NAGA minimum deposit: How to deposit money – Fast and easy

Table of Contents

Online trading can be tricky, especially for new traders. Opening your new online trading account and depositing money into it can be challenging. However, the right deposit tutorial can help you get past these challenges. Here, we will tell you everything there is to know about the NAGA minimum deposit and how you can deposit money into your trading account.

NAGA offers investors a platform that is reliable and trustworthy. If you aren’t sure of your market brilliance yet, you can start with a NAGA demo account. The demo account helps a newcomer learn how to trade and develop an understanding of the market. One can sign up for an online trading account with NAGA with ease. You only need to click on the ‘sign-up’ button, and you are ready to go!

Similarly, you can deposit funds into your NAGA account without much effort. You need to click on the ‘add funds’ option to fund your NAGA account to invest across various marketable securities. We will discuss the NAGA minimum deposit process in the subsequent sections.

You can start with any minimum amount if you are a first-time investor. NAGA does not specify any minimum amount on its website for the first-timers. However, it strongly advises its clients to begin with at least 250 USD. NAGA’s minimum deposit amount can vary according to the type of trading account you select.

Also, depositing funds into your NAGA account is hassle-free because of the multiple payment options. It means that you can choose a payment method that suits your needs the best and is convenient for you. Before discussing the available payment methods and the withdrawal tutorial, let us dive into some information about NAGA.

About NAGA

NAGA, which came into being in 2015, operates to offer the traders the most significant finance app. In contemporary times, NAGA has over 1 million registered clients who are earning potentially high rates of returns with the help of the broker.

Every day NAGA conducts millions of transactions. Many investors across the globe join this online trading platform every day. It is because NAGA is a publicly registered company with transparent operating procedures. NAGA has a user-friendly interface that makes it possible for beginners to understand the trading details.

Conclusively, NAGA is an all-in-one trading platform that offers security and privacy to its clients. The ease of using the NAGA app and website attracts many investors to this online trading platform. It is a child’s play to open a NAGA trading account and deposit funds in it. Also, one does not have to stress much about the amount of initial investment in his NAGA trading account. One can deposit any amount using the payment methods available on the website.

The below section will help you get an idea about the NAGA minimum deposit amount.

What is the minimum deposit?

The minimum deposit is an investor’s amount into his NAGA account to start trading across securities. It is the amount that a trader must deposit to make his trading account operational. A minimum deposit amount lets the investor explore the market and invest according to his liking. It also enables him to test the online trading platform and its features. After experiencing trading with a minimum deposit, a trader can top-up his account with more funds to invest in the stock market.

How much is the NAGA minimum deposit?

As we have already mentioned, NAGA has no fixed minimum deposit amount. You can start with any amount higher than 250 USD. It is not a hard and fast rule to fund your NAGA account with 250 USD. However, the broker recommends that the clients fund their trading account with this minimum amount to enjoy the benefits of trading.

| NAGA minimum deposit | 250 USD |

If you want to make the NAGA minimum deposit in a currency other than USD, you should ensure that the amount is equal to or higher than 250 USD.

Usually, all the beginners start their trading journey on NAGA with an initial investment of 250-500 USD. It is because this amount is sufficient for them to have an enhanced trading experience with the broker.

NAGA minimum deposit does not mean that you cannot fund your account further. You can always top up your trading account balance with any amount of funds anytime. However, there can be a deposit limit for some trading accounts.

If you are using a credit or debit card to deposit funds into your NAGA account, you might face some trouble owing to the international transfer limit on your card. To overcome this issue, you can get in touch with your bank so you can continue trading without any interruptions.

Now that we know about the minimum NAGA deposit, let us find out how to make the deposit. Here is a list of the available deposit methods at NAGA.

Available deposit methods

Like every online trading platform, NAGA offers its users multiple payment options to deposit funds into their trading account. A variety of payment options extends convenience to the users. They can fund their account with the NAGA minimum deposit with the most suitable payment option.

If you want to deposit funds into your NAGA account, you can use any of these options.

- Credit/Debit cards

- Wire transfers

- Crypto Currencies like Bitcoin, Etherium, NAGA Coin, Litecoin, etc.

