CFD Broker Libertex minimum deposit and payment methods

Table of Contents

The minimum deposit in the trading business is a convenient condition. Libertex broker accepts users with a small deposit of € 100. New traders at the broker first want to open an account with a small deposit, so they look for the right deposit amount. Libertex is one of the most popular ones among brokers. Because Libertex broker supports the lowest deposit. In this article, we will give you all information on that topic.

You should be aware that both the potential profit and loss in Libertex broker may vary proportionally with the selected factor. So, for those who are new traders on Libertex, we think the minimum multiplier of 1 should be used to avoid risk in adverse market conditions.

Facts about the Libertex minimum deposit:

- The minimum deposit to start trading with Libertex is € 100

- It offers multiple payment methods

- No deposit fees

- Leverage up to 1:30 is available

(Risk warning: 74.91% of retail investor accounts lose money when trading CFDs with this provider.)

What is the Libertex minimum deposit?

Libertex allows a minimum deposit of € 10 for existing accounts and € 100 for new trading accounts. The minimum deposit amount is required to start trading. From our experience, it is better not to trade with so little money on the financial markets. Users of small deposit accounts may not use every financial market correctly. So if you are new to Libertex Broker, we recommend adding more money to your account to use different trading strategies. Then your business opportunities will increase a lot.

Libertex is one of the most popular brokers. Several brokers are at the forefront of offering minimum deposit benefits, Libertex does not offer any bonuses. Such new traders are much more attracted to these brokers and create accounts.

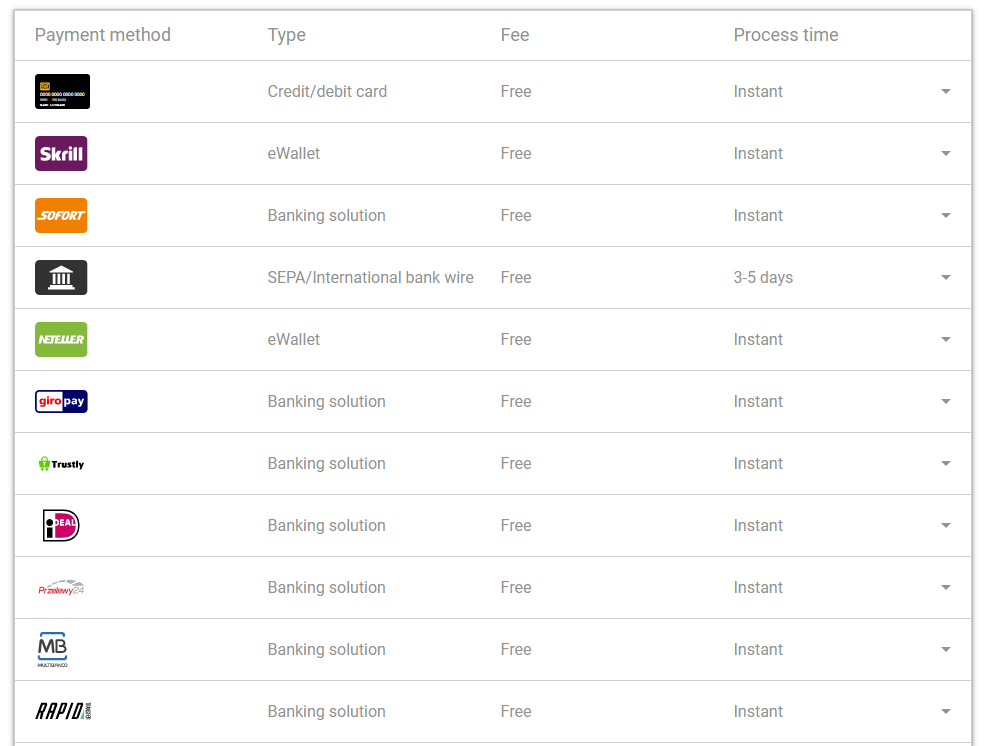

What are the Libertex minimum deposit methods? (how to deposit)

Libertex allows you to use a variety of payment methods. This allows you to transfer your transactions in a much easier way. It is possible to make instant secure online payments using Visa cards, MasterCard, and credit cards. Traders use this method a lot to transact. Libertex accepts Visa cards and MasterCard cards issued as prepaid too. If you have an account with the broker, you can see this. If you want to know about the restrictions on using the card, you need to make sure to contact the issuer.

