FXTM minimum deposit: How to deposit money – A quick tutorial

Table of Contents

If you are one of those who are keen to trade with a minimum deposit, there are options in the market. One such is the FXTM which is quite a leading name in the trading market. The FXTM minimum deposit is $10. The AUD, USD, EUR, JPY, HKD, CAD, and others will be available as base currencies for new FXTM traders. You can use different messages in the IC Market to make a minimum deposit while utilizing a standard or raw spread account.

Customers are attracted to the cheap minimum deposit, increasing interest while trading. FXTM is a well-known forex and contract for difference (CFD) broker. As a result, a new trader needs to sign up to gain trust. The minimum deposit facility supplied by FXTM is just a condition to boost trader consumer interest and create opportunities. The minimum deposit in the trading entirely depends on the platform. Once you know it and payment methods, a trader can smoothly trade.

What is the minimum deposit?

A minimum deposit, also known as an initial deposit, is the amount of money needed to create an account with any financial institution, including a brokerage firm or trading platform.

Higher minimum deposits are typically connected with accounts that offer premium services, whereas mainstream products typically have smaller minimum deposits to attract new consumers. With FXTM, the minimum deposit is a part of the process, and consumers get fair treatment. With the mentioned minimum deposit of $ 100, you can trade in any available markets. The minimal deposit assists in the initial activation of the account, but it is not applicable on any of the available older accounts.

How does the minimum deposits work?

The FXTM minimum deposits, like every other platform, work similarly, and you need to be aware of the same, from the payment methods to the minimum amount fees. Minimum deposits ensure that the revenues earned by the client are sufficient to pay the administrative costs and other overheads connected with managing that account from the service provider’s standpoint.

Premium goods typically have huge minimum deposit requirements, while mass-market products usually have lower or even no minimum deposit requirements.

In some sectors, increased competition among financial services businesses has lower fees and lower minimum deposit requirements. This is especially evident in the discount brokerage and investment management industries, where companies like Wealthsimple and Betterment provide low-cost platforms with no minimum deposit restrictions in some circumstances. This low-cost strategy has also spread to other fees, such as removing per-trade costs.

Available deposit methods

FXTM doesn’t impose any fees/charges for any deposits done on the platform. The feature is trader-friendly since the broker will not deduct any fees from your deposits, leaving you to calculate just the fees imposed by the respective bank or third party with which you transmit the money.

Each trading account carries a base currency, allowing funds to stay in that currency by the broker. You have the freedom to own multiple trading accounts under different base currencies connected with firms.

What is the significance of this? If you deposit a currency other than the target trading account’s base currency, you will be charged a currency conversion fee. It’s probably not a significant deal, but it’s something you should be aware of.

