How much does it cost to trade with AvaTrade? – Spreads & fees explained

Table of Contents

A CFD trading is different from Forex, and it is nothing more than a financial contract. It is a contract between a buyer and a seller or a client and a broker that does not utilize any stock, currency pair, commodity, or futures exchanges. A CFD trading happens as differences in settlement prices between the opening and closing trades, allowing the investors to trade the direction of securities.

Unlike CFD, a Forex trader must focus on several other factors before trading. First, it is because the assets involved are currency pairs. So, we can say that the trader needs to know about the basics of currencies, spreads, and fees before jumping into Forex and expecting profits. Moreover, the trader using an account of a regulated broker like AvaTrade should also have a brief idea of how much it costs to trade.

AvaTrade fees and spreads

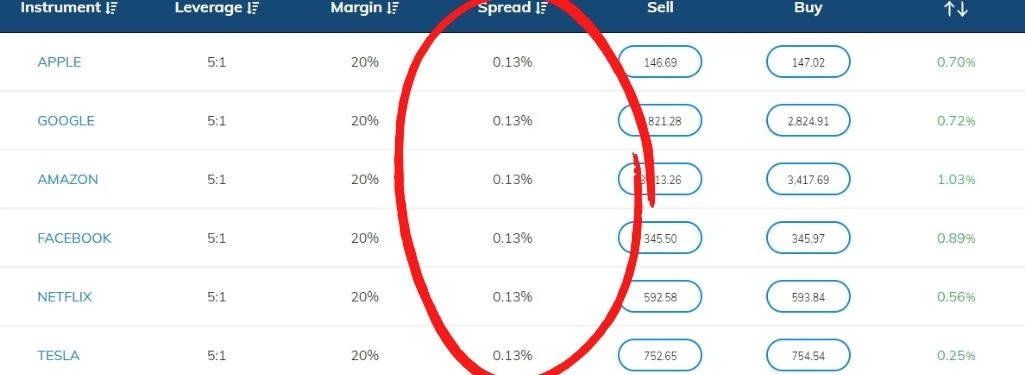

Although the Forex brokers usually focus on spreads for profits, many brokers charge fees separately. But, unlike those brokers, while trading through an Ava Trade account, you need not worry about paying for the execution of your buy or sell orders. Instead, Ava Trade compensates that through the market bid-ask spread, which is nothing but the price difference between the selling or buying of the asset. The spreads, however, would differ according to the currency pairs. The spread table for AvaTrade is shown below.

(Risk warning: 71% of retail CFD accounts lose money)

AvaTrade spread table

Instrument | Leverage | Margin | Spread |

EUR/USD | 400:1 | 0.25% | 0.9 |

GBP/USD | 400:1 | 0.25% | 1.6 |

USD/JPY | 400:1 | 0.25% | 1.1 |

EUR/CHF | 400:1 | 0.25% | 2 |

EUR/JPY | 400:1 | 0.25% | 1.8 |

EUR/GBP | 400:1 | 0.25% | 1.5 |

USD/CAD | 400:1 | 0.25% | 2 |

So, we can infer that the minimum spread is at 0.9 pips

Fees

The fees at AvaTrade can be classified into two groups:

- Trading fees are the type of fees that incur while a trading activity is done. It includes deposit fees, spread costs, overnight funding fees, etc.

- Non Trading fees- It is the type of fee concerned with non-trading activities such as withdrawal. It includes the withdrawal fees and inactivity fees.

Deposit fees

AvaTrade is one of those Forex brokers that does not charge any deposit fees. It means, unlike several other brokers, where there is an additional charge for depositing your fund, with AvaTrade, it is free of cost. However, as a new trader, you may be required to deposit a minimum amount in your account, but that cannot be considered a fee because the user of that money is the trader herself.

The amount for minimum deposits would depend on the type of payment chosen by the trader. Usually, it is $100 or £100 or the equivalent in other currencies for methods such as credit card payment or e-payment. However, it may go up to $500 if the trader decides to pay through wire transfer or bank transfer.

(Risk warning: 71% of retail CFD accounts lose money)

Transaction fees

Transaction Fees are fees that a broker charges to purchase or sell an asset. While executing your buy or sell order, various brokers charge their transaction fees or trading commission differently. The idea behind charging such a fee is that they have lent the platform for the trade to happen in the first place. But unlike other brokers, there is no transaction fee with Ava Trade. Instead, you just have to make the trade, and the cost will be compensated through the bid-ask spread itself.

