The 5 best day trading accounts in comparison for beginners

Table of Contents

Welcome to our guide about the 5 best day trading accounts. Here, we will compare the best platforms and show you the ones that have scored the first place. Since trading has become so popular plenty of people are looking to start day trading. But with the number of available brokers on the market, it’s hard to decide whom to partner with.

Here is a list of the 5 best day trading accounts:

Broker: | Review: | demo account: | Spreads: | Assets: | Advantages: | account: |

|---|---|---|---|---|---|---|

1. XTB | Yes, free | Starting 0.1 pips | 3,000+ | + More than 3,000 different markets + Very good trading conditions + Direct market access + Bonus Program | Live account from $0(Risk warning: 72% of retail CFD accounts lose money) | |

2. Vantage Markets | Yes, free | Starting 0.0 pips | 400+ | + Real ECN Trading + Very fast execution + No hidden fees + Low trading fees + Supports MetaTrader 4/5 + Free bonus available | Live account from $200(Risk warning: Your capital can be at risk) | |

3. Markets.com | Yes, free | Starting 0.6 Pips | 250+ | + Accepts international traders + Free demo account + Low spreads and commission +24-hour support + More than 100 different markets | Live account from $250(Risk warning: 67% of retail CFD accounts lose money) | |

4. Libertex | Yes, free | Starting 0.0 pips | 250+ | + Offers free demo account with € 50,000 virtual funds + More than 250 different trading underlying assets + Over five different languages customer support + Offers several CFDs | Live account from $100(Risk warning: 74.91% of retail investor accounts lose money when trading CFDs with this provider.) | |

5. eToro  | Yes, free | Starting 0.2 pips | 3,000+ | + A regulated and safe company + Social and copy trading + Innovative and user-friendly platform + Professional support + Minimum deposit of only $ 200 | Live account from $076% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

See the list of the 5 best 5-day trading accounts here:

- XTB – Good trading conditions

- Vantage Markets – Reliable support and service

- Markets.com – Over 8,200 markets to trade

- Libertex – Popular trading platform

- Etoro – Leverage up to 1:30 for European traders

1. XTB – Good trading conditions

This broker is known as the biggest CFD and forex broker. With more than 2000 tradeable assets, XTB offers diversity and maximum exposure to the different asset classes. It was founded in 2004, and since then, it has gained more than 290,000 clients from around the globe.

XTB is regulated in different countries. This company adheres to the strict rules implemented by the Cyprus Securities and Exchange Commission, the Belize International Financial Services Commission, and the Financial Conduct Authority. It is also regulated by The Comisión Nacional del Mercado de Valores and the Dubai Financial Services Authority.

Multiple assets can be traded on XTB’s trading platform. There are 57 currency pairs, which include both major and minor pairs. With over 1500 CFD stocks to trade, you will surely see well-known companies such as Microsoft, Apple, and Tesla. 135 ETF CFDs and more than 20 indices, and over ten commodities are also tradeable with this broker.

But XTB also offers cryptocurrency for traders who want to invest in that asset. The cryptocurrencies available are Bitcoin, Bitcoin Cash, Ripple, Litecoin, and Ethereum.

XTB has its own trading platform known as the xStation 5. Safari, Chrome, Firefox, and Opera browsers can be used to access the web-based platform. This is also available for free on both desktop and mobile devices. You can download it from the website, Apple App Store, or Google Play Store.

You can utilize XTB’s free demo account to get the hang of its trading platform. You can also test out the available trading tools and access educational materials to broaden your knowledge regarding trading. On the website, there are also articles, price tables, and market news to keep you informed so you can better prepare yourself for your next live trade. If you’re ready to start live trading, you can deposit any funds to your account via PayPal or QIWI.

This broker’s dedicated customer support service is available 24/5, and you can reach them through the live chat feature on the website and platform. The chat system supports languages such as English, Czech, French, German, Hungarian, Italian, Polish, Portuguese, Russian, Romanian, Spanish, Slovak, Turkish, Vietnamese, Thai, and Arabic.

Traders from the United States, Australia, Canada, Japan, Singapore, Slovakia, Mauritius, Israel, India, Turkey, Pakistan, Ethiopia, Bosnia and Herzegovina, Uganda, Cuba, Syria, Iraq, Iran, Kenya, and Romania, however, can not use this specific broker for their trades.

