How to get the best rates from your trading broker?

Table of Contents

When it comes to trading, you need to know a few things to maximize profit. For instance, are broker fees negotiable?

That’s a million-dollar question, given how high these fees can get. Therefore, if one isn’t wise, broker fees can take a considerable amount of money, thus lowering your investment return.

Here is a detailed discussion of this crucial aspect of trading. You will also learn how to get the best rates from your trading broker. Check it out!

What types of broker fees exist?

Regarding broker fees, there are various types, but they fall under two major categories. These categories are based on the types of brokerage firms: full-service and discount.

The two offer different services, which explains the variable pricing. However, don’t be surprised to find two brokers with different prices despite falling in the same category. The costs can be for various activities, usually categorized into trading and non-trading fees.

Here is a detailed discussion of each group:

- Trading Fees

- Non-Trading Fees

Trading Fees

In the course of trading, broker fees, and costs may compromise the following:

- Commission and Transaction Fees: These fees apply every time to place a trade. Depending on the broker, it can be a percentage of the trade or a flat fee

- Currency Conversion Fees: Sometimes, your trading account’s base and deposit currencies may differ. Therefore, converting your money to another currency will be vital, which is where this conversion cost comes in

- Deposit Fees: Similar to the withdrawal fee, this arises when depositing funds to your trading account. Again, it is rare among brokers

- Overnight Funding: It is also referred to as swaps, and the daily interest fee is a perfect definition of this broker fee. One pays it to hold a position through the night using leverage

