The 4 best Bitcoin brokers for beginners – Comparison and test

Table of Contents

Do you want to invest in digital currencies? Bitcoin is the most well-known one here. The cryptocurrency Bitcoin is traded as an alternative currency in the digital space. For this reason, more and more traders are also investing in Bitcoin. However, before investing in cryptocurrency, it makes sense to find a suitable broker. After all, the trading conditions, especially accruing fees, also play a decisive role in the return.

To support your choice, we have prepared a Bitcoin broker and mobile app comparison for you, giving you groundbreaking advice on which broker is worth trading Bitcoins with.

See the list of the 4 best Bitcoin brokers for traders here:

Bitcoin Broker: | Review: | Crypto Assets: | Advantages: | account: |

|---|---|---|---|---|

1. XTB  | 20+ Crypto-CFDs | + Leverage up to 1:2 + Userfriendly + Low spreads + PayPal | Free account:(Risk warning: 72% of retail CFD accounts lose money) | |

2. Capital.com  | 120+ Crypto-CFDs | + Beginner-friendly + No spread trading + 200+ Cryptocurrencies CFDs + Professional charting | Minimum deposit of $ 100 (Risk warning: 75% of retail CFD accounts lose money) | |

3. RoboForex  | 20+ Crypto-CFDs | + Huge variety + Micro accounts + Bonus program + Leverage 1:2000 + ECN accounts | Minimum deposit of $ 10 (Risk warning: Your capital can be at risk) | |

4. IQ Option  | 27+ Crypto-CFDs | + Leverage up to 1:100 + Best Software + BTC withdrawals + 24/7 support | Minimum deposit of $ 10 (Risk warning: Your capital might be at risk.) |

We have tested the following Bitcoin brokers and apps. We came to the conclusion that this list includes our best Bitcoin brokers:

- XTB – Powerful analysis platform

- Capital.com – Trade Bitcoin with low fees

- RoboForex – High leverage is possible

- IQ Option – Amazing app with powerful features

Which brokers are suitable for Bitcoin trading?

Buying bitcoin is possible on many platforms. However, only a few also allow security when buying and trading and enable the trading of Bitcoins at low fees. We have therefore chosen five providers where trading the crypto Bitcoin is possible.

The Bitcoin brokers presented are well-known brokers that shine with good trading conditions and where it is advisable to get started. Traders should consider which brokers are trustworthy before opening an account with the respective crypto broker. The five brokers presented are subject to state regulations and have been established trading platforms on the market for years.

Criteria for comparison:

- Internet presence and mobile app

- Trading platform

- Bitcoin offer

- Trading conditions

1. XTB – Powerful analysis platform

The fourth place in the Bitcoin broker comparison goes to the broker XTB. Trading cryptocurrencies is, of course, also possible with this broker. This broker is also known as a CFD broker above all and thus enables the trading of cryptos via CFDs.

Trading CFDs can result in high losses, which is why at least the broker should be trustworthy. Investors trust and appreciate XTB as a broker because it is CySEC, FCA, and KNF regulated and also offers an attractive trading platform.

The cryptocurrency offer is available subject to regulation. The broker has multiple regulators in CySEC (Cyprus), FCA (UK), and KNF (Poland). All client funds are held in a segregated client bank account in accordance with the Cyprus Securities and Exchange Commission’s (CySEC) client funds rules.

With the crypto CFDs from XTB, it is possible to trade Crypto CFDs, such as Bitcoin, Litecoin, Ethereum, and many more, and that is 24/7. Thus, you do not buy real Bitcoins at XTB but Bitcoin CFDs. These merely track the price of bitcoin. It is important to note that.

In addition to the attractive XTB trading platform and website, the provider also has an app. We will take a closer look at this in the following.

The bitcoin app at a glance:

Quotes can be viewed via the XTB app. It is also possible to trade actively via the app. Both real trading and trading via a demo account are possible in the app. So traders have the choice: Do you want to speculate directly in the app or simulate trading?

In addition to trading, it is also possible to contact customer service via the app. This is possible via live chat as well as by mail. The support is available in English as well as in different languages.

The conditions for traders:

XTB’s trading conditions are very fair and please many investors. Thus fall for:

- Deposits

- Real-time foreign exchange rates

- Dynamic charts and graphs

- Opening and closing trades

- Live price quotes on stock CFDs

and roll-over positions do not incur any fees.

