Introduction to the Eurex exchange – experience & test for traders

Table of Contents

Rating: | Stock exchange affiliation: | Trading times: | Offer: |

|---|---|---|---|

(5 / 5) (5 / 5) | Deutsche Börse AG | Ab 7:30 am to 10:30 pm | Derivative products |

But how reputable is Eurex and what offers are waiting for investors? In the following test, Eurex experiences are shared and the exchange is evaluated. The Eurex Exchange is a futures and options exchange based in Eschborn, Germany, and is thus located in the immediate vicinity of the financial metropolis Frankfurt am Main. A large number of investors choose Eurex as the number one exchange for trading futures and options.

Stock exchange Eurex – introduction and history of the company

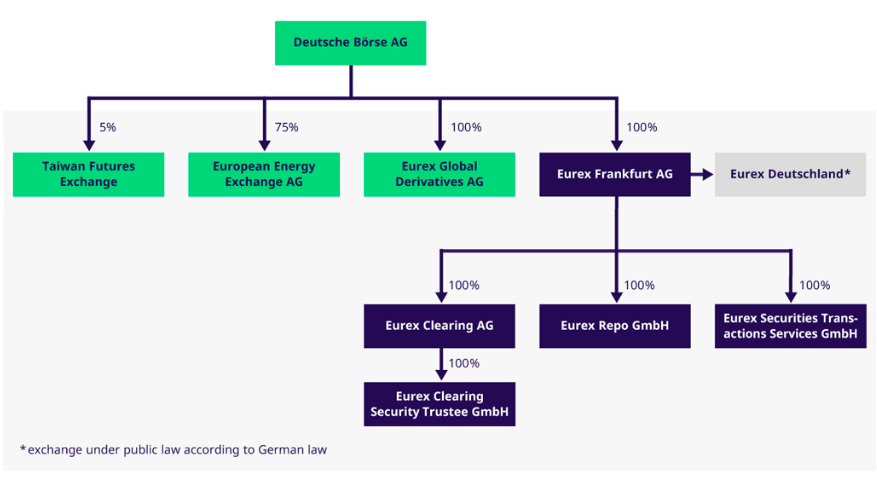

Eurex was founded in 1998 and is a merger of DTB and SOFFEX. Thus, Eurex is a part of Deutsche Börse AG. The aim was to create a joint trading and clearing platform between the German stock exchange and SWX Swiss Exchange. Eurex’s business model focuses primarily on futures trading. In the meantime, the trading volume of contracts is therefore estimated to exceed 2 billion.

Despite its headquarters in Eschborn, near Frankfurt am Main, the Eurex Exchange is also internationally oriented. In 2004, the Eurex US derivatives exchange was launched in Chicago. Therefore, there are basically three different types of Eurex:

- Eurex Germany

- Eurex Global Derivates AG

- Eurex Frankfurt AG

Eurex Frankfurt AG is in turn divided into four segments. These are:

- Eurex Clearing AG

- Eurex Clearing Security Trustee AG

- Eurex Repo GmbH

- Eurex Security Transactions Services GmbH

In the following, we take a closer look at Eurex Clear and Eurex Repo in detail.

Eurex Clearing

Eurex’s clearinghouse acts as an intermediary between banks and financial institutions, ensuring the basic supply of financial systems. This minimizes operational risk for investors and investors.

The clearinghouse enables clearing for various exchanges. These include:

As a financial institution, it is possible to become a Clear Member at the AG and thus benefit from the advantages. Among other things, liquidity is increased and default risks are minimized. For investors, this in turn means that there is less risk of default on exchanges that are members of a clearinghouse.

Eurex Repo

So-called Repos are repurchase agreements that can be traded on Eurex Repo by financial services providers. The range includes German and Austrian government bonds, debt securities, Pfandbriefe, and other products suitable for Eurex trading. Refinancing with European securities is thus guaranteed for financial service providers.

The fulfillment of the service obligation is guaranteed by Eurex Clearing AG.

