How much does it cost to trade with IC Markets? – Spreads & fees explained

Table of Contents

Regardless of the great features, before choosing a broker, you must always be aware of the spreads and fees that come along with it. That determines how much it will cost to trade with a particular broker.

However, IC Markets stands out from the rest in that case also. It offers a Spread structure that is distinct from other brokers. You can even open a separate Raw Spread account in it. The spreads start from 0.0 pips in a Raw Spread account, making it one of the cheapest offerings.

Additionally, they have flexible leverage options offering up to 1:500. Wherein they accept deposits in 10 major currencies. So, let us understand the basic terms first and then look into the IC Markets Spreads and fees.

(Risk warning: Your capital can be at risk)

IC markets spread and fees:

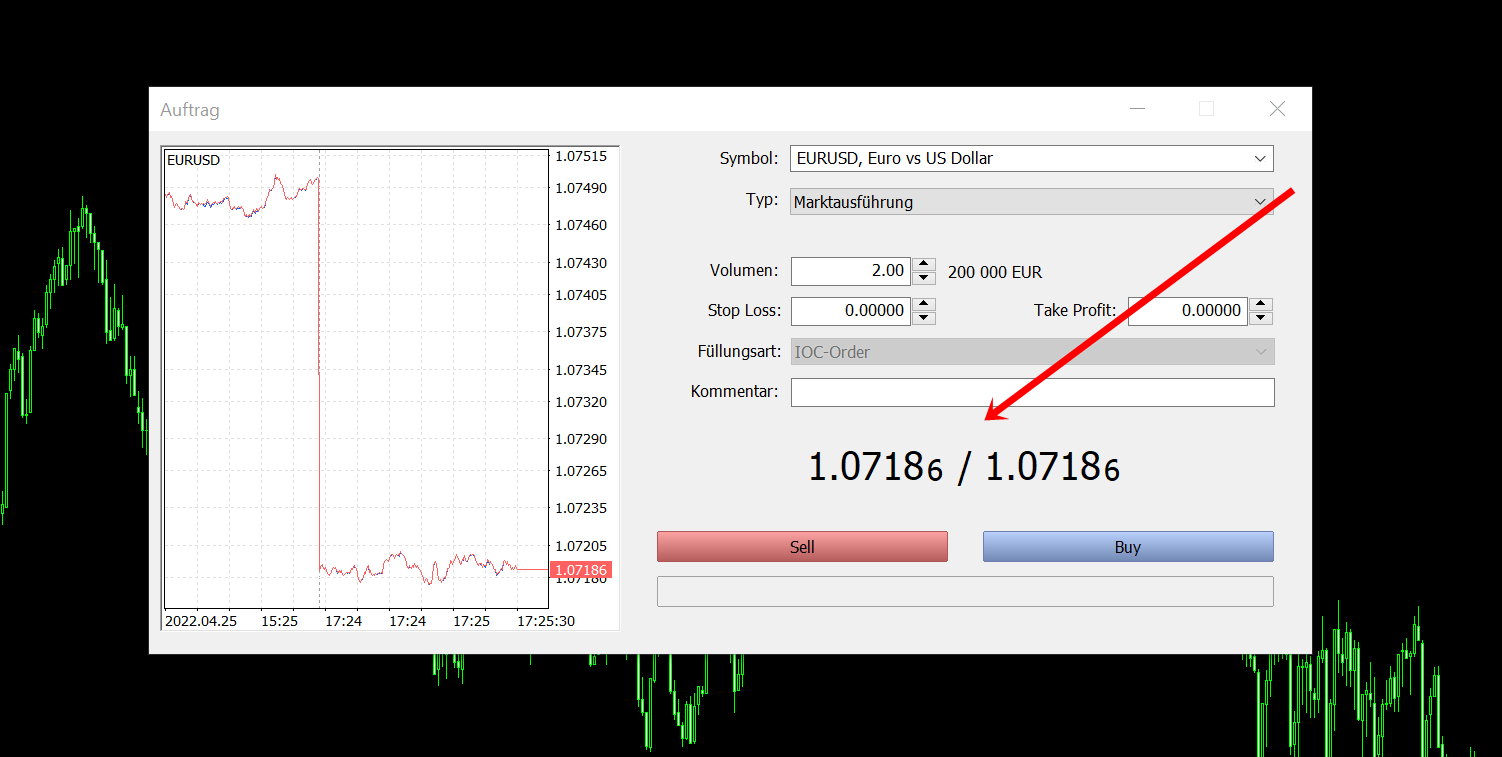

IC Markets maintains the lowest spreads among all major and minor currency pairs. Their average EUR/USD spread is particularly the lowest in the world. It starts at just 0.1 pips.

IC Markets spreads are market-leading, and it offers prices from over 25 different sources at the highest speed. The Spreads at IC Markets can go as low as 0.0 pips if you look into MetaTrader 4, 5, and cTrader RAW platforms.

