FP markets demo account: How to use it with trading? – A quick tutorial

Table of Contents

Prospective traders or investors usually go for demo accounts to practice trading and understand strategies before investing their real money. Many companies provide online tutorials for new investors to obtain a feel for trading on actual markets without the risk of losing money. It shows how FP markets demo accounts work and trade through it. Numerous new investors use demo accounts for learning purposes. Although there are many advantages, some of the skills learned might be troublesome in practice.

Beginner traders can practice on a free demo trading account provided by FP Markets. This Demo account interface is the perfect tool for traders who want to learn how to trade without risking any money. The FP Markets Demo Account allows you to experience forex trading in a risk-free environment. The trading on demo account becomes handy when using different trading tools, including VPS, Forex Calculator, Autochartist, and others. The ultimate aim of a demo account for trading is to learn the basics before going for bigger spreads.

What is the demo account?

New investors can use a demo account to test out methods and gather information on how trading technology works without the hazards of the actual markets. Users trade with fictitious funds, and the demo account replicates these returns of a real-money account. Demo accounts are frequently used in high schools and colleges to teach investing and compete against other schools in trading competitions, and this helps newbies learn how to use it and be risk-free.

These accounts are popular among stock, currency, and commodity traders, although they are less effective for long-term investors. A demo account allows prospective investors to understand real-world trading procedures and learn what to look for when trading real-world assets and securities.

Due to the supply of virtual money for practicing trading, a demo account stands helpful as a practice account. It allows traders to study the broker’s services without risking losing money.

Beginner traders will get complete help with demo accounts and get hands-on experience in the fast-paced live trading environment. Further, they can hone their trading skills and develop their trading methods by actively participating in trades.

How does it work?

Once you understand the demo account and its purpose, you should understand how a demo account works. Many people who desire to trade find online trading platforms to be complicated. Demo trading is available on real trading platforms to practice using the real platform in the future. Trading platforms that aim to attract new consumers can use this as a marketing technique. It further allows creating FP markets demo accounts and trades before going ahead with the real account.

How to open the demo account – Step-by-step process

As a part of the account opening process, a trader must register with the FP markets. Below are the steps-

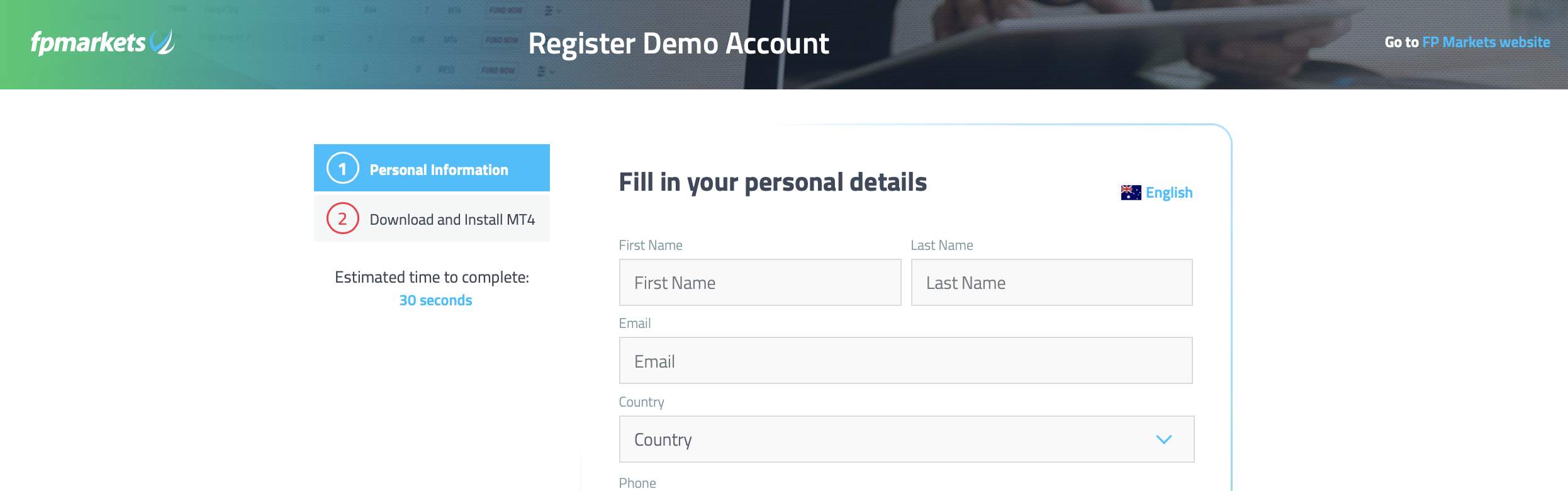

- Visit the FP Markets website and click the ‘Try a Free Demo’ link towards the top of the page.

