Who is John C. Bogle? – History of the trader and investor

Table of Contents

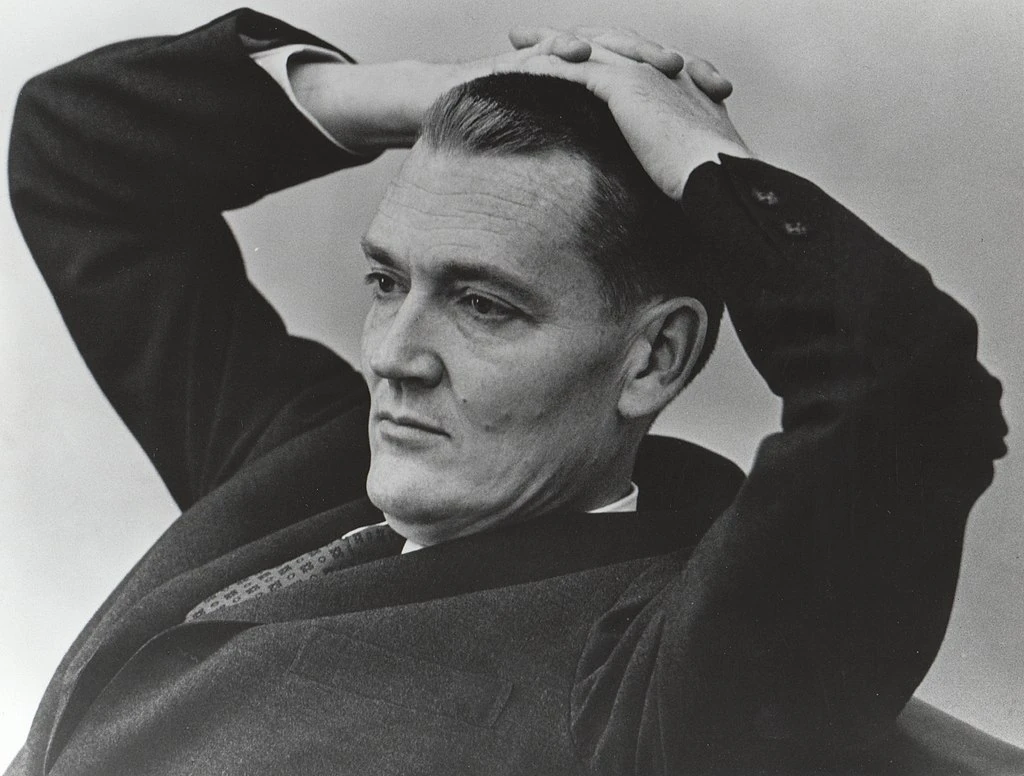

‘Invest you must’ is great trading advice by the greatest trader. John C. Bogle was an immaculate trader who invested in several stocks and became wealthy.

John C. Bogle had a strong belief, in the fact that holding your money would never make any person rich. Saving dollars is a myth. Any person should direct their surplus funds into investing.

Thus, John C. Bogle played a great role in framing the minds of several traders with his trading journey. Let’s explore John C. Bogle’s life further and get inspiration from his trading strategies.

About John C. Bogle

Date of birth: | 8.05.1929 |

Wealth: | 89 million USD |

Strategies: | – holding money would never make rich – the low-cost index fund – avoid high-cost investing – following the advice might be profitable – diversification has immense benefits for any trader – perfect timing is essential – building great knowledge when trading |

Website: | |

Interesting facts: | – American business magnate – excellent academic career – fascination for numbers – founder of The Vanguard Group |

- John Clifton Bogle, often called Jack, was a well-known trader and great investor. John Bogle started his trading career at a young age. The investor is also famous for his contribution to creating the Index Fund

- Besides being a trader, John C. Bogle was also an American business magnate. He took great enthusiasm in founding and managing The Vanguard Group

- The trader had an avid interest in investing and saw the perfect trading opportunities just in time

- John C. Bogle had a great hand at managing money. The trader followed the principles of trading over speculation. He believed a trader should be patient when making long-term or short-term investments

- The investment vehicle John C. Bogle followed for trading included the low-cost index fund

Good to know!