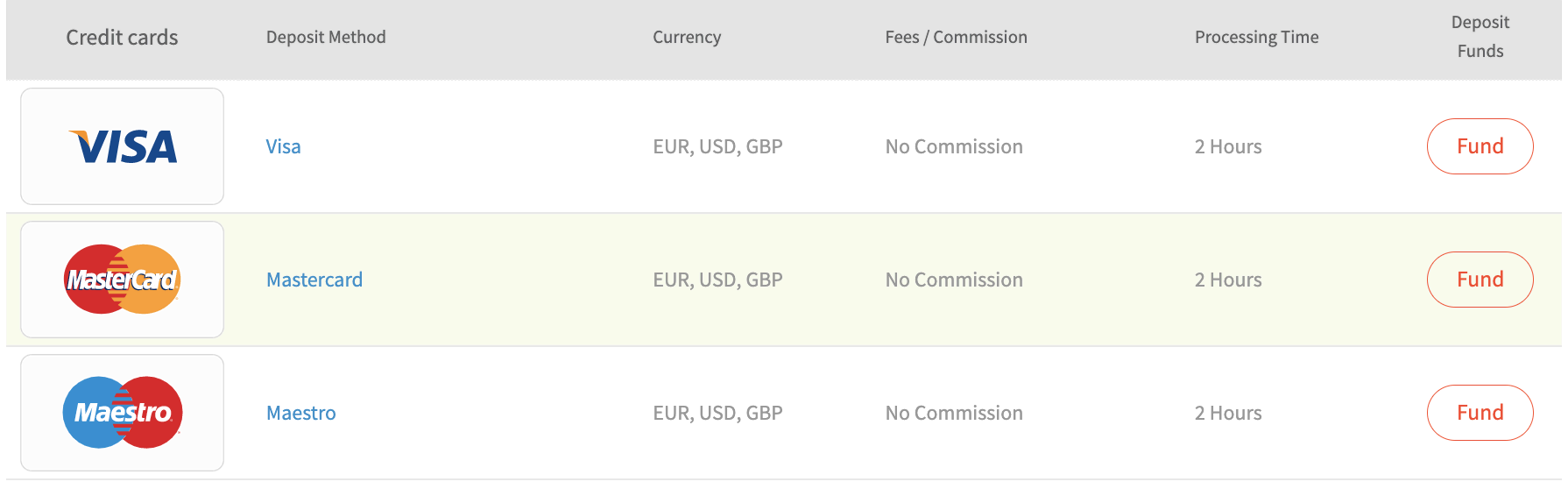

The available methods of deposits are as follows:

- Skrill

- Paypal

- Debit or Credit card

- Bank or wire transfers

- Neteller

Payments are initiated promptly through different channels, including PayPal, Neteller, or Skrill. Furthermore, traders can deposit through bank transfer or debit/credit card, and Domestic Wire can be transferred in one working day in this transaction. If you transfer via debit card or credit card deposit, it may take 3 to 5 days. However, traders depositing for the first time using the debit or credit card need to email or upload the image of the copy of both sides.

FXTM welcomes payments from all countries and will receive deposits in any manner that complies with local laws. Customers are increasingly interested in this trading because the broker has incorporated a variety of deposit ways.

Deposits

Currency | USD, EUR, AUD, CAD |

Fees/Commission | None |

Processing time | 24hrs |

How to deposit on the platform?

To perform the FXTM minimum deposit, there are certain methods or steps to follow-

- Opening the Broker Account

You will need to open a trading account on the platform. As a part of account opening, you must supply personal information such as your date of birth or job status and take a financial awareness test. Once completed, you will need to verify your address and identity. A copy of your ID card and the document confirming your residential address works for this verification.

- Making the deposit

To begin, log in to your registered trading account and locate the depositing interface. After that, you choose one of the deposit methods supported, enter the amount, and complete the transaction. As mentioned above, there are different methods to deposit money, including bank transfers and cards. However, if you are depositing a card, then verify the same by taking the image of the side.

This is an effective anti-money laundering measure. Using credit or debit for deposits is quite a convenient method adopted. However, some brokers limit card deposits, so a bank transfer is an ideal option if you need to deposit a bigger amount than the prescribed cap.

- Reviewing the Transaction

Depending on the method you used, it may take a few days for your deposit to reflect on the brokerage account. The broker will email you to confirm the deposit’s receipt.

Below are a few things to remember

- The sender (trader) has to register with FXTM or any of the trading platforms

- Transactions done in currency other than your account’s currency will be automatically converted at the FXTM exchange rate.

- The minimum deposit amount is about 100USD for every transaction.

- RBI’s maximum transaction limit is 100,000 INR, with a daily restriction of 200,000 INR for Indian clients.

- On successful deposit, it will be credited to your account right away. If FXTM or the payment providers cannot validate your information, there may be a delay.

