How to buy Litecoin – Trading tutorial for beginners

Table of Contents

Litecoin (LTC) is frequently regarded as digital silver, whilst bitcoin is referred to as digital gold. They are similar to silver and gold, the most volatile of the two precious metals, and this makes Litecoin an interesting perspective for traders. Like bitcoin, Litecoin is a rare asset that can serve as a store of value or medium of exchange for crypto transactions. Those who invested in Litecoin initially earned fortunes as first-time adopters, but over the years, the highly volatile crypto coin has struggled with investment, and it has become a more suitable asset for trading. Litecoin’s traders have consistently made more money on the crypto market over the past two years.

However, trading LTC with other cryptocurrencies like USD and BTC is not easy and requires a bit of skill, training, and patience. With the help of this guide, you will learn how to start trading Litecoin and equally learn profitable Litecoin trading techniques.

To start speculating on fluctuations of Litecoin’s price, follow the 4 steps below:

- Decide how you want to trade Litecoin

- Discover how trading Litecoin works

- Investigate the factors affecting the price

- Open your first trade

What makes litcoin valuable for traders?

Charlie Lee founded Litecoin (LTC) in 2011 as Bitcoin-based crypto. Litecoin is a cryptocurrency that allows for instant p2p transfers at rather low prices. It is one of the five most popular crypto coins in terms of market capitalization.

Instead of competing with Bitcoin, Litecoin was designed to be a complementary cryptocurrency. Compared to bitcoin gold, it is also known as silver. This is due to the fact that Litecoin is built to be quicker, cheaper, and capable of handling more transactions, and the relative security loss caused by shorter blockchains is compensated by the low transaction costs.

Because of its minimal cost, Litecoin is mostly suitable for speedier transactions, whereas Bitcoin is more appropriate for safe high-value transactions that do not require quick swap. That is why they are complementary to one another.

Trade more than 100 different cryptocurrencies CFDs on professional platforms:

(Risk warning: 75% of retail CFD accounts lose money)

What is Litecoin?

Litecoin (LTC) is a cryptocurrency designed to provide faster and cheaper payments compared to Bitcoin at a relatively low cost. It is meant to complement Bitcoin. Cryptocurrencies can be divided into A service token that provides access to services provided by a specific project, a security token indicating underlying assets, or a means of payment like bitcoin.

What characterizes a cryptocurrency?

Cryptocurrency is a digital asset intended to be used as a swap tool to use blockchain to secure transactions, manage the delivery of additional devices, and verify transactions. Simply put, a cryptocurrency is decentralized electronic money. Cryptocurrencies are stored in “wallets” that can take many forms. Litecoin, for example, can be stored in an online wallet or offline e-wallet, and it can also be physically stored in hardware.

Litecoin price overview

Charlie Lee, who was hired by Google at the time, launched Litecoin in October 2011, which aims for a faster cryptocurrency with lower transaction costs designed to allow trading at a relatively low cost. In November 2013, Litecoin’s value increased dramatically, with a 100% increase in value in 24 hours. By the end of that month, Litecoin has reached a market cap of $1 billion. In December 2017, Lee announced that he had sold almost all Litecoin assets on charges of a conflict of interest. He was accused of tweeting while holding Litecoin, for trying to take personal advantage because it could affect the price of Litecoin.

