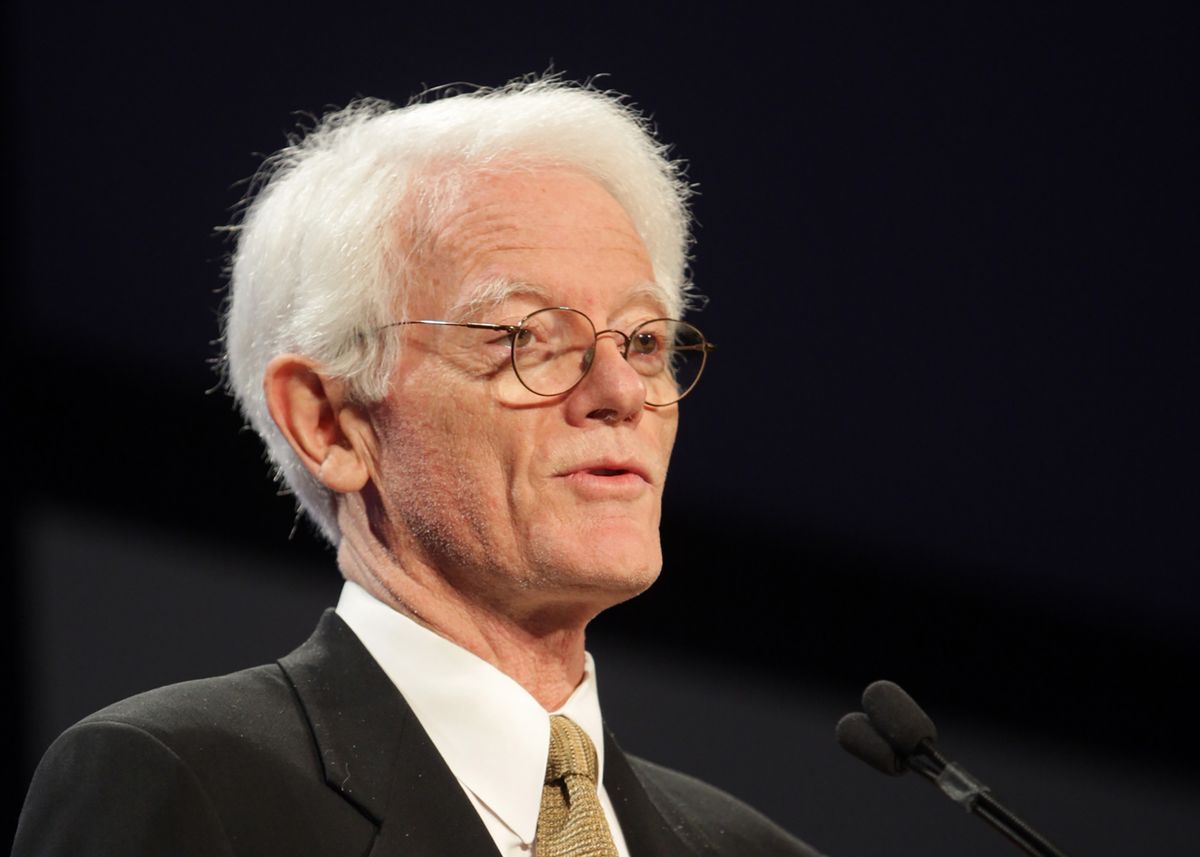

Who is Peter Lynch? – History of the trader and investor

Table of Contents

Any budding trader would like to know the full information about their ideal trader. Peter Lynch is a great trader known for their great net worth. Like every trader, Peter Lynch has a great interest in trading, which he turned into his passion soon.

Peter Lynch has many titles. He is an American business magnate. Also, he is known for his great trading skills and philanthropic activities.

Peter Lynch’s trading strategies helped him manifold his wealth while investing in mutual funds. Here, we will explore Peter Lynch’s trading strategies after discussing a few things about him.