Spread costs

It simply signifies the cost for the transaction of an instrument, as mentioned before. Instead of charging a separate fee from the traders, the cost is incorporated into the buy and sell price in a spread cost.

So, the trader need not pay a separate fee. Instead, it will be balanced automatically. Of course, it depends on the spread structure of the broker you trade with. So, ensuring a broker like AvaTrade which offers a minimum spread cost, is helpful in trading cost-efficiently.

Currency conversion fees

We already know that Forex trading is all about converting currencies in pairs. So, whenever there is a need to convert one currency into another, many brokers charge an additional fee.

While trading in a Forex account, currency conversion is usually concerned with the base currency you are trading with. So, when you prefer to convert it to another currency, which could be according to your trading strategy, there is a chance of an additional fee for the job.

Though many brokers do not exempt it and charge high, Ava Trade is not among them. However, a new trader must note that Ava Trade offers only a limited number of base currencies compared to others. Therefore, it creates a relative lack of support for other currencies; hence the conversion fee needs to be paid if the trader deposits with a different currency.

However, the charges may not be as high as others, yet according to Ava Trade, the conversion shall be at an exchange rate they determine depending on the current market rates, which is justified.

Overnight funding

There is an overnight fee that Ava Trade charges on any position a trader holds overnight. The trader can easily avoid overnight charges by closing the position on the same day or as determined by the broker. Ava Trade has put the time limit for overnight funding charges at (22:00 GMT). Moreover, if the trader holds the position over an entire weekend, she will be charged a 3 day swap fee usually charged on Wednesdays.

(Risk warning: 71% of retail CFD accounts lose money)

