What are Forex Broker fees? – All costs for traders explained

Table of Contents

Forex brokerage services come with fees. Every trade you place as a retail forex trader attracts one or more charges. The primary source of currency brokers’ income is these charges and they make up a better part of the customer’s trading costs. Traders should be aware of all of them. If not, they can eat into the profit, and trading forex would not be worth the trouble. Truthful brokers display all their charges on their sites, the trading platform, or both places. However, some brokers may only show you the common ones. Below, we explain all the forex brokerage fees you need to be conscious of as you trade.

What are forex broker fees?

Forex broker fees are fees that you pay a brokerage company for executing your trades and giving you access to the forex market. The broker charges different fees for services that they provide. Every trade comes with a fee, that though, seems minute, can add up to a sizable expenditure for the trader.

Being aware of all the expenses you may incur while trading can help you properly plan your trades for success in your forex business venture.

A summary of forex broker fees

Brokerage fees may be directly or indirectly related to your trading activities. Fees such as spreads, commissions, overnight charges, storage fees are all directly related to trading. Certain brokers may charge inactivity or withdrawals fees. These two are not directly related to transactions in your forex accounts. All of these are not charged on each trade.

Spreads and commissions are standard fees in the industry. Some brokers may deduct both as specified in their policies. Others only charge spreads for each trade executed and do not charge commission. The other fees may depend on your trading style, length of the position, and the broker’s policies. We explain each of these fees further below.

Trade forex with the best conditions and a regulated broker:

Broker: | Review: | Advantages: | Free account: |

|---|---|---|---|

1. Capital.com  | # Spreads from 0.0 pips # No commissions # Best platform for beginners # No hidden fees # More than 3,000+ markets | Live account from $ 20: (Risk warning: 75% of retail CFD accounts lose money) | |

2. RoboForex  | # High leverage up to 1:2000 # Free bonus # ECN accounts # MT4/MT5 # Crypto deposit/withdrawal | Live account from $ 10 (Risk warning: Your capital can be at risk) | |

3. Vantage Markets  | # High leverage up to 1:500 # High liquidity # No requotes # MT4/MT5 # Spreads from 0.0 pips | Live account from $ 200 (Risk warning: Your capital can be at risk) |

Forex broker fees

1. Spreads

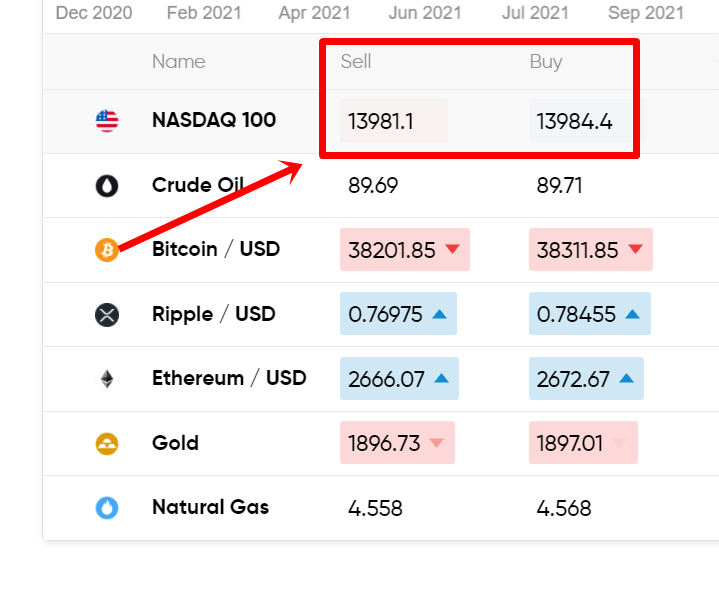

Spread is the standard fee charged by all brokers in the forex market. It is the key source of forex brokers’ income and represents the difference between the BUY and SELL price you receive in the quote when you trade. Depending on the broker, spreads can be fixed or vary according to market conditions. If a spread is fixed, it means no matter how high or low the price moves, you will be charged the specified amount of pips. If it’s a variable spread, it means your fee changes as the market moves. The currency pair you trade will mostly determine your expenses about spreads. Pairs with greater liquidity usually have lower pip spreads attached to them. When liquidity is high for a major pair like the EURUSD, some brokers may charge 0pip. So, to enjoy lower spreads fees, the most liquid crosses should be your choice of currencies.

2. Commission

This is another standard and sometimes unavoidable broker fee. More than a few brokers offer commission-free accounts. Meaning they only charge spreads for each trade. But with others, especially ECN brokers, you will pay a fixed commission rate. Though in most cases with them, the spreads would be lower than the market average. Traders end up paying less in a commission-based account than a commission-free one.

Commissions too can come in fixed or relative. A relative commission usually depends on the size of the trade. Though this type of fee is rare among forex brokers. Many brokers who you this model generally charge a fixed commission fee per trade, and this fee can range from $5 – $10.

3. Interest in leverage

Many brokers offer leverage so that traders can open positions higher than their capital. Leverage trading presents an exciting opportunity for traders because they can make much more profit with little capital. But this loan attracts an interest fee that can range from 1 to 5%. Therefore the higher the leverage, the bigger the charges on this debt. Though it can be covered if the trade is profitable. If it is not, the trader can be in serious debt.

