How to Buy ZCASH (ZEC) – Trading tutorial for beginners and new investors

Table of Contents

Zcash is a decentralized open-source cryptocurrency that provides privacy and transparency for transactions. Zcash is a fork of the Bitcoin protocol based on work done by leading Bitcoin developers. Zcash is an alternative cryptocurrency developed on a decentralized blockchain, primarily aimed at providing integrity-focused digital currencies to users who want anonymity. It not only ensures the anonymity of Zcash users but also protects transactions taking place on the blockchain. The platform does not use intelligence to confirm transactions while maintaining the confidentiality of personal information and transaction data. The blockchain is based on the bitcoin infrastructure and shares a lot of properties with BTC.

What is Zcash?

With the development of Zcash along with the development of Zcash using cryptography, Zcash’s code in the Zerocoin protocol was modified until the final release of Zcash in 2016. Even if Zcash payments are announced on the public blockchain, the sender, recipient, and transaction amount will remain confidential. The privacy features of the blockchain are optional and users can choose their privacy options.

Trade more than 100 different cryptocurrencies CFDs on professional platforms:

(Risk warning: 67% of retail CFD accounts lose money)

Zcash is based on peer review crypto research conducted by a team of security engineers on an open-source platform based on the Bitcoin Core codebase. Confidentiality is considered a significant improvement over bitcoin because it uses zero-information encryption technology to ensure the validity of transactions while maintaining confidentiality. Despite the fact that Zcash is built on the Bitcoin source code (BTC), it differs from Bitcoin in two ways: honesty and efficiency. When funds are transferred to the Zcash blockchain, all network participants are aware that the payment was completed on the public blockchain. Even so, yet nobody recognizes who sent the message, who received it, or how much money was sent!

This is done through a technique called the No Knowledge Test. Technology allows two people to confirm transactions without revealing any personal information! The second reason Zcash differs from Bitcoin is that it performs much faster transactions. Zcash can confirm transactions every 2.5 minutes, but Bitcoin takes 10 minutes, which makes it much more convenient as a global payment system. Zcash and Bitcoin use a consensus model called proof of work, but there are really important differences.

Zcash and Bitcoin use a consensus model called proof of work, but there are really important differences. Despite its similarity to BTC, Zcash offers its users a higher level of integrity, anonymity and convenience. Many cryptocurrency users strive for anonymity which has become rare for a variety of reasons. Zcash is an innovative attempt to provide a safe and practical solution to privacy-conscious users. ZEC stands for Proprietary Blockchain Token, which at the time of writing was around 61.11 dollars with a market value of over 600 dollars a million.

Zcash technology

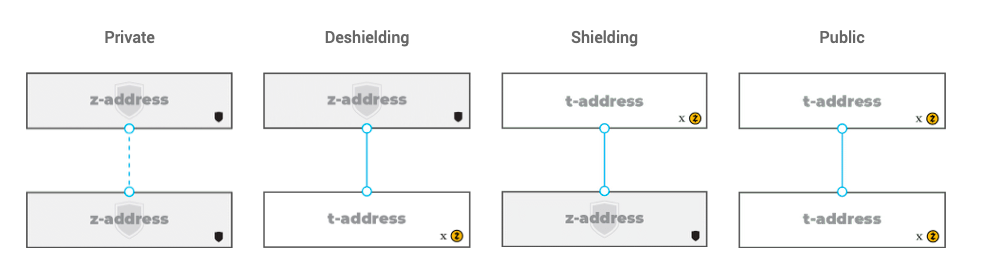

Since Zcash encrypts the content of the selected transaction to keep it confidential and payment information is also encrypted, the protocol uses encryption to verify the validity of the transaction.

For Zcash, a zero-information drawing called zk-SNARK developed by the Zcash team is used. This design allows the network to maintain a secure balance sheet without revealing the parties or amounts involved, and the zk-SNARK protocol does not detect fraud or theft. The basic concept is that Zcash is not very different from Bitcoin, which facilitates public payments, the only difference is that Zcash payments, which are transferred from a transparent address to a secure address, protect the transfer amount. It is also possible to ensure that the transfer amount is not secure and the information is fully disclosed from transparent to transparent.