- John’s writing is nothing less than a great classic in the trading world among all traders

- Also, Bogle was a great philanthropist. Various charitable concerns received his donations

The best brokers for traders in our comparisons – get professional trading conditions with a regulated broker:

Broker: | Review: | Advantages: | Free account: |

|---|---|---|---|

1. Capital.com  | # Spreads from 0.0 pips # No commissions # Best platform for beginners # No hidden fees # More than 3,000+ markets | Live account from $ 20: (Risk warning: 75% of retail CFD accounts lose money) | |

2. RoboForex  | # High leverage up to 1:2000 # Free bonus # ECN accounts # MT4/MT5 # Crypto deposit/withdrawal | Live account from $ 10 (Risk warning: Your capital can be at risk) | |

3. Vantage Markets  | # High leverage up to 1:500 # High liquidity # No requotes # MT4/MT5 # Spreads from 0.0 pips | Live account from $ 200 (Risk warning: Your capital can be at risk) |

Biography of John C. Bogle

- John C. Bogle was from New Jersey. He grew up in Mont Clair

- His family was among many who underwent the consequences of the Great Depression

- The situation of John’s family became so intense that they had to sell off their home

- John had an excellent academic career. Because of his excellence, John C. Bogle could avail himself of some scholarships, which he took

- With time, John developed a fascination for numbers

- Later, Bogle made it to Princeton University. Here, he opted to study economics

- When John C. Bogle studied economics, he also read about mutual fund investing. It developed his interest in investing, and soon he stepped into the trading world

Good to know!

At this time, the trader was looking after the company’s investment division. Thus, John C. Bogle got a chance to improvise his trading skills further.

The net worth of John C. Bogle

The trader built himself a net worth of 89 million USD. He could build this wealth by revolving his trading strategies around index investing. John was more into speculating than investing.

Good to know!

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 75% of retail CFD accounts lose money)

Trading and investment strategies of John C. Bogle

The trader has written about his favorite investing tips in his book. The main trading strategies and advice that John C. Bogle has in store for traders include the following.