- E-wallets like Skrill, Giropay, Neteller

- NAGA cards

Let us look at these NAGA payment methods in detail.

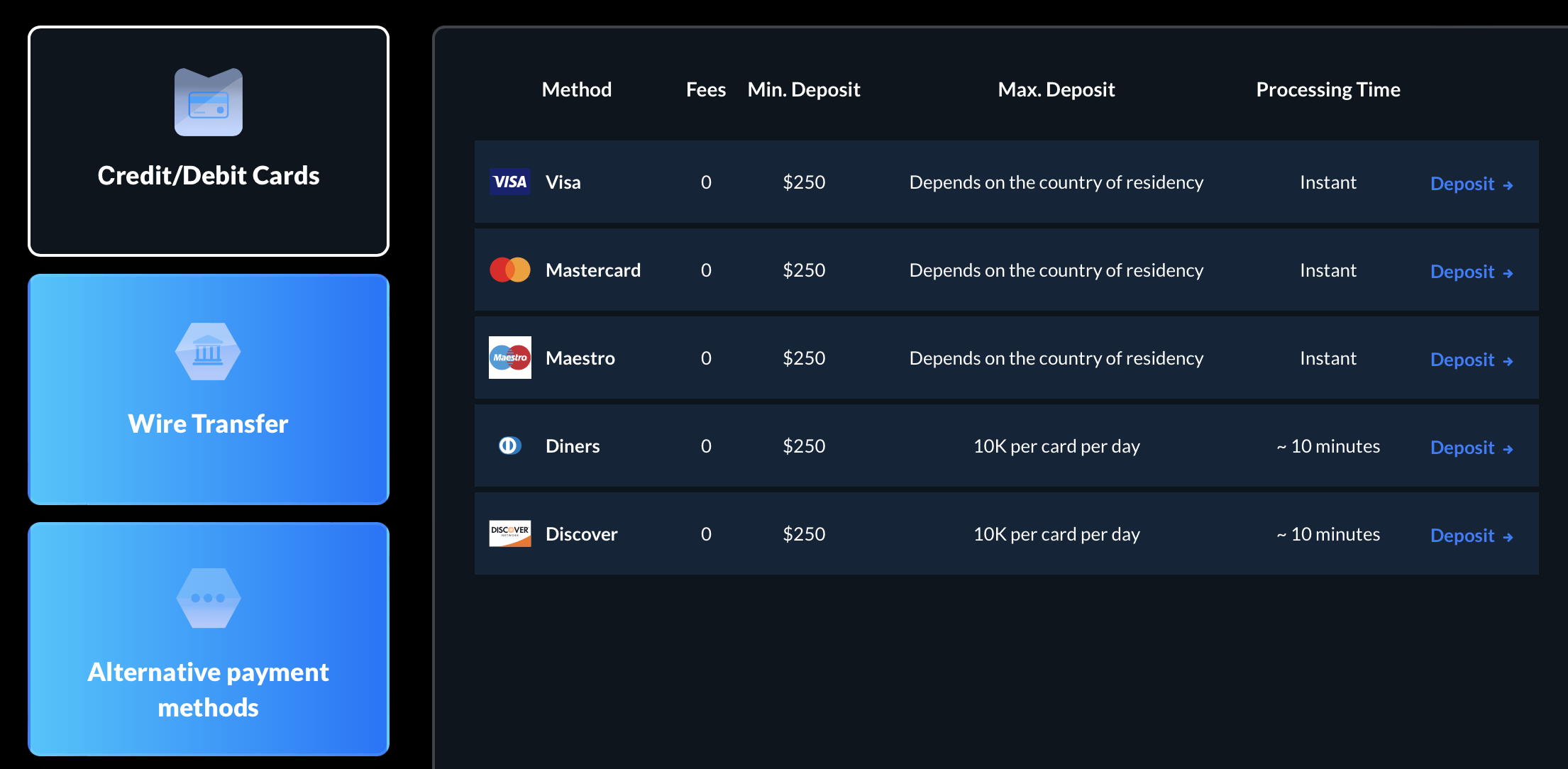

Credit/Debit cards

Credit and debit cards are the most common payment options to deposit funds into your trading account. You can deposit a minimum of 250 USD or an equivalent amount into your NAGA trading account with your cards. NAGA accepts all the Visa debit and credit cards for funding the account. You can use your Visa credit/debit card to deposit funds, like making payments while shopping for stuff online. You only have to enter your card details and approve the payment.

