Deriv minimum deposit: How to deposit money

Table of Contents

When we ponder how to increase wealth, trading is most likely the first way that we could imagine. People are embracing the trading world in hopes of earning more.

It has become the most inherent aspect of wealth that all of us must explore nowadays because of a rising trend. So, if we keep ourselves behind from trading, we might miss huge opportunities.

Though we are aware of various forms of trading, the most common way is online trading now. People saw a difficult time with trading before the internet came into its present form.

They had to physically gather at the exchanges, call for orders, and write down wins and losses. All of it ended with online trading. We can now trade with multiple assets and markets with a few clicks on our device.

However, online trading demands a good broker by your side. As a broker is the one who mediates the transaction, it is essential for a new trader especially.

The brokers offer various platforms for online trading, which come with different types of accounts, payments, deposits, etc. It is needless to mention that the first step in trading is opening a trading account.

However, before signing up for an account, a beginner trader must know what additional charges may arise with it. Many brokers also have a minimum deposit amount that a trader must put in to begin trading.

A minimum deposit is something a new trader often misses to look at before entering the trading domain. Later, they realize its significance in their trading methods. It can give the entire budget of the funds a spin if not paid proper attention.

Also, many online brokers keep a high minimum deposit limit. Such limits make it difficult for new traders to join sooner because beginners may not always have a proper amount to start with.

However, Deriv is one online broker having a minimum deposit amount of only $5 or equivalent in other currencies. It means that anyone can start investing right away without a financial barrier. Due to this reason, the most common traders can test themselves well in the stock market, forex market, etc.

Moreover, Deriv stands apart from the rest of the trading platforms because of the deposit and withdrawal fees. It offers its clients free deposits and withdrawals. That means the only requirement is to deposit the minimum amount to begin with trades.

The trader can use the deposit later as well, so it does not count as a charge per se. Therefore, such benefits have gained Deriv the trust of its clients and enabled it to become an ideal broker over time.

Deriv has been serving traders worldwide with integrity for over 22 years. Since 1999 it has embarked on a journey that led to its 2.5 million customers globally. Deriv is among the top and largest online brokers.

It offers trading in numerous instruments, including CFDs, forex, indices, cryptocurrencies, commodities, synthetics, etc. In addition to all its features, Deriv offers a distinct deposit process. So, if you are new in the trading world, you can know all about how to deposit money in your account here.

What is the minimum deposit?

A minimum deposit is the smallest sum of money needed to open an account with a financial institution. The financial institution could be a brokerage firm or a bank. A minimum deposit is also known as an initial deposit.

The accounts that offer premium services require higher minimum deposits. Whereas products aimed at a broader customer base typically have considerably lower deposits. A low minimum deposit is attractive to a new customer.

A new trader usually does not want to spend thousands of dollars on an initial deposit to start trading. They are looking to start with the least amount of money possible. So having a minimum deposit of $1000 will only push new traders away from the platform.

We can say that heavy competition in the financial industry has led to reduced minimum deposit requirements. It is particularly apparent in brokerage businesses. Most brokerages now offer a minimum deposit as low as $5-$10. Some brokerages offer even lower minimum deposits. But they are quite rare.

Financial organizations compete for clients by charging a low fee for asset management fees and withdrawing or transferring cash. Therefore, a low minimum deposit can draw new customers to the platform.

Apart from Forex trading, some platforms also offer customers the option to trade in multiple markets. These may be cryptocurrency markets, commodities markets, or the stock market. All these markets to trade in, and all the customer needs to start trading is a $5 or lower minimum deposit.

An advanced trader may not want an account with a low minimum deposit and no benefits. So, the platforms offer different types of accounts to choose from that benefit the traders. But they may come with a high initial deposit.

While keeping minimum deposits low to attract new customers is vital. It is also important to offer a variety of different options. Customers of all types will find this helpful when opening an account.

Accounts with a low initial deposit and few benefits may seem attractive to a beginner trader. But an experienced trader might not find it to be worth his time. Advanced traders usually open accounts with added benefits.

