How to withdraw money on Admirals – Withdrawal tutorial

Table of Contents

Admirals or Admiral Markets is accountable as the household brokerage platform in Europe and the UK. The platform is destined to implement the best trading conditions and technology for traders from all across the world.

The broker also offers a brilliant service level to all of their customers. They are mostly praised for their withdrawal speed, overall transaction processing, and other features.

The traders prefer to choose the Admiral Markets or Admirals for their investor education system and MetaTrader facilities. They have the Supreme add-ons and have an extensive range of assets such as CFD markets, forex, shares, and premium research content.

This helps beginner traders get hold of the platform and the trading psychology. With this knowledge and skill development, they can eventually leverage the maximum potential of Admirals.

They have over 90,000 users active over their platforms as of today. And they have the system to offer their productive services globally, even outside of the UK. They have their regional offices even in Estonia and Australia.

The company started its brokerage platform in 2001 and has maintained the proper registrations with relevant regulators, such as FCA and CySEC. All of the traders within this platform will have the consumer protection offered by these agencies.

Most beginner traders have a simple question about how they can withdraw their funds. The deposits are often easy to understand over the trading platforms, but the withdrawals are often hidden with charges.

This is the common scenario for most brokerage platforms out there in the market. And with that impression, the beginner traders are also willing to know the Admirals withdrawal procedure of Admirals to go ahead and start their trading journey.

Therefore, this article intends to educate beginner traders on how they can use this platform for seamless trading aspects. This post focuses on the Admirals withdrawal on priority because that is what you searched for today!

But, you will also get a summarized glimpse at what this platform is and how it has embarked on a great reputation within its established competitions.

Getting started with Admirals

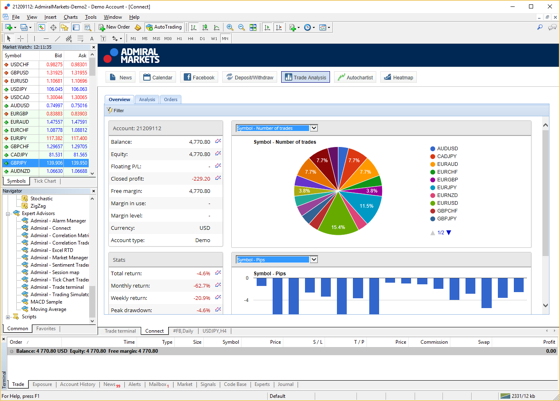

Before you go ahead with the prime topic, it would be best to understand what this platform offers and demands to/from you. The Admirals brokerage platform allows you to set up a demo account first.

This account will help you get familiarized with the platform and the trading features available within it. The professionals who turn up to this platform might skip using the demo account, as they already know the necessary trading strategies.

But the beginners who are new to trading and even Admirals must count on using the demo account. The demo account reflects the real-time market, and the graph of assets also represents the real-time fluctuations.

The only difference is that you will not be depositing any of your real funds but will use the virtual funds to trade assets over a demo account. You can strategize your investments over here and take all possible risks to predict your future in trading assets.

When you are ready with your skills and knowledge, it is time for you to head to the live trading account. You need to make a minimum amount of deposit of $200 to get started with your live trading account.

Many brokers demand more for you to enter into the account and start trading. $200 is still a nominal amount! This platform’s services are multi-lingual, which means they are available in different languages.