Unlike other brokers, IC Markets also offers variable spreads for MetaTrader 4, MT5, and cTrader platforms. They also offer tight spreads on each of their platforms. It is possible because of their mix of liquidity providers. We can see that their pricing consists of over 25 different liquidity providers. That ensures their spreads stay tight with deep liquidity. Let us view their spreads through the following tables:

Forex spreads (examples):

Product: | RAW Account: | RAW Account: | Standard Account: | Standard Account: |

|---|---|---|---|---|

Min. | Avg. | Min. | Avg. | |

AUD/USD | 0 | 0.17 | 0.6 | 0.77 |

EUR/USD | 0 | 0.02 | 0.6 | 0.62 |

GBP/USD | 0 | 0.23 | 0.6 | 0.83 |

USD/CAD | 0 | 0.25 | 0.6 | 0.85 |

USD/CHF | 0 | 0.19 | 0.6 | 0.79 |

USD/JPY | 0 | 0.14 | 0.6 | 0.74 |

(Risk warning: Your capital can be at risk)

Commodities spreads (examples):

Product | Min. (All Accounts) | Avg. (All Accounts) |

Brent Crude Oil | 0.020 | 0.028 |

Cocoa | 3.000 | 4.608 |

Coffee | 0.300 | 0.300 |

Corn | 0.680 | 0.680 |

Cotton | 0.150 | 0.150 |

Sugar | 0.030 | 0.033 |

Soyabean | 1.350 | 1.350 |

Crypto spreads (examples):

Product | Min. (All Accounts) | Avg. (All Accounts) |

BCH/USD | 2.210 | 5.839 |

BTC/USD | 8.710 | 42.036 |

DOT/USD | 0.011 | 0.013 |

DSH/USD | 0.000 | 1.241 |

EMC/USD | 0.157 | 0.157 |

(Risk warning: Your capital can be at risk)

Fees that can occur with IC Markets

We know that various brokers do not limit their costs to only the spreads they offer. In addition to the spreads, they also levy additional fees. However, IC Markets is among those brokers who charge fees only wherever necessary. Moreover, it does not hide its fees and commissions. So let us now look at the types of fees applicable with IC Markets.

Deposit fees

Deposit fees signify the non-trading fees incurring when the trader transfers money to the trading account from the bank account. We cannot see the brokers levying the charges for depositing the trader’s own money commonly. Though some brokers keep a deposit fee, IC Markets is not among them, and it charges nothing while depositing. As a result, you can see the same amount of funds in the trading account you transferred through the bank account.

Withdrawal fees

Many brokers charge a fee while you withdraw your gains from the account in the name of withdrawal fees. However, IC Markets does not charge any withdrawal fee from its clients. It does not matter what amount you want to withdraw from your online trading account.

You are not required to pay a single dollar to IC Markets for making a withdrawal. But it is applicable only as long as the withdrawal is domestic. In contrast, IC Markets charge their users 20 AUD for international bank transfers. Also, if you are transacting in a currency other than AUD, you need to pay a withdrawal fee equivalent to 20 AUD in that currency.

Swap fees

Swap rate or rollover is also called overnight fees. Swap fees is the interest added or deducted for holding an open position overnight that extends the time limit. Usually, the time is set at 22:00 GMT, so if you hold the same position beyond the said time, you need to pay Swap rates. IC Markets also charges a swap fee. However, that’s determined by the overnight interest rate differential between the two currencies involved in the pair. It is also dependent on whether the position is long or short.

Inactivity fees

The broker expects you to trade without a long gap when you open an account. So if your account stays dormant for a long time, many brokers charge inactivity fees. They charge this fee for the maintenance, administration, and compliance management of the inactive accounts. Such a fee also compels the trader to trade or at least make a deposit before the expiry of the inactivity period.

We can see a usual period of 21 days which various brokers offer, that may or may not be extended. But, you can exclude IC Markets from such brokers as it does not charge an inactivity fee. So, you can trade as you wish with the IC Markets account.

Conclusion: Low spreads and fees on IC Markets

IC Markets enjoys being one of the best Forex and CFD brokers in the world. It offers advanced trading features with various platforms and trading accounts. Moreover, being a regulated broker, IC Markets guarantees the safety of the Client’s money. However, it is essential that when we look for a reliable broker, we should not blindly focus on features alone.

Traders should use the spreads and costs to judge the suitability of a broker. Interestingly, with IC Markets, we can see that the lowest possible spread that begins at 0.1 pips is available here. Moreover, it excludes most of the additional fees that other brokers usually levy. Therefore, we can conclude that it can serve as the best and most affordable choice for all the traders regardless of their expertise.

(Risk warning: Your capital can be at risk)

(Risk warning: Your capital can be at risk)

Important knowledge: What do spreads and fees signify?

A spread is a difference between an asset’s buy and sell prices. In the financial world, it’s a word that is thrown around a lot. It influences how much trade would cost – the lower the spread, the less it will cost. Spread is used by many brokers, market makers, and other providers to cite their pricing.

On the other hand, the customers pay fees to the platform in exchange for their services. Though most platforms make their money using spreads, some through fees. Fees are fixed charges and are rarely changed.

