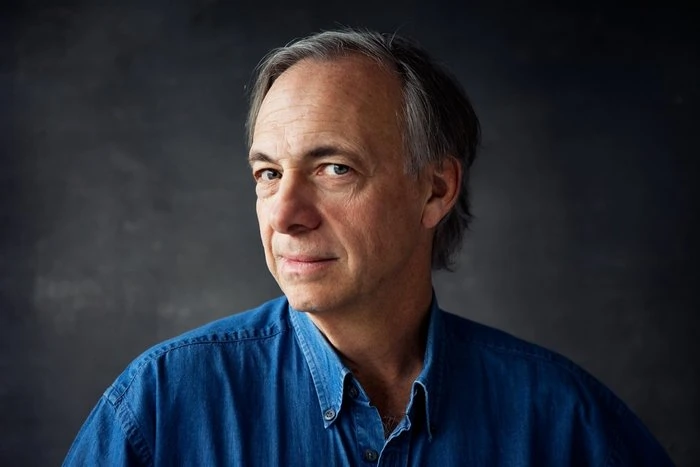

Who is Ray Dalio? – History of the trader and investor

Table of Contents

A big hedge fund, Bridgewater Associates, is run by Ray Dalio. Ray Dalio could muster up the wealth and courage to start this hedge fund after making a fortune by trading. His trading style and knowledge make him special in amassing billions of dollars.

Ray Dalio is a great investor and an even better money manager. Traders can learn and explore so much from Ray Dalio’s trading journey. So, let’s explore more about Ray Dalio.

About Ray Dalio

Date of birth: | 8.08.1949 |

Wealth: | 16 billion USD |

Strategies: | – identifying the trading risk just in time – focus on economic trends – the study of macroeconomic factors – pay caution to inflation – a trader could invest some of his funds in gold – diversification is the way to go when trading |

Website: | |

Interesting facts: | – 36th richest man in the USA – Ray Dalio’s father was a jazz musician – at the tender age of 12, Ray Dalio started trading – Ray’s family had an Italian linkage |

- Ray Dalio hails from America and secures the place of the 36th richest man here

- His investment philosophy is very famous among world investors

- Ray Dalio set up his hedge fund in 1975. Surprisingly, in only 5 years, the hedge fund could generate 5 million USD

- Investor constantly comes up with several innovations in the trading world

- Ray has come up with certain trading principles that help traders even today. These principles are more like innovations that help traders have a competitive edge

- Ray Dalio believes in money management. Even his trading principles focus on managing money well

- The investor has become successful in gathering a wealth of 150 million USD. Interestingly, in the 70s, Ray had his wealth touch 20 billion USD

- It is his trading approach that made him rich

- Ray Dalio chooses his portfolio after careful thought. He had only such assets or stocks in his portfolio that he thinks are worthy of making profits

- Dalio’s investment strategies revolve around 5 key themes. These themes focus on identifying the trading risk just in time

- Usually, Ray Dalio focuses more on economic trends because of his macro investing behavior

Let’s explore some biographical information about Ray Dalio.

The best brokers for traders in our comparisons – get professional trading conditions with a regulated broker:

Broker: | Review: | Advantages: | Free account: |

|---|---|---|---|

1. Capital.com  | # Spreads from 0.0 pips # No commissions # Best platform for beginners # No hidden fees # More than 3,000+ markets | Live account from $ 20: (Risk warning: 67% of retail CFD accounts lose money) | |

2. RoboForex  | # High leverage up to 1:2000 # Free bonus # ECN accounts # MT4/MT5 # Crypto deposit/withdrawal | Live account from $ 10 (Risk warning: Your capital can be at risk) | |

3. Vantage Markets  | # High leverage up to 1:500 # High liquidity # No requotes # MT4/MT5 # Spreads from 0.0 pips | Live account from $ 200 (Risk warning: Your capital can be at risk) |

Biography of Ray Dalio

- Ray was born in NYC

- He completed his education at Harvard Business School

- Ray Dalio launched his hedge fund, Bridgewater Associates, from his apartment room

- By 2013, this hedge fund became quite popular as it grew greatly in value

- Ray Dalio’s father was a jazz musician

- When the investor was just a kid, he had several odd jobs. Sometimes, he mawed lawns or just shoveled snow

- Ray’s family had an Italian linkage

- Later in his life, Ray Dalio started caddying. The Links Gold Club was the first company for which Ray indulged in caddying

- He continued caddying for several people on Wall Street

- Finally, he got in touch with a Wall Street trader, who offered him a job. During summers, Ray Dalio could work at the trader’s trading firm

- At the tender age of 12, Ray Dalio started trading. He invested 300 USD in Northeast Airlines

- Later, the airline merged with another, which helped Ray Dalio triple his investment

- Finally, he studied finance and got his MBA

Good to know!

