Is IQ Option in India legal or not?

Table of Contents

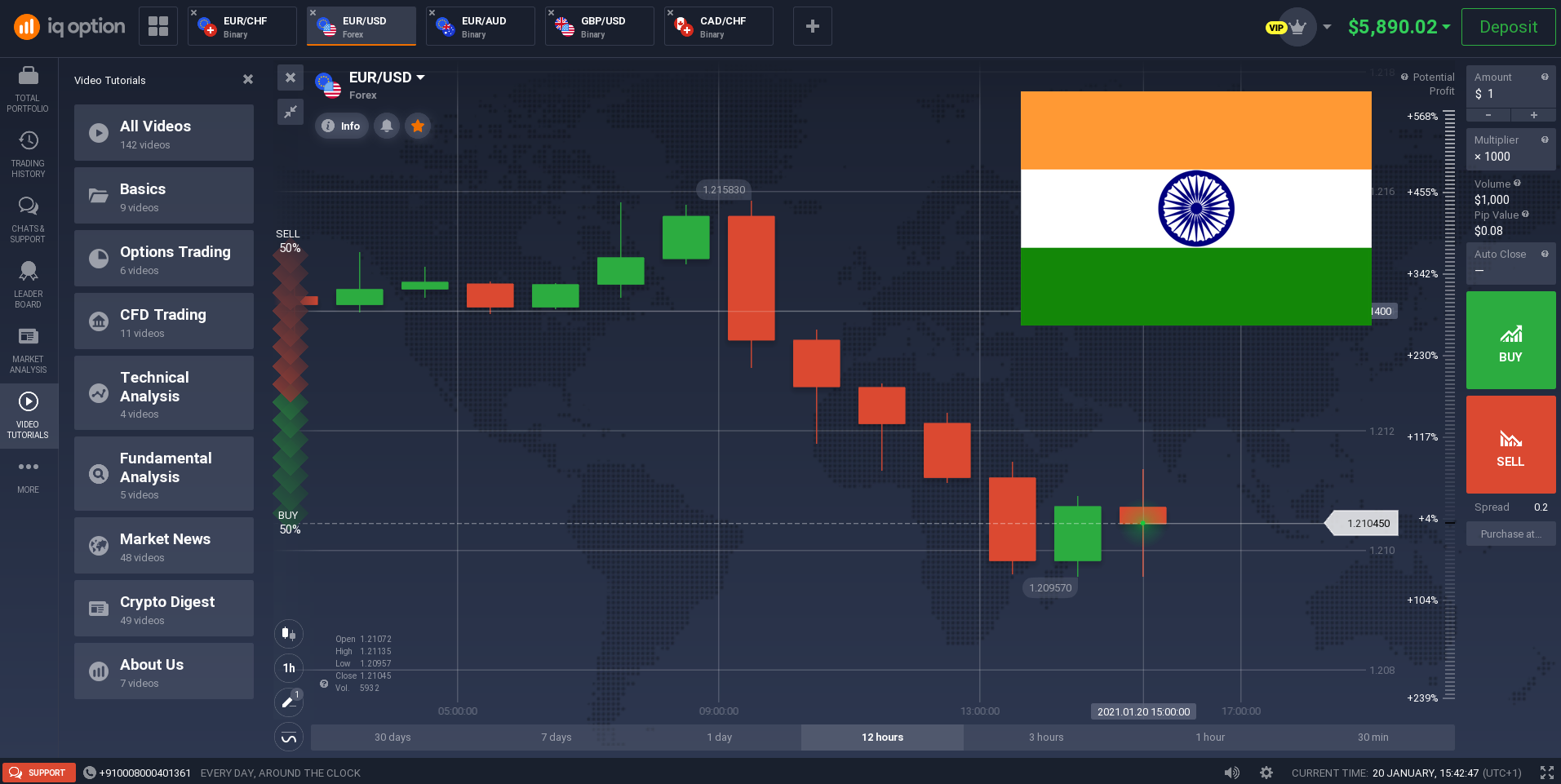

Is IQ Option legal in India or not? – It is fully legal and legit! IQ Option is an official business from Europe regulated by the Cyprus Securities Exchange Commission. The platform accepts international clients and operates in India too. Indian traders who want to invest in the financial markets can use IQ Option. There are no restrictions or bans from the government.

Overall, the platform has more than 7 million clients and many of them are from India. The broker claims that there is a turnover of multi-million dollars per trading day on their platform. Indian traders are supported by the English language. You can easily deposit money and withdraw your profits in a few minutes. IQ Option is fully legal in India. In the following article, we will show you which features are for Indian traders and what you can expect by signing up with this online broker.

