The 5 best Forex Brokers and platforms in Jordan – Comparison and reviews

Table of Contents

The global foreign exchange market is the largest and most liquid financial market globally, with an average daily turnover of $5.3 trillion in 2016. Jordan is no stranger to this; according to the World Bank, the country’s FX market turnover was $116.4 billion in 2016, up from $111.8 billion in 2015, making Jordan one of the most significant FX hubs in the region.

See the list of the best Forex Brokers in Jordan:

Forex Broker: | Review: | REgulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. Capital.com  | CySEC, FCA, ASIC | Starting 0.0 pips variable & no commissions | 6,000+ (70+ currency pairs) | + Best platform + TradingView charts + MT4 + Leverage up to 1:500 + Best education + Personal support | Live-account from $ 20(Risk warning: 78.1% of retail CFD accounts lose money) | |

2. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 78.1% of retail CFD accounts lose money) | |

3. RoboForex  | IFSC | Starting 0.0 pips & $ 4.0 commission per 1 lot traded | 9,000+ (50+ currency pairs) | + Huge variety + Micro accounts + Free bonus program + Leverage up to 1:2000 + ECN accounts + MT4/MT5/cTrader | Live-account from $ 10(Risk warning: 78.1% of retail CFD accounts lose money) | |

4. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

5. IQ Option  | CySEC | Starting 0.1 pips variable & no commission | 500+ (25+ currency pairs) | + Easy to use + Binary Trading + Support 24/7 + Min. Deposit 10$ + Lowest spreads on main trading hours | Live-account from $ 10(Risk warning: Your capital might be at risk.) |

There is a high demand for quality Forex brokers.

Below, there is a list of the top 5 forex brokers in Jordan:

