How much does it cost to trade with BDSwiss? – BDSwiss spreads and fees explained

Table of Contents

BDSwiss is the FX and CFD broker based in Switzerland, which commenced its brokerage operations in 2012. The licensing for this brokerage platform is in the US by National Futures Association, CySEC, and FSC in the EU. There are several groups of firms, which include BDSwiss GmbH, BDS Markets, BDSwiss Holding PLC, and BDSwiss LLC.

The website has the information highlighted in the English language. However, international customers have access to change the language for better understanding. The popularity of BDSwiss persists with its record of over 10 million transactions processed every year. They have over 1 million accounts registered over the platform from over 170 countries.

Apart from that, this platform also offers a wide range of services and features such as educational resources, advanced trading platforms, market news, and a responsive customer support team. But even with all of these features, beginner traders are still lacking some information about the brokerage, making them hesitate to join this trading platform.

One amongst such considerations is the understanding of fees and spreads over BDSwiss. People want to know the costs they have to pay for trading with this platform. Some people do their research to get this information, while some don’t even try to explore the website of the brokerage platform for digging this insight. Therefore, this article is a solution for people who like less research.

Hence, this article focuses on elaborating the information on spreads and fees to help beginner traders get the confidence to start their journey. Apart from that, you will also be aware of the tentative cost that you need to spend in order to start trading.

The BDSwiss features that make this platform stand out

Before you inch towards the information of fees and spreads, you need to count on understanding the features that this platform offers. These features are all practical and functional for beginners, intermediates, and professionals simultaneously. So, to help you get a clear insight, here are brief descriptions of all features:

#1 General idea of the spreads

The spread is accountable for the difference between the asking and bid prices. The assets within the platform of BDSwiss have dissimilar spreads. With BDSwiss, the traders are not liable for paying any kind of fees or commission for most of the trades. But, some trading fees are supposed to be charged as spreads.

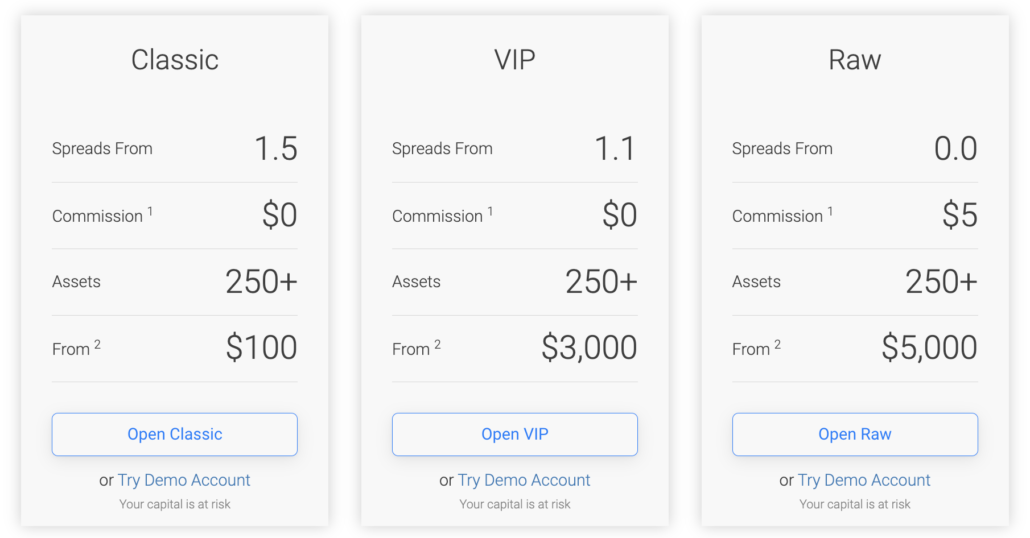

This value of spreads varies throughout the entire day. And this variation depends upon the conditions and volatility in the market. To help you get a brief understanding, you should know that different BDSwiss accounts have their specific spreads. The Classic, Raw, and VIP accounts have spreads that start from 1.5 pips, 0.0 pips, and 1.1 pips, respectively.

#2 Customer support channels

The next inevitable feature of BDSwiss is its customer support channels, which are accountable for ensuring customer satisfaction. The brand has put up a very effective support system for the customers and clients to contact and resolve their queries. Speaking of channels, the brokerage platform comes with hotlines with different representatives proficient in communicating in different languages.