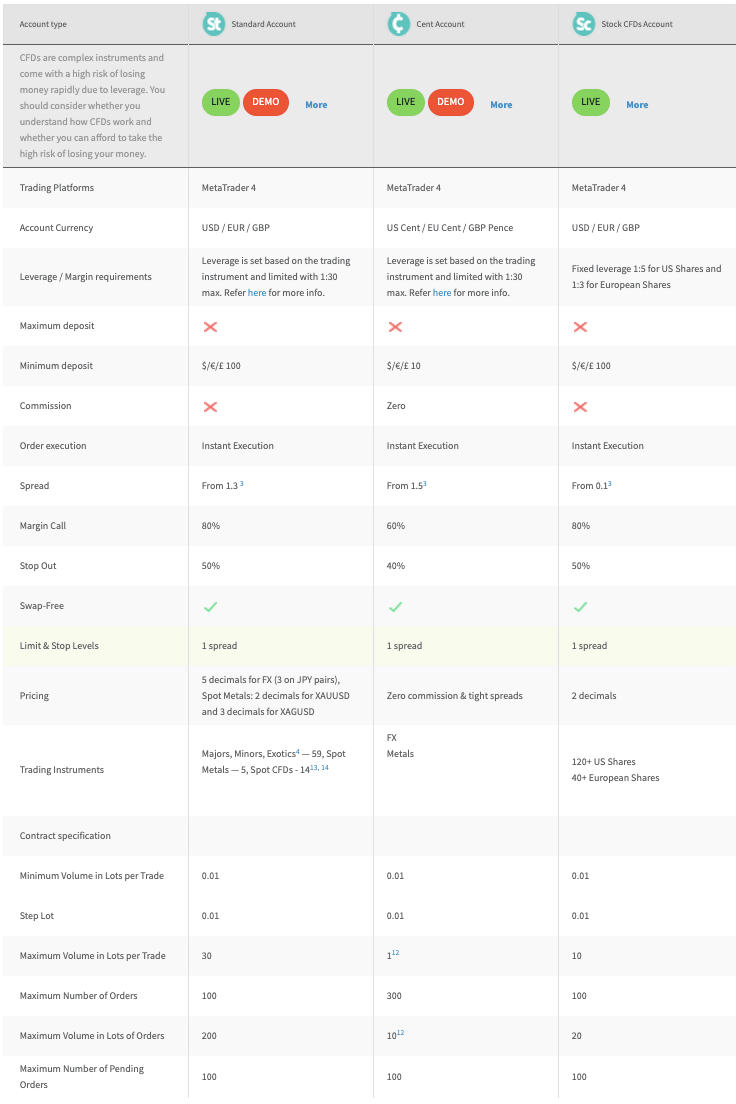

FXTM account types

FXTM has 7 distinct account types, each with its unique set of trading conditions. These account kinds are intended to offer traders a unique trading experience and atmosphere, as well as the most competitive price schedule.

#1 Standard account

In FXTM, there are no commissions on these trades, but you will have to pay a spread fee. The MetaTrader 4/5 forex trading platform is used in this account. This account is tailored to the needs of newcomers to the FX market. The account comes with some features-

| Minimum Deposit | $100(or the equivalent to GBP, EUR, or NGN) |

- MetaTrader 4 and MetaTrader 5 are available to use.

- When utilizing MetaTrader 4, users can use live and demo accounts and an Islamic account.

- Leverage starts at 1:2000 and goes up from there.

- Quick execution

- Spreads starting at 1.3 pips

- 40 percent margins call with a 20 percent stop-out.

- MetaTrader 4 traders have access to 50 Forex pairs, 5 spot metals, 14 spot CFDs, and 4 cryptocurrencies, whereas MetaTrader 5 traders have access to 33 Forex pairs and 2 spot metals.

#2 Cent account

| Minimum Deposit | $10(or the equivalent to GBP, EUR, or NGN) |

- MetaTrader 4 is available to you.

- Forex leverage ranges from 1:1000 to 1:25, whereas spot metals leverage is from 1:500 to 1:25.

- Trading with no commissions

- Spreads starting at 1.5 pips

- 60 percent margin call and 40 percent stop-out.

- There are 25 Forex pairings and two spot metals available.

- The step lot, as well as the minimum volume in lots per trade, is 0.01.

#3 Stock CFD account

| Minimum Deposit | $100(or the equivalent to GBP, EUR, or NGN) |

- MetaTrader 4 is available to you.

- Traders have access to only a live account and an Islamic option. The Stocks CFD Account does not allow for the creation of demo accounts.

- US stocks have a fixed leverage of 1:10, while European stocks have fixed leverage of 1:3.

- Trading with no commissions

- Spreads starting at 0.1 pips

- 40 percent margins call with a 20 percent stop-out.

- More than 120 US stocks and more than 40 European stocks are available.