The biggest advantage you get when you transact with a card is that you can revolve around every transaction with certainty. Don’t use the wrong methods when you deposit, Take a look at the Libertex deposit methods below:

- A debit card or credit card

- Skrill

- PayPal

- Neteller

- Bank transfer

- Jeton

- Sofort

- Blink

- Rapid transfer

- Multibanco

- Trustly

- GiroPay

- iDEAL

On the trading platform, if you deposit by credit/debit card, you can use the same card for any withdrawal. When you click withdraw for wire transfers, you will be sent a request to submit your bank details. Libertex offers customers a huge range of payment methods. So you can start your broker business through this trading. All the facilities you need to provide international training will be available here.

(Risk warning: 74.91% of retail investor accounts lose money when trading CFDs with this provider.)

Are there deposit fees?

Libertex is a much more popular broker for limited fees and commissions. There are no fees for deposits. Traders are charged a commission or fee for performing transactions. Libertex charges commissions depending on the underlying asset. You can see all of this information in this broker’s trade window. Libertex uses this method to make it clear to the customer.

What is the offer of the broker for clients?

Libertex Broker 250- CFD underlying assets leverage up to 1:30 for retail clients on CFDs on currencies, stocks, ETF, commodities, cryptocurrencies, and indices. Users can see all of the Libertex offers in their account dashboard. So traders can accept these offers and realize. The importance of offers in providing business skills is wide.

Users will be able to access the broker account through the mobile app and monitor all offers. The number of new clients of this broker is increasing day by day due to the accessibility of their mobile app.

Why you should start trading with Libertex:

- Regulated broker by CySEC

- Free demo account

- A low minimum deposit of € 100

- Tight spreads

- Limited commissions

- Free deposits

- Award-winning platform

- Personal support

Conclusion on the Libertex minimum deposit

If you decide to start trading, you can use this CySEC regulated broker to trade CFDs. You can start trading using a minimum deposit of € 100. So Libertex is one of the best and most transparent brokers in the area. If you have a large number of deposits, you can use a large deposit without using a minimum deposit.

Risk warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 74.91% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money

FAQ – The most asked questions about Libertex minimum deposit :

What are the different cards allowed to make the minimum deposits on Libertex?

Libertex allows for a variety of deposit methods. Credit cards, Master cards, and Visa cards may all be used to send money instantaneously. You need to contact the card issuer if you wish to know about the restrictions of the card.

What is the minimum deposit allowed on Libertex?

For every beginner trader or investor who wants to start their account on Libertex, the minimum deposit is set at 100 euros. There won’t be any fees charged on the deposit transactions. Also, the platform offers leverage of 1:30.

What are the different deposit methods through which the payment can be made on Libertex?

The different deposit methods allowed on Libertex are credit and debit cards, electronic wallets, banking solutions, and many others. It also supports SEPA or wire transfers in an international bank account. So, based on your preferences, you must select the deposit option that is most suitable for you. There will be no charges levied on these deposit instruments.

What are the deposit fees at Libertex?

Libertex is popular for its low transaction fees. No fee is charged for depositing money, but traders are charged a commission of a minimal amount for transactions. The fees depend on the assets you hold. All the procedures and fees are transparent and are visible in the broker’s trade window.

See other related articles about online brokers:

Last Updated on January 27, 2023 by Arkady Müller

Leave a Reply

Want to join the discussion?Feel free to contribute!