- The Bitcoin spread is only $100. (price captured 07.07.2021 – 16 p.m.)

Thus, XTB only incurs costs for overnight funding, currency conversion, and inactivity fees. Thus, trading Bitcoin does not generate any other costs.

(Risk warning: 72% of retail CFD accounts lose money)

2. Capital.com – Trade Bitcoin with low fees

With 10 years of experience, the Capital.com broker already has a lot of experience in the financial field. Investors who still want to practice trading also have the option to open both a live account and a demo account with this broker. The risk of buying cryptocurrencies through the demo account is 0.

Digital currencies such as Ripple, Bitcoin, and many more can also be traded here as CFDs. CFD stands for Contracts for Difference and refers to the mapping of the Bitcoin price in Bitcoin trading.

If you want to trade Bitcoin, you can choose between Bitcoin Cash and Bitcoin and buy them. When trading cryptocurrencies, a leverage of 1:2 is possible. Furthermore, as a crypto broker, you do not need an e-wallet with Capital.com

Good to know!

Trading is possible via the MetaTrader trading platform as well as via the mobile app.

The bitcoin app at a glance:

The Capital.com app impresses with a functional and user-friendly interface allowing trading on tablets and smartphones. The app’s functions are also distinctive and include various tools available on trading platforms for trading on (Bitcoin) exchanges.

The Capital.com app offers:

- User-friendly interface

- Email login to the app

- Selection of technical analysis

- Use of trading signals

- News from Trading Central and Investing.com

- Demo and live account use directly in the app

- Buy, sell, pre-orders, stop-loss, withdrawals

- Real-time quotes

The conditions for traders:

Trading fees for trading asset classes are also charged at Capital.com. However, trading fees vary from asset class to asset class. Since we want to trade the cryptocurrency Bitcoin, we will only look at cryptocurrency fees below.

Usually, trading fees for bitcoin and other cryptos always come with a spread. However, this is not the case with Capital.com. Instead, there are commission fees for trading Bitcoin. Trading Bitcoin, Bitcoin Cash, and Bitcoin Gold, as well as all other cryptocurrencies of the broker, such as Ethereum, incur commission fees of 0.4%.

The fees for Bitcoins can be rated as very favorable at the CFD broker Capital.com in the test.

In addition to the commission for trading, fees for Capital.com withdrawal can also be incurred, depending on the selection of payment methods. Furthermore, the broker charges a rollover fee for CFD instruments that are traded outside of trading hours.

(Risk warning: 75% of retail CFD accounts lose money)

3. RoboForex – High leverage is possible

You can also buy Bitcoin at the broker RoboForex. With over 900,000 customers worldwide, Roboforex convinces you with an extensive range of trading instruments, multi-asset brokerage, and fair trading conditions. Trading cryptocurrencies is also possible via the broker RoboForex. In the trading range, a total of 26 cryptocurrencies can be traded as CFDs.

The Bitcoin broker RoboForex offers the following cryptocurrencies:

- Bitcoin

- Dash

- EOS

- Ethereum

- Litecoin

- NEO

- Ripple

Furthermore, it is possible to invest in crypto indices. For this purpose, the trading instruments Crypto.TOP and Crypto.ALT is available. Trading is supported by the RoboForex app.

The MobileTrader RoboForex app enables trading via MetaTrader and RoboForex via mobile devices and thus online on the go. Unlike other brokers, RoboForex offers different apps for IOS and Android users.

For example, the R Mobile Trader app can be downloaded for free from the Apple Store. As a mobile platform, the iPhone app allows you to:

- Live trading

- Analysis tools

- CopyTrading via CopyFX

- Transaction management, bonuses

- Demo account available

- Real-time charts and quotes

The Android app, on the other hand, offers a link to the MetaTrader trading platform. This is denied to iPhone users. Thus, Android investors can benefit as follows:

- Charts in real-time

- Trading in the chart

- Quotes also in offline mode

- Demo account available

- Executions in the app

- 30 technical indicators for trading

- Linkage with MetaTrader 4 and 5

The trading conditions for investing with the online broker RoboForex, on the other hand, are again the same for all investors. Thus, it is possible to trade Bitcoin and other asset classes with a minimum deposit of 10 dollars. This is possible directly in a BTC account.