Hence, the clients from different selected countries can talk to the representatives and get their solutions in their native language. Suppose the language support is not available for the clients of specific countries. In that case, there is a live chat option, where more language experts are recruited for healthy and understandable communication with the clients and customers.

Apart from that, you can also count on contacting the BDSwiss team through Telegram, WhatsApp, and even Email. The customer care channels and teams are active at any time throughout the working days.

#3 Efficacy of the trading platform

When you are talking about the features, you cannot ignore the efficacy of the trading platform for BDSwiss. This brokerage is offering clients MT4 and MT5 trading platforms. MT4 comes with all kinds of fundamental features, which that individuals need in order to trade successfully. Hence, this is a great help for beginners to learn trading and master it in a short span of time.

Along with that, the MT5 platform is accountable to be more advanced, which comes with additional features such as hedging options. The BDSwiss website has all the brief information on the differences between the two trading platforms. Check that insight for a better understanding. All of these details will help you out in making more decisions that are informed.

You have the flexibility to download and use one of the two trading platforms on iOS or Android devices. Moreover, you can also download the platforms on MAC or PC. The BDSwiss mobile application and the web trader are also evident parts of the trading platforms that different traders are leveraging as per their preferences.

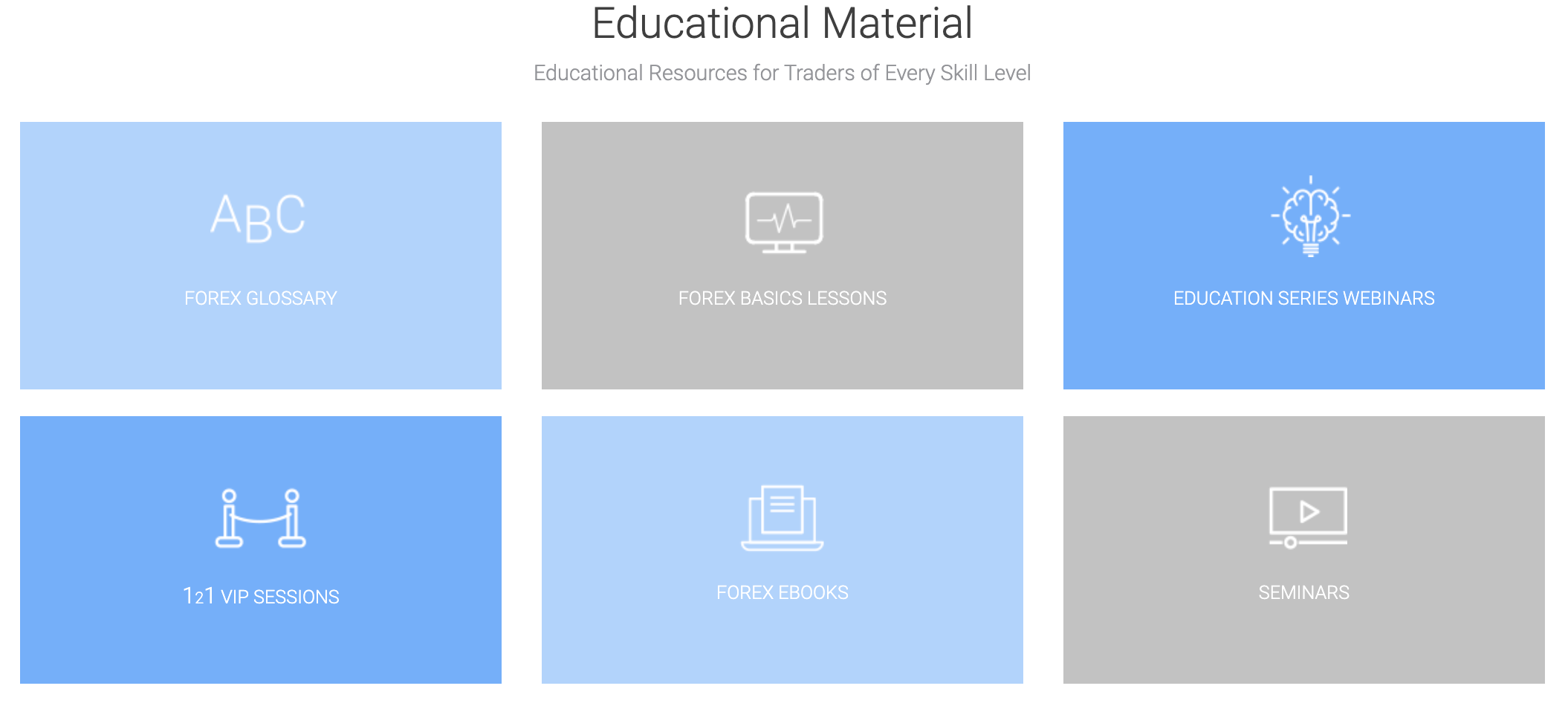

#4 Educational resources

BDSwiss offers a plethora of educational resources ideal for beginners and experienced traders. In addition, the brand has also invested in a specific BDSwiss Trading Academy, which offers beginner, intermediate and advanced courses for suiting the needs of traders as per their respective experiences.

The traders have the proficiency to benefit from webinars and seminars that are organized by this platform. Moreover, it has a free demo account and updates you with market news on the site for helping the traders improve their knowledge and skills on trading.

Information on fees while you trade with BDSwiss

Here is the list of fees that occurs while you trade with BDSwiss:

- BDSwiss does not have any kind of fees or charges for the deposits of the minimum amount or more.

- The withdrawal charges are imposed only if the trader is withdrawing profits less than $100 while using the bank wire mode of transfer. A $10 fee will be charged to the traders for withdrawing a lower than the minimum amount. Apart from the bank wire mode of transfer, all other payment methods charge a $20 fee for withdrawals below the minimum amount.

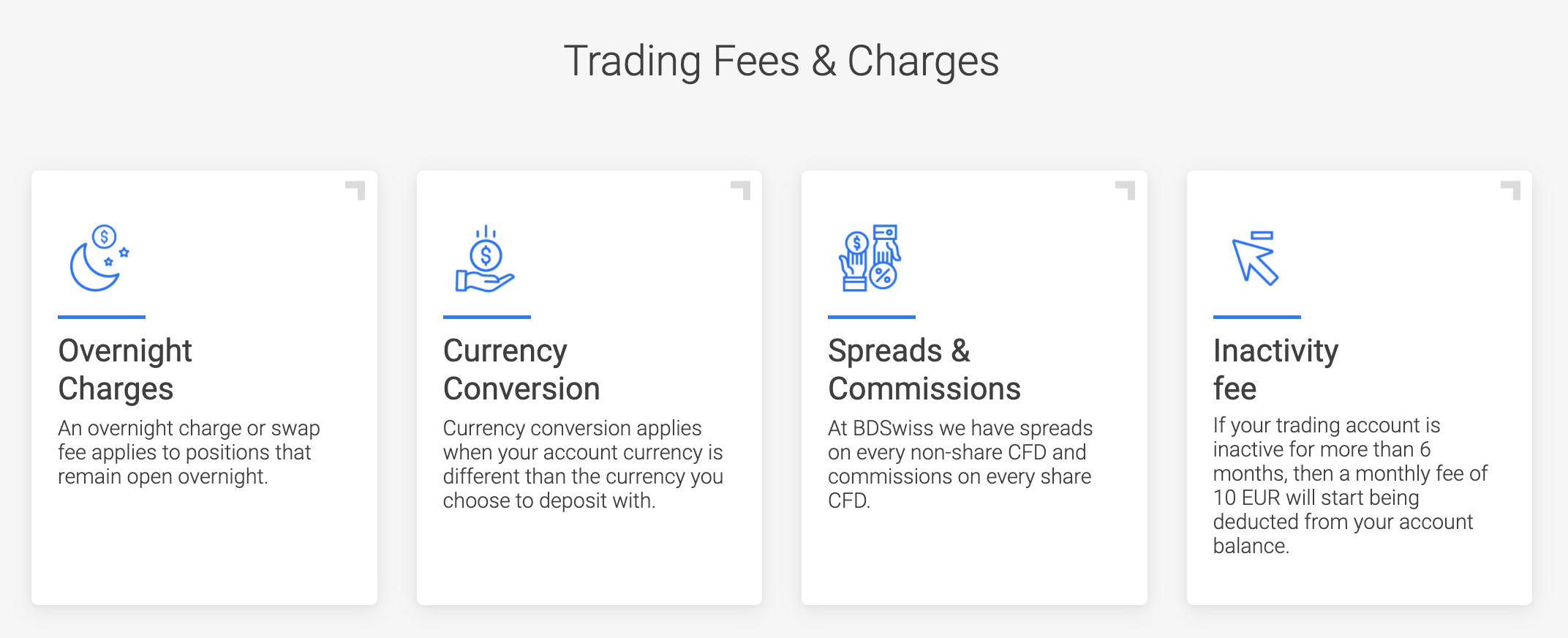

- BDSwiss applies for a currency conversion fee if the trader’s account is in a different currency than that of the currency that the traders actually deposit the funds in.

