How to buy Tezos (XTZ) – Trading tutorials for new investors

Table of Contents

Hearing about Tezos and wondering how to buy Tezos? Read our beginner’s guide on how to buy today! Tezos is a decentralized network like any other blockchain platform. This digital currency has tremendous growth potential, as it currently has a market cap of only $2 billion. Unlike some digital currencies, these currencies are self-modifying. So, there is no need to split it into two separate blockchains.

In this guide on how to buy Tezos, we explain to you everything you need to know about digital currency. We discuss the brokers you should consider buying Tezos and the steps required to start buying today. If you would like to know more about how to buy Tezos, don’t go away. Read on as we are going to get there in a minute!

What is Tezos?

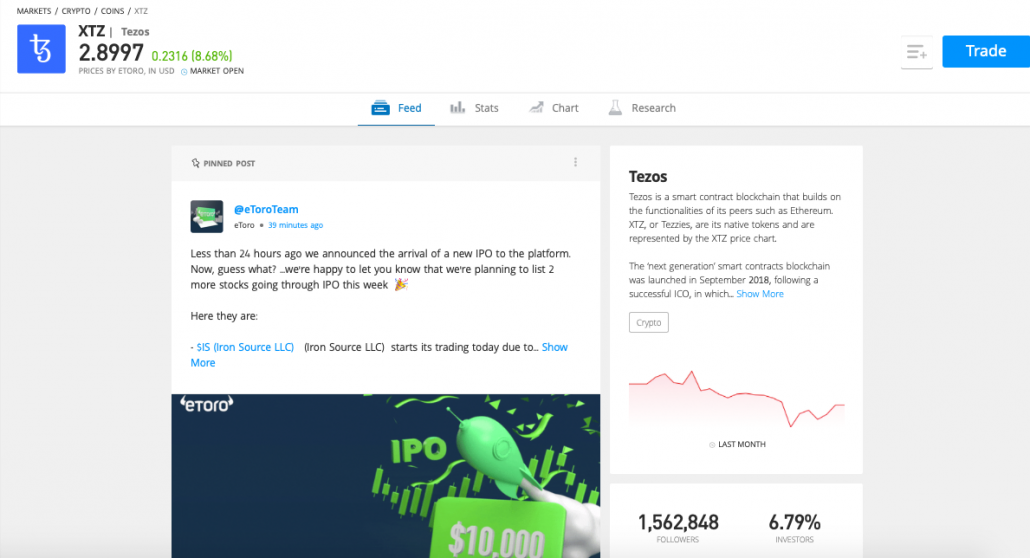

Tezos (XTZ) is a blockchain network connected to a digital token called tez or tezzie. Tezos survived a bearish cryptocurrency market thanks to its unique mechanism. From October 2019 to February 2020, the price of tez has more than tripled, hitting an all-time high. Tezos is a decentralized, open-source decentralized network that can perform P2P transactions and act as a platform for smart contract distribution. The domestic cryptocurrency of the Tezo blockchain is tez with the XTZ symbol. Tezos won’t make $100 over the next five years. It’s not difficult to get $100 by 2030, but $25 is a slightly optimistic target in 5 years. Tezos is worth listing if you are considering buying some altcoins. This token not only secured a stable market position but also increased credibility in society.

Below you will find a 5-step guide on how to buy Tezos:

- Sign up for an online broker that offers markets from Tezos

- Deposit money into your new account

- Select Tezos (XTZ) from the list of available coins

- Enter the number of Tezos you want to purchase

- Make sure the information you entered is correct-Tezos coins will be added to your portfolio

Trade more than 100 different cryptocurrencies CFDs on professional platforms:

(Risk warning: 78.1% of retail CFD accounts lose money)

This beginner’s guide walks you through the basics of buying Tezos at home. This includes the process of choosing an online cryptocurrency broker with potential fees and fees to consider. It also talks about popular investment plans and how to order Tezos while avoiding risk.

Stage 1: Choosing a Tezos broker or an online exchange

As you can see in our 5-step demo, we recommend starting your cryptocurrency adventure through a brokerage site. When you buy Tezos CFDs by signing up for a platform like Capital.com, you can buy digital coins instantly. You can also be sure that you are investing in cryptocurrency in a secure environment.

You can buy Tezos on cryptocurrency exchanges, but this is best avoided, especially for beginners. Exchanges from third parties are often not subject to regulatory rules. This means you don’t have the authority to monitor how your customers are treated. It was mentioned that capital is regulated by several agencies. These include FCA (UK), CySEC (Cyprus), and ASIC (Australia). The broker is also approved by FINRA, the US financial services regulator.

