ActivTrades minimum deposit: How to deposit money

Table of Contents

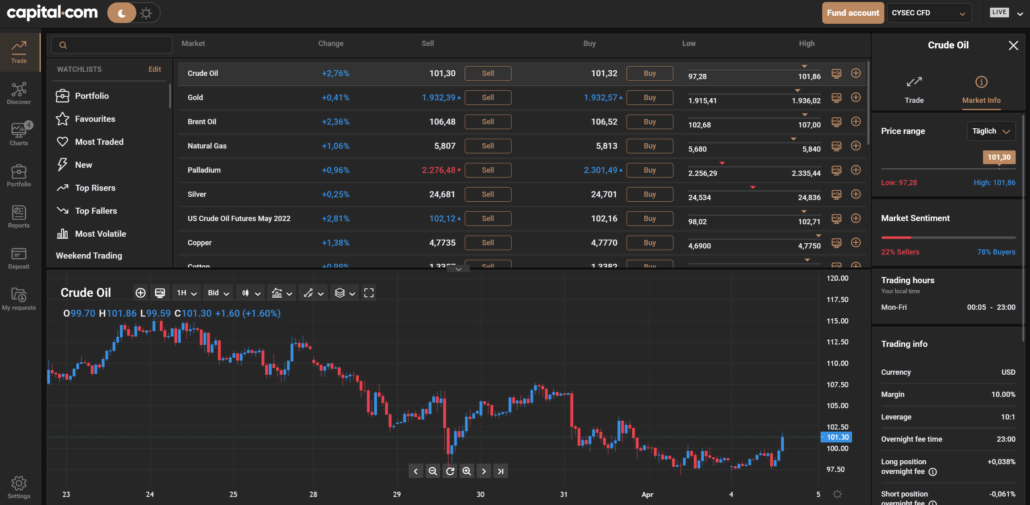

ActivTrades is a financial broker that serves as a trading platform to a majority of EU nations like Germany, France, Portugal, Italy, and some parts of Australia. It specializes in Forex and CFD with spread betting on trading interfaces like MT4 and MT5. This guide is all about a summary of ActivTrades’ minimum deposit and how you can start betting by paying your respective bet. Also, we have highlighted some pros and cons of why ActivTrades is better than its competitors.

Types of account

ActivTrades offer majorly three trading accounts where two of which have negative balance protection. The individual and professional accounts have many features in common, though the prior one also includes risks alerts and leverage warnings.

Individual account with ActivTrades

Individual accounts are a popular account type on ActivTrades. You have to pay a deposit of $1000 to open the account. Once you have an account, you can trade using MT4, MT5, or the broker’s proprietary trading interface. These platforms allow users to trade CFDs on over 500 assets. The account’s spread starts at 0.5 pips and goes up from there. You can use the account as an Islamic trading account if necessary.

Islamic account at ActivTrades

Users who want to trade without having to worry about swaps can use the Islamic account. This account type allows you to start trading with as little as $500. You can only use USD to access the MT4 platform with a swap-free account. All supported base currencies are available on the MT5 platform.

This account does not charge an exchange fee, making Sharia law compatible. A replacement fee will be levied if you hold a job for more than 24 hours. If you’re an Islamic trader interested in learning more, ActivTrades has a wealth of information on the subject.

If you’re looking for ActivTrades alternatives for Islamic accounts, check out our comparison of swap-free Islamic forex brokers.

Professional account with ActivTrades

A professional account is also available from the broker. You must meet two primary conditions to be eligible for this account. To begin, you must have completed at least 10 large-scale transactions per quarter in the previous year. The second condition is a financial instrument portfolio in your trading account or bank worth more than €500,000.

Account Type | Minimum Deposit |

Individual Account | $1000 |

Islamic Account | $500 |

Professional Account | $2000* |

*The client must have a bank worth of more than €500,000.