Benefits of XTB:

- Fully regulated in different countries

- Free 30 days trial period

- No XTB minimum deposit required

- 57 forex pairs, 30 indices, 15 cryptocurrencies, 1846 stock CFDs, and10 commodities

- Has its own trading platform known as xStation 5

- Spreads start from 0.01 pips

- Low commission of 0.08%

- Monday to Friday chat and email support

- Has a trading academy, price tables, articles, a market calendar, and a market analysis

(Risk warning: 72% of retail CFD accounts lose money)

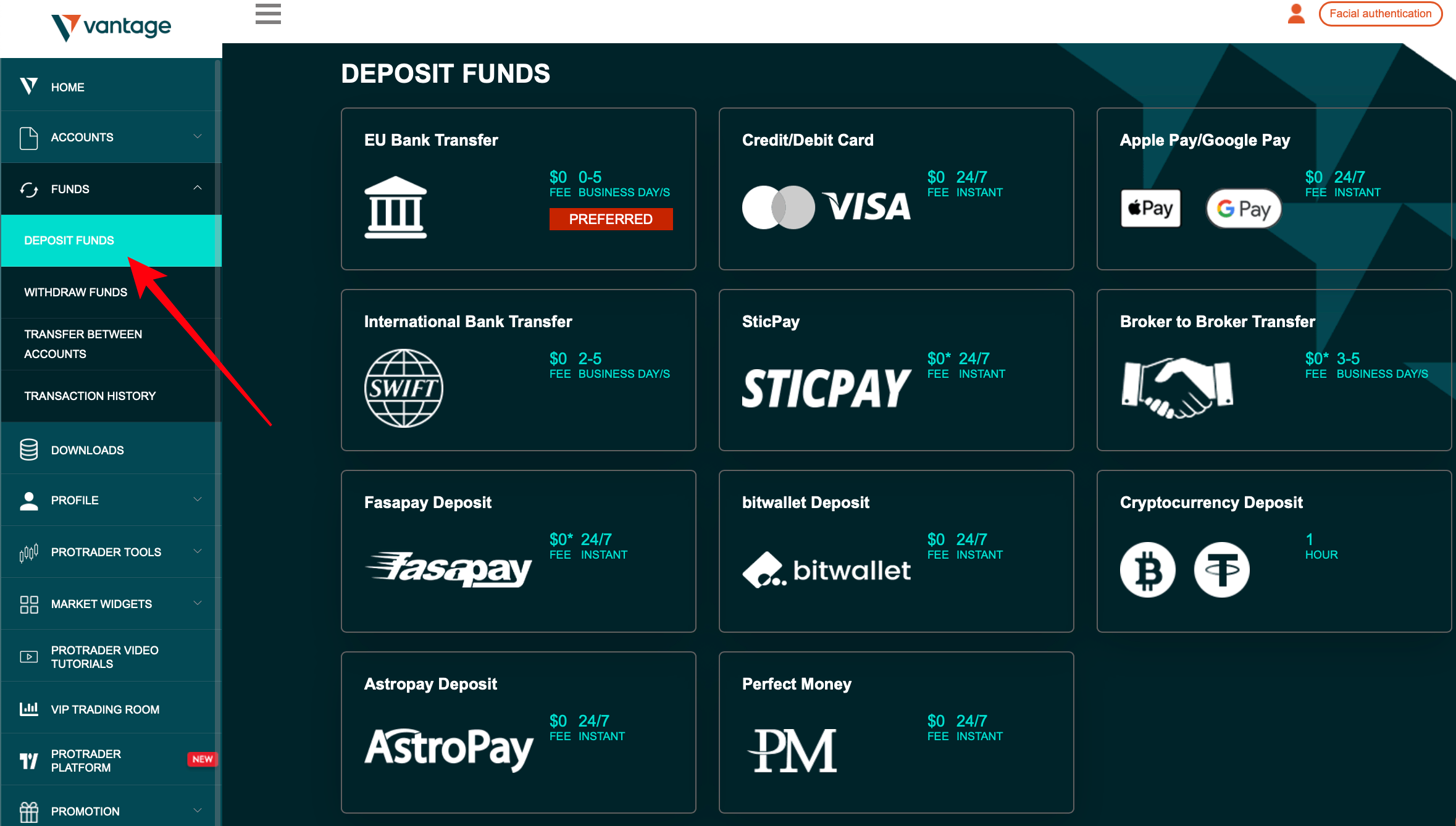

2. Vantage Markets – Reliable support and service

Vantage Markets is among the best brokers out there. This company can be very interesting for beginners or advanced. In particular, the provider is recommended for traders who want transparent and secure trading.

