Our best 10 trading tips and tricks for Forex and CFD trading

Table of Contents

Are you looking for effective and applicable trading tips and tricks? – Then this page is the right place for you. With over 9 years of experience in the financial markets, we will tell you in the following texts our best trading tips for beginners. Improve your trading and avoid high losses. Knowledge is the power in exchange trading and thus you are several steps ahead of other traders.

1. Use the economic calendar and news

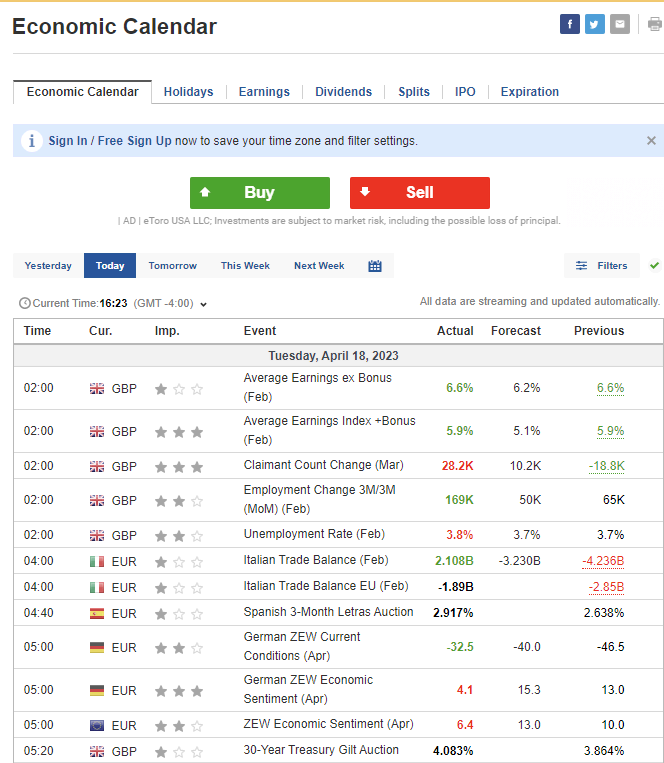

The first trading tip deals with the economic calendar and the news. The Economic Calendar is an essential tool for any trader. Whether short-term day traders or long-term swing traders, economic news always has an impact on the markets. Investing.com’s calendar shows you upcoming news and past news. The exact time when the news arrives is published. For example, trading strategies can be derived from the data.

We strongly recommend that every trader check this economic calendar before trading. After the news, there can be very strong movements in the market. From our experience, it is not very meaningful to trade this news, because the movements are unpredictable in most cases.

In the picture above, you can see a part of the economic calendar from the website investing.com. The strength of the news is indicated by the “bull’s heads”. From our experience, one should not act on the news with 3 “bullheads”. Volatility is simply too high and liquidity is too low. Risk-taking traders can open trade to speculation right after the release.

Where can you see this Economic Calendar? – The website investing.com shows you this economic calendar. Besides, most Online Brokers give you the service of the Economic Calendar.

Facts about the Economic Calendar:

- The News has a strong impact on the markets

- Due to high volatility and low liquidity, it is dangerous to trade.

- Inform yourself before you trade

- Different strategies can be derived from the news.

2. The demo account for beginners and advanced traders

The trading demo account is very important for beginners and advanced traders to test trading platforms, strategies, etc. It is a virtual credit account that imitates real money trading. The terms and conditions are the same. The demo account allows the trader to trade without risk.

Many beginners start too fast with real money trading. We strongly recommend practicing with the demo account first until you are profitable and feel very secure. In addition, order execution must be practiced and familiarized with the trading platform to avoid serious mistakes. A demo account can be opened with any broker. In the table below, you will find a selection of our top providers.

Facts of the trading demo account:

- The demo account is an account with a virtual balance

- Real money trading is simulated with “play money”

- Beginners should practice trading with it

- Advanced students can test new markets and try out strategies

- You can open a demo account for free

3. Choose cheap and reputable brokers

This is probably the most cost-effective trading tip for the trader. With more than 9 years of experience, we have tested many brokers and looked for the best providers. Trading fees can be extrapolated to the year, so you should definitely look for a cheap broker. Alone with a saving of 1$ per order opening, a very large sum comes out calculated on the year.

In addition, the broker should be reliable and reputable. The surplus of possibilities makes it hard for a beginner to decide which broker is really good. Pay attention to official regulations and services, which is offered to the trader. In the table below, you will find our top 3 providers. IQ Option offers the best overall package. A change can be very rewarding for you.