Another criterion is that you have appropriate financial services industry expertise. If you meet two of the broker’s requirements, you’ll be able to open an account with a $2000 minimum deposit. This account has a high leverage ratio of 400:1 on Forex. It also includes an accessible virtual private server (VPS) and more complex charting capabilities.

Deposit bonus at ActivTrades

ActivTrades does not currently provide any deposit bonuses. They do, however, give referral money if you trade through the broker’s SCB-regulated firm.

If you’re still interested in bonus offers, have a look at our top ten list of forex broker bonuses. Bonuses are not permitted within the European Union.

How is ActivTrades different?

In comparison to other brokers, ActivTrades has a lower minimum deposit.

CFDs are complicated instruments that have a high risk of fast loss owing to leverage. When it comes to CFD trading, 74 and 89 percent of retail accounts lose money. You should think about whether you can afford to risk losing all of your money.

What are the various currency options available on ActivTrades?

The following are the currencies that ActivTrades accepts as deposits.

ActivTrades accepts a wide variety of deposit currencies. These currencies are the same as the broker’s account base currencies. EUR, USD, GBP, and CHF, are all accepted as payment methods. The value of the base currency is vital. A conversion fee is incurred if you deposit a currency that is not the account base currency.

How to make a deposit in the ActivTrades account?

Following these steps will help you deposit funds into your ActivTrades account.

ActivTrades makes it simple to deposit funds. For that, you must first create a platform account. One can open a demo account if you are new to FX trading. A 30-day trial period applies to the demo account. You may get a decent idea of how the site operates using a demo account.

You can apply for a live ActivTrades account once you’ve figured out how the platform works. If you’re already familiar with how the platform works, you may skip the demo. You’ll need to authenticate your account after applying for a live account.

It will include completing a Know Your Customer (KYC) process to verify your identity as a legitimate trader. To complete this process, you’ll need some primary documents to establish your identity and address, such as your passport and a utility bill or bank statement.

Soon after, their team will validate your account, and you will be able to deposit any amount you like. You must, however, stick to the deposit minimums. Wait for your payments to be processed once you deposit the monies, and you will be notified when the funds are received in your account. After that, you can start trading with ActivTrades on a variety of assets.

How to create a demo account on ActivTrades?

To begin with, create an ActivTrades Demo Account.

For inexperienced traders or unfamiliar with a broker, a demo account has various advantages and is usually an excellent place to start.

It allows you to experience what the broker has to offer in a real trading environment while avoiding the danger of losing your money.

Aside from that, by opening a demo account, you are not required to deposit actual money. It’s the ideal setting for practicing and honing your trading skills.

ActivTrades is a top choice for you when it comes to outstanding demo accounts and as a broker in general, even though it isn’t included in our list of the best FX demo accounts.

Funding options at ActivTrades

A large variety of deposit options are available on ActivTrades. Wire transfers, credit cards, debit cards, MasterCard, Visa, Neteller, eWallets, PayPal, Skrill, and SoFort, are the most popular methods for making deposits. With the exception of wire transfers, which might take several days depending on your bank, most deposit options are quick.

But, how do these techniques affect the process of finding a forex trading account? Here’s a quick rundown of what it’s all about.

#1 Wire transfer

The foreign exchange trader goes to the forex broker’s payment page. It is decided to use the “Bank wire” procedure. Some brokers supply bank transfer information so that traders can move funds via an online bank account or a physical bank transfer.

The user should provide all necessary data for the wire transfer (for example, the receiver’s IBAN, SWIFT, address, transaction description, and so on) should be provided by the user.

#2 Deposits using a credit/debit card

The trader is prompted to enter credit/debit card data (credit card number, name on card, expiration date, CVV/CVC) on the appropriate payment form when they arrive at the credit card payment page.

After which, the transaction is processed and either accepted and paid quickly or denied.

ActivTrades’ brokers have attempted to improve the process’ security by allowing traders to save their credit card information so that it does not have to be entered on the payment form each time.

