What are broker fees and costs that can occur while trading?

Table of Contents

When people invest, they set aside a certain amount of capital. However, they overlook anything else that’s not the purchase price or the initial investment.

An excellent example is broker fees and costs, often referred to as brokerage fees. As the name suggests, brokers charge investors a commission or fee to provide relevant services, such as transaction execution on their behalf.

It is common in several industries, including real estate, financial services, delivery services, and insurance. One pays the fees for different services such as delivery, negotiations, consultations, sales, and services.

Let’s learn more about these broker fees and costs for a better understanding and wise decisions.

Different types of broker fees

Here’s a discussion of the major types of broker fees:

- full-service broker fees

- discount broker fees

- non-trading fees

- trading fees

Full-service Broker Fees

As the name suggests, these broker fees offer a wide range of products and services. Equally important, you will dig deeper to acquire these services.

They are usually essential financial services such as estate planning, retirement planning, research and advice, portfolio development and review, tax preparation, and tax consultation.

In most cases, these broker fees and costs are usually a flat rate for every service. These brokers tend to avoid charging per transaction.

Alternatively, brokers opt to charge commissions depending on the product. There are no distinct packages since the brokers offer services depending on the needs of that particular client.

But it’s not only the number of services that makes these fees and costs so high; delivery of such services requires human involvement. These brokers have opted out of robot advisors, a cheaper alternative, thus making their operational costs higher.

The price you pay mostly depends on your assets under management (AUM). The total comprising commissions and an annual fee can be below 1% of your AUM or even exceed 2%, depending on the broker.

Another factor determining this fee is the security the broker is managing, often charged per trade. You may need a minimum balance to open or maintain a trading account with such a broker.

Discount Broker Fees

On the other hand, an investor may choose a discount broker who doesn’t offer as many services as a full-service counterpart. Their services revolve around buying and selling orders on the investor’s behalf.

As for the rest of the services, you will need to seek them elsewhere. Don’t expect to get investment advice from them unless on rare occasions. It also explains why you don’t have to pay much for their services.

Depending on the broker, the fee can be between $4.95 and $20. However, most of these brokers charge from $7 to $10.

These brokers often lower their brokerage fees to get as many customers as possible. It helps these brokers gain market share, thus is worth it eventually. Don’t be surprised to find some who offer free trades for the same reasons.

Consider a discount broker if you want to save a lot of money in the name of transaction costs. That said and done, you can only benefit this way if you choose a great broker.

Discount broker fees are also referred to as online brokerage fees.

Regardless of the type of broker fees, below-mentioned are the services that investors often pay for:

- Non-Trading Fees

- Trading Fees

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 76% of retail CFD accounts lose money)

Non-Trading Fees

As the name suggests, they have nothing to do with the trading process. They include the following:

- Account maintenance fees. Some brokers charge this fee from traders with trading accounts that do not have more than a specified value in them. The charge is deducted monthly and for each trading account

- Inactivity fees. Almost all brokerage firms charge an inactivity fee when you do not consistently use your account on their platform for more than 12 or 24 months. A lot goes into managing an account from the back end, for which inactivity costs brokers from their end, which they collect as inactivity fees from your account. The commission charged from investors due to inactivity ranges between $5 to $20 every month after the grace period

- Withdrawal fees. Most of the top renowned brokerages have no limit on minimum deposit or chargeable withdrawal fee. But certain brokers might specify a minimum withdrawal limit, below which you might have to pay a minimal fee

Trading Fees

In the course of trading, broker fees and costs may compromise the following:

- Commission and transaction fees. It is the amount of money you pay each time you place a trade with your broker. Depending on your brokerage firm, it can be a flat fee or a percentage.

- Currency conversion fees. These apply if the currency you use to deposit funds differs from the base currency of your trading account. The conversion of currencies attracts this fee.

- Deposit fees. As you fund your trading account, some brokers will charge you for the deposits.