The fee incurred for trading Bitcoins is measured by the variable spread of the cryptocurrency and is thus the difference between the buying and selling price. The minimum spread at RoboForex is 1.3 pips when EUR/USD is considered. Compared to other brokers, this is a relatively high spread. However, it should be emphasized that no commission is charged by the broker.

Costs can also arise when depositing and withdrawing via various payment methods.

(Risk warning: Your capital can be at risk)

4. IQ Option – Amazing app with powerful features

IQ Option Bitcoin Overview

The fifth place in the Bitcoin broker comparison is occupied by the broker IQ Option. The broker’s trading offer covers over 250 underlying assets. In addition, the broker’s trading offer includes 12 cryptocurrencies. The broad range of brokers, coupled with excellent conditions and reputable regulations, offers the best conditions for trading for investors. For Bitcoin trading, the cryptocurrencies Bitcoin, Bitcoin Gold, and Bitcoin Cash are available for selection. Trading is possible both via coins and in the form of CFDs.

You can invest with this Bitcoin broker for as little as one euro and can even pay in Bitcoin. IQ Option offers a leverage of 1:2 for trading and also convinces you with a user-friendly online trading platform. This can also be used via mobile apps.

The app at a glance

IQ Option’s trading platform is also available as a mobile app for Android and IOS devices. In the platform, you can benefit from multi-chart displays, use technical analysis, and view price histories. In addition, it is possible to influence your own experience via various widgets.

Fundamental analyses, a news feed as well as the viewing of an economic calendar are useful indicators for Bitcoin trading. In general, investors can use more than 100 widgets at IQ Option.

Last but not least, the social vein should also be mentioned for this Bitcoin broker. Via app or via the online platform, it is possible to exchange with the IQ community and follow other traders.

Terms and conditions for traders:

The trading conditions for trading Bitcoin as coins or as CFDs can be rated as fair. In general, the broker does not charge any costs for deposits or withdrawals. However, the payment methods differ and so you may have to pay fees if you choose to pay via Paypal, credit card, Skrill, Neteller, or Sofortüberweisung. Therefore, pay close attention to the transaction type.

IQ Option trading platform

Generally, there are also no spreads for trading at IQ Option. However, cryptocurrency trading is an exception. Thus, the crypto spread can be between 0.5% to 2%, and that is quite high. Inactivity fees also apply.

We have summarized the trading conditions for you once again as an example:

- Bitcoin variable spread starting at 0.5%.

- Inactivity fee: $50 per year for the absence of at least 90 days

- Bitcoin investments from $1

- Only a $10 minimum deposit

- Deposits and withdrawals in Bitcoin

(Risk warning: Your capital might be at risk.)

How does trading with Bitcoins work?

But how does bitcoin trading actually work? Bitcoin is considered a lucrative cryptocurrency that is appreciated by many investors. After all, cryptos only became prominent because of bitcoin, and so bitcoin is also considered the world’s best-known and most promising coin among cryptocurrencies.

As an alternative to a traditional currency, Bitcoin can undoubtedly offer investment potential. However, investors should not underestimate the price developments. Bitcoins are considered to be very volatile, and thus trading is definitely associated with a high risk.

Those who nevertheless decide to trade Bitcoins can do so in two ways:

- Trade Bitcoins as CFDs

- Actually buy and sell Bitcoins

It should also be mentioned at this point that Bitcoins are never traded on a regular exchange. Instead, there are so-called Bitcoin exchanges where you invest directly and do so through your broker. On such Bitcoin exchanges, investors can buy or buy cryptos from each other.

In the following, I will go into more detail about the forms of Bitcoins trading.

Speculating on the Bitcoin price with a CFD

Putting money into CFD trading is also possible when buying Bitcoins. Thus, one trading strategy is CFD trading. A crypto CFD allows investors to forecast a price change. Since it is a forecast and not a direct purchase, crypto CFDs also do not count as direct trading. Instead, it would be best if you had a wallet to trade. Whether you are trading privately or professionally, the leverage for a crypto contract for different trading may vary. However, for private investors, this is capped at 1:2.

In order to speculate on a Bitcoin price with a CFD, depositing a cash payment as collateral in the wallet with the broker you trust is necessary. After all, it can always happen that investors lose money in CFD trading. A deposit of money when trading CFDs is therefore always necessary.