- Capital.com

- BlackBull Markets

- RoboForex

- Pepperstone

- IQ Option

1. Capital.com

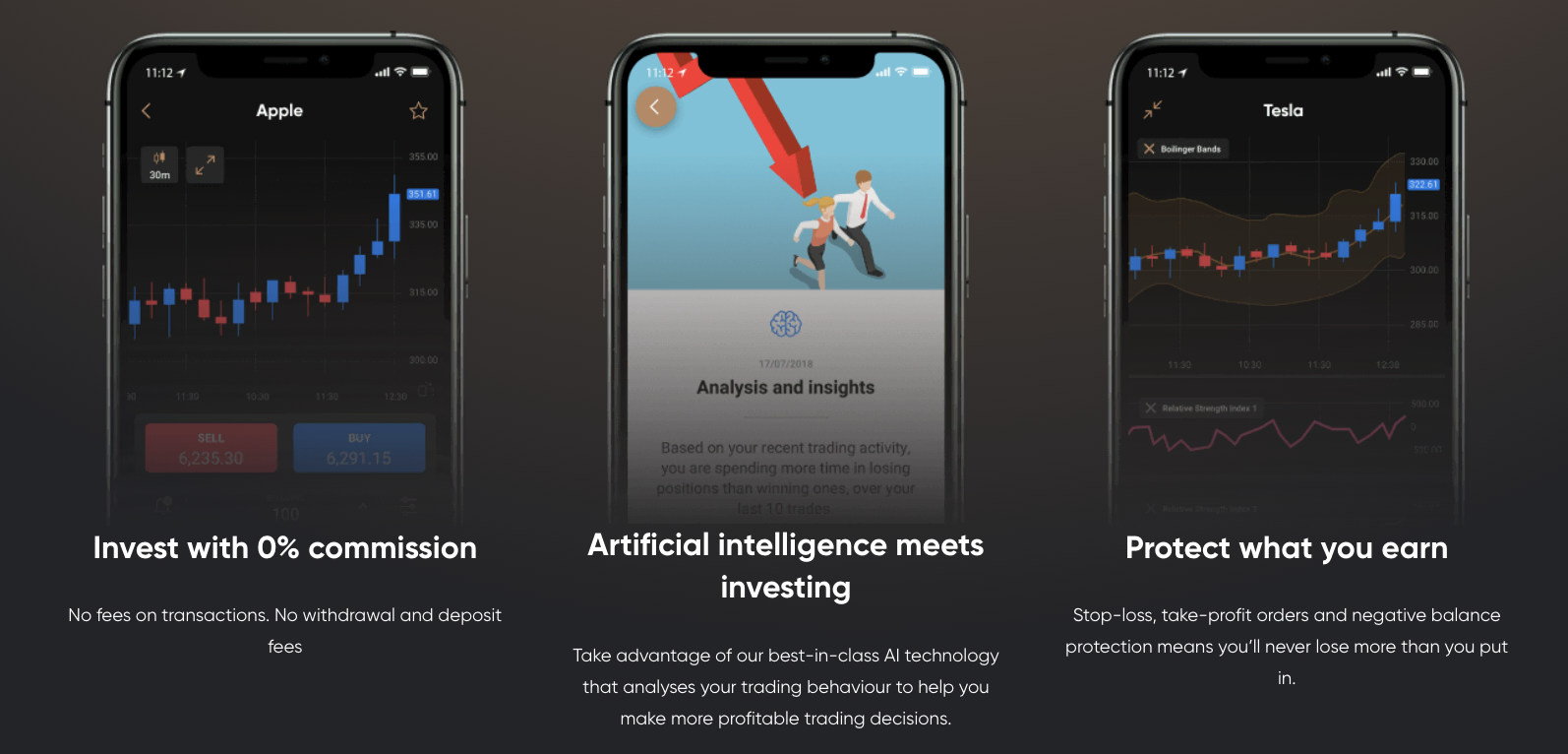

The company focus on CFD and Forex trading. It is a subsidiary of CFD Ltd, which is authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC). Capital.com is a web-based platform and can be accessed from any device with an internet connection.

Capital.com is a licensed and regulated broker that offers CFDs on Forex, stocks, commodities, and indices. With over 1,000 different tradable assets, Capital.com caters to traders of all experience levels. No commissions are charged on trades placed through the Capital.com web platform or mobile app. This broker has something to offer everyone – whether you’re just starting or are a seasoned trader.

Advantages of Capital.com

- Traders do not trade for a commission on the Capital.com trading platform.

- Capital.com provides its traders with standard educational materials.

- Traders are provided a sizable range of 477 cryptocurrency CFDs.

- Various videos are available to traders for market analysis.

Disadvantages of Capital.com

- MetaTrader 5 is not provided for traders on the Capital.com trading platform.

- The range of symbols available is lower than the industry standards.

(Risk warning: 78.1% of retail CFD accounts lose money)

2. BlackBull Markets

This trading platform is a Forex and CFD broker that offers its clients a wide range of tradable assets, competitive spreads, no commissions, and a user-friendly trading platform.

The company is registered with the Financial Conduct Authority (FCA) in the United Kingdom and regulated by the New Zealand Financial Markets Authority (FMA). BlackBull Markets adheres to the strictest financial regulations and provides clients with a safe and secure trading environment.

BlackBull Markets offers a variety of account types, each with its own set of features and benefits.

It is also a broker that allows you to trade in various markets, including stocks, cryptocurrencies, and Forex. Also, they offer competitive spreads and no commission trading. Besides, BlackBull Markets offers a wealth of educational resources to help you learn about trading and market analysis.

BlackBull Markets offers the tightest spreads in the industry, ensuring that your orders get filled quickly and at the best possible price. The desktop and mobile platforms are both designed for easy navigation so that you can execute your trades without any trouble. BlackBull Markets also offer 24/7 customer support so that you always have someone to help guide you through the process, no matter what time of day or night it is.

Merits of BlackBull Markets

- Customer service is available for traders around the clock.

- BlackBull Markets trading platform.

- Traders’ orders are fulfilled fast on BlackBull Markets.

- It offers its traders tight spreads.

- BlackBull Markets has low forex fees.

Demerits of BlackBull Markets

- Traders are charged a withdrawal fee on the BlackBull Markets trading platform.

- The research instruments available to traders are limited.