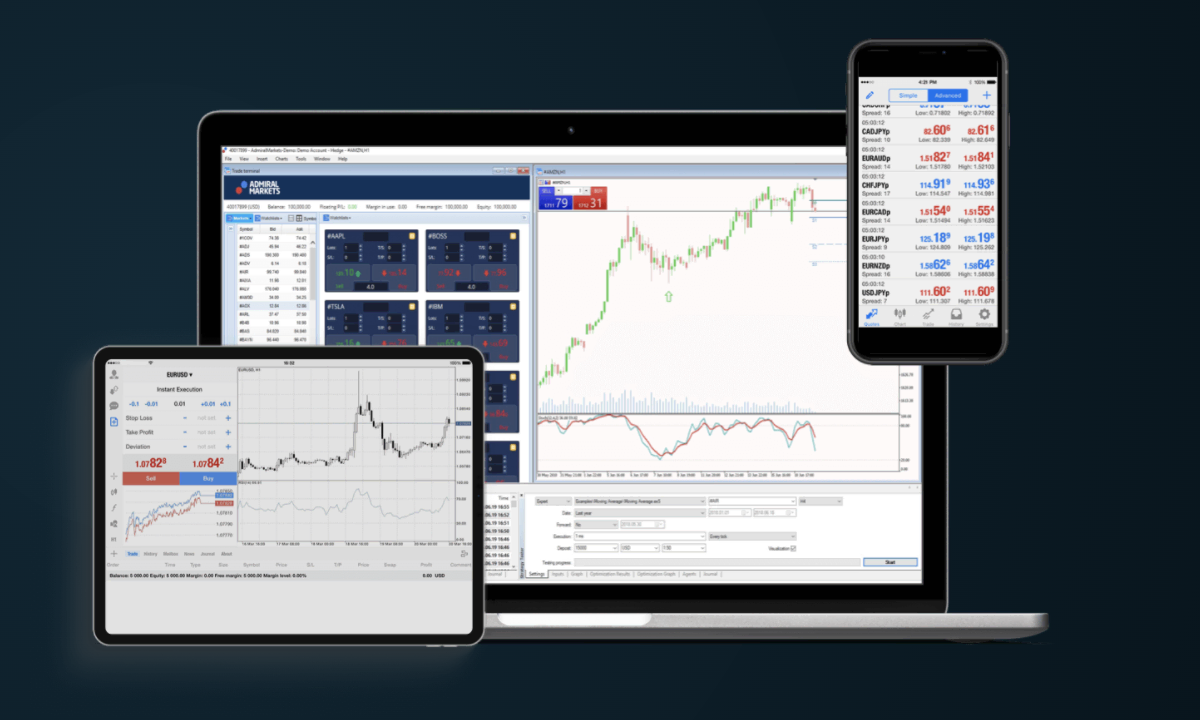

All users can make up their deposits through different payment processors of their preference. Hence, this is the ease that the beginners get with Admiral Markets; for their brokerage needs, Admiral Markets offer MT4 and MT5 platform, which are the two current and popular versions of the popular online trading platform.

Moreover, they also have the custom Web Trader platform for the traders who would like to explore the trading features through their web browsers on the desktop.

The traders also get the mobile application in iOS and Android for better usability. Hence, this application comes up with some very neat features which come with an optimal variety of automatic trading tools.

These automatic trading tools are destined to help beginner traders and professionals for marking up asset movements, analyze the market, and make strategic investments. You get to trade with Indices, Stocks, Cryptocurrencies, Commodities, and Forex.

Markets | Number of Instruments |

Forex | 50 |

Indices | 43 |

Stocks | 3352 |

Commodities | 28 |

Cryptocurrencies | 32 |

Apart from that, Admirals offers bonuses on initial deposits of over $15,000. The brokerage platform has not revealed the exact amount of bonus that it offers to the traders upon their deposits.

The amount keeps on varying, depending upon the market demands and scenarios. There are no such fees imposed upon the Admirals withdrawal. But there is a deposit fee of 0.9% only with Neteller and Skrill payment methods.

The minimum deposit of $200 is for the Trade MT4 & MT5 and Zero MT4 & MT5 accounts. The Invest MT5 account comes with a minimum deposit of $1. Hence, this is the ease of trading that you get with Admirals. You will know more about the withdrawals and their fees later in this article!

How to withdraw money?

If you are willing to withdraw capital or profit from your Admirals account, you need to provide the withdrawal insistence from the Client Area. The platform allows you to make withdrawals through the same payment methods that the clients used for making their deposits.

Hence, this makes it convenient for the investors to access all of their funds at any possible duration. There are no Admirals withdrawal fees over the platform, which is very unlikely for most competitive brokers.