- The trader will get an online application form, asking for the first and last name of the user’s email address and mobile number.

- Click ‘Register’ once the above process is completed with all the required information.

- After the form submission, the trader can move to the other process. There will be an option to choose between trading platforms, account types, account currencies, leverage, and an initial deposit (this will be virtual money).

- After making their selections, the trader can click ‘continue’ and receive a notification that their application has approval.

- To obtain their sample trading account details, the trader must check their email.

- After getting account information, the trader can successfully log in and go to the download section of their client portal’s ‘Trading Tools’ tab to download their preferred trading platform. Make sure to remember the user-id to sign- up next time.

When you feel ready to trade with real money, you can check out our other turorials: Here is our withdrawal tutorial for FP Markets. and here we show you how to deposit money.

How to use the demo account?

Using an FP markets demo account or simply a demo account the right way can benefit from understanding its aspects. Here are some ways to make the best use of demo account-

- Making true assumptions

It’s critical to establish reasonable assumptions when using the demo account for practice and make the best out of it. You might, for example, place a bid. However, this bid was within a certain amount of the movement’s peak or low. Your order may appear to be completed in a demo account in such a case. In a live account, however, this may not be the case.

As a result, earnings and losses from such trades should get a deduction from the net profit/loss account in these circumstances. It’s safe to believe that these exchanges never happened. The orders and bids are considered completed if the pricing trades within a certain amount are more.

- Research and more research

Keeping in mind that you will not lose any money in your demo account, make use of this opportunity to learn more about the specific assets you are interested in. Traders with their demo accounts will have complete access to trading charts, allowing them to study them in-depth. Well-thought traders adhere to assets in which they have a solid understanding, and your demo account will enable you to do so.

- Making the use of slippage

The discrepancy between the estimated trade and execution price is known as Slippage. During instances of significant volatility, Slippage is very common, and it can also happen when there isn’t enough trading volume for keeping the current bid/ask spread in place.

It is better to consider 1% slippage in the demo account, especially if trading high-volume equities. More significant Slippage is vital to consider carrying lower volume or more volatile equities, which will better prepare you for the actual trading world.

- Monitoring your emotion

When using the FP Markets demo account or, in that matter, any demo account, a trader needs to keep in mind that there is no place for emotions. While trading, it’s critical to be aware of your emotions. Fear and greed are the two vital emotions that harm trading decisions. Fear of losing money can lead a trader to execute deals too soon or hold on to a position for too long in the hopes of the market turning around.

This obstructs the ability to make well-informed decisions based on thorough research. It may result in missed chances or increased losses. Furthermore, greed may cause traders to hold on to their holdings for too long in the hopes of making more money. However, significant losses could result if the market suddenly went against them. The desire to generate high profits can cause traders to overlook potential risks.

- Trading with realistic capital

When practicing with a demo account, it is better to use the same amount of money as you would while trading in real life, which will prepare you for live trading. If this isn’t possible in the demo account, trade with just a portion of the demo money.

Demo accounts will not magically help you transform into a skilled trader despite their numerous benefits. With regular practice and managing your risks, you can improve your chances of success.

Features of demo account

Every demo account comes with some features equally available in the real trading account. The features of the FP Markets demo the trader’s trading platform will determine the account, whether MetaTrader 4, MetaTrader 5, or cTrader, connected with the demo account. To put it another way, one can access demo account features using the trading platform depending on Markets’ asset classes, spreads, leverage, and other factors.

Real stock quotes and prices were presented well on the demo account. The main distinction is that the market has no bearing on your offers to purchase or sell an item. For example, if an investor buys gold to expect the price to climb to a million dollars, the market will be affected instantly.

Other traders will notice that someone potential is quite determined to spend a big amount in gold and will follow suit, driving the rise in gold’s price and causing it to become overbought. Of course, the market will not respond if you buy gold on a demo account with a virtual million, and it makes no difference.

The trader must first download the trading platform to one of the following platforms to have access to the demo account:

- Mobile – Android, iOS, or iPad

- Desktop – MS Windows, Mac OS, and Linux

Once you download the software, sign up and access the FP Markets demo account.

Difference between live market and FP market demo account

Even if you are trading in market-like conditions, there are several variations between real and demo trading. The fact that there is no significant harm that can result from paper trading is, without a doubt, evident.

- Slippage, interest, or out-of-hours price changes will not apply to trades executed through the demo account.

- On the demo account, there are no charges for chart packages.

- If you have insufficient cash to cover the margin, which is quite a high chance in the live account, trading will continue.

- One of the significant differences between the FP market demo account and the live market account spreads. Demo accounts need to follow the same exchange rates as open accounts, although this doesn’t always happen.

