Broker scams: How they work and how to avoid them?

Table of Contents

Most traders get caught up in a broker scam by trading online. It causes them to lose more money than they would lose while trading an asset. Traders fall into the trap of scam brokers by believing in their false trading tactics.

Even a regulated broker can sometimes cheat a trader. So, a trader must be very careful while choosing a broker. A trader should try to avoid becoming a victim of broker scams.

Let’s explore broker scams further to understand how they work.

Definition: what are broker scams?

Broker scams usually occur when a broker indulges in malpractices while extending his services. A scam broker might cause a trader to lose his investment. There are several ways a trading platform or a broker indulges in a broker scam.

Good to know!

Broker scams comprise all the frauds that traders face while trading online. Broker scams implement dirty tricks and communicate false information to traders. Usually, these brokers lure people into joining their trading platform by giving them false hope of making high returns with low money.

How does a broker scam work?

As mentioned, brokers might use dirty tactics to rob investors of their money. Scam brokers make empty promises to traders. They promise them high returns, but traders never get around to that point.

A scam broker might indulge in several illegal practices:

- Insider-trading

- Ponzi schemes

- Fund misappropriation

- Difficulty withdrawing funds

- Unauthorized trading

- Misrepresentation of facts

- Churning

- Offering unregistered securities

Insider-trading

Most brokers indulge in broker scams with insider trading. These brokers hold confidential information about the stock of any concern. The brokers do use this information to manipulate the investor’s trading decision.

Broker scams might compel traders to trade such stocks. Sometimes, traders lose a lot of money because of such practices of scam brokers.

Ponzi schemes

Under Ponzi schemes, a scam broker will amass funds from new investors. It attracts many clients and uses its funds to pay returns to its existing clients.

This broker scam is highly prevalent in the trading world. The new investors become vulnerable to such malpractices by their broker. It is because such schemes only operate as long as the broker can connect with new clients.

Fund misappropriation

A broker scam might also involve the misappropriation of client funds. Most trading platforms might indulge in stealing client funds. Scam brokers transfer the trader’s funds into their accounts. So, the client’s account has nothing to place a trade.

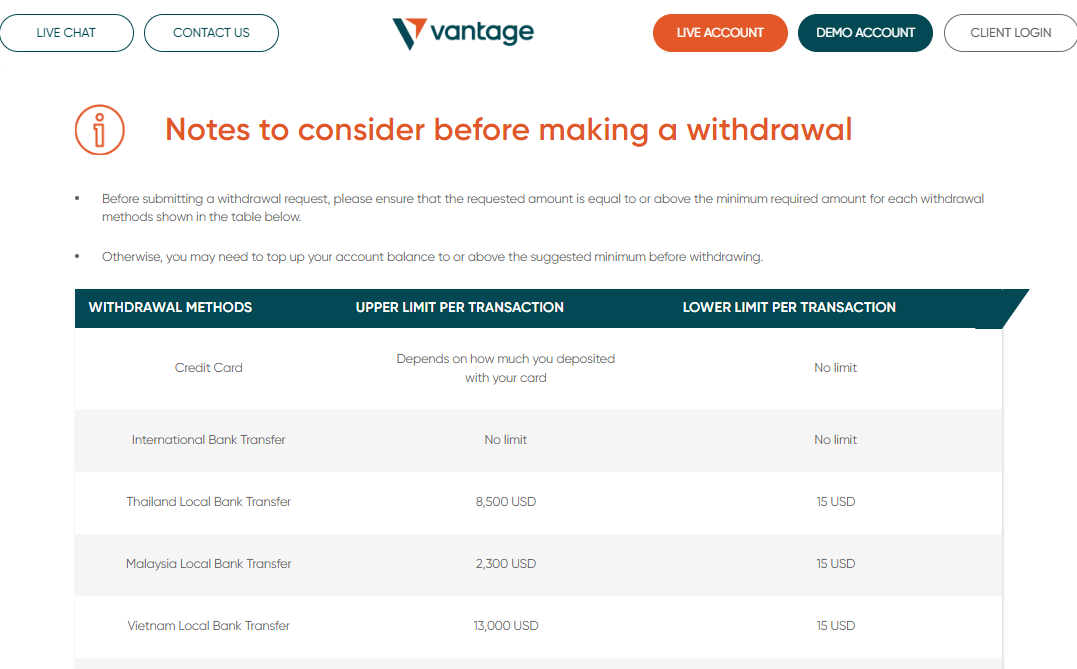

Difficulty withdrawing funds

Sometimes, a trader’s trading experience might be smooth on a trading platform. A trader might also succeed in earning profit from his trades. However, the broker might make it impossible to withdraw the funds for a trader. It is the most common broker scam in the trading industry.

