Which Forex broker is legit? – Regulation and license

Table of Contents

Introduction

The forex industry has grown because of technology and the internet over the past two decades. Financial experts estimate that 6.6 trillion worth of securities is traded regularly. They also advise that there are 10 million traders worldwide.

When you research forex, trading you will get many reviews of scammed forex traders. Before forex regulation got introduced many shady companies were operating as forex brokers.

Thousands of people claim to have lost money from unlicensed forex brokers through unscrupulous means. However, more forex brokers are getting regulated to reduce these cases of scams in forex.

Regulation and safety

There is an increase in forex brokers making profits from forex traders through fraud. It has created the need for regulation of forex brokers. Different government authorities and independent organizations came up with regulatory bodies.

These regulatory bodies got the mandate to reduce fraud in the forex market. Through taming forex brokers that work with traders within their jurisdiction. Forex brokers from one country can access markets beyond their own country.

They have to be registered and regulated with regulatory bodies from the markets they wish to access. Some of the well-known forex regulatory bodies include:

- The National Futures Association (NFA) – United States

- Commodities Futures Trading Commission (CFTC) – United States

- The Financial Conduct Authority (FCA) – United Kingdom

- Securities and Futures Commission (SFC) – Hong Kong

- Australian Securities and Investment Commission (ASIC) – Australia

- China Securities Regulatory Commission (CSRC) – China

- Cyprus Securities and Exchange Commission (CySec) – Cyprus

These are a few of the many regulatory institutions which work in their countries. Any country which allows its citizens to trade in forex and securities has a regulatory body. It is to protect its citizens from getting scammed.

They do this by setting up laws or policies that all brokers that access that country have to follow. It means they have to be licensed by that regulatory body to register forex traders.

Trade from 0.0 pips over 3,000 markets without commissions and professional platforms:

(Risk warning: 78.1% of retail CFD accounts lose money)

Roles of forex regulatory bodies

The regulatory institutions reduce forex cons in a variety of ways. Different countries have different laws that operate in each country. The practices are through:

It registers forex brokers and licenses them to operate in that country. The registered forex brokers permit these regulatory bodies to supervise their services. The regulations ensure that they cannot perform some trading activities within the country.

It monitors the forex brokers’ activities through auditing and reviewing their reports. To make sure that they adhere to the standards kept. It includes the client trading data and trading accounts. Such that the regulatory bodies can keep track of the trades.

Ensuring that the funds of traders are safe in separate accounts. It makes sure that the client funds don’t fund the operations of the forex brokers. The forex traders’ funds get separated from the funds of the forex brokers. Such that the forex brokers cannot use them for their operations.

Another function is to punish those that infringe the laws to protect forex traders. Punishments can be sanctions or banning the forex broker from the forex market.

Which forex broker is legit?

Capital.com is a legitimate forex broker registered to trade in over 180 countries in the world. It adheres to the European Securities and Market Authority (ESMA), rules and regulations.

We have pointed out some reasons why Capital.com is a trustworthy forex broker;

Trade forex with the best conditions and a regulated broker:

Broker: | Review: | Advantages: | Free account: |

|---|---|---|---|

1. Capital.com  | # Spreads from 0.0 pips # No commissions # Best platform for beginners # No hidden fees # More than 3,000+ markets | Live account from $ 20: (Risk warning: 78.1% of retail CFD accounts lose money) | |

2. RoboForex  | # High leverage up to 1:2000 # Free bonus # ECN accounts # MT4/MT5 # Crypto deposit/withdrawal | Live account from $ 10 (Risk warning: Your capital can be at risk) | |

3. Vantage Markets  | # High leverage up to 1:500 # High liquidity # No requotes # MT4/MT5 # Spreads from 0.0 pips | Live account from $ 200 (Risk warning: Your capital can be at risk) |

Capital.com regulation and licensing

Capital.com is a trading broker located in the United Kingdom that is one of the best brokers in the forex market. Regulation is done in Australia with the ASIC, in the United Kingdom by the FCA. In Belarus with the National Bank of the Republic of Belarus NBRB, in Cyprus by the CySec.

It has won many prestigious awards for a fair trading environment for forex traders. It has a trusted record in the forex market, you can confirm it through the documents on their websites. They provide the best trading tools, transparent transactions, and fees.

Safety of clients’ data in Capital.com

In capital.com, all client information gets safeguarded through the PCI data security standards. The trading accounts get checked by top forex financial auditors. It means that Capital.com ensures they provide top-tier brokerage services.

The investor data is well encrypted with Transport layer security. Such that clients don’t have to worry about the safety of their data. Their accounts have a two-step verification process which makes them safer to use.

It has listed the management team on the website, which increases its trustworthiness. A company that withholds the owners would attract skepticism on its credibility.

Free trading resources in capital.com

Trading resources give clarity on whether the trading broker is legitimate or not. Often, legitimate trading platforms have more easy-to-use trading resources, compared to other unregulated brokers.

Capital.com uses the top leading Meta trader 4 trading platform. It offers three types of accounts, the Standard, the plus account, and the premier account. Experts recommend that the Standard account for new traders has a low minimum deposit of $20.

It has a forex spread of 0.6 pips at the lowest. These accounts come with the advantage of educational resources. They have around 70 indicators and numerous charting software. It gives you access to price alerts so you can make better trading decisions.

Its interface is user-friendly and easy to navigate for a new user. It is clear and has a range of features to provide the best trading experience. You can access trading central for trading ideas and views from the experts.