- BDSwiss also charges an inactivity fee of 10% of the balance in the account every month if the account goes dormant for 90 days in a row.

- The minimum deposit for joining this brokerage platform is $100.

- When the traders proceed with trades upon financial instruments such as forex, they can expect to pay overnight or swap fees. It will be charged when the positions are held for more than a day. The Muslim traders do not have to pay any of these fees through provisions of Islamic Account, which is available over the classic and VIP accounts.

- BDSwiss doesn’t offer Spread Betting, for which there are no fees for that as well.

Explanation of diverse payable and non-payable sections within BDSwiss

To help you get a better understanding of what different chargeable and non-chargeable sections mean, here is a brief understanding for all of them:

#1 Deposit fees

It is the fees that brokers demand from the traders upon making deposits onto the account. It is usually a very minimal fee, which is charged for the sake of maintaining the trader’s account over time. However, BDSwiss doesn’t impose such charges upon traders upon minimum deposits or more. The minimal deposit is $100 for the Classic Account and is also the minimum amount to start trading with BDSwiss.

#2 Withdrawal fees

The withdrawal fees are charged by the brokerage platform to process the payment onto your bank account. And this is one of the business earning tactics for most brokerage platforms. With some platforms, you might have to pay withdrawal charges in some percentage, irrespective of what amount you withdraw. However, with BDSwiss, you will be paying withdrawal charges only if you are withdrawing an amount less than the minimum specified amount for respective payment methods.

#3 Currency conversion fees

When you are depositing the funds to the broker platform in one currency, but are running the account in some different updated currency, then there is a nominal currency conversion charge which is automatically deducted from the deposited amount while it was internally converted. BDSwiss has nominal charges for this.

#4 Inactivity fees

This fee is charged when the trader is not active for around 90 days in a consecutive manner. This charge will be used for the management and administration aspects of the dormant account. BDSwiss also has a moderate charge for inactivity within the trading account. It keeps on charging the account on a monthly basis until the account balance is Zero.

#5 Overnight fees

This form of interest charge is applied only to the leveraged position when it is kept open beyond the end of a trading day, corresponding to that of an underlying asset. Hence, the practice is referred to as that of the overnight interest. BDSwiss has minimal overnight or swap fees for the trading of certain financial instruments.

Tables of fees and spreads

After discussing the fees, you must now get a glimpse at commissions and spreads upon the BDSwiss platform for seamless trading. Here is the table that explains the different commissions charged by the brokerage platform, depending upon the account type and asset:

VIP Account | Raw Account | Classic Account |

$0 on all pairs | $5 on all pairs | $0 on all pairs |

$0 on all Indices | $2 on all Indices | $2 on all Indices |

0.15% on all Shares | 0.15% on all Shares | 0.14% on all Shares |

For the stock CFDs, there is a brokerage commission of 0.1%, which is charged at the opening and closing of a specific position. The company also intends to place a rollover fee for the position held overnight. The rollover fees depend upon the asset type, which deducts from the account, depending upon the direction of investment.

Fees and spreads in terms of account types

Features | Classic Account | Raw Account | VIP Account |

Starting Spreads | From 1.5 pips | From 0.0 pips | From 1.1 pips |

Decimal Pricing | Up to 5 decimals | Up to 5 decimals | Up to 5 decimals |

Swaps and Rollovers | Yes | Yes | Yes |

Roll Over Fee or Swap Fee | No | No | Yes |

Available Leverage | Up to 1:500 | Up to 1:500 | Up to 1:500 |

Minimum Deposit | $100 | $5000 | $3000 |

Process of opening a BDSwiss account

The account opening process at the BDSwiss platform is quite easy, even for beginners. You just need to start with a demo account to gain the skills and expertise you need for successful trading. Though you might be an experienced trader and are switching your trading practices to the BDSwiss platform, you need to consider exploring the demo account to get used to the new interface.