Unauthorized trading

Usually, a trader has plenty of funds in his trading account. After researching the market, the trader authorizes his broker to place the trade on his behalf.

However, some broker scams might involve unauthorized trading. These brokers end up placing trades without the trader’s permission.

Misrepresentation of facts

Most trading scams occur because of misrepresenting facts that hold significance for a trader. A scam broker might present misleading information to a trader regarding the investment product. Sometimes, broker scams involve leaving out important information, thus misrepresenting an investment opportunity for a trader.

Churning

Scam brokers indulge in excessive trading to multiply their high commissions. These brokers conduct a high trading activity in a very small period from a trader’s account. A trader must be diligent and figure out if there are any repeated transactions from his trading account.

Offering unregistered securities

A trader can and should trade only the registered securities. Unregulated securities do not protect traders as they are less controlled than regulated securities. Broker scams involve offering traders unregistered securities with high return claims.

Good to know!

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 67% of retail CFD accounts lose money)

List of scam brokers

There is not one, but many brokers which indulge in scams and rob traders’ money. Some brokers that traders must avoid at all costs include the following:

- 100xfx

- 1cOption

- Alpha Finance

- Bit4U

- Cac400.com

- CFD corporate

- Capex24

- Coinderix

- EveryOption

- Fairstone

- ForenX

- High Tech Trade

- Golden Hill Capital

- BECFD

- Capitals.fund

- CryotoFxonline

- Investing online services

- Italimatket.com

- Master4x

Besides these brokers, several other scam brokers exist in the trading industry. They make earning profit a challenge for traders. Besides, they are known to run away with traders’ money.

So, a trader must be cautious while choosing a broker to invest his funds. However, judging a broker can sometimes become very difficult for a trader. Scam brokers make their trading platforms appear very lucrative and genuine. So, a trader may find it difficult to tell the difference.

How do you know that a broker is scamming you?

Most of the time, a scam broker does not prioritize the trader’s best interest. A scam broker is only interested in multiplying their earnings and commissions from the trader. Plenty of unscrupulous brokers exist in the brokerage industry. So, a good trader should look for several red flags that help determine whether the broker is scamming them.

Red flags that help determine whether the broker is a scam

Protecting yourself from losses while trading online can be quite challenging. However, a trader can save his investment from falling into the trap of a scam broker by looking out for a few disturbing signals:

- Erratic communication

- Unauthorized trading

- Irrational promises

- Difficult accessibility

- Difficulty withdrawing funds

Erratic communication

A good broker with the trader’s best interest at their heart makes communication simple for traders. A scam broker does not believe in the necessity of having proper communication with the traders. It results in real challenges for traders trading online.

Good to know!

Unauthorized trading

Traders should always keep an eye on their trading account balance. If a trader sees unauthorized transactions from his trading account, it signals that his broker might be an illegal or a scam broker.

Irrational promises

Broker scams usually involve a broker making irrational promises to traders. These scam brokers may claim that their trading platform is the best in the brokerage industry.

Besides, they lure traders into joining the trading platform by promising them very high returns. They make very irrational claims that a trader might find hard to believe.

Difficult accessibility

It is a red flag if a trader finds it hard to access his trading account or the trading platform. Broker scams sometimes involve making it hard for a trader to log in to his trading account.

Difficulty withdrawing funds

After earning a profit on the trading platform, it is a broker fraud signal if a trader finds it hard to withdraw his funds. A trader must be able to easily withdraw funds with a genuine broker.

The best brokers for traders in our comparisons – get professional trading conditions with a regulated broker:

Broker: | Review: | Advantages: | Free account: |

|---|---|---|---|

1. Capital.com  | # Spreads from 0.0 pips # No commissions # Best platform for beginners # No hidden fees # More than 3,000+ markets | Live account from $ 20: (Risk warning: 67% of retail CFD accounts lose money) | |

2. RoboForex  | # High leverage up to 1:2000 # Free bonus # ECN accounts # MT4/MT5 # Crypto deposit/withdrawal | Live account from $ 10 (Risk warning: Your capital can be at risk) | |

3. Vantage Markets  | # High leverage up to 1:500 # High liquidity # No requotes # MT4/MT5 # Spreads from 0.0 pips | Live account from $ 200 (Risk warning: Your capital can be at risk) |

How to report a scam broker?

A trader can report broker scams to the regulating authorities, such as the SEC. In addition, a trader can also file a suit against the broker. If a trader feels that his broker is scamming him, it is wise to get in touch with the broker scam lawyer instantly.