They also give you the latest news on what is going on in the forex market. They have a mobile and a desktop trading platform to suit different traders. Furthermore, they give their active account managers to solve any issues they face.

They have comprehensive news and analysis of the market. They have automated trading platforms which makes forex trading less tedious. It scans the markets for forex signals and trades on behalf of the user. Their Artificially integrated platform makes trading easy for forex traders.

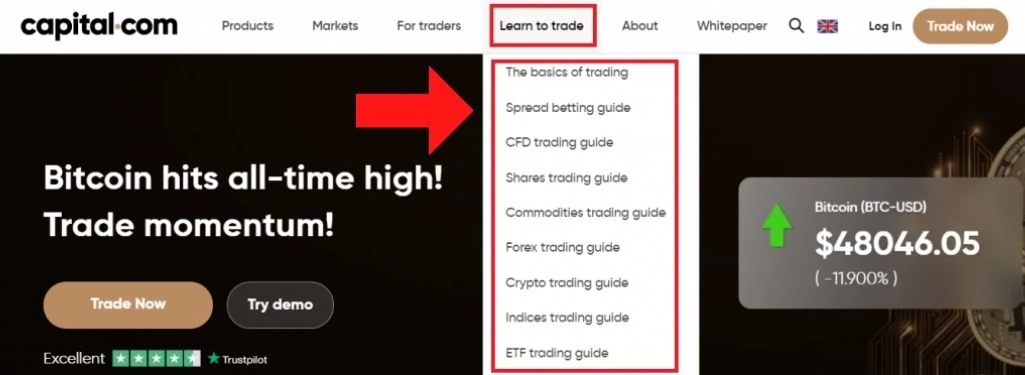

Free educational resources

Capital.com is popular for its educational resources with extensive knowledge of the forex market. They have courses for all stages of traders, from the beginner to the expert level. It has articles and information on tips and areas that forex traders watch.

You can get their educational resources on social platforms like YouTube. There is also a demo account that traders can use for practice. It simulates a trading experience like live trading and is easy to switch from the demo account to the live trading account.

Its educational materials are among the leading resources for forex traders.

Transparent trading fees

Trading charges is an area where most traders get scammed, this is due to unregulated forex traders. They manipulate the charges to profit from forex traders. Capital.com has fees displayed on a trader’s account.

They don’t charge anything for registering an account. They also have no transactional fees when withdrawing or depositing. They don’t charge inactivity fees or commissions on traders. They only charge overnight fees.

The overnight fee is charged on an open position using leverage, and these fees are among the lowest in all forex brokers. They make their profits through forex spreads. They have transparent forex spreads when you decide to trade.

Responsive customer care

It is easy to identify a false forex broker through their support team. They tend to be unresponsive and distant from their clients. Capital.com hires account managers for each client that they have. They deal with any problems that clients have regarding their trading accounts. They are available 24/7 through live chat, calls, and email. They are also on social media platforms like WhatsApp / Telegram.

The support team is present to help, even with the account manager present. They offer services in eight languages. They are fast and responsive within a matter of minutes.

How can forex traders ensure the safety of their funds?

Forex brokers can play a part in protecting their funds. They can do this through enough research on a forex broker before settling for one. There are many social platforms created to review services from brokers.

It is crucial to see what other forex traders say about forex brokers. In that way, you can avoid brokers with negative reviews. Another way is checking whether a forex broker is regulated. These regulatory bodies have websites you can check.

You can check the license of a forex broker through these websites. You can even double-check the license numbers to verify if they are true.

Conclusion

It is the work of forex brokers and forex traders to ensure that their funds are safe. It is to regulate more trading platforms to provide a safe and conducive environment for trading. So far, many trading platforms are regulated.

One such platform is capital.com which is growing fast. It is one of the most trusted forex brokers to get forex broking services. Forex training and access to the best forex trading resources. Start a trading experience by joining Capital.com, where all your funds are secure.

Trade from 0.0 pips over 3,000 markets without commissions and professional platforms:

(Risk warning: 78.1% of retail CFD accounts lose money)

FAQ – The most asked questions about Which forex broker is legit :

Which Forex broker is legit? What are some of the free trading resources offered by the platform?

For anyone looking for the answer to which forex broker is legit, Capital.com is the answer to it.

Educational resources, charting software, 70+ indicators to price alerts, etc., are some of the free trading resources that are offered by Capital.com.

The platform also offers the latest comprehensive news about the market and proper market analysis through their desktop and mobile versions to suit the requirements of different traders. With the automated trading platform, they are definitely trying to make forex trading a lot less tedious.

Which forex body regulates the United States Forex Brokers?

The United States Forex brokers are regulated and controlled by ‘The National Futures Association (NFA)’ and ‘Commodities Future Trading Commission (CFTC).’ These bodies help the citizens to remain protected and not get scammed.

How can I know which forex broker is legit and regulated?

It is important to ensure that the broker is legit and well-trusted to avoid scams. To do so, one can,

Look for the regulatory status of every forex broker individually across the international forex landscape.

Find the license number of the broker. Look for the registration number from the disclosure section provided on the homepage.

Confirm the broker’s public profile (check the entity name) on the regulator’s website to validate the registration number.

Find out the timely audits and reviews of the reports provided by Forex Brokers. Check the rank and rating of the forex brokers across different regulators, etc.

See our other articles about forex trading here:

Last Updated on January 27, 2023 by Arkady Müller

(5 / 5)

(5 / 5)