- IQ Option is legal in India

- It is a legit business based in Europe

- The broker accepts Indian clients

- Indian traders are supported

(Risk warning: Your capital might be at risk.)

Introduction to IQ Option

IQ Option is a standard binary options brokerage firm. Trading binary options represent one of the most profitable and thus popular ways to make money on the internet. We can see binary options as a form of derivative which allows you to trade on the potential movements of the prices of financial assets.

Binary Options allow you to “bet” or “stake” on the direction of movement of assets such as stocks, cryptocurrencies, commodities, and of course, forex. In this case, you are not really interested in owning the underlying assets, but in the directions, their prices will most likely move after a particular time. If the price will go in the upward direction, you go for a “Buy” trade, and if you believe the price will go downwards, then you enter a “Sell” trade. All of these will be done over the internet.

But to be able to trade Binary Options, you need to get registered with a binary options broker. This broker has developed a platform that then gives you access to trade. All you need to do is deposit some funds with the broker and you can start trading and making profits. Note, however, that there are a whole lot of brokers out there. Sadly, amongst them, we have scams and phonies as well.

Hence the need for you to go for credible and reliable brokers who display certain features. For one, your broker of choice must have some level of recognition in the industry. Furthermore, they must have some commendable track records and good reputations. It is also important that they be registered with appropriate authorities. One of such brokers is IQ Option.

IQ Option is an international binary options broker that boasts tens of thousands of daily active traders on its platform. These traders are spread across Asia, Africa, Europe, and Latin America. Headquartered in Cyprus, it is registered with and regulated by the Cyprus Securities and Exchange Commission (CySEC), amongst other reputable regulatory bodies. IQ Option is an award-winning broker, having won the “Best Binary Options Broker” in Europe by the Global Banking and Finance Review.

IQ Option in India

IQ Option’s services are available all over the world, except in certain countries such as the USA, Japan, Israel, Canada, Russia, and a few others. The reason why it is not available in some of these countries is that binary options as financial instruments are completely banned. Since the Indian government has not banned binary options, then IQ Options are much available in India. In fact, the broker has a dedicated website for Indian traders.

IQ Option India Regulation

IQ Option, globally, is well regulated. As mentioned earlier, it is registered under CySEC, a well-respected regulator of derivatives brokers. However, IQ Option is not registered with or regulated by any Indian government financial regulatory agency such as the Securities and Exchange Board of India (SEBI). This is really no cause for any alarm as IQ Option has been certified to be a very credible broker.

What markets can you trade on IQ Option India?

IQ Option India allows you to speculate on the direction of prices of assets listed on major financial markets in the world, using binary options. On IQ Option, you can trade:

- Currencies/forex

- Commodities – such as Gold, Crude oil (WTI and Brent)

- Indices – such as the S&P 500, US 30, and others.

- ETFs

- Cryptocurrencies – such as Bitcoin, Ripple, Ethereum, and Litecoin.

One quite unique thing about IQ Option is that it provides stocks as investment instruments. In fact, you have access to stocks from more countries than the US alone. This is something you do not find with many binary options and other derivatives brokers.

(Risk warning: Your capital might be at risk.)

Account types on IQ Option India

There are different types of accounts that are available for trading with IQ Option India. They are summarised below:

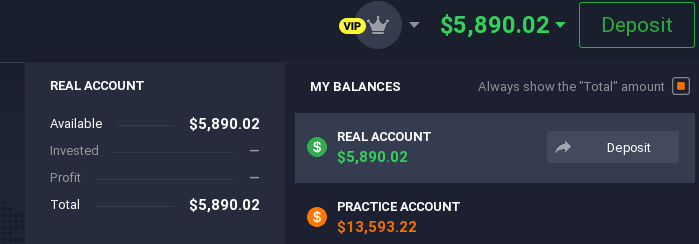

The demo account

The demo account is one of the most important tools for any trader; that is, no matter their level of expertise at trading. In fact, one of the attributes of a good broker is providing its traders with a demo account. IQ Option does just that. The demo account is a practice account provided to you by the broker. The account contains virtual money that cannot be converted into cash. As said earlier, it is a ‘practice’ account that you can utilize to practice your trading skills.

The live account

On the other hand, we have a Live Account. In this case, you are the one depositing your real cash into your trading account. You are putting real money on the line.

IQ Option, however, has various options for this. There is a basic, real account that requires a minimum deposit of $10 for you to trade with. With this account, you can access all the services provided by IQ Option.

Then, there is the VIP account. With this, you get access to all the perks that come with the basic live account and more.

Some of these perks include the following:

- Personal managers are assigned to the holders of this account type.