Therefore, it is crucial to know which account to trade for. A beginner trader should look for a low initial deposit account and understand the various methods offered in that particular platform beforehand.

Available deposit methods with Deriv

As we know that depositing your funds initiates the trading journey, we must be careful while transferring them. Often, a trader gets confused with which deposit method to choose.

Also, most brokers offer only a narrow selection of methods for depositing. However, with Deriv, the trader can choose from a long list of depositing methods that vary in the minimum deposit amounts. So, the trader can decide which method is convenient and feasible.

#1 Online banking

It is probably one of the most used methods for various financial transactions. Deriv also acknowledges the deposit through online banking methods. Moreover, it further accepts a variety of methods in it that include PayTrust, bank wire transfer, Help2pay, etc.

#2 Instant bank wire transfer

A bank transfer can be termed as an online check, in other words. Since it is an online method, it doesn’t involve any physical exchange of cash. It is mainly an electronic exchange via a network that the banks and transfer service agencies administer.

It involves a sending and receiving institution and requires information from the party initiating the transfer, such as the receiver’s name and account number.

#3 PayTrust

PayTrust is an online bill payment system that aims to eliminate the use of paper currency. A Deriv account trader can use this method to deposit the funds instantly.

#4 Help2pay

A payment gateway allows a user to access merchants through an automated platform. It offers real-time market solutions as well. So, as Deriv accepts the deposits through this method, traders can utilize it for an easy deposit.

#5 Credit/Debit cards

Card payments are among the most convenient and the fastest ways to transfer money. Therefore, Deriv also offers a deposit through this method. It offers a diverse list of cards that you can use to deposit your fund.

Moreover, if there is any delay in the credit, you can freely contact the 24/7 available customer support to resolve any issue.

#6 E-Wallets

E-wallets are nothing but digital wallets which barter the payment through digital units. You can have an amount as e-wallet money in it that you can use for cashless transactions. It is an easy and simplified method, so Deriv offers deposits through all the major E-wallets. It includes the following:

- FasaPay

- Perfect Money

- Skrill

- Neteller

- Webmoney

#7 Cryptocurrency/Crypto Wallets

Unlike a regular wallet, a crypto wallet differs in storing the keys instead of cash or cryptocurrencies. It carries the public and private keys that a trader uses for crypto transactions.

So, we can say that it differs from the e-wallets as well. Deriv understands the increasing use of crypto transactions, so it offers a smooth pathway of depositing through the same.

It accepts all the popular cryptos, including Bitcoin, Ethereum, Litecoin, USDcoin, and many more. So you can deposit your funds in the form of an asset like crypto in addition to all the conventional forms.

#8 Fiat on-ramp

It is a unique way of paying and depositing funds that few brokers offer. A beginner trader might be unaware of such a term, so we can say an on-ramp signifies nothing but an exchange in simpler words. A Fiat on-ramp is a payment service that lets you offer Fiat money in exchange for crypto.

Now, Fiat money is a currency issued by the government, so it has more validation. However, unlike other currencies, Fiat money is not backed by a commodity like gold.

But, it gives the central banks more prominent control over an economy. Therefore, a Fiat on-ramp is a platform or an exchange where the trader can base the fiat-crypto transaction on the current market rates.

Deriv offers this unique system for its deposit methods to diversify its portfolio. So, you can choose to buy crypto on popular exchanges such as Changelly, Banxa, Xanpool, etc., and use them for your deposit.

#9 Deriv P2P

The Deriv P2P is an exclusive method developed by themselves. Only the traders having a Deriv account can use it for deposits. It is a hassle-free method that traders can access through even the local currencies.

The DP2P is a fast and secure peer-to-peer deposit and withdrawal service. It allows an easy exchange with fellow traders to move funds in and out of a Deriv account.

It is a service that comes with added benefits like the trader can make speedy deposits and withdrawals on it. Moreover, all the exchanges are finished within 2 hours.

Additionally, you can exchange your local currency at your preferred rate. A trader can also communicate in real-time with the chosen trader with the chat in-app. It gives a faster exchange altogether.

How much is the Deriv minimum deposit?