(Risk Warning: Your capital can be at risk)

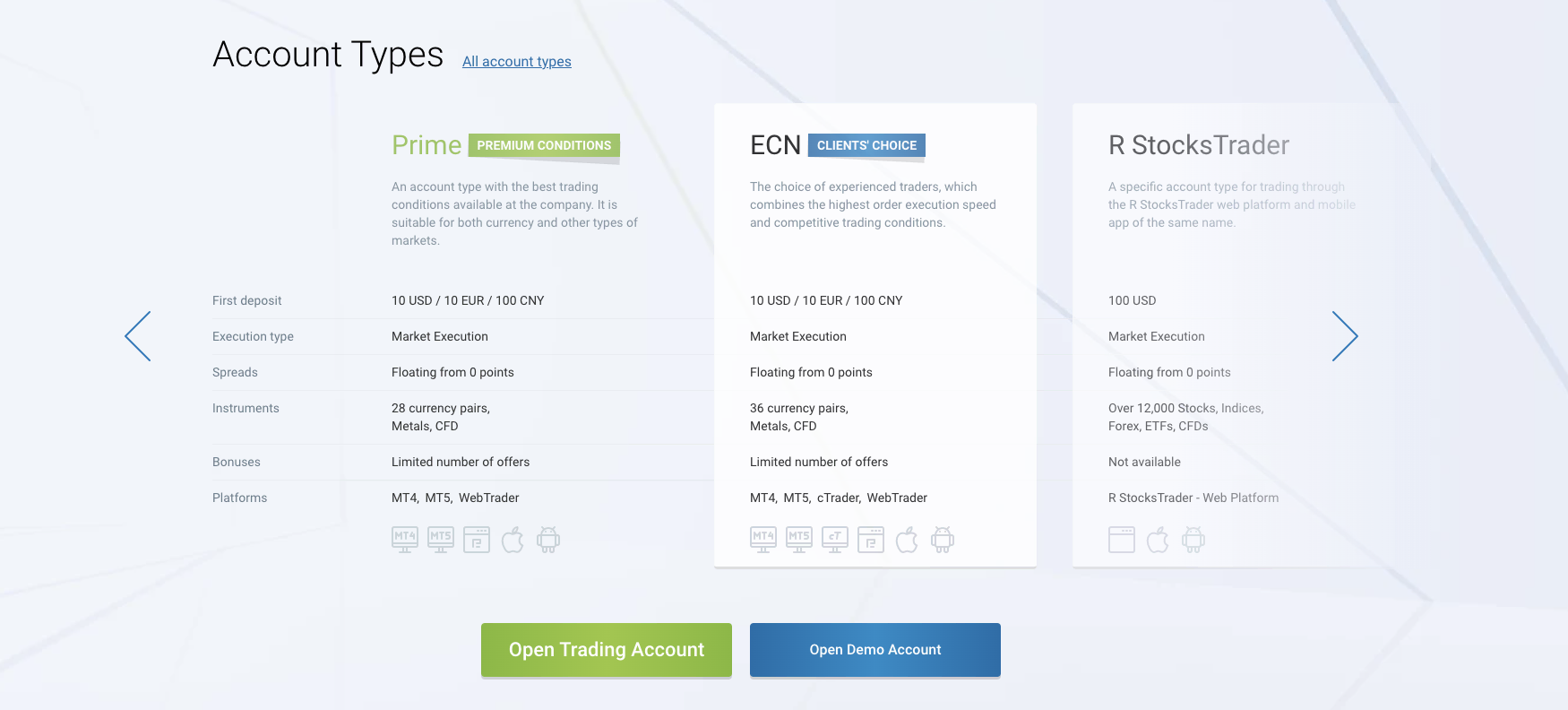

3. RoboForex

This trading platform is young but fast-growing Forex and CFD broker, offering its clients top-notch technology, highly competitive spreads and commissions, and comprehensive educational resources. RoboForex is an ECN broker with high liquidity and tight spreads from 0 pips.

RoboForex is a regulated international broker on the Forex market. RoboForex provides online trading services to individual traders and institutional clients from over 100 countries worldwide.