At the end of 2017, only 4% of Zcash coins were in the shadow segment, but this number is expected to increase as more wallets are developed to support Zcash coins. Like Bitcoin, Zcash has a total of 21 million coins in fixed assets. 20% of the coins produced in the first 4 years will be distributed to investors, developers, and non-profit funds. Zcash was launched in October 2016 and is currently priced at $750 after an increase of 149% since December 1, 2017, and Cash for 2017 at 965%.

Places to buy Zcash?

Before you purchase or buy Zcash tokens, you have to realize that there are many forms. What method you take depends on your money, the underlying asset, and the investment plan you want. The first option is to purchase direct currency. ZEC tokens are a form of cryptocurrency that can be bought, sold, and stored. The second method is to estimate the value of Zcash tokens by utilizing financial instruments to open and close trading locations.

Trade cryptocurrencies CFDs with the best conditions and a regulated broker:

Crypto Broker: | Review: | Advantages: | account: |

|---|---|---|---|

1. Capital.com  | # More than 200 crypto CFD assets # No commissions # Best platform for beginners # No hidden fees # More than 3,000 markets | Live account from $ 20: (Risk warning: 67% of retail CFD accounts lose money) | |

2. Libertex  | # More than 50 crypto CFD assets # Trade with leverage 1:2 # Userfriendly # Fiat deposits & withdrawals # PayPal | Live account from $ 100: (Risk warning: 85% of retail investor accounts lose money when trading CFDs with this provider.) |

If you want to participate in Zcash for the long term, you will believe that ticket prices will increase substantially in weeks or months, so owning ZEC tokens is a great idea. This implies you’ll need to buy famous digital currencies like Bitcoin and Ethereum, then trade them for altcoins like Zcash using a crypto exchange service. To save your currency over time, you’ll need a cryptocurrency that will keep it secure before you sell it for a profit.

If you want to make fast money with Zcash tokens, however, your trading approach is better suited to your investment plan. To do so, you should work with a broker who can use investment products to open and close trading positions for numerous tokens, such as Zcash. These trading platforms make this situation much simpler by allowing you to purchase instruments such as difference contracts (CFDs), which you can easily trade without fear of losing money. This allows you to trade in a much more convenient and cost-effective manner.

How does Zcash trade with CFDs?

For those who want to trade Zcash, another way to take advantage of Zcash’s volatility is through CFDs. CFD is a tool that closely monitors the movement of underlying assets (Zcash in this case). CFD traders do not own any assets and enter into contracts with brokers. Leading brokers offering the Zcash CFD trading platform include IQoptions, represented in 183 regions, with a monthly trading volume of around $11 billion with withdrawals.

Whichever plan you choose, keep in mind that you’ll only invest money that you can afford to lose. The crypto market is extremely volatile and can be financially lucrative, but you can lose all of your money in a matter of minutes. Always control your risk, invest in a diverse range of attractive currencies, and quit when the time comes.

- Local wallets: These wallets are more difficult to use, but they recognize Zcash’s private addresses and were created by the Zcash and Zcash groups. It is significant to regularly back up your wallet. Eventually, swap wallets can be utilized, but they don’t support Zcash’s privacy options, so they ought to only be utilized as a last option, particularly given the swap wallet concerns and hack risk.

- Purchase Zcash with fiat currency: Traders who do not own Bitcoin or Ethereum but would like to buy Zcash in fiat currency can do that on many exchanges that accept US treasury bills and Euros. Traders can buy Zcash (ZEC) with fiat currency through HitBTC. CEX.IO is also another exchange that converts US dollars to Zcash.

Purchase Zcash with Bitcoin or Ethereum

Bitcoin or Ethereum are also viable options for purchasing Zcash (ZEC). You will proceed to the next level if you already own Bitcoin or Ethereum. Most exchanges have fiat currency in the form of Bitcoin or Ethereum. Coinbase is a well-known cryptocurrency exchange where traders may purchase Bitcoin or Ethereum in US dollars. Customer identification is important to Coinbase, so validate your account by phone number, upload a picture of your photo Identification, and confirm your credit/debit card or bank account.