The broker offers you the options you need for professional trading. From our experience, there are no disadvantages except the language barrier in English using the support. Vantage Markets is a reputable and trustworthy broker with an extensive and favorable trade offer for international traders.

If you need a high level of leverage and want to trade tight spreads, you should switch now or open your first trading account.

Overall, Vantage Markets has more than 180 different tradable assets. These include forex (currencies), indices (Dax, SP500, etc.), commodities, precious metals, energies, and cryptocurrencies. The selection here is extensive, and every trader should find his matching asset to trade. The broker is constantly striving to expand the offer and to implement new markets.

Vantage Markets also offers 3 different account models (STP, RAW ECN, and PRO ECN – more on that below). The leverage can be up to 1:500 high for all accounts, and the spreads start depending on the account model from 1.4 pips or 0.0 pips. The commission per trade from 1 lot is either $ 3 or $ 2 high. Therefore, Vantage Markets is among the cheapest forex brokers.

There are 8 different base currencies available for the trading account, and an Islamic account version is adjustable. Incidentally, there are no hidden account maintenance fees. After my tests, the execution for trades at Vantage Markets is sensational and happens directly without requotes. You can rent a VPS server if you need an even faster connection. The support team will be happy to help. In summary, Vantage Markets stands for a professional trading experience at low fees. The offer and the terms of the broker clearly exclude the competitors.

FOREX PAIRS: | 44+ |

|---|---|

STOCK INDICES: | 15+ |

COMMODITIES: | 10+ |

STOCKS: | 500+ (UK, US, Europe, Australia) |

CRYPTOCURRENCIES: | 40+ |

Facts about the trading conditions:

- Minimum deposit of $ 200

- Over 300 different markets

- Several account models (commission-based and spread-based)

- Leverage up to 1:500

- No account maintenance fees

- Very cheap trading fees

- Spreads starting at 0.0 Pips

Benefits of Vantage Markets:

- Regulated and safe Forex Broker

- Real ECN Trading

- The best trading conditions for Forex

- Very fast execution

- Reliable support and service

- No hidden fees

- Low trading fees

- Supports MetaTrader 4/5

- Free bonus available

3. Markets.com – Over 8,200 markets to trade

Markets.com was created in 2008 and is known as a forex and CFD broker. It has won numerous prestigious awards, including “Best Trading Platform” in 2020, and was a runner-up for the Best FX broker in 2019. This broker is one of the trading arms of Finalto Limited, which used to be a TradeTech Group.

When it comes to its regulation, whoever regulates Finalto Limited regulates Markets.com. The Financial Services Commission, or the FSC, regulates this company. This regulatory body ensures only to register trustworthy brokers to ensure maximum security for traders around the globe.

With 67 currency pairs, including major and minor pairs, over 2,2000 shares of major global companies, 40 stock indices, and 28 commoditiesMarkets.com offer diversity. They will surely help broaden your exposure to the tradeable asset classes. There are also cryptocurrencies for traders who want to dabble with that asset. Among the cryptocurrencies available are Bitcoin, Ethereum, Ripple, Litecoin, and many more.

With Markets.com’s free demo account, you can train yourself to trade the different asset classes before investing your hard-earned cash. Creating a demo account is the same as creating a live account. Additionally, you can choose from EUR, GBP, USD, DKK, PLN, AUD, SEK, CHF, ZAR, or NOK as your trading currency. Just make sure to keep your demo account active since if there is no activity on it for 90 days, the broker will automatically close the account.

To start trading with a live account, you must deposit at least $100. Payments can be made using PayPal, Skrill, Neteller, Visa or MasterCard credit card, and wire transfer. The available account currencies are USD, GBP, ZAR, and EUR.

A 24/5 customer support team can readily assist you through the sign-up process or help you find what you’re looking for on the platform. They support English, Arabic, and Spanish, and the website is simple and user-friendly. Markets.com also has a knowledge center as well as multiple trading tools that can help you with your following trades.

Markets.com is not available for traders from India, Singapore, Puerto Rico, Iran, Hong Kong, Syria, New Zealand, Israel, Turkey, Canada, Belgium, Brazil, the Russian Federation, Japan, and the United States of America.