Regulation and security

As Eurex belongs to Deutsche Börse AG, the exchange is part of a strictly regulated financial market infrastructure. Thus, Eurex stands for transparent markets. Eurex is regulated by the German BaFin. In addition, the guidelines of MiFID (Markets in Financial Instruments Directive) and MiFIR (Markets in Financial Instruments Regulation) are adhered to.

Like any other exchange, Eurex has a set of rules that transparently reflect the regulations governing the day-to-day activities. This can be viewed on the website.

The best brokers for traders in our comparisons – get professional trading conditions with a regulated broker:

Broker: | Review: | Advantages: | Free account: |

|---|---|---|---|

1. Capital.com  | # Spreads from 0.0 pips # No commissions # Best platform for beginners # No hidden fees # More than 3,000+ markets | Live account from $ 20: (Risk warning: 78.1% of retail CFD accounts lose money) | |

2. RoboForex  | # High leverage up to 1:2000 # Free bonus # ECN accounts # MT4/MT5 # Crypto deposit/withdrawal | Live account from $ 10 (Risk warning: Your capital can be at risk) | |

3. Vantage Markets  | # High leverage up to 1:500 # High liquidity # No requotes # MT4/MT5 # Spreads from 0.0 pips | Live account from $ 200 (Risk warning: Your capital can be at risk) |

Asset classes at Eurex

The derivatives exchange is the largest derivatives exchange for derivative products. Trading in options and futures in the form of contracts is therefore particularly interesting for investors. However, options and futures are not the only tradable asset classes at Eurex. The trading offering extends to many more asset classes. These include:

- Interest rate derivatives

- Equity derivatives

- Exchange-traded ETFs

- Energy derivatives in the form of commodities

- Forex

- Volatility index derivatives

Eurex trading hours

Unlike other exchanges, Eurex’s exchange operations have not just one trading period, but four. Namely, the trading hours are divided into periods: The pre-trading, trading, and post-trading periods. The exact trading hours can be found on the website, depending on the product. As a rule, however, the Pre-Trading trading period begins at 7:30 am CET. Meanwhile, the Post-Trading period ends on average at 10:00 am CET to 10:30 pm CET.

Pre-Trading Phase

A pre-trading phase is new for many traders, but it offers great potential. For example, orders and quotes can still be entered, changed, deactivated, and deleted in the Eurex Deutschland system before the opening of trading. This is what you need to keep in mind during the trading phase.

Trading Phase

The trading phase is again divided into an auction phase and continuous trading. In the auction phase, orders and quotes can again be entered, modified, deactivated, and deleted by Eurex. The auction always ends with the conclusion of the clearing process.

Closing Phase

Post-trading can also be referred to as the closing period and is therefore the phase in which the closing price is set. Again, Eurex can enter, modify, deactivate and delete quotes and orders.

Post-trading phase

Once the closing period is over, the closing price is set. In the Post-Trading Period, however, Eurex can again enter, modify and delete orders.

Small conclusion: Trading diversity on the exchange

Trading on the Eurex derivatives exchange is thus very suitable for trading contracts. Private investors need an online broker or a bank where a securities account can be set up in order to participate in trading. This is the only way for them to take advantage of the Eurex offer and to benefit from the variety of derivative products. Thanks to the merger with the German stock exchange, trading is also very secure and can be classified as reputable.

Clearing transactions are a great offer for the exchange segment, especially for financial institutions, but private investors also benefit indirectly from the partnership in clear membership from the broker, bank, or financial institution.

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 78.1% of retail CFD accounts lose money)

Eurex trading platforms introduction

Trading on the Eurex derivatives exchange is available to investors through an online broker or bank. However, to make Eurex trading even more convenient, investors can use the exchange’s trading platforms. While it is also possible to trade directly through the broker, it is often helpful to use trading tools in order to view even better analyses and valuations of the trading instruments being monitored. In addition, it is possible to place an order or a sale directly from trading platforms. The desired contract can thus be bought and then traded quickly and easily.