A spread is used to cover the cost of the broker’s order execution. All brokers have fees associated with placing trades on your behalf, not to mention the costs of creating systems, paying people, marketing, and so on. These charges are financed by the spread collected from the clients. Some assets, like stocks, may not involve a spread and will instead charge on a commission basis; other assets may have a combination of the two.

When you open and close positions, the spread is calculated on its own. As a result, to contribute to the spread, you will not need to do anything independently. So, when you make a trade, the spread is automatically taken into account by the buying price being slightly higher and the selling price being a little lower than the asset’s original price. Major currency pairings have a lower spread since they are traded in big volumes, while obscure pairs have a greater spread.

The spread is usually expressed in percentage in points (pips) that refers to a minor shift in the value of a currency pair in Forex. When it comes to Forex, most currency pairs are generally priced to four decimal places, with the pip change being the last decimal point. A pip, therefore, is equal to 1/100 of one percent.

A currency pair is the main asset in Forex. It is a quote of two separate currencies, with the price of one currency expressed against the price of the other. For example, EUR/USD is trading at 1.1116, so if a trader wants to buy 1 EUR, he must pay 1.1116 USD.

The currency is also the most liquid asset in the world. As a result, it has the most minute bid-ask spreads (one-hundredth of a percent). In comparison, Stocks and other less liquid assets may have much higher spreads.

A Bid-ask spread is usually applicable while trading with currency pairs or stocks. One of the uses of this spread is to measure market liquidity. Some markets have more liquidity than others. As a result, their spreads are lower, and we can assess that with a Bid-ask spread.

We can exchange most currency pairs in Forex without any costs. However, the spread is a cost that comes with the exchange. Several factors can influence the spread size of a broker. It may change depending on the liquidity, volatility, and volume. Moreover, a spread may be floating or variable as well.

Therefore, the trader must always check the spread size and place their orders accordingly when trading with spread. The market price should be above the spread price to make a profit. However, a new trader must know that heavily traded assets will have a tight spread. Also, the trading volume and demand level affect how high a bid-ask spread is.

In addition to the bid-ask spread, another type of spread is there, which is rarely seen. It is called Credit spread. It is more commonly known as Yield spread and signifies the ratio of returns on different investments with varying maturities or risk profiles. If you subtract the return of one asset from the return of the other, you can see the yield spread.

We must know that the Brokerages make money through spreads. So it can be seen as a charge they issue for their services. Such services include the data provided for trades and the trading platform as a whole. But they cannot entirely set the data and control it. Therefore, we must observe various factors affecting the spread rate as well.

Knowledge regarding spreads is a must for anyone preparing to start trading. Going into a trade without knowing its spread rates can cause a heavy loss to the trader. It holds especially for Beginners. They often miss looking at a spread value, which results in losing money on trades.

(Risk warning: Your capital can be at risk)

FAQ – The most asked questions about IC Markets fees :

Does IC Markets charge a commission?

With IC Markets, you can trade in two types of MetaTrader accounts. It offers a Standard account and a Raw Spread account. The standard account is the leading type in the market and excludes commissions. However, it applies a spread mark up of 1 pip. But, that is applicable only above the Raw inter-bank prices received from our liquidity providers.

On the other hand, the Raw spread account charges a commission. The rates are different depending on the base currency accounts and can range from 5-54 in denominations. However, they charge a commission of $7 per standard lot.

Is IC Markets free?

We cannot expect a broker to offer only free services. However, IC Markets is a broker that does not charge various types of fees commonly charged. It also excludes the commission for the standard account.

It charges only the swap rates, which is also applicable only if you violate the time cap; otherwise, you can avoid that. So we can say that it is free from additional fees. But, it charges a commission for the Raw spread account.

It also offers a spread, just like many brokers do. But, the spread starts with the lowest possible rates as opposed to other brokers. Therefore, it is free in certain aspects, but you need to pay a nominal amount while trading with it, depending on how you use its services.

Is IC Markets fees nil?

No, a trader must pay a fee to the broker to use the platform. IC Markets fees are thus payable by a trader who wishes to trade any underlying asset. However, the broker charges a very reasonable fee from traders. IC Markets fees are one of the lowest in the market. It is what makes it a good trading platform for traders.

Are IC Markets fees justified?

Yes, IC Markets fees are very reasonable. It is justified for IC Markets to charge whatever fee it charges from traders. The fee is very low in comparison to the services that this trading platform offers traders. Besides, it also offers plenty of underlying assets that traders can trade.

Are there any IC Markets fees for inactive accounts?

Fortunately, it is one broker that has nil inactivity fees. IC Markets fees for inactive accounts is $0. So, it is a plus point for traders trading on IC Markets. If they wish to take a break from trading, they can do so without any problem.

Do IC Markets fees exist for withdrawals?

No, there are no IC Markets fees that a trader has to pay for making withdrawals.

See more articles about forex trading here:

Last Updated on January 27, 2023 by Arkady Müller