#3 E-wallets

For currency transactions, there are numerous digital wallets accessible. While some, like Skrill and Neteller, cater to a global audience, others, like Moneta and WebMoney, are more focused on a single country.

Typically, the trader will be referred to their digital wallet. They must log in and finish the transaction in order for funds to be settled into the forex account immediately. In order for transactions to be completed, each digital wallet has its authentication mechanism.

What factors affect the decision to deposit in a Forex account?

When it comes to depositing methods, there are FX traders that are spoiled for choice. Others may have limitations in terms of the possibilities available to them. In general, the decision to use a forex deposit method is influenced by a number of criteria, like:

- What is the total amount of money that has been deposited?

- Originating country

- Issues of Security

- Refunds and chargebacks are two terms that are used interchangeably in the industry.

- Acceptability

- Legality

Laws passed by several governments exercise monetary control. When it comes to determining how much money may be placed into a forex account, country laws and forex broker authorities will define how much money can be moved to a trading account for each deposit type.

For example, credit card deposits have a limit on how much a deposit forex account can accept. The amount of money that can be wired in some countries is limited. Investors who want to deposit Forex with their brokers must abide by the legislation of their respective nations. This will significantly impact the amount of money that traders can deposit with their brokers via a specific deposit method.

#1 Originating country

Some may wonder why any country of origin has anything to do with how one funds their FX account. The answer is quite a few things. Not every country has unrestricted access to international financial markets.

Some countries, such as North Korea, are subject to international sanctions. In contrast, others are renowned hotbeds for terrorism and drug trafficking and hence are barred from using payment systems where it may be challenging to track who owns the money on a continual basis.

As a result, some traders may discover that they can only use one or two payment systems with their deposit forex accounts. Many traders are limited to utilizing only bank wires, which is significant. These dealers are forced to make do with what they have.

#2 Issues with security

Specific payment methods are more secure than others. The usage of bank wires, for example, guarantees that funds are routed through bank accounts with adequate KYC documents, and the names of persons running the accounts are known.

As a result, several forex brokers require traders from specific countries to deposit using only bank wires. Then there’s the question of security. Credit card accounts and digital wallets are much more vulnerable to hacking. Theft or loss of a credit card is possible. It can be copied if it gets into the wrong hands, and highly horrible things can happen if that happens.

That’s why some traders will avoid using them altogether. A digital wallet or bank account, on the other hand, cannot be stolen physically. Traders in conservative countries, where the adoption of new technology and ways of doing things is delayed, are more likely to use conventional payment methods, such as bank wires, to deposit funds into their forex accounts.

#3 Refunds and chargebacks

For traders who live in places where credit cards are widely used, refunds and chargebacks are becoming increasingly important. It will be easier to obtain a chargeback and reimbursement for unlawful transactions if a trader deposits funds into a forex account with a credit card.

#4 Acceptability

In order for a payment method to be globally recognized, it must be accepted by a diverse group of traders and brokers.

#5 Legality

The manner of payment must be lawful. The practice of implementing a Know Your Customer (KYC) method to identify all users of a payment system has become a global standard. Unfortunately, there was a time when both forex brokers and traders used illicit payment methods to launder money. One such approach that springs to mind is Liberty Reserve.

Fees for deposits with ActivTrades

Except in two situations, all deposits are accessible on the platform. The bank may charge you a fee if you send money via wire transfer. You might also have to pay a conversion fee if you’re using a non-matching base currency. If you’re an EU resident depositing funds from outside the EU, you’ll have to pay a fee as well. You will be charged a 1.5 percent fee in this situation.

Steps to make a minimum deposit on ActivTrades platform

The steps for sending the minimal deposit are as follows:

The method of making your minimum deposit to ActivTrades may differ slightly from the instructions below, but in general, the steps are as follows:

Step #1 Create a brokerage account

You may open a trading account with most brokers online. To set up an account, you must supply personal information such as your date of birth or job status, as well as take a financial awareness test. The verification of your identification and residency is the final stage in the account opening process. A copy of your ID card and a document that verifies your evidence of residence, such as a bank statement, is generally required for this verification.