- Overnight fees. If you want to hold a particular position overnight, your broker will ask you for this fee. The leverage is also known as swaps.

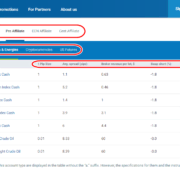

- Spread costs are the difference between the bid price and the ask price of a certain trading asset. In most cases, spread costs go hand in hand with transaction fees. You pay them upon entering a trading position.

To help you better understand this, the bid is the amount that is called the best market price for buying security. But the ask is the best probable price for someone who wants to sell a share or security.

Investors or share buyers won’t get the market price for buying or selling any stock or share. Therefore, they are lured to either pay more than the market price or receive less than that when sold. You are asked to pay a premium if you want to buy a share at market price, which is the charge specified by brokerages.

The best brokers for traders in our comparisons – get professional trading conditions with a regulated broker:

Broker: | Review: | Advantages: | Free account: |

|---|---|---|---|

1. Capital.com  | # Spreads from 0.0 pips # No commissions # Best platform for beginners # No hidden fees # More than 3,000+ markets | Live account from $ 20: (Risk warning: 76% of retail CFD accounts lose money) | |

2. RoboForex  | # High leverage up to 1:2000 # Free bonus # ECN accounts # MT4/MT5 # Crypto deposit/withdrawal | Live account from $ 10 (Risk warning: Your capital can be at risk) | |

3. Vantage Markets  | # High leverage up to 1:500 # High liquidity # No requotes # MT4/MT5 # Spreads from 0.0 pips | Live account from $ 200 (Risk warning: Your capital can be at risk) |

The impact of broker fees on the investment returns

Unfortunately, there is no way you can skip paying some of the fees at any brokerage. You should make those payments to encash your profits or buy your shares. A percentage fee is imposed by most brokers, which affects the investment returns or portfolio in a not-so-good manner.

To make it easy for you to understand, every dollar you are paying as fees is one dollar you pay less into investment. For instance, there are investment portfolios where the total cost of fees paid by an investor is 2% of the total amount in a year.

Hence, if you have invested $1000 with the thought of multiplying it exponentially through compounding over the years, then in fact you have invested only $980 for the year. So, you ultimately cannot expect to get a higher profit when you are paying too much of your money in fees.

But instead, if you look out for a brokerage platform that offers you its services at a low fee, you will save a big chunk of your profit.

Imagine investing $10,000 and holding it up for the next thirty years. Now, with a 2% fee and a net return of 3%, you will only get $24,270. But if the fee percentage is dropped to 0.5%, and the net return is the same at 3%, you will be getting around $37,450 at the end of thirty years.

Now, you have the difference in front of you for a better understanding of how the broker fees impact your overall investment returns and portfolio.

So, you must understand that the ongoing fees imposed by your broker act towards reducing the investment balance on your account. As a result, you may lose any good return you would have earned from that amount.

Even though the ongoing fee seems very low at the start, over time, it will greatly impact your investment returns. Therefore, consider using broker platforms with low fees for their services.

How to avoid or minimize broker fees?

If you want to avoid or minimize broker fees, try out the following:

- Change your broker: It is no secret that various brokers charge more broker fees and costs than others. So, compare what yours offers with the costs of transacting with others. If there is a cheaper one, switching to it will help you minimize that cost.

- Change the account type: We have discussed two broker fee categories: full-service and discount costs. Since the latter is cheaper, switching to a broker offering this type of service may significantly reduce costs. In some cases, you may not have to switch to another broker because they offer the two services concurrently. So, you only need to change the account type, and you are good to go.

- Take note of all possible charges: If the broker charges you for staying inactive for three months, ensure that you transact at least once within that period. That’s an excellent way of avoiding such broker fees and costs. The same applies to maintaining the set minimum account balance. Additionally, avoid brokers that charge fees for closing or transferring a trading account.