Once the money is deposited, you can speculate on the price. Provided that you assume that the price will rise, you buy Bitcoin CFDs. On the other hand, if you assume that the price will fall, you sell. The forecasting options offer the possibility of high profits.

Trade Bitcoin via exchange

As mentioned above, it is also possible to trade Bitcoins via Bitcoin exchanges. Here you do not invest in a CFD but buy and sell coins. The Bitcoin exchanges are also called “Exchanges.” Trading Bitcoins is possible on these exchanges among buyers and exclusively online.

Exchanges offer a number of advantages for investors. We have summarized the most important facts for you:

- Exchanges offer security for investors through a regulated platform

- Processes can be automated

- An exchange partner for trading coins can be found quickly at an exchange.

Unlike traditional exchanges, however, your money is not stored in a physical location. An exchange is a so-called peer-to-peer exchange and thus represents a direct trade between users.

However, you do not have to worry about your security if you want to trade on such exchanges. An exchange is just as secure as other exchanges. However, to protect yourself privately, it makes sense to create a wallet if you have not already done so. This way, you minimize your own risk.

How can you recognize a good Bitcoin broker?

Now you know how to trade Bitcoins and which Bitcoin brokers are suitable for you. But how can you actually tell if a broker is reputable or if you should rather keep your hands off registering? After all, there are also black sheep among brokers. In general, the Internet always provides you with the answer as to whether a broker is reputable or not.

So it is possible to search for testimonials on the Internet or to take a closer look at the website and offers of a broker. The following information gives an excellent insight into the world of the broker and can be an indication of a serious brokerage:

- The broker is supervised by a reputable regulatory institution

- The customer service is accessible and convincing with multilingualism

- The website and platform for trading are user-friendly

- A low-cost structure is in place

If these points can be answered with yes for you on a checklist and thus raked off, the broker can also be classified as reputable. We will now go through these points together.

Regulation

Based on the regulation of a broker, you can quickly tell whether a broker is reputable. If a broker is supervised by a regulatory authority, it also has a license number and a certificate from the respective institution.

As an investor, you should always make sure that the certificate has been issued in the current year. If this is the case, the broker can be classified as reputable. Regulatory authorities issue the certificates every year anew. If a broker at some point no longer complies with the regulations, it also receives no certification.

In the broker comparison, we have presented you with several brokers that are suitable for trading cryptocurrencies. Of course, these are also regulated.

You can see the respective form of regulation in the following table.

BROKER | REGULATION |

|---|---|

Capital.com | CySEC |

RoboForex | IFSC |

IQ Option | CySEC |

XTB | CySEC, FCA, KNF |

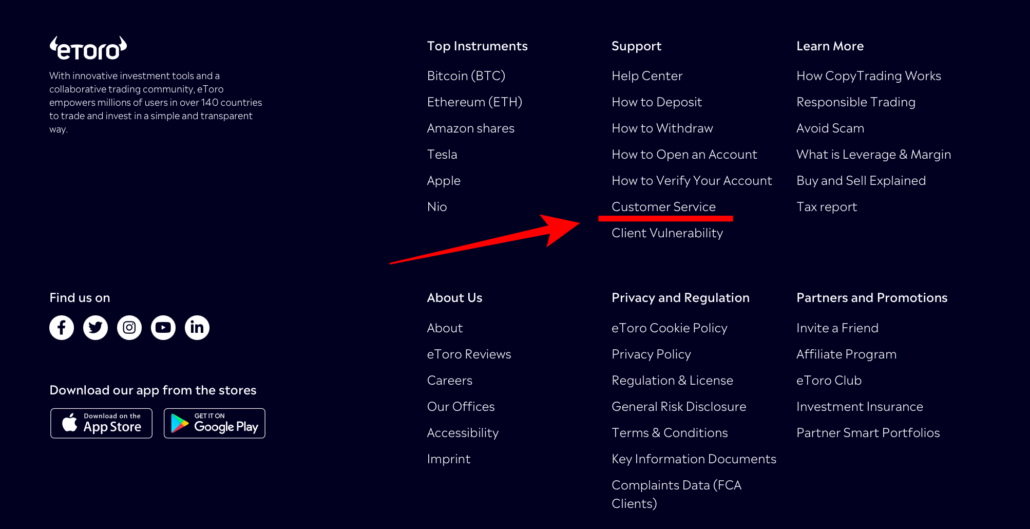

Customer service

In addition to regulation, the accessibility and friendliness of customer service are also crucial. If a broker does not offer any customer service at all, it can already be classified as dubious. However, even if a broker lists customer support on the website, but this can be reached neither by phone nor by e-mail, this can also not be characterized as trustworthy.

