How much does it cost to trade with Alpari? – Spreads & fees explained

Table of Contents

Along with various services, we can see that Alpari offers a diverse market spread and fees. Therefore, it can be your goto choice to begin Forex trading. First, however, a brief comparison of the fees is essential. It helps us know why an exchange company like Alpari is needed for Forex Trading.

It is not hidden that the Forex market is one of the most liquid and the largest market at the same time. So, it is always possible that people may get attracted to it effortlessly. But, like any trading market, the trader needs to understand how it works first. To excel in it, traders must know the marketplace, best brokers, market spreads, broker fees, etc.

So, to better clarify, let us focus on basic concepts like spreads and fees first.

Common types of fees in forex

These charges arise due to the cost and time during your trade. It mostly depends on the broker to charge fees according to their policies. So, different brokers will have different fee patterns. But, the following are some common types of charges.

Overnight funding fees

As the name hints, it is a fee charged by brokers for overnight funding. Usually, the broker requires you to deposit an amount to open a position and lends the rest of the money required. But, if the position’s closing happens on the same day, they charge no funding fee. On the other hand, keeping it overnight will cause you a small fee that is essential to cover the cost of the money borrowed by you.

Currency conversion charges

We know the significance of currency change in our daily activities. It is because of the currency exchange various economic activities take place. No doubt, the brokers also charge fees for doing the same. But, in the broker’s case, this charge occurs if you trade in a currency other than the base currency.

Extra services and charges

These are the types of charges that occur additionally. It includes an inactivity fee, international deposits fee, withdrawals via wire payments, etc.

Alpari is one of the best forex brokers in the world, as it has been on the market for many years and offers attractive conditions for traders.

Does Alpari charge commission?

Alpari is, without a doubt, a good Forex broker, but that does not mean they should not charge any commissions. There may be a few types of commissions and other charges that a trader might have to pay in Alpari. As a responsible trader, you cannot refuse them and are obligated to pay them all. Therefore, it is always wise to keep track of all the expenses. It will help you ensure that you receive more money in returns and avoid any discrepancy. However, when we compare it with other brokers, Alpari’s fees and commission charges are relatively lower. The starting commission can go as low as 0.4 pips, even on major currencies. Let us now have a look at various commissions at Alpari.

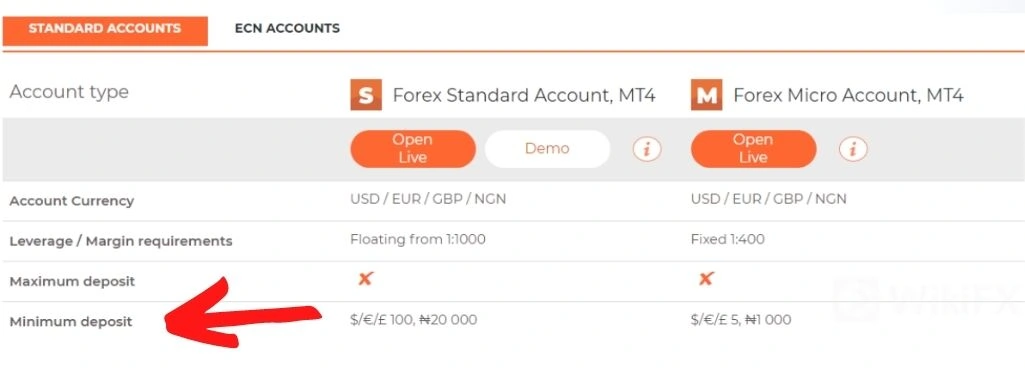

The Alpari fees and commission start at around $5, 50, or 100, fluctuating between the account types. Some accounts may not charge any commission; however, the Spreads are available for the broker range according to the type of account the trader holds. For example, if we take the micro account that functions on MT4, we can see the spread offer with a base rate of 1.7 pips. It is a fair charge per other major forex pairs.