- Avoid large spreads: It is no secret that spreads are unavoidable. However, some investment trading has smaller spreads than others. If you choose them, rest assured that your brokerage fees will reduce.

- Understand the broker fee’s structure: Before settling for a broker, ensure they disclose all the fees they charge their customers. This will help you avoid surprises later.

- Select lower-cost investment options: If you choose to invest in mutual funds, you will incur an expense ratio fee annually. If you want to minimize this fee, consider investing in exchange-traded funds (ETFs). Their expense ratios are quite low, thus making them a great investment. Alternatively, choose an investment option that doesn’t charge the cost to avoid it entirely.

- Choose commission-free investment: An investor who goes for a competitor’s fund will incur a cost. However, the case is different if one chooses a proprietary fund since it is usually commission-free. Choosing a commission-free investment whenever possible is advisable to avoid such costs.

- Look out for hidden fees: Gone are the days when almost every broker had some hidden fees. Whereas rare, it is possible to find a brokerage firm that still charges these hidden fees. Be keen to avoid such brokers to protect yourself from such trading costs.

- Avoid the assets that ask for front-end or back-end loads: Front-end loading is when you pay commissions to the broker when buying an asset. And back-end loading is when you have to pay a commission for trading the assets.

- Acquaint yourself with intraday and delivery trading charges: Understand the difference between fee distribution in intraday trading and delivery charges. Intraday trading has a low fee as the shares or stocks are bought and sold within a day. For delivery trading, the stocks are purchased and held longer. Thus, the charges are higher in this form of trading. Understanding this difference will help you strategize your trading practices and save some money on broker fees.

- Don’t disregard cashback, benefits, and discounts: Beyond the fees or charges, you should also look for cashback, benefits, and discounts on the annual maintenance charges of brokers, which will be credited to your trading account. It will help you recover some money you paid as fees, which you can use in your trading practices.

- Opt for fixed commissions for higher shares: Prefer to go with a fixed price broker, as you will have to pay just the same commission, over and over again, irrespective of how big or small your orders are. In this system, higher trades are often beneficial as the fee you pay will be minimal. You don’t have to abide by the rule of percentage for paying the fees.

- Choose per-share price brokerage for small trades: If you favor making small trades, then per-share price brokerage might help you cut the overall fees. These brokers have the policy to charge a low commission for every share without imposing a fixed price per trade. It is ideal only if you are buying just a few shares at a time. If you are using it for large orders, the fees might add up quickly.

- Stop overtrading: Do not count on making up for your losses by over-trading over the brokerage platform. It will unnecessarily increase your overall trading fees. Even though you are winning some trades, the collective commission will consume a heavy chunk of your profit. Therefore, it is better to sit back and avoid paying more commissions when there is no scope.

However, don’t focus too much on avoiding and minimizing broker fees and costs. That’s because cheaper alternatives aren’t always the best options.

You may come across a relatively expensive broker who renders services worth every penny you spend. Should you overlook the quality and turn away such a rare opportunity?

Unless you have a cheaper alternative that matches that, paying the extra will pay off eventually. If you are investing considerable amounts or long-term, full-service fees may be better than their discount counterparts for obvious reasons.

So, strive only to avoid unnecessary fees and costs. However, avoid compromising the quality of necessary services to reduce expenses.

Best low-cost brokers

Now you are aware of broker fees and how to minimize them with various tips. While there are many brokers out there, if one were to go by low fees and costs, the following would top the list:

- RoboForex

- XTB

- Capital.com

- Vantage Markets

- ActivTrades

- OctaFX

- FBS

1. RoboForex

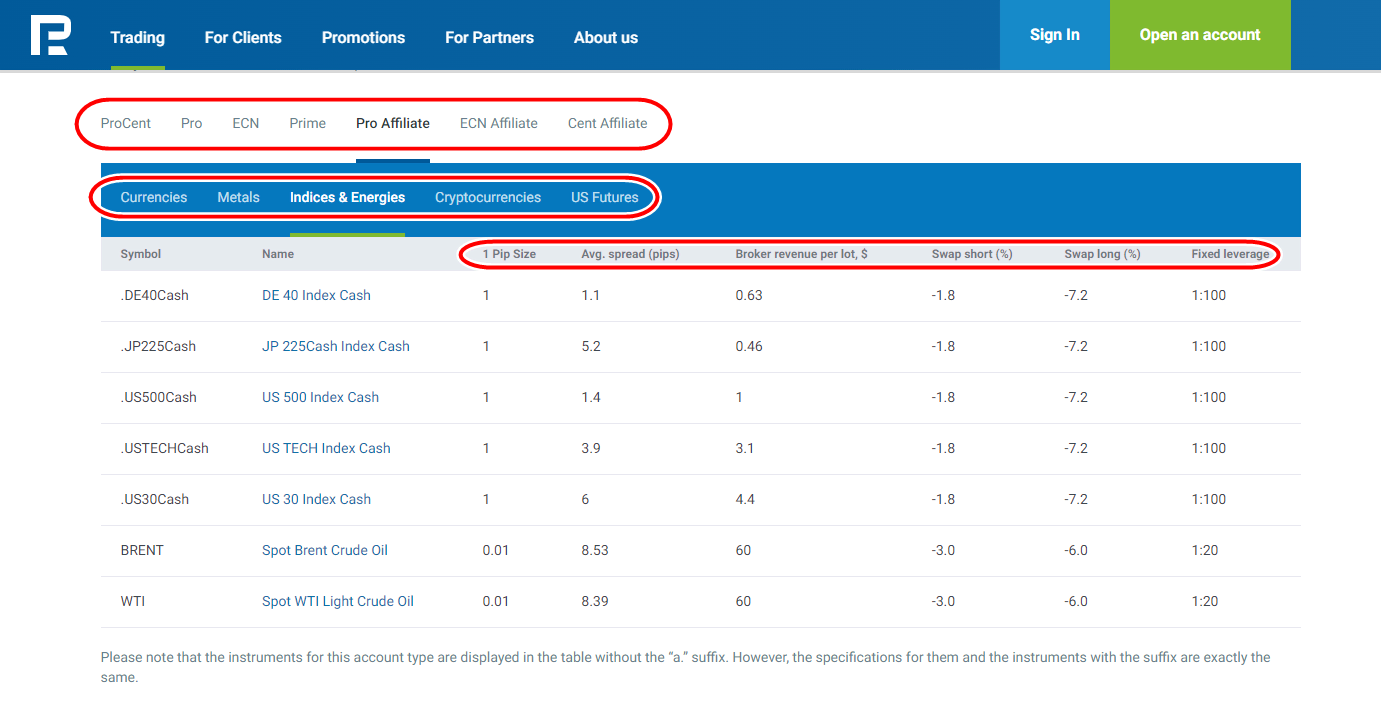

RoboForex is the best among low-cost online brokers. That’s because it doesn’t charge its customers any trading fees when using pro accounts.

Equally important, investors don’t pay much regarding account-related costs. Despite low costs, its traders receive great services for successful trading.

It is ideal for experienced traders and novices alike thanks to its user-friendliness and educational content. For example, beginners enjoy demo accounts and various tutorials that help them master the art of trading.

On the other hand, their experienced counterparts take advantage of their ECN Accounts. The same applies to RoboForex R StocksTrader.

One must admit that finding a platform that balances what novices and advanced traders need is hard. However, this broker seems to be doing it excellently.

Some notable features include portfolio analysis, vast investment tools, and detailed educational resources. The investment returns are also impressive.