Use our broker picker tool if you’re not sure which broker is right for you.

Step #2 Place a deposit

To begin, log in to your already established trading account and locate the depositing interface. Then, pick one of the methods of deposit of your choice, input the amount and make the transaction.

Following are the methods and how you cany carry out the process:

- Bank transfer (also known as wire transfer)

On the deposit interface, you must enter your bank account number. Make sure the bank account of your choice is in your name. Following that, make a bank transfer from your account. Then, after a while, the broker will provide you with a reference number which you need to add in the transaction comment. Only then, your deposit will be considered.

- Credit or debit cards

You must input the same card information as you would for a typical online purchase. Unlike any other online transaction, however, you must use a credit card registered to your name. You have to scan and send your card to the broker in some situations, such as with IC Markets.

This is just another action taken by them to combat money laundering. The most common and convenient method of deposit is with a credit card. Some brokers, on the other hand, set a limit on card deposits, so you may need to use a bank transfer if you need to deposit a more significant amount.

- Online wallets such as Paypal, Skrill, Neteller, and others

Operates in the same way as any other online transaction. The wallet’s interface will appear, prompting you to input your credentials (username and password), as well as complete your transaction.

Step #3 Go over your transaction again

It may take a few days for your deposit to appear on your brokerage account, based on the mode you used. When this occurs, the brokers will generally drop an email to verify the deposit’s receipt.

Pros and cons of ActivTrades minimum deposit

Pros

- The broker supports a large variety of deposit methods

- Most supported deposit types have no deposit charge

- The platform allows for the opening of demo accounts for 72 hours without requiring registration

- There is no inactivity fee which is great for casual traders.

- Trading expenses are meager across the broker offering

Cons

- There are only a few deposit currencies permitted;

- The minimum deposit amount is relatively high compared to all other firms.

- The demo account has a 30-day expiry date.

Conclusion

Finally, it can be concluded that the deposit method you choose for your forex account has an impact on your trading style and results. It is feasible to deposit forex capital on Monday, trade from Tuesday through Thursday, and receive profits on Friday, and there are deposit methods that facilitate this trade pattern. Other traders, on the other hand, are restricted in the payment mechanisms they can employ.

That’s why, if you want to try trading in other markets, Activtrades provides that option too to their clients. You can choose from stocks, commodities, ETFs and what not. The platform focuses on giving a fair-trading experience to their clients by providing 500-600 assets to choose from. In this way, you can fetch desirable benefit from a set amount of money.

This raises the question of whether deposit bonus forex brokers and Forex no deposit bonus brokerage can reach out to users who live in areas of the world where current payment methods are underserved.

FAQ – The most asked questions about ActivTrades minimum deposit :

How can I trade by funding with the ActivTrades minimum deposit?

You can trade on ActivTrades by signing up for a trading account. If you want to test out this trading platform, you may start with a demo account. Otherwise, you can click on sign up for a live account.’ to trade using real funds. Of course, to do that, you would need to fund your trading account with the ActivTrades minimum deposit.

What’s the ActivTrades minimum deposit for the bank transfer?

Traders have to pay a fixed amount of money on ActivTrades. The ActivTrades minimum deposit amount you must pay to the bank wife is $500. Following that, you must go through a process. First, go to the firm’s ActivTrades own web page. Then navigate to your panel and choose “deposit.” Then, select a deposit method and transfer money to your trading account. You can use any deposit/withdrawal method.

Is ActivTrades minimum deposit affordable?

Yes, ActivTrade’s minimum deposit amount is affordable for most traders. They can enjoy trading by funding their trading accounts with the minimum possible amount. Thus, ActivTrades is the most suitable online trading platform for most traders. Also, it offers reliable services.

See more articles about forex trading here:

Last Updated on January 27, 2023 by Arkady Müller