Benefits of Markets.com:

- Regulated by FSCA, CySEC, FSC, ASID, and FCA

- Free demo account

- The minimum required deposit is $100

- 64 forex pairs, 2,000+ shares, 25 cryptocurrencies, 40 major stock indices, 28 commodities, 60 ETFs, 4 bonds, and 21 stock blends

- Has two proprietary trading platforms (Marketsi and Marketsx) but MT4 and MT5 are also available

- Average spreads of 0.70 pips

- Low commission on select stocks such as CFDs

- 24/5 phone and live chat support

- Trading tools and a knowledge center are available

(Risk warning: 67% of retail CFD accounts lose money)

4. Libertex – Popular trading platform

Founded in 1997, Libertex is the older broker on this list. It has more than 20 years of experience on the market and has won multiple prestigious awards. Clients can rest assured that if they partner with Libertex, they are working with an experienced and well-seasoned brand.

Naturally, Libertex is regulated by one of the most well-known and reliable regulatory bodies, CySEC or the Cyprus Securities and Exchange Commission. It has been issued a license number of 164/12, and this broker is 100% transparent regarding its fees or charges.

There are over 200 assets to trade using Libertex’s proprietary trading platform known as cTrader. It has a user-friendly interface with all the tools you need to trade efficiently. However, you may also use the MetaTrader 4 or MetaTrader 5 platform if you are more accustomed to that.

These platforms are compatible with iOS and Android devices and can be downloaded from the Google Play Store or Apple App Store. But if you’d instead not download the platform, you can easily access it from any web browser on both desktop and mobile devices.

The assets offered include forex pairs, cryptocurrencies, ETFs, stocks, indices, and commodities. For forex pairs, you will find seven of the major currency pairs. These are NZD/USD, AUD/USD, USD/CAD, USD/CHF, GBP/USD, USD/JPY, and EUR/USD. There are also a couple of minor and exotic pairs as well.

Cryptocurrencies like Bitcoin, Litecoin, and Ethereum are available on Libertex’s platform. You will also see well-known stocks from different countries, like Apple, Microsoft, Google, Facebook, Tesla, and more.

Creating an account with Libertex also entitles you to a free demo account. Here, you can use virtual funds to train risk-free. For live accounts, however, you will need to deposit a minimum of €100 to be able to start trading. The accepted payment methods are Visa, wire transfer, Sofort, Skrill, Rapid Transfer, Neteller, iDeal, Giropay, MasterCard, and Trustly.

If you need additional information on Libertex, you can contact its customer support system via email. You might have to wait a couple of hours to get a reply, though. But all the important information can be found on the website, and there is even an FAQ section.

The website supports English, Polski, Portuguese, Dutch, Italian, French, Spanish, and German. Traders from the European Economic Area or EEA can use Libertex and all its features and services.

Benefits of Libertex

- CySEC regulated

- €50,000 virtual funds in the free demo account

- The Libertex minimum deposit is €100

- 50+ forex pairs, 18 indices, 100 stocks, 16 commodities,10 ETFs, 50+ cryptocurrencies

- Has its own trading platform but also supports MT4 and MT5.

- No charge for spreads

- Commissions between 0.1% and 2.5%

- Multilingual customer support

- Free trading signals

(Risk warning: 74.91% of retail investor accounts lose money when trading CFDs with this provider.)

5. Etoro – Leverage up to 1:30 for European traders

Etoro is arguably the most famous broker on this list. It’s so popular that even non-traders have heard of the company’s name. You can see ads for this broker on almost any social media platform, and it has gained popularity since trading became mainstream. To date, Etoro has over 20 million clients from more than 100 countries around the globe.

Three regulatory bodies monitor this broker. CySEC, the Cyprus Securities Exchange Commission, FCA, and the Financial Conduct Authority. And the ESMA, or the European Securities and Markets Authority.

With the launch of its sophisticated trading platform in 2010, eToro has proven to be one of the best brokers for day traders or any trader. Now, the platform is known as CopyTrader, and it is available on any desktop or mobile device.

On the trading platform, clients gain access to forex pairs, cryptocurrencies, stocks, and CFDs. Etoro is best known for its wide selection of stocks from the global market. Among the stocks that you can trade include Apple, Coca-Cola, Tesla, Microsoft, Google, Nike, Amazon, Activision, Netflix, and many more.

