How to withdraw money on Capital.com – A quick withdrawal tutorial

Table of Contents

Capital.com is a world-class trading platform that provides investors with many opportunities every day. You can earn a high percentage of profits while trading on Capital.com.

When you have earned a good amount of profits on your investment, you can withdraw them anytime from your trading account—making a Capital.com withdrawal does not require you to read a thick book.

The withdrawal process is as easy as depositing funds into your account. It does not matter if you are a short-term investor or a long-term investor. One day you would want to enjoy the profits you earned while trading on Capital.com for your benefit. When that happens, this withdrawal tutorial will help you withdraw funds without any trouble. Before discussing the withdrawal process, let us look at various withdrawal options.

Withdrawal methods on the Capital.com platform:

Just as you deposited funds into your account, you can withdraw them anytime. As a Capital.com client, you do not get bound to hold your funds in your account without your willingness. You can operate your trading account as you wish.

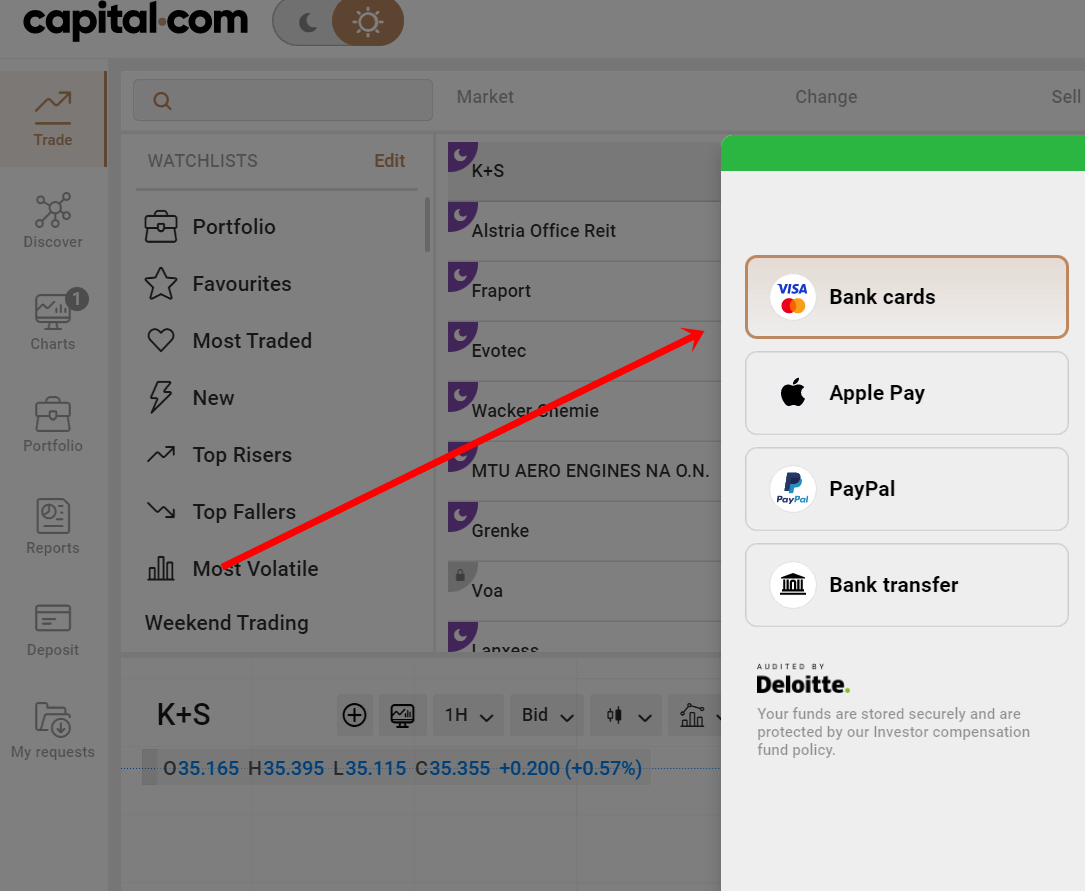

To deposit funds into your account, you can use your debit or credit cards. You can also make use of the bank transfer option. For withdrawing your funds, Capital.com offers you the following options.