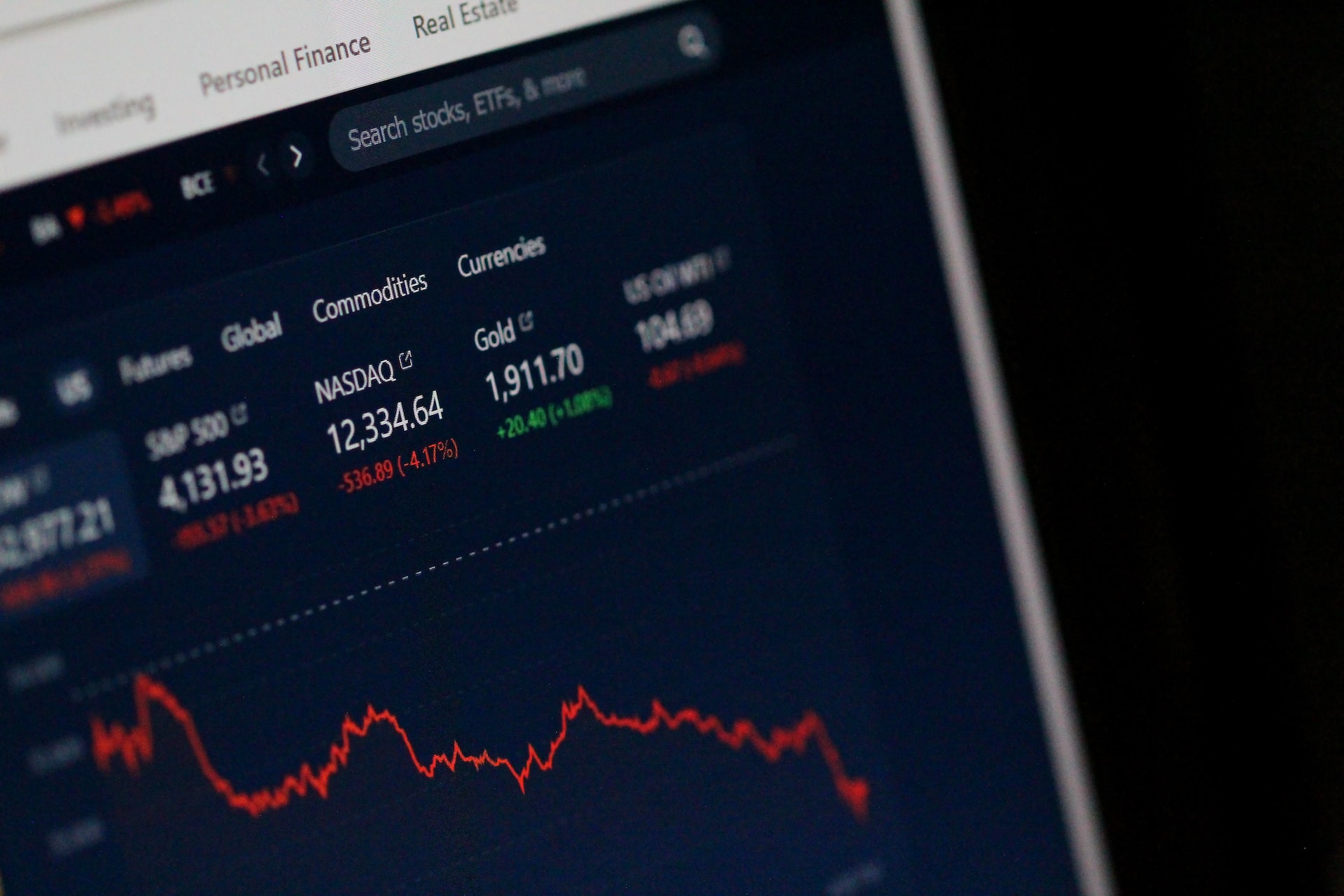

Choose low-cost funds

According to John C. Bogle; a trader must avoid investing in funds that are high in cost. Usually, investing in low-cost funds can help you benefit in the long run.

Before choosing any low-cost fund, the trader must also assess its marketability. It would allow him to sell them off when the situation so permits.

Consider the cost of advice

When a trader is active, he might receive suggestions from the trading community. However, a trader must know how much weight this advice deserves. Mostly, all trading advice carries a cost.

Following some advice might be profitable. But following the herd, every time might not offer you the best benefits.

Avoid overrating past performance

It is likely for any trader to check the market performance of any asset before investing in it. However, giving high weightage to its past performance is a mistake a trader would make. Instead, a trader must seek to analyze this asset’s future possibilities.

If a stock or an underlying asset performed well earlier, it might not do the same.

Diversify

Diversifying your investment is a great way to shield yourself from any upcoming losses. A trader can diversify his investment to let his trading goals work. Diversification has immense benefits for any trader.

However, at the same time, a trader should avoid diversifying as it might leave him with little or no returns.

Hold your portfolio

A trader must try to build his portfolio and hold it. Holding a portfolio might help a trader benefit when the assets he is holding rise in value.

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 75% of retail CFD accounts lose money)

What can you learn from John C. Bogle?

The investor has acquainted traders with the best trading philosophies in his books. The trader also leaves behind several valuable lessons for all traders. These lessons can help a trader manifold his wealth when the time is right.

Indulge in investing

As mentioned, John C. Bogle believes holding money will not benefit you. However, if you consider investing in it, it might turn into a profitable venture for any trader. Thus, investing means a trader or any person can manifold their fortune.

Good to know!

Believe in time

Time is the greatest factor a trader must consider when investing. Perfect timing is essential whether a trader is looking forward to buying or selling assets. If a trader makes well-timed trading decisions, he stands a better chance of becoming wealthy through trading.

Give up impulsive behavior

A trader must try to act rationally when trading. Giving up on impulsive behavior and adopting a patient one is the key to getting rich when trading. Impulsive behavior can make a trader lose out on any important profit-earning venture.

Build low-cost portfolios

A great way for traders to make money in the trading world is to choose low-cost portfolios. Low-cost portfolios allow traders to invest a low amount and then benefit from them after selling them at a high price.

Have knowledge

Finally, a trader should also focus on building great knowledge when trading. An expert knowledge of the trading world in which a trader operates helps him in the long run.

Conclusion about the investing experience of John C. Bogle

John C. Bogle always traded strategically after following his great technical analysis. As per the trader, an investor should tap the short-term market fluctuations to ensure that he speculates well.

Also, a trader should try to invest more in several low-cost funds that he thinks are profitable. Whenever investing, a trader should trade in a time-focused manner. It is essential to understand the time relevance as it helps traders pick a perfect time to buy or sell the security.

Thus, John C. Bogle’s trading skills are worth it for any trader.

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 75% of retail CFD accounts lose money)

FAQs – frequently asked questions about John C. Bogle

Who was John C. Bogle?

John C. Bogle was a great investor and a leading name in the American stock market. The investor was also a great speculator who was utterly successful in amassing huge wealth. John C. Bogle displayed great trading knowledge through his trading decisions.

Is reading John C. Bogle’s book worthwhile?

John C. Bogle wrote the book about all the principles he followed while trading. So, reading his book can be worth it if you wish to have perfect knowledge about trading.

What is John C. Bogle’s greatest advice?

John C. Bogle gave investors the greatest advice to look for stocks that are available at a low cost. It will help them profit once the stock grows in value over time.

Last Updated on February 26, 2023 by Yuriy Kunets

(5 / 5)

(5 / 5)