Once you have completed this step, select Buy/Sell from the top menu. Select “Bitcoin” and enter the number or amount of coins you want to use. Bitcoin can be purchased infractions, and the system performs mathematical calculations in local currency for a specified quantity. Review the information you entered, click Buy, and then click Confirm Purchase. If you are in a country where the Coinbase service is not available, you can buy bitcoins on other exchanges such as CEX.IO or Coinmama.

Trade more than 100 different cryptocurrencies CFDs on professional platforms:

(Risk warning: 67% of retail CFD accounts lose money)

Next: Convert Bitcoin or Ethereum to Zcash (ZEC)

Choose Buy/Sell from the menu bar once you’ve finished this phase. Choose “Bitcoin” and enter the desired number or sum of coins. Bitcoin can be bought in fractions, and the device calculates the value in local currency for a given quantity. Review the details you entered, then press Buy and Confirm Purchase to complete the transaction. If Coinbase is unavailable in your region, you can purchase bitcoins on other exchanges such as CEX.IO or Coinmama.

After completing these steps, you will have Bitcoin or Ethereum in your HitBTC or Binance account. Click “Replace”, find ZEC/BTC or ZEC/ETH, enter the amount and click “Buy ZEC”.

How to purchase Zcash from a broker

If you are an investor or short-term trader, you need to choose your broker wisely, taking into account many aspects of the quality of your service. These can include usability, intuitive interface, customer support, charting and trading tools, demo accounts, and high security. It is always a good idea to choose a regulated broker with a good track record.

1. Register with the broker

Once you have chosen a broker, you now need to register and open an account. Most major trading platforms like capital.com only need basic information including name, email address, and strong password. You must use a password that contains a combination of upper and lower case letters, special characters, and numbers. Some brokers may even more conveniently register on the platform using their social media profiles.

Trade cryptocurrencies CFDs with the best conditions and a regulated broker:

Crypto Broker: | Review: | Advantages: | account: |

|---|---|---|---|

1. Capital.com  | # More than 200 crypto CFD assets # No commissions # Best platform for beginners # No hidden fees # More than 3,000 markets | Live account from $ 20: (Risk warning: 67% of retail CFD accounts lose money) | |

2. Libertex  | # More than 50 crypto CFD assets # Trade with leverage 1:2 # Userfriendly # Fiat deposits & withdrawals # PayPal | Live account from $ 100: (Risk warning: 85% of retail investor accounts lose money when trading CFDs with this provider.) |

2. Identity verification (KYC procedure)

This may not seem like an ideal scenario, but it helps investors. Regulated brokers are required by law to apply Anti-Money Laundering (AML) and Know Your Customer (KYC) rules to prevent money laundering, tax evasion, tax fraud, and illegal platform trading. Verifying your identity is not a tedious process, it keeps your personal information and money safe.

Note:

In order to complete the process, the broker will ask for proof of your identity, such as an ID card, driver’s license, electricity bill, or proof of residential address.

3. Deposit using your preferred payment method

Before depositing, you need to choose your payment method carefully. All major trading platforms and brokers offer users a variety of payment options, but the fee structure varies from method to method. Understand how transaction costs work and read the fine print. Think about speed, convenience, and cost before choosing a payment method. Using a credit card, for example, can be a bit more expensive, but deposits are almost instantaneous.

It is also advisable to start trading with a minimum deposit. This is usually between 200 and 500 dollars depending on the platform. Don’t invest a lot of money in your account until you know everything about the platform and have enough confidence to make informed investment decisions.

4. Place the long/short position on the ZEC

A trader called Bears is in a short position and believes that the price of ZEC coins will decline in the future. So they bet on falling prices to make money. On the other hand, investors, so-called bulls, take a long position and believe that the price will rise in the future. Developing an effective investment strategy requires a basic understanding of short and long-term jobs.