The lawyer allows a trader to take all the correct steps while dealing with broker fraud.

When filing a complaint against a forex broker, the first step is to gather evidence, such as emails, screenshots, and other documentation, that supports the allegation that the broker is dishonest or fraudulent.

Following this, the proof and information will be reported to the regulatory agency in the jurisdiction where the investor resides, where the broker is later authorized, licensed, and regulated to offer its services.

Dealing with a broker can be easier in countries where no supervisory body exists. It is still possible to report a fraudulent broker to the relevant regulatory body if the broker falsely purports to be regulated by that body.

It is necessary to file a complaint with each organization the broker claims to be regulated by. To fill out these complaint forms, the reporting investor may be asked for information such as (but not limited to) their email address, first and last name, and mailing address.

Mention the below information while reporting a scam:

- Email Address

- First and Last Name

- Name of the Broker

- How the investor found this broker

- The amount the investor deposited or lost

- They used the transfer method– bank transfer, credit card, or electronic payment

- A description of what happened

- Uploads of proof or evidence, including a URL to the broker’s website

File a complaint in court

Even though a trip to court should be avoided, it sometimes becomes necessary to guarantee that the culprit or parties are penalized for their activities when an amicable resolution cannot be reached, which is especially important when bad actors are behind these frauds.

How do you know if a broker is legit?

In the contemporary trading world, it might get difficult for any trader to differentiate legit brokers from illegal ones. A trader should try to answer 11 questions before choosing a broker. If the broker receives a score of 11 on these parameters, it is a green flag.

However, if the score is less than eight or nine, a trader might need further research to protect his funds:

- Regulation

- Regulators register

- Standard payment methods

- No cold calls

- Existing penalties issued by regulators

- SSL

- A promise of high rewards

- The promise of no risk

- Warning list of regulators

- Feedback/reviews of trusted sources

- Customer service

1. Regulation

Whether the broker is regulated is the first question a trader should ask himself. A trader must sign up with only regulated brokers to avoid broker scams.

2. Regulators register

The brokers with a regulating authority overseeing their functions refrain from indulging in malpractices. So, a trader should check the regulatory status and the regulators’ register of the regulating authority that controls the brokers’ functioning.

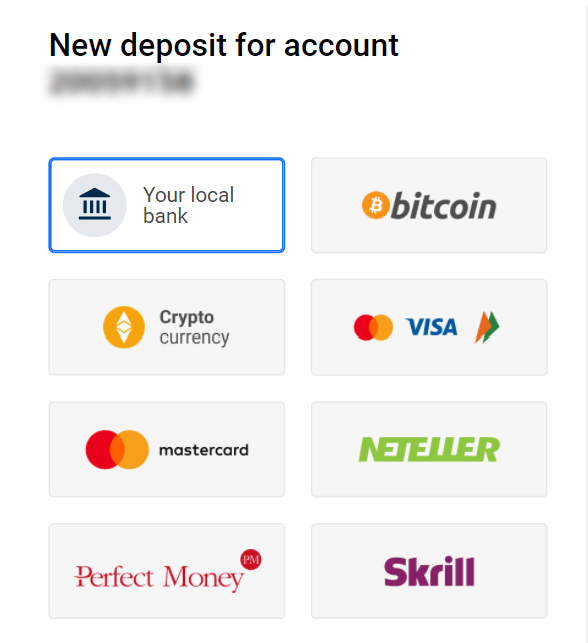

3. Standard payment methods

Does the broker offer standard payment methods to traders? If yes, a trader can sign up without a second thought. However, if a broker offers very limited or non-standard payment methods, it might be a scam broker.

Usually, all legit brokers offer traders standard payment methods. These include credit cards, debit cards, electronic wallets, cryptocurrency, and bank transfers.

4. No cold calls

Traders connect with a legit broker on their own. Such a broker does not indulge in cold calling its clients. However, if a trader finds a broker cold calling, it might mean that the broker is scamming.

5. Existing penalties issued by regulators

Before signing up on a trading platform, traders must ensure that the broker does not have penalties issued by the regulators. Most brokers that operate in the trading industry indulge in scamming traders.

Sometimes, even regulated brokers can find their names in the regulators’ register if they indulge in broker scams. So, it is best that a trader checks for any penalties issued to a broker. He should also check whether the regulated brokers have any penalties issued to them.

Good to know!

6. SSL

All transactions on the trading platform should be SSL encrypted. If a broker does not offer a safe transaction platform to traders, it might signal that the broker is illegitimate. Such a broker might indulge in scamming traders.