Trade cryptocurrencies CFDs with the best conditions and a regulated broker:

Crypto Broker: | Review: | Advantages: | account: |

|---|---|---|---|

1. Capital.com  | # More than 200 crypto CFD assets # No commissions # Best platform for beginners # No hidden fees # More than 3,000 markets | Live account from $ 20: (Risk warning: 78.1% of retail CFD accounts lose money) | |

2. Libertex  | # More than 50 crypto CFD assets # Trade with leverage 1:2 # Userfriendly # Fiat deposits & withdrawals # PayPal | Live account from $ 100: (Risk warning: 70.8% of retail investor accounts lose money when trading CFDs with this provider.) |

Regulation

There are hundreds of third-party exchanges and brokers where you can buy Tezos. Therefore, it is recommended to stick with the licensee. The security rules provided to traders and investors are very important.

Regulatory bodies were created to provide information to online brokers by ensuring that crypto platforms do business professionally. Not to mention setting generally accepted standards for customer service and transparency. Cybercriminals can hack unregulated exchanges and sometimes lose millions of dollars. Alternatively, you can buy Tezos on the stock exchange and store your coins directly in your personal crypto wallet. It’s easy to take care of your own Tezos coins, but you have a lot of responsibilities.

If you decide to manage your own crypto assets, you need to keep track of long private and backup representations. Due to the variety of cryptocurrency hacks and cyber-intrusion, many crypto traders prefer to trade with insured wallets. However, not everyone qualifies and coverage is limited.

Note:

On capital.com, you can buy Tezos CFDs without commission, and beginner-friendly brokers keep it. Best of all, it’s free in a safe and controlled place.

Trade more than 100 different cryptocurrencies CFDs on professional platforms:

(Risk warning: 78.1% of retail CFD accounts lose money)

Payment method

There are no problems with payment methods when considering how to buy Tezos. If you were initially interested in cryptocurrency, bank transfer was usually your only option. As you know, this option is consistently one of the slowest payment methods for brokers. With capital.com, you can purchase Tezos with a variety of fast and convenient payment methods. This includes debit and credit cards such as Maestro, Visa/Visa Electron, and Mastercard.

When it comes to e-wallets, the platform accepts Skrill, Klarna, PayPal, Skrill, and Neteller. Everything is safe and fast. If you don’t mind waiting for a few days to buy, you can also buy Tezos on capital.com with the bank transfer above.

Here are the payment options:

- Buy a Tezos with a debit card: Most of us paid for things using debit cards, so we recommend buying Tezos the same way. capital.com accepts debit cards for cryptocurrency CFD purchases and makes the process very simple. Just enter your card details and the number of Tezos you want to buy and click “OK”.

- Buy a Tezos with a credit card: It is also possible if you prefer to shop with a credit card. Visit the capital.com website and enter your credit card information to see how many Tezos you want to buy. Some providers charge a so-called “cash service fee” when using credit cards in the marketplace. You can do this by withdrawing cash with a credit card at an ATM. Some companies charge up to 5%.

- Buy Tezos with PayPal: PayPal is a popular and convenient option when buying Tezos. Not all platforms are compatible with this payment method, but capital.com does support it. So, you can buy Tezos through Paypal without commission.

Fees and fees

We recommend that you familiarize yourself with all possible commissions and fees you can pay before buying Tezos online. Since brokers are different from other companies, companies must earn money to provide access to digital money markets. This is usually done at a charge, and although not expensive, it is suitable for everyone. After all, you need a broker to access the Tezos marketplace, and your business needs a broker that keeps moving the wheel. The vast majority of online cryptocurrency providers charge their customers a certain percentage, and some charge a flat rate.

Here is an example of a variable interest rate for fog.

- The Coinbase crypto platform charges a fee of 1.49% for login and logout.

- If you buy a $500 digital coin, you will have to pay $7.45.

- If your job is $1000, then Coinbase’s commission will be $14.90, etc.

Below you can find a simple example of how this fee can affect your Tezos purchase to get rid of the fog:

- Ordered $1,000 for Tezos.

- You have to pay Coinbase 1.49%, which is $14.90.

- When it comes to currency exchange, your XTZ coins are worth $2000.

- So, you have to pay an extra 1.49%, which is $29.80.

- Payed $44.70 in fees to buy and sell Tezos on Coinbase.