Deriv offers a relatively lower minimum deposit as compared to its competitors. It starts from $0 and can go to $5-10. However, the minimum deposit primarily depends on the methods chosen. The following tables shall show the amounts in brief:

#1 Online banking minimum

Method | Currencies | Min-maxdeposit | Depositprocessing time |

Instant Bank Transfer | USD | 5 – 50,000 | 1 working day |

PayTrust | USD | 10 – 17,000 | 1 working day |

Help2Pay | USD | 15 – 10,000 | Instant |

#2 Credit/Debit cards minimum

Method | Currencies | Min-maxdeposit | Depositprocessing time |

Visa | USD EUR AUD GBP | 10 – 10,000 | Instant |

Mastercard | USD EUR AUD GBP | 10 – 10,000 | Instant |

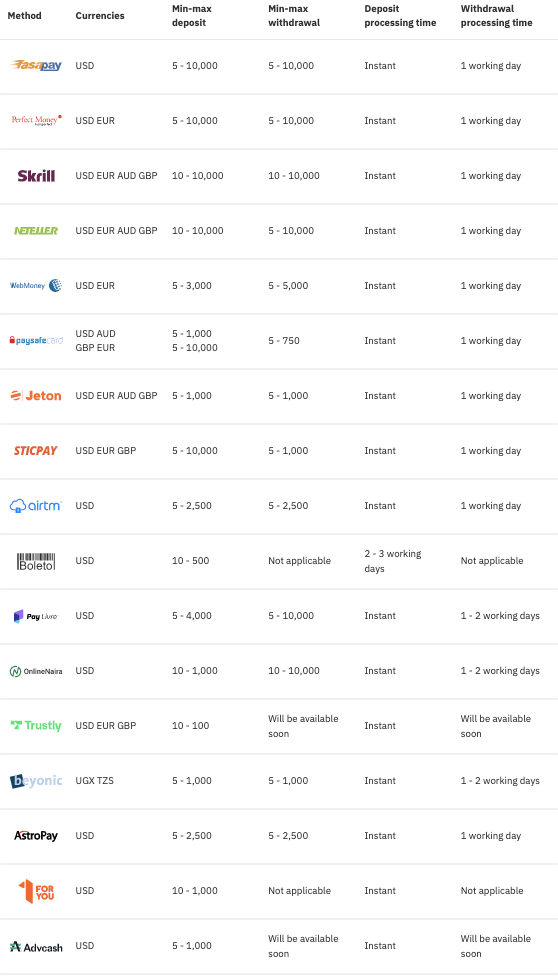

#3 E-wallets minimum deposits

Method | Currencies | Min-maxdeposit | Depositprocessing time |

Fasapay | USD | 5 – 10,000 | Instant |

Perfect Money | USD EUR | 5 – 10,000 | Instant |

Skrill | USD EUR AUD GBP | 10 – 10,000 | Instant |

Neteller | USD EUR AUD GBP | 10- 10,000 | Instant |

Web Money | USD EUR | 5 – 3000 | Instant |

#4 Cryptocurrencies minimum deposits

Method | Currencies | Min-max deposit | Depositprocessing time |

Bitcoin | BTC | No minimum | available as soon as confirmed |

Ethereum | ETH | No minimum | available as soon as confirmed |

Litecoin | LTC | No minimum | available as soon as confirmed |

So we can see that, though there is a difference in the minimum deposit amounts, they are quite low. Moreover, Deriv stands apart from others in offering no minimum deposit for cryptos.

Deposit currency

Being a Deriv account trader, you can have Hassle-free deposits and withdrawals. We can see that brokers often offer a limited number of base currencies that the trader can use.

But, Deriv allows you even to use your local currency for its deposits. Moreover, the different currencies that are accepted also include:

- EUR

- USD

- GBP

- AUD

How to deposit – Tutorial

Many traders have a complicated process when depositing the funds into your trading account. However, Deriv offers a simple process that involves easy steps. So, even a beginner trader can deposit without any risk. However, a new trader must remember that the depositing process can vary slightly with Deriv.