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 67% of retail CFD accounts lose money)

The net worth of Ray Dalio

The investor and the CEO of Bridgewater Associates manages a net worth of 16 Billion USD. It is the amount that Ray Dalio owns himself. However, his hedge fund manages money up to 150 billion USD.

Thus, Ray Dalio’s net worth undoubtedly makes him a rich American. The great trader is also a great philanthropist. Ray has made several charities throughout his life.

Good to know!

Trading and investment strategies of Ray Dalio

Ray Dalio’s success in the trading world becomes evident from his trading policies. Some important policies that Ray incorporates into his trading regime are as follows.

Study economics

Ray talks about something other than taking up economics as a subject. However, the trader focuses on making some provisions for incorporating the study of macroeconomic factors in your trading strategy.

Good to know!

Check inflation

While implementing any trading move, a trader must pay caution to inflation. Inflation can pose a threat to a trader. Thus, a trader must refrain from diverting all his money in stocks.

Ray Dalio believes that a trader could invest some of his funds in gold instead. It helps prevent any trader from undergoing the risk of draining the real purchasing power of his investment.

Combine unrelated assets

Nevertheless, diversification is the way to go when trading. A trader is likely to diversify his investments if he wishes to avoid making a loss at one time. However, diversification helps a trader only when he builds a portfolio of unrelated assets.

Combining uncorrelated assets will ensure that your investments do not go downhill at one time.

Don’t be biased

While deciding which stock might help you bring profitability, you must ensure biases do not influence your trading decisions. Market trends might make any trader bearish or bullish. However, a trader must avoid feeling or having any directional bias.

Even though trading might involve some bias on the trader’s end, he can still avoid that bias by analyzing the market conditions and the investments he is making.

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 67% of retail CFD accounts lose money)

What can you learn from Ray Dalio?

Investing like Ray Dalio is possible for traders once they understand his trading lessons well. Here are the top Ray Dalio management lessons that help any trader improvise how he trades:

- A trader must try to shield himself from his ego. Trading might inevitably cause him losses rather than profit. In that case, a trader should always be able to reassess his situation and recognize his trading mistakes

- When a trader witnesses any market change, he must try to analyze what causes such market change to occur

- A trader can only sometimes be right, according to Ray Dalio. However, if a trader becomes comfortable with being wrong on his journey to becoming a successful trader, he has a better chance of staying in the long game

- Even if a trader commits a mistake, it is not wrong. However, if a trader does not endeavor to make things right, it might pose trouble to the trader’s further journey

- Ray Dalio suggests that a trader might find several voices interfering with his trading routine. However, a trader must stay confident and not listen to every piece of advice

- Group decisions can be a great part of trading. However, to get the best out of such group decisions, a trader must avoid losing his personality

- If the stock market undergoes any problem, it is usually because of a root cause. So, a trader must try to find its root cause

- Ray Dalio also suggests that traders stay away from Monday morning quarterbacking

- Finally, a trader should always make himself accountable for the trading losses he undergoes and the mistakes he commits

Conclusion about the investing experience of Ray Dalio

Ray Dalio’s trading journey is highly inspiring for many traders. The trader got into trading when he was only 12, which is a big thing. Because of his trading skills, the trader could accumulate substantial wealth when he got into high school.

Ray Dalio had little wealth and started his trading journey very small. However, Ray could add 16 billion USD to his fortune because of his money management skills, making him a rich American.

Ray has showcased his investment skills in his books. A trader can get a hand on these books to learn more about the trading philosophies of Ray Dalio.

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 67% of retail CFD accounts lose money)

FAQs – frequently asked questions about Ray Dalio

Is Ray Dalio rich?

Yes, Ray Dalio is a rich investor who amasses wealth because of trading. As of 2020, Ray Dalio’s net worth is around 16 billion USD. The trader has excellent trading skills, because of which he has made measurable wealth.

How can I trade like Ray Dalio?

The trader believes in putting macroeconomic study to use to identify opportunities. These macro-environment factors also allow traders to ascertain the risk. Thus, a trader should implement it in his trading analysis to see the bigger picture like Ray Dalio.

Is Ray Dalio alive?

Yes, the great investor is alive and manages Bridgewater Associates as a CEO.

Last Updated on February 26, 2023 by Yuriy Kunets

(5 / 5)

(5 / 5)