For opening up the demo account, you need to sign-up to BDSwiss and follow all of the prompts. After you complete the sign-up process, your demo account will be ready automatically. Now, you can access the demo account from your trading dashboard anytime you want. After that, you can go ahead and select your preferred type of account and then click on ‘open.’

Enter the personal details and other trading-related information to commence with the process. When you are completely registered with the account, you will obtain the trading platform and your login details for your individual access. Before you can commence with the trade, you will have to verify the identity after taking the Appropriateness Test.

After confirmation of the account, you can now go to the dashboard to access the account. Check all the details, make the deposits and proceed with the withdrawals. Hence, this is how you can open your desired account type, make the minimum deposit amount and start with your trading journey at ease. You can check the details over the website to get better information upon the deposit or withdrawal process.

Conclusion

BDSwiss is a well-rounded platform that has its focus on supplying a superior level of execution and competitive price. All investors can find impactful value upon BDSwiss offerings and features. In addition, experienced traders can leverage the full potential of proficient trading tools such as MT4 and MT5 platforms.

Moreover, it also has a straight-through processing execution and is updated with all kinds of market news. The beginners with less or no experience are also being welcomed to the platform. It is because they have the help of a demo account to learn and utilize their skills to have a successful trading experience.

The low-starting deposit amounts, educational resources, and other such guidance features are ideal for beginners to master the art of profitable trading. All of the fees and spreads information has been updated over this article to give you the bigger picture. Hence, you are now ready to commence with your ideology of financial asset trading with one of the best brokerage platforms of all time.

Sign-up to the platform, explore the demo account, check the blogs section, take the lessons and make your deposit to start trading seamlessly. There are even webinars to keep the traders updated with the latest market trends. The dashboard will also help traders be aware of what they invested, how the asset is performing, and their profits. So, it is time to leverage its full potential.

FAQ – The most asked questions about cost to trade with BDSwiss :

Is BDSwiss good for beginners?

Yes, BDSwiss is ideal for beginners as there are all kinds of accessible information to guide the traders to make their initial investments. There is a section called ‘BDSwiss Blog’ where you will get updates on recent trends and stock news. Hence, you will get complete information on developing your skills and knowledge. Moreover, there are also educational resources that will help you develop the ideology of choosing stocks, investing funds, and using other such features.

Is there any additional charge for withdrawal?

If you are withdrawing a minimum of $100, you won’t have to pay any charge. But if you are withdrawing any amount less than that, you will have to pay a $10 fee for bank wire transfers and $20 for other payment methods. Apart from that, you might also have to pay the charges imposed by the bank or financial institution, which has nothing to do with BDSwiss. You can inquire about the same with your bank to know the exact charges. Hence, this is all that you should know about the withdrawal charges.

Does BDSwiss charge commission?

Yes, BDSwiss charges commissions depending upon the type of account you select. The table is specified in the ‘Table of Fees and Spreads’ section. Check that out to know the commissions that different account holders have to pay for different financial instruments.

Is BDSwiss free?

BDSwiss is not a completely free brokerage platform, as it has some charges upon different features and functionalities. But you are not charged anything for making the deposits of any amount. But remember that you cannot make any deposit below $100 for Classic Account, $5000 for Raw Account, and $3000 for a VIP account.

What are the spreads on BD Swiss fees?

Spreads have different values throughout the day. And this variance is based on the market’s conditions and volatility. You should know that distinct BD Swiss accounts have unique spreads to give you a quick insight. Spreads begin at 1.5 pip for the Classic account, 0.0 pip for the Raw account, and 1.1 pip for the VIP account, respectively.

Can I only deposit in BD Swiss from my windows pc, and will it incur any fees?

No, you can use your smartphone, too, to make a deposit. BDSwiss doesn’t charge you for making deposits. The trading platform is available for download and uses on iOS and Android smartphones, giving you flexibility. In addition, the platforms are available for download on both MAC and PC. The BD Swiss mobile app and web trader are obvious components of the trading platforms that various traders use in accordance with their preferences.

What are the BD Swiss fees for stock CFDs?

The broker charges a brokerage commission of 0.1% for stock CFDs, which is assessed at the beginning and end of a single position. Additionally, the business plans to impose a rollover fee for the overnight holding position. The rollover fees vary depending on the asset class and are deducted from the account according to the investment strategy.

See more articles about forex brokers here:

Last Updated on January 27, 2023 by Arkady Müller