After you have a basic understanding of these investment methods, it will be much easier to decide on short-term or long-term investments. Many of the leading brokers we recommend, such as capital.com, offer risk reduction features that you can take advantage of, such as stop-loss and take-profit options.

Trade more than 100 different cryptocurrencies CFDs on professional platforms:

(Risk warning: 67% of retail CFD accounts lose money)

5. Exit the trade

Risk management features such as Stop Loss and Take Profit are designed to prevent handover play. This doesn’t mean you lose control of your transactions. Instead, simply put in a safety net when things don’t match your expectations. This will help reduce losses and secure profits.

If you think the public website has earned enough money, and you feel it is a bit risky to keep it open, you can undo the fetching and closing of the website. Likewise, you can redefine the stop loss if the price hasn’t risen, and you’ve already lost some of your capital.

How to purchase Zcash on the stock exchange

Use an exchange service to store Zcash coins for long-term investments. This is for investors who believe that ZEC ticket prices will continue to rise over the coming weeks and months, or for tech enthusiasts who believe in projects. Before choosing a cryptocurrency exchange, you need to go through an evaluation step and evaluate a variety of features including intuitive user interface, customer support, available payment methods, various cryptocurrencies, transaction costs, and more. You should also be aware of some exchanges that do not meet your requirements and may not be secure.

1. Set up your Zcash wallet

Before buying ZEC, you need to make sure you have a cryptocurrency wallet to keep your tickets secure. It may seem daunting at first, but the cryptocurrency industry has come a long way, and these steps are simpler and more convenient than ever before. You can choose from different types of cryptocurrencies depending on how long you want to store Zcash.

- Exchange/Web Wallet: is a browser-based cryptocurrency wallet that takes the form of a website, add-on, or integrates into your broker or exchange website.

- Software Wallet: As the name implies, it comes in the form of a desktop or mobile application and provides adequate security along with other features

- Hardware wallet: If you don’t want to compromise the security of your funds, a hardware wallet is your best bet. Because it is completely isolated from all networks and has hardware inside to protect your money.

Trade more than 100 different cryptocurrencies CFDs on professional platforms:

(Risk warning: 67% of retail CFD accounts lose money)

2. Choosing and joining a crypto exchange that sells Zcash

When listing on cryptocurrency exchanges, there are many trusted industry-leading platforms including CEX.io and Coinbase. You can buy Zcash tickets from them, but before choosing, make sure you have chosen the ticket that suits your needs. Some exchanges may require detailed personal information and large deposits, while others have easier transaction fees. Before registering, you should review the pros and cons of each exchange. If the exchange is regulated, you will need to prove your identity by providing proof such as a driver’s license or passport.

3. Choose a payment method to purchase Zcash

With the process of choosing an exchange, it’s time to evaluate the different payment methods offered by the platform of your choice and decide which method best suits your goals and investment strategy. For example, you can buy ZEC tickets by choosing bank transfer, debit or credit card, and other electronic payment methods, but first, you need to find the right balance between speed, convenience, and transaction cost.

Note:

Some cryptocurrency exchanges do their best to make it easier for users to use and offer the option of including a bank account in their exchange account. This will give you access to your bills for easy access at any time.

4. Place a purchase order for Zcash

To buy Zcash currency, you can use any popular currency such as Bitcoin or Ethereum and exchange it for Zcash as you like. Some exchanges may sell ZEC tickets directly for regular cash, while others may not. First, you need to choose the fiat currency in which to deposit your money. The calculator will tell you how many ZEC tickets you can get with that amount. After completing these steps, you can submit your purchase order.

If you’ve enabled two-factor authentication, commonly referred to as 2FA, you’ll receive an OTP that you need to access before processing your transaction. This provides greater protection.

5. Safely store Zcash in your wallet

As the investment strategy is long-term, it is not wise to leave ZEC tokens in the wallet or change accounts. Although relatively secure, it is at high risk for cyber-attacks and technical issues. This is why it is so important to transfer Zcash to a dedicated cryptocurrency wallet. Just enter your public key and your coins will appear in your wallet. However, if you have two-factor authentication enabled, you will need to re-enter the OTP to receive Zcash transfers.

