What is a Forex broker license? – Why is it so important?

Table of Contents

A forex market is a place where there is no interference with third parties when transacting. It has created an environment where scammers operate freely. Some countries have created licensing and regulatory bodies for forex brokers.A forex license shows traders that their funds are safe. Many forex traders have lost thousands of their investments to unlicensed forex brokers. New forex brokers give false promises to forex traders while stealing their funds. The only way to distinguish legal forex brokers from the rest is through licensing. Some countries have strict guidelines on licensing. There are regions where forex brokers cannot operate without a license.

What is a forex broker license?

It is a number that a forex regulatory institution gives a forex broker. It shows that their activities get monitored by that regulatory organisation. The regulatory body audits and monitors all the operations of the forex broker.

Forex traders look for the license number to verify whether a forex broker is regulated. The license gives the broker access to the clients and investors from the region where the regulatory body is in charge.

Why is it necessary to get a forex broker license?

To have the credibility and reliability of Forex investors

The regulation restricts forex traders from accessing risky assets. It acts as a form of protection from losses for forex traders. Forex traders prefer forex brokers regulated by more than one regulatory body. Since the more licensed it is, the more reliable it is.

To make a Forex broker legal

All forex brokers that are not licensed are often considered scams. It is because in case you disagree about funds, it is hard to resolve that issue. It is why a forex broker must get a license for trading.

To get access to more Forex clients

Licensing is a positive step for forex brokers since they can offer services to other countries. Forex brokers who provide quality services can get more investors in their platform. Since the license gives you the chance to cover other forex traders.

Trade forex with the best conditions and a regulated broker:

Broker: | Review: | Advantages: | Free account: |

|---|---|---|---|

1. Capital.com  | # Spreads from 0.0 pips # No commissions # Best platform for beginners # No hidden fees # More than 3,000+ markets | Live account from $ 20: (Risk warning: 75% of retail CFD accounts lose money) | |

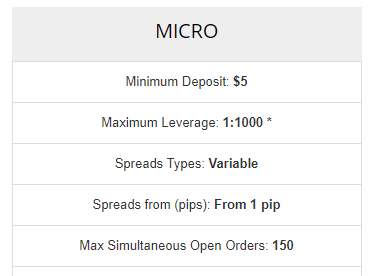

2. RoboForex  | # High leverage up to 1:2000 # Free bonus # ECN accounts # MT4/MT5 # Crypto deposit/withdrawal | Live account from $ 10 (Risk warning: Your capital can be at risk) | |

3. Vantage Markets  | # High leverage up to 1:500 # High liquidity # No requotes # MT4/MT5 # Spreads from 0.0 pips | Live account from $ 200 (Risk warning: Your capital can be at risk) |

Where do you apply for a forex license?

The regulatory bodies in charge of forex trading in countries license forex brokers. They license forex brokers that follow rules placed when operating in that country.

These rules vary from one country to another. Some of

the top forex regulatory bodies that give licenses are the :

- Commodity Futures Trading Commission (CFTC) based in the USA

- National Futures Association (NFA) in the USA

- Financial Conduct Authority (FCA) based in the United Kingdom

- Australian Securities and Investment Commission (ASIC) in Australia

- Financial Industry Regulatory Authority (FINRA) in the USA

- Financial Services Agency of Japan (FSA) in Japan

- Securities and Futures Commission (SFC) in Hong Kong

- Cyprus Securities and Exchange Commission (CySec) in Cyprus

- China Securities Regulatory Commission (CSRC) in China

There are more regulatory institutions set up in countries that accept forex trading. These institutions ensure that forex trading is safe for all forex traders. They help reduce the chances of forex traders having an unfair trading environment.

Some of their roles are;

To carry out audits on the forex brokers through monitoring their transactional records. They also provide reviews of forex broker services.

The forex broker gets monitored if their services qualify the standard industry. Then they get licenced and regulated after evaluation. Licensing can take six to twelve months before the forex broker gets the license number.

To punish forex brokers that break the rules in place. The punishment can be sanctioning the brokers from offering certain services. Those with grave issues get banned from operating in those regions.

Trade from 0.0 pips over 3,000 markets without commissions and professional platforms:

(Risk warning: 75% of retail CFD accounts lose money)

What do you need to get a forex license?

There are conditions forex brokers need to meet first to get licensed. The demands are not similar in all regions, but some which apply in most countries like;

- The forex broker has to get registered as a company.

- The forex broker has all the documents that show it operates legally.

- They have to ensure that they perform their functions as required.

- The forex broker should adhere to KYC and AML guidelines. Together with the appropriate documents to support the claim.

- They need a bank account registered under the forex broker company.

- If they have all these documents, they can apply for the forex license.

These steps are some of the few of many demands for forex brokers to get registered and licensed. Other requirements are a physical office in one of the countries they wish to get licensed.

Their employees need to have an employment contract with a monthly stipend. Some countries need a functional website with clear information about the forex broker. They also ask to display risks and the benefits involved with forex trading.

Which are the best countries to get a forex license?

Forex licensing is harder in different countries. There are countries where you can get a license fast, while others have stringent laws. The countries are in levels of difficulty when accessing a forex license.

The first level

The countries on this level have tough policies for forex brokers to follow to get licenses. They include Japan and the United States. These laws get enforced by the CFTC and NFAin the united states and FRA in Japan.

The second level

The countries on the second level have strict laws. They regulate forex brokers who operate in their jurisdiction. These countries are the United Kingdom and Australia.

The third level

They also have strict laws that watch the activities of a forex broker. They are not as tough as the first and second level countries. They work to ensure fairness when trading. These countries are like Malta, Cyprus and New Zealand.