Pros:

- The broker offers various platforms, including the MetaTrader Suite

- If you have a pro account, you won’t pay any commission

- There are also various types of accounts

- The fact that it is an award-winning broker speaks volumes about the quality of the services you get from RoboForex

- Traders will enjoy instant withdrawals

- Expect amazing trade conditions, especially when using its accounts such as R StocksTrader, Prime and ECN

Cons:

- Prime, ECN, Pro-Cent, and Pro accounts have 36 currency pairs which are lower than most of its competitors

- Pro account holders don’t enjoy great trade conditions compared to their counterparts

- You will incur a withdrawal fee when using this broker

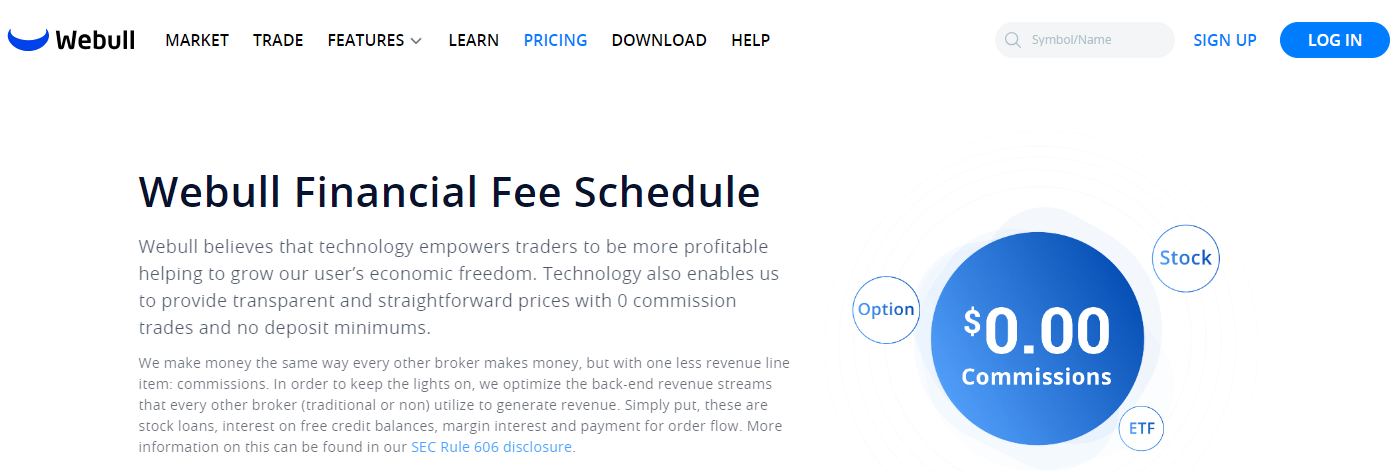

2. XTB

XTB trading platform has several investment options, usually at a low cost, including index funds. It has a wide range of tradable assets, including crypto, stocks, forex, ETFs, and commodities.

Regardless of the asset, expect low trading fees making it ideal regardless of one’s budget. The non-trading fees are also low, if not absent.

For example, the inactivity fee is as low as a monthly fee of $10, which you only incur after being inactive for a year. If you withdraw more than $100, the withdrawal fee will be $0.

On the other hand, withdrawals below $50 will cost you about $20. The deposit Fee is also $0, but credit or debit card transactions will cost you a commission of about 2%.

You can use the platform from your smartphone or desktop since it has a mobile application. However, regardless of what you choose, the trading experience is great.

One of the features available is excellent charting and analysis. Every trader knows that the significance of such tools in determining one’s success is indisputable.

If you are a sophisticated yet active trader, this platform suits your needs perfectly. After all, it offers tight spreads, advanced charting, hotkeys, and 1-click trading.

Pros:

- The platform is powerful enough to facilitate successful trading

- Traders find it easy to use and thus reliable when trading

- Even beginners find it user-friendly and a perfect broker to help you start trading

- It comes with an incredible mobile application ideal for trading while on the go

- Its leverage can be as high as 1:500

- It puts at your disposal more than 2000 underlying assets to choose from during trading

- Traders also enjoy negative balance protection

- The broker has competitive spreads

- The immense regulation guarantees investment protection

- Lastly, expect excellent research materials

Cons:

- It doesn’t receive MetaTrader support since it was suspended not long ago

- If you are a US resident, you can’t enjoy this platform since it doesn’t offer its services in this region

- Traders don’t have many choices for trading platforms

- It only has one withdrawal method, and that’s a bank transfer

3. Capital.com

Regardless of your level of trading experience, Capital.com won’t disappoint; its features favor both parties.