The tradeable forex pairs include seven major currency pairs, minor pairs, and exotic pairs. All in all, there are 14 cryptocurrencies available on the platform. BNB, ZEC, NEO, EOS, XLM, MIOTA, ADA, ETC, LTC, DASH, XRP, BCH, ETH, and BTC. A complete list of the available CFDs can be found on the website.

The process of opening an Etoro account is easy and quick. It will only take a couple of seconds. To speed up the process even more, you can link your Facebook or Google account to create an Etoro account.

Successfully signing up with Etoro gives you access to both the live and demo trading feature. The demo trading, also known as your virtual portfolio, can be accessed with a button. This is free, and you can train or devise new strategies without risking your hard-earned cash. You will use virtual funds to practice trading the available assets on the trading platform.

To start live trading, you must deposit a minimum amount of $200. You can top up your account via Apple Pay. PayPal, BPAY, Neteller, Perfect Money, Skrill, Rapid Transfer, Swift, UnionPay, Visa, Venmo, Webmoney, Yandex Money, and wire transfer.

The great thing about Etoro is its copy-trading feature. You can check out and directly copy other traders using the platform. This helps a lot of beginners get an idea of how to trade a specific asset. You can also connect with other traders on the platform to get a second opinion before you execute a trade.

Although the platform is easy to navigate and user-friendly, it is common to have difficulties locating a particular feature. To remedy this, Etoro has a built-in help desk on the platform to contact customer support representatives to guide you. They are available 24 hours a day, from Monday to Friday.

Etoro’s website and platform support multiple languages. These are English, Spanish, Italian, German, Russian, Chinese, French, Arabic, Polish, Dutch, Norwegian, Portuguese, Swedish, Czech, Danish, Romanian, Vietnamese, Thai, and Finnish.

Etoro is unavailable for traders from Singapore, Hong Kong, Japan, Canada, Turkey, Iran, New Zealand, Saudi Arabia, Macao, India, and Madagascar.

Benefits of Etoro:

- Regulated by CySEC, ESMA, and FCA

- Free eToro demo account

- The minimum deposit is $50 for US residents, $200 for others

- 51 forex pairs, 1042 shares, 80 ETFs, 26 cryptocurrencies, 10 indices, and 7 commodities,

- Uses eToro CopyTrader as its trading platform

- Spreads as low as 1 pip

- Zero commissions

- 24/5 email support

- Ideal for copy trading

76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

What is a day trading account?

As the name suggests, day trading accounts were built for day trading. Depending on your broker, you might be limited to Pattern Day Trading Rules. With this, it is best to double-check first with your broker so that you will be able to trade multiple times in a day to make use of your day trading skills.

Day traders aim to consistently gain small amounts of profits through trading minuscule movements of market assets. To maximize this opportunity, they would have to use either margin, leverage, or a combination of both, depending on their trading strategy.

With that said, these days, trading accounts usually offer both margin and leverage and access to multiple assets to ensure that clients can find the most opportunities in the assets available. To help with this, day trading accounts usually offer built-in charting software so that clients wouldn’t need to navigate toward third-party service providers.

Since day traders take advantage of the volatility that comes with news reports, you can expect brokers that offer day trading also offer news updates and an economic calendar for users to anticipate market-moving news. For beginners, most of these brokers also offer insights in the form of fundamental and technical analysis.

Brokers for day trading are usually chosen for their speed of execution and low cost of trades. With these, clients can open and close multiple trades without fearing hidden costs or slippage risks.

With their practiced discipline and self-control, day traders will be able to make the most of the market regardless of market conditions. They can trade bounces, impulse moves, or even minuscule parts of both downtrends and uptrends. Even with minimal gains per day, they pride themselves on being able to shell out consistent gains that they exponentially accumulate over the course of their trading career.

