Alpari minimum deposit: How to deposit money

Table of Contents

Alpari International provides a variety of live trading accounts from which to pick. Each one provides investors with unique chances and allows them to trade in various ways. Check out the features of their Standard, Pro, Micro, and ECN Accounts to see which one is right for you. Whether you’re new to currency trading or have a lot of market knowledge, their account selection allows you to experience the forex market in the best way possible.

How to deposit money?

Every investment entails some level of risk, and that is why newbies should experiment on their demo accounts first. Alpari offers a variety of risk-free accounts, giving you the freedom, space, and security to hone your trading abilities in an environment that mimics factual market circumstances while posing no danger to your money.

How do you deposit money into your Alpari account?

- In MyAlpari, go to ‘My Money’ on the left arm side of the menu. Select ‘Deposit Funds’ from the dropdown menu.

- Select a card deposit solution that corresponds to the sort of card you’ll use to make the deposit.

- Select ‘Account’ and the trading account you want to fund from the dropdown menu. Make sure you select the currency you wish to trade in and enter the amount you want to deposit.

- Complete the remaining fields on the form (if appropriate) and click ‘Confirm’ to continue.

- Before clicking ‘Submit,’ take a minute to review all of the information you’ve entered. You’ll then be routed to a payment processing page, where you’ll enter your credit card information.

- If you want to check the status of your deposit, go to MyAlpari History.

Before you make your deposit, there are a few things you should know

When making a deposit, it’s crucial to keep the following in mind:

- Alpari does not take payment from third parties.

- They will require a color duplicate of both sides of the Mastercard as a portion of the deposit process. They recommend hiding all the credit card numbers on the front to save the last four numbers. For added security, they recommend covering the CVV code (the last 3 digits found on the back of the card). The rest of the document must be legible, and the back should be signed.

- Alpari only accepts deposits in the following currencies: USD, EUR, and GBP. If you pay in a currency other than USD, EUR, or GBP, their system will change it to USD, EUR, or GBP, and you may incur a conversion fee.

- For each transaction, the card processor will charge the receiver a fee payable by Alpari clients. Your trading account will be credited with the net amount, funded via the card processor.

- Your deposit should be credited to your trading account as soon as possible. If Alpari or the card processor cannot validate your details, you may suffer delays.

- If you want to withdraw the money, you must use the same card you used to deposit it.

- For your card deposit, they may need an authorization code. In some cases, a screenshot of the online bank statement or card statement may be required for your card deposit.

- If they need anything about your card information, they will provide it to you via an official Alpari email address. They will never request you for personal information such as your credit card’s CVV or 3D security code. If you receive any malicious emails, please report them to [email protected] as soon as possible.

- Alpari does not keep track of customer credit card information.

- Customer card information is secured utilizing a Transport Layer encryption — TLS 1.2 – and an application layer with the method AES and a 256-bit key length, as specified by the PCI Security Standards Council.

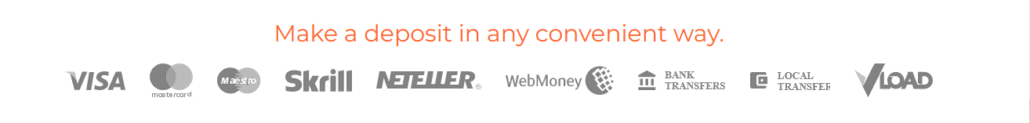

Payment Methods

Deposits and Withdrawals

On Alpari, deposits, and withdrawals will be determined by which of the two Alpari firms (Alpari US or Alpari UK) is used for trading. Deposits and withdrawals are often made using the following methods:

- Wire Transfer

All investors are websites that can use bank wires because they are widely acknowledged.

- Credit Card

The 2 credit card brands which can be utilized on Alpari to make instant deposits and withdrawals are VISA and MasterCard.

- Cheque

This is mostly utilized by those who have Alpari US trading accounts. This will necessitate having a bank account in the United States.

- Neteller

Traders can only deposit and withdraw money from the Alpari trading accounts using Neteller, the only e-payment method available.

The Alpari minimum deposit needed to start trading forex on Alpari varies depending on the account type used. The section under “Account Types” has more information about this. The maximum deposit amount and the minimum and maximum withdrawal amounts are unrestricted.