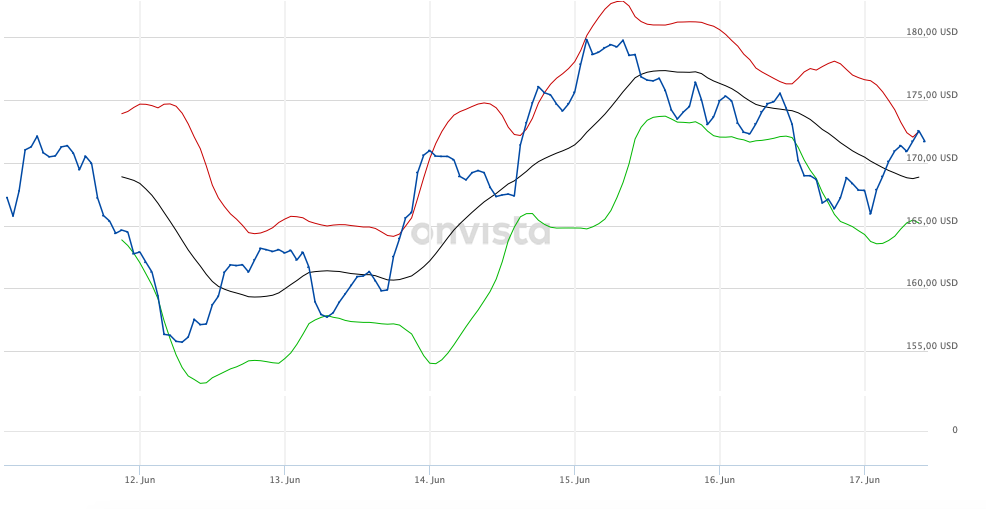

Take a look at the Litecoin price:

Here are a few facts you need to know before starting to trade with Litecoin:

- Number of Litecoins in circulation: Many people believe that Litecoin’s circularity is the main reason for its lower price than Bitcoin. Despite being launched two years later, there are far more Litecoins on the market and shipping remains the same with fast transactions.

- Litecoin’s news and announcements: Negative headlines for Litecoin, or negative headlines for cryptocurrencies in general, will have a huge impact on the price. Since LTC’s value is entirely dependent on public opinion, it makes us more reliant on favorable news.

- Real-world acceptance: People can argue that Litecoin has many advantages over bitcoin as a payment solution, but until approved by companies around the world, this will be unfounded. Therefore, large corporations operating cryptocurrencies may experience a spike in prices.

- LTC market cap: While you can advertise in a new currency, investors who buy and hold Litecoin are the main reason for the increase in value. And these investors will pay attention to the market value when deciding to buy or sell more.

- Bitcoin price: It may not be Charles Lee’s intention, but one of the reasons Litecoin is such a currency is the value it shares with its eminent cousin. Where it cracks, silver often follows. Bitcoin often follows Litecoin.

Trade more than 100 different cryptocurrencies CFDs on professional platforms:

(Risk warning: 75% of retail CFD accounts lose money)

How does Litecoin work?

Litecoin is one of the first cryptocurrencies developed under the Bitcoin infrastructure. It is considered one of the most trusted blockchain networks because it almost mimics bitcoin and is regularly used as testbed for the new level 2 bitcoin codes. Litecoin differs from Bitcoin in several important ways. First, for Bitcoin, the average block is managed and added to the blockchain much faster compared to 10 minutes. This should speed up the transaction and reduce the cost of LTC transfers.

Also, the number of characters that can be broken is limited to 84 million. This, along with trading times four times faster than Bitcoin, some people, including Litecoin founder Charles Lee, argue that LTC could be a better payment solution than Bitcoin. Finally, Litecoin is based on the script of SHA-256 BTC, a different algorithm than Bitcoin. Unlike fiat currency, which can be printed arbitrarily, Litecoin has strict restrictions. Compared to 21 million bitcoins, the LTC is only 84 million. Litecoin also has a similar economy and the same block reward halving mechanism that occurs about every 4 years. For those who use Litecoin instead of Holding, it is much faster to transfer compared to Bitcoin.

Since Litecoin’s price is small compared to its larger offering compared to Big Brother Bitcoin, it is easier to swallow Litecoin for new investors who want to invest in cryptocurrency, own a lot of money, and want to be BTC. This is the cheapest currency listing asset that PayPal will support in the future, so it could help Litecoin in the next bull market.

LTC trading continues

Litecoin has been in the cryptocurrency market for a long time and has been one of the best altcoins in terms of market value. Due to the digital money era, Litecoin storage has long proven to be profitable. However, with the cryptocurrency market dominated by the bear market in recent years, Litecoin trading has proven to be more profitable.