Account Type Pro Account | Standard Account | Micro Account | ECN Account | Pro Account |

Initial Deposit | €/£/$ 100, ₦20000 | $/€/£ 5, ₦1 000 | €/£/$ 500, ₦20 000 | $/€/£ 25 000 |

Spread | 1.2 | 1.7 | 0.4 | 0.4 |

Commission | No | No | 1.5$/lot per side | No |

Leverage | 1:1000 | 1:400 | 1:1000 | 1:300 |

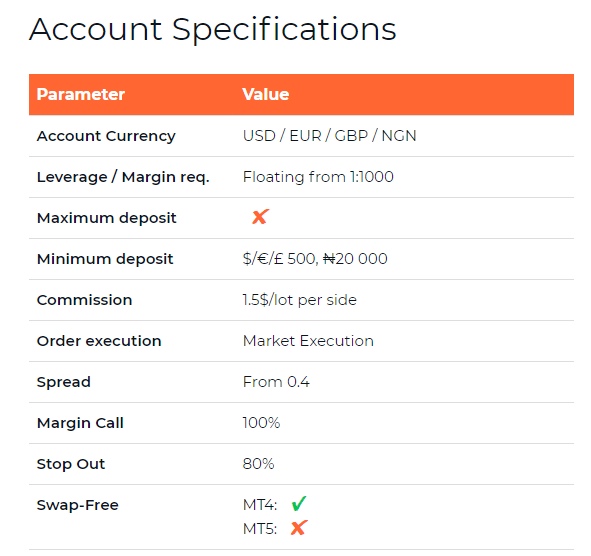

In contrast, you can see the difference in the spread if you choose to go for a standard MT4 account. It will cost you only 1.2 pips which is lower than before. But, if you are a Forex trade assess further they reduce the spread, then the ECN account is ideal. It starts at 0.4 pips, but it is meant for expert traders. We can further see that Alpari offers an ECN Pro account for traders interested in trading individual stocks.

Is Alpari free?

Alpari requires the trader to deposit a minimum amount, as we discussed before. Unless, of course, it’s a demo account. But, there are certain fees payable, so we cannot say that it is free per se. But, the fees payable at Alpari are flexible according to the account types. Moreover, the fees are not as high as other brokers demand you to pay. For example, it does not charge any commission on account types like the Forex Standard or the micro-accounts earlier in the table. But, when the trader opts for a Forex ECN account, a fee of $1.5 is payable per lot per side while executing your trades. Hence, whether Alpari is free primarily depends on the account type. It’s free for some, whereas for others it’s not.

Broker fees

Alpari is a broker that does not charge any deposit fees, although depending on the account, sometimes deposit money may be required by the trader, which a trader can use for trading and does not count as a fee. But it charges an amount in fees for withdrawal. That will depend on the method used while making such a withdrawal request.

Following are some of the fees for several methods:

- Fasapay – 0.5%

- Southeast Asia Online Banking – 1.4%

- Latin American Solutions – Brazil: 3.2% and Mexico: 1% plus an additional 1 EUR.

- Online Banking Malaysia and Indonesia – 2%

- Nganluong (E-Wallet) – 1.1% plus an additional 0.05 USD

- WebMoney – 2%

- Perfectmoney – 0.5%

- Bitcoin – 1%

- Bank Wire Transfer – 30 EUR

Additional fees

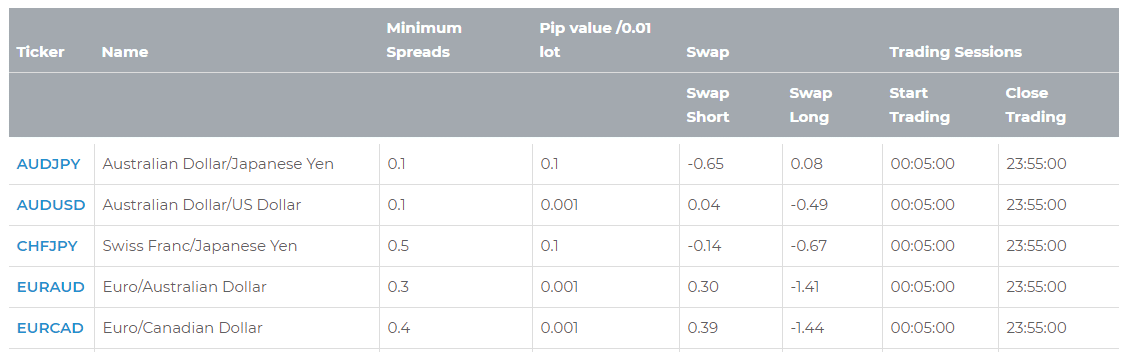

Traders may have to pay overnight or swap fees as it is known otherwise. It is applicable when the traders hold the position for longer than a day.