- Faster payouts – within 24 hours.

- Expert training materials: These have been provided by top binary options brokers.

All of these are geared towards giving you maximum profitability. However, not all traders can have access to the VIP account. For one to gain access, the trader must make deposits into his/her trading account, totaling $1900 over a given period.

(Risk warning: Your capital might be at risk.)

What are the services for Indian clients?

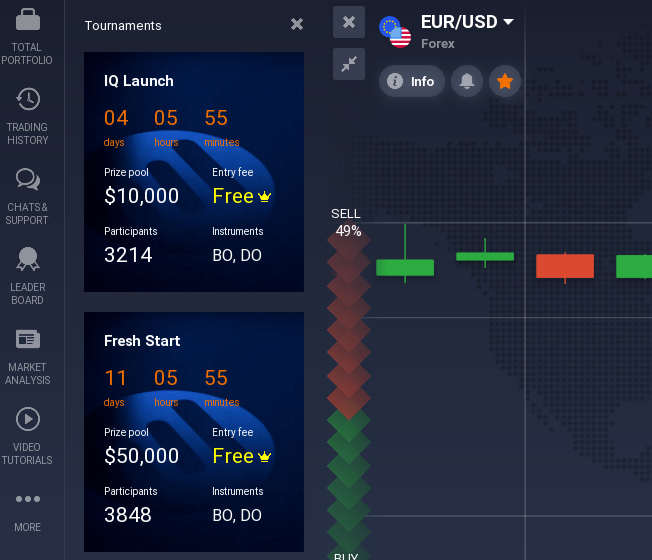

IQ Option India gives you access to an area of excellent services. Apart from a quality trading platform, you also get access to 24/7 customer care. IQ Option also looks out for your growth and development as a trader and so provides you with educational services and materials.

However, one very notable benefit that IQ Option India provides its traders and which is quite scarce in other places is a trading bonus. A trading bonus is a sum that your broker gives you to trade. Simply, the broker gives you extra funds to trade, usually as a percentage of whatever funds you have in the account.

IQ Option India usually provides traders with a welcome bonus. Just for signing and depositing into their trading account, IQ Option gives traders a welcome bonus of 50% of whatever amount they deposit into the account. There are also some promotional offers from time to time. It should be noted that bonuses cannot be withdrawn or converted into cash. You use them to boost your trading capital so that you can take on more trades.

Deposit & Withdrawal

The minimum amount that you are allowed to deposit into your IQ Option India account is $10. If we look at it, this is one of the lowest minimum deposit requirements you find with binary options brokers.

To make deposits into your IQ Option India account, you have many options. These include:

- Bank cards – either debit or credit.

- Local bank transfers

- Electronic wallets – such as Skrill, WebMoney, FasaPay, GlobePay, ADVcash, and others.

- Cryptocurrencies – especially Bitcoin.

The above channels are also the ones you use when you want to withdraw your funds. You should note that whatever channel you choose to deposit with will be the one through which you will withdraw your funds as well. IQ Option and other brokers put this in place to prevent fraudulent activity. There are no limits or minimum requirements for withdrawals.

Conclusion on IQ Option in India

For seamless and successful binary options and forex trading business, you need a stress-free, organized, and tested broker. IQ Option India is one of such trusted brokers in the binary options space. It is a fully legal business in India and also the platform is secure and safe. Funds are managed in European banks and the broker withdraws profits within a few hours. You can also read our full IQ Option review.

(Risk warning: Your capital might be at risk.)

FAQ – The most asked questions about IQ Option India :

Why should Indian traders trust IQ Option?

With more than 7,000,000 users worldwide, IQ Option is one of the most reliable online brokerage platforms that people should try. It offers access to 500 different markets and is associated with several other trading instruments.

Is IQ Option under the regulation of any Indian authority?

No, IQ Option is not under the regulation of any Indian authority. However, it is under the governance of the Cyprus Securities and Exchange Commission. Therefore, it is reliable, safe, & trustworthy. Apart from this, the online website has an SSL protection program to ensure the user information is not used in any other way or accessed by anonymous IP addresses.

What are the different accounts on IQ Option India?

Traders and investors from India can access the demo account, where they will get a certain amount as the demo fund. This will help them practice and sharpen their skills in binary trading. Apart from this, traders and investors can have a live account with a personal manager, 24 hours payout time limit, and several online trading materials.

Does IQ Option offer a trading bonus to Indian traders?

Yes, are you option offer trading bonus to the Indian traders. It also offers a welcome bonus where they get a return of 50% of the deposit amount.

See other articles about online brokers:

Last Updated on January 27, 2023 by Arkady Müller