About Peter Lynch

Date of birth: | 19.01.1944 |

Wealth: | 450 million USD |

Strategies: | – investing in mutual funds – a trader should invest in stocks that he can easily understand – a strong follower of the bottom-up approach – a trader should analyze the company’s plan – follow a long-term approach while trading – avoid investing in any ‘famous’ or a ‘hot stock’ |

Website: | |

Interesting facts: | – American business magnate – worked for Fidelity Investments – generate returns equivalent to up to 30% – “One Up in Wall Street” – the book by Peter Lynch – worked as a Caddie – Peter began by trading the shares in his teenage days |

- Peter Lynch worked for Fidelity Investments

- He started his investment career only after he got hired by Fidelity Investments

- During his tenure, Peter accumulated vast knowledge about mutual funds trading

- Thus, he started to invest in mutual funds

- Peter Lynch became so successful in reaching his trading goals that he could generate returns equivalent to 30%

- This return was double that of the S&P index’s performance in the financial world

- Peter Lynch has jotted down his investment strategy in a book, ‘One Up in Wall Street’. In addition, there are two other books that Peter Lynch has published

- The investor has left great trading messages for traders of all ages. His books are compelling reasons why many teenage investors look forward to investing

- The investment strategies of Peter Lynch are the reason why he could amass wealth

- He believes in two-minute drills before a trader considers building his portfolio

Let’s look at Peter Lynch’s biography before we discuss his strategy.

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 75% of retail CFD accounts lose money)

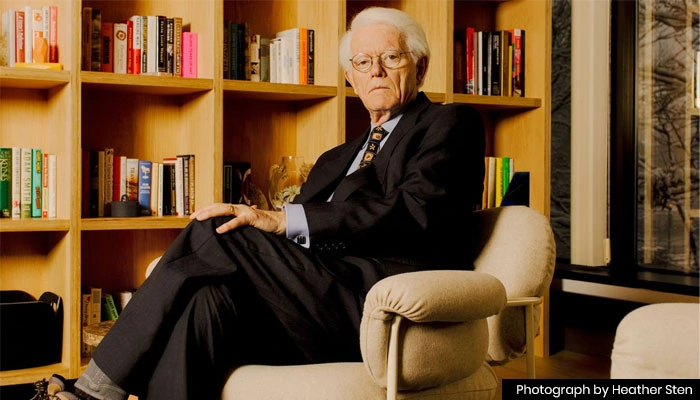

Biography of Peter Lynch

- Peter belongs to Newton, Massachusetts

- The great investor was born in 1944

- When Peter was only 7, he received the greatest shock of his life as his father was diagnosed with cancer

- So, after a torturous life of three years, Peter’s father gave in to cancer

- After this, Peter Lynch’s mother had to tend to the family

- However, Peter worked as a Caddie. He did this to offer support to his mother

- Finally, in his Sophomore year, Peter Lynch had some savings that he used to buy shares

- He invested his money in the shares of Flying Tiger Airlines at 8 USD per share

- Eventually, the stock rose in value later. It went up to 80 USD per share. Peter Lynch made profits by selling off these shares and supported his higher education with these profits

- Later, he graduated and went on to get an MBA degree. Since then, he has started investing

Good to know!

Thus, from a young age, Peter Lynch got his hands on trading. He began by trading the shares in his teenage days. It helped him complete his education and build his investment career further.

The net worth of Peter Lynch

As of 2023, Peter Lynch’s net worth stands at 450 million USD. Thus, it is a great net worth that he has accumulated through trading alone.

Good to know!