RoboForex broker allows you to trade with Forex, precious metals, oil, stocks, and indices. The company provides its clients with various account types, which differ by the minimum deposit, the spread size, and the leverage. All RoboForex accounts are ECN accounts that give access to interbank liquidity and the tightest spreads in the market.

RoboForex is a broker with more than ten years of experience that allows you to trade currencies, stocks, CFDs, and futures. RoboForex has received numerous awards for its achievements in the Forex industry, including “The Best Forex Broker” in Russia (according to the Russian edition of Forbes) and “The Most Reliable Forex Broker” (according to the international edition of The Banker), and many others.

Benefits of RoboForex

- MetaTrader 4 and 5 are available on RoboForex.

- The trading conditions on RoboForex are favorable for traders.

- The process of withdrawing your money on RoboForex is instant.

- RoboForex provides its traders with unique investment programs such as CopyFx.

Drawback of RoboForex

- RoboForex trading platform requires traders to make a minimum deposit of $10 before they can start trading.

- A small number of currency pairs are available on RoboForex.

(Risk Warning: Your capital can be at risk)

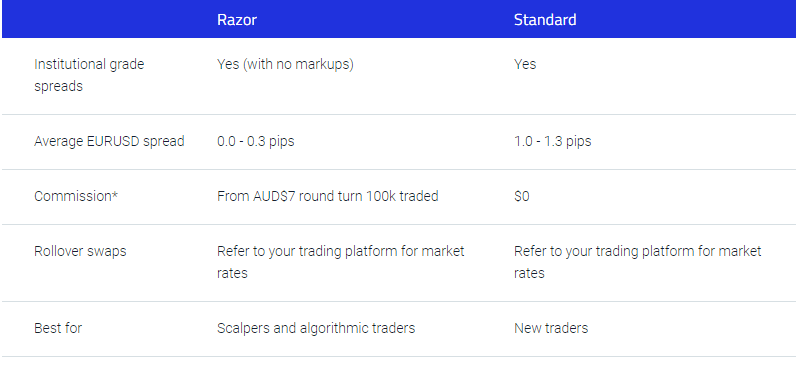

4. Pepperstone

This company provides online trading services for currency and CFD (Contracts for Difference) markets. Pepperstone started in 2010 as an Australian broker and has quickly become one of the world’s largest retail FX brokers. Pepperstone is a regulated Forex and CFD broker headquartered in Melbourne, Australia. The company is regulated by the Australian Securities and Investments Commission (ASIC).

Pepperstone is a forex broker that allows you to trade over 50 currency pairs and CFDs on commodities, indices, and stocks. Pepperstone offers three types of accounts: standard, ECN, and Razor. The standard account is the most popular and is best for beginner traders. ECN accounts offer tighter spreads and are ideal for more experienced traders. Razor accounts are for high-volume traders who want the lowest spreads and commissions. The Standard account is excellent for traders who want to trade with low spreads and no commissions. The Razor account offers even tighter spreads and no commissions. Both accounts offer access to the latest technology, including the popular MetaTrader 4 platform.

Pepperstone offers a wide range of educational resources, including webinars, trading guides, eBooks, and video tutorials.

Merits of Pepperstone

- Pepperstone provides the latest technologies for their traders to trade.

- Multiple add-on platforms are provided for traders on Pepperstone.

- Pepperstone offers competitive pricing to active traders.

- On the Pepperstone trading platform, many social copy trading platforms are available.

Demerits of Pepperstone

- The educational materials provided to traders are of average quality.

- The course provided on the Pepperstone trading platform does not have an assessment section to help traders track their progress.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

5. IQ Option

It is one of the most popular brokers in the world. IQ Option was founded in 2013, and it is based in Cyprus. It is regulated by CySEC. IQ Option is one of the most reliable brokers in the world. It also offers a wide range of assets for trading, including stocks, indices, commodities, and currencies.

IQ Option is a binary option (only for professional traders and outside EAA countries) broker that offers several features to make trading more accessible and profitable. These include a wide range of expiry times, varying from 60 seconds to one month; the ability to trade on multiple assets simultaneously; a choice of trading platforms, including both mobile and desktop versions; and excellent customer service. IQ Option has also been awarded numerous accolades, such as being named the best binary options broker in 2015 by International Financial Magazine.