Trade more than 100 different cryptocurrencies CFDs on professional platforms:

(Risk warning: 67% of retail CFD accounts lose money)

Would you like to buy or buy Zcash?

Buying and trading Zcash are two completely different investment methods. If you want to keep it for a long time or if you believe in your project, you should buy Zcash. However, to take advantage of Zcash’s price volatility, it is best to trade ZEC through the CFD brokerage website.

What is the difference between Zcash exchange and broker?

The Zcash cryptocurrency exchange is a digital platform that allows traders to buy the most popular ZECs like Bitcoin and Ethereum. This is why these platforms are called cryptocurrency exchanges. If you use the long-term investment method, you should choose an exchange because you sell, transfer, sell and hold ZEC coins that you are entitled to own.

Conversely, if you want passive income to supplement your main income, trading is your best bet. To trade ZEC, you need to choose a crypto broker that can quickly buy and sell ZEC financial instruments such as futures, options, and CFDs. In this scenario, you can expect a return due to the unpredictability of the cryptocurrency market.

Long and short investment

If you want to invest in ZEC over the long term or support project development, you should only invest if you are confident that the coin price will continue to rise over the coming weeks. Cryptocurrency exchanges are better because you can buy and own ZEC tokens if you follow a long-term investment strategy.

However, if all you need is a short-term profit, trading with ZEC financial instruments is a much more efficient way to manage than owning cryptocurrencies. You can make money using market volatility, but to make money, you need to buy and sell in a timely manner. This method does not require you to create a custom wallet and does not reduce your transaction costs.

Advantages and disadvantages of buying Zcash

Benefits:

- Managed Personal Information: Zcash offers a compromise between maximum personal information and unlimited access. In a world where safety is an issue, this is an advantage. You can choose which transactions to track and which transactions to perform privately.

- Listed on Gemini: Gemini is one of the highly regulated exchanges in the cryptocurrency world. It contains a very small number of cryptocurrencies, most of which can generate long-term profits. Zcash is one of the few privacy coins on the platform. This not only proves the potential of the money but also shows that it meets the requirements of some authorities.

- BOLT: Zcash plans to start trading BOLT (Blind Light Weight Offline) to eliminate high computational requirements for private transactions. We hope it makes economic sense to use secure Zcash transactions, which account for only 12% of ZEC’s total transactions in 2019.

- Signal value: Every successful cryptocurrency has symbolic value. As secret coins, most of them used ZEC coins to support the defense of Julian Assange, CEO of WikiLeaks. This move gave the currency a sign of freedom and opposition to dictatorships and neoliberalism. Some may not like it, but Zcash will have a loyal user community.

Minus:

- Similar to competitors: The public blockchain works similarly to Bitcoin. Secure transaction services are also facing fierce competition with Monero and DASH. Worse, Ethereum and Bitcoin are planning to create a private blockchain.

- Limited purchase options: Like most future coins, Zcash cannot be purchased on most exchanges. On most platforms, you have to trade other cryptocurrencies that require additional transaction fees.

What is the Zcash purchase fee?

When buying Zcash on a stock exchange or broker, the following fees apply: Fair value varies from platform to platform.

- Transaction Fee: This is a fee charged by the stock exchange or brokerage platform for each transaction. Some exchanges apply a fixed rate, while others charge different rates depending on market factors.

- Deposit Fee: This is the amount charged for each deposit. Most reputable exchanges like Coinbase do not charge deposit fees.

- Withdrawal Fee: Each platform charges a certain percentage when withdrawing from the platform. This is the standard for the entire cryptocurrency industry. Spreads and commissions: common on trading platforms. It is between 0.2% and 1%.

3 tips for buying Zcash

Now that you have a basic understanding of how cryptocurrencies and swaps can be used for various investment methods, here are three very useful tips that will help you manage your risk much more efficiently and make your investments much safer. Keep these important points in mind when investing in Zcash.