- Bank Transfers

- Debit or credit cards

- Electronic wallets

Let us have a look at these payment methods one by one.

(Risk warning: 75% of retail CFD accounts lose money)

1. Bank transfer

Bank transfer is the most commonly used method to deposit and withdraw funds at Capital.com. If you wish you withdraw your funds through a bank transfer, you can select this withdrawal method.

You will need to enter your bank account details to get the funds credited into your account. After this, Capital.com shall initiate a fund transfer for the amount that you selected.

2. Debit or credit cards

Depositing funds through your debit or credit card is another option at Capital.com. You can select this as your withdrawal method. You only need to enter your card details and proceed with the confirmation. Capital.com shall send you an email notifying you about the initiation of the fund transfer.

Payment through a debit and credit card is a positive point for investors trading with Capital.com. Not all online trading platforms offer this benefit to their clients.

3. Electronic wallet

Again, not all trading platforms offer their clients the privilege to deposit and withdraw funds with the help of the electronic-wallets. Capital.com, however, is an exception.

You can deposit and withdraw funds through your e-wallet by selecting this as your desired payment option. Your funds will get credited into your e-wallet instantly.

(Risk warning: 75% of retail CFD accounts lose money)

How to withdraw money?

You are now aware of the payment methods. Let us further discuss the process of withdrawing funds. If you want to withdraw funds from your Capital.com account, you can follow these steps.

#Step 1 – Log in to your trading account at Capital.com.

#Step 2 – Click on the settings tab and go to the “My Accounts” section.

#Step 3 – Click on the ‘Withdrawal’ or ‘Withdraw Funds’ option at’ My Accounts.

#Step 4 – Select the withdrawal method amongst all the methods available at Capital.com.

#Step 5 – Fill in the withdrawal amount and click on the ‘submit/ confirm’ button.

You can also enter a short description or reason for withdrawal if prompted by the broker. While making a withdrawal request, you can only withdraw the amount you have in your brokerage account. You cannot draw out more than what is in your account.

If you want to withdraw more funds, you will have to sell the investments and securities that you are holding. After selling some of your stocks, you must wait for the trade to settle. The amount will get credited to your trading account, and you can withdraw this amount whenever you want.

How long does it take to withdraw money from Capital.com?

After confirming the amount you want to withdraw, you can expect a fund transfer anytime from Capital.com. However, the time involved in getting your account transferred with the Capital.com withdrawal amount may vary according to the payment method you choose.

Here is a brief description of the time involved in withdrawing money from your Capital.com trading account.

Withdrawal Method | Time involved |

Bank transfers | 4-5 working days |

Credit or Debit cards | Up to 24 hours |

Electronic wallets | Instantly |

(Risk warning: 75% of retail CFD accounts lose money)

Usually, the payments through a card would not make you wait for much longer. It will take 24 hours to the maximum for the payment to get credited. If you choose a bank transfer option, it might take a long time for the fund to transfer to your bank account.

Time duration of 4-5 working days is normal when you choose this option. Capital.com initiates the fund transfer from its end when you submit a withdrawal request. The payment could sometimes take a few days to clear as per the bank’s operating procedures. So, if there is a dire need for funds, you must ensure that you submit a withdrawal request on time.

Withdrawing through electronic wallets is the most convenient option if you need funds instantly. You can select this withdrawal method, enter the amount you want to withdraw, and click on the confirm button.

The electronic wallet you used to fund your account will get credited with the withdrawal amount when you submit your request.

What is the minimum amount you can withdraw?

When you trade with Capital.com, there is no minimum amount that you need to enter to make a withdrawal request. You can withdraw any amount of your choice from your Capital.com account.

So, if you have made a massive profit by trading on the online platform, you can withdraw your profits and use them as you like.

However, if you choose bank transfer as your payment option, you will have to withdraw a minimum of 50 EUR/USD/GBP. For debit or credit card withdrawals, you can take out any amount. The same holds for e-wallet transfers.