- The step lot, as well as the minimum volume in lots per trade, is 0.01.

#4 Stocks account

| Minimum Deposit | $500(or the equivalent to GBP, EUR, or NGN) |

- MetaTrader 5 is available to you.

- Traders can only open a live trading account; there is no choice between a demo account or an Islamic account on this account.

- There is a 1:1 leverage given.

- Trading with no commissions

- Execution of the market

- Tight spreads are available.

- 100 percent margins call with a 0 percent stop-out.

- Stocks from the United States are available.

- The step lot, as well as the minimum volume in lots per trade, is 0.01.

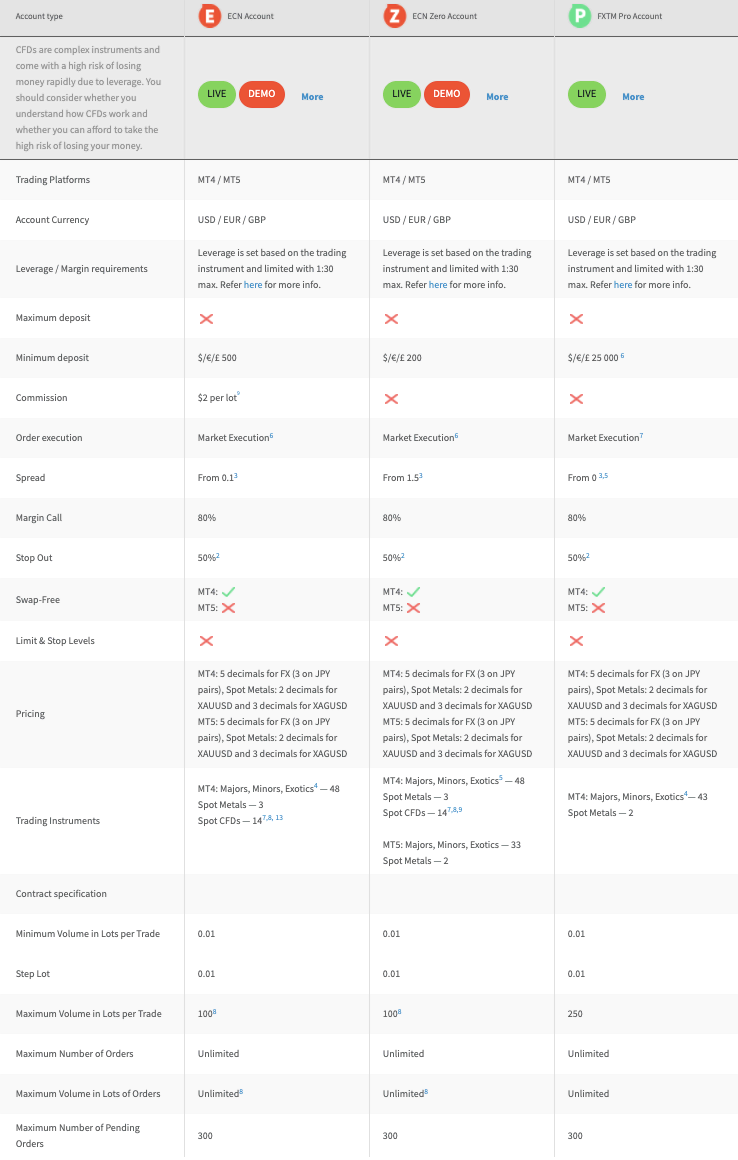

#5 ECN account

| Minimum Deposit | $500(or the equivalent to GBP, EUR, or NGN) |

- MetaTrader 5 and MetaTrader 4 are available.

- When utilizing MetaTrader 4, both live and demo accounts are available and an Islamic account.

- Leverage starts at 1:2000 and goes up from there.

- There are two-dollar commissions per lot.

- Trades are executed in the market.

- Spreads starting at 0.1 pips

- A call with a margin of 80 percent and a stop-out of 50 percent

- MetaTrader 4 trading instruments include 48 Forex pairs, 3 spot metals, and 14 spot CFDs.

- The step lot, as well as the minimum volume in lots per trade, is 0.01.