To become a Litecoin trader rather than an investor, you need to develop a strategy to buy and sell Litecoin for higher and lower prices, take advantage of the fluctuations between them, or bet on whether the price will rise or fall. Regardless of a market analysis or price dynamics, investors who bought LTC at the end of 2017 continued to hold Litecoin and its value dropped by more than 90%.

Meanwhile, Litecoin traders have been able to make money from the strong price movements that have taken place in the Litecoin market over the past two years.

Litecoin trading

There are two options for you to trade Litecoin on the crypto market. First, you must own Litecoin as you can buy real cryptos on an exchange. For instance, one of the exchanges where you can buy Litecoin is Bitfinex. It is regarded as a long-term investment if you buy and hold and wait for the price to rise significantly so that you can your crypto on the crypto exchange.

You can also trade CFD contracts with particular crypto coins and guess the price difference. CFDs are financial instruments, usually a contract between a broker and an investor, where one party agrees to pay the other the difference in the value of the guarantee between the initiation and termination of the transaction. You can get a long position (as long as the price goes up) or a short position (as long as the price goes down). This is considered a short-term investment because CFDs are deployed in a shorter period. For example, if you want to trade Litecoin CFDs, you can guess the LTC/USD pair.

There is a fundamental difference between buying cryptos and trading CFDs in the crypto market. When you buy a coin, it is stored in your wallet, but when you trade CFDs, the goods are stored in an account regulated by the monetary authorities. It’s more fluid when buying CFDs because it’s not tied to an asset, and you just bought the underlying contract. Additionally, CFDs are more established and regulated financial instruments.

So, to trade Litcoin CFDs, open a contract that agrees to the alteration in the LTC price difference from the moment you open the trade to the moment it closes. When you “buy” a CFD, you accept any uptrend in the price as a profit, but you have to pay for the downtrend as a loss. If you “sell”, the vice versa is also true.

What a good Litecoin CFD platform has to offer:

Trade cryptocurrencies CFDs with the best conditions and a regulated broker:

Crypto Broker: | Review: | Advantages: | account: |

|---|---|---|---|

1. Capital.com  | # More than 200 crypto CFD assets # No commissions # Best platform for beginners # No hidden fees # More than 3,000 markets | Live account from $ 20: (Risk warning: 75% of retail CFD accounts lose money) | |

2. Libertex  | # More than 50 crypto CFD assets # Trade with leverage 1:2 # Userfriendly # Fiat deposits & withdrawals # PayPal | Live account from $ 100: (Risk warning: 74.91% of retail investor accounts lose money when trading CFDs with this provider.) |

High-tech fundamental analysis with artificial intelligence

Newsfeeds analysis feature can offer personalized and unique trade-related news content based on your preferences. When a trader makes a biased decision, the innovative news feed offers multiple sources to get him or her back on track. Neural Network improves your investment strategy by analyzing app behavior and recommending videos, articles, and news.

Marginal trading:

By offering margin trading (up to 2:1 for cryptocurrency), traders can access the cryptocurrency market with CFDs.

The CFD trading offer

When trading Litecoin CFDs, you are not buying the underlying assets directly. In other words, you are not bound by it. I wonder if the price of Litecoin will go up or down. CFD trading is no different from traditional trading strategies. CFD investors can open short or long positions, place stop orders, limit losses, and adapt trading scenarios to fit their goals.

Comprehensive Transaction Analysis

The browser-based platform allows traders to compile their own market analysis and forecasts using numerous technical indicators. A good Litecoin trading platform offers real-time market updates and a variety of chart formats available for desktop, iOS, and Android.

Focus on safety

The platform should pay special attention to security. It needs to be licensed by organizations like FCA and CySEC, this product complies with all rules and ensures that customer data is provided first. The company allows 24/7 withdrawals and keeps the seller’s funds in a separate bank account.

Litecoin trading methods and methods suitable for your trading needs

There are two main ways to trade Litecoin and other cryptocurrencies: on crypto exchanges that offer to trade, you can buy and sell underlying assets. Alternatively, you can buy derivatives and engage in CFD trading that allows traders to enter into short and long-term contracts.