Pros of IQ Option

- IQ Option is a regulated broker; hence it is safe for traders to trade on IQ Option.

- The account opening process is straightforward.

- IQ Option does not charge traders deposit and withdrawal fees.

- Various instruments are available to traders on the IQ Option trading platform.

Cons of IQ Option

- IQ Option does not provide service to traders in Canada and some other countries.

- MetaTrader 4 and MetaTrader 5 trading platform is not available on IQ Option.

(Risk warning: Your capital might be at risk.)

What are the financial regulations in Jordan?

Jordan is a small country with a big heart. Located in the Middle East, it has been impacted by political and economic turmoil for many years.

The field of finance is highly regulated in Jordan. Banks and other financial institutions are overseen by the Central Bank of Jordan, which has several regulations in place to protect depositors and ensure the stability of the Jordanian financial system. The insurance sector is regulated by the Ministry of Social Affairs. The capital market is regulated by the Securities Commission. The government has also put in place a number of regulations to protect consumers from fraud and sharp business practices.

Jordan has been undergoing a process of financial sector reform to make the sector more efficient and attractive for domestic and foreign investors. The reform includes introducing several new regulations in recent years.

One key area of reform has been the introduction of a new regulatory framework for Islamic finance. The new regulation includes developing new products and the establishment of several sharia-compliant institutions. In addition, there have been several initiatives to promote capital market development in Jordan, which include the establishment of a stock exchange and the introduction of new regulations governing listed companies.

Jordan has a well-developed financial regulatory framework that covers all aspects of the financial sector. The Central Bank of Jordan (CBJ) is the primary regulator of the financial sector and is responsible for issuing licenses, regulating credit institutions, and monitoring and supervising the activities of financial institutions. The CBJ has put in place several regulations to protect consumers and ensure the stability of the Jordanian financial system.

One such regulation is the Credit Institutions Law, which sets out rules for the licensing and supervision of credit institutions. This law aims to ensure that credit institutions operate safely and soundly. Some brokers, like Capital.com, are highly regulated and therefore a good option for forex traders from Jordan.

(Risk warning: 78.1% of retail CFD accounts lose money)

Security for traders from Jordan – Be aware of cybercriminals!

Jordan is one of the most popular Forex trading destinations in the world. Jordan’s central and stable economy makes it an ideal place for Forex traders worldwide to do business.

Foreign exchange, or Forex, traders in Jordan face a unique security challenge. Cyberattackers increasingly target this relatively new and lucrative target, seeking to steal traders’ login credentials, sensitive personal data, and money. While banks have long been the main target of cybercrime, many forex brokers are now being targeted. This is because forex trading offers high liquidity and faster transaction speeds, making it more attractive to cybercriminals.

Cybercriminals are always on the lookout for new ways to exploit traders, and they can often succeed because many traders are not aware of the risks involved in online trading. Traders need to take steps to protect themselves against security threats. There are several ways that traders can protect themselves against security threats. One of the most important is to ensure that they have good antivirus software installed on their computer. They should also make sure that they have a strong password and do not share their passwords with anyone. Also, ensure you trade with a regulated and reputable trading platform.

Is it legal to trade Forex in Jordan?

Jordan is one of several countries in the Middle East. Forex trading is legal in Jordan and regulated by the Jordan Securities Commission (JSC). The regulator has set out several rules that must be followed by forex brokers operating in the country. These include capital requirements, consumer protection measures, and provisions relating to financial reporting.

The Central Bank of Jordan has issued some regulations and laws governing forex trading. These regulations are designed to protect traders and ensure that all transactions are carried out fairly and transparently.

Forex trading is not illegal in Jordan. Forex brokers licensed and regulated in other countries can offer their services to traders in Jordan.

How to trade Forex in Jordan – Tutorial for traders

Forex trading is considered a precarious investment, but it can be quite rewarding if done correctly. Some people are under the impression that forex trading is only for wealthy individuals; this is not true. Forex trading can be done with a small amount of money. The most important thing to remember when trading currencies is never to trade more than you can afford to lose.