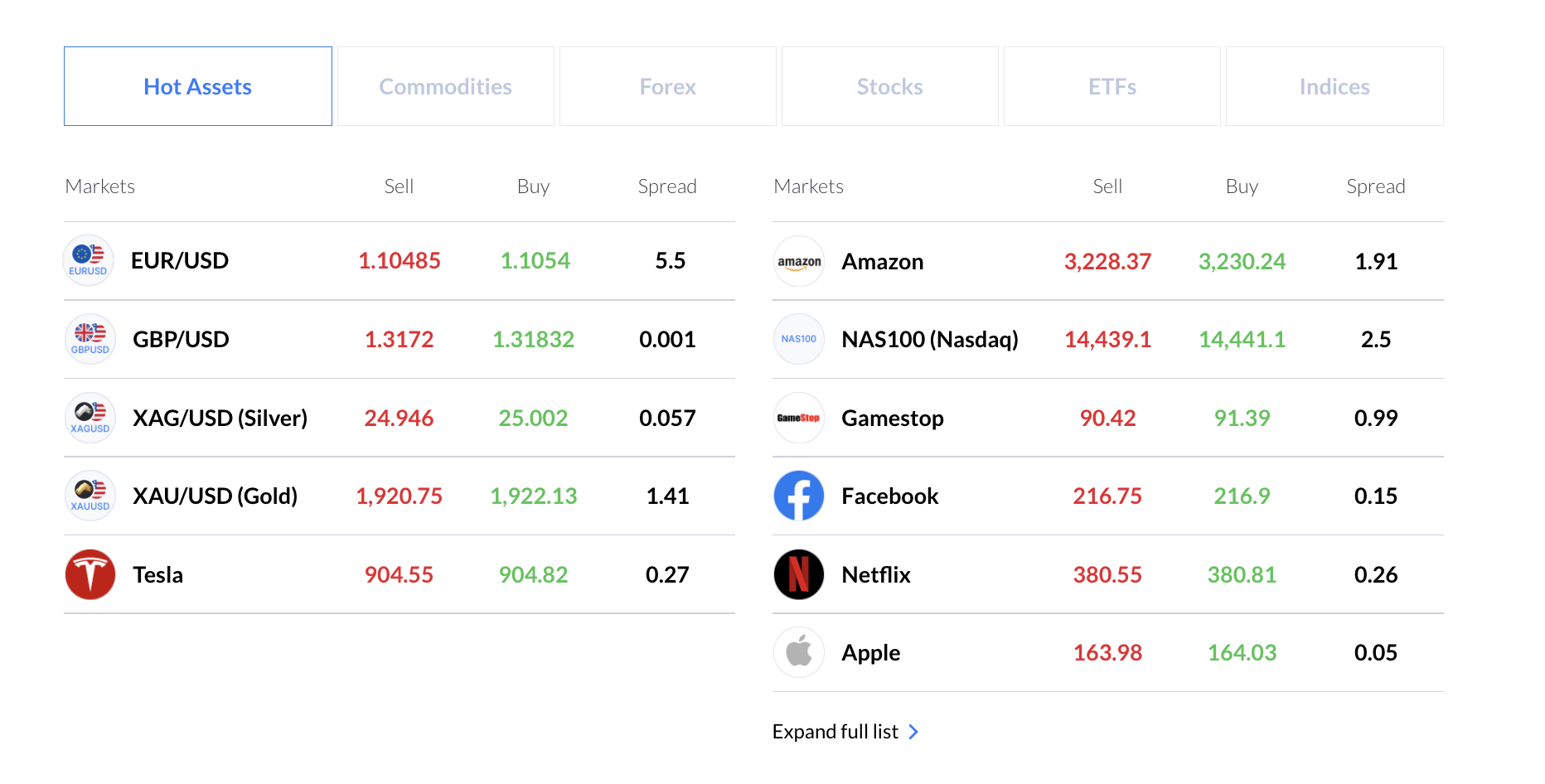

- Spread Costs: Similar to the transaction fee, you pay it after entering a position. This cost is the difference between the ask and bid price of an asset the trader is trading

Non-Trading Fees

- Account Maintenance: As a client, you won’t incur this broker cost unless some conditions aren’t met. For instance, you will pay a fee if your account balance is below a particular figure. However, the fee is rare; if charged, it is usually annually

- Inactivity Fees: As it states, the investor incurs this cost upon not using the trading account for a given period. This period is commonly several months, and the traders levied this fee are usually the less active traders

- Withdrawal Fees: Once you make profits and it is time to withdraw, some brokers will demand a fee. It is also rare and often a flat fee for each withdrawal

- Checking account service fees: It is common for brokers with banking arms. This fee is charged by the checking services connected to your trading account. It is important to note that the connection is usually indirect, the same for saving account services

- Account closing fees: Yes, you heard it right because some brokers will charge you when closing your account. If you paid a fee to open the trading account, there are high chances you will pay more to close it. It is probably the most controversial brokerage fee

- Paper statement fees: Traders will receive their paper statements, and the broker will charge this fee for the service. Fortunately, it is optional, and one can always get online statements for free

- Wire transfer fees: The brokerage firms often charge these fees are the banks. As the name suggests, traders incur this cost for a wire transfer, which is often a one-time fee but can be huge

- Account transfer fees: If you shift from your old broker to a new one, the former will charge you an account transfer fee. The Automated Customer Account Transfer Service (ACATS) will facilitate the transfer

- 401 (k) fee: Its role is to maintain your plan and usually comes from an employer

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 76% of retail CFD accounts lose money)

Are broker fees negotiable?

If you were to ask this question to a broker, don’t expect a yes. However, that shouldn’t discourage you since the fee is negotiable.

There are high chances of getting a negotiated rate if you have a large trading account. The same applies to active traders.