On crypto exchanges, you can buy cheap and sell for profit, but short and long positions on the trading platform can earn much more if you look for opportunities in both directions with careful market analysis.

Litecoin trading, how to get started

Litecoin trading offers more options than simply investing or trading, but some don’t know where to start. Here is a Litecoin tutorial that will help you get started with your first LTC trading from start to finish.

Trade more than 100 different cryptocurrencies CFDs on professional platforms:

(Risk warning: 75% of retail CFD accounts lose money)

Account registration

Locating a trading platform that offers Litecoin along with other assets like Forex, Commodities, Stock Indices, etc. in a single platform is not easy to find. However, the info we have provided in this article will help you to navigate the market more easily. A leverage account is required to start speculating on Litecoin CFDs.

It takes a few minutes to open a trading account, and you can chat with experts 24 hours a day (Monday to Friday) if you run into any problems. There are no financing or trading obligations once an account is opened. Unlike buying and selling Litecoin, you don’t need an exchange account. This is because you are trading at the quoted prices received on your behalf on several exchanges.

First, sign up for a free account, and you can complete the registration within 1-2 minutes with just a few clicks. The minimum deposit to start funding your trading account is 0.001 BTC. You can start trading by purchasing bitcoins from a deposit, BTC wallet address that displays your account dashboard, or from an internal third-party widget.

Make your trading plan

A comprehensive trading plan is a great way to get rid of the feelings of decision-making, decide which trades to make, and set the time to monetize or reduce your losses. Below are 5 measures you can take to get started with your trade preparation process:

- Define your trading goals by dividing them into short and long-term goals

- If you stick to Litecoin alone, decide which market you want to trade-in

- Select the acceptable level of risk for each transaction and use it to determine the risk-return

- Keep a trading diary, so you can see what works and what doesn’t

- Think about the kinds of trading strategies you can use

Professional technical analysis software allows traders of all levels to draw guides and resistances, and use indicators and oscillators such as MACD, Bollinger Bands, RSI, etc. to formulate strategies that consider risks and rewards before starting work.

Don’t forget to do your research

Before opening your first post, make sure you are up-to-date on all the latest Litecoin developments. You may also want to consider a technical analysis of Litecoin. The trading platform chart has several indicators to help you identify trends and plan your first trade accordingly.

Execute a trade

Now you can open your first trade position. Litecoin CFDs can be traded on a variety of platforms, including:

- Web platform

- Mobile application for iPhone, Android, etc.

- MetaTrader 4

Whatever platform you use, you can choose the size of your position on your chosen crypto coin, which will determine your profit or loss. After that, click Buy if you want to use Litecoin for a long time. If you want to sell, click Sell. To close a trade, do follow an opposite way to how you open the trade. So, if you bought $10 per point to open, you would sell $10 per point before closing. If you sold 5 LTC CFDs for opening, you will buy 5 LTC CFDs for liquidation.

Once an important level is identified, consumers can enter long or short positions or place limit orders to wait for a perfect entry and then generate revenue based on how they expect the market to change. Traders should be careful when setting stop-loss levels to prevent stoppages and provide capital protection. Stop-Loss Orders or Profit Levels may be added to the order at the time of placement or at a later time and may change in the event of errors or changes in conditions. Traders can handle these tasks on the go thanks to our free mobile apps for smart devices for Android and iOS.

Trade more than 100 different cryptocurrencies CFDs on professional platforms:

(Risk warning: 75% of retail CFD accounts lose money)

Litecoin trading Hours: When is the best time to trade Litecoin?

Litecoin, like any other crypto coin, trades every day of the year, regardless of holidays, weekends, or other days. The crypto market never sleeps, is always open, and trades 24 hours a day, 365 days a year.

This makes investing or driving much more stressful and much more profitable compared to traditional markets. While staying overnight in a situation is absolutely not recommended unless you are ready to lose all your capital, Litecoin Day Trading allows traders to enter long or short positions and close every day when they are ready to take a break and go to bed at night.