Wire transfers

You can use bank transfers, also called wire transfers, to fund your account with a minimum NAGA deposit. All you have to do is enter your bank account details and verify the payment. You should also note that you can deposit funds only through your personal bank account. NAGA does not accept deposits from third parties because of security concerns.

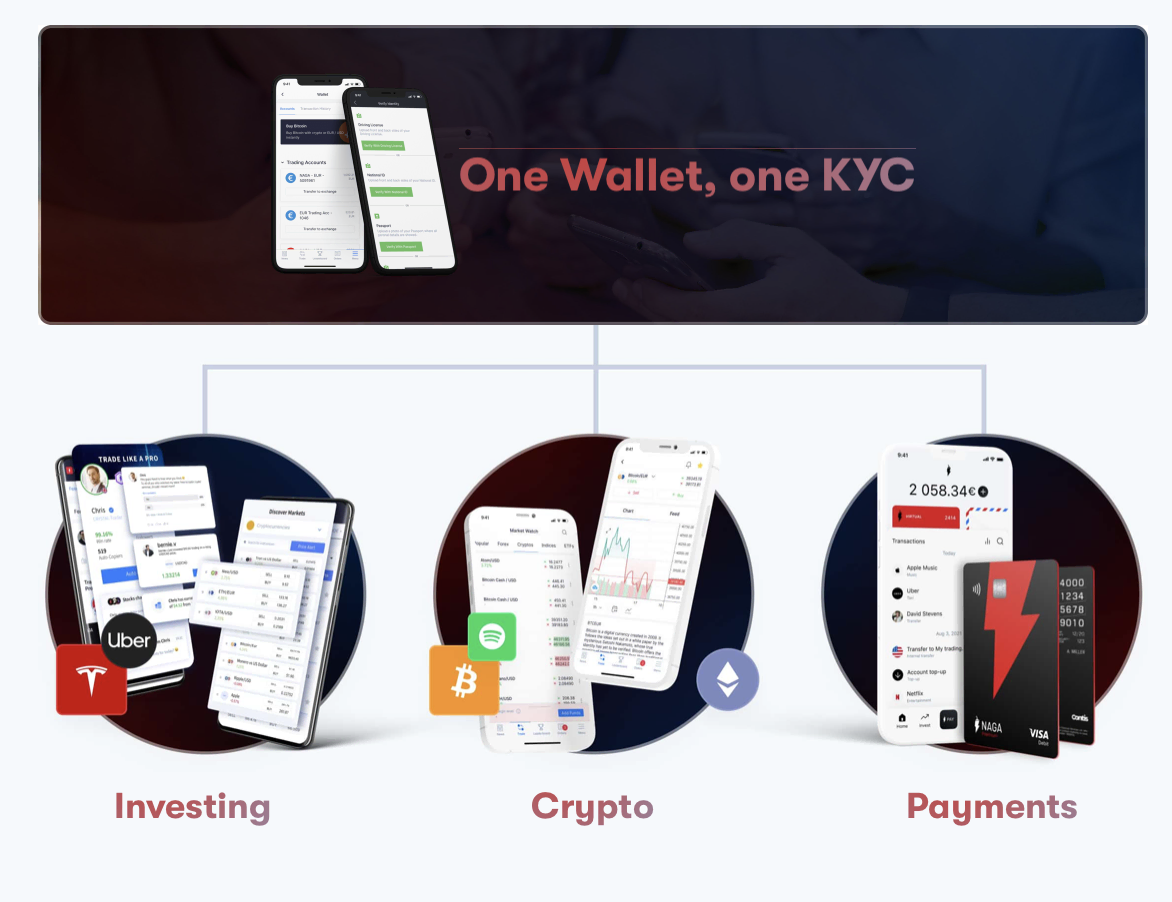

Crypto currencies

NAGA supports deposits made with Crypto Currencies. Suppose you are the holder of the Crypto Currencies such as Bitcoin, Bitcoin Cash, NAGA coin, Etherium, Litecoin, etc. In that case, you can fund your account with a NAGA minimum deposit using them. So, it depends entirely on you. You can select any payment method that fits your needs.