There are numerous deposit methods involving various partners; therefore, the steps may change accordingly. However, we can form an overview with the usual basic steps. They are as follows:

- Create an account

- Deposit the funds

- Review the transactions

Now, since it differs depending on the payment or deposit methods in Deriv, we can view the steps in the three common deposit methods for better insight.

#1 Online banking method

Steps

- The first step requires you to log in to your Deriv.com account. Then you need to navigate to the Cashier icon and click it.

- After clicking the cashier icon, you can see a Deposit at the left corner. You need to click that and select the online banking method such as Help2Pay, PayTrust, etc.

- You will be asked to fill in your banking credentials now. After you complete your details, you can click Next. Further, it would require you to click on the continue button to proceed.

- It will direct you to the page to fill in your banking account details. After following the instructions there, you can deposit your amount.

#2 Credit/Debit cards

Steps

- You have to log in to your Deriv account, locate the cashier icon and click it.

- Then, you must click the deposit icon and select the card of your choice.

- The third step requires you to fill in the card credentials along with the amount you want to deposit. After that, you need to click deposit now to receive a confirmation of the approved transaction.

- Finally, you will receive an email confirmation of the successful deposit.

So, we can say that the card deposit is even simpler than the online banking method. It does the job instantly and excludes the bank account details.

#3 How e-wallet differ in steps?

- The first two steps are common for all methods, which involve login and selecting the method.

- In an e-wallet method, you need to enter your deposit amount and your e-wallet account ID. Then click on Next.

- You will see a Continue button; clicking on that will open your transaction in a new window.

- Next, you need to feed in your e-wallet account credentials. After which, you will receive a confirmation PIN in your email. You may use that to log in to your e-wallet account later.

- You have to enter the PIN from the email and click on the Process tab. Further, you have to review the transaction form and click on the Process button.

- Deriv shall send a confirmation message to your e-wallet account for your successful deposit. Also, you will receive an email from Deriv for the same, which marks the end of the process.

We can see that the e-wallet method requires a few additional steps than the previous ones. However, the trader can choose the method and follow their steps depending on the minimum and maximum deposit amount.

Conclusion

Deriv is among the largest online brokers, without any doubt. It offers a distinct deposit process that involves simple steps. With Deriv, the traders get a variety of deposit methods in addition.

Moreover, the minimum deposit it offers is low and affordable for any new trader. Therefore, we can conclude that it can be an ideal broker for anyone looking for an affordable and reliable trading experience.

FAQ – The most asked questions about Deriv minimum deposit :

Does Deriv charge deposit fees?

No, Deriv offers a free-of-cost deposit. It means that you would not be charged any additional amount, unlike other brokers, irrespective of your chosen methods.

Can you withdraw the deposit bonus with Deriv?

Yes, you can withdraw the free deposit bonus amount from Deriv. However, the bonuses are subject to the fulfillment of certain conditions. But, once you have exceeded an account turnover of 25 times the bonus amount value, you can withdraw it.

What is the process for funding the Deriv minimum deposit?

Follow these procedures to deposit in your Deriv account:

First, log on to your Deriv account option.

Then, click on the cashier option.

After that, click on the deposit option.

Then, move on to the payment methods.

From there, choose a payment method.

Check your account balance and then go to the click on payment option.

Select click on pay with the wallet.

Then you will receive a confirmation email from the company.

What is the Deriv minimum deposit?

The Deriv minimum deposit completely depends on the payment method you opt for. And it keeps changing with the payment method you choose. Furthermore, the minimum deposit you can opt for is 5 USD/EUR/GBP/AUD via e-wallets. Moreover, you can look out for other payment methods as well. There you can find out the payment method, withdrawal amounts, and minimum deposit.

What are the methods available for Deriv minimum deposit?

There are several methods for the Deriv minimum deposit. You can opt for instant bank transfers, Paytrust, and Help2pay. Furthermore, there are some more payment methods, for example, debit and credit cards and crypto wallets. You can also use Deriv P2P and fiat on-ramp.

See more articles about forex trading:

Last Updated on January 27, 2023 by Arkady Müller