Tips when negotiating broker fees

Here is a piece of advice when negotiating brokerage fees:

- Check whether the brokerage firm offers other customers a negotiated rate to gauge your chances of getting lower rates

- If you threaten to transfer your trading account if the broker doesn’t lower the fees, do it if your efforts don’t yield fruit

- If you are a customer that any broker would appreciate having, there are high chances of getting a negotiated rate

- Based on the trading style you adopt, you can have a high or low commission to account for value. There are also high chances of getting a negotiated commission if it is low

- It always helps if you quote the rate of the broker’s competitor

- Don’t ask for a negotiated commission until your trading track record makes you worth a better rate

The best brokers for traders in our comparisons – get professional trading conditions with a regulated broker:

Broker: | Review: | Advantages: | Free account: |

|---|---|---|---|

1. Capital.com  | # Spreads from 0.0 pips # No commissions # Best platform for beginners # No hidden fees # More than 3,000+ markets | Live account from $ 20: (Risk warning: 76% of retail CFD accounts lose money) | |

2. RoboForex  | # High leverage up to 1:2000 # Free bonus # ECN accounts # MT4/MT5 # Crypto deposit/withdrawal | Live account from $ 10 (Risk warning: Your capital can be at risk) | |

3. Vantage Markets  | # High leverage up to 1:500 # High liquidity # No requotes # MT4/MT5 # Spreads from 0.0 pips | Live account from $ 200 (Risk warning: Your capital can be at risk) |

How to adapt your broker fees?

Negotiating your broker fees is an excellent example of reducing brokerage fees. Alternatively, you can try out some adaptations, including the following:

- Different accounts for different types of trading

- Different brokers with different fees

Different accounts for different types of trading

In most cases, you will find that a certain account is suitable for a particular type of trading, whereas another account is ideal for a different type of trading. You can take advantage of this common situation.

It has seen many traders save a lot by paying fewer broker fees. That’s because they will create an account that charges less fee for a certain type of trade. Eventually, they will participate in various types of trading while paying fewer broker fees since they are using different accounts.

Different brokers with different fees

Alternatively, one can change the broker. Rest assured that some brokers will charge less than others.

Unless they offer poor quality services, always go for a broker with fair costs. You will be surprised how much you can increase your investment returns by minimizing brokerage fees and costs.

3 best brokers with competitive fees

If you are looking for platforms with competitive fees, here are the best options:

- RoboForex

- XTB

- Vantage Markets

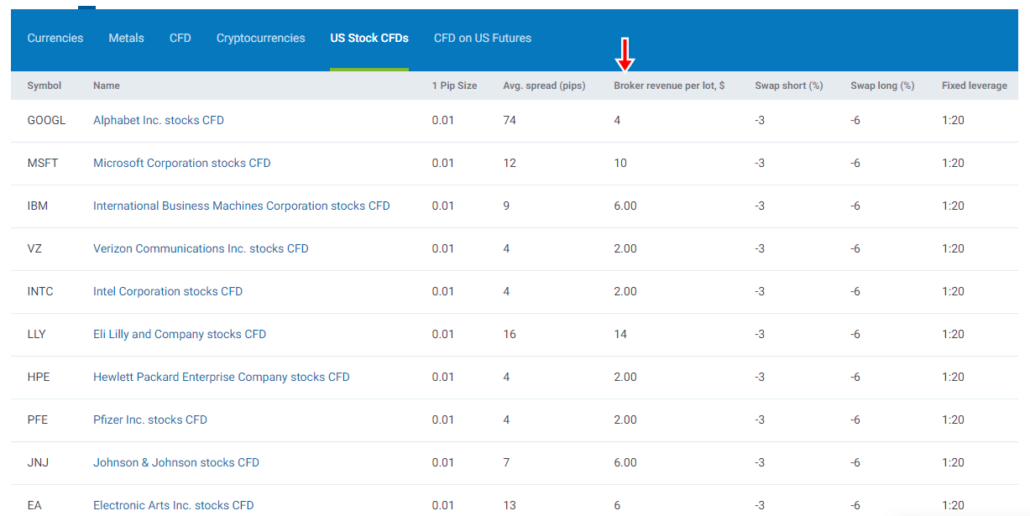

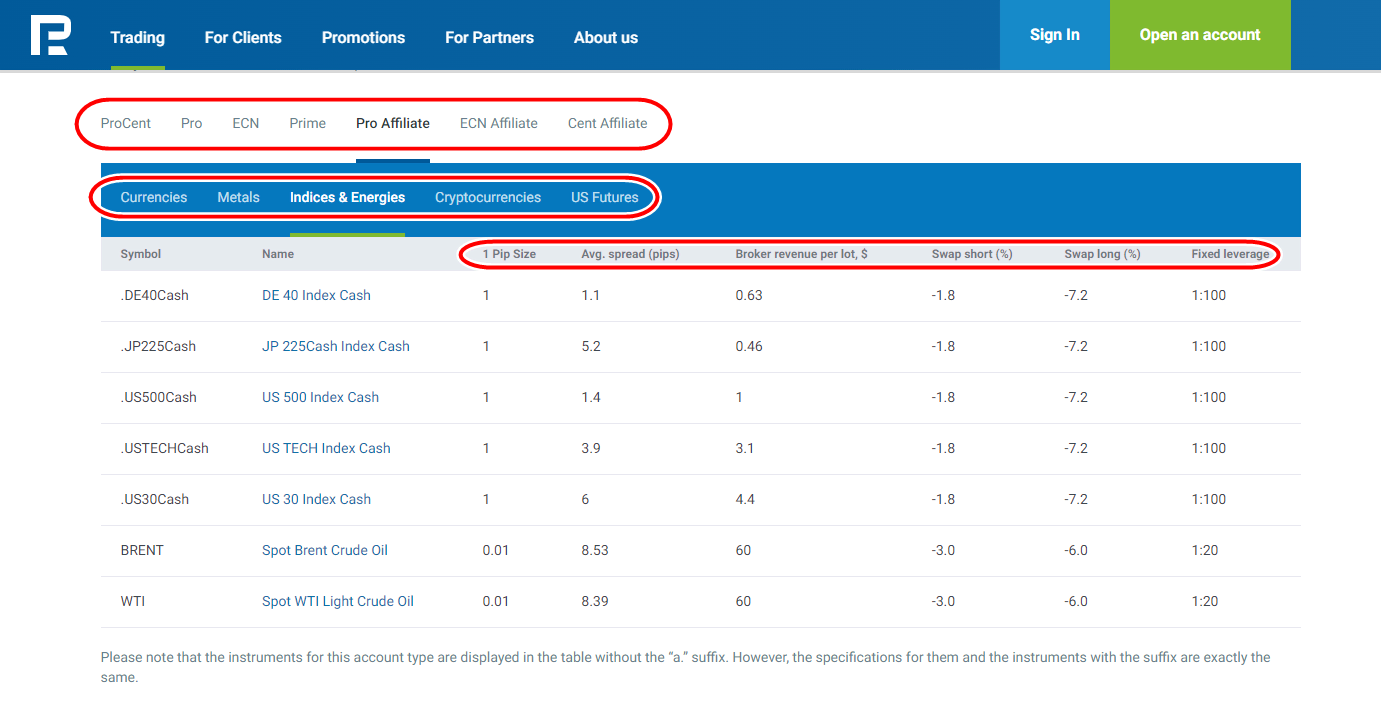

RoboForex

RoboForex is a platform that won’t disappoint you that’s to its competitive trading fees. For instance, you won’t incur any trading fee if you have a pro account.

Even in instances where you have to pay, the costs remain pocket friendly. Don’t equate that to poor services because this broker has one of the best trading experiences.

The broker got you regardless of how long you have been trading or how well you know its tricks and strategies. For instance, novices can take advantage of its tutorial, well-researched educational content, and demo accounts to gain experience.

Advanced traders can also use pro accounts, including RoboForex R StocksTrader and ECN Accounts. Their features match that experience hence ideal under such circumstances.

Pros of RoboForex

- Traders enjoy educational content that helps them perfect the trading art

- This platform also has a wide array of investment tools

- Wise traders also take advantage of the portfolio analysis feature

- You won’t incur any cost in the name of the commission if you have a pro account

- Its accounts, such as Prime, ECN, and R StocksTrader, have excellent trading conditions

- You have various accounts to choose from depending on your budget and level of experience

- Expect instant withdrawals too

- It has a great reputation characterized by awards hence trustworthy

Cons of RoboForex

- It has fewer currency pairs, 36 to be exact, than other common traders, including its Pro, Pro-Cent Prime, and ECN accounts.