Open an account

Opening a forex account in Jordan is a great way to get started in the foreign exchange market. By following a few simple steps, you can have your account up and running. Here are the basics of what you need to do:

1. Choose the right broker – not all brokers are created equal, so it’s essential to do your research and find one that meets your needs.

2. Complete the account application – this will include your personal information and contact details, and you have to provide your valid identification card.

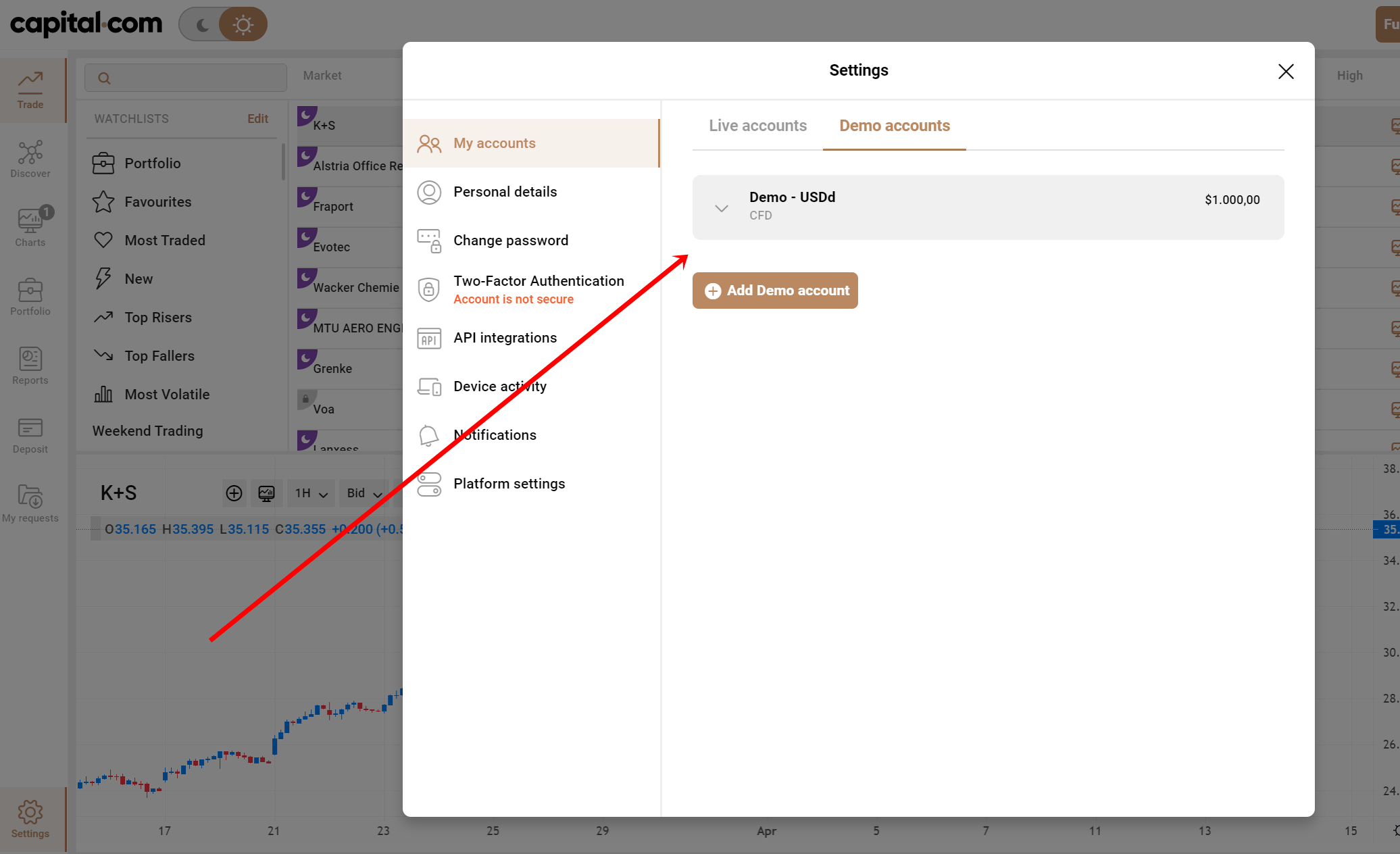

Start with demo or real account

When you want to start trading Forex, you have to decide whether to use a demo account or a real account. A demo account is a virtual account that you can use to try out binary options trading without risking your own money (only for professional traders and outside EAA countries only) . A real account is an account with real money that you can use to trade binary options.

