum withdrawal using a bank transfer, there are chances that you might incur a fee equivalent to or greater than your withdrawal amount. So, IC Markets always recommends its users withdraw an amount higher than the convenience or handling fee of the bank.

(Risk warning: Your capital can be at risk)

Problems/ issues with IC Markets withdrawal

While withdrawing funds from IC Markets is pretty straightforward, a trader might encounter some problems. Especially if you are taking out funds from your IC Markets trading account for the first time, you can undergo some troubles. Here is a description of some problems and the ways to avoid them.

Third-party withdrawals

Some beginners make the mistake of withdrawing funds from third-party accounts. It means that they try to get IC Markets withdrawal in someone else’s bank account or card. It is not possible to get third-party withdrawals from IC Markets. You can withdraw funds only in the bank account, card, or electronic wallet that belongs to you.

It is only for your safety and security that third-party withdrawals are not allowed. It protects your trading account from any breach of privacy. So, you can request IC Market withdrawal in your own bank account or any other payment method.

Using a withdrawal method different than the deposit method

Sometimes traders fund their trading accounts through electronic wallets. But, they request fund withdrawal through bank transfer or card payment. At IC Markets, you cannot use different deposit and withdrawal methods. Suppose you used your electronic wallet to fund your account you can request a fund withdrawal in your electronic wallet.

However, if you use your card to deposit funds in your trading account, withdrawals get processed through card payments or bank transfers and vice versa.

(Risk warning: Your capital can be at risk)

About IC Markets

You must be new to the world of online trading if you haven’t heard about IC Markets. It is among the most famous names among all the brokers. IC Markets came into being 15 years ago in 2007. Since then, it has offered its clients a cutting-edge online trading platform with superior liquidity.

With the help of IC Markets, even a small trader can get access to the pricing, which was previously only available to high net worth individuals or investment banks. It has totally revolutionized the world of online trading for its clients.

The management team of IC Markets has experience in forex, CFD, and equity markets in Asia, Europe, and North America, which helps them pick the best pricing providers. By offering its clients a user-friendly online trading platform, IC Markets aims to bridge the gap between retail and institutional clients. Anyone can start trading with IC Markets by opening their live trading account with the broker.

You can start trading with the minimum deposit amount and invest it across various CFD and forex instruments. You can request an IC Markets withdrawal when you have sufficient funds in your trading account. As we mentioned before, the process of requesting a fund withdrawal with IC Markets is not challenging.

Conclusion: Withdrawals on IC Markets without fees

Withdrawing funds from your IC Markets online trading account involves only a few clicks on the mouse. A trader can withdraw funds from his trading account using any payment option like bank transfer, credit or debit card, or even an electronic wallet.

IC Market withdrawals are free of charge, which means that an investor can enjoy the fruits of his investments without paying anything to the broker. IC Markets processes all the withdrawal requests of its clients within 24 hours after the approval of the withdrawal. A beginner can easily adapt to this online trading platform because it is user-friendly. Many active users of IC Markets highly recommend using this trading platform.

(Risk warning: Your capital can be at risk)

FAQ – The most asked questions about IC Markets withdrawal :

How can I withdraw funds from my IC Markets online trading account?

You can follow the process of requesting IC Markets withdrawal to take out funds from your trading account. You can submit a withdrawal request by logging in to your IC Markets account.

Which payment method can I use to withdraw my funds from my trading account with IC Markets?

Many payment methods are available at IC markets. These include bank transfers, credit cards, debit cards, and electronic wallets. You can withdraw funds from your IC Markets trading account through any of these payment methods. However, you can use only that payment method for withdrawal that you used to deposit funds into your account.

Does IC Markets charge any withdrawal fees from its users?

No, IC Markets does not charge any withdrawal fee from its clients. You can withdraw any amount without caring about the withdrawal fee as there is none.

Is there any minimum amount I must withdraw from my IC Markets trading account?

No, there is no limit of any minimum withdrawal from your IC Markets trading account. You can withdraw any amount that seems reasonable to you.

How much time do IC Markets withdrawals take?

The IC Markets withdrawal time completely counts on the method you use for it. If you process it through a bank transfer, it can take 3-5 business days to get to your bank account. So, you must wait about 3-5 business days after requesting it. Bank wire transfers withdraw the accounts which get funded by Klarna. And this transfer can take additional charges.

Which is the fastest IC Markets withdrawal method?

These days, brokers are quick at processing the withdrawals of traders. So, even if you choose bank wire transfer, IC Markets withdrawals would take only up to 8 hours to process your withdrawal. The ultimate duration depends on how long banks take to settle transactions between them. So, if you wish to use a payment method that will allow you to access your funds instantly, you can use electronic wallets or cryptocurrency.

What problem can I encounter while making an IC Markets withdrawal?

A common problem that traders encounter while making an IC Markets withdrawal is that they try to use someone else’s bank account. No broker will allow you to use a third party’s accounts while withdrawing. You can use only your bank account or other payment methods.

(Risk warning: Your capital can be at risk)

See more articles about forex brokers:

Last Updated on January 27, 2023 by Arkady Müller