E-wallets

Deposits through E-wallets are instant, and many investors prefer to use them to fund their accounts. NAGA accepts deposits made through E-wallets such as Skrill, Neteller, and Giropay. The NAGA minimum deposit for the payments made with E-wallets is also 250 USD, or an equivalent amount.

NAGA card

You can also use the NAGA card to fund your trading account with 250 USD. It is also a quick way of adding the NAGA minimum deposit into your account.

How to deposit – Tutorial

To deposit funds into your NAGA account, you don’t have to read a thick textbook to learn the process. Depositing funds into your NAGA trading account is straightforward and involves these steps.

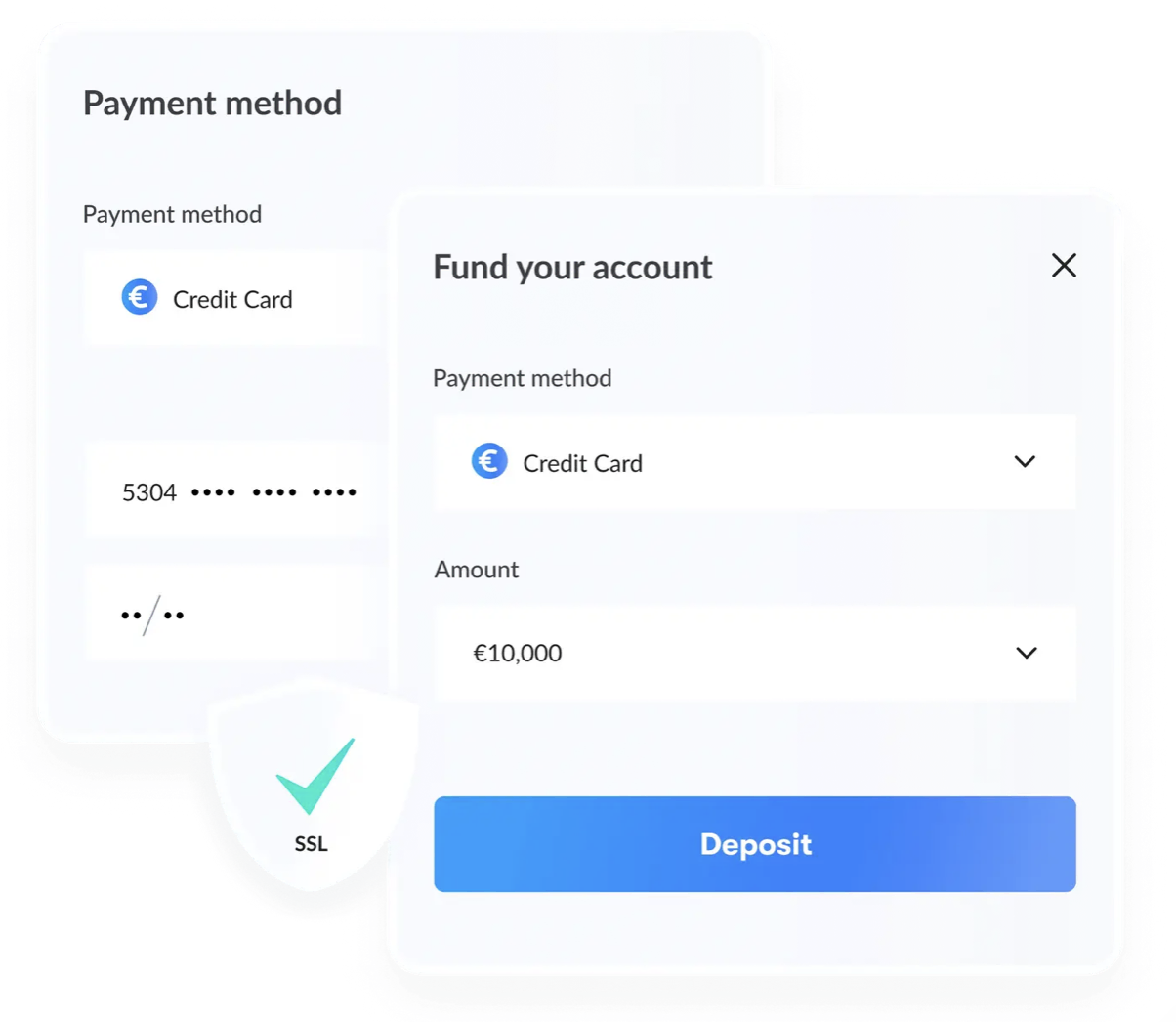

- Log into your NAGA account and make sure that you are using an upgraded version of your account.

- Click on the ‘Fund account’ option to add the NAGA minimum deposit to your account.

- Choose the deposit method that you want to use. There are many payment options available at NAGA. You can choose one option from card payments, wire transfers, e-wallets, Crypto Currencies, and NAGA cards.

- Enter the amount that you want to add to your NAGA trading account. The NAGA minimum deposit is 250 USD. If you wish to use any other currency like EUR, GBP, etc., you can add the amount equivalent to or more than 250 USD.

- Confirm your deposit by confirming the payment. Your NAGA account will get funded with the amount you entered, and you can begin investing your funds in the market.

- For depositing funds through card payment, you can enter the card details like the card number, name, CVV, expiry date, etc., on the window that appears on your screen. You can confirm your deposit and approve the payment by entering the OTP.

- E-wallet transactions will require you to log in to your E-wallet and review the transaction. You can then confirm the payment from your Skrill, Neteller, or Giropay wallet.

- Your NAGA account will get credited with funds in time. It time involved also depends upon the payment method you choose. Some payment methods take much longer to deposit funds into your trading account. For instance, bank transfers usually take up to five working days for the payment to reflect.

Let us look at the duration of crediting your account with the NAGA minimum deposit.

How long does it take for the funds to reflect into your NAGA account?