However, Eurex’s trading platforms are not comprehensive trading platforms like Guidance or similar tools. Instead, they offer custom-fit tools that are useful for trading per contract and are a supplement to the tool from one’s own online broker or a third-party provider.

Eurex trading is therefore supported by a total of two trading platforms:

- Option Master

- Strategy Master Online

These are discussed below and evaluated in the Eurex test.

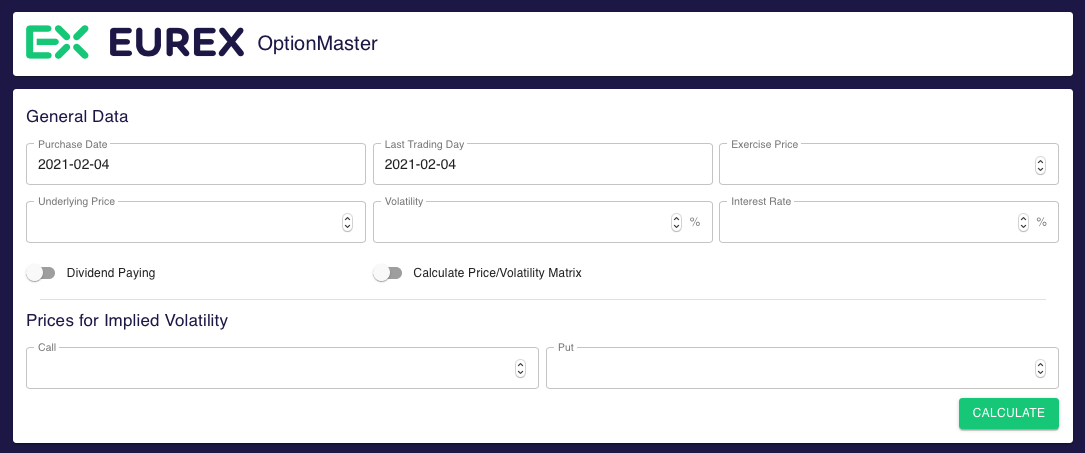

Fact Overview: Option Master

Eurex’s Option Master supports options trading. Investors and traders can calculate options prices and option ratios directly online in the program. Thanks to an integrated matrix, the results are not only calculated but also displayed graphically. This allows investors to quickly see how prices and rates are developing. For further information on options, this tool is therefore very useful.

It should be mentioned at this point that the tool for Eurex trading is available free of charge on the website. Under the Trading and Trading Programs tab, you can access it directly and check your own options without registering.

Fact Overview: StrategyMaster Online

Another tool that is available free of charge is the StrategyMaster. This tool is much more extensive in usage than Option Master, but it is not available for everyone. Although the tool is free of charge, it only supports older Java versions than the current standard. The use of the Mozilla Firefox browser may help to start the trading program.

But what can it do? StrategyMaster Online allows you to simulate trading strategies with futures, options, and other underlying assets. This also includes stocks and interest rate derivatives. Again, data is the basis for the calculation but is also again visually illustrated with a diagram. This allows investors to quickly see whether the desired strategy could be successful. Since this is a simulation and therefore a calculation that does not exist with the purchase in real-time, it must be said that the simulation is only indicative. However, it is not a guarantee that one’s trading strategy will bear fruit.

Tools for trading with Eurex at a glance

In addition to the trading programs, other tools are also available for Eurex trading. These can be taken from the website and also, like the others, can be used free of charge and without registration. A trading tool is characterized by the fact that it facilitates and supports trading – but it does not necessarily have to be analysis tools. Also, tools that provide information or map the trading at Eurex in a scheduled manner are top tools for traders. Based on the results and information, trading decisions can be made.

Selected tools are presented below. You can use them as a supplement to the tools from your broker and thus trade futures and options as well as underlying even better and more strategically.

