How much does it cost to trade with Markets.com? – Spreads & fees explained

Table of Contents

We must continuously look for ways to earn a better living. One of the prime needs that we need to fulfill for a better living standard is an improved financial status. Our wealth in assets and currencies both together determine how financially sound we are. So we must always look forward to multiplying them. People often find themselves misguided and desperate in this regard. So, they end up choosing the wrong path to get rich. That brings them to the point of more suffering instead.

We cannot find a better way to increase your wealth than trading. It is a fact that is getting attention nowadays with the increasing use of digital technology. More people are showing keen interest in joining the trading world; moreover, if there is a popular way to trade presently, online trading.

You can find various platforms offered by the brokers with multiple features and different account types. You can avoid physically going to the market exchanges and executing the trades with a few clicks through online trading.

The brokers understand its potential; that is why they come as mediators. They let you use their platforms and features and charge an amount for the same. For a beginner trader, the need for a broker is essential to start the trades as they fulfill all the trading needs.

However, we can also see that many of them get hesitant after thinking that it may be costly. It is not a completely wrong notion, as beginner traders often ignore the broker’s fees and end up losing more funds than their budget.

Therefore, it is needless to say that before beginning to trade, we must assess the spreads and fees for the particular broker. After going through the schemes, choosing the one with the least additional costs is always advisable.

When it is about choosing a trustworthy broker to commence your trading expedition, Markets.com can be the ideal choice.

It may be a new name for beginners, but those in the CFD, Forex, or Stock trading business can’t forget it. Markets.com commenced its services in the trading domain in 2008. Since then, it has been a consistent broker that has offered relentless trading and investments in financial markets worldwide. You can select from more than 8,000 assets, making it an advanced multi-asset platform.

You can also utilize Markets.com to trade over 2,200 instruments, which gives you remarkable control over your trading methods. With Markets.com, you can get a VIP service that treats you like an exclusive customer. Moreover, it provides help and support whenever you need them.

Markets.com draws its roots from Finalto Limited, a constituent of Playtech. Moreover, it is also an FTSE 250 listed company that understands the scale and has the resources to raise the bar for the clients in trading.

We can safely say that it is one of the international giants in CFD, Forex, and even Stocks brokerages. Its contribution to the industry has also been listed on Finance Magnates and Forex Live.

Moreover, it holds the title of the best platform in 2020, making it a certified contender in the trading world. It is also a safe broker, and the traders can entrust their funds, as several financial authorities regulate it, such as CySEC, FCA, etc.

Markets.com traders can also benefit from the services and platforms under its indigenous brands: The MarketsI and MarketsX platform. These two platforms help you trade better and in a sorted fashion as the former focuses on share-dealing and investing, while the latter is used for CFD trading.

Understandably, before using the features of Markets.com, you must sign up for your trading account. It is an untroubled process that you can easily execute on its website. After that, you can add the funds by selecting the payment methods and then use them in trading, with the easy steps.

Depositing and withdrawing are effortless processes that you can undertake as you wish. Since it does not charge any additional fees, you can withdraw any amount from your trading account once you select a payment method.

However, the minimum amount that a trader must deposit is set at $20, and the minimum withdrawal depends on the methods. Though it does not charge any withdrawal or deposit fees, there are spreads and costs that a trader has to pay while trading.

Therefore, as we mentioned before, we must look into the conditions for the spreads and fees before choosing Markets.com. So, let us understand the basic terms first and then understand how much it will cost to trade with Markets.com.

What do spread and fees signify?

A spread denotes the difference between two prices. Bid-ask spreads are the most common type of spread. Spreads are usually measured in PIPs or percentages in points for Forex. Traders should always note the spread rate before trading, as a spread can be fixed or floating.

On the other hand, fees are what the customers pay the platform in exchange for their services. Though most platforms make their money using spreads, some through fees. Fees are fixed charges and are rarely changed.

Markets.com is a trading platform with one of the lowest spreads and fees. Markets.com offers a floating spread. It means that depending on factors such as the current volatility of markets or the availability of funds, the spread can vary throughout the day.