There is no limit to how many withdrawals traders can earn in a month. There are no fees associated with withdrawals. Alpari UK lets traders use floating leverage, while to comply with CFTC requirements, Alpari US does not permit leverages greater than 1:50.

Fees that may be charged

There are no deposit fees, and quickly processing withdrawals

Alpari has made depositing and withdrawing funds from your trading accounts a breeze. One of their driving factors is improving their services continually. They are constantly working to provide you with more deposit and withdrawal alternatives to enhance your online trading experience.

Are there any fees associated with internal transfers? Internal transfers are not subject to a commission. If the denomination between the two accounts is different, the funds will be translated using the Alpari exchange rates on the same day the money is credited to the account.

Internal Transfers

Transferring money from one account to another

Select ‘Internal Transfers’ from the upper menu in My Alpari.

Make sure you select ‘Internal Transfer’ as the appropriate ‘Transfer Type’ on the form that opens.

Choose ‘Trading Account’ as the ‘Transfer Method’ and then pick the account from which you want the funds to be moved.

You must choose the account you intend this transfer to move to and the transfer amount before clicking ‘Confirm.’

You will receive a password through the email address or SMS you used to register to verify the transfer request. To complete the purchase, enter this password in the required field.

You can check the status of your transfer at any moment by going to ‘MyAlpari History.’

Transfer conditions

Internal transfers with Alpari are instantaneous; however, the balance in your accounts may take a few minutes to change. Delays may occur on rare occasions. If your new balance does not appear in the accounts, please feel free to contact them, and they will assist you in resolving the issue as soon as possible.

There is no commission.

Crucial information

It’s critical to keep the following details in mind when moving funds across accounts:

Transferring funds to third-party trading accounts is not permitted at Alpari. Funds can only be transferred between accounts with the same name.

EUR, GBP, and USD are all accepted currencies for transfers. Conversion rates are available on MyAlpari and are updated on a daily basis.

Platforms for trading

Alpari provides the following trading platforms:

- MetaTrader: The MT5 and MT4 trading platforms are available at Alpari. With the MT5 platform, Alpari claims to offer a no-dealing-desk environment and the capacity to trade FX and precious metals with a maximum leverage of 1:500.

- MetaTrader for Smartphones: Alpari offers iOS applications for the iPad and iPhone and Android MT4 and MT5 apps for Android-based tablet and smartphone devices.

- MT4 Multi-terminal — This platform is perfect for individuals who want to trade on multiple MT4 accounts simultaneously. This is the solution to utilize if you are a manager dealing with multiple accounts or a managed account service supplier.

- Alpari Direct Pro: This tool is a Currenex-powered web-based expert trading platform that allows traders to trade precious metals as well as 57 currency pairings. The platform is completely customizable, and there is no necessity to download anything with Direct Pro.

- Alpari Direct: This is the Direct Pro platform’s downloaded version. Currenex powers Alpari Direct Pro and Alpari Direct; the main difference is that the prior is web-based, and the second is downloaded. The rest of the features are the same.

Deposit Method | Fees / Commission |

Local | No Commission |

Credit Cards | No Commission |

E-Wallets | No Commission |

Bank Wire Transfer | No Commission |

Account Types

Alpari traders can use the following sorts of accounts:

a) A demo account. This is mainly for inexperienced traders to understand how the system works. Traders can choose between a spot metals demo account and an all-currency demo account.

b) A Micro account: This is the best account for newcomers in the forex market. This account requires a $200 deposit and a 1 micro-lot ($1000 contracts) minimum trade size.

b) The Classic account, which requires a $500 Alpari minimum deposit and is traded on MetaTrader4, is a $500 Alpari minimum deposit account.

d) An MT5 account is a customized account that allows you to trade without using a dealing desk on the MetaTrader platform. A $200 deposit is required.

e) Professional traders can use the Pro Accounts to trade on the Alpari Direct and Direct Pro platforms. The initial deposit is $20,000.

Account Type | Minimum Deposit |

Micro | $200 |

Classic | $500 |

MT5 | $200 |

Pro | $20000 |

Special features

The floating leverage is one of Alpari’s unique features. The trader can adjust the leverage upon which account is managed with floating leverage. Alpari UK has a feature called floating leverage.

Another unique feature is the availability of a forex VPS, which enables traders to host and run expert advisors on their accounts without being impacted by network outages or system shutdowns.