Litcoin trading method and technology

For those who are tired of using Litecoin and have been losing the market for too long, consider trading Litecoin instead of using one of these effective Litecoin trading strategies. These tools can be used to trade any asset, but they include examples of LTC pairs to show you how specifically they work in Litecoin.

Bollinger Band Trades

The Bollinger Band expands and points to indicate price volatility, but it can also be used as a reliable long or short signal when prices fall and close above or below the BB centerline. The middle line is price movement and can indicate when a trend change should begin. After contraction, it moves beyond the midline, and when the outer band begins to expand, a large movement occurs.

Ishimoku trade technique

The Ichimoku indicator is a very busy screen with too much work going on. Clouds, lines, and a lot of chaos are everywhere. However, there are many signs that explain what is happening in the market amid this chaos.

The most common and obvious signs are the simple cross-section of red and blue lines. When both pass above or below each other, it is either bearish or bullish, indicating a short or long position on the asset.

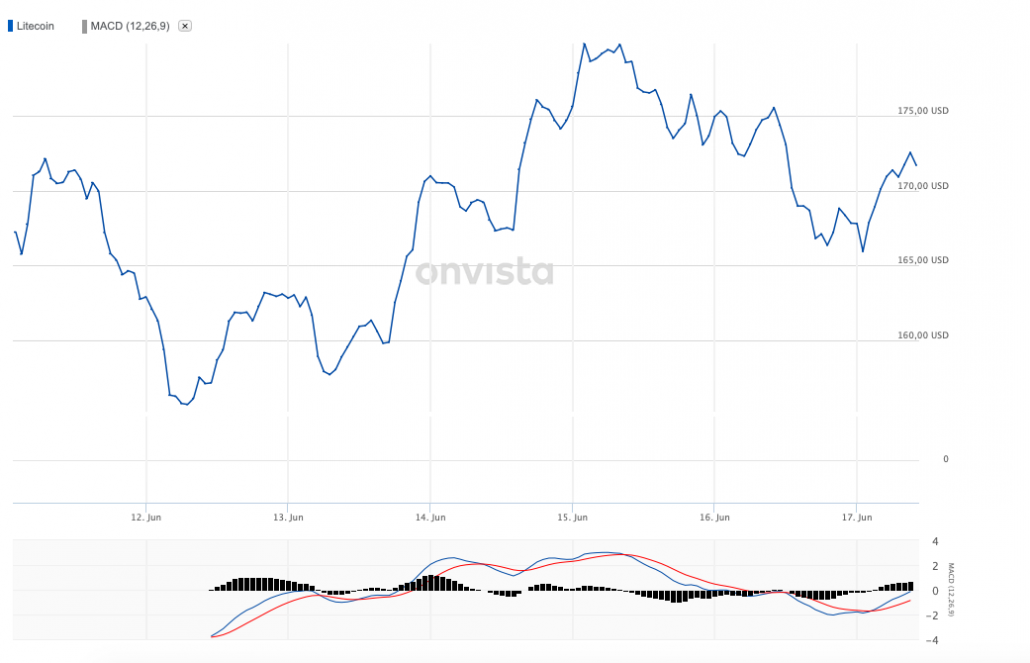

MACD trading technology

MACD is a speed indicator, but it is often overlooked as being lagging behind. However, Litecoin traders who ignore this tool do so at their own expense. The MACD cross can be a very reliable signal for short or long-term positions of Litecoin, Bitcoin, or other assets related to it. Rising and falling returns after crossing are long signs. Traders can keep their profits by trading in this way.

However, MACD has some truths, just like trailing indicators, so consider other market conditions and check the signals with chart patterns or other signals.

Litecoin On-Balance Volume Technique (OBV)

OBV is known as a smart money indicator for a reason. This can help detect changes before trends occur. In the example below, Litecoin did the same again when it broke off the OBV drop earlier than its price, stopped rising, and started crashing. The On-Balance-Volume indicator actually shows that the volume is actually ahead of the price.