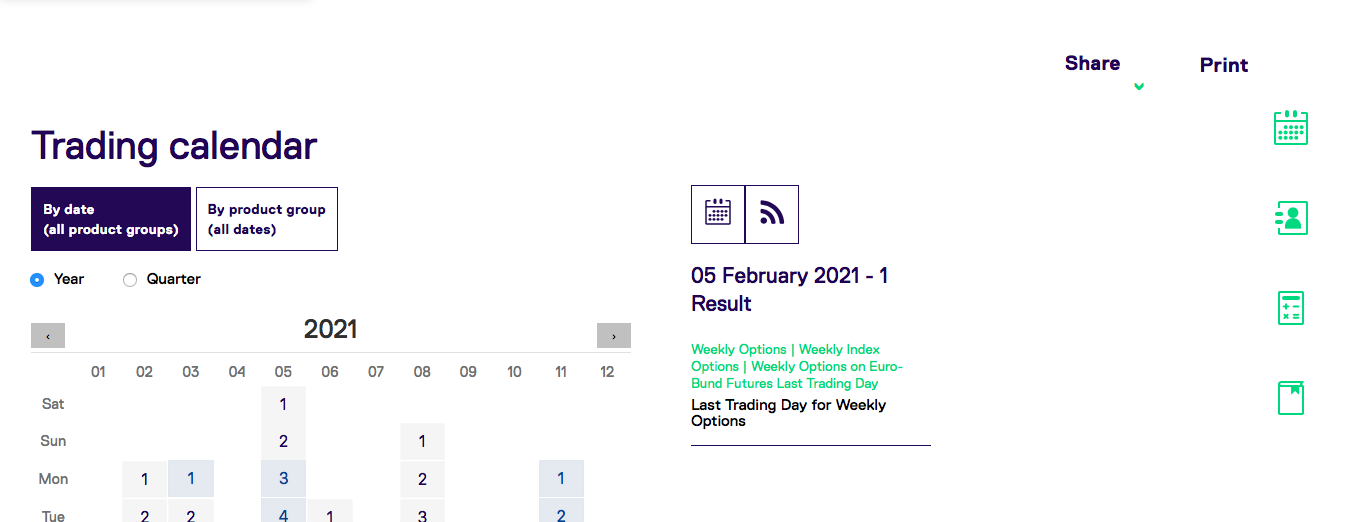

Trading calendar

A trading calendar is a typical tool provided by almost every market. It contains all events and dates that could be important for investors, banks, and brokers. With the Eurex trading calendar, users can view it both per year and quarter. An image of the current day is also available.

In addition, the calendar also offers the option of displaying by product group, so that you can really only see the dates that are relevant to you. For example, if you trade options, you do not have to look at the dates of futures or other asset classes.

Margin Calculators

Banks, brokers, and customers can benefit from Eurex margin calculators. These allow you to simulate the margin requirement at Eurex Clearing and thus have a clear basis for calculation. Eurex offers two tools for this purpose:

- Eurex Clearing Prisma

- Risk-based Margining, RBM for short

Eurex Clearing Prisma is subdivided into the Prisma Online Margin Calculator, the Prisma Margin Estimator, and the Prisma Margin Estimator in Cloud.

Since these tools are rather uninteresting for private investors, they will not be discussed further. Basically, however, these tools are important margin analysis tools for brokers and banks.