But, if the client makes a withdrawal to their e-wallet, there will be a nominal charge. The withdrawal time varies depending upon the method of payment you choose. The below table will elaborate upon the withdrawal time and fees for the different methods.

Payment Method | Withdrawal Time | Fees |

Credit Card | 1 day | Zero |

Skrill | 1 hour | Zero |

Neteller | 1 day | Zero |

Bank Transfer | 3 days | Zero |

PayPal | Instant | Zero |

As per the reviews available over the internet for this platform, the traders have mentioned that they didn’t encounter any such problems while withdrawing their capital funds or profits.

So, you can rely upon this platform if withdrawal is your prime concern. You will know more about these payment methods in the next section of this article.

Payment methods

The payment method you used for both depositing and withdrawing the funds. But if you want to switch to alternatives, then here are some other options and their criteria for making the withdrawals:

#1 Bank transfer

You might want to withdraw your profits and capital funds directly to your bank account without commission fees. With Admirals, it is possible as it allows you 1 free withdrawal every month.

There are currency options that you can request a withdrawal for. Depending upon the residence country, you can withdraw funds in currencies EUR, USD, BGN, AUD, HRK, PLN, and others. It might take around 3 days to process the bank transfer withdrawal request.

#2 PayPal

It is a very popular method of transaction in Admirals. People prefer this method for the ease of receiving funds directly to the linked bank account. The currencies that you can seek Admirals withdrawal with are EUR, USD, CHF, GBP, HUF, CZK, AUD, SGD, PLN, and others.

You can withdraw the funds without putting up any commission or fee. With PayPal, you get 1 free withdrawal request every month. Anything more than that will have a nominal charge.

#3 Neteller

The Admirals brokerage platform allows the traders to withdraw funds through Neteller for free. The deposits through this platform have a 0.9% fee, but the Admirals withdrawal is completely free.

But, the restriction is that you can withdraw only two currencies through this method, including GBP and EUR. The currency limitation is the same for both deposits as well as withdrawals. Even with Neteller, you get 1 free withdrawal request every month.

#4 Skrill

It is another popular withdrawal method that allows traders to withdraw funds using select currencies. GBP, USD, PLN, EUR, BGN, HRK, HUF and others. There is no specific fee for withdrawing with this method, and it is a fast method that settles the payment in just 1 hour. The count of free withdrawal requests per month is 1, the same as all other methods.

#5 Credit card

You can also get your withdrawals directly through your credit card. The money will be sent to the bank account linked to the card. If it was the original mode of payment in the first place, then you will be asked to pick it as a default option, which will make withdrawals even easier for you.

The best thing is that you don’t have to pay any fees for the same, but you need to wait for the day to see the amount reflected in your card or bank account.

So, these are the payment methods that you might use in the pursuit of withdrawing your deposited capital or earned profits. In either way, the concluding factor is that the withdrawal aspect of Admirals has been designed to make the traders attain peace while depositing and investing over the platform.

Depending upon the platforms, the minimum deposit amount is mostly specified as $1, and the maximum amount for most methods is $10,000. It varies depending upon the various payment methods available with Admirals. So, it is better to check them out before proceeding with the withdrawals.

Fees embedded upon the Admirals brokerage platform

So, you have the answer to your prime question that drew you to this article. But, if you have an urge to get a brief into all types of fees that you might have to pay within the Admirals platform, then here is the table for your reference.

This table will try to cover all types of charges that are being taken over the platform to give you a scope of taking a better decision. The table is as follows:

Account Types | Minimum Deposit | Charges/Commissions/Fees |

Trade MT5 Account Type | $250 | $0.02/share for Single Share and ETF CFDs. No commissions on other instruments. |

Invest MT5 Account Type | $1 | $0.02/share for Stocks and ETFs. |

Zero MT5 Account Type | $250 | Forex & Metals – from $1.8 to $3.0 per 1.0 lotsCash Indices – from $0.05 to $3.0 per 1.0 lotsEnergies – $1 per 1.0 lots |

Trade MT4 Account Type | $250 | $0.02/share for Single Share and ETF CFDs. |

Zero MT4 Account Type | $250 | Forex & Metals – from $1.8 to $3.0 per 1.0 lotsCash Indices – from $0.05 to $3.0 per 1.0 lotsEnergies – $1 per 1.0 lots |

If you have made over 10 transactions of significant sizes in every quarter in the last year, then you might be eligible for becoming the Admirals Pro. For that, you will also need a portfolio of financial instruments of over $500,000.