Promotions and bonuses

Alpari no longer offers deposit bonuses, which appears to be happening with many other Forex brokers. Instead, they offer options to urge you to keep trading rather than register an account. Their cashback program rewards you with points for doing specific tasks. These points can be used for cash or commission reimbursements. Premium clients are eligible for prizes, which you may learn more about on their site. In addition to these promos, both the demo and live versions of the platform have contests.

Mobile Trading Alpari has a lot to offer regarding mobile trading. They have invested a significant amount of time and resources in ensuring that they are at the frontier of mobile technology. There are a variety of apps accessible to download for people who want to trade in more than simply Forex. There is a dedicated app for currency pairs for whatever device you are using. You may switch between the MetaTrader website and the app when you’re trading on the go.

You can also use the app to create an account. It gives up-to-current information and analysis, and you can set up alerts to stay up to speed with the news on the go.

Specifications

We’ve already covered how well this broker performs when it pertains to mobile trading, but a few more aspects render this broker the best option.

They provide teaching resources to help newcomers learn how to trade and an easy-to-understand glossary to help them understand the numerous words. You can even trade in cents if you have a Nano account. Small-volume trading is ideal for those looking to go from a demo account to a live platform. Start small and increase your investment as you gain confidence.

Customer Service

You can access customer service between the hours of 5 a.m. and 7 p.m. GMT by using the live chat boxes or calling the displayed phone number. You can also reach them over Skype. If you prefer to communicate via email, there is a customer care email address. Different departments handle payments with an operator on duty 24 hours a day, Monday through Friday.

How much is the Alpari minimum deposit?

To create a Micro Account and begin trading in the live markets, the Alpari minimum deposit you need is a five-dollar, five-pound, or five-euro deposit.

Conclusion

Alpari is a well-known international broker having a long track record. Though there is currently minimal educational material and analysis available, the trading parameters and account choices are unrivaled. This is backed up by top-notch customer service and assistance for the industry-leading MT5 and MT4 platforms.

You can’t go wrong with the Alpari platform if you’re inexperienced in trading and would like to know the ins and outs of Forex trades. They cater to a novice investor who intends to ease into the field of investing. They also cater to more professional traders with a longer track record and more incredible experience. There is plenty for each level of a trader among the six accounts available. They also make their platforms available on the market’s most popular and frequently utilized Forex trading platform.

Alpari has a demonstrated track record of integrity, accreditation, and oversight in several countries. Their popularity and credibility are measured by the number of individuals they serve and the countries in which they do business. With its vast mobile trading choices and many trading features, Alpari hasn’t much to like. For both inexperienced and experienced traders, they are an excellent choice.

FAQ – The most asked questions about Alpari minimum deposit :

How long will it takes for my deposit to be processed?

The time duration for each payment option is listed on their Deposits and Withdrawals page. If they need to review or verify additional information, the processing time may be delayed.

Can I make a deposit from a nation other than my own country?

There’s a chance, but you’ll have to explain yourself in an email to [email protected].

Is it possible to make a deposit using a way that isn’t in my name?

Transfers to third parties are not permitted. The name of the sender must match the name on file with myAlpari.

Why is my account balance different from what I deposited?

Any minor variations in your amount could be due to additional fees imposed by the payment provider or bank. If you need extra information, please contact the payment processor, as they do not have accessibility to third-party service systems.

What is the Alpari minimum deposit amount for beginners?

The Alpari minimum deposit amount is the same for all. Regardless of your level of trading experience, you must deposit a minimum of $200. However, this minimum deposit can vary according to the trader’s account type. Alpari provides 4 account categories. A trader can choose one according to his experience level.

How does a trader make a minimum deposit in Alpari?

A trader can make the Alpari minimum deposit by logging into his trading account. For that, you would need to sign up for one. Then, you will see the ‘add funds’ option on your dashboard. Click on this option. To deposit money, enter the desired amount and payment type. Finally, you can click submit to have your trading account funded with the minimum deposit amount.

How much does a trader need to pay to make the Alpari minimum deposit?

A trader has to pay nothing to make the Alpari minimum deposit. The broker offers traders to fund their trading account with their desired method without paying anything to the broker. So, Alpari is a very affordable trading platform from the perspective of fees and minimum deposit amount.

See more articles about forex trading here:

Last Updated on January 27, 2023 by Arkady Müller