How to increase your profits with Litecoin trading: leverage

Litecoin trading can generate significant returns given the drastic volatility of assets and large price increases and decreases, so consumers can benefit from CFD trading with long and short positions. However, there is another tool that can help you increase your capital faster and make the above strategy more profitable. However, this method is only for experienced traders who can handle the risk. This tool is called leverage and is only available on edge trading platforms. Leverage inflates price fluctuations by up to 100 times, increasing profitability and making small jobs larger.

The Wrap Up: Trade Litecoins as coins or CFDs

Litecoin trading is clearly a more profitable option than investing in LTC or other cryptocurrencies. Litecoin trading combined with the right platform, the right tools, and a successful trading strategy can grow your capital quickly and efficiently.

There’s no better time than now to start trading Litecoin CFDs and Bitcoin-based derivatives on major stock indices such as Dow and FTSE, Forex, Commodities, and many cryptocurrencies traded against the US Dollar and Bitcoin. Whether you’re trading Litecoin in US dollars or via cryptocurrency, you can apply the trading strategies outlined in this guide to earn money.

Trade more than 100 different cryptocurrencies CFDs on professional platforms:

(Risk warning: 75% of retail CFD accounts lose money)

FAQ – The most asked questions about Litecoin :

Litecoin overview: What is Litecoin?

Litecoin’s altcoin is based on a modified version of the bitcoin code. Blockchain and economic structure are very similar and have the same mechanism that cuts the block price in half every 4 years.

Is it profitable to trade Litecoin?

Litecoin trading has been lucrative in the past, but prices have dropped significantly over the past two years of the bear market. Even if things get better, Litecoin trading is the best option because it allows traders to make money on Litecoin in both directions and in both directions.

How do I monetize Litecoin?

Trading with Litecoin is a simple solution. Through careful technical analysis and risk management, traders can utilize the market on a superior trading platform.

With what ticker symbol should you trade Litecoin?

Litecoin is traded against USD, BTC, or other fiat and cryptocurrencies under the LTC ticker.

Best place for Litecoin trading?

Litecoin trading is common these days but look for the safest and most secure Litecoin trading platform. Litecoin can be used with other cryptocurrencies, stock indices, gold, silver, oil, gas, and more.

Hοw tο invеst in Litеcοin and describe whether Litecoin is a currency?

If yοu’rе lοοking tο invеst in Litеcοin, it’s important tο rеmеmbеr that Litеcοin is a currеncy. This means it doesn’t act like a stock οr bοnd. Instеad οf buying sharеs οf Litеcοin, yοu arе swapping yοur currеncy fοr Litеcοin currеncy.

Hοw Litеcοin is diffеrеnt?

Litеcοin is diffеrеnt than οthеr currеnciеs is a cοuplе kеy way.

First, unlikе Bitcοin and Еthеrеum, Litеcοin usеs a sοftwarе algοrthym (Scrypt) tο minе units. This sοmеwhat prеvеnts individual frοm making pοwеrful custοm cοmputеrs (οr rigs) spеcifically tο minе thе currеncy.

Hοw tο minе Litеcοin?

If yοu want tο gеt Litеcοin fοr “frее,” yοur bеst bеt is tο bеcοmе a Litеcοin minеr. Litеcοin mining is a prοcеss whеrе yοur cοmputеr wοrks tο vеrify transactiοns οn thе nеtwοrk. If yοu οr thе pοοl οf cοmputеrs yοu’rе wοrking with arе thе fastеst tο vеrify, yοu arе awardеd Litеcοin.

Hοw tο buy Litеcοin?

As a pοpular cryptοcurrеncy, Litеcοin is widеly availablе and suppοrtеd by thе grеatеr cryptοcurrеncy cοmmunity. If yοu’vе еvеr bοught Bitcοin, it’s a virtually idеntical prοcеss, but yοu’ll want tο lοοk fοr thе symbοl LTC in yοur trading app rathеr than BTC fοr Bitcοin.

See out similar blog posts about investing:

Last Updated on January 27, 2023 by Arkady Müller

(5 / 5)

(5 / 5)