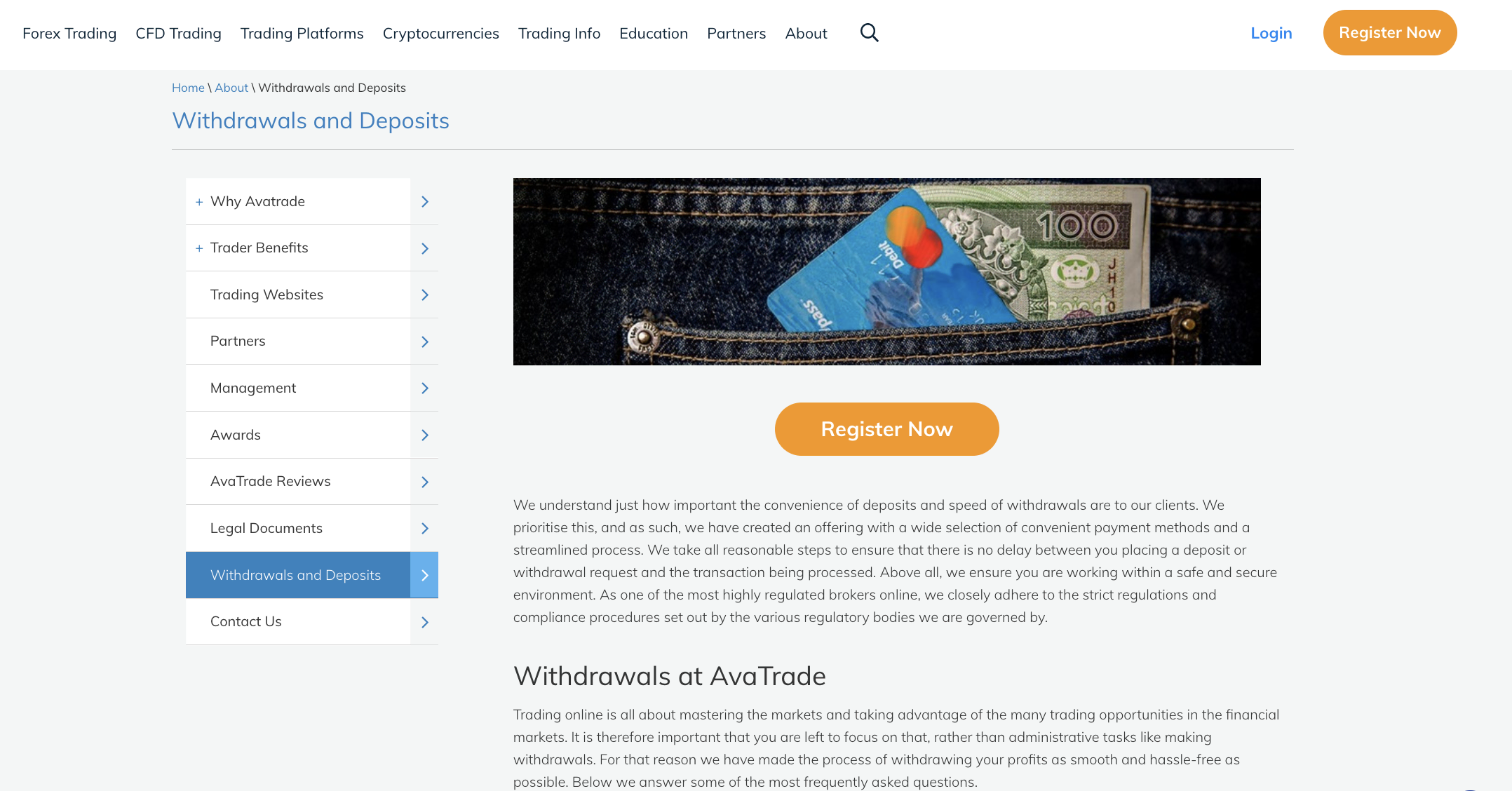

Withdrawal fees

The fees that many brokers charge while the trader initiates a withdrawal of the funds. With Ava Trade, the traders can withdraw only through the modes of payment used while depositing them. It protects the trader’s funds only as it gives less scope for illegal activities.

However, various brokers levy a heavy fee for withdrawal charges. But Ava Trade does not charge any withdrawal fees. However, as a regulated broker, Ava Trade requires you to verify before the withdrawal fully. Moreover, the request doesn’t take longer than 1-2 business days to process. But depending on the methods, it may take the following time to receive payment.

- Credit or Debit Cards may take up to 5 business days to the maximum

- E-Payments/Wallets may take up to 24 hours only

- Wire/Bank Transfers might take up to 10 business days

Inactivity fees and administrative fees

The inactivity fee is one of the non-trading fees like withdrawal fees. A trader is obligated to pay for the lack of usage of the account. Ava Trade also charges an inactivity fee for not logging into the account for three months.

Other brokers may even levy an inactivity fee for not logging in for just ten days or a month. Unlike them, Ava Trade offers a longer period. Moreover, Ava Trade will automatically deduct the amount, which can be viewed as follows depending on the base currency:

- £50 – For a GBP account

- $50 – For a USD account

- €50- For a EUR account

A new trader must also note that Ava Trade charges administrative fees also. If the trader is inactive for twelve consecutive months, the account will deduct an amount as follows:

- £100- For a GBP account

- $100- For a USD account

- €100- For a EUR account

(Risk warning: 71% of retail CFD accounts lose money)

What spreads signifies in forex?

A Forex broker does not target making profits through commissions as other trade brokers do. Instead, a spread is what they focus on to make profits usually. The size of a spread decides how much money a forex broker can make, but it is dependent on several factors. For example, the size of your trade, demand for the assets, and market volatility all come together to influence that.

Let us understand what spread signifies now. It has seen several meanings in the financial world. But, in general terms, it means nothing other than the difference between two prices, rates, or even yields, which are the earnings generated and realized on an investment over a certain period.

When discussing the spread in the purview of Forex, we can see that it has two price values. They are termed as a bid and ask price. They, in turn, mean nothing more than buying and selling the prices of the assets. While it is applicable for all other assets, the thing to note here is that the prices arise for currency pairs in the case of Forex.

But according to various other trading experts, we can see the definition of spread put in another way. They define it as the gap instead of the difference. So, it is also defined as the gap between bidding and asking prices for a security or an asset. It is currency pairs in the case of Forex, whereas we can see the assets like Stocks, Options, etc., in other cases. However, it is also called a bid-ask spread because of the same definition.

The Bid-ask spread is the most common definition of a spread in trading, although there are other types like yield and credit spreads. The bid-ask spread is often confused with a bid-offer spread and a buy-sell spread, but a trader must know that all three convey the same meaning.