So when does customer service count as trustworthy? Good customer service should be reachable in at least two ways. Both a postal address and a contact form or contact by e-mail should always be guaranteed. In addition, it can be useful for inquiring customers if service times are noted on the broker’s website. This way, they can contact customer service directly during office hours.

In the age of Web 2.0, customer support is particularly convincing if there is also a live chat option. However, this is rather a plus point and not a nonplus ultra to be considered serious.

Depending on which country the broker comes from, the language of the customer service is also crucial. English should be spoken in any case at any broker. However, good customer service is also characterized by the option to speak in different languages.

User-friendliness

Of course, a broker’s website and platform should also be user-friendly. Without the right usability of the website, it is difficult to use tools and extract maximum success from trading. The user-friendliness of a trading platform depends on three main factors:

- Customized dashboard

- Clear menu navigation

- Mobile availability

First, of course, you should have no problems finding your way around the trading platform. Otherwise, it could quickly happen that you accidentally press the wrong button while trading or fail to find entire menu items. However, not only the layout of a trading platform but also the individuality is crucial.

As an investor, you ultimately want to keep an eye on the trading instruments and cryptocurrencies that you already own or are planning to buy. An individualized watchlist, as well as an individual dashboard, are useful for this. News, charts, and current analyses on the respective trading instruments should be available there.

Finally, it is now also important that you can trade from anywhere. The best brokers, therefore, also offer an app that is available for both Android and IOS devices. This way, you won’t miss any price fluctuations, and you can buy and sell directly from the app.

Low fees

A reputable broker is also characterized by the fact that the pricing structure is kept relatively low. After all, when you trade on the stock market or crypto, you want to make returns. If you spend too much money on fees, your profit margin will drop significantly. You can find out whether a broker charges too much in a broker comparison test. To do this, look at different brokers and compare the prices. An average can be easily determined this way.

Bitcoin broker fees explained:

When trading Bitcoins, the costs can vary greatly. Basically, when trading cryptos, a fee is often charged in the amount of the spread. This can be both fixed or variable with a broker. However, brokers may also decide that you charge a fixed percentage as a commission fee for trading the cryptocurrency. However, when buying Bitcoin, you should make sure that the fees are as low as possible. A fee equal to a spread is fair, but you should not have to pay additional fees.

For example, it is often the case that there are fees when buying or withdrawing via a certain payment method. These are not charged by the broker directly but by the payment service provider. Therefore, keep an eye on the payment service providers offered by a broker and choose the best financial service provider.

Lastly, a broker may also have other general costs that are incurred regardless of cryptocurrency trading. These are:

- Rollover costs

- Custody fees

- Inactivity fees

- Withdrawal costs

- Minimum deposits

A good broker is characterized by low fees and a low-cost structure.

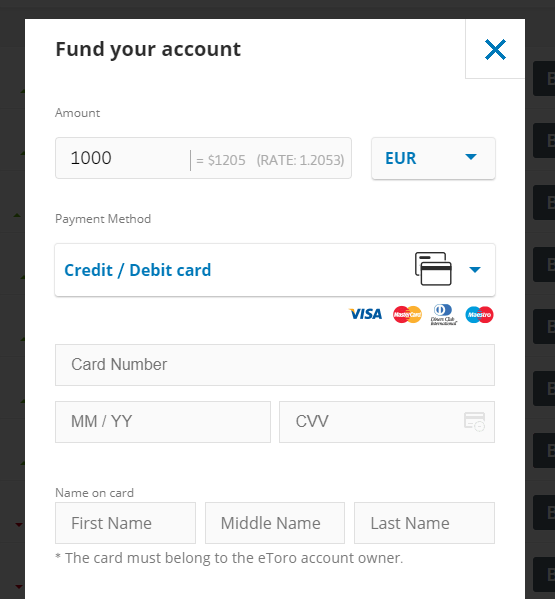

Deposits and withdrawals at the Bitcoin broker and app

In order to trade cryptocurrencies, you must, of course, make deposits and withdrawals. For this, depending on the broker, different payment methods are available to you. Thus, there is usually the possibility of paying by credit card. This has a special charm in that almost everyone has a credit card anyway and thus does not have to open an account with a payment service provider.