Equally important, the minimum initial deposit is as low as $20. It has 6000 tradable assets and 138 currency pairs. Other specifics include 38 commodities, 27 indices, 239 cryptocurrencies, and 2,813 stocks.

Your trading options include CDF cryptocurrency trading, non-CDF US stock trading, non-CDF international stock trading, and forex trading.

It has a mobile app that makes it easy to trade anywhere, anytime. Traders can also use the MT4 app, especially if they love MetaTrader.

Its deposit and withdrawal methods include bank wire, credit or debit cards, Visa and Mastercard, and PayPal. If you are an active or VIP trader, expect discounts from this trading broker.

Pros:

- It has incredible tools for risk management and hedging mode

- Its customer support is excellent and available 24/7, including a live chat feature

- The platform uses AI technology to enhance user experience

- It has various training materials comprising training guides, online courses, and an educational app

- You can deposit as little as $20 using card payments

- The broker is regulated by great authorities, including CySEC, ASIC, FAS, and FCA

- Its demo account never expires

- Its order execution is fast

- Expect tight spreads

- The broker doesn’t charge any commission

- Traders don’t incur any hidden fees

Cons:

- US clients can’t use this platform

- The broker charges overnight fees

- MetaTrader 5 is unavailable

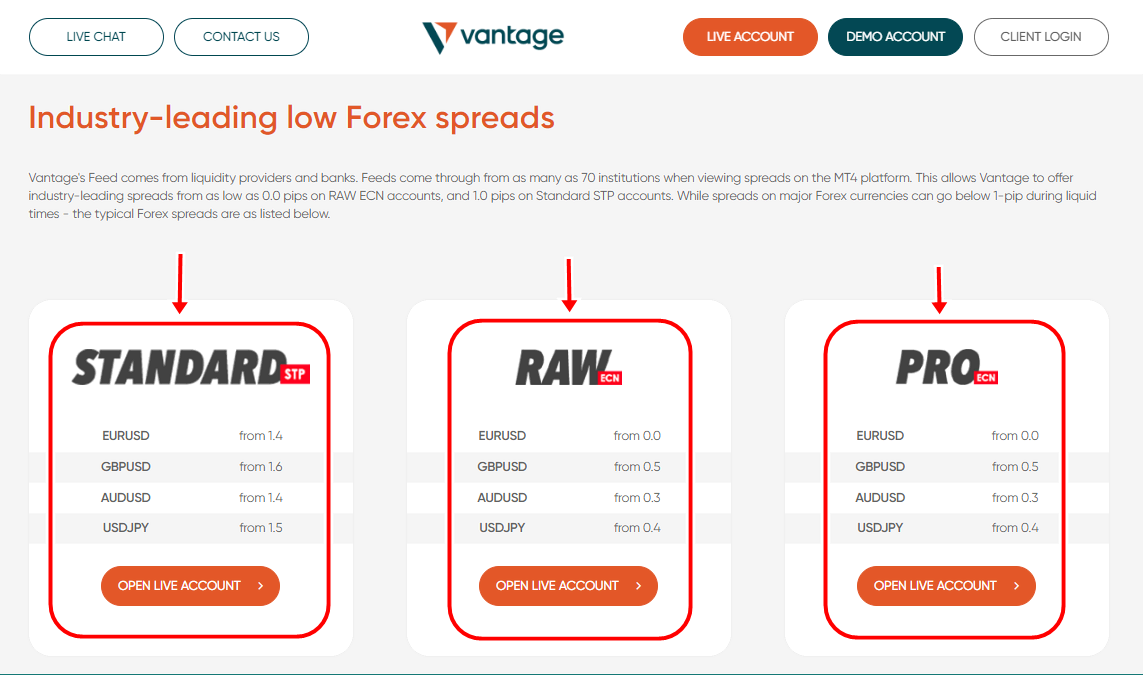

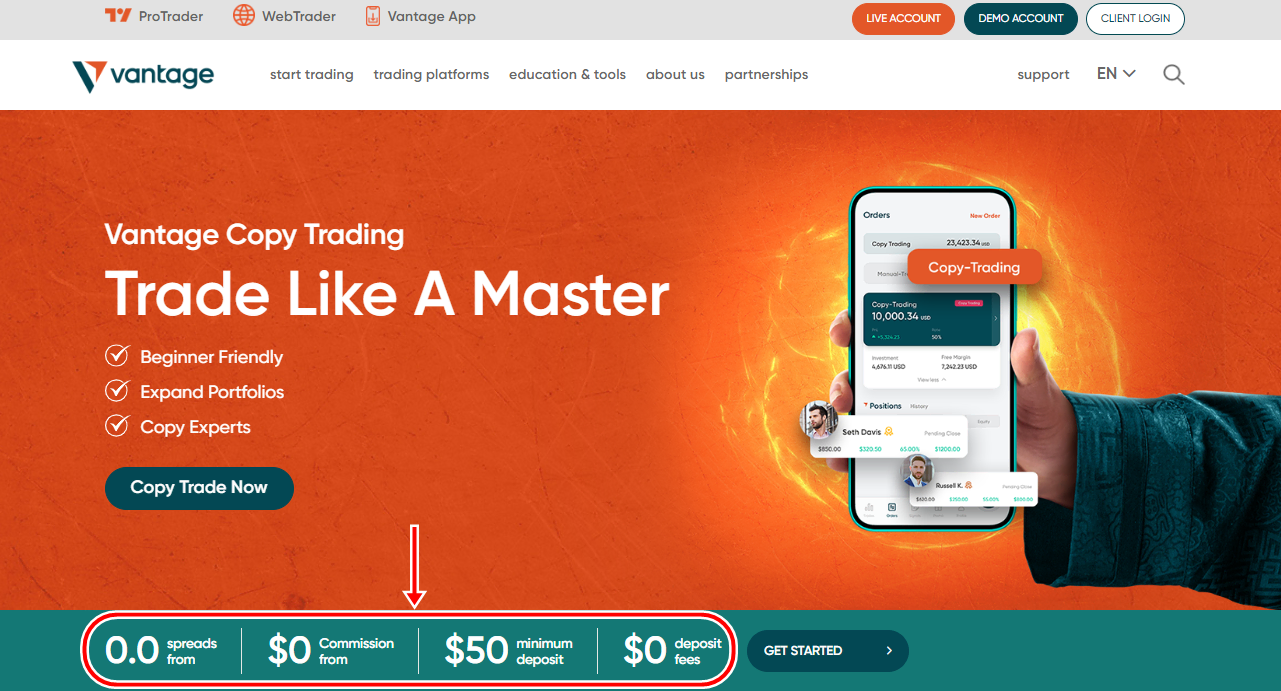

4. Vantage Markets

Vantage Markets promotes its MetaTrader platform, which supports several social trading platforms. With a minimum deposit of $200, you can commence your trading journey over Vantage Markets. But there is no deposit fee levied by Vantage to ensure that the traders can use their full deposited amount into trading.

It offers a very high leverage of around 500:1, depending solely on the asset class. One of the best features of Vantage is its PRO trader tools. These tools will be available to traders with an account balance of over $1000. These tools make it easy for traders to track asset performance.