- Choose the right time and do your own research: To get the most out of the fluctuating market, you need to buy and sell Zcash tickets in a timely manner. By reading all the guides and materials available on our website and getting the latest coin information, you can develop your investor’s intuition. Rumors can also raise or lower the price of the cryptocurrency market.

- Zcash purchase cost comparison: If you can’t control the cost of the transaction, you can eat up to 30% to 50% of the final result. Many new investors face high transaction costs. Make sure you include everything including spreads, commissions, exchange fees, deposit/withdrawal fees and storage fees. The associated costs can quickly add up to eat the final result.

- Security: When trading with Zcash or any other cryptocurrency, you need to understand that not everything is done for you. For example, you should try to keep your coins safe by choosing strong crypto using 2FA and expressions.

Trade more than 100 different cryptocurrencies CFDs on professional platforms:

(Risk warning: 67% of retail CFD accounts lose money)

What is the best payment method to buy Zcash?

Buy Zcash with cash. First, you need to buy bitcoins for cash through an ATM and then exchange them for ZEC. Buying Zcash with a credit/debit card is a bit more expensive, but it is one of the most popular payment methods for buying ZEC. Zcash purchase via bank transfer-the transaction cost is very convenient and reasonable. However, it is slow compared to other payment methods. For example, you can buy Zcash with PayPal-a fast and efficient payment method, but with limited availability.

The above method is the most practical and economical for buying Zcash and trading ZEC on multiple platforms. Now, after reading this detailed guide, I am willing to buy ZEC and invest in other coins. This guide contains less popular options that you can use to buy Zcash:

- Peer exchange (P2P) is a website or platform that connects cryptocurrency sellers and buyers. It is not listed on the stock exchange and can be purchased directly from individuals. However, you should make sure that you have verified your personal information with reviews and transaction history. P2P trading is not only convenient and versatile, but it is also very economical.

- Since Zcash tokens are mined, they cannot be obtained during the mining process.

We are working hard to keep you up to date on all coins, including Zcash, and we will keep updating this guide as new news, updates and ticket information become available.

Conclusion: Trade Zcash through different options

Zcash is a lucrative way to invest money in cryptocurrencies. Cryptocurrencies are of course very volatile, but there is hope that Zcash is a good alternative to Bitcoin, not least because the two currencies are very similar and Zcash is not yet as highly valued compared to Bitcoin.

To buy Zcash, you can choose from several options. We recommend buying Zcash through the broker capital.com. However, other brokers, as well as cryptocurrency exchanges and markets, are also available. The offer is refined by suitable pricing models and conditions. Traders should always pay attention to their own security when buying Zcash and store the cryptocurrency in a secure wallet afterward.

Trade more than 100 different cryptocurrencies CFDs on professional platforms:

(Risk warning: 67% of retail CFD accounts lose money)

FAQ – The most asked questions about Zcash :

How good is Zcash?

Zcash is a cryptocurrency that wants to offer its clients greater privacy features by implementing cryptography methods than other cryptocurrencies in the market, like Bitcoin and Ethereum. The codebase of Bitcoin forms the basis of Zcash. After multiple research, analysis, scientific algorithms, and predictions, it has been found that Zcash has successfully managed to secure a spot in the top ten most successful cryptocurrencies in the world.

What is the use of Zcash?

People use Zcash for its top-class features that protect our privacy. It is a science-built cryptocurrency that helps people to make transactions efficiently, with low fees. Zcash maintains the confidentiality of all transactions. It also gives people the option to share transaction and address details with the people they select to meet the terms of regulatory and auditory compliance.

When was Zcash created?

Zcash was created by Zooko Wilcox, the CEO of ECC (Electric Coin Company), in 2016. Currently, Zcash runs as an open-source project under a private company with a supply of a total of 21 million coins.

Can you mine Zcash with a computer?

Yes, a miner can easily mine Zcash at home, and all they require is a computer with a good graphics processing unit (GPU). To do so, you will first need to download the related software that would help you control your hardware.

Read our similar blog posts:

Last Updated on November 14, 2023 by Andre Witzel

(5 / 5)

(5 / 5)