- A demo account’s pricing feed and a genuine account’s price feed, including bid and ask prices, can be very different. While spreads in real trading accounts change based on buyer-seller interaction, they are frequently set in demo accounts.

Advantages and disadvantages of demo account

Advantages

- No-Risk of losing money: There is a nil risk of losing any money even if you make a wrong trading decision.

- You can continue for the long-term– There is no expiry date or limitation to trade in the demo account. You can continue unless you gain perfection.

- Less Stress– Genuine trading elicits feelings of greed and terror, and they frequently deny traders access to critical information needed for effective risk management. Paper trading keeps the emotional roller coaster at bay, allowing a new trader to focus entirely on the method.

- Keep Practicing– From the preparation for a trading session till the final registration of a profit or loss, a newbie gains experience in every aspect of the trading process. If traders gain complete access to the demo account, they can learn how to utilize the software for real-money trading.

- Gain Confidence– Engaging in making complex decisions rewarded with a hypothetical profit can significantly impact a beginner’s confidence, and believing that you can trade using real money is on the line.

Disadvantages

- Psychology effect– Demo trading does not elicit the same feelings as real trading; such as profit or loss on a live account. Due to a lack of market discipline, many traders bring down the profit margin to gain loss in the real account. This act results in pressure to decide that he would not make a demo account.

- Adjustment– Demo traders tend to exaggerate their performance; reasons why real trading will be superior to the demo. It can be impossible to tell whether you would be able to perform an utterly equivalent trade in the real market owing to a variety of reasons. Entry and exit adjustments are possible, which is why the demo account results would be a little subjective at best and incorrect at worst.

Conclusion

It’s simple to create an FP Markets demo account on the exchange. Demo accounts can be quite beneficial to a professional in optimizing his techniques. When opening a demo account, a trader should be aware that execution, emotions, and other characteristics of demo trading may differ from those of actual trading. It is critical to consider certain aspects mentioned above while transitioning from a demo to a live environment. Do check for a reliable demo account to reset your account, and it has a tutorial for learning.

FAQ – The most asked questions about FP markets demo account :

Is it possible to make money through a demo account?

A demo account cannot be used to gain money. The money in a demo account is fictitious. After mastering your trading skills on a demo account, you can only make money with a real trading account. It is better to practice on a demo account first and then move on to a real account with low capital.

Why should you go for an FP markets demo account?

FP Markets is the ideal platform for CFD trading in Forex, stocks, commodities, and cryptocurrency. With spreads as low as 0.0 pips, their trading accounts provide consistently narrower spreads. The platform has teamed up with both banking and non-banking financial organizations to create a deep liquidity pool with some of the best market rates.

On the world’s largest exchanges, you can trade over 10,000 CFD products. Choose from a variety of powerful platforms, such as MT4, MT5, etc., and trade on the go with our mobile, app, and web-based accessibility options.

What are the benefits of an FP market demo account?

Liquidity in abundance- To get a varied liquidity mix and aggressive pricing, tap into a big liquidity pool of top, tier one, regulated financial institutions.

Complete Transparency- With a trading account from FP Markets, you can stay in control with transparent pricing and commissions.

Latency is low– Using the best-in-class technology reduces order slippage and achieves ultra-low latency order execution.

Raw Spreads That Are Tight- Our pricing strategy encourages price competitiveness, resulting in narrow bid/ask spreads. On major currency pairs, our spreads are routinely as low as 0.0 pips.

What markets do FP markets offer?

It offers different markets including, Forex, Shares, Commodities, Bonds, Digital Currencies, and Indices.

What is the difference between MT4 and MT5?

The MT5 platform is designed to be the predecessor of the MT4 platform, and it offers significantly more features and technology than MT4. Although MT4 is currently more popular because of its long time on the market, MT5 will soon entirely replace MT4.

Is the FP Markets demo account safe for beginners?

FP Markets demo account is safe to use if you are a beginner. The easy-to-use interface will be a great help to you. Also, you can try CFD trading in Forex, commodities, stocks, and cryptocurrency. The platform provides its users with narrower spreads. Plus, you will be able to trade over 10,000 CFD products. There are various platforms to prefer, such as MT4, MT5, etc.

Can I make money through the FP Markets demo account?

Unfortunately, you can use the demo to earn money. The demo account has unreal money. Real money is available only for the real trading account. If you wish to generate income, create a live trading account on FP Markets. It is preferable if you begin with a demo account. You can practice on a demo account first. Then, invest in a real account with low capital.

Does the FP Markets demo account use real money?

No, the demo account does not use real money. Instead, you will get virtual funds. You can use it for learning to trade any asset class. Additionally, you will discover the techniques that you can apply to a real account. Therefore, try out the demo account first, then use the real account like a pro.

See more articles about forex trading

Last Updated on January 27, 2023 by Arkady Müller