Payment Method | Minimum Withdrawal Amount |

Bank transfer | 50 EUR/USD/GBP |

Electronic wallet | No minimum amount |

Credit or Debit cards | No minimum amount |

A trader should also be careful about bringing his brokerage account balance to nil. You should maintain some balance in your trading account so that you can easily cover up the margin requirements. Withdrawing all the funds from your account is not recommended if you wish to continue trading online.

If you want to learn more about capital.com, we can also recommend this article of ours. Here we show you what the minimum deposit is.

(Risk warning: 75% of retail CFD accounts lose money)

Fees that can occur while making Capital.com withdrawal

Capital.com does not charge any withdrawal fees from its clients. It means that you can completely enjoy your profits and earnings from trading without paying any withdrawal fee to the broker.

No matter which payment method you choose, basic withdrawals are free of any charge at Capital.com.

Payment Method | Withdrawal Fee |

Bank transfer | Free withdrawal |

Credit or Debit cards | Free withdrawal |

Electronic wallets | Free withdrawal |

The multiple withdrawal options and a zero fee offer a trader more liberty in withdrawing his earnings. Unlike other trading platforms, Capital.com does not charge an exorbitant withdrawal fee from its clients.

It is what makes Capital.com a favorable trading destination for millions of investors. However, your bank can charge you convenience or a handling fee while withdrawing your funds from Capital.com.

The online trading platform can not control it because this fee belongs to the bank for the services it renders. Other than this, your Capital.com withdrawals are free of any withdrawal fees.

The account opening process, fund deposit, and withdrawal are easy tasks on Capital.com. One does not need hours of lessons to withdraw funds from their trading account. They can do it anytime and anywhere only by logging into their account, selecting a payment method, and entering the amount.

Here is our article fully dedicated to the topic of demo accounts at capital.com.

Problems and issues with making Capital.com withdrawal

While it is an effortless process to make a withdrawal request, an investor might face some problems in the process. Some issues may arise while you struggle to get your hard-earned money in a usable form. It can hinder the activities that you planned with your profits.

Let us look at some of these issues that might come up while making a withdrawal request. We will also look for possible solutions to these problems.

1. Getting your fund withdrawal into a third-party account.

If you are thinking of getting a fund withdrawal into a bank account that is not yours, you might want to rethink. It is the most common problem that investors face, and it has no solution.

By law, Capital.com should transfer funds into the bank account that has your name on it. The same clause applies to debit and credit cards. You can withdraw any amount of funds into your bank account or your cards.

But, third-party withdrawal is not an option at Capital.com. No online trading platform supports third-party withdrawals due to security purposes.

(Risk warning: 75% of retail CFD accounts lose money)

2. Not having IBAN for withdrawal

IBAN signifies the international bank account number that most investors do not have. If you make a withdrawal request and do not have an IBAN, it can be troublesome for you.

However, a solution is to clarify your withdrawal amount to Capital.com and provide a valid bank statement. It will help the broker identify and verify your identity. Your bank account statement should contain the following details.

- Name of your bank

- Swift Code

- Account Number

- Your name and address

Providing these details to Capital.com will help resolve the issue of IBAN, and you can withdraw funds from your trading account free of any stress.

3. Decline of withdrawal

Sometimes Capital.com may decline your withdrawal request. It can be because of many reasons. One reason can be that there are insufficient funds in your brokerage account, and you have requested a higher amount.

It is also possible that your bank may decline the payment. If that happens, you can contact your bank and Capital.com’s customer support as well. They can guide you to make your Capital.com withdrawal a success.

In some cases, you might make the mistake of requesting a withdrawal through a mode other than that of the deposit. For instance, you deposited funds into your account through your debit or credit card.

You can not get funds credited into your account via a bank transfer for this payment. Your mode of payment and your withdrawal method should be the same.

If your withdrawal request declines due to incomplete documentation, you can upload the requested documents on the broker’s website.

Conclusion: Fast withdrawals with Capital.com guaranteed

If you are looking for an AI-enabled online trading platform, Capital.com is the right choice to make. It has a history of leaving its clients with the best user experience. For beginners, Capital.com offers opportunities for learning more and training better.