The platform also tries to maintain a narrow spread. Though, certain assets are too volatile, which causes their spreads to be wide. They also recommend that the customers look at the spread rate before placing a trade. The platform mainly uses bid-ask spreads.

Markets.com is ideal for both beginner traders as well as experienced ones. It doesn’t have any hidden or unnecessary fees. They don’t charge the customers for adding funds to their trading account. The platform even reimburses the transaction charges incurred by the customers if they deposit upwards of $2500.

However, they do charge a fee for inactive accounts. Accounts that have not placed any trades in 90 days or more are categorized as inactive. These accounts are charged $10 monthly for their maintenance. They will be deducted from the balance remaining in the account. If there is no balance, there will be no deductions.

Knowing spread rates can help traders set the proper stop loss/take profit orders. It will help minimize loss and maximize profit. And as always, it is recommended to research before placing trades. So, knowing more about the trades will help place the right trades.

It is also crucial for you to research the trading platform. Many trading platforms have ridiculously high spread rates. Some platforms also incorporate hidden charges in providing essential services. These charges may seem minuscule at first glance. But they can add up over time.

Markets.com spreads

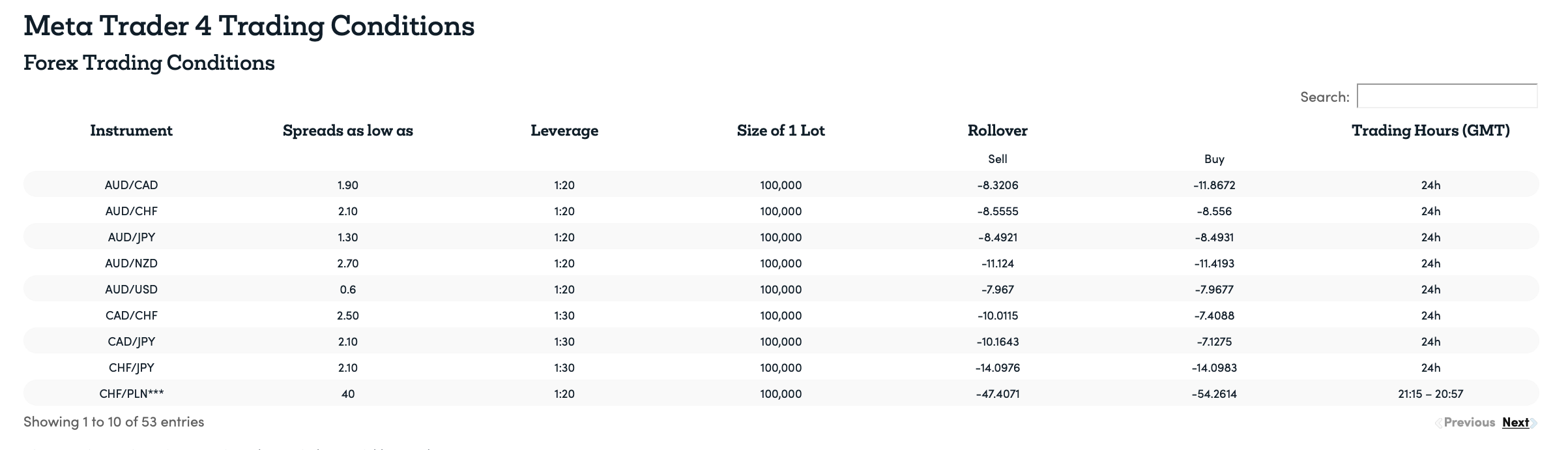

It has a Spread structure that varies according to the trader’s platform. Moreover, the Spreads differ according to the assets as well. So, let us get an overview of Markets.com Spreads with the following tables.