This is the request that will make you a professional-client. If you meet the criteria, you will get the approval email, and you can enjoy the benefits of the professional services of this platform.

Some of the features that you get as a professional-client are:

- You have no leverage restrictions.

- You get the negative balance protection

- You get all sorts of communication and risk warnings

If you have prior experience in the investment arena of financial instruments, then you can right away get the confirmation of Admirals Pro from the initial stage. There is no additional chargeable fee by the platform for upgrading you to the Professional Services.

Conclusion

Hence, this is the complete elaboration upon the withdrawal service of Admirals. Along with that, this review guide also covered a basic insight into what Admirals have to offer as a whole.

This trading platform has a user-centric interface that helps you earn good bonuses and higher profit margins. Make sure you have read all of the policy rules and regulations before you start using this platform.

You also get a demo account to practice your skills and expertise in trading assets. You get virtual funds to try your strategies and take all the possible risks without fear of loss. When you find yourself confident enough to take on the market fluctuations with your real money, you are eventually set for earning good profits.

FAQ – The most asked questions about withdraw money on Admirals :

How long will my withdrawal be pending on Admirals?

It depends upon the method of payment you choose for your withdrawal process. Some payment modes allow you to get instant withdrawals, while some take a day or more to process the funds.

The financial process works backstage—the website and this article detail which payment method takes how much time to process the funds. Have the patience to wait for the given tentative period to reflect the funds in your bank account.

If the mentioned time exceeds and you still haven’t received the payment, you can contact the customer service of Admirals to check the same and do the needful. The customer service department is very prompt, and you will have the best solutions in no time.

Which method is best for making withdrawals over Admirals?

Again, it depends upon the preferences of traders to decide which withdrawal method suits them the best. Some traders want instant payments for which they use Skrill and Neteller as their prime mode of withdrawals.

But some of the other traders do not want to go through these third-party payment applications and want direct bank transfers. Such people are ready to wait for a couple of days to get the payment, but they want it directly into their account.

Some people do not even bother to consider the alternative payment options, as they seek to get withdrawals on their original deposit mode. This is a hassle-less mode of withdrawal that doesn’t ask you for your credentials again and again.

The credentials you fed at the time of deposit will be used for processing the profits and capital back to the same linked account.

Is Admiral markets a good broker?

Admiral Markets is accountable as one of the most popular brokers of all time and has a popularity score of 83/99. It is not publicly traded and doesn’t operate any bank.

It has the authorization of two tier-1 regulations, two tier-2 regulators, and zero tier- 3 regulators. Admiral Markets is a trustworthy platform for beginners and professionals to trade their desirable stocks.

What payment methods are available for Admirals withdrawal?

There are several payment methods for clients seeking Admirals withdrawal. For example, you can use bank transfers to withdraw the profits and capital funds directly from your bank. And you are not required to pay any charges, commissions, or fees. Also, you can use Neteller or Paypal to withdraw your money for free. Skrill is another famous withdrawal method. Plus, it is a fast process that settles the amount in just 1 hour.

Can a trader withdraw funds from Admirals using a different payment method than the one they utilized to deposit?

No, the trader must use the same method for Admirals withdrawal that he used for making a deposit. The broker will allow you to use a similar payment method. However, if, due to any reason, a trader cannot use the same payment method, he can get in touch with the efficient customer support of Admirals.

What problems does a trader encounter while making an Admirals withdrawal?

A trader can encounter several problems while opting for Admirals withdrawal. For instance, you might be able to make an Admirals withdrawal because of insufficient funds in your trading account. Additionally, traders who request withdrawals via another mode of payment than the one they used to make deposits may encounter difficulties.

See more articles about forex trading here:

Last Updated on January 27, 2023 by Arkady Müller