Why do Forex liquidity providers have an important role? – An explanation

Table of Contents

There is one indispensable factor in the world of forex trading that ensures the successful completion of transactions. This paramount factor is liquidity. Greater liquidity means transactions flow easily, and prices remain competitive. The forex market enjoys greater liquidity than all others in the financial market. However, sometimes, unexpected world events and economic news can cause a drop in liquidity. The cost of trading can increase due to wider spreads once this occurs. Liquidity providers play a vital role, especially in situations like these, by making sure the market retains a level of liquidity. Below, we explain the terms relating to liquidity, including liquidity providers. And we bring you examples of these terms used in the forex industry.

What is liquidity?

A simple definition of liquidity in finance is how fast you’re able to turn an asset into real cash. Some assets have greater liquidity than others in that it is easy to sell them and get paid. The forex market is a prime example of a liquid market. Currency pairs are bought and sold, and funds settle in accounts within two days at most. This is beneficial for all the players as large orders can be filled without problems, and spreads remain competitive.

Other markets may not enjoy this level of liquidity.

Factors that contribute to the forex markets’ high liquidity.

Several factors make the forex market more liquid than any other financial market. They include:

1. The market participants.

Major participants in the market contribute to liquidity by trading in high volume. These players include investments firms, mutual funds, hedge funds, retail forex brokers and traders, and high net worth individuals.

2. The hours of operation.

This market runs 24-hours a day, starting from Australia’s opening on Sunday evening to New York’s closing on Friday evening. The market is always accessible to traders all over the world who contribute to its liquidity.

3. Apart from these contributing elements mentioned above, some entities take on the duty of ensuring that the forex market enjoys this liquidity rate. They are called liquidity providers.

Trade forex with the best conditions and a regulated broker:

Broker: | Review: | Advantages: | Free account: |

|---|---|---|---|

1. Capital.com  | # Spreads from 0.0 pips # No commissions # Best platform for beginners # No hidden fees # More than 3,000+ markets | Live account from $ 20: (Risk warning: 75% of retail CFD accounts lose money) | |

2. RoboForex  | # High leverage up to 1:2000 # Free bonus # ECN accounts # MT4/MT5 # Crypto deposit/withdrawal | Live account from $ 10 (Risk warning: Your capital can be at risk) | |

3. Vantage Markets  | # High leverage up to 1:500 # High liquidity # No requotes # MT4/MT5 # Spreads from 0.0 pips | Live account from $ 200 (Risk warning: Your capital can be at risk) |

What is a forex liquidity provider?

A forex liquidity provider is an entity that creates a market by buying and selling currency pairs. They act as professional market makers and are involved in both sides (buy and sell) of forex transactions. Usually, these entities trade large volumes and are known as the big players. Investment corporations, commercial banks, and sometimes large brokerage firms are examples of liquidity providers.Some brokers fall under this category. Dealing desk brokers are also liquidity providers and offer quotes for currency pairs. Most times, these brokers fill orders by taking the opposite side of the trade.Brokerage firms are connected to all these liquidity providers. So when you place an order, depending on the type of broker, the order is sent to several liquidity providers. The order is filled according to the best price the broker receives.

Liquidity providers are divided into two (2) categories;

Tier-1 Liquidity Provider

Tier-2 liquidity provider

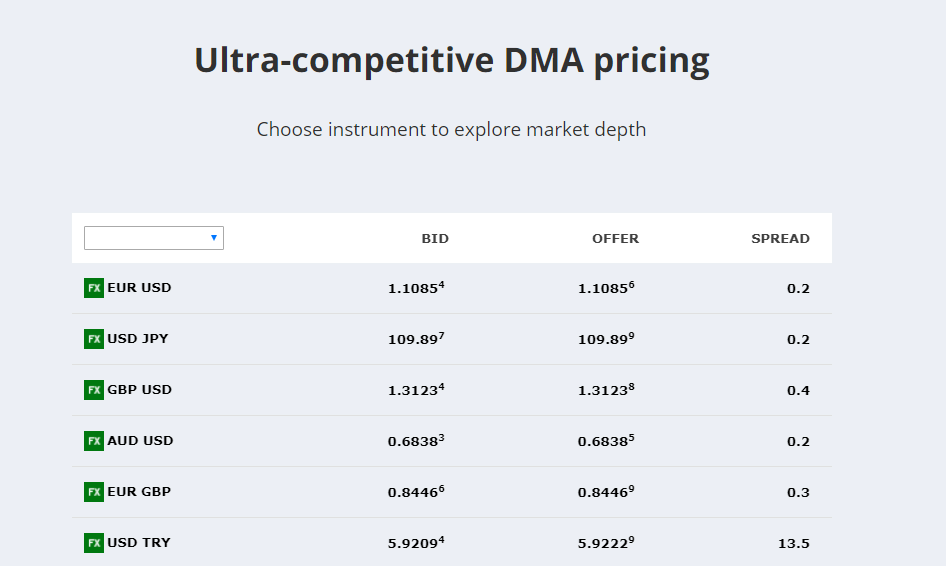

Tier-1 LPs consist of large investment corporations and commercial banks. Brokers connect to the Electronic Communications Network(ECN) of banks and other market-makers through them. These Liquidity Providers offer BUY and SELL quotes for all forex pairs, and those who deal with them enjoy the tightest spread. Though they make a profit from there, They also charge commissions and fees to the brokers. Apart from these sources of revenue, they rely heavily on trading the market for profits too. JP Morgan Chase, Barclays, Deutsche Bank, BNP Paribas, Citibank, and HSBC are prime examples of Tier-1 Liquidity providers.