As we said before, the time for crediting your trading account with the NAGA minimum deposit can vary according to the payment method. If you want to fund your NAGA account instantly, E-wallet is the most suitable option for you.

Payment method | Processing time |

Wire transfers | 4-5 working days |

Credit/Debit cards | 1 working day |

Crypto Currencies | Instant |

E-wallet | Instant |

NAGA Card | Instant |

Credit and debit card deposits may take a few hours to credit your account. At the most, card payments may involve one working day for processing.

If you are using the option of wire transfers, it may take a few days for the amount to reflect into your account. Bank transfers or wire transfers take such a long time because of the involvement of the transactions between two banks internationally. You will receive a confirmation mail from NAGA when the fund deposit is successful in their bank account. After the broker receives funds in their bank account, they will credit it to your trading account. This process generally takes up to 4-5 business days.

When you are using the option of bank transfer, you might even have to incur a small fee charged by your bank for transferring funds internationally. It is called a convenience fee and is payable by you. So, if you are afraid of missing out on a profitable investment due to a lack of funds in your account, you can use the option that requires less time for funding your account.

You can use Crypto Currency to fund your account with the NAGA minimum deposit. It is an instant mode of payment which means that your trading account will ger credited with funds on a real-time basis. Many NAGA clients also use their NAGA cards to fund their accounts. NAGA Card is also a quick and secure payment method.

Fees/Charges for funding your NAGA account

You don’t have to pay any fee to the broker to fund your account with a NAGA minimum deposit. NAGA covers all the deposit charges, leaving no burden on its clients. So, you can begin investing with NAGA without worrying about any deposit fees.

| NAGA deposit fees | 0 USD |

It is quite relieving for the traders that do not have to pay any deposit fee to the online trading platforms. Not all trading platforms offer their clients free-of-charge deposits. However, NAGA stands out as an exception in this regard.

