Simple Olymp Trade trading strategy for beginners

Table of Contents

One of the most essential attributes of any profitable trader is having a trading strategy. Not having a specific trading strategy more often is a precursor of failure.

What is a trading strategy?

There is no single definition as to what will qualify as a trading strategy; however, we can refer to it as the collection of guidelines and plans that are aimed at making you a consistently profitable trader. These tips and techniques might include those specifically aimed at helping you avoid or reduce losses as well as those aimed at helping you protect your account, amongst others.

(Risk warning: Your capital can be at risk)

Olymp Trade trading strategies

Listed below are some of the tested and trusted strategies that work quite well on Olymp Trade. Be aware of the timeframe you are using for these strategies. From our experience, the strategies have a much higher success rate if you are using timeframes like 1 hour or higher.

Support and resistance trading strategy

First of all, we want to start with the most powerful trading strategy for Olymp Trade. Markets are trading in 70 – 80% of the time in a range. That means it does not happen so much and you will see a price range where the market is moving.

See an example below:

Go through the chart and search for prices where the market turns around more than 1 time. The theory concept behind this trading strategy says that the prices are cheap or expensive. At these prices a lot of traders a willing to buy or sell. In addition, big traders need often more than one test of the market price in order to get all orders into the market.

See another example:

(Risk warning: Your capital can be at risk)

In the picture above you will see price zones. It is important to know that the market will not always launch an exact price. There are mostly zones where the market is turning around. For better results, you should mark price ranges in order to find a good entry.

You can combine this strategy with technical indicators to get a confirmation that the market is overbought or oversold.

See this example:

On the left side, you see the market is rising and is going short very fast. This is a good sign of a strong selling zone. Now you are waiting for the entry. On the right side, you see the market comes into this zone one time and goes right away short. The market tests this zone a second time. This is the perfect confirmation for your short trade. But you can also use the first entry into the zone.

Trade cancellation

Trade cancellation is one of the most innovative features introduced by Olymp Trade to its trading platform. Trade Cancellation is an account-protecting Strategy that gives traders an opportunity to protect themselves from negative trade results.

You use this strategy when you see that the trade is going against you. That is, you open a trade and after some time (before the trade expiration), you sense that it will not end in your favor; you can exercise the trade cancellation option to take you out of the trade. You will not lose any amount of money.

Steps to using trade cancellation

Step 1: Make your Trade.

Step 2: You notice your trading is moving against you. Do not let the trade expire. Scroll down the trading interface to where your open trades are listed. Click on the trade you want to cancel.

Step 3: You see a “SELL” button, and the amount you get back when you close the trade. Click on it and end the trade.

(Risk warning: Your capital can be at risk)

Trade diversification

Another account protection Strategy. Trade diversification involves reducing risks while trading.

It basically involves the trading of various assets that are not connected to one another, at the same time.

A lot of tradable assets in the financial markets are connected to each other. For instance, the United States Dollar (USD) is directly related to Gold (XAU) in that a positive movement on the Dollar is almost equal to a negative movement in Gold.

This is due to basic economics. Gold is seen as a “safe-haven” asset; so when the US economy is not doing quite well, and risky assets such as stocks and the currency start to drop, investors will naturally move to Gold. This will increase Gold’s price. And if the economy begins to improve, investors will leave Gold.

As such, you do not want to trade both assets at the same time.

You can look for uncorrelated assets like Gold and Bitcoin.

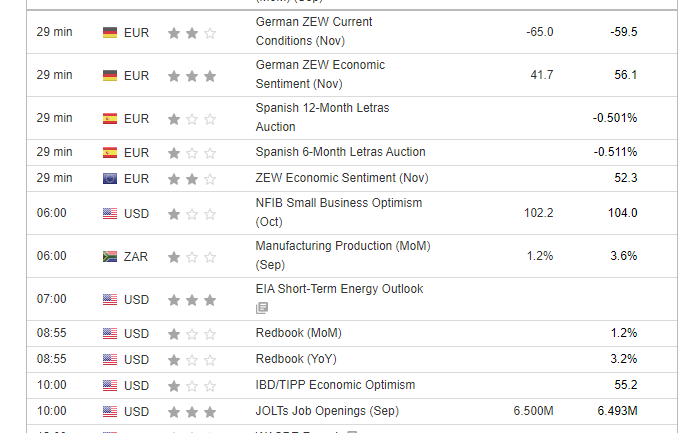

Trading the news

Perhaps the biggest mover of the market is economic news. Economic news in this sense includes events, speeches, reports, and statistics that may help us predict future economic direction.

The economic news that affects future economic direction significantly causes huge price moves in the market. It is not uncommon to see large candle movements in instruments like Gold, currencies, and even stock indices, after the periodic Federal Open Market Committee (FOMC) of the US Federal Reserve Bank.

There are 2 ways to use the news:

- To protect your account: If you are aware of impending economic announcements, you are strongly advised to pull out of any trades in instruments that may likely be affected by such news. For instance, for the monthly Non-Farm Payroll (NFP), you are advised to avoid major currencies, Gold, US stock indices, amongst others.

- To boost your account: On the other hand, the news can be your means to good profits if you use it well. There are several news trading Strategies out there, but we will not be recommending any. We strongly advise that you first test them out on a demo account before applying them to your live account.