The best brokers for traders in our comparisons – get professional trading conditions with a regulated broker:

Broker: | Review: | Advantages: | Free account: |

|---|---|---|---|

1. Capital.com  | # Spreads from 0.0 pips # No commissions # Best platform for beginners # No hidden fees # More than 3,000+ markets | Live account from $ 20: (Risk warning: 75% of retail CFD accounts lose money) | |

2. RoboForex  | # High leverage up to 1:2000 # Free bonus # ECN accounts # MT4/MT5 # Crypto deposit/withdrawal | Live account from $ 10 (Risk warning: Your capital can be at risk) | |

3. Vantage Markets  | # High leverage up to 1:500 # High liquidity # No requotes # MT4/MT5 # Spreads from 0.0 pips | Live account from $ 200 (Risk warning: Your capital can be at risk) |

Trading and investment strategies of Peter Lynch

If a trader knows the trading and investment strategies well, he has a better chance of making profits. Peter Lynch’s trading strategies can guide any trader looking to make money by buying stocks or investing in mutual funds.

Opt for understandable stocks

Peter Lynch suggests that a good trader should invest in stocks that he can easily understand. Also, a trader should have confidence in the performance of such stocks.

Good to know!

Bottom-up approach

Peter Lynch is a strong follower of the bottom-up approach when making the stock selection. The investor believes that a trader should pick a stock one by one and then place his bet after carefully analyzing them.

Analyze the company’s plan

A trader must try to analyze the company’s plan when looking forward to investing in their stocks. If a trader is clear about the company’s plan, it will offer traders directional knowledge.

Traders would know how an asset would perform if they knew the company’s prospects.

Find out how the company does business

When considering an investment decision, a trader should consider how a company does business. Here a trader should try to find the company’s goals in helping their shareholders increase their earnings.

A trader should also consider how the company expects to increase its revenue.

Company earnings

While selecting an asset you want to invest your funds in, a trader must look at the performance. The company earnings can have a significant impact on any trader’s decision. In addition, a trader should look at the yearly earnings and watch out for the trend that a company is following.

If a company’s earnings continuously increase, a trader can expect his investment to grow with that company.

Long-term approach

Finally, traders must try to follow a long-term approach while trading. No company would skyrocket in value in one day. Thus, a trader must believe in value investing.

What can I learn from Peter Lynch?

Traders have tons of things that they can learn from Peter Lynch:

- First, a trader must avoid investing in any ‘famous’ or a ‘hot stock’. These stocks are not profitable for the trader in the long run

- Even though Peter Lynch suggests that a trader should invest in a company with bigger plans, do not invest until the company proves so. A trader must only believe in what he sees, according to Peter Lynch

- If a profitable company is trying to diversify its divisions, it might be a red flag for a trader to invest in such a company

- A trader must look forward to maintaining his edge in the stock market for the long term. It is a known fact that only long-term investments can help traders reap the profit they want

- Peter Lynch suggests that a trader believes in rotation. If a trader looks forward to selling a stock, he must consider buying the stock of another company. However, this company must have a better prospect than the company whose stock a trader just sold

- Finally, a trader should invest in the stock of only that company that passes his entire research criteria

Conclusion about the investing experience of Peter Lynch

Thus, Peter Lynch’s trading journey has many lessons for traders. Peter follows a simple trading strategy which includes assessing the performance of an asset before investing in it.

Thus, Peter Lynch always puts forward research that helps him back his trading decisions. He invests in only such assets that look lucrative in helping him make more money.

So, if a trader wishes to make enough money like Peter Lynch, they can learn a lot from his trading strategies. Besides, the books that Peter Lynch has penned down are also a great helper for traders.

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 75% of retail CFD accounts lose money)

FAQs – frequently asked questions about Peter Lynch

Why is Peter Lynch famous?

Peter Lynch is famous for the excellent trading tactics he implements. He is a great trader who ensures he conducts proper research before investing in any asset. His trading skills help him generate profits.

How did Peter Lynch become rich?

Peter Lynch became rich by trading stocks of various companies. With his excellent trading skills, he could accumulate USD 450 million.

How can a trader trade like Peter Lynch?

A trader can trade like Peter Lynch by following his trading strategies. Also, a trader must try to assess the company before buying its stock.

Last Updated on February 26, 2023 by Yuriy Kunets

(5 / 5)

(5 / 5)