For MT4 Trading: Forex Spread

Instrument | Spread | Leverage |

AUD/CAD | 1.90 | 1:20 |

AUD/CHF | 2.10 | 1:20 |

AUD/JPY | 1.30 | 1:20 |

AUD/NZD | 2.70 | 1:20 |

AUD/USD | 0.6 | 1:20 |

CAD/CHF | 2.50 | 1:30 |

CAD/JPY | 2.10 | 1:30 |

CHF/JPY | 2.10 | 1:30 |

Crypto Spread

Instrument | Spread | Leverage |

Litecoin | 1.5 USD | 1:2 |

Ethereum | 5 USD | 1:2 |

RIPPLE | 0.01 USD | 1:2 |

Dash | 16 USD | 1:2 |

BTCFutures | 50 USD | 1:2 |

Commodities Spread

Instrument | Spread (pips) | Leverage |

Brent Oil | 0.04 (USD) | 1:10 |

Cocoa | 10 (USD) | 1:10 |

Coffee C | 0.65 (USD) | 1:10 |

Copper | 0.0060 (USD) | 1:10 |

Gold | 0.5 (USD) | 1:20 |

Natural gas | 0.006 (USD) | 1:10 |

Oil | 0.04 (USD) | 1:10 |

For MT5 Trading: Forex Spread

Instrument | Spread (pips) | Leverage |

AUD/CAD | 1.90 | 1:20 |

AUD/CHF | 2.10 | 1:20 |

AUD/JPY | 1.30 | 1:20 |

AUD/NZD | 2.70 | 1:20 |

AUD/USD | 0.60 | 1:20 |

CAD/CHF | 2.50 | 1:30 |

CAD/JPY | 2.10 | 1:30 |

Crypto Spread

Instrument | Spread | Leverage |

Litecoin | 1.5 | 1:2 |

Ethereum | 5 | 1:2 |

Dash | 5 | 1:2 |

RIPPLE | 0.01 | 1:2 |

BCHUSD | 10 | 1:2 |

Commodities Spread

Instrument | Spreads (as low as) | Leverage |

Brent Oil – UK Cash (UKOil) | 0.04 USD | 1:10 |

Cocoa | 10 USD | 1:10 |

Coffee C | 0.65 USD | 1:10 |

Copper | 0.006 USD | 1:10 |

Gold | 0.50 USD | 1:20 |

Natural Gas US Cash | 0.006 USD | 1:10 |

Palladium | 4.5 USD | 1:10 |

Fees that can occur when you trade with Markets.com

- Deposit Fees

- Withdrawal Fees

- Overnight Fees

- Currency Conversion Fees

- Inactivity Fees

Deposit fees

Deposit fees are the non-trading fees applicable when the trader transfers money to the trading account from the bank account. It is not a common fee that a broker would charge for depositing your own money. So, Markets.com also refrains from charging deposit fees to its customers.

When you trade with Markets.com, you can see the same amount of funds in the trading account you transferred through the bank account or vice versa if you requested for withdrawal. However, there is a requirement for a minimum deposit amount, which is relatively cheap and starts at just $5.

Withdrawal fees

A withdrawal fee incurs while you withdraw your profits or funds from the trading account. It is an additional amount that various Forex and other brokers charge as non-trading fees.

However, you would not find Markets.com charging fees for withdrawing your profits. It offers a free-of-cost withdrawal process that lets you receive the same amount you request.

Overnight fees

Overnight fees are also known as rollover swap fees. It is a type of trading fee that many brokers charge. An overnight fee arises when you hold the same trading position longer than the permissible limit.

So, it is charged when a trader fails to close the position within the given time limit, which is 22:00 GMT at Markets.com, and holds the same position overnight.

Many brokers often levy high amounts as their overnights fees. However, Markets.com charges an overnight fee that varies according to the asset type. It is also linked to low-interest rates and an extra financing charge that it defines, unlike its counterparts.

Currency conversion fees

A currency conversion fees occur when you want to conduct a transaction other than the default one. Markets.com also levies currency conversion fees from its customers. However, it only applies when the trader has an account currency different from the quoted currency.

Therefore, the varied quoted currency underlies the asset you trade determines whether you must pay the currency conversion fees. Moreover, the fee will be shown as a percentage of the conversion rate it uses, set at 0.6% for CFDs and 0.5% for shares.