Pros:

- Excellent asset tracking and price indicator tools

- Narrow spreads and low commissions

- Highly functional mobile application with easy UI

- Available with different asset classes

Cons:

- Comes with a high minimum deposit of $200

- Not for US-based traders

5. ActivTrades

ActivTrades is popularly known for its low trading fees. Opening an account over ActivTrades is quite easy, and the deposits and withdrawals are not charged over the platform. Most of the renowned financial regulators from various countries look out for ActivTrades.

It offers many benefits to traders through educational resources, competitive spreads, reward programs, and access to MetaTrader 4 and 5. It is also an award-winning broker, which ensures it’s genuine in offering you a low-cost trading experience.

Pros:

- Doesn’t charge trading, deposit, or withdrawal fees

- The account opening process is easy with ActivTrades

- Available with educational tools for beginners

- Available with MT4 and Low Spreads

Cons:

- Inactivity and conversion fee is charged

- It has a slim product or asset portfolio

6. OctaFX

OctaFX is a CySEC-licensed brokerage platform that has been offering its services since 2011. As of now, it has more than 6.6 million clients from across the world. But OctaFX is mostly focusing on offering its services to the Asia-Pacific region.

The platform is ideal for use by both active traders as well as passive investors. In 2021, Capital Finance International awarded OctaFX as the Best CFD Broker of the Asia-Pacific region.

Pros:

- Easy to set up an account, and the minimum account opening balance is also low

- You can execute strategies such as EAs, hedging, and scalping

- Accessibility to leverage of up to 500:1 enabled with negative balance protection

- No commission or registration fees are involved

Cons:

- It isn’t available for US traders

- Some assets and currency pairs are not available for you to trade over the platform

7. FBS

FBS is a licensed and regulated broker that has been offering its services for 13 years and has won over 75 international awards. Today, it is present in over 150 countries and enables traders to invest in CFDs and Margin FX.

FBS traders can access various financial markets and learn trading through educational resources over the platform. You can use the videos, articles, and webinars over the FBS website, app, or through social media platforms.

Pros:

- Supports high leverage of up to 1:3000, ideal for high-risk traders

- Supports super-fast execution of trades within 0.40 seconds for almost 95% of all trades

- Available in both web and mobile trading applications

- Low commissions and spreads

Cons:

- A fee is charged on both deposits as well as withdrawals

- UK, EU, and Australian clients have few account options on the platform

Conclusion about broker fees and costs

Broker fees and costs couldn’t be explained any better. The article puts a lot at your disposal, from what they are and how they affect your investment returns.

There are two major categories of these expenses which majorly differ in services and pricing. They have advantages and disadvantages; hence, choosing what’s best for you is important.

There are also various ways of avoiding and minimizing what you pay. For instance, consider the 7 best low-cost brokers above.

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 76% of retail CFD accounts lose money)

FAQs – frequently asked questions about broker fees and costs

What is the average broker fee?

If you choose full service, the average brokerage fee ranges from 1% to 2% of your transaction value. On the other hand, the average broker fee for a discount option is between 7% and 10% of the transaction value.

How do I get around a broker fee?

When it comes to broker fees, one can avoid or minimize them. One can avoid the cost incurred for not meeting certain conditions by ensuring they meet them at all times.

As for minimizing costs, an investor should choose a broker with reasonable fees.

How are broker fees calculated?

Various brokerage firms calculate their fees differently. For instance, some settle for a flat rate, whereas others choose a certain percentage of the investment.

Fees can be calculated per transaction or annually too. So, always be keen when choosing a broker and calculate the applicable fees thoroughly.

Why are broker fees so high?

Everyone wants to make money that can sustain their needs, and brokers are no exception. So, they can’t afford to offer free services.

The contractual nature of the task contributes to the high fees brokers charge. The number of customers at any given time is unpredictable.

So, they maximize the money they make once they get a client. They also don’t have a salary, so they rely on the fee to cater to all expenses.

Last Updated on June 18, 2023 by Yuriy Kunets

(5 / 5)

(5 / 5)