#6 ECN zero account

| Minimum Deposit | $200(or the equivalent to GBP, EUR, or NGN) |

- MetaTrader 4 and MetaTrader 5 are available.

- When utilizing MetaTrader 4, both live and demo accounts are available and an Islamic account.

- Leverage starts at 1:2000 and goes up from there.

- Trading without commissions

- Execution of the market

- Spreads starting at 1.5 pips

- A call with a margin of 80 percent and a stop-out of 50 percent

- MetaTrader 4 traders have access to 48 Forex pairs, three spot metals, and fourteen spot CFDs, whilst MetaTrader 5 traders have access to 33 Forex pairs and two spot metals.

- The step lot, as well as the minimum volume in lots per trade, is 0.01.

#7 Pro account

| Minimum Deposit | $25000(or the equivalent to GBP, EUR, or NGN) |

- MetaTrader 4 and MetaTrader 5 are available.

- This account type does not allow for the creation of a demo account, although it can be converted to an Islamic account.

- Floating Leverage ranges between 1:200 and 1:25.

- Trading with no commissions

- Execution of the market

- Spreads starting at 0.0 pips

- A call with a margin of 80 percent and a stop-out of 50 percent

- MetaTrader 4 trading instruments provide 43 Forex pairings and two spot metals.

- The step lot, as well as the minimum volume in lots per trade, is 0.01.

- The maximum number of orders or the maximum volume is both unlimited, whereas the maximum number of lots per trade is 250.