Tier-2 LPs are made up of brokers and smaller investment companies who connect retail forex trade to larger liquidity providers. As we’ve mentioned, some brokers can act as market makers, ensuring liquidity for trade and quoting prices of currency pairs. These brokers fall under tier-2 LPs.

Trade from 0.0 pips over 3,000 markets without commissions and professional platforms:

(Risk warning: 75% of retail CFD accounts lose money)

How do Forex brokers provide liquidity to retail traders?

As we’ve explained, forex brokers fall under tier-2 liquidity providers.

A retail trader can not trade directly with a tier-1 LP, the same way a retailer in a regular market may not buy goods directly from manufacturers. Retail forex traders are granted access to trade through their broker, so they have to have a brokerage trading account.

These brokers use tier-1 LPs to fill the retail traders’ orders. Most of them partner with only one tier-1 LP, but others deal with multiple. They use ECN(Electronic Communications Network) or STP(Straight-Through-Processing) networks to execute trades placed by their customers. Their partnered Liquidity Providers give them access to these networks for specified fees and commissions.

Other dealing desk brokers provide liquidity themselves. When a trader enters a position, they take the opposite side to ensure that this order is filled. These ones are known as market maker brokers. Most traders avoid them because of the conflict of interest presented by such a trade, but they are also liquidity providers.

Key points about Forex liquidity and liquidity providers

1. Tier-1 Liquidity providers offer liquidity to forex online brokers and smaller investment companies who are tier-2 LPs. These Liquidity Providers function as a B2B, dealing in large volume, with themselves, brokers, and other smaller investment firms.

2. Tier-2 liquidity providers, that is online brokers and other smaller firms, operate a B2C business model. They deal with the big players and provide forex services to retail traders. Some brokers act as market makers and provide liquidity for their customers directly without passing on the risk to the tier-1 LPs.

3. The forex market enjoys high liquidity most of the time. But sometimes, sudden news releases may affect market conditions. A sudden price move may result from low liquidity, and this would lead to wider spreads.

4. Higher liquidity in the forex market translates to the easy flow of transactions and lower costs of trading. Everyone benefits from high market liquidity as orders are filled no matter how large, prices remain competitive, and the trading cost is reduced.

Currency pairs that experience the most liquidity

To trade the forex market profitably, it is essential to choose currency pairs that have high liquidity. Some currencies enjoy a higher turnover than others as liquid as the market is. With the most liquid forex pairs, you can enjoy tighter spreads and earn a lot of profit from trading often.

Below, we outline some of the most liquid pairs in the forex market:

1. EURUSD. The Euro vs the American dollar

This pair is without a doubt the most liquid in the forex market. A daily volume of up to $580billion is traded in the market. This is because both currencies are widely used. Some brokers offer as low as 0 spreads on this because of the high market activities and the volume traded.

2. USDJPY. The US dollar vs the Japanese Yen

The second most traded forex pair is the US dollar versus the Japanese Yen cross. This pair trade up to $577billion per day. Traders can enjoy spreads as low as 0.5pips with a good broker.

3. USDCHF. The US dollar vs the Swiss franc

Also known as the Swissy, this pair trades over $400billion daily and is the third most liquid in the forex market. The average spread on it is between 2.5 to 5pips.

4. GBPUSD. The British pound sterling vs the American dollar

These pairs see a daily trading volume of up to $350billion in the forex market. It’s nicknamed “the cable” since, in the distant past, quotations were made through the transoceanic cable. People who trade this pair enjoy an average spread between 2 to 4-pips.

5. AUDUSD. The Australian dollar vs the US dollar

The exchange rate is easily affected by commodity prices as Australia relies heavily on raw materials. The pair trades $250billion per day and is the fifth most liquid. Its average spread is between 2.5pips to 4.5.

Other currency pairs that see a lot of trading volume are the New Zealand dollars vs the US dollar, the Euro vs the British Pounds, and the Euro vs the Japanese Yen.

There are other liquid pairs, but the ones listed are among the most liquid. These pairs present the active trader with opportunities to place profitable trades.

Liquidity is a crucial factor for the successful completion of transactions in any market. Liquidity providers play one of the most vital roles in the forex market, ensuring that all orders are filled and trades flow efficiently.

Trade from 0.0 pips over 3,000 markets without commissions and professional platforms:

(Risk warning: 75% of retail CFD accounts lose money)

FAQ – The most asked questions about Forex liquidity provider :

What are the benefits of a forex liquidity provider?

One of the greatest benefits of a forex liquidity provider is access to various markets. Access to limited partnerships opens up a wide range of markets, including those for commodities, equities, bonds, and currencies. In order to trade a variety of instruments, traders might diversify their investment portfolio.

Who are the forex liquidity providers?

Today’s markets have a variety of liquidity sources, including banks, financial institutions, and main trading companies (PTFs). These liquidity providers can assist the market in various ways thanks to their business models and capacities.

How do forex liquidity providers make money?

A charge is earned on each transaction a cryptocurrency liquidity provider makes within a liquidity pool. They can earn more cryptocurrency by trading or selling it in a pool with incentives. Another well-liked strategy for making money is yield farming.

What do you mean by the forex liquidity provider?

A company that generates a market by buying and selling currency pairs is known as a forex liquidity provider. They participate in both the buy and sell sides of FX transactions as professional market makers. These companies trade in high numbers and are referred to as the major players. Liquidity providers include investment companies, commercial banks, and occasionally sizable brokerage organizations.

See more articles about forex trading here:

Last Updated on January 27, 2023 by Arkady Müller

(5 / 5)

(5 / 5)