Though NAGA does not charge any deposit fee from its clients, you might have to incur a separate fee when you make international payment transfers. Your bank can charge you a convenience or handling fee for transferring funds into your NAGA account. It is entirely out of the broker’s control, and this fee will have to be borne by you.

Other than this, you don’t have to pay any deposit charges, and it is all the more alluring to start trading with NAGA.

How many times can you fund your NAGA account?

There is no limitation on the number of times you can fund your NAGA account. You can deposit funds into your trading account as many times as you wish to without worrying about anything. You can add any amount of funds using the payment method of your choice.

However, you might face difficulty depositing funds in your account if your bank has an upper ceiling on international payments. Your credit/debit cards might also decline online transactions after a definite limit.

If you face any difficulty regarding this, you can contact your bank and remove the ceiling on international transfers. After this, you can fund your account multiple times in any given month.

Conclusion

NAGA stands out from the rest of the online trading platforms across the market. It offers a perfected user-friendly interface to its users, which is also easily understandable by the new investors.

Anyone can open their online trading account with NAGA without any inconvenience. It is also easy to fund the trading account with the NAGA minimum deposit. A trader can select a payment option from the multiple methods available on the trading platform. Also, NAGA does not charge any deposit fees from its clients, making it even more advantageous to begin trading with NAGA.

The NAGA minimum deposit recommended by the broker is equivalent to 250 USD. The account funding process is safe as all the transactions use Secure Socket Layer (SSL) technology. This technology ensures that the personal information of NAGA’s clients stays intact.

So, winding everything up, one can experience and learn so much about trading with NAGA. If you are new to the world of trading, NAGA online trading platform is, without any doubt, worth it.

FAQ – The most asked questions about NAGA minimum deposit :

Is NAGA a genuine online trading platform?

Yes, NAGA is one of the most reliable and successful online trading platforms. It gets its license from the European Union financial regulators. It is easy to sign-up with NAGA to open your trading account. For beginners, it is the most suitable online trading platform.

How much NAGA minimum deposit should I make to begin trading?

You can start trading with NAGA by depositing a minimum of 250 USD. If you want to deposit funds into your trading account in any other currency, make sure that the amount is equivalent to or more than 250 USD. Only then will you be able to realize the benefits of online trading.

Which payment option should I use to fund my NAGA account?

To fund your NAGA account with a minimum deposit, you can choose from multiple payment options available on the website. You can select wire transfer, credit/debit cards, Crypto Currencies, E-wallets, or the NAGA card.

How long should I wait for the payment to reflect in my NAGA trading account?

The time involved to update the balance of your trading account depends upon the payment method. Card payments usually take one working day, whereas wire transfers might involve 4-5 working days. Crypto Currencies, E-wallets, and NAGA cards are instant payment options.

Do I have to pay a deposit fee to make the NAGA minimum deposit?

NAGA does not charge any deposit fees from its client. However, you might have to pay handling and conveyance charges for bank transfers or card payments. It is beyond the broker’s control, and you will have to bear these costs.

Is there any limit to funding my account?

There is no limit on depositing funds into your NAGA trading account. You can fund it any number of times.

What is the Naga minimum deposit amount to begin trading on the platform?

The initial deposit amount differs according to the trading account he signs up for. For instance, if you choose the basic of all Naga trading accounts, the minimum deposit amount is only $50. As you choose aa higher account type, the Naga minimum deposit amount increases for the trader.

How can I fund my trading account with the Naga minimum deposit amount?

You should first register for a brokerage account in order to begin funding it with the Naga minimum deposit. Then, a trader would need to log into his Naga trading account. He will see the option of ‘add funds’ on the dashboard. Clicking on this option will allow you to choose a payment method you wish to use for Naga minimum deposit amount funding. After that, traders can enter the amount and confirm the payment.

What modes of payment are accepted for the Naga minimum deposit?

There are several payment methods that Naga offers traders to make the Naga minimum deposit. Traders trading on Naga can use these methods for depositing funds.

Bank transfers

Electronic wallets

Cryptocurrency

Debit and credit cards

Thus, a lot of payment methods at Naga make trading convenient for any trader.

See more articles about forex trading:

Last Updated on January 27, 2023 by Arkady Müller