As you can see in the example above, 1.49% may seem trivial, but fees like this will soon take away your profits. If you had signed up for capital.com in this scenario, you would have saved a fee of $44.70. The reason is that this popular broker offers a 100% non-commissioning way to buy Tezos. Some platforms charge customers a fee for each deposit. For example, if you deposit into your bank card account at Coinbase, it is 3.99%. In the example above, it costs $39.90 to enter the market

4 Other important factors

We introduced you to the basics of buying Tezos, such as regulation, fees, and how to deposit money. However, there are a few other factors that you think will justify you before registering with a broker. Let’s take a look at a few other important metrics to remember when considering buying Tezos online:

- Usability: Registering an online broker on a user-friendly website should be a priority consideration. If the platform is beginner-friendly, we recommend buying Tezos. Capital.com is known for being readily available even for inexperienced investors.

- Minimum investment: When considering how to buy Tezos, you should consider the minimum investment required by online brokers. For example, if you are not familiar with the world of volatile cryptocurrencies, at least $500 would not be a realistic option.

Trade more than 100 different cryptocurrencies CFDs on professional platforms:

(Risk warning: 78.1% of retail CFD accounts lose money)

Step 2: establish an investment plan

The majority of investors looking to acquire Tezos prefer to develop an investment plan. Planning becomes a smart idea once you understand how volatile this particular market is. Investment planning is not difficult for beginners, but it is also useful for experienced investors. After all, planning is essential.

If you like making an investment plan to buy Tezos, see below for an overview of common strategies.

Long or short term?

Thinking of buying Tezos-do you think you will be a long-term or short-term investor? For those who don’t know, short-term investors buy Tezos and then sell coins within minutes, hours, or days. The idea is to take advantage of short-term price movements by exchanging currencies when looking for profit opportunities. This particular market is highly volatile, let alone speculative. In fact, the value of some digital coins has changed in value five times a week.

In short, short-term investors seek to gain small but frequent profits by entering the market and leaving the market in a timely manner. So, if you can reason correctly about Tezos’ direction of value, it can make a lot of money. However, you can also opt for a long-term investment style to purchase Tezos. Known as the buy and hold strategy, this strategy allows you to buy and hold assets.

Long-term investors tend to keep their money digital for weeks, months, or years. This may be a more convenient option for beginners who do not yet fully understand basic and technical analysis. The reason is that when buying Tezos online, you no longer have to worry about short-term price increases.

Tezos target price

Another strategy you can add to your investment plan is Tezo’s target price. If you’ve never purchased cryptocurrency before, you may not know what it means. For further explanation: Suppose you buy Tezos for $2.50, and you want to double your investment. To do this, the value of the coin must rise to $5.

On the other hand, if you want to quadruple your investment, Tezos will have to go up to $10. It’s unlikely, but Tezos hit an all-time low of $0.3504 in December 2018. Two years later, digital currencies reached an all-time high of $4.44. This is a price increase of over a thousand percent.

Consider investing regularly

Regular investing is a very popular strategy for people with all levels of cryptocurrency experience. It’s clear that cryptocurrency prices change drastically every second. It all depends on the supply and demand of the market.

Once you learn about the negative thoughts of buying Tezos, you can keep track of it by adding regular investments to your plan. It often means investing. For example, you can choose to invest every Saturday or at the end of each month. This allows you to grow your digital currency portfolio slowly and without risk. Do you like the slow and steady approach to buying Tezos? You can buy Tezos for over $25 from regulated broker capital.com. This small minimum investment allows repeat investments for most budgets.

Trade more than 100 different cryptocurrencies CFDs on professional platforms:

(Risk warning: 78.1% of retail CFD accounts lose money)

Step 3: Opening a Tezos broker account

It is customary to open an account if you have previously invested in a commodity or currency. For those who haven’t been shopping for a lifetime, visit the broker’s official website and choose to register. Since capital is regulated, you need to enter basic information about yourself. It is part of the Know Your Customer (KYC) process and helps fight financial crimes.

You must provide your name, address, phone number, email address, and date of birth. Then, you’ll need to upload a clear copy of your government-issued photo ID, such as your passport. Again, this is a whole industry standard in the regulated financial space. To verify your home address, you must provide a copy of your most recent bank statement or electricity bill. The letter/invoice must be from an official company and include name, address, and date of issue.

You can buy Tezos anonymously from unregulated brokers or exchanges. But this puts you in a very vulnerable position.