(Risk warning: Your capital can be at risk)

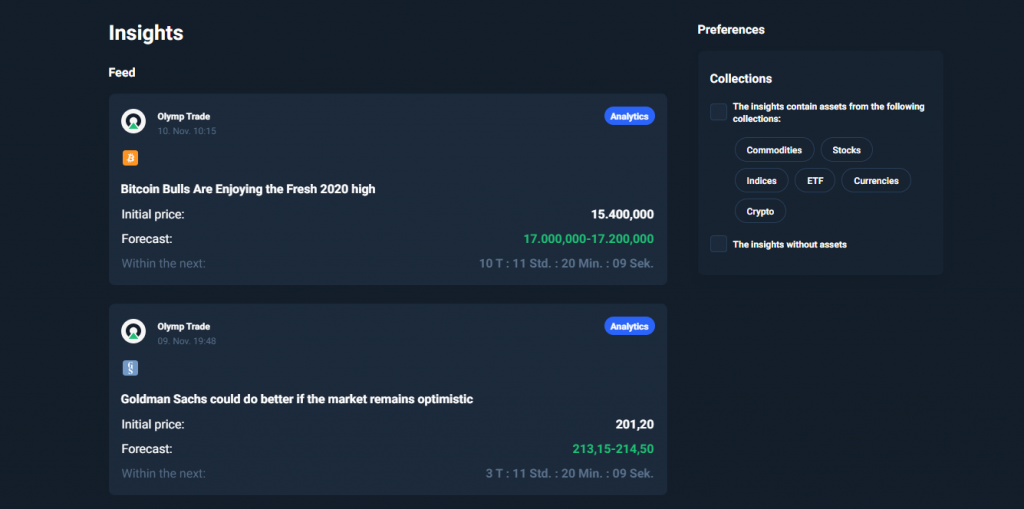

Olymp Trade signals and analytics

It is no contradiction that Olymp Trade is one of the few brokers out there that is committed to your success as an online trader. One very innovative service that Olymp Trade introduced is expert analysis.

Olymp Trade analysts are experienced persons who have been trading in the financial market for many years. They publish a lot of interesting analytical notes daily.

Daily reviews are published in Olymp Trade’s blog. These reviews cover the most critical market-relevant news items covering currency pairs, indices, stocks, commodities, among other instruments in an easy-to-understand format.

This should give you clear perspectives as to potential market performance for that day.

This is a time-saving method. To conduct a proper fundamental analysis, you have to go visit several news platforms and go through countless articles. But the OlympTrade daily study presents the most important to you in a concise form.

However, that’s not all. Olymp Trade supports a signal service right there on its trading platform. In addition to the signal, traders receive a brief comment on the reasoning behind the signal.

(Risk warning: Your capital can be at risk)

Technical Analysis Patterns

- Chart patterns

- Trends

- Price action

Technical analysis is one of the most important and by far the most common types of market analysis. Technical analysis generally involves the use of mathematical and graphical analysis to forecast the future movement of prices of financial assets.

However, technical analysis involves many things. For one, we have the principle of price action. In basic terms, price action is a trading technique that allows a trader to read the market and make subjective trading decisions based on the recent and actual price movements, rather than relying solely on technical indicators. Techniques in price action include Support and Resistance and Japanese Candlesticks.

Very close to the above is the idea of chart patterns. Here, recurring patterns on a chart are used to make the analysis of potential price movements.

There are also indicators, which are tools found on a trading platform used to foretell price movements. Popular ones include the Moving Average, Bollinger Bands, Fibonacci (Extension and Retracement), Relative Strength Index (RSI), amongst others.

(Risk warning: Your capital can be at risk)

See our other articles about Olymp Trade:

- Withdrawal proof and tutorial

- Trading strategy

- Trading platform tutorial

- Tips and tricks

- Is a robot legal?

- Mobile app tutorial

- Olymp Trade Indonesia

- Olymp Trade India

- Forex trading tutorial

- Deposit

- Fixed time trades tutorial

- Olymp Trade Africa

- Bonus

FAQ – The most asked questions about Olymp Trade trading strategy :

What are the trading strategies supported at Olymp Trade?

Olymp Trade is one of the best online brokerage platforms, supporting several trading strategies for traders and investors. Regardless of the trading and investing instruments, the strategies this platform supports are support and resistant strategy, trade cancellation, trade diversification, and trading the news.

Are the trade signals on Olymp Trade trustworthy?

Yes, the trade signals displayed on the screen of the Olymp Trade website are trustworthy. These signals and the corresponding analytical results are provided by some of the trusted online brokers having experience in the concerned field. Therefore, investors and traders can know the price action movement of the concerned market and make the best decision using the proper investment strategy.

What are the technical analysis patterns supported on Olymp Trade?

Olymp Trade supports 3 primary technical analysis patterns. These are the chart patterns, price action movement, and market trends. Out of these three options, trends and price action movements are considered to be the most accurate and precise when compared to that chart patterns.

Is trade cancellation allowed on Olymp Trade?

Yes, Olymp Trade allows traders and investors to cancel their trades by selling the assets they have in holding in case they detect a certain price action movement against their bid or the market crashes due to unwavering reasons.

See other articles about online brokers:

Last Updated on January 27, 2023 by Arkady Müller