Transaction methods

Alpari offers the following deposit and withdrawal methods:

- Credit Card

- Cryptocurrencies

- FasaPay

- Neteller

- PerfectMoney

- Skrill

- Webmoney

- Wire Transfer

What is behind the company Alpari?

For a newbie Forex trader, Alpari might be a new name. It is not a requirement to know about Alpari, without which you can also trade. But, every trader must know about the different exchange companies out there. They should know about the market leaders and their fees as well. It gives us the path to move forward.

Alpari is a foreign exchange company that claims to be one of the largest brokers in Forex Trading. It opened its way to the public in 1998, when it began operations as a small provincial dealing center. Since then, it has become a name in the Forex world. It offers various services and platforms to customers looking for a hold in Forex.

The company has seen several hardships over the years from 1998. It was first established in Russia, and then in 2000, it began expanding to various other countries. It has opened and closed several branches and closed many of them, but presently they are licensed to trade in Belarus and Saint Vincent and Grenadines. It previously had branches in the UK and US as well. However, Alpari is currently headquartered in Kingstown, the capital city of Saint Vincent and Grenadines in the Caribbean.

What does a spread signify?

In Forex trading, the spread might confuse many of those just beginning. So, to simplify it, we should know that a forex trader does not focus on making money by charging commissions. Instead, they make money through spreads. The size of spreads can determine the amount they can make, but many factors can influence it. The size of your trade, demand, volatility all come into action while doing so.

Now, let us understand what a spread means. It is nothing but the difference between two prices, rates, or even yields. We can say that there are two price values in the financial context, especially in Forex trading. They are called a Bid and an Ask price, which are nothing fancy but the prices for selling the asset. So, when it is for Forex, it refers to the buying and selling prices of currency pairs.

Now, we can call the difference between such currency pairs a forex spread. But, some trading experts also like to put it in another way. Instead of the difference, they define it as a gap between the bidding and asking prices for a security or asset. That is why it is also called a bid-ask spread in the trading world. The bid-ask spread is one of the commonest definitions for a spread, along with names like bid-offer spread, a buy-sell spread, etc. All in all, they convey the same meaning.

If we want to simplify it further, we can find various other definitions. But, the closest answer would be that it can also refer to the gap in trading positions. That is because the gaps between short and long positions in one future contract or currency have similar meanings as the gaps in selling and buying prices. The whole process is called a spread trade.

A financial institution or a trader may have to associate with various processes. According to such processes, the meanings may change. Let us take the example of underwriting for better clarity. It is a process in which a financial institution takes risks in turn of a fee. An individual can also do the same, and the risks come in loans, insurance investments, etc. So, in the case of underwriting, the spread may mean; differently, it may be the difference between the amount between the insurer and the investor. The amount paid to the insurer and the amount paid by the investor for the security plays the role of buying and selling prices we discussed before.

When we say spread, it usually means the bid-ask spread, and various factors can influence it. First, it can include supply which is the total number of shares available for trading. Next comes the demand, or we can say the interest of the future traders in the stock. Finally, when the above two factors combine with the total trading activity of the stock, the overall spread can get affected.

Forex trading is among those which involve security in the form of currency pairs. Therefore, the bid-offer spread differs for securities like the future options, options, or currency pairs like in Forex. It is the difference between immediate orders and immediate sales prices in such cases. Whereas it is for a stock option, it is simply the difference between the strike price and market value. So, we can say that the meanings may differ depending on the securities, but the function of a spread remains essential.

The spread trade is also known as the relative value trade. It signifies the buying of one security and selling another related security. As discussed before, usually, spread trades are done with options or futures contracts. Wherein a bid-ask spread is particularly useful to measure the market’s liquidity and the size of the transaction cost of the stock.