Criteria for a good broker selection:

- Regulation and licensing

- Free demo account

- Low trading fees

- No hidden costs

- Fast execution

- Professional multi-language customer support

The best brokers for traders in our comparisons – get professional trading conditions with a regulated broker:

Broker: | Review: | Advantages: | Free account: |

|---|---|---|---|

1. Capital.com  | # Spreads from 0.0 pips # No commissions # Best platform for beginners # No hidden fees # More than 3,000+ markets | Live account from $ 20: (Risk warning: 78.1% of retail CFD accounts lose money) | |

2. RoboForex  | # High leverage up to 1:2000 # Free bonus # ECN accounts # MT4/MT5 # Crypto deposit/withdrawal | Live account from $ 10 (Risk warning: Your capital can be at risk) | |

3. Vantage Markets  | # High leverage up to 1:500 # High liquidity # No requotes # MT4/MT5 # Spreads from 0.0 pips | Live account from $ 200 (Risk warning: Your capital can be at risk) |

4. Learning and continuing to trade continuously

Information and knowledge make you a successful dealer. It is important to start with the basics. From our experience, there is a problem that many beginners with advanced knowledge want to start trading. Usually, the terms are not even correctly understood and one does not understand what one is actually doing.

Trading has to be built up like a foundation from the very beginning. You start with absolute basic knowledge. Many brokers offer, for example. webinars, coaching, books, and more to learn to trade. This is a very good way to refresh your knowledge. For advanced knowledge, there are also other books on Amazon or Youtube videos.

Our recommendation is this: “Take a look at our trading guide. It’s also for beginners too.”

You should ask yourself these questions first:

- How is the price determined on the stock exchange?

- How does order execution work?

- How do I determine the correct position size for a trade?

- How much money do I want to risk?

- Will there be strong news coming soon that will affect my market?

- Which trading approach do I follow?

- Where are my loss limit and the goal of the trades?

Overall, the financial market is very complex and there are countless different markets and financial instruments. Our first tip is to look for a special subject area and become a professional in this area. Don’t focus on too many things at the same time. This can cause a lot of confusion in the beginning. As an introductory book, we can recommend an eBook for your trading mindset, for example:

5. Avoid stress and emotions

Many traders start trading in poor physical conditions. For example, you should not trade if you are ill or stressed at work. From our experience, it makes very little sense to sit at the computer and start trading after a fight with your girlfriend.

The body should be rested because you need a full focus on trading. Distractions should also be avoided. The smartphone or news can distract the trader while trading. The consequences are the wrong decisions. Trading is about earning money and every trader wants to get the best out of it. That’s why you should focus entirely on execution.

In addition, many people are emotionally controlled. Emotions, for example, are associated with money because they have worked hard for it. In stock market trading, you have to take a risk in order to make a profit at all. Don’t let a loss put you off.

For many traders, it is difficult to switch off after several losses. They trade on afterward and make even more mistakes through emotions. You have to learn to switch off. Make sure you set yourself a loss limit. A loss limit prevents the worst wrong decision and emotions.

Our rules for good emotions:

- Only trade in a good physical condition

- Avoid stress

- Set yourself a loss limit to prevent emotional action

- Do not trade with expectations

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 78.1% of retail CFD accounts lose money)

6. Create strategies and rules

There are millions of functioning trading strategies for the stock exchange. The biggest mistake traders make is that these trading strategies are not consistently executed. In order to achieve the right result, the strategy must be executed step by step. The trader acts almost like a machine and executes the rules.

A set of rules is very important for stock exchange trading. It describes the principles of the trading strategy. Without a set of rules, the trader will fail miserably. From our experience, we can say that our performance is significantly better if we trade a strategy according to a fixed set of rules.

You can create the rules yourself. But for this, you need experienced and knowledge that you can acquire over a longer period of time. Backtests can be carried out in the demo account. Creating a strategy and set of rules costs a lot of time. However, it will help you significantly with trading.

You need a fixed trading strategy:

- Test different trading strategies

- Execute these strategies strictly according to the following rules

- Develop your own set of rules for the retail trade

7. Reasonable risk and money management

As mentioned above, trading is risky and requires the use of capital. The higher the risk, the higher the profit. The risk must be planned before each trade and is delimited by the stop loss (more on this in the next trading tip).

Trading involves several losses in a row. Therefore one should use meaningful risk management, in order not to damage his trading account too strongly. If, for example, you set 20% of the total capital per trade, your account will be almost 60% smaller after 3 loss trades. This does not really make sense and you will quickly destroy your account. In addition, there are emotions, because too high sums are used.

Professional traders put 0.5 – 2% risk on your trading account per trade. This is a very good value to hedge against fluctuations. Would you rather gamble or increase the capital calmly and long-term? – This is your decision.

Our trading tips for money management:

- The risk must be planned prior to each trade

- How much money would you like to risk?

- Professional traders use only 0.5 – 2% risk of the total account per trade.

- Too high a risk leads to emotions and wrong decisions

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 78.1% of retail CFD accounts lose money)

8. Use profit (take profit) and loss limits (stop loss)

Use Take Profit and Stop Loss (picture below) for your trades. Pre-trade preparation is essential and these automatic limits are part of it. Optionally, the stop loss can also be added to the profit and thus the risk is taken out of the market.