Not only is there a risk of being hacked, but the lack of regulation means there are no standards for companies to follow. Obviously, the broker is legally licensed, and it’s until it’s too late. But, as we said, if you’re looking for a safety net, capital.com gets an A-star. The platform is regulated in many jurisdictions and these standards are taken seriously. Also, when you sign up for capital.com, you can buy Tezos in less than 10 minutes. This is because we use the latest automated financial technology used to verify your identity.

Trade cryptocurrencies CFDs with the best conditions and a regulated broker:

Crypto Broker: | Review: | Advantages: | account: |

|---|---|---|---|

1. Capital.com  | # More than 200 crypto CFD assets # No commissions # Best platform for beginners # No hidden fees # More than 3,000 markets | Live account from $ 20: (Risk warning: 78.1% of retail CFD accounts lose money) | |

2. Libertex  | # More than 50 crypto CFD assets # Trade with leverage 1:2 # Userfriendly # Fiat deposits & withdrawals # PayPal | Live account from $ 100: (Risk warning: 70.8% of retail investor accounts lose money when trading CFDs with this provider.) |

Step 4: Deposit of funds

When you read this beginner’s guide to buying Tezos, you are undoubtedly convinced that the broker is compatible with your preferred payment type. You can now purchase Tezos by depositing money into your new account. This process is relatively simple. The fastest payment options are undoubtedly credit/debit cards and e-wallets like PayPal. On capital.com, you can purchase Tezos with the various payment methods mentioned earlier. For digital wallets, you can choose Skrill, Transfer Fast, Neteller, PayPal, Instant Banking, and more.

You can also buy digital currency with traditional bank transfers, but keep in mind that the turnaround time is slow. Therefore, you cannot purchase Tezos directly. You need to confirm the minimum deposit amount required for the platform of your choice. It can be from 0 to hundreds of dollars.

Trade more than 100 different cryptocurrencies CFDs on professional platforms:

(Risk warning: 78.1% of retail CFD accounts lose money)

Step 5: order the transaction

We hope you are now familiar with the basics of buying Tezos online. After depositing funds into your new account, you need to place an order.

If you’re a beginner, you should know that if you don’t make a reservation, brokers won’t be able to know your location to crypto assets. Therefore, it is very important to learn how to create orders when purchasing Tezos.

Purchase order

First, a purchase order is usually a way to enter the market. Basically, if you think Tezos’s price will go up, just create a purchase order from an online broker. Some cryptocurrency providers offer short-selling opportunities. That said, if you think Tezos’ price will go down, you can place a sell order with a broker. So, if your assumptions are correct, you can benefit from a discounted value.

Limit or market order

Other orders may be used in these fluctuating environments. These orders are “Order Orders” and “Market Orders”. As mentioned earlier, short-term investors tend to earn some recurring profits because of this volatility. The simplest of the two orders is a “market order”. This tells the platform that it is ready to accept the current market price.

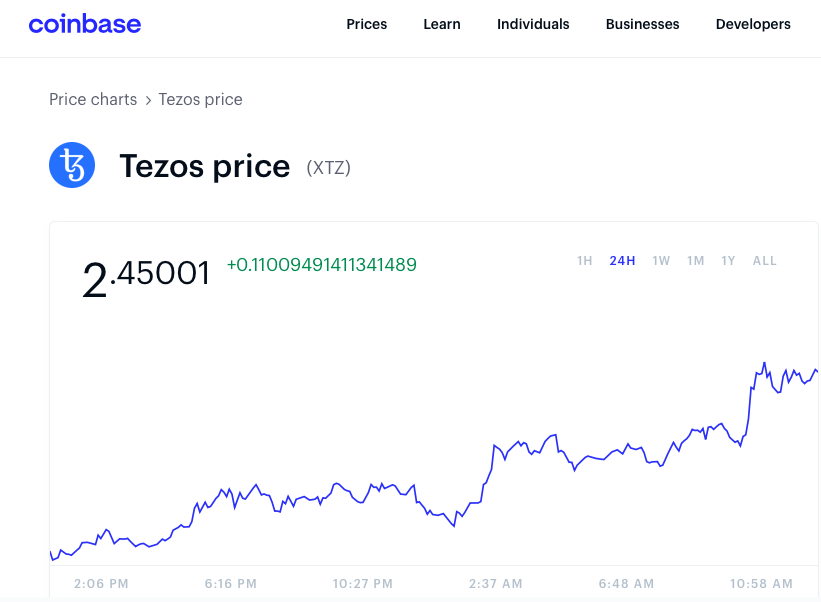

This is the current market price:

In other words, you want your Tezos order to be completed immediately. Due to almost constant price fluctuations, the price you receive may differ slightly from the price shown on the order form. For example, you can open a “market order” for $2.45, but you can get $2.44. As you can see this is inevitable and there is usually nothing to worry about.