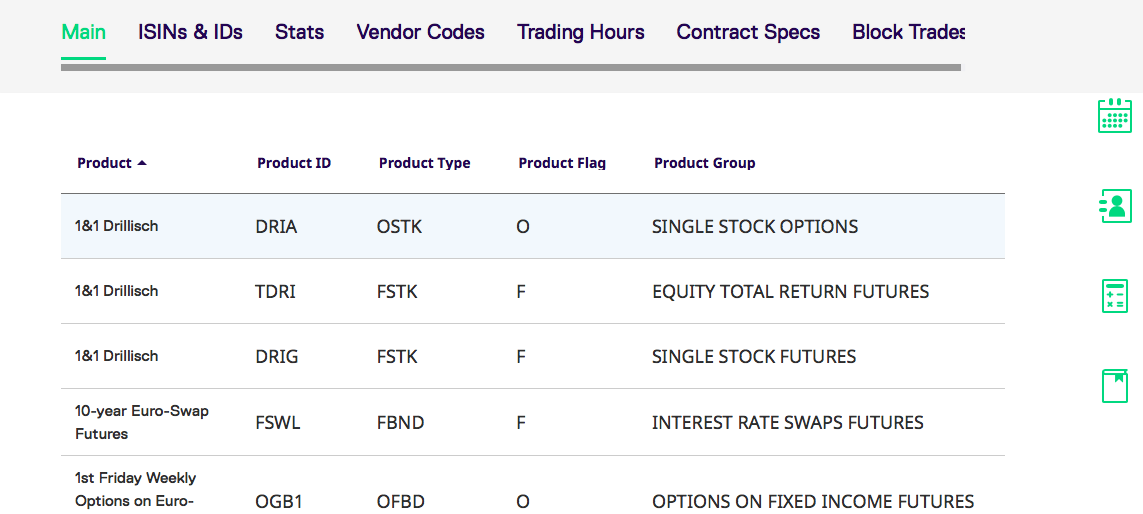

Product search

More exciting for the private investor is the product search. The Eurex product portfolio contains a large number of products from various groups. The product ID, the product type, the product flag, the product group, or the name of the product can be used to search for the product.

search

The products can be searched and filtered both online and via CSV file, which can be called up via Microsoft Excel. The second has the advantage that you only have to search for the products online once and can then find them again and again without an Internet connection.

Another practical aspect of the product search is that the tool provides extensive knowledge. Among other things, you can see exactly the trading hours per product. Furthermore, it is possible to search for

- ISINs and IDS

- Statistics

- Vendor Codes

- Specs

- and Block Trades.

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 78.1% of retail CFD accounts lose money)

News

Why is news about companies and prices important? Quite simply: they are indications of the development of a market. Depending on which press releases a company issues or which trends are noticeable in the market, the prices develop. So if you regularly read and listen to stock market news, you can save money by reducing your own losing trades. It also reveals unexpected opportunities, which in turn can lead to lucrative investments in futures and options or other contracts.

Eurex also offers such on its own website. Visitors to the website from Germany can also read them in German. The English language is also available.

Fees and costs

Without fees, no exchange trading. The game is always the same. So also the order of contact or exchange-traded derivatives costs a sum X in the amount of a fee. In general, Eurex charges a fixed transaction fee for trades concluded off-book via Eurex T7 Entry Services.

However, the price ultimately paid by an investor depends on the particular broker. For example, at the online broker LYNX, trading options and futures cost only 2.00 euros per contract. However, the price is not a benchmark and differs from broker to broker.

However, the pricing of Eurex can be described as fair in the test when the offer is considered towards the private investor.

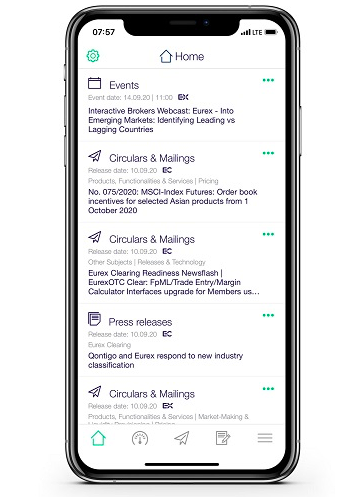

Mobile availability of Eurex

Mobile availability is especially crucial in exchange trading. Price developments do not wait until you are sitting in front of your computer at home again. Quick action is often necessary, even while on the move. In addition, a mobile way of using the offers is often more convenient.

For private investors, it is therefore often crucial that the respective broker also has an app. However, it is also worth checking whether certain exchanges have an app. At Eurex, it is worth taking a look at the App Store or Google Play Store in any case, because there is an app here. The offers that are available on the website can thus also be accessed via the app.