Markets.com also states that it affects any conversions made on used margin, profit, loss, overnight rollover, etc

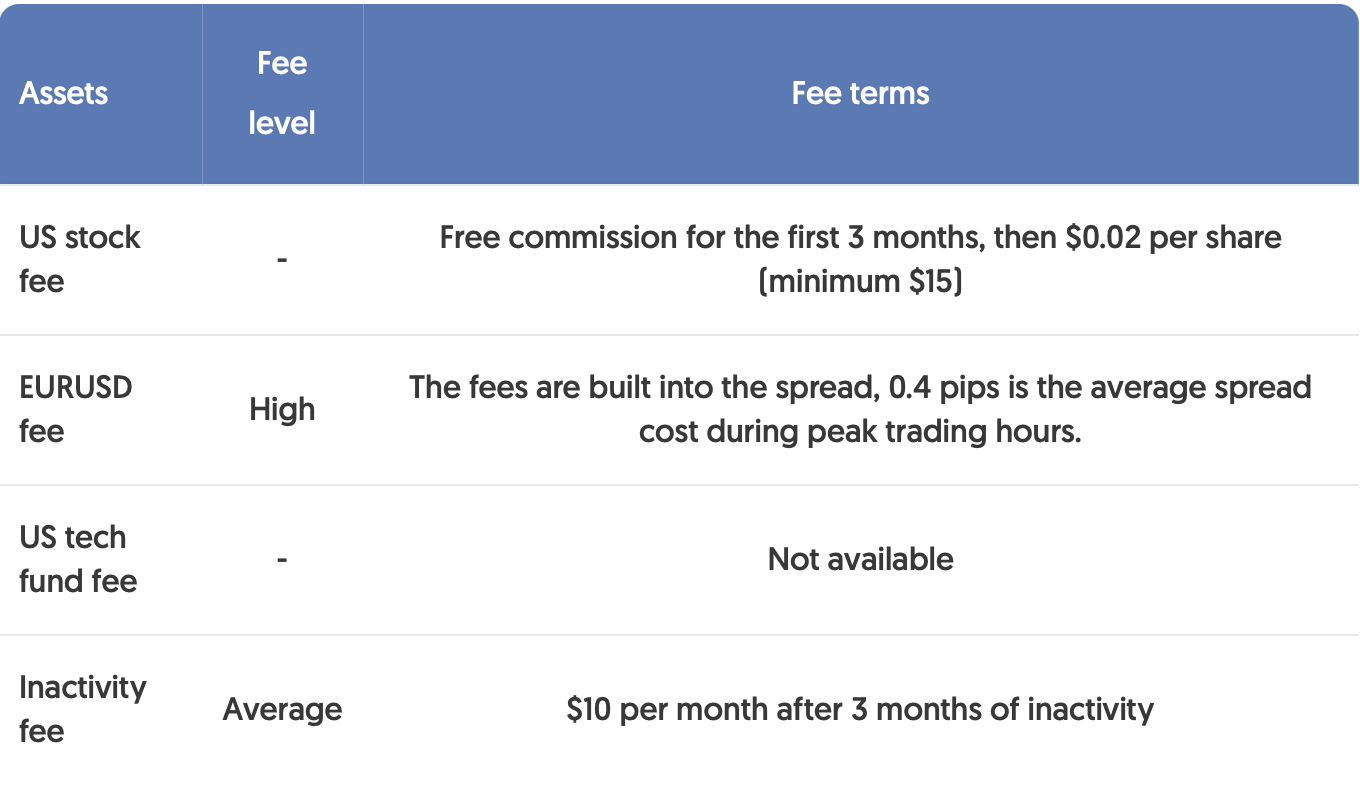

Inactivity fees

When you create an account with any broker, you also hold the responsibility to use it without keeping it inactive for long. An inactivity fee is levied by various brokers when it is not in active use for a long time.

Some brokers let you have an inactive period of 21 days or more in rare cases. At the same time, some others do not charge any such fees from their customers.

But, if you have a trading account with Markets.com, inactivity fees of $10 per month are applicable. It occurs when you have not placed a trade or opened or closed positions.

It is also applicable when you have not made any deposit into your account. The duration for the fees is 90 days, which is longer than most other brokers. Markets.com charges this fee for the maintenance, administration, and compliance management of the inactive accounts.