4. Swap rates and fees

Commonly called Swap fees, they accrue when you leave positions open overnight. This fee results from interest rate differences between the base and the quote currency. Swap rates can move in your favor, and you could make an extra profit here instead of paying charges. For instance, if you open a SELL trade for the EURUSD pair. You’re betting on the dollar to strengthen against the Euro. The USD’s interest rate is higher than the Euro. You can earn on that interest if you leave the trade open overnight. Be sure that your broker pays these extra funds to your account. Positive swap rates are also called successful Carry trade in forex. People deliberately use this strategy in positional trading.

5. Storage fees

This fee is related to overnight charges. A few brokers may charge this on top of overnight and rollover fees. They refer to it as the cost of maintaining the positions you leave open. The fee is unnecessary, and traders can find many good brokers who do not charge it.

6. Inactivity fee

This is another unnecessary fee. Some brokers deduct this if the trader does not use their account for a specified period, usually three months. The broker may place a monthly charge of $10, which would be debited from the account after three months of no activity. It might be charged quarterly in some cases. The broker deducts this charge until the account is empty or the trader resumes activity. Not all brokers charge this fee.

7. Withdrawal charges

Many brokers do not charge you for transferring funds from your account, but a few of them do. It might be a small fee, and in this case, the withdrawal might be credited quicker than usual. However, it is unnecessary and adds to the trader’s costs. Third-party charges already apply here so the trader would be paying double fees for this service. Many reputable brokers do not charge this, so it might be better to find those ones.

Trade from 0.0 pips over 3,000 markets without commissions and professional platforms:

(Risk warning: 75% of retail CFD accounts lose money)

How to minimize your trading fees

All these fees may not apply. Some of them would depend on the broker. Forex traders can manage their cost of trading by understanding the ones that apply to them and finding ways to keep the expenditure at a minimum. We recommend the following ways to lower the cost of trading forex:

1. Find a good broker with competitive fees

Broker fees vary. Some charge higher than others. These are overpriced brokers. A few of them attach unnecessary fees to trading. Traders should avoid these. Many good brokers offer their service with tight spreads and low commissions. And they’ll publish these fees on their websites or trading platforms. The broker’s fees should be part of your research. Remember that a commission-based account does not necessarily mean higher charges. Most of these accounts are more affordable because the commissions would be fixed. Spreads-only accounts might present wider spreads for the trader. The fees might turn out higher than commission-based.

2. Focus on liquid currency pairs

Currency crosses with high liquidity often come with tighter spreads. In some cases, the trader may enjoy zero fees on the pairs because they are highly traded in the market. The trader who wants to minimize their expenses should focus on these types of currency pairs.

3. Learn profitable trading strategies

If you wish to minimize your trading cost, it is wise to stick with strategies that would cost less. Many retail traders conclude their activities within the day. This is called day-trading and is the most popular trading approach among retail traders. Leaving positions open overnight costs money. If your currency pairs are okay for day-trading, the overnight fees are avoidable.

4. Trade when the market is most active

High activities in the market equal greater liquidity, and this results in lower spreads. The forex market is always open for business, but it’s not always active. Some currency pairs also have suitable trading times. Traders should be aware of these, and open positions at the time of high activities to limit their costs.

We have explained all the fees you may expect from your broker. We have also recommended a few ways to limit your trading costs. Remember that a good broker is crucial to your trading success. One of their characteristics is competitive fees. Traders also need a good trading plan that contains a favorable trading routine to lower their expenses. Note that there are different fee models, depending on your broker. Choose the one that would be most suitable for your trading style. For instance, a fixed fee model would be more favorable to a highly active and high-volume trader. Some fees only apply if you leave positions open overnight. Use appropriate trading strategies and never leave trades open unless it is necessary for the pairs you choose.

Be aware of your broker’s rates before you trade with them. You can search this on their website, or by signing up for a demo account. The fees are also displayed on their trading platforms. You can contact their customer service to ask questions and get clarifications.

Trade from 0.0 pips over 3,000 markets without commissions and professional platforms:

(Risk warning: 75% of retail CFD accounts lose money)

FAQ – The most asked questions about Forex broker fees :

What are forex broker commission fees?

A commission on US shares can be anywhere from $0.018 with a minimum fee of $10. Numerous brokers provide commission-free accounts. They only charge spreads for each trade, in other words. But when dealing with some, particularly ECN brokers, you’ll have to pay a set commission rate. Commissions might also be fixed or based on performance.

What are forex broker swap fees?

When you leave positions open overnight, the growth is referred to as Swap fees. The swap fees can be anywhere between 0.5 pips t 1 pip per day. The difference in interest rates between the base currency and the quote currency causes this charge. Swap rates may change in your favor, and instead of incurring fees, you could gain an additional profit.

What are spreads in forex broker fees?

The spread is the uniform charge made by all forex brokers. The difference between the BUY and SELL prices you see in the quote when you trade is the main source of income for forex brokers. It can be between 1 to 5 pips between two competitive pricing. Spreads may be fixed or subject to change depending on the broker and the state of the market. If a spread is fixed, you will be charged the specified number of pips regardless of how much the price changes.

See more articles about forex brokers here:

Last Updated on January 27, 2023 by Arkady Müller

(5 / 5)

(5 / 5)