- Despite instant withdrawals, they come at a cost too

- Its pro account trading experience leaves a lot to be desired

XTB

XTB is a broker to go for when looking for a trading partner that charges reasonable trading and non-trading fees. Trading options include commodities, forex, crypto, ETFs, and stocks.

Withdrawal costs range between $0 and $20; the more the amount, the less the fee. For instance, you won’t pay a dime for withdrawing any amount above $100.

The deposit fee is also $0 unless you use a debit or credit card. The inactivity fee is as low as $10.

It allows cross-platform usage with both desktop and mobile applications. Active traders have many reasons to choose it over other platforms.

Pros of XTB

- Its research materials are phenomenal.

- Your investment is safe thanks to the strict regulations

- Its spreads are competitive too

- It would be best if you didn’t worry about a negative balance regardless of how unsuccessful your trades become

- It has over 2000 trading assets

- You can take advantage of its mobile app, especially when on the move

- It is suitable for inexperienced and advanced traders alike

- Anyone can easily use the platform

- It is quite a powerful trading broker

Cons of XTB

- Any trader would appreciate more trading choices for obvious reasons

- MetaTrader suspended its support of this platform a while back

- Its services aren’t available in the United States

- You can only use bank transfers for withdrawals

Vantage Markets

It is a brokerage firm based in Australia, ideal for CFD and forex trading. Its regulators are the Vanuatu Financial Services Commission and ASIC.

Its services are available in various parts of the world, including Germany, France, Sweden, Norway, and the United Kingdom. It secures your investments by adhering to safety protocols and settling for indemnity insurance to protect your hard-earned money.

Its notable features include copy trading, MetaTrader, research, and trading tools. Its leverage is impressive, and so is the educational content.

On the other hand, one can trade anywhere, anytime, thanks to its mobile application. It has done away with most non-trading fees, including inactivity, account, and deposit costs.

You enjoy a free international bank withdrawal monthly. Any additional one costs you about $20 or the same amount for any other currency.

Credit and debit card users don’t incur any withdrawal fee. Your trading options include cryptocurrency CFDs, share CFDs, commodities, indices, and forex.

Pros of Vantage Markets

- It is one of the best brokers for any trader interested in copy trading

- The same applies to someone who prefers using MetaTrader

- Those engaging in copy trading enjoy several social platforms for the same

- As for MetaTrader users, some add-ons come in handy during trading at your disposal

- Vantage also has one of the best integrations, full one must admit, with the MetaTrader platform

- This broker has an average risk that’s its regulations in 1 tier-3 and 2 tier-1 jurisdictions, especially when trading CFDs and forex

Cons of Vantage Markets

- For anyone working with a tight budget, its Pro ECN account isn’t ideal since one needs to deposit a minimum of $20,000

- Only deposits not less than $10000 attract active trader rebates

- Similarly, traders on a Standard account who aren’t eligible for the rebates get unfavorable spreads

- Don’t expect access to Trading Central’s Pro trader Tools unless you deposit at least $1000

Conclusion about how to get the best rates from your trading broker

Broker fees are hard to avoid when trading, and they are often high. Fortunately, they are negotiable, but it is easier said than done. Various tricks can help you at the negotiation table. The better the trading account, the higher the chances of getting a negotiated rate.

Besides negotiations, other tricks can help you reduce these costs. One of them is taking advantage of the various brokers and trading accounts available. Lastly, always choose a broker with competitive prices. You can opt for one of the recommended options for a great trading experience at a low price.

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 76% of retail CFD accounts lose money)

Last Updated on June 18, 2023 by Yuriy Kunets

(5 / 5)

(5 / 5)