For some people, however, the choice of a credit card or their own account represents an increased risk. In these cases, many brokers also offer the possibility to deposit and withdraw money via a PrePaid card. This has the advantage that your money is protected. In the event of fraud, only the money on the PrePaid card can be misappropriated. On the other hand, your money in the bank account remains safe.

eWallet payment providers are becoming increasingly popular. This includes brokers, especially financial service providers such as PayPal, Neteller, and Skrill. These payment service providers specialize in online transactions and can also be used as a PrePaid platform. However, it is also possible to link the accounts with your own bank account.

Deposits and withdrawals with eWallet providers are straightforward, fast, and also secure. PayPal, for example, offers customers buyer protection and would, in the case of fraud, even refund the buyer or investor money if necessary.

A disadvantage of eWallet providers, however, is that costs are often incurred for a transaction. However, this varies and cannot be generalized.

Thus, many payment methods are open to you for trading. You yourself can then decide which payment method is right for you. Some brokers even offer coins, such as Bitcoin, Ethereum, or other cryptocurrencies, among the payment methods. Thus, not only trading but also payment with cryptocurrencies is possible.

Our conclusion about Bitcoin brokers – Pick one of the 5 best Bitcoin brokers!

Trading Bitcoins can be quite profitable. As the most famous crypto, Bitcoin enjoys special attention among investors. However, where and how Bitcoins are traded should be decided consciously by each investor. For example, Bitcoins can be traded as a cryptocurrency both via contract for difference with an online broker or via an exchange.

In the broker comparison, the broker Capital.com performs the best. Nevertheless, it should be emphasized that investors can also buy Bitcoin with an account at the other five brokers with a clear conscience. For cryptocurrencies, these providers are very well-suited and convincing, with a wide selection and fair trading conditions. The mobile availability of the platforms also ensures that investors can trade bitcoins from anywhere.

When choosing a broker, you should also pay attention to which form of Bitcoin you want to trade. Would you rather trade Bitcoins as CFDs or in the form of coins after all? Depending on your investment strategy, different brokers may be suitable for you.

All online brokers in this comparison can be considered favorable for trading cryptocurrencies and are among the best in their field. Security, a good selection, and easy buying and selling of Bitcoins are guaranteed with these providers. I recommend trading through Capital.com if you want to trade Bitcoins with a provider as CFDs, however, the most.

Should you decide to trade via a broker, it is important to distinguish yourself from a reputable provider. Top brokers offer investors a good trading platform, a reasonable cost structure, friendly customer support, and secure deposits. The five brokers presented here can be classified as reputable and serve as prime examples of suitable brokers where you can trade cryptocurrencies.

Additionally, you can learn more through our total reviews:

FAQ – The most asked questions about bitcoin brokers:

What is a bitcoin broker?

As you know, a broker is an organization or individual who acts as a financial halfway for people who want to exchange funds for a service or product. A cryptocurrency bitcoin broker provides online financial services for a person who wants to sell or buy cryptocurrencies.

Can you buy Bitcoin from a broker?

You can find several options to buy Bitcoin from brokers. The 5 best brokers for trading cryptocurrencies are:

Capital.com

Robo Forex

XTB

IQ Option

Is a broker required to purchase Bitcoin?

No, a broker is not required to buy Bitcoin (BTC). You may trade it there without using a broker by going to a reputable crypto exchange that deals in Bitcoin. Look for a bitcoin broker that provides the desired derivatives product as a substitute.

Do Bitcoin brokers charge any fees?

The expenses might differ significantly while trading bitcoins. In essence, a fee is frequently assessed while trading cryptocurrencies, usually in the form of a spread. With brokers, this might be either fixed or floating. However, brokers may opt to charge a certain percentage as a transaction fee for trading cryptocurrencies. Therefore, you must check that the costs are as little as possible before purchasing Bitcoin. It is OK to charge a fee equivalent to the spread, but no other costs shall be imposed.

Last Updated on November 14, 2023 by Andre Witzel

(5 / 5)

(5 / 5)

Leave a Reply

Want to join the discussion?Feel free to contribute!