Another closest explanation of a spread can be the reference to a gap in trading positions. A gap between a short and long position in one futures contract or currency signifies a similar meaning as the gaps in selling and buying prices. Such a process involving the spread is called a spread trade. As mentioned before, usually, spread trades are done with options or futures contracts. Wherein a bid-ask spread is particularly useful to measure the market’s liquidity and the size of the transaction cost of the stock.

In Forex, the securities, which are the national currencies, are traded in pairs. So, we can expect that the bid-offer spread might differ for such securities. Unlike other securities like the stock options, where the difference is between the strike price and market value, Forex is the difference between immediate orders and sales. Hence, the significance of a spread is always prevalent, even though the meaning might differ depending on the securities.

To understand the currency pairs, we must know that there are two parts to them, a base currency and a quote currency. We can describe the base currency as a transaction currency also. It is nothing but the currency that appears first in the pair.

The base currency is the part that tells us how much of the currency the trader would require to buy one unit of the base currency. At the same time, the quoted currency is nothing but the counter currency. We can clarify the understanding of currency pairs with a simple example.

For instance, take GBP/USD trading at 1.8641; in that case, the first currency is GBP so, it is the base currency, whereas USD is the counter currency. From the definition, we know that it signifies that a trader must pay 1.8641 USD to buy 1 GBP.

Furthermore, there are two rates in Forex spreads that we discussed before: bid and ask price. However, it will depend on whether the trader is willing to buy or sell the base currency to incur different rates because the bid and ask prices for the same currency may differ.

Now, in the context of Forex, a broker such as AvaTrade offers to buy a base currency in turn of an asking price from you. We can illustrate the process with an example of GBP/USD at a bid price of 1.8887. It means that is the price for buying; now, if the broker puts an asking price of 1.8885, then we call that there is a spread of 2 pips. Here a pip signifies the percentage in point, and it is nothing but the slightest movement in price, which is 2 in the above example.

Now, as a trader, you must know that when you open a trade, it is needless to say that a time will come to close it as well. So at that time, you pay the spread to the broker, and hence, in Forex trading, it is how a broker like Ava trade makes a profit.

Conclusion: Low fees and spreads with AvaTrade

Ava Trade can place itself among the top-ranked Forex brokers. Traders can get many benefits that come exclusively from an Ava Trade account. Moreover, now it is evident that the cost for trading Ava Trade is reasonable for any new trader looking to make profits through Forex or CFD especially.

(Risk warning: 71% of retail CFD accounts lose money)

FAQ – The most asked questions about AvaTrade fees :

Does AvaTrade charge commissions?

Ava Trade does not charge a commission in the usual sense. Unlike other brokers, you can trade without trading or withdrawal commissions here. However, an overnight fee is applicable for those who hold the position longer than closing time.

Is AvaTrade free?

With Ava Trade, a trader can trade freely without any account fees. It also offers free deposits and withdrawals, though a minimum deposit is required. But Ava Trade charges inactivity fees that a trader can pay for not using the account for three months at $50 per quarter.

What are the two types of Avatrade fees?

Two kinds of fees are available at AvaTrade. The kind of expenses that are incurred during trading activities are called trading fees. It comprises deposit charges, spread expenses, overnight financing charges, etc. Non-Trading fees apply to non-trading actions such as withdrawals. It covers the inactivity and withdrawal fees.

Are there any Avatrade fees for account inactivity?

AvaTrade does not provide guaranteed stop losses or volume discounts, and opening an account requires $100. After three months of account inactivity, they charge a $50 cost; after a year of inactivity, they impose a $100 administration fee.

How much profit can I earn after paying Avatrade fees?

When the asset value reaches a particular level, an automatic Take Profit order will be placed. A trader may believe that a stock with a price of $100 and an upward trend can only rise to $120, where his take profit order is placed before reverting.

What are the Avatrade fees per trade?

No trades on AvaTrade are subject to commission fees. The basis for option spreads is 1-month at-the-money options. The second currency mentioned in an FX pair (CUR1/CUR2: USD/JPY, EUR/USD, etc.) is referred to as the secondary currency. Unless otherwise noted, AvaTrade gets paid via the bid-ask spread.

See more articles about forex brokers here:

Last Updated on January 27, 2023 by Arkady Müller