It is the best trading platform in the industry, enabling its users to maximize their earnings. Numerous deposit and withdrawal methods are available to the clients, so one does not have to stick to only one payment method.

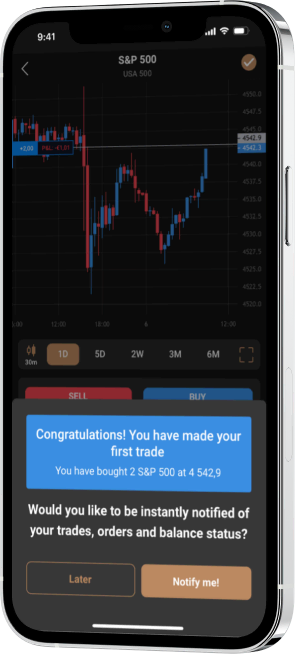

It is a reliable and trustworthy platform compatible with mobile phones and computers. The platform offers the privilege of trading through a demo account to its users. It is an advantage for beginners since they can test their market knowledge through this demo account.

Accordingly, they can step into the real-world market and increase the scale of their investments. It has won the hearts of its clients and awards for being a well-founded, authentic, and easy-to-use platform.

Want to learn more about different trading platforms? Then check out our overview of the 20 best forex brokers here.

(Risk warning: 75% of retail CFD accounts lose money)

FAQ – The most asked questions about Capital.com withdrawal :

How can I make a withdrawal request to withdraw my funds from Capital.com?

If you want to withdraw your funds or a share of profits from your trading account, you can log in to your Capital.com account and click on the ‘Withdraw’ button. You can enter the amount of your choice to withdraw select a payment method. Finally, you can click on confirm/submit to request Capital.com withdrawal.

Which payment methods can the traders use to withdraw funds from a trading account?

At Capital.com, you can use the payment options of debit or credit cards, electronic wallets, and bank transfers to withdraw your funds. You can select the payment method you used to fund your Capital.com account. After you submit your request, the broker will initiate the fund transfer from its end.

How long will my withdrawal be pending on Capital.com?

The time for which your withdrawal stays pending on Capital.com depends upon the payment method that you choose. You have to wait for 24 hours to receive your funds for card withdrawals.

Bank transfers might make you wait for 4-5 working days because of the lengthy procedures. Your electronic wallets will instantly get credited with the withdrawal amount after submitting a request.

Can I withdraw funds into someone else’s account or card?

Sadly, this is not an option because of security reasons. You can withdraw funds into the account that is in your name. You cannot involve a third party in depositing or withdrawing your funds.

How many funds should I withdraw from my Capital.com brokerage account?

You can withdraw any amount from your brokerage account as there is no minimum withdrawal amount at Capital.com. Also, you need not worry about any withdrawal fees as it does not charge any.

What is the minimum amount for the Capital.com withdrawal?

There is a definite amount for Capital.com withdrawals. You can only withdraw the whole amount if you have under 50 USD/EUR/GBP in your trading account. If you’ve more than 50 USD/EUR/GBP, the minimum amount to withdraw is 50 USD/EUR/GBP. Get ready to start your trading business with capital.com.

How much time does capital.com withdrawal take?

Capital.com withdrawal is kind of instant. The withdrawal process doesn’t take too long. In general, it takes about 1 business day. But it often takes several business days. Most of the time, it takes 1 business day to arrive.

How do I make a Capital.com withdrawal?

Go through these steps to make a capital.com withdrawal:

First, go to the account section.

Then, visit the payments option.

After that, move on to the withdrawal section.

Then, select the funding method that you have used to make your deposit.

Then, specify the desired withdrawal amount.

At last, click the confirm option.

Is there any fee involved in Capital.com withdrawal?

No, a trader does not have to pay any fee to make the Capital.com withdrawal. All withdrawals using any payment method are free for traders. However, you must adhere to the Capital.com minimum withdrawal amount.

(Risk warning: 75% of retail CFD accounts lose money)

See more articles about forex trading:

Last Updated on January 27, 2023 by Arkady Müller