Spread in forex

We are already aware that in Forex, the exchange of currencies always takes place in pairs. The pairs consist of a base currency and a quote or a counter currency. Let us illustrate the meaning with a simple example. Take, for instance, assuming a pair EUR/USD trading at 1.7835. The currency EUR becomes the base currency, and the USD is the counter currency.

In simpler terms, this condition just tells USD is trading at 1.7835 for 1 EUR. In other words, for a trader, 1 EUR will cost 1.7835 USD to buy. After understanding this, we can move forward with Forex spreads now. We already know that there are always two rates in a spread. There will be a bid and ask price for securities like currency pairs as discussed before. It depends on whether the trader is buying or selling the base currency to pay different rates. While trading in Forex, the bid price is what the broker, like Alpari, offers to buy the base currency. In comparison, the asking price is what they would demand from you while selling it to you.

For example, EUR/USD is the currency pair at a bid price of 1.7835, which is the price for buying, and the broker is willing to sell at an ask price of 1.7833, then we can say it is a spread of 2 pips. A pip is nothing but an acronym for percentage in point. It is the smallest movement in price. Such a change is made by the exchange rate depending on the market convention. In Forex trading, the spread creates the profit for the broker. That happens because when you open a trade, you need to close it at some point. It is then that you pay the spread to the broker.

Is Alpari a good broker?

As mentioned before, Alpari places itself among the top Forex brokers globally. We can say that its services are reliable, because of diverse experience in various countries and the long-standing market. So, to classify it as a good broker, we need to assess further the overall cost that a trader might incur while trading with Alpari. Moreover, it also depends on the Alpari fees and its spreads for Forex traders.

Types of account

By getting a view of the types of accounts in Alpari, we can assess how it offers its services. For example, it offers the following types of accounts to its users.

- Nano Account- It functions on the MT4 platform

- Micro Account-MT4

- Standard Account- Functions on the MT4 platform

- Standard Account- Separate one that functions on the MT5 platform

- ECN Account- Functions on the MT4 platform

- Pro ECN Account- On MT4

- ECN Account- Separately functioning on the MT5 platform

In addition to all these account types, we can find that Alpari also offers Demo accounts. It can be useful to the new traders, as they can use it for practicing their strategies, and it serves as a risk-free trading method. Along with that, Alpari offers an Islamic account of the strict followers of the Islamic teachings. With its help, they can engage in a halal form of trading acceptable by their faith or the Sharia law.

Conclusion

The spreads, and fees of Alpari, give a definite idea of the costs occurring while trading. It tells us the minimum amount to hold while beginning Forex trading. Therefore, it can help the trader reduce unforeseen expenses and keep track of the overall cost. However, we must also conclude that Alpari is one of the few best brokers offering reasonable costs and fees.

FAQ – The most asked questions about cost to trade with Alpari :

What happens if you leave the forex position overnight?

Alpari does not exclude overnight fees; therefore, leaving a forex position overnight will attract an overnight fee. However, as compared to other brokers, it may be small.

How long is the validity of the demo account?

Unlike certain brokers who offer the demo account for a limited period, Alpari offers it indefinitely. The demo accounts do not expire and remain active as long as the trader logs in on the platform every ten days. That means it only requires you to reconnect with the server every ten days to keep the account going.

What are starting Alpari fees?

Alpari’s fees and commissions start at about $5, $50, or $100, depending on the type of account. Depending on the type of account the trader owns, certain accounts may not charge any commissions; however, the spreads are available for the broker’s range. Suppose you think of a macro account on MT4; there will be a spread offer of 1.7 pips on it as a base value. In comparison to other significant forex pairs, it is a reasonable fee.

Are there any Alpari fees charged by the broker from the users?

Alpari is a broker that doesn’t charge any deposit fees, but depending on the account, a trader might occasionally need to make a deposit. This deposit money can be used for trading and doesn’t count as a cost. But there are withdrawal costs that must be paid.

Does Alpari include a fee for the minimum deposit?

Alpari demands that traders deposit a minimum sum while opening a new account. But it’s not for a demo account, of course. We can’t say that it is free in and of itself, though, because some costs are involved. However, Alpari offers a customizable price structure based on the type of account. Additionally, compared to other brokers, these charge less in fees.

See more articles about forex brokers here:

Last Updated on January 27, 2023 by Arkady Müller