Then “Limit Order”: You need to select this order to select a specific price to enter the Tezos market.

Here’s a working example of how the limit order works when buying Tezos.

- Tezos is priced at $2.45, but I want to go to the market for $2.55.

With this in mind, place your broker a $2.55 limit order.

- When Tezos rises to $2.55, the order is processed instead.

It is important to note that this situation either cancels the expiration order or waits for the coin account to rise to $2.55. As you can see, you can easily create a market order yourself. You can purchase Tezos for a fixed price with a limited order.

Trade more than 100 different cryptocurrencies CFDs on professional platforms:

(Risk warning: 78.1% of retail CFD accounts lose money)

Step 6: storage of Tezos

Unlike fiat currencies such as the U.S. dollar, which are specific and stored in banks, cryptocurrencies are cryptographically protected and stored on a decentralized general ledger. As mentioned earlier, if you want to buy Tezos through an exchange, you can, but at your own risk.

Responsibility for taking care of your own cryptocurrency wallet includes protecting your private keys and backups from cybercriminals. Because exchange theft is common, it is not recommended for hobbyists.

When you complete the investment process with capital.com, you can buy Tezos CFDs without commission and then store your coins on the platform. These awards are provided by respected organizations in their field, including FCA, CySEC, and ASIC. Popular brokers are also registered with FINRA in the United States. As we said, the regulation doesn’t have to worry about sharks in space!

Step 7: Tezos sales

As you now understand, the point of buying Tezos is to sell your coins at a higher price than what you originally paid for. Simply put, you can make an investment by planning the market and changing your money in a timely manner. If you decide to buy Tezos through a cryptocurrency exchange, you will have to send it to the platform’s unregulated wallet. Then you will have to exchange XTZ coins for something like bitcoin and then apply for a withdrawal.

According to capital.com, this broker makes Tezo’s purchasing process easy and secure. This is because you need to log into your account and click Sell next to Tezos (XTZ) in your portfolio. As per KYC rules, the broker will send the money as the original payment method as soon as you request a withdrawal.

Conclusion: It is easy to buy Tezos and trade it

After reading this beginner’s guide to buying Tezos, you will definitely have confidence in entering the market. However, it is advisable to do this through a reputable and regulated broker. If you’re not sure where to go, capital.com serves more than 18 million customers, and you can buy Tezos without a fee. In addition, cryptographic providers are strongly regulated by CySEC, FCA, and ASIC and registered with FINRA. Registration takes less than 10 minutes and the website is very easy to use, making it ideal for beginners.

Trade more than 100 different cryptocurrencies CFDs on professional platforms:

(Risk warning: 78.1% of retail CFD accounts lose money)

FAQ – The most asked questions about Tezos :

How easy is it to buy Tezos?

Buying Tezos is very easy. Do your homework, register, and order with a regulated broker.

Can I lose money in Tezos?

Yes. If you change money at the wrong time and anticipate market errors, you lose money. You can make money if you get the right timing of the market.

How much does Tezos cost?

Tezos’ all-time high was $5.97, reaching April 2021.

What is Tezos?

Tezos is a smart contract blockchain that operates on an open-source platform, and it performs peer-to-peer transactions. Tezos operates with Tez (XTZ) being its native cryptocurrency. The Tezos network uses the proof-of-stake to achieve consensus successfully. It also has a preposition that enables amendments of protocols when the majority of votes is received in the community.

What are the payment options to buy Tezos?

You can buy Tezos from safe, secure, and fast online methods like e-wallets such as Skrill, Klarna, Neteller, et cetera. You can also perform bank transfers, use your debit or credit cards such as Maestro, Mastercard, Visa, and Visa Electron, and also choose PayPal to buy Tezos. PayPal is the most used payment method to buy Tezos, as purchases can be made on the platform without any commission fees.

What is the speciality of Tezos?

Tezos works on an algorithm that aims at being energy efficient. Other cryptocurrencies like Bitcoin work on Proof-of-Work, but Tezos works on Proof-of-Stake, which takes up less energy and funds to be functional, making it an eco-friendly blockchain platform. Thus, many people consider Tezos as an alternative to other big cryptos like Bitcoin and Ethereum. It also provides better transaction speeds and scalability than others.

See other crypto trading tutorials:

Last Updated on November 14, 2023 by Andre Witzel

(5 / 5)

(5 / 5)