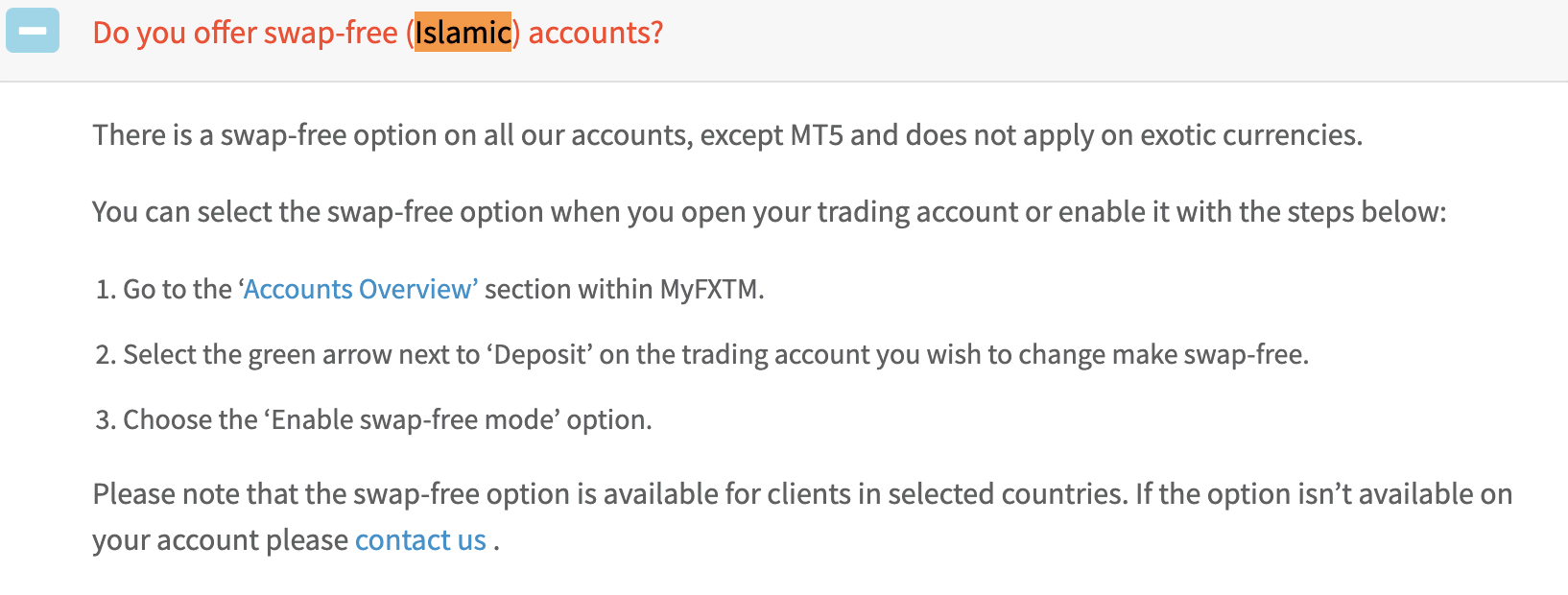

Islamic account

An Islamic Account is designed exclusively for Muslim investors who strictly follow Sharia law, which forbids its believers from paying any interests, even overnight fees, which are deemed useless or unethical.

Traders who stay open for an extended post-trading day are charged overnight fees. This type of account helps users to eliminate such charges or fees if they keep positions active for a longer period of time.

Except for the Stocks Account, all accounts can convert a live trading account into an Islamic account. FXTM does not appear to levy additional trading costs to compensate for the lack of overnight or swap fees. Because of the range of FXTM account choices, traders have exposure to a trading environment that is attractive and cost-effective in respect of trading and non-trading expenses.

FXTM traders benefit from the edge they need to enhance their trading activities, irrespective of the level of ability, competence, or knowledge.

Pros and cons

Pros | Cons |

Fully-Regulated Platform | Restrictions for US clients |

Different Types of Accounts to trade | |

Commission free trading | |

$100 minimum deposit |

Conclusion

If you’re looking for a leading online platform for trading with a minimum deposit, FXTM is the best. The FXTM minimum deposit is something that attracts traders to open an account. The broker is a well-known trading platform among international and Indian investors. In the market, there are three sorts of acceptable accounts for traders so that you can add this broker with confidence. Because of the differences in trading accounts, you might accept several forms of leverage offers. In terms of offers, FXTM trading remains at the top. FXTM can be beneficial with easy payment methods and a minimum amount if you’re new to the broker business.

FAQ – The most asked questions about FXTM minimum deposit :

How many instruments does FXTM allow to trade with?

FXTM allows multiple instruments to trade on:

Spot Metals

Share CFDs

Stocks

Forex

Cryptos

What is a micro account?

The Micro Account is specifically created for traders looking forward to trading with the industry-standard MetaTrader 4. It also boasts a low minimum deposit of just $10, so if you’re new to trading, you won’t have to worry about investing a lot of money right away.

The Micro Account has no commissions, tight spreads, and a low initial deposit of just $10 – all while allowing you to trade metals, indices, foreign exchange, and commodities.

What is an advantage account?

Advantage account not only allows traders to trade on the market execution but on spreads too. Possibly the biggest critical factor for investors to take into consideration when choosing which account to open — are frequently zero on some of the globe’s most exchanged currency pairs, such as EUR/USD and EUR/JPY, and as low as zero on Gold/USD. It is accessible on both the MetaTrader4 and MetaTrader5 platforms. After finishing a few others steps in the user registration process, you will be free to trade equities such as Facebook, Amazon, and Apple, among others.

Is FXTM minimum deposit amount big?

Most brokers allow traders to start trading with a low minimum deposit amount. Since FXTM is a leading broker, it does not have a very big minimum deposit amount. Any trader can begin trading with FXTM by adhering to the FXTM minimum deposit amount. You can get started on this amazing trading platform by paying a minimum deposit of only $10.

How can a trader fund his trading account with the FXTM minimum deposit?

Traders can use plenty of methods to fund their trading accounts with the FXTM minimum deposit amount. The most common payment methods that traders can access in FTXM include bank transfers, cryptocurrency, electronic transfers, and debit and credit card payments.

A trader can use any payment method to fund his trading account with the FXTM minimum deposit amount. It will allow you to trade conveniently.

What is the FXTM minimum deposit amount for MT5?

FXTM offers traders a wonderful trading platform called MT5. You can also access the MT4 trading platform with this broker. However, to begin trading it, you would have to pay fund your trading account with more funds. The FXTM minimum deposit amount for the MT5 trading platform is $500. If you use any other currency, you must pay an equivalent amount.

See more articles about forex trading:

Last Updated on January 27, 2023 by Arkady Müller