7. No promise of high rewards

A trader can only get a reward on investment when he is cautious and trades perfectly. Some brokers might promise high rewards to traders. However, traders can’t achieve these rewards. It is only possible by following rights, trading tactics, and investing in the right financial instruments.

8. No promise of no risk

No trading can take place without risk. Trading involves substantial risk, which a trader must learn to tackle. So if any broker promises no-risk trading to traders, it can signal a broker scam.

A scam broker will make traders believe that trading on their platform involves no risk. However, when a trader signs up for a trading account and starts trading, it might bring him losses.

9. Warning list of regulators

Most regulators come out with a warning list of unregulated scam brokers from time to time. A trader must check the warning list of regulators before choosing any broker. The regulator includes the names of all brokers a trader must avoid when trading online.

10. Feedback/reviews of trusted sources

Finally, a trader must go through several online sources that allow him to know more about the broker’s credibility. Several trader communities and online forums allow traders to know more about the operating habits of a broker. The trader must read these reviews to ensure that the broker with which a trader is signing up offers the best services.

11. Customer Service

Scam brokers’ primary concern is making as much money as they can off of as many victims as quickly as possible. Therefore, you need to verify the broker’s trustworthiness by examining their support.

It’s easy to gauge interest and response by asking a few questions before they sign up. Consider switching brokers if communication with them is slow or ineffective.

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 67% of retail CFD accounts lose money)

5 Trusted brokers

Traders can trust the following five brokers as they offer the best services:

RoboForex

RoboForex is a great broker that offers great services to traders. This broker ensures that a trader can enjoy the best trading conditions. RoboForex is a regulated broker that is also very reliable. Besides, the customer reviews of this trading platform are highly positive.

Vantage Markets

Vantage Markets offer traders a perfect trading experience. This broker has several underlying assets that traders can trade. In addition, this broker’s trading terms and conditions are highly transparent.

XTB

Traders can rely on XTB to fulfill their trading requirements. This broker offers traders a rewarding trading experience. Deposits, withdrawals, and placing a trade with this broker go absolutely seamlessly for a trader. Besides, this broker has no history of indulging in any scams.

XM

XM is a regulated broker that offers traders a variety of trading services. In addition, the broker also offers traders a great number of underlying assets that they can trade. This broker does not indulge in any scams with the traders and has goodwill in the trading market.

Moneta Markets

Traders can rely on Moneta Markets to use a trading platform that does not indulge in broker scams. This broker is highly reliable, and traders can enjoy seamless trading services. In addition, Moneta Markets offer traders great customer support.

Conclusion about broker scams and how to avoid them

Traders should follow trading practices that protect them from scams. The trading world offers a lot of possibilities for traders, however, it involves as many scams. A trader cannot keep scam brokers from operating in the market, but they can follow a checklist to distinguish between scam and legit brokers, and thus pick only genuine ones.

Signing up with a genuine broker saves a trader from many trading scams. Also, a trader can expect his money to be safe while using such a broker’s trading platform. So, it is best for a trader to sign up with a regulated and legit broker like RoboForex, Moneta Markets, XM, Vantage Markets, and XTB.

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 67% of retail CFD accounts lose money)

FAQs – frequently asked questions about broker scams

Can I trust my online broker?

A trader can trust his online broker if he scores 9 or more on the legit broker checklist. A broker with a high score ensures that traders get the safest trading conditions. However, if the broker does not pass the test, traders should avoid signing up with such a broker.

How do you not get scammed by a broker?

An experienced trader can avoid getting scammed by a broker if he is cautious enough. A trader must make sure that he checks the legitimacy of the broker by considering the things that help determine whether the broker is genuine. If the broker’s legitimacy qualifies, a trader can sign up with such a broker. Also, a trader should stop trading with a broker if he witnesses any red flags.

Which brokers are the most trusted?

Of all brokers in the brokerage industry, the following 5 brokers are highly trustworthy:

– RoboForex

– Vantage Markets

– XTB

– XM

– Moneta Markets

How can you check a broker’s license?

Your broker must be duly licensed in the jurisdiction(s) where your company is incorporated or conducts business. You can access a wealth of broker data in the United States through the FINRA BrokerCheck database.

It would be best to verify a broker’s legitimacy by requesting their CRD registration and other relevant paperwork before agreeing to work with or trade with them (Central Registration Depository). This system maintains a database with registration and license details for over 650,000 FX brokers.

Last Updated on June 17, 2023 by Andre Witzel

(5 / 5)

(5 / 5)