Take Profit and Stop Loss are automatic limits that automatically end the position at any price. The trade is then closed. This happens in the case of profit or loss. Stop Loss is the most important tool for a trader to hedge his risk. Trading without Stop Loss is absolutely not recommended and can lead to high capital losses.

These two limits can be changed at any time after the position has been opened. In summary, Take Profit and Stop Loss are the most important means of securing your profits and limiting losses.

9. Pay attention to stock exchange opening hours and volatility

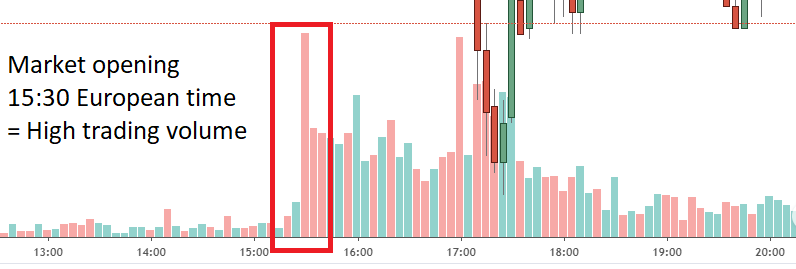

A trader should definitely know his market. This includes the important opening hours of the stock exchange. Some markets may be electronically tradable 24 hours a day, but trading hours play a significant role in trading.

Volatility and liquidity increase during trading hours. In addition, movements are less controlled by algorithms. The trader should pay attention to this.

When does it make sense to open a trade?

For example, only the official opening hours of the exchange make sense for day trading. You will notice a clear difference between day and night. In addition, the volatility (movement) is significantly higher when the exchange is opened. You should be prepared for this.

For example, it does not make sense to make a quick trade on Friday evening. The movements are hardly noticeable and many traders have already gone into the weekend. You will get the best results during the official trading hours.

Some markets also don’t trade at night. Positions can therefore not be opened or closed.

- IPOs cause high volume and volatility

- Outside opening hours it makes little sense to trade

- Know your market and its characteristics

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 78.1% of retail CFD accounts lose money)

10. Avoid trading signals and trading robots

In my more than 9 years of experience in stock exchange trading, we have not yet found a functional signal service. In 100% of the cases, this is a rip-off and the signals don’t work.

Mostly questions beginners about signals or automatic trading systems. Ask yourself the question: Why should someone offer profitable signals for you and preferably for free? – It doesn’t work! These providers either want to rip you off with high fees or earn you money when you lose money.

Should an automatic signal generator work, you would be rich in a few months and would not have to publish and advertise it. Keep absolutely away from such offers. Independent trading according to your own strategy will lead you to success. Gladly one can exchange oneself with other traders, but everyone has their own estimate of the market. This can cause confusion.

Our recommendation:

- Avoid a Signal Service

- Stay away from automatic trading programs

- Rather invest in your own knowledge

Conclusion on the 10 best trading tips and tricks for traders

On this page, we have shown you our best 10 trading tips and tricks. Now, you should be much safer in trading. You will also know how to prepare yourself better for the markets with a little effort.

All 10 tips are part of a successful trade and no tip should be neglected. In our 9 years of experience in the financial markets, we have made some mistakes. That’s why we created this page to make it easier for beginners to start trading.

Trading is difficult and risky. However, you can simplify trading with a few tricks.

We wish you much success in trading.

You need more knowledge than other traders in order to make a profit in the markets. Knowledge is power

Trusted Broker Reviews

Experienced traders since 2013Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 78.1% of retail CFD accounts lose money)

FAQs- The most asked questions about Trading:

Which market is best for trading?

There’s no such thing as the “best” market for trading. The ideal market for you to trade in depends on your knowledge and experience trading in the market. Beginners should steer clear of illiquid and abstract markets. The stock market is generally considered a good jumping-off point. However, you could also consider trading in the Forex market if the trade barriers are low.

Is hiring a stock broker better than learning to trade?

A stock broker may supply you with trading tips and help you make potentially profitable trades. But ultimately, a stockbroker is not a stock advisor. It’s not right to expect a broker to be as concerned about your future well-being as you are. Trading isn’t rocket science, and with some effort, you should be able to make good trading decisions on your own.

Is trading better than investing?

One would invest in a security of any kind with the goal of long-term growth. The daily fluctuations in the security’s price are less important than growth over decades. Investors make their money with the power of compounding. On the other hand, trading involves taking risks in the short term to generate large profits. Trading involves transaction costs and taxes and takes niche knowledge and practice to pull off. Trading and investing both have their pros and cons. It’s up to you to decide the best approach for you.

See other articles about online trading:

Last Updated on April 18, 2023 by Res Marty

(5 / 5)

(5 / 5)