There are pros and cons to both demo accounts and real accounts. A demo account is an excellent way to learn about binary options trading without risking your own money. A real account is an excellent way to make money by trading binary options (only for professional traders and outside EAA countries only).

Deposit money

When you open a forex trading account, you will need to deposit money into that account before starting trading. The amount of money you need to deposit will vary depending on the broker you choose, but most brokers require a minimum deposit of $100.

There are various ways you can deposit money into your forex account. The standard methods are bank transfers, debit cards, and credit cards. You can also use online payment processors like PayPal or Skrill.

Notice:

The payment methods are depending on your country of residence. Forex Brokers are offering all kinds of methods separately for each country.

Use analysis and strategies

Position trading

Position trading is a type of stock trading where the trader holds security for an extended period. The goal is to profit from the long-term price movements of the security rather than from the day-to-day fluctuations.

The advantage of position trading is that it allows the trader to profit from the price appreciation of the security while minimizing the risk of short-term price fluctuations. In addition, position traders can hold a security for a more extended time, which allows them to benefit from the compounding effect of interest.

Scalping

Scalping is a trading strategy that attempts to exploit the market’s inefficiencies by making numerous small profits on small price changes. The goal is to amass a large sum of money by buying and selling stocks, commodities, or other financial instruments at specific points during the day.

Day trading

Day trading is buying and selling stocks, commodities, and other securities within the same trading day. It usually involves a higher degree of risk and higher potential rewards than long-term investing.

Day traders typically use technical analysis to make their decisions rather than fundamental analysis. They attempt to exploit tiny price movements to make a profit. Many day traders also use margin trading, which allows them to control a much more prominent position than they could afford with their capital.

Make profit

Forex trading is buying and selling currencies to make a profit. It may seem challenging to understand at first, but with a bit of practice and the proper guidance, it can be a very profitable way to make an income.

Here are a few things you need to know before starting to trade Forex. It would be best to find a forex broker who will allow you to trade on their platform with your local currency. Once you have registered with a broker, you will need to fund your account with some money so that you can start trading. Make sure the broker you decide to trade with is regulated by a reputable body and is recognized outside Jordan.

(Risk warning: 78.1% of retail CFD accounts lose money)

Conclusion: The best Forex Brokers are available in Jordan

This article discussed the five best forex brokers in Jordan. Jordan is a great place to do business, and these brokers are well-established and reputable. If you are looking for an excellent broker to help you invest in Jordan’s thriving economy, these are the five best options.

FAQ – The most asked questions about Forex Broker Jordan :

Does a forex broker in Jordan offer traders a demo account?

The brokers offer a demo account to traders everywhere. So, if you are a trader in Jordan, your broker will offer you a demo account. For thirty days, forex brokers in Jordan allow traders to use a demo account. You can skip fees for a demo account for thirty days. However, once thirty days expire, brokers might charge you a fee for using a demo account.

Which forex brokers in Jordan have low fees and commissions?

Fees and commissions are one thing that a trader must consider when choosing a broker. After all, a trader wouldn’t want to share a greater part of their earnings with the broker. So, you must choose a forex broker in Jordan that charges low fees and commissions. Traders in Jordan can choose one of the following five brokers to avoid unnecessary fees and commissions.

BlackBull Markets

RoboForex

IQ Option

Pepperstone

Capital.com

What payment methods does a forex broker in Jordan offer traders?

Traders looking forward to depositing with a forex broker in Jordan can use the following payment methods.

Bank transfers

Cryptocurrency

Electronic wallets

Debit and credit cards

Last Updated on January 27, 2023 by Arkady Müller

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)