The fourth level

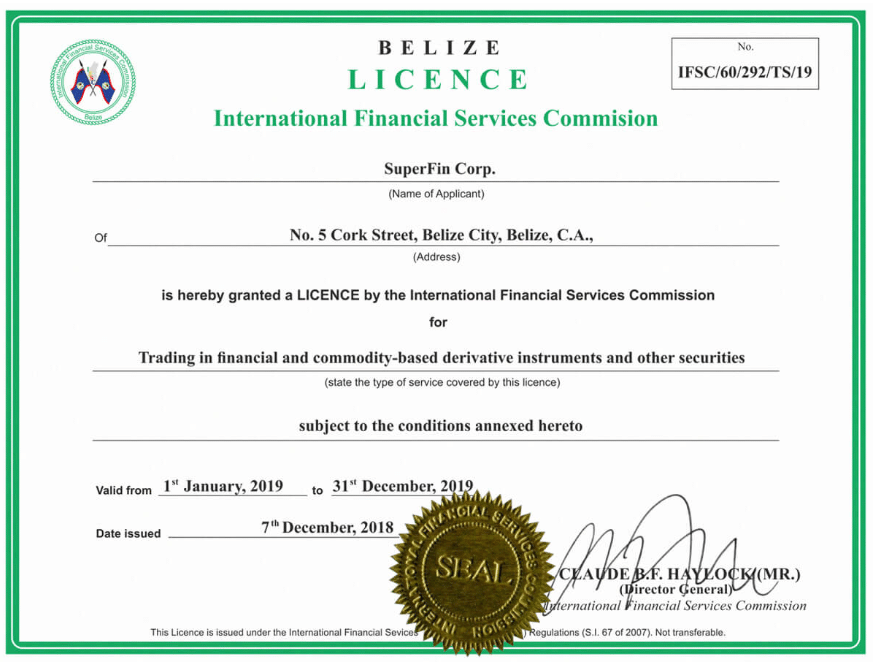

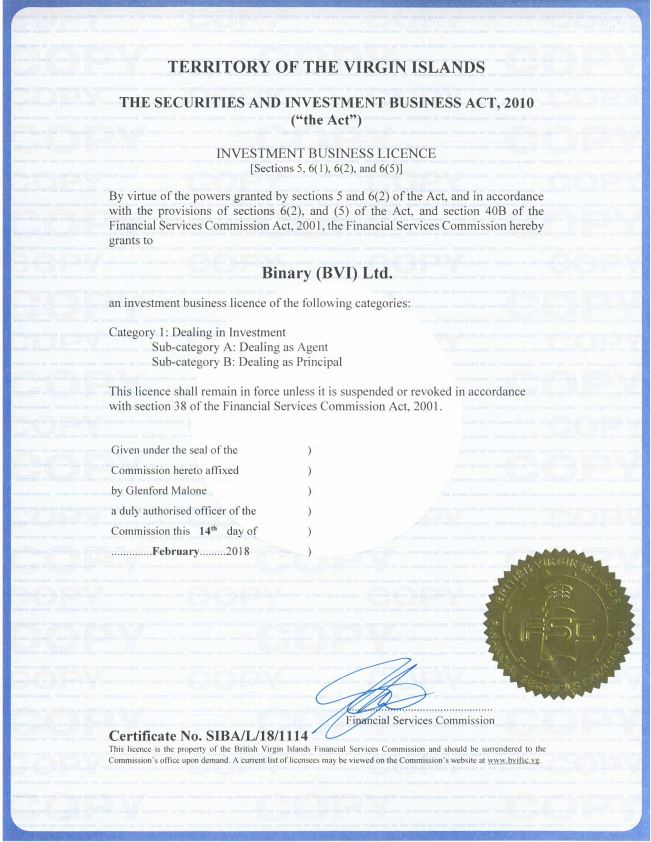

It is easier to get licensing and regulation in these countries than in all the other levels. Their laws are less stringent, and they do not have a harsh auditing policy. These countries are like the Cayman Islands, British Virgin Islands, Vanuatu and Belize.

The fifth and sixth level

These countries have regulatory bodies that do not have strict laws. They watch forex brokers, and some do not offer to license. These countries are like Seychelles and Latvia.

The best forex brokers tend to get registered from the fourth level and upwards. The forex brokers with registration in countries on the first and second levels attract more clients.

Trade from 0.0 pips over 3,000 markets without commissions and professional platforms:

(Risk warning: 75% of retail CFD accounts lose money)

FAQ – The most asked questions about Forex broker license :

Do the forex brokers need the forex broker license?

If you are wondering what a forex broker license is and whether the forex brokers need it, know that a forex trading license is a special permit that the broker needs to have to sell its services on the open forum.

The answer to whether the forex broker license is needed is Yes. So, if you are a beginning forex broker or are planning to start a forex brokerage business, obtaining a forex license is something you will have to consider.

What regulations are for the forex brokers?

Forex brokers are required on a daily basis to deal with top-tier financial institutions or liquidity providers. They are also expected to keep the client’s funds in a separate account. So, the forex brokers are required to meet up these criteria along with some other ones, like capital and fiscal requirements, to stay in business and to avoid regulatory intervention.

How do you verify a forex broker license?

In order to verify, one needs to perform a quick search on the website of the FCA. There, you will be able to serve through the name and number or even check if regulatory information on the website of the broker matches up. In case the broker is listed, verify the contact details that have been listed here and on the website of the broker.

See more articles about forex trading here:

Last Updated on January 27, 2023 by Arkady Müller

(5 / 5)

(5 / 5)