In the app, users even have more options than on the website itself. For example, users can quickly and easily create an account in the app and then personalize the app. The following offers await private investors in the Eurex app:

- Personal Newsfeed

- Production Newsboard

- Service Status

- All information sources in one place

- Calendar entries

- Storage of important news

- Push-up notifications

- Sharing content via social media

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 78.1% of retail CFD accounts lose money)

Support and customer service

For free questions about the Eurex exchange and Eurex trading, investors are also welcome to contact customer support. German investors benefit herein that the company’s headquarters are in Eschborn, making both the time and language convenient for them. However, international investors have no reason to panic either: International customer support will gladly take care of their concerns.

The easiest way to reach support is via the contact form on the Eurex website. The contact form is available for inquiries of any kind. However, if you are looking for direct contact, you should go to the Hotline section in the footer. There you will find telephone numbers and e-mails that are organized by topic and focus. For private investors, the contact options for the Customer Helpdesk Derivatives and Customer Technical Support are the crucial ones. You will find the contact options listed below:

Client support: | Telephone: | E-mail: | Accessibility: |

|---|---|---|---|

Customer Helpdesk Derivatives | T +49-69-211-1 12 10 | monday to friday 1:00 am to 10:00 pm | |

Customer Functional Support | T +49-69-211-10 333 | monday to friday 9:00 am to 6:00 pm |

Further training opportunities

Eurex trading certainly requires some knowledge in dealing with (DAX) futures, options, equities, and other derivative products. Eurex is aware of this and therefore offers various resources to help with individual training. These can be found on the website under the Resources tab. There you will find current news and publications as well as events. All this information can improve your own Eurex trading and supplement your trading knowledge.

However, the webcasts and videos are particularly interesting. There you will find a variety of explanatory videos in English that explain exactly what derivative products are, how to trade them, and other information about Eurex trading.

Conclusion about the Eurex exchange

The Eurex exchange is one of the largest futures exchanges in the world, but it is the largest futures exchange in Germany when it comes to trading derivatives. The trading price per contract depends on the broker. However, there is no transaction fee per contract either way. Eurex customers from Germany and around the world can select and trade derivative products from various product groups and asset classes.

Eurex trading is supported by appropriate trading tools, information, and knowledge content. Even though trading futures and options at Eurex is ideal, other asset classes such as equities can also be profitable. Current prices can also be analyzed in the Eurex app.

Overall, it is well worth buying on the reputable Eurex exchange. You can lose money anywhere, but winning money is of course also possible. However, when trading on Eurex, you should keep an eye on the trading hours, as they differ from other exchanges.

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 78.1% of retail CFD accounts lose money)

FAQ – The most asked questions about Stock Exchange Eurex:

What is Eurex?

Eurex was created in 1998. It is a merger of DTB and SOFFEX. Moreover, it is a part of Deutsche Börse AG. The goal was to combine the trading and clearing infrastructures of the German stock market and the SWX Swiss Exchange. Its headquarters is in Eschborn, near Frankfurt am Main. There are three different types of Eurex: Eurex Germany, Eurex Global Derivates AG, and Eurex Frankfurt AG.

When does the stock exchange Eurex open for trading?

The trading day of Eurex has three distinct segments: pre-trading, trading, and post-trading. At 7:30 am CET, the Pre-Trading period begins. Meanwhile, Post-Trading time typically winds down between 10:00 am and 10:30 pm CET.

How much does Eurex cost?

Eurex imposes a fixed transaction fee for off-book trades via Eurex T7 Entry Services. While broker fees vary, investors can expect to pay at least some of the spread.

Is Eurex available on a mobile phone?

There should be a private investment app available from the brokers. The mobile applications of Eurex are available. So, you can get the same deals that are on the website just by downloading the app. The app provides even more customization choices than the website. Easy account creation means users can start using the app immediately.

See other articles about online trading:

Last Updated on January 27, 2023 by Arkady Müller

(5 / 5)

(5 / 5)