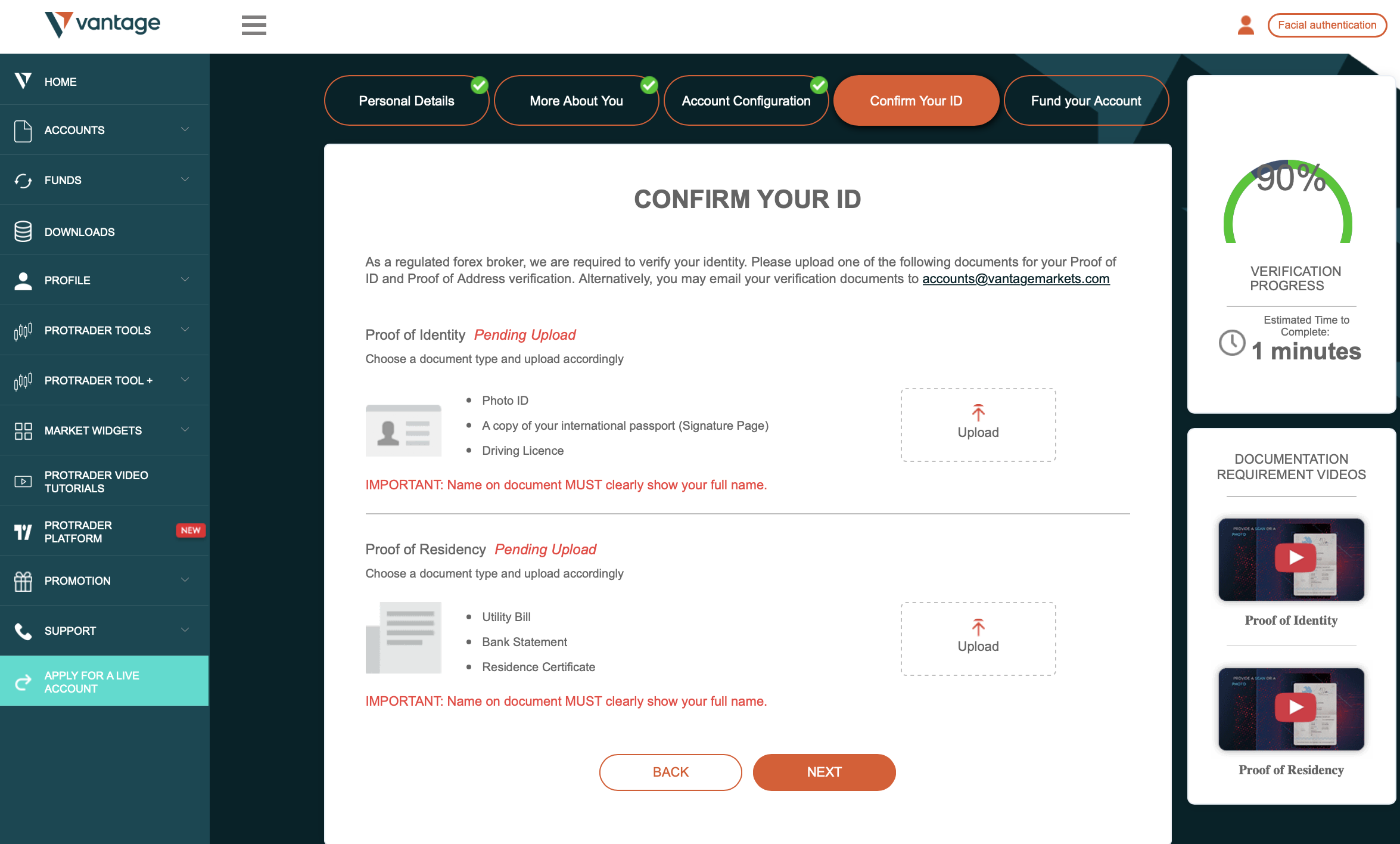

How to open a day trading account

Opening a day trading account is a straightforward and easy process. Some brokers require you to fill out a form asking for basic details such as your complete name, email address, phone number, and choice of currency. Other brokers allow you to link your social media accounts so you can instantly access the platform and start trading.

The process mainly depends on your broker, but rest assured that you can create an account within a minute. Additionally, signing up for a live account also instantly gives you access to a demo account when it comes to the brokers listed above.