Cost for CFD trades

When you trade with Markets.com, you can find that it offers a fee structure that is different for CFD trades and share dealings. We can infer that Markets.com charges mainly two types of costs for CFDs.

Firstly, the trader has to pay the spread that varies according to the assets. Next, overnight fees may arise if she fails to close the position at the required time limit. However, we can also see that for trades in future contracts that carry an expiration, it may also levy expiry rollover fees. It is usually applicable to commodities and cash indices.

Cost for share dealing

When the trader wishes to trade in shares, she has to pay

- The market spread of the shares can go as low as 0.0036.

- Commissions start after the first three months, as it charges 0 initially. The commission differs according to the location.

For US Shares-2c (Min $15)

For UK Shares-0.1%(Min £8)

For EU Shares-0.1%(Min €10)

- A custody fee of 0.12% per annum with a minimum of 10GBP per month shall also be levied

- It shall charge a Conversion fee of 0.50% in the case of shares.

- Lastly, taxes will be applied wherever it is appropriate according to their policy.

Conclusion

Without any doubt, Markets.com is one of the top brokers in the Forex and CFD world. It also offers online trading in other assets like stocks, commodities, etc. Moreover, it has grabbed the title of the best broker in 2020 for its remarkable services.

But, when we start looking for a reliable broker, we must assess it based on its fees and spreads. An ideal broker must not charge unnecessary fees and commissions from its customers.

Markets.com outperforms all other brokers by providing an affordable fee and spread structure. Though it varies according to a trader’s assets, the expenses are relatively low. So we can conclude that it is an ideal choice that provides affordable trading for any trader irrespective of the expertise.

FAQ – The most asked questions about cost to trade with Markets.com :

#1 Does Markets.com charge commission?

Markets.com does not charge any commission for CFD traders. So, all they have to pay is the spread according to the asset type and the overnight fees, if applicable. But, if you trade in shares, then Markets.com charges a commission.

However, a trader must note that the first three months of share dealings are commission-free. But, after that, the trader has to pay the commission according to the location of the shares, which can range from 0.1% to 2c.

#2 Is Markets.com free?

We cannot say that Markets.com is free. Though it offers many services without any cost, it still charges through its spreads and other fees. The spreads depend on the asset types, whereas the fees vary for CFD trading and share dealings.

However, it does not charge any deposit fees or withdrawal fees. Also, it is free from commission for CFD trades. So, it depends mostly on the trading mode and the assets you wish to trade.

#3 What is the inactivity fee for multiple trading accounts?

The inactivity fees for Markets.com are set at a nominal amount of $10 per month. It applies when there is no trades or deposit into the account. Also, the duration extends to 90 days.

However, you may have multiple trading accounts with Markets.com. So, if all the accounts are not in active use, then it charges the inactivity fees separately for all the accounts.

But, if you have multiple accounts and even one of them is in use, there would be no inactivity fees. It extends to the other inactive accounts as well. So, you can avoid the fees altogether by at least using one account.

Can I get access to Markets.com without paying Markets.com fees?

No, this trading platform is not free. Although you can benefit from several features out of cost, you must pay Markets.com fees for spreads and other charges. Moreover, you won’t be asked to pay any deposit or withdrawal fees. Also, there are no charges for CFD trades. Thus, it is mainly subject to the trading mode and the assets you wish to trade.

What are the Markets.com fees for share dealing?

If a trader wants to trade in shares, they have to pay a few charges. You have to pay Markets.com fees and commission charges, which vary according to location.

For UK Shares-0.1%(Min £8)

For US Shares-2c (Min $15)

For EU Shares-0.1%(Min €10)

In addition, there is a conversion fee of 0.50% and a custody fee of 0.12%. So, at last, you might have to pay a few taxes.

Can a trader avoid Markets.com fees?

No, a trader cannot avoid Markets.com fees. They will have to pay the broker’s fees for extending its amazing trading platform to traders. However, Markets.com charge very nominal fees from traders.

See more articles about forex trading:

Last Updated on January 27, 2023 by Arkady Müller