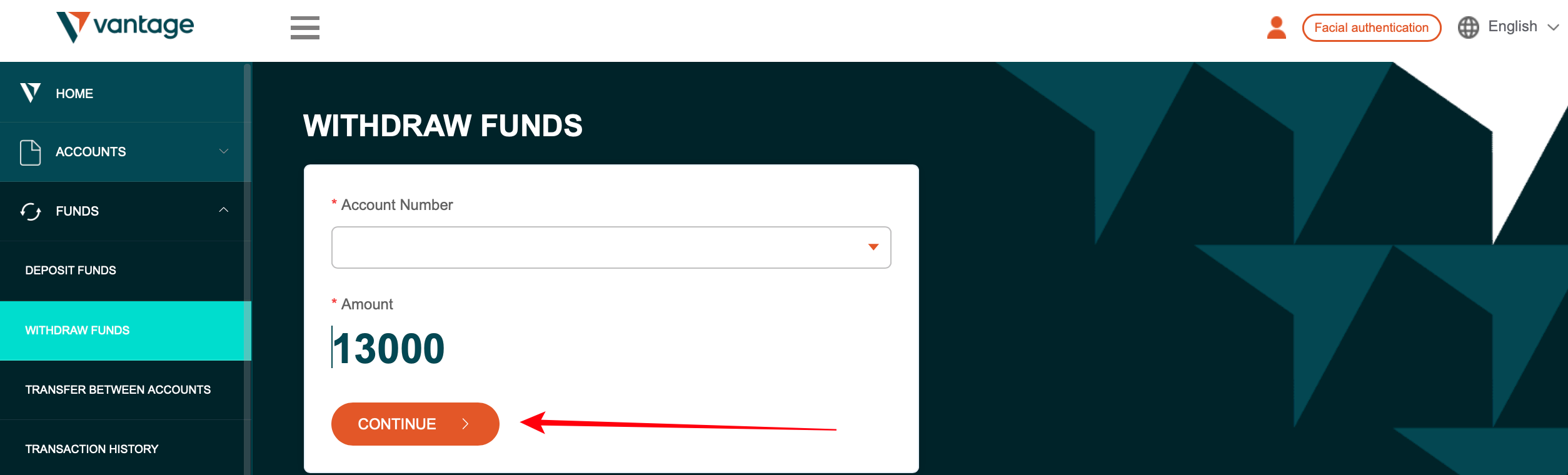

Verification process

Usually, brokers will only need to verify your email. To do this, they will send you an email, and you must click on the link provided. But when withdrawing funds, brokers will require you to verify your address and ID. You will need to send in any document with proof of address and any official ID to do this.

This acts as an extra layer of protection to ensure your funds will only go to you. This also helps prevent hackers from stealing hard-earned profits from your account.

Demo online day trading account

Demo online day trading accounts are free and can be accessed by simply signing up. You won’t need to deposit any funds to start using this feature. Here, you can trade using virtual funds provided by the broker to hone your skills. You can also use this opportunity to familiarize yourself with the broker’s platform before trading live.

Deposits

Deposit funds to your account can be done through the broker’s platform. The payment methods for each broker in this list can be found above. There’s no deposit fee, but keep in mind that some brokers require a minimum deposit amount.

Withdrawals

The payment methods mentioned above also act as withdrawal methods. Similar to depositing funds, this can be done through the trading platform. The only difference is you must verify your address and send in an official ID.

Fees for a day trading account

Fees come in the form of commissions and spreads. The amount or percentage depends on your broker and the asset being traded. Make sure to check their websites to confirm the amount or inquire by emailing or chatting with them via the live chat features. Additionally, there may be withdrawal fees as well. But all the brokers listed here are transparent, and the fees can easily be found on their website.

Conclusion – Try one of the best 5-day trading accounts!

The brokers listed above are all ideal as day trading partners. All the data you need to make an informed decision can be found in this article, but you should check out the brokers yourself to make sure. Doing some research and comparing them to one another is also advisable.

FAQ – The most asked questions about day trading accounts:

What account is best for Day Trading?

All the brokers mentioned above are best for day trading. If the broker offers multiple account choices, the basic account is the best way to start.

How much do you need to day trade?

This depends on the broker you partner with. The minimum deposit is usually enough, but for brokers that don’t require a minimum deposit amount, only invest what you can afford to lose. Trading will always be risky. You wouldn’t want to lose all your money in a single trade.

What is the significance of a day trading account?

A day trading account helps traders significantly in earning profits every day. The account helps you open and closes your positions every day. So, a day trading account is extremely beneficial for a trader. If you use your day trading account well, you can enjoy enhancing your wealth every day.

Which day trading account is the best for a trader?

A trader must sign up for a day trading account with the platform that offers them all the top features. It must cater to a trader’s need for all the trading tools. Besides, it should offer you several underlying assets that perform well in day trading. Then, you would benefit while trading.

How to use a day trading account?

A trader can use the day trading account by signing up for one. A trader would first need to find a reliable day trading broker. Then, after entering the required information, traders will become eligible to use their day trading account. They can search on their day trading account for all the underlying assets they can trade. The day trading account will permit you to open and close your trades on the same day.

Last Updated